Editor’s Verdict

Overview

Review

FINQ launched in 2017, offering traders a balanced asset selection from the MT4 trading platform plus a web-based alternative. It promises assistance to traders from its multi-lingual support team. I reviewed FINQ to evaluate its trading environment and conclude if traders should trust this broker. Is FINQ a broker you should consider?

Summary

Headquarters | Seychelles |

|---|---|

Regulators | FSA |

Year Established | 2017 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 4, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like that FINQ offers 2,100+ assets across seven sectors but caution traders to read the fine print. For example, cryptocurrency CFDs are subject to a seven-day expiration clause, at which point FINQ will automatically close positions at market prices between 7:30 pm and 9:00 pm GMT. I find this unacceptable, as it takes effect at the discretion of FINQ and does not reflect market conditions or best practices.

FINQ - The first look:

- Unfavorable trading conditions, limitations, and restrictions

- Mismarketing of the product and services portfolio targeted at beginner traders who lack the knowledge to differentiate between a competitive trading environment and one that favors broker profitability

- History of cold calls by customer service representatives posing as professional analysts, giving trading recommendations in high-spread assets intended to accumulate trading losses and broker profits

- No research or education, as FINQ relies on customer service representatives to increase broker profits, potentially on a commission-basis of generated income

- FINQ does not accept EU-based traders, despite no limitations to offer services across the EU

- Traders get the core MT4 trading platform, and a FINQ-branded, web-based alternative

- The account structure deprives beginner traders of services that can help them and offers them to traders who do not require them

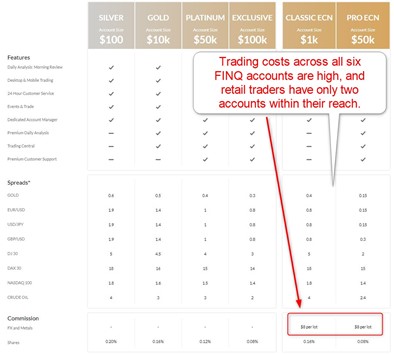

- Unacceptable trading costs across all six account types

FINQ Main Features

Retail Loss Rate | Undisclosed |

|---|---|

Regulation | Yes |

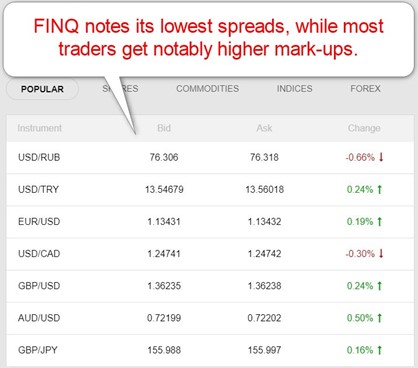

Minimum Raw Spreads | 0.15 pips (most retail at 0.80 pips) |

Minimum Standard Spreads | 0.80 pips (most retail at 1.90 pips) |

Minimum Commission for Forex | $8.00 per round lot |

Commission for CFDs/DMA | 0.20% |

Commission Rebates | No |

Minimum Deposit | $100 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | $25 monthly after three months |

Deposit Fee | Third-party |

Withdrawal Fee | Third-party |

Funding Methods | 6 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. FINQ presents clients with one regulated entity.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Seychelles | Financial Services Authority | License Number SD007 |

What I like about Seychelles brokers:

- Higher leverage

- Negative balance protection

- Competitive regulator

- Segregation of client deposits from corporate funds

- Flexible trading conditions

What is missing?

- Investor compensation fund or,

- Third-party insurance or,

- Financial Commission membership.

- Profiles of core management team

Noteworthy:

- Dilna Investments Ltd owns and operates FINQ and is a Cyprus-registered business, also acting as the primary payment processor except for Skrill and Neteller

- Leadcapital Corp Ltd, a Seychelles-regulated securities dealer, owns Dilna Investments Ltd and processes Skrill and Neteller transactions

- JM Financial Brokerage Services Co, registered with the Ministry of Commerce in the State of Kuwait, is the payment processor for traders from GCC countries

- FINQ appears to maintain a clean regulatory track record

The Seychelles Financial Services Authority is a capable regulator and maintains a competitive trading environment, but FINQ does the bare minimum to ensure a secure and trustworthy broker. FINQ does not compare well versus other Seychelles and globally regulated brokers, with notable shortfalls across the board.

Fees

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

FINQ offers traders two cost structures:

- The commission-free trading costs for traders with deposits below $10,000 starting from 1.9 pips or $19.00 per 1 standard lot

- Commission-based accounts or traders with less than $50,000 commence from 0.8 pips for a commission of $8.00 for a total cost of $16.00 per 1 standard lot

Noteworthy:

- Traders with an account balance above $10,000 but below $50,000 get a minimum spread of 1.4 pips or $19.00 per 1 standard lot

- A 1.0 minimum mark-up or $10.00 is available for deposits above $50,000 and below $100,000

- Portfolios above $100,000 get 0.8 pips spread or $8.00

- The commission-based account lowers spreads to 0.15 pips but requires a minimum deposit of 50,000

- Equity CFD commissions range between 0.08% and 0.20%, where most traders pay the latter

- Trading costs at FINQ are over 300% more expensive than the closest competitors, but FINQ advertises them as generous and industry-beating

Here is a screenshot of FINQ live quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads. A very high minimum deposit of $100,000 is necessary to qualify for them.

Which pricing environment should Forex traders select?

I recommend the following:

- All trading accounts feature unacceptable trading costs

- Most brokers offer all traders lower costs versus the best offer available at FINQ, where traders must deposit a minimum of $100,000

- The Classic ECN is available from a minimum deposit of $1,000 and presents the best option at FINQ if traders can accept the costs

- I recommend beginner traders compare the pricing environment at various brokers to see the difference and compute average trading costs, roughly 300% higher at FINQ

What is missing at FINQ?

- An acceptable price structure available to all traders

- A volume-based rebate program for the commission-based trading account

The absence of a volume-based rebate program is notable and keeps the commission-based pricing environment more expensive compared to other similar Forex brokers. Trading costs for the EUR/USD above $7.00 per 1 standard lot, without rebates, remain unacceptable, with more competitive broker offers ranging between $4.00 and $6.00.

The average trading costs for the EUR/USD in the commission based FINQ Classic ECN account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.8 pips | $8.00 | $16.00 |

Noteworthy:

- Trading costs on average are 300%+ higher versus Forex brokers presenting the most competitive trading conditions

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- FINQ manipulates swap rates in its favor and does not pass positive swaps on short trades, where can traders get paid money to hold overnight positions with strong positive interest differentials.

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission based FINQ ECN Classic account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.8 pips | $8.00 | -$13.2099 | X | $29.2099 |

0.8 pips | $8.00 | X | -$12.2775 | $28.2775 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.8 pips | $8.00 | -$92.4693 | X | $108.4693 |

0.8 pips | $8.00 | X | $85.9425 | $101.9425 |

My additional comments concerning trading costs at FINQ:

- A $25 monthly inactivity fee applies after 90 days of dormancy

- A $100 administration fee exists after twelve months

- FINQ does not list any currency conversion charges

- CFD rollover fees also exist

What Can I Trade?

FING offers 2,100 assets across Forex, cryptocurrencies, commodities, indices, stocks, ETFs, and bonds. Throughout the FINQ asset lists, clicking on See All redirects to the main asset page. It states 55 currency pairs and 26 core indices. A page titled MT4 Trading Conditions offers more details, suggesting traders must use the web-based trading platform for all trading instruments.

What is missing?

- Clear details about its asset selection, preferably via a detailed asset specifications list

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

FINQ Leverage

FINQ advertises maximum leverage of 1:300 but lists the EUR/USD, the most liquid currency pair, at 1:290, while the MT4 Trading Conditions state it as 1:30.

Other things I want to note about FINQ leverage:

- Negative balance protection exists, ensuring traders can never lose more than their deposit

- FINQ does not offer a straightforward approach to leverage and lists three different maximums at various sections of its website for the same asset class

FINQ Trading Hours (GMT-1 Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Forex | Monday 00:00 | Friday 24:00 |

Commodities | Monday 22:01 | Friday 20:55 |

European CFDs | Monday 07:05 | Friday 15:30 |

US CFDs | Monday 13:31 | Friday 20:00 |

Noteworthy:

- Equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies

- Not all currency pairs are available 24/5

- Some commodities open later or close earlier

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

FINQ offers six account types, but neither has an acceptable structure and sacrifices trader profitability for broker profits

Traders must decide between the following:

- Commission-free versus commission-based account

My observations concerning the FINQ account types:

- FINQ has four commission-free accounts and two commission-based alternatives, but only two are within reach of retail traders

- All six account types have unacceptably high trading costs, often 300%+ higher versus competitors

- Trading Central services are available but require a minimum deposit of $10,000

- Corporate and Islamic accounts are not available

- Supported account base currencies are USD, RUB, ZAR, EUR, LKR, INR, and CHF

My recommendation:

- Traders must carefully consider the trading costs, which rank among the highest industry-wide

- The ECN Classic presents the best choice but requires a minimum deposit of $1,000

FINQ Demo Account

FINQ offers $10,000 demo accounts for its web-based trading platform. MT4 also supports demo accounts and does not list time restrictions in its terms and conditions. Demo accounts are ideal for testing EAs or different trading strategies. I want to caution beginner traders about using a demo account as an educational tool. It creates unrealistic trading expectations, and the absence of trading psychology negates the educational value.

My recommendation:

- MT4 offers flexible deposits, and traders should select one similar to what they plan for their live trading account

Trading Platforms

Traders get the out-of-the-box MT4 trading platforms, and FINQ offers 370 assets covering five sectors. MT4 comes as a desktop client, a web-based alternative, and a mobile app. MT4 supports algorithmic trading, where it remains the industry leader, and has an embedded copy-trading service.

A FINQ-branded web-based trading platform for manual traders exists, where all trading instruments are available, together with chats by Trading View. Traders may also opt for the mobile app.

What is missing?

- MT4 add-ons are unavailable, leaving traders with the core MT4 version and a sub-standard trading solution

My observations:

- Traders with MT4 EAs must use the desktop client

- FINQ offers notably fewer assets on MT4 than its branded web-based alternative

- The trading environment at FINQ lacks advanced trading tools, or infrastructure for demanding traders, and places FINQ notably behind competitors

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | No |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | Yes |

Social Trading / Copy Trading | Yes |

MT4/MT5 Add-Ons/Upgrades | No |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | Balanced asset selection for manual traders |

Unique Feature Two | Trading View charts in the web-based platform |

Unique Features

FINQ does not have any obvious unique features except a sentiment indicator based on in-house positions.

Research and Education

FINQ neither generates research nor has an educational section for beginner traders. For a deposit of $10,000, services by Trading Central are available, which most brokers offer for a deposit of $500 or less. FINQ relies on customer service reps to cold call traders, offering trading signals, an unacceptable approach.

My takeaways:

- As an execution-only broker, FINQ does not present a quality trading environment

- FINQ does not offer any research, creating a services quality gap to competing brokers

- An educational section is missing

- The $10,000 demand for Trading Central services is very high

My recommendations:

- Research is not available, but traders can evaluate the copy trading feature embedded in MT4

- MT4 has thousands of EAs, and traders may explore them to determine if they suit their trading style

- Traders can also access numerous free research online and must source educational content before considering FINQ

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |       |

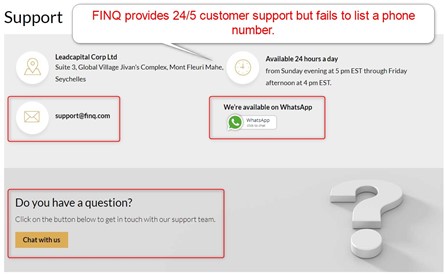

FINQ provides customer support from Sunday 5:30 pm through Friday 4:00 pm EST via e-mail, WhatsApp, or live chat. Phone support is not available.

A limited FAQ section exists, and many traders have reported an unresponsive customer support representative after making a deposit.

My recommendations:

- Traders should read the FAQ section before reaching out to a customer service representative

- For non-urgent questions, I recommend live chat or WhatsApp

- FINQ fails to provide phone support or access to the financial department, leaving traders with inadequate assistance in an area where most issues usually occur

Bonuses and Promotions

FINQ offers a $50 no deposit bonus but lists 81 countries on its restricted list who do not qualify for it. Additionally, a first-time deposit bonus is available, but it expires after 30 days. During that period, traders report numerous daily calls to promote trading activity.

Following that period, customer service representatives may attempt to lure in more deposits with additional bonus offers or stop calling if they believe they cannot secure more capital. A refer-a-friend promotion is also available, with an identical 30-day limit.

My recommendations:

- Terms and conditions apply, and I urge traders to read and understand them

- The bonus program at FINQ does not assist committed long-term traders but intends to promote trading activity by beginner traders to secure broker profits, which is why I recommend traders ignore the offers

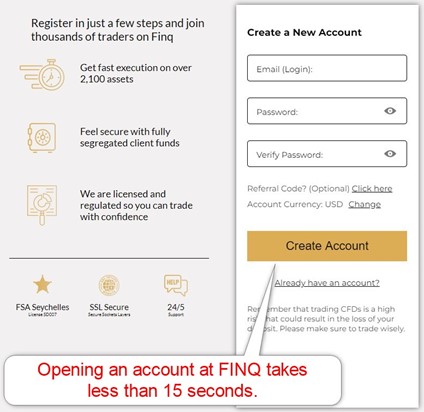

Opening an Account

FINQ maintains a swift account opening process and merely asks for an e-mail address, desired password, and account base currency selection. As a regulated broker, account verification is mandatory. Most traders will complete it after sending a copy of their ID and one proof of residency document no older than three months.

Minimum Deposit

The minimum deposit for the FINQ commission-free trading account is $100 or the currency equivalent, and $1,000 for the commission-based alternative. Both are higher versus many competing brokers, and the former remains within a reasonable range while the latter is excessive.

Payment Methods

FINQ offers bank wires, credit/debit cards, Skrill, Neteller, and FasaPay.

Accepted Countries

Unlike most international brokers, FINQ has many restrictions listed in its terms and conditions. Traders from the UAE, Qatar, and Sri Lanka can open accounts, but FINQ does not accept US or Indian traders. Despite banning Indian traders, FINQ offers the Indian rupee as an account base currency. The same applies to Russian traders, who cannot open accounts at FINQ, but the Russian ruble is an account base currency option.

Deposits and Withdrawals

All financial transactions take place in the secure back office of FINQ. The options remain limited but sufficient for most traders.

My observations:

- FINQ lacks transparency concerning the deposit and withdrawal process and only lists the icons of accepted payment processors

- The minimum withdrawal is $20, except for bank wires, where it is $100

- Withdrawal requests below those amounts face a handling charge of $10 and $50 for bank wires

- FINQ reserves the right to cancel deposits, and traders also report canceled withdrawal requests

My recommendations:

- Traders should select the payment processor with the lowest fees

- I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

The Bottom Line

FINQ presents itself as a trustworthy broker to beginner traders who are unlikely to spot the several red flags. It offers traders an expensive cost structure, which it markets as generous and industry-beating. FINQ has a history of cold calls by customer service representatives posing as professional analysts to lure deposits and force trading activity, supported by time-limited bonuses. I recommend traders approach FINQ with caution, evaluate the trading environment carefully, and consider the negatives. While FINQ is a regulated broker, it lacks transparency and trust. Numerous negative reports exist of sharp business practices. FINQ has its registered headquarters in Mont Fleuri Mahe, Seychelles. Traders can delete their accounts by sending a request to verification@finq.com.FAQs

Is FINQ com safe?

Where is FINQ located?

How do I delete my FINQ account?