Editor’s Verdict

FTMO is a Forex prop firm headquartered in the Czech Republic. It was the Technology Fast 50 Winner by Deloitte for the past four years, has prop traders from 180+ countries, a maximum profit-share of 90%, allows maximum leverage of 1:100, a two-step verification process, and has no strategy restrictions on the MT4, MT5, and cTrader trading platforms. Should you consider FTMO as your prop trading firm?

The Pros & Cons of FTMO

Traders should consider the pros and cons of FTMO. I have summarized the ones I found stood out the most during my review.

Overview

Traders from 180+ countries enjoy a maximum profit share between 80% and 90%.

Headquarters | Czech Republic |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2014 |

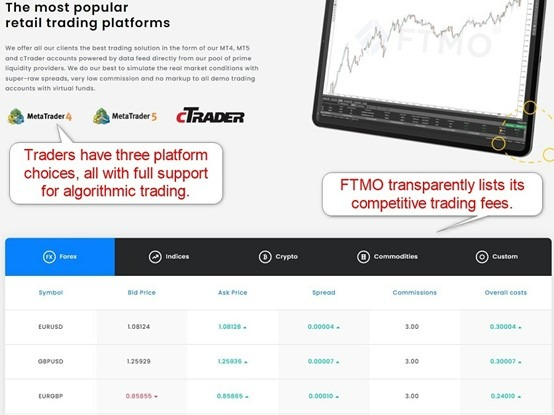

Trading Platform(s) | MetaTrader 4, MetaTrader 5, cTrader, Proprietary platform |

Average Trading Cost EUR/USD | 0.6 pips ($6.00) |

Average Trading Cost GBP/USD | 0.8 pips ($8.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.19 |

Average Trading Cost Bitcoin | $171.00 |

Minimum Evaluation Fee | € 155 |

Profit-share | 90% |

Daily Loss Limit | 5% |

Maximum Trailing Drawdown | 10% |

Funded Account Options | 5 |

Minimum Funded Account | $10,000 |

Maximum Funded Account | $200,000 |

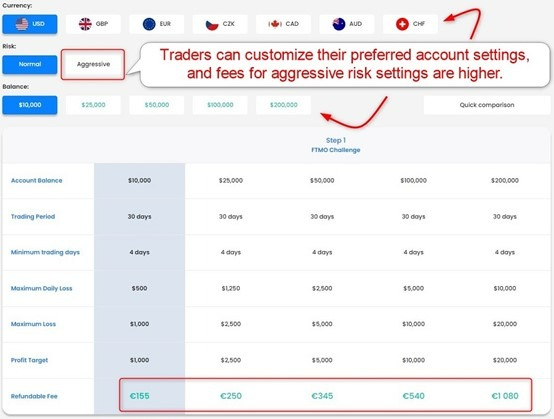

I like the customization options of the FTMO evaluation process. Traders should choose carefully, as accepted prop traders will have the same settings in their prop account as the evaluation configurations. The evaluation fee increases with the account balance and risk settings. I also appreciate the choice of trading platforms.

FTMO Trustworthiness & Reputation

Trading with a Forex prop firm, which is an unregulated business, requires traders to ensure that a trusted brokerage manages all accounts, and that the Forex prop firm maintains an excellent reputation among its prop traders.

Is FTMO Legit and Safe?

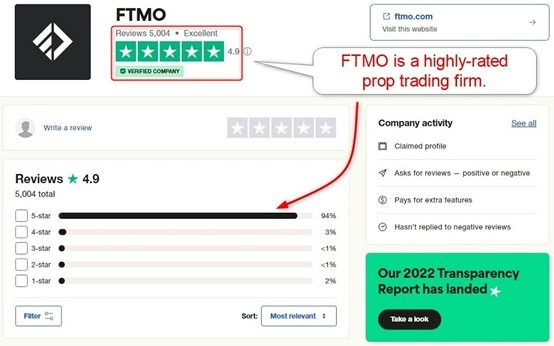

FTMO is a Czech-based company with an excellent reputation. It was the Technology Fast 50 Winner by Deloitte from 2019 through 2022, and it has a 4.9 out of 5.0 rating on Trustpilot based on 5,004 reviews.

It operates several subsidiaries for compliance purposes. FTMO Evaluation Global s.r.o. manages all non-US prop applications, and FTMO Evaluation US s.r.o. caters to US-based traders. FTMO s.r.o. owns and operates the website. My review did not uncover any negatives about FTMO, but I would appreciate it if FTMO disclosed their brokers and liquidity providers.

FTMO Features

FTMO follows best practices duplicated across the Forex prop firm industry, which remains in its infancy.

The most notable features at FTMO are:

- A two-step evaluation with a profit target of 10%

- A minimum of four trading days to achieve the profit target with a minimum of one trade placement per day.

- MT4, MT5, and cTrader trading platforms.

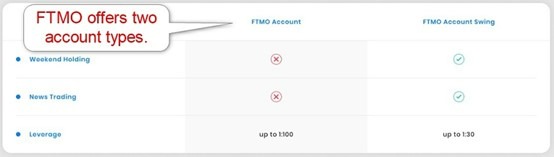

- Maximum leverage of 1:100 for the FTMO account and 1:30 for the FTMO Account Swing

- A 5% to 10% daily loss limit

- A 10% to 20% trailing drawdown limit

- No weekend positions or news trading in the FTMO account, which are available in the FTMO Account Swing

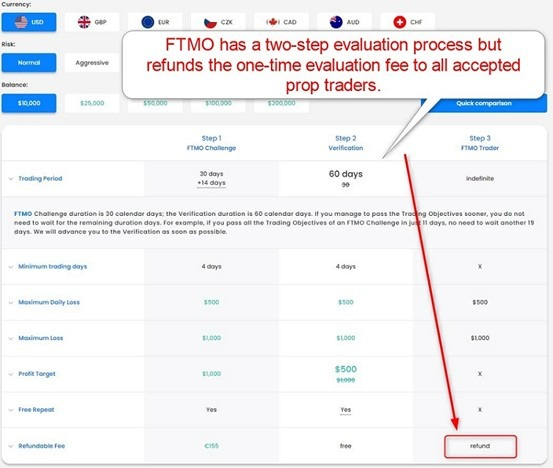

- Refundable evaluation fee for all traders who qualify as prop traders.

- Free trial

- A scaling plan which increases the account size by 25% every four months

- Seven account base currencies

- 42 currency pairs, including exotics and emerging markets.

- 8 metals and 4 futures contracts

- 14 cash indices and commodities

- 10 cryptocurrencies

- 23 blue-chip equities listed in the US and the Eurozone

Evaluation Fees & Profit-Share

Traders must pay a one-time evaluation fee per evaluation, ranging between €155 and €1,080, dependent on the desired size of the funded account. Trades cannot change this value once approved, meaning if they qualified on a $10,000 account, then they will manage a $10,000 portfolio. FTMO refunds the one-time evaluation fee for all approved prop traders.

The 80% to 90% FTMO profit share places FTMO at the top of the industry range, ensuring prop traders get the highest levels industry-wide.

Minimum Evaluation Fee | €155 |

|---|---|

Maximum Evaluation Fee | €1,080 |

Profit-share | 80% to 90% |

The minimum evaluation fee at FTMO for a fully upgraded $10,000 MT4 account is:

Type of fee | Fee (without discounts) |

|---|---|

One-time evaluation fee for a $10,000 funded account (the smallest one) | €155 |

Hold-over-the-weekend | €0 |

Double leverage | Not applicable |

Stop-loss not required at trade entry. | Not applicable |

Total one-time fees for a $10,000 MT4 account | €155 |

Account Types

FTMO has two distinct account types, FTMO and FTMO Account Swing, with six funding options. FTMO only displays five on its comparison page, as the final one requires special permission, but FTMO notes in the scaling plan. The scaling plan can double assets under management, irrelevant to the starting balance.

The evaluation fee depends on the desired account balance, and traders cannot change it once the evaluation begins. The trading rules are generous, and I like that FTMO refunds the evaluation fee to all traders who get accepted as prop traders.

What are the Trading Rules at FTMO?

After interested prop traders choose their preferred evaluation account settings and pay the evaluation fee, the 30-day FTMO Challenge begins. Traders must earn 10% during this period, with a minimum of four trading days if they select the “Normal” risk setting. The “Aggressive” option requires a minimum profit of 20%.

Violating the trading rules results in account closure, but traders can start again by paying the evaluation fee. In some circumstances, FTMO grants a 14-day extension or a free retrial.

The trading rules for the FTMO Challenge are:

- 5% daily loss limit (normal risk), 10% daily loss limit (aggressive)

- 10% trailing drawdown limit (normal risk), 20% trailing drawdown limit (aggressive)

- A minimum of one trade over four days for 30 days

After traders pass the FTMO Challenge, a 60-day verification period starts. The same trading rules apply, except for the profit target, which is 50% lower than the FTMO Challenge.

Noteworthy:

- FTMO will never grant access to live trading accounts.

- Accepted prop traders will manage demo accounts, and the FTMO software duplicates them in live trading accounts of FTMO.

- It enhances risk management and compliance for FTMO.

Trading Platforms

Traders can use MT4, MT5, or cTrader. FTMO also developed custom trading apps to help prop traders’ discipline, journal, and analyze their portfolios. There are no restrictions on trading strategies, and FTMO allows algorithmic trading.

The maximum leverage of 1:100 and choice of highly liquid trading assets cater well to aggressive short-term traders, the primary target for most prop trading firms. FTMO supports medium-to-long-term strategies in its FTMO Account Swing.

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

DOM? | |

One-Click Trading |

Education

The FTMO Academy consists of education that can help beginners get started. I also like the written content on the FTMO blog and appreciate the dedicated section covering trading psychology. With that in mind, beginners have no place in the ultra-competitive, fast-paced, high-stress, result-driven professional trading environment.

FTMO cares about its prop traders, evidenced by the availability of performance coaches, but I cannot ignore the targeting of beginners. They are unlikely to pass the evaluation process, irrelevant to the available educational content. Only seasoned traders with experience should consider prop trading.

Customer Support

FTMO offers 24/7 customer support in 17 languages via e-mail, live chat, and WhatsApp, while phone support is available Monday through Friday from 9 a.m. to 5 p.m. (CEST). The FAQ section answers many questions, and I doubt most traders will require assistance. I appreciate the transparency at FTMO, which boosts its trustworthiness and credibility.

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |       |

How to Get Started with FTMO

Traders can start by clicking “FTMO Challenge” on the FTMO homepage, which loads the login or registration screen. Traders must provide their desired e-mail and password or use their Google, Apple, or Facebook IDs to register.

The next step consists of choosing their preferred evaluation account settings, and the last step is paying the one-time evaluation fee.

FTMO is a highly rated and verified prop trading firm. It also conducts ongoing interviews with its prop traders and publishes them on its official YouTube channel.

Minimum Evaluation Fee

The minimum evaluation fee at FTMO is €155 for the smallest account package.

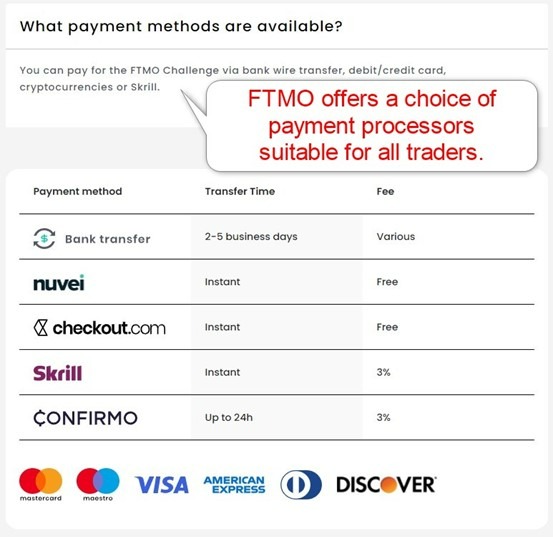

Payment Methods

FTMO supports bank wires, debit/credit cards, Skrill, and cryptocurrencies.

Accepted Countries

FTMO claims traders from 180+ countries and does not list restrictions.

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via bank wires, debit/credit cards, Skrill, and cryptocurrencies, which are withdrawal methods for the 80% to 90% profit share at FTMO.

The Bottom Line - Is FTMO a Good Forex Prop Firm?

I like FTMO for its transparency, trading rules, and profit share of up to 90%. FTMO offers two account types with six funded account options, one for day traders and one for traders who need to keep positions open for longer, seven account base currencies, and a free trial.

Regrettably, FTMO does not disclose its brokers and liquidity providers, which is the only information I am missing as a prop trader. I appreciate that FTMO allows all trading strategies, including algorithmic trading. The only red flag, which FTMO shares with all prop trading firms, is targeting beginner traders, aiming to turn retail traders into success stories. It creates a small revenue stream from pocketing the one-time evaluation fee, which it refunds to accepted prop traders.

FTMO is highly rated, verified, and transparent. I rate it among the most competitive prop trading firms with a bright future, supported by awards, including the four-time winner of the Technology Fast 50 Winner by Deloitte award.

Traders who violate the trading rules during the evaluation period get invalidated, but no real money loss occurs. They may pay the evaluation fee again and start over. Accepted prop traders get their FTMO Account Agreement terminated but can start the process over. They do not owe losses to FTMO. Over 90% of traders fail the FTMO Challenge, as most participants are retail traders who try to achieve the profit target in the given time. They lack the experience to manage prop trading accounts. Yes, the profit-share payout is automatic and monthly, but traders can request a custom profit withdrawal after 14 days from the first trade. FTMO shares plenty of success video stories where its prop traders participate in 30-minute interviews, confirming FTMO pays its prop traders. FTMO ranks among the most trusted and transparent prop trading firms. It paid over $130M to its prop traders per data published on its website. FTMO ranks highly on Trustpilot based on 5,000+ reviews, with a 4.9 out of 5.0 rating.FAQs

What happens if you lose FTMO money?

What is the success rate of the FTMO Challenge?

Does FTMO actually payout?

Is FTMO trustable?