Editor’s Verdict

Funded Traders Global is a US-based proprietary Forex prop firm with prop traders from 180+ countries. It offers MT4/MT5 accounts in partnership with Australian-based multi-asset CFD broker Eightcap, allowing its traders to trade 300 assets with maximum leverage of 1:10, features six funded account options, a one-step evaluation period, and a profit-share of 75% for its prop traders. Is Funded Traders Global the right Forex prop firm for you?

The Pros & Cons of Funded Traders Global

Traders should consider the pros and cons of Funded Traders Global. I have summarized the ones I found stood out the most during my review.

Overview

A Forex prop firm offering 75% profit-share with traders from 180+ countries

Headquarters | United States |

|---|---|

Year Established | 2018 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

I like the flexibility of the evaluation process at Funded Traders Global. After selecting the desired trading platform, MT4 or MT5 provided by Eightcap, traders can opt to hold traders over the weekend, double their leverage, or trade without the stop loss requirement at trade entry. All options increase the one-time fee but ensure traders can customize their funded trading account to best suit their trading strategy.

Funded Traders Global Trustworthiness & Reputation

Trading with a Forex prop firm, which is an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts and that the Forex prop firm maintains an excellent reputation among its prop traders.

Is Funded Traders Global Legit and Safe?

Funded Traders Global is a US-based Forex prop firm owned by Blue Ribbon Capital, which provides the capital for funded accounts. Funded Trader Global is a white-label solution of Prop Account LLC, and it acts as a mediator between prop traders and Prop Account LLC. Limited to no information is available on all three entities other than the founding year of Blue Ribbon Capital.

It is not unusual to have multiple entities collaborating on a Forex prop firm. Funded Traders global partnered with Australian-based Eightcap, and I rank them among the most trusted brokers industry-wide. Therefore, I trust the due diligence at Eightcap, which accepted Funded Traders Global as a corporate client, but I would ideally prefer to see more information about Blue Ribbon Capital and Prop Account LLC.

Funded Traders Global Features

Funded Traders Global presents a straightforward business model, following best practices duplicated across the Forex prop firm industry, which remains in its infancy.

The most notable features at Funded Traders Global are:

- A one-step evaluation with a profit target of 10%

- No minimum or maximum trading day requirements, but a minimum of one trade per 30 days

- MT4/MT5 accounts at Eightcap

- Maximum leverage of 1:10 with an option to upgrade to 1:20 for an extra fee for Forex and metal trading

- A 4% daily loss limit

- A 5% trailing drawdown limit

- No weekend positions, adjustable for an extra fee

- Stop-loss requirement with each trade placement, voidable for an extra fee.

- Maximum open positions of 1/10,000th of the account balance with risk (once the stop-loss level equals the entry, the lot does not count towards the maximum, as it carries no risk)

- Prop traders may trade a selection of 300 assets.

Evaluation Fees & Profit-Share

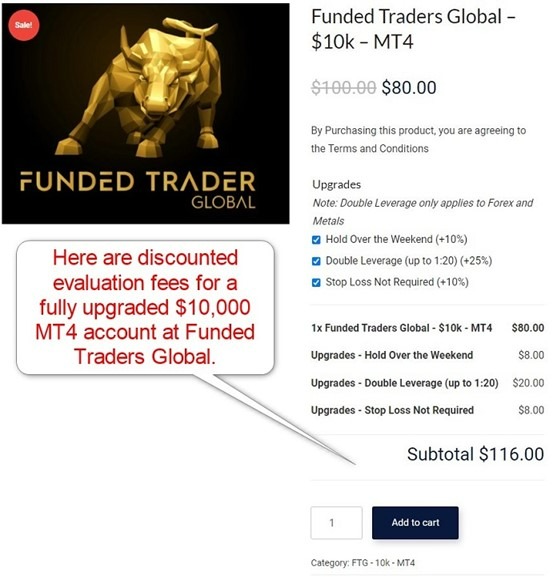

Traders must pay a one-time evaluation fee per evaluation, ranging between $100 and $3,749. The evaluation fee depends on the funded account package, where the minimum is $10,000. Funded Traders Global offers occasional discounts, lowering the evaluation fee by 20%, as was the case during my review. Therefore, prop traders can pay as little as $80 to start their prop trading evaluation in a $10,000 fund at Funded Traders Global.

The 75% profit-share at Funded Traders Global places this prop trading firm in the middle of the competition and at an acceptable level.

Minimum Evaluation Fee | $100 |

|---|---|

Maximum Evaluation Fee | $3,749 |

Profit-share | 75% |

The minimum evaluation fee at Funded Traders Global for a fully upgraded $10,000 MT4 account is:

Type of fee | Fee (without discounts) |

|---|---|

One-time evaluation fee for a $10,000 funded account (the smallest one) | $100 |

Hold-over-the-weekend (10% fee) | $10 |

Double leverage from 1:10 to 1:20 (25% fee) | $25 |

Stop-loss not required at trade entry (10% fee) | $10 |

Total one-time fees for a $10,000 MT4 account | $145 |

Account Types

Funded Traders Global offers six account options from a minimum of $10,000 to a maximum of $500,000. The trading condition and rules remain identical, but the one-time evaluation fee changes notably from $145 to above $5,430.

Hard rules violations outlined below result in account closure and an end of the prop trader agreement. The evaluation fee is non-refundable, and once traders make the payment, the evaluation period starts.

What are the Trading Rules at Funded Traders Global?

After potential prop traders pay the evaluation fee, they will start in a demo account until they reach the 10% profit requirement while adhering to the Funded Traders Global trading rules, which consist of hard and soft breach rules.

Violating hard breach rules results in account closure, while breaking soft breach rules results in the closure of positions violating the rule, but prop traders can keep trading.

The hard breach rules at Funded Traders Global are:

- 4% daily loss limit

- 5% trailing drawdown limit

- A minimum of one trade every 30 days

The soft breach rules at Funded Traders Global are:

- Stop-loss requirement with each trade placement.

- No weekend positions (Funded Traders Global closes all open positions on Friday at 3:45 PM EST)

- Maximum open positions of 1/10,000th of the account balance with risk

Noteworthy:

- Traders can eliminate the stop-loss requirement and no weekend positions rule by paying an additional 10% fee at sign-up.

Trading Platforms

Funded Traders Global offers the MT4 and MT5 trading platforms provided by Eightcap but does not specify if it allows algorithmic trading or if prop traders can copy their trades from an existing portfolio. While MT4/MT5 supports both, some prop trading firms insist on manual traded execution. The Funded Traders Global website does not mention algorithmic or copy trading, which suggests they are not allowed.

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform |

Education

The FTG Knowledge Bank is the educational section of Funded Traders Global. It provides well-written content with a focus on beginner traders.

Customer Support

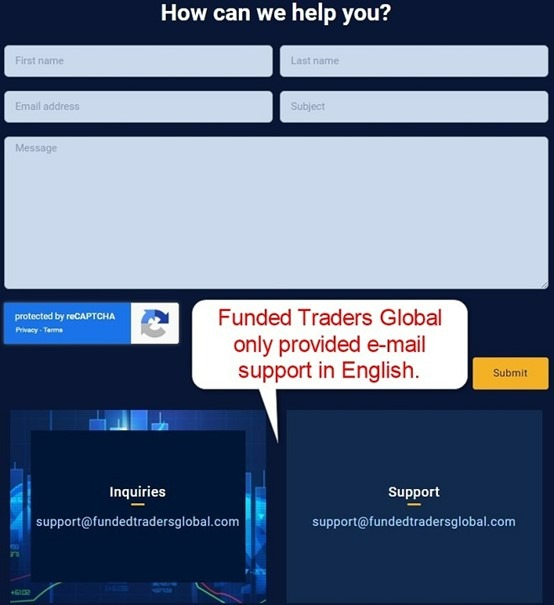

Only e-mail support exists at Funded Traders Global. The limited FAQ section answers the essential questions about the evaluation and assessment period but does not fully address other core topics for when traders become funded. Also missing are answers potential prop traders may have before considering Funded Traders Global, especially about using algorithmic trading and withdrawal policies of trading profits.

Customer Support Methods |  |

|---|---|

Support Hours | Undisclosed |

Website Languages |  |

How to Get Started with Funded Traders Global

Traders should select one of the funded account packages and choose their trading platform, MT4 or MT5. Clicking on the trading platform loads a customization screen, where prop traders can select from three upgrades before moving on to the payment screen, where three payment options exist.

Once Funded Traders Global receives payment, it will e-mail login credentials to prop traders, and the evaluation period begins. During this assessment, prop traders must earn 10% to become funded traders while trading within the rules of the assessment period.

Minimum Evaluation Fee

The minimum evaluation fee at Funded Traders Global is $100 for the smallest account package without upgrades. During my review, a 20% discount was applied to all six packages, lowering the minimum to $80.

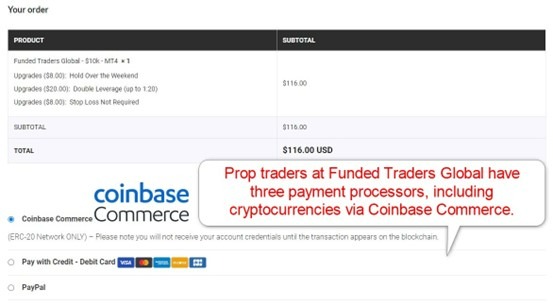

Payment Methods

Funded Traders Global supports credit/debit cards, PayPal, and ERC-20 on Coinbase Commerce.

Accepted Countries

Funded Traders Global claims traders from 180+ countries and does not list restrictions.

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via credit/debit cards, PayPal, or Coinbase Commerce. Since those are the three payment options, they likely represent the withdrawal methods for prop traders, who receive a 75% profit share from Funded Traders Global.

Bottom Line - Is Funded Traders Global a good Forex Prop Firm?

I like Funded Traders Global for its customization options of funded trading accounts and its partnership with Eightcap. I would have preferred more information about the ability to use algorithmic trading solutions, how and when Funded Traders Global pays the 75% profit share, how successful traders can withdraw profits, and about Blue Ribbon Capital or Prop Account LLC. Funded Traders Global has partnered with Eightcap, which has a reliable due diligence team for corporate clients. Funded Traders Global offers a 75% profit share, placing it in the middle of the Forex prop firm sector. The evaluation fees depend on the account size and range between $100 and $3,749. Funded Traders Global has its headquarters in Grand Rapids, Michigan, US.FAQs

Is Funded Traders Global a trustworthy prop firm?

What is the profit share at Funded Traders Global?

What are the evaluation fees at Funded Traders Global?

Where is Funded Traders Global headquartered?