Editor’s Verdict

FlowBank is a Swiss-based online bank and broker featuring a competitive choice of trading platforms, assets, and fees. It aims to disrupt and simplify the financial system with a customer-centric approach. Beginners get quality education and research, and FlowBank maintains a secure and trustworthy investing and trading environment. I reviewed FlowBank to determine the competitiveness of this online bank/broker. Is FlowBank the best choice for your trading portfolio?

Overview

A Swiss online bank and broker with an overall excellent trading environment.

Headquarters | Switzerland |

|---|---|

Regulators | FINMA |

Year Established | 2020 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $0 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the asset selection and trading fees at FlowBank. With 50,000+ trading instruments, FlowBank caters to all requirements and strategies, from beginners to institutional clients. It has also emerged as a promising choice for stock traders. The competitive pricing environment features commission-free and commission-based trading, expanding the competitive edge at FlowBank.

FlowBank Regulation & Security

Trading with a regulated entity will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. FlowBank presents clients with one regulated entity and maintains a secure trading environment.

Name of the Regulator | FINMA |

|---|

Is FlowBank Legit and Safe?

FlowBank is a licensed bank in Switzerland and ranks highly in security and trust, despite its relatively short operational history. The Swiss regulator is among the most capable and trusted financial regulators globally. FlowBank segregates all client deposits from corporate funds, and Credit Suisse is its custodial partner.

Negative balance protection exists, and FlowBank and depositor protection of up to CHF 100,000 applies via esisuisse. I rank FlowBank as one of the most secure banks and brokers, which counts CoinShares, the leading digital asset investment and trading group in Europe, as one of its core investors.

Fees

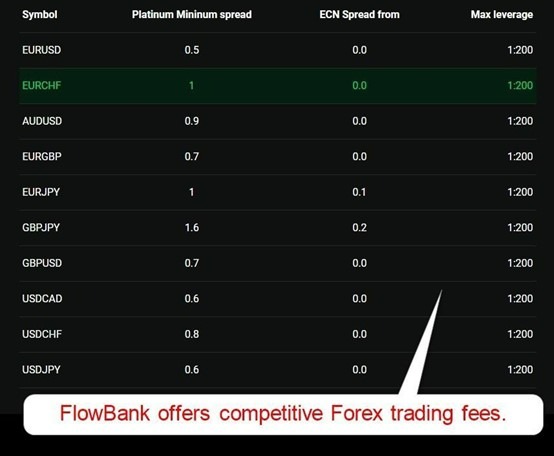

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. FlowBank offers competitive trading fees, including commission-free Forex and Swiss equity trading. An annual custodial fee of 0.10% applies, payable each quarter, with a CHF 40 minimum and CHF 200 maximum. Forex traders get spreads from 0.5 pips, which can decrease to raw spreads of 0.0 pips for portfolios above CHF 100,000. Adding the low equity commission fees, from CHF 0 to €/$6.50 and £25, and competitive swap rates on leveraged overnight positions, FlowBank ranks among the cheapest brokers industry wide.

Minimum Raw Spreads | 0.0 pips |

|---|---|

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee |

The minimum trading costs for the EUR/USD at FlowBank are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.5 pips (Platinum) | $0.00 | $5.00 |

0.0 pips (ECN) | $0.00 | $0.00 |

Here is a screenshot of FlowBank MT4 fees during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

Noteworthy:

- Equity investors may pay monthly real-time data subscription fees for select markets.

- A 0.50% currency conversion fee exists.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD and holding the trade for one night and seven nights.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.7 pips | $0.00 | -$10.16 | X | $17.16 |

0.7 pips | $0.00 | X | $2.88 | $4.12 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.7 pips | $0.00 | -$71.12 | X | $78.12 |

0.7 pips | $0.00 | X | $0.00 | -$13.16 |

Noteworthy:

- A trader holding a EUR/USD short position for seven days would get paid $13.16, confirming the competitive pricing environment at FlowBank.

Range of Assets

The asset selection of 50,000+ trading instruments places FlowBank among the leaders in this category. It includes 50+ currency pairs for Forex traders, 4,500+ CFDs, and a wide selection of ETFs and managed funds. FlowBank also offers cryptocurrency traders a choice of a range of products including ETFs, ETPs, ETNs, and tracker certificates. Therefore, the range of assets at FlowBank supports all strategies, making it a one-stop solution for long-term investors and short-term traders alike. FlowBank also offers fractional share dealing, allowing smaller portfolios to achieve asset diversification.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds | |

ETFs |

FlowBank Leverage

FlowBank offers maximum Forex leverage of 1:200, making it among the most competitive tier-1 regulated brokers. Index CFDs and commodities also get a maximum of 1:200, equity CFDs max out at 1:100, and bond and interest rate traders get 1:200. It adds to the overall competitiveness of FlowBank, which also provides negative balance protection, meaning traders can never lose more than their deposits. I urge traders to execute risk management to avoid magnified losses.

FlowBank Trading Hours (GMT + 1)

Asset Class | From | To |

|---|

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, and commodities, which essentially trade 24/5

Account Types

FlowBank offers two account types: the Classic and Platinum accounts. An automatic upgrade to the Platinum account with lower trading fees exists once clients exceed a balance of CHF 100,000. While I appreciate the simplistic approach, I would like a short description of the core account details for traders rather than piecing it together. There is no minimum deposit, which I welcome, as it grants complete flexibility in building portfolios.

Supported account base currencies are USD, EUR, AED, AUD, CAD, CHF, CZK, DKK, GBP, HKD, HUF, ILS, JPY, MXN, NOK, NZD, PLN, SEK, SGD, THB, TRY, and ZAR.

Trading Platforms

Traders are offered the familiar out-of-the-box MT4/MT5 trading platforms, where the former remains the leading algorithmic trading platform and the latter a preferred equity trading solution. Both have integrated copy trading services. FlowBank does not offer any third-party plugins for MT4/MT5 for manual traders but presents its proprietary solution FlowBank Pro, where clients get 50,000+ assets spanning seven sectors, and its user-friendly mobile app FlowBank. FlowBank also offers proprietary trading platforms, FlowBank and FlowBank Pro.

MT4/MT5 cater to traders, who qualify for volume-based rebates, while FlowBank Pro remains a superior option for investors. It includes advanced trading tools. The basket order function allows investors to execute multiple cross-asset transactions from one order ticket.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

The unique features that stand out are the superb asset selection at FlowBank, with 50,000+ trading instruments covering seven sectors, including fractional shares, followed by low trading fees, and the overall combination of a cutting-edge Swiss online bank with a brokerage. It rivals well-established online brokers, online banks, and brick-and-mortar competitors.

Research & Education

FlowBank excels with its combination of in-house and third-party research, which includes actionable trading recommendations provided by Technical Speak Easy. Clients get well-written and thought-provoking market insights, a live wire feed from FlowBank, a client positioning tool, a theme-based portfolio section, a daily newsletter, and FlowTV, hosted on YouTube.

Beginner traders can start with the short video-based introductions and guides at FlowBank, which appeal to younger traders and investors. A well-written educational blog is equally available, and I found the overall educational approach at FlowBank a solid introduction. FlowBank also hosts events, which increases its educational value and client engagement.

I recommend beginners who want to trade with FlowBank seek additional in-depth education from third parties available for free, including trading psychology, before opening a FlowBank trading account. Beginners should always avoid paid-for courses.

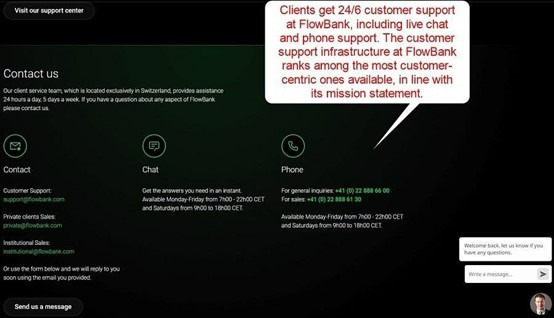

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/6 |

Website Languages |    |

FlowBank offers 24/6 customer support in English, French, and German, but live support hours for chat and phone assistance are Monday through Friday from 07:00 to 22:00 (CET) and Saturday from 09:00 to 18:00. The support center answers the most common questions. I recommend live chat for non-urgent inquiries. I like that FlowBank provides phone support, which is ideal for emergencies, and I rank the overall customer support infrastructure and availability among the best versus competing banks and brokers. Clients of FlowBank can also address their inquiries by submitting an online form that is available on the FlowBank website.

Bonuses and Promotions

FlowBank awards new clients who make a minimum deposit of CHF 1,000 with one free stock valued up to CHF 500. FlowBank also covers transfer fees for clients who move their portfolios from other banks and brokers to a maximum of $750. Terms and conditions apply.

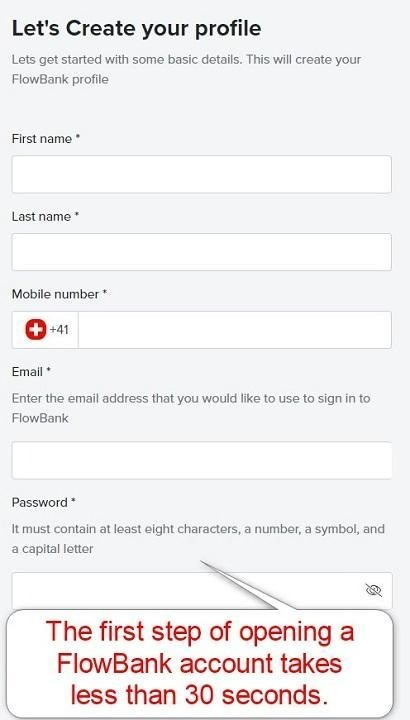

Opening an Account

Opening a FlowBank account starts with providing a name, mobile phone number, e-mail, and desired password. FlowBank will e-mail a six-digit code to confirm the e-mail and completing this step grants access to the secure back office at FlowBank.

FlowBank is a Swiss bank and broker authorized and regulated by FINMA. Therefore, account verification is mandatory. Uploading a copy of their ID and one proof of residency document no older than six months will pass most clients, following well-established industry practices. FlowBank might ask for additional information on a case-by-case basis.

Minimum Deposit

FlowBank has no minimum deposit requirement, granting clients complete freedom to manage their finances and portfolios.

Payment Methods

FlowBank supports bank wires and credit card deposits and withdrawals.

Withdrawal options |   |

|---|---|

Deposit options |   |

Accepted Countries

FlowBank accepts traders from most countries and is one of the most accessible online banking providers, except for traders resident in Belgium, Canada, and the US or any jurisdictions that prohibit FlowBank from operating.

Deposits and Withdrawals

The secure FlowBank Personal Area handles all financial transactions for verified clients.

FlowBank does not levy internal deposit fees nor withdrawal costs. Clients should consider potential third-party processing fees and the 0.50% currency conversion fee. Custody fees are capped at CHF 50 per quarter.

I miss e-wallets for flexibility and fast, low-cost transactions, which is where FlowBank fails to deliver in the only negative aspect I found during my review. FlowBank notes that wire deposits may take up to four business days to arrive, while credit card withdrawals may take three business days. Clients may also deposit and withdraw via the mobile app FlowBank, but the feature does not exist in the desktop version FlowBank Pro.

Is FlowBank a good broker?

I like the trading environment at FlowBank for its industry-leading asset selection among online banks and brokers, low trading fees, indulging competitive swap rates, and generous retail leverage for tier-1 regulated banks. I appreciate the customer-centric approach, proprietary trading platforms next to MT4/MT5, the absence of a minimum deposit requirement, and fractional share dealing for smaller portfolios. FlowBank maintains an overall infrastructure supportive of all trading and investing requirements. I determine that FlowBank established itself as one of the most disruptive industry forces in online banking. The FlowBank fees, besides the annual custodial fee, remain dependent on the client and their financial requirements. FlowBank fees consist of spreads, commissions, swap rates on leveraged overnight positions, a 0.50% currency conversion fee, a CHF 10 to CHF 25 withdrawal fee, and monthly real-time data subscription fees. Other one-time fees may apply, and FlowBank lists all costs transparently on its website. FlowBank has no minimum deposit requirement. All clients must pay the 0.10% annual custody fee, payable every quarter in 0.025% installments. The minimum is CHF 40, and the maximum is CHF 200. A detailed ownership structure is unavailable, as it is a private Swiss bank, but Charles Henri Sabet founded the bank/broker in 2020, and CoinShares is a major shareholder.FAQs

What are the FlowBank fees?

What is the minimum deposit for FlowBank?

What are FlowBank custody fees?

Who owns FlowBank?