Editor’s Verdict

Firstrade is a US-based brokerage that eliminated most trading fees, offers services to international traders focused on China and the EU, and is an excellent choice for equity investors preferring long-term dollar-cost averaging strategies. The downside is its sub-standard trading platform, but investors have sufficient tools to manage portfolios and retirement accounts. I conducted this Firstrade review to evaluate its investment environment. Does Firstrade offer you an edge beyond pricing?

Overview

Firstrade eliminated all transaction fees, making it an excellent choice for investors.

Headquarters | United States |

|---|---|

Regulators | SEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1985 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform |

Average Trading Cost EUR/USD | NA |

Average Trading Cost GBP/USD | NA |

Average Trading Cost WTI Crude Oil | NA |

Average Trading Cost Gold | NA |

Average Trading Cost Bitcoin | NA |

Minimum Raw Spreads | NA |

Minimum Standard Spreads | NA |

Minimum Commission for Forex | NA |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Firstrade Five Core Takeaways:

- Commission-free cost structure

- One of the best regulatory track records of any US-based broker

- No minimum deposit requirements

- Limited sector coverage

- No algorithmic trading capabilities or copy trading functions.

Firstrade Regulation & Security

Trading with a regulated broker can limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Firstrade ranks among US-based brokers with the cleanest regulatory track record spanning almost 40 years.

Country of the Regulator | United States |

|---|---|

Name of the Regulator | SEC |

Regulatory License Number | 16843, 8-34642 |

Regulatory Tier | 1, 1 |

Is Firstrade Legit and Safe?

My Firstrade review found no misconduct or malpractice by this broker. Therefore, I highly recommend this broker as a legitimate and safe choice.

Firstrade regulation and security components:

- Founded in 1985

- Excellent regulatory track record

- SIPC protection up to $500,000 per client, including a $250,000 cash limit.

- Lack of transparency

What would I like Firstrade to add?

Firstrade should improve its regulatory transparency and how it secures clients.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Firstrade is the best-priced US-based broker I have reviewed. It is the only one offering options trading without contract fees and free mutual fund investments for every mutual fund.

Here is a snapshot of Firstrade core investment fees:

- Stocks and ETFs - $0

- Options - $0

- Broker-assisted stocks and options trading - $19.95 + $0.50 per contract

- Mutual funds, load funds - $0

- Mutual funds, no-load funds - $0

- Mutual funds, no transaction fee (NTF) funds - $0

- Fixed income securities - Net yield basis

- Primary market CDs - $30

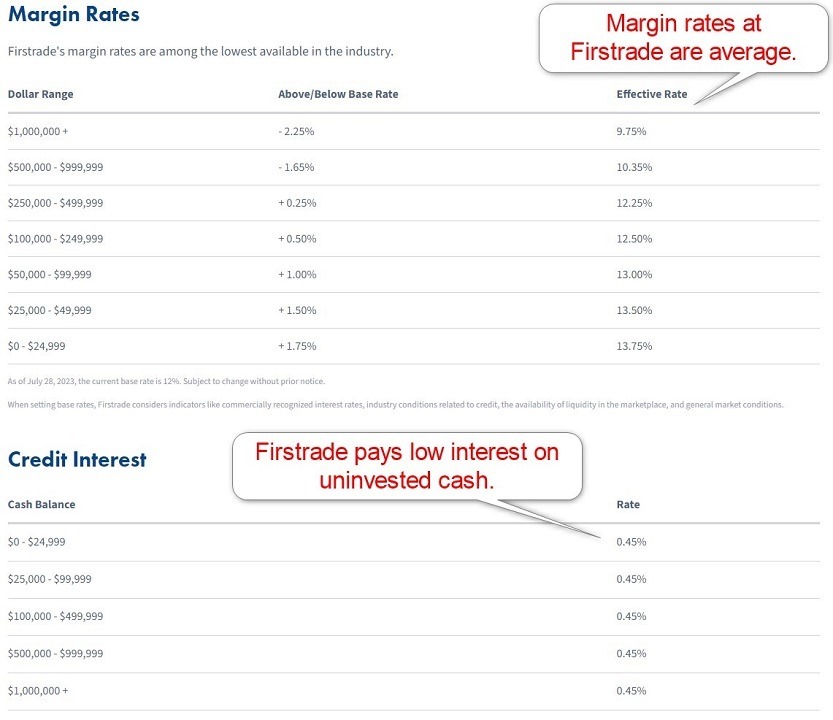

Non-trading fees are limited. Clients face a $75 Automated Customer Account Transfer (ACAT) fee if they transfer their account elsewhere. A partial ACAT fee of $55 also exists. The only drawback at Firstrade is the interest it pays on uninvested cash. At 0.45% annually, it ranks last in this category among brokers that I have reviewed.

Average Trading Cost EUR/USD | NA |

|---|---|

Average Trading Cost GBP/USD | NA |

Average Trading Cost WTI Crude Oil | NA |

Average Trading Cost Gold | NA |

Average Trading Cost Bitcoin | NA |

Minimum Raw Spreads | NA |

Minimum Standard Spreads | NA |

Minimum Commission for Forex | NA |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

Swap rates on leveraged overnight positions are one of the most ignored trading costs. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Firstrade Trading Hours

Asset Class | From | To |

|---|---|---|

Stocks (non-CFDs) | Monday 08:00 | Friday 20:00 |

Bonds | Monday 08:00 | Friday 20:00 |

ETFs | Monday 08:00 | Friday 20:00 |

Options | Monday 08:00 | Friday 20:00 |

Range of Assets

The asset selection at Firstrade is most suitable for long-term investors with a buy-and-hold strategy, low-frequency transactions, or retirement planners. Firstrade does not offer Forex, cryptocurrency, commodity, or index trading. Margin trading is available, but the infrastructure is uncompetitive. Unlike most US-based competitors, Firstrade does not offer IPO trading. Firstrade allows clients to invest in a spot Bitcoin ETF as of January 2024.

Firstrade offers the following asset classes:

- Stocks

- ETFs

- Options

- Mutual funds

- Fixed income securities

- CDs

Firstrade Leverage

Maximum Retail Leverage | 1:2 |

|---|---|

Maximum Pro Leverage | 1:2 |

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

What should traders know about Firstrade leverage?

- Not all assets qualify for margin trading.

- Clients must have a minimum account balance of $2,000 to qualify for margin trading.

- Traders will receive a margin call if their equity balance drops below 30% and have three days to cover it.

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Account Types

Firstrade offers five account type categories, which deal more with various legal specifications than custom-tailored products.

Firstrade has the following account types:

- Brokerage account (also available as a joint brokerage account, a Joint Tenants with Rights of Survivorship (JTWROS) account, or a Tenants in Common account)

- Retirement accounts (Traditional IRA, Roth IRA, and Rollover IRA)

- International accounts (catering to 28 countries)

- Education accounts (Coverdell Education Savings Account)

- Business accounts (SEP-IRA and SIMPLE IRA)

The core features of the brokerage account are:

- No minimum deposit requirement

- Commission-free trading

- Options trading without contract fees

- No commissions on any mutual funds

- Extended hours trading

- Dividend reinvestment plan

- Securities lending income program

Firstrade Demo Account

Firstrade does not offer demo accounts, a significant oversight it shares with many US-based brokers and a clear indicator that it does not cater to active traders.

Trading Platforms

My Firstrade review found that this broker offers a basic web-based investment platform, a mobile app, and a dedicated options trading platform by OptionsPlay. The latter has a detailed one-hour educational video, but Firstrade needs to introduce its investment platform.

The OptionsPlay options trading platform features:

- Trading strategy checklists

- 1-month/6-month trend indicators

- Support/resistance levels

- Proprietary OptionsPlay Score

- 65+ technical indicators

- Technical/fundamental rankings

- Profit and loss simulations

- 40+ complex options strategies

The mobile app includes:

- Smart Menus for Faster Trades

- Consolidated Portfolio Dashboard

- Enhanced Trading Workflow

- Fast Options Trading with Advanced Strategies

- Watchlists with Pre-defined Top Lists

- Upgraded Research with Advanced Charts

- Order History

- Easy Account Funding

The web-based investment platform offers:

- Account overviews

- Screeners and filters

- Charting package

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Besides commission-free mutual fund investments on all funds and options trading without contract fees, my Firstrade review found the Firstrade cash management account has a unique feature that stands out. It requires a minimum account equity balance of $25,000 and includes a free ATM debit card and check-writing capabilities provided by UMB Bank.

Firstrade also offers a tax centre with tools for investors, but more is needed for professional tax advice.

Research & Education

Morningstar provides the core of research at Firstrade via written analytics and video commentaries. Investors can access it directly from the trading platform. A heatmap offers a quick sector overview, and investors can use the Sectors & Industries Stock Research Tool and the redesigned Advanced Screener to find their next investment. A 30-minute weekly webinar by OptionsPlay is also available.

The fundamental data section and the economic calendar provide investors with data covering:

- Earnings Announcements

- Dividends

- Rating Changes

- Economic Indicators

- IPOs

- Splits

I rate the research capabilities at Firstrade among the most competitive ones for investors and retirement planners among US-based brokers.

What about education at Firstrade?

Firstrade maintains an Education Center, which only offers a short introduction covering stocks, options, ETFs, mutual funds, fixed income, and margin loans. A few videos show investors some basics, including how to upload documents or fund their accounts. Following my Firstrade review, I rank the educational section among the worst.

My conclusion:

Firstrade offers educational introductory material for investing in stocks, ETFs, mutual funds, options, and fixed income. I recommend beginners seek in-depth education from third parties, starting with trading psychology and the relationship between leverage and risk management. Avoid paid-for courses and mentors.

Customer Support

Bonuses and Promotions

During my Firstrade review, a small $50 welcome bonus for new accounts funded with $5,000 existed. Clients who fund their account with $1,500,000 qualify for a $5,000 bonus. Firstrade also offers a promotion for clients who transfer their portfolios to Firstrade, covering up to $250 in transfer fees. Terms and conditions apply, and I advise investors to read and understand them.

Customer Support Methods |  |

|---|---|

Support Hours | Monday to Friday, 08:00 to 18:00 |

Website Languages |   |

Opening an Account

New clients can open a Firstrade via a multi-step online application, following established industry practices, which include data collection. Firstrade has one application for US residents and one for international clients.

What should traders know about the Firstrade account opening process?

- Firstrade complies with global AML/KYC requirements.

- Account verification is mandatory.

- Firstrade collects unnecessary data on employment and financial data.

- Most traders pass verification by uploading a copy of their driver’s license or government-issued ID.

- Firstrade may ask for additional information on a case-by-case basis.

Minimum Deposit

There is no Firstrade minimum deposit requirement.

Payment Methods

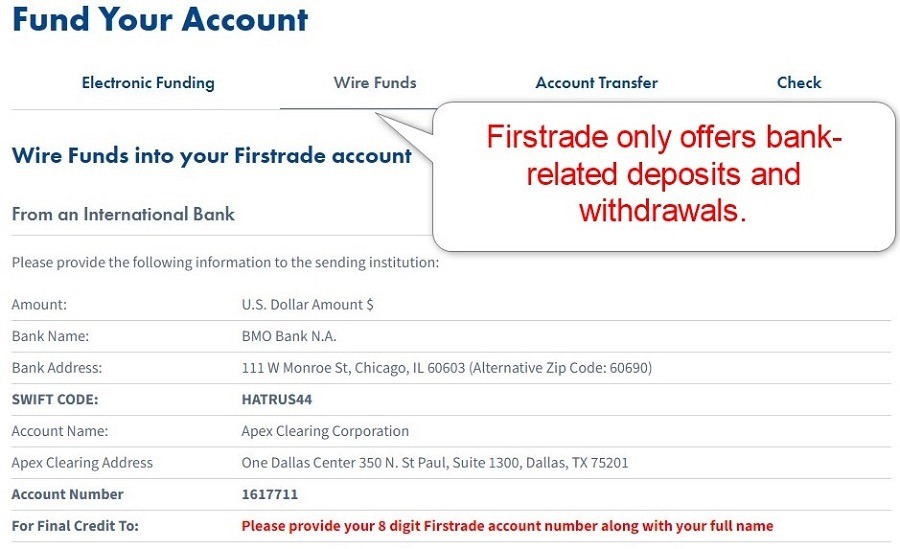

Firstrade only accepts bank wires, checks, and broker-to-broker transfers.

Withdrawal options |   |

|---|---|

Deposit options |   |

Accepted Countries

Austria | Belgium | China | Czech Republic | Denmark |

|---|---|---|---|---|

Finland | France | Germany | Hong Kong | India |

Ireland | Israel | Mexico | Japan | South Korea |

Macau | Malaysia | Singapore | New Zealand | Norway |

Poland | Portugal | Italy | Spain | Sweden |

Taiwan | Thailand | United Kingdom | United States |

Deposits and Withdrawals

The secure Firstrade back office handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at Firstrade?

- Firstrade only accepts bank-related deposits and withdrawals.

- There is no minimum deposit requirement.

- Outgoing bank wires incur a $25 withdrawal fee.

- Firstrade does not list a minimum withdrawal amount.

- Firstrade submits electronic transfers requested before 13:00 ET to Apex for same-day processing.

- It can take up to two business days for electronic transfers to arrive.

- Check withdrawals are only for US domestic accounts.

Is Firstrade a good broker?

I like the trading environment at Firstrade for long-term investors and retirement planners, as Firstrade has eliminated all fees. It is the only US-based broker I have reviewed that offers options trading without the contract fee and free mutual fund investments, regardless of their classification.

Clients with a minimum account equity balance of $25,000 qualify for a Firstrade cash management account. It features free ATM debit cards and check-writing capabilities provided by UMB Bank. Firstrade accepts clients from the US and 28 additional countries, making it a unique US-based broker.

I rate the research among the best across US-based competitors, but active traders will find the trading environment disappointing. The absence of algorithmic trading support and asset selection makes it unsuitable for traders. Long-term investors will find it challenging to find a more competitive US-based brokerage. Firstrade is a US company headquartered in New York. Firstrade earns most of its money from interest on its credit and margin balances, spread, routing venues, and shares execution income. Firstrade accepts clients from 28 countries. Firstrade is an excellent broker for long-term buy-and-hold investors and retirement planners, as it has eliminated all fees. Firstrade complies with US rules and regulations and has the cleanest track record I have reviewed among all US-based brokers. Therefore, client money is safe with Firstrade.FAQs

Is Firstrade a US company?

How does Firstrade make money?

Can foreigners use Firstrade?

Is Firstrade a good broker?

Is my money safe in Firstrade?