Editor’s Verdict

FundedNext is a Forex prop firm owned by Next Ventures, founded by Bangladeshi entrepreneur Syed Abdullah Jayed in 2022. Despite its short existence, it already serves 51K+ traders from 195+ countries and paid over $51M+ in profits. FundedNext has a maximum profit share of 90%, and unlike most competitors, it pays out 15% during the evaluation period. The average payout time is five hours, and I conducted an in-depth review to determine if this Forex prop firm lives up to its hype. Should you take the funding challenge at FundedNext?

Overview

FundedNext caters to 51K+ traders from 195+ countries and accepts crypto deposits.

I like that FundedNext allows prop traders to use algorithmic trading while paying a fixed profit share of 15% on the starting portfolio balance. The low and refundable evaluation fee ensures accessibility to all. I also like the choice of cryptocurrency deposits available at FundedNext. Traders should choose carefully between the funded account options, as accepted prop traders will have the same settings in their prop account as the evaluation configurations.

Headquarters | United Arab Emirates |

|---|---|

Year Established | 2022 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Minimum Evaluation Fee | $49 (refundable) |

Profit-share | 60% to 90% (progressive) |

Daily Loss Limit | 5% |

Maximum Trailing Drawdown | 10% |

Funded Account Options | 5 |

Minimum Funded Account | $5,000 |

Maximum Funded Account | $200,000 ($300,000 combined) |

FundedNext Trustworthiness & Reputation

Trading with a Forex prop firm, which is an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts, and that the Forex prop firm maintains an excellent reputation among its prop traders.

Is FundedNext Legit and Safe?

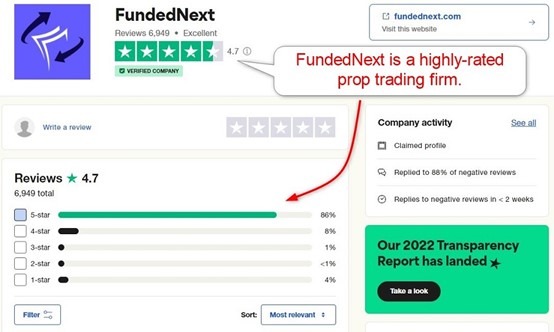

FundedNext is part of Next Ventures, which has an excellent reputation. The management team is open and transparent, and FundedNext has partnerships with leading companies, including Meta and Alphabet. It has a 4.7 out of 5.0 rating on Trustpilot based on 6,930 reviews.

It is transparent concerning its business model and has held three live events. I appreciate the openness at FundedNext, and my review did not uncover any negatives, malpractice, or fraud about FundedNext. Some of the negative reviews on Trustpilot are notably fake.

Therefore, I rate FundedNext among the industry leaders, a disruptor among Forex prop trading firms, and a legitimate and safe company to partner with.

FundedNext Features

FundedNext follows best practices duplicated across the Forex prop firm industry, which remains in its infancy.

The most notable features at FundedNext are:

- One-step or two-step evaluation with a profit target of 25% and 10%, respectively

- A minimum of five to ten trading days to achieve the profit target without a maximum.

- MT4 and MT5 trading platforms

- Maximum leverage of 1:100

- A 3% to 5% daily loss limit

- A 6% to 10% overall loss limit

- 60% to 90% profit share

- 15% profit share during the evaluation process

- Algorithmic trading allowed.

- Copy trading is allowed only between FundedNext Challenge accounts owned by the same person where the combined total value of the accounts is under $300,000.

- Weekend positions and news trading available

- Refundable evaluation fee

- 10% discount on the evaluation fee for retrials

- Average withdrawal time of five hours

- Ability to combine multiple accounts into one with a maximum value of $300,00

- 51 currency pairs, including exotics and emerging markets.

- Five commodities

- 13 indices

- Swap-free trading accounts

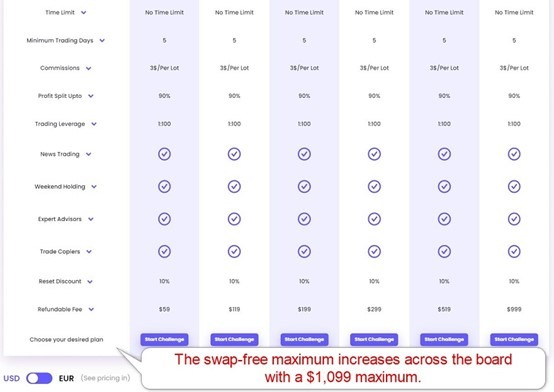

Evaluation Fees & Profit-Share

Traders must pay a one-time evaluation fee per evaluation, dependent on the desired funded account size and evaluation type. It ranges between $49 and $1,099, but FundedNext refunds the one-time evaluation fee for all approved prop traders. Please note that traders cannot change the account value once approved, meaning if they qualify on a $15,000 account, they will manage a $15,000 portfolio.

The maximum profit share of 90% places FundedNext at the top of the range, ensuring prop traders get the highest levels industry-wide. The first payout has a profit share of 60%, the second increases to 75%, and from the third one moving forward, traders get 90%. I also want to note that FundedNext pays a 15% profit share of the starting portfolio during the evaluation period, a feature most competitors do not have.

The minimum evaluation fee at FundedNext for a $6,000 MT4 account is:

Type of fee | Fee (without discounts) |

|---|---|

One-time evaluation fee for a $6,000 funded account (the smallest one) | $59 |

Hold-over-the-weekend | Free |

Double leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total one-time fees for a $6,000 MT4 account | $59 |

Minimum Evaluation Fee | $49 (refundable) |

|---|---|

Maximum Evaluation Fee | $1,099 |

Profit-share | 60% to 90% (progressive) |

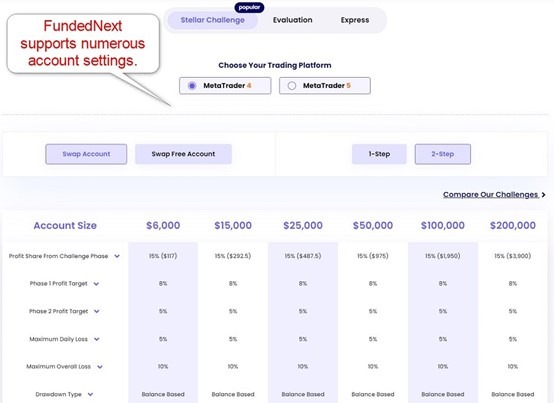

Account Types

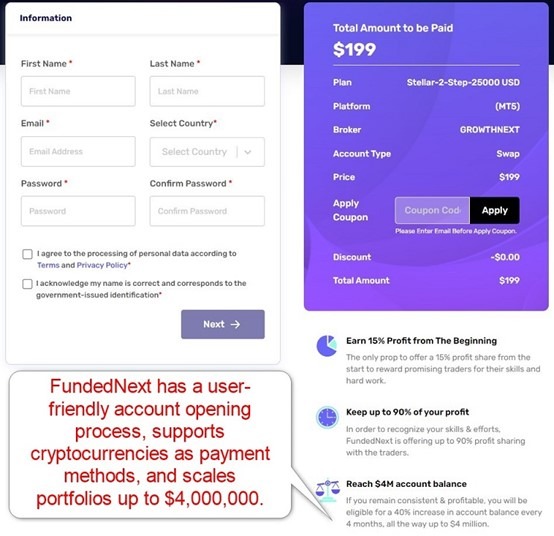

FundedNext offers six account types and three evaluation structures with several sub-account choices, like swap-free trading, one-step or two-step verification, consistency, or non-consistency. While the maximum funded account balance is $200,000, FundedNext allows traders to combine accounts up to a maximum of $300,000. FundedNext rewards consistency and allows portfolio scaling up to $4,000,000.

The evaluation fee depends on the desired account balance and settings, and traders cannot change it once the evaluation begins. The trading rules follow well-established industry standards, except for no upper time limits, and I appreciate that FundedNext does not apply time pressure on performance targets. I also like that FundedNext refunds the evaluation fee to all traders accepted as prop traders.

What are the Trading Rules at FundedNext?

Once prospective prop traders choose their preferred evaluation account settings and pay the evaluation fee, the FundedNext Challenge starts. The minimum trading requirement is five days but without an upper limit. The two-step verification process requires a profit target of 8% and 5%, respectively, versus 10% for the one-step option.

Violating the trading rules results in disqualification, but traders can start again with a 10% discount on the evaluation fee.

The trading rules for the FundedNext Challenge are:

- 5% daily loss limit (two-step verification)

- 3% daily loss limit (one-step verification)

- 10% maximum overall loss (two-step verification)

- 6% maximum overall loss (one-step verification)

- A minimum of five trading days with trading activity

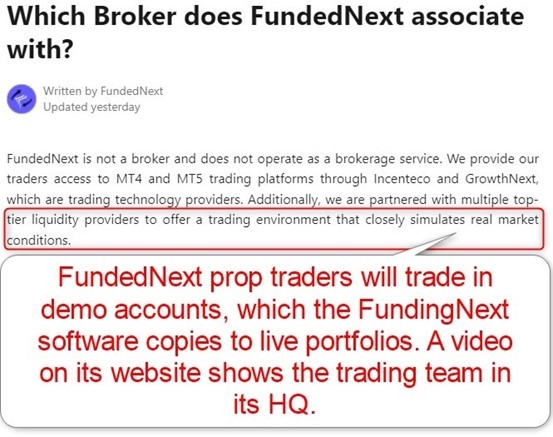

Noteworthy:

- FundedNext will never grant access to live trading accounts.

- Accepted prop traders will manage demo accounts, and the FundedNext software duplicates them in live trading accounts of FundedNext

- It enhances risk management and compliance for FundedNext

FundedNext Futures

FundedNext Futures is FundedNext’s prop trading offering for futures traders, granting access to nominal capital once a futures traders has successfully completed one of the evaluation challenges. FundedNext Futures offers multiple account sizes to suit different trading levels, ranging from smaller starter accounts to larger professional allocations, with the possibility to scale up in line with performance. A high level of profit-sharing is offered, which can be as high as 90%.

A wide variety of futures contracts can be traded, with FundedNext Futures listing an assortment of CME- Group listed futures including equity indices, Forex, metals, energies, and agricultural commodities. Both mini and micro futures are also available.

FundedNext Futures allows access to popular trading platforms like NinjaTrader and Tradovate. There are strict risk management rules, which include daily loss limits and maximum drawdowns.

Trading Platforms

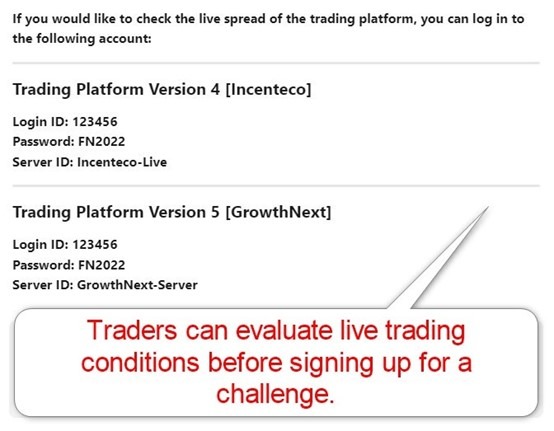

Traders can use MT4, provided by Incenteco Trading Ltd, a Cypriot registered company with license number HE307114, or MT5 from GrowthNext FZC with license number 28831 in the UAE. There are no restrictions on trading strategies, and FundedNext allows algorithmic, news, and weekend trading.

The maximum leverage is 1:100, except for one account type where traders get 1:30. The choice of liquid assets caters well to aggressive short-term traders, the primary target for most prop trading firms. I like that FundedNext provided login details for interested traders to evaluate the spreads, swaps, and other trading conditions.

Platform Languages | Arabic, Bulgarian, Chinese, Croatian, Czech, Danish, Dutch, English, Estonian, French, German, Greek, Hebrew, Hungarian, Indonesian, Italian, Japanese, Korean, Latvian, Mongolian, Polish, Portuguese, Romanian, Russian, Serbian, Slovak, Slovenian, Spanish, Swedish, Thai, Turkish and Vietnamese |

|---|---|

OS Comparability | Windows, Mac, Mobile |

Charting Package | Yes |

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

Education

FundedNext does not provide education, as beginners are not their target market. Only seasoned traders with experience should consider prop trading. I like that FundedNext does not encourage beginners to spend money on an evaluation process, which they generally fail. It shows the genuine approach to prop trading rather than a money grab from failed evaluation fees, and I applaud FundedNext for it.

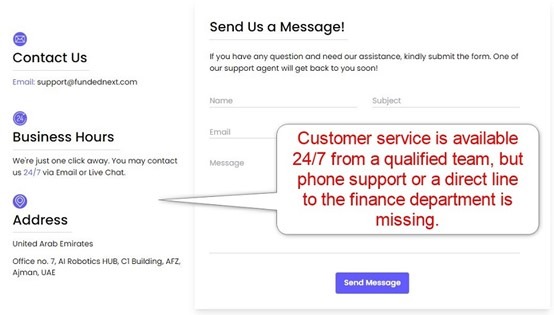

Customer Support

Customer support is available 24/7, and FundedNext, as shown in its corporate video, invests significant resources to ensure top-tier support for all prop traders. I recommend the FAQ section, which answers many questions. Since FundedNext explains its services well, I doubt most traders will require assistance. I appreciate the transparency at FundedNext, which boosts its trustworthiness and credibility, but I am missing a direct line to the finance department, where most issues could arise.

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

How to Get Started with FundedNext

The best way is to select the desired portfolio, settings, and challenge type on the FundedNext homepage, followed by clicking “Start Challenge.” It will load the registration screen, where traders must provide basic details. They can also review their selection before proceeding by clicking “Next.” The final step consists of paying the one-time evaluation fee.

Minimum Evaluation Fee

The minimum evaluation fee at FundedNext is $49 for the $6,000 evaluation challenge.

Payment Methods

FundedNext supports bank transfers, credit/debit cards, Bitcoin, Ethereum, Litecoin, Dogecoin, Solana, USDC, Perfect Money, and USDT (TRC20 and ERC20).

Withdrawal options |     |

|---|---|

Deposit options |     |

Accepted Countries

FundedNext claims traders from 195+ countries and does not list restrictions.

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via bank transfers, credit/debit cards, Bitcoin, Ethereum, Litecoin, Dogecoin, Solana, USDC, Perfect Money, and USDT (TRC20 and ERC20). FundedNext notes that it prefers credit/debit card deposits, and its corporate video highlights its work to enable bank wire withdrawals.

The Bottom Line - Is FundedNext a Good Forex Prop Firm?

I like FundedNext for its transparency, up to 90% profit share, support for cryptocurrency deposits, acceptable terms and conditions, and lack of support for beginner traders. It shows that FundedNext is a genuine Forex prop firm. I also appreciate the absence of trading restrictions, as traders can execute algorithmic, news, and weekend trading. It also pays a 15% profit share during the evaluation period.

FundedNext is highly rated, verified, and transparent. I rate it among the most competitive prop trading firms with a bright future, and I highly recommend FundedNext for traders serious about prop trading.

FundedNext is a Forex prop firm owned by Next Ventures, founded by Bangladeshi entrepreneur Syed Abdullah Jayed in 2022. The maximum funding for an evaluation account is $200,000, but FundedNext allows traders to combine multiple portfolios up to $300,000. Consistent performance qualifies for portfolio scaling up to $4,000,000. FundedNext does not offer cryptocurrency trading. Otherwise, it is a top-tier prop trading firm. FundedNext is a legit company headquartered in the UAE and a subsidiary of Bangladeshi company Next Ventures with offices in five countries. FundedNext does not impose any time limit on its funding challenges, which can be good news for traders hoping to get funded. Yes, the use of EAs (expert advisors) is allowed by FundedNext. Residents of Bangladesh, North Korea, Syria, and the United States cannot open accounts with FundedNext. US persons resident outside the United States also cannot.

FAQs

Who owns FundedNext?

What is the maximum funding for FundedNext?

What are the cons of FundedNext?

Is FundedNext legit?

Is there a time limit for FundedNext?

Does FundedNext allow the use of EAs?

Which countries are banned from FundedNext?