Editor’s Verdict

Funding Traders, founded in 2023 in Hong Kong, is quickly ascending the ranks of the best retail prop firms with more than 5,600 prop traders and payouts of 4.7M+. Traders can earn a profit split of up to 100% and scale accounts up to $2M. I have conducted an in-depth review of the industry-leading trading conditions at Funding Traders. Should you consider the evaluation fee at Funding Traders?

The Pros & Cons of Funding Traders

Traders should consider the pros and cons of Funding Traders. I have summarized the ones that stood out the most during my Funding Traders review.

Overview

Funding Traders offers competitive trading conditions with a 100% profit share.

I like that Funding Traders offers an excellent scaling system that includes professional trading psychologists and performance coaches after prop traders scale for the sixth time. Traders can also purchase add-ons to boost the profit share to 100% and decrease the payout period to seven days.

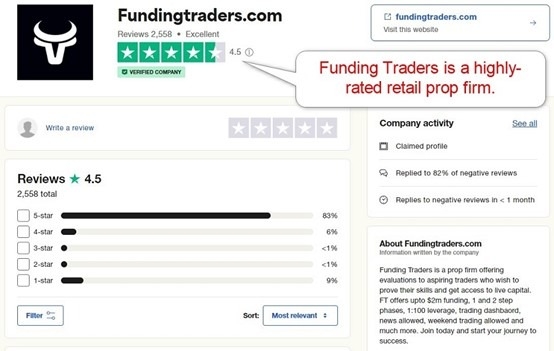

Funding Traders Trustworthiness & Reputation

Trading with a prop firm, an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts and that the prop firm maintains an excellent reputation among its prop traders.

Is Funding Traders Legit and Safe?

Funding Traders, founded in 2023, lacks operational history. It has a 4.5 out of 5.0 rating on Trustpilot based on 2,560 reviews.

My Funding Traders review found several negative reviews about account breaches, but Funding Traders replied to most of them. After reading the replies, I found that most traders failed the 2% risk management rule. I advise traders to consider the negative comments skeptically, as they come from traders who have been unable to pass the paid-for evaluation challenge or breached trading rules in funded accounts. Therefore, I cautiously rate them as a prop trading firm interested traders could try to establish a rapport with.

Funding Traders Features

Funding Traders follows best practices established across the prop firm industry, which continued its rapid expansion.

The most notable features of Funding Traders are:

- One-step and two-step evaluation

- No time limits during the evaluation process

- Commission-free and swap-free trading during the evaluation

- A profit target of 10% for the one-step evaluation

- A profit target of 10 and 5% % for the two-step evaluation

- A minimum of one trading day during the evaluation (except for accounts above $200K)

- A maximum daily drawdown between 4% and 5%

- A maximum drawdown between 5% and 10%

- A maximum profit share of 100% (through add-ons)

- Cryptocurrency withdrawals

- Algorithmic trading, news trading, swing trading, and weekend positions

- Up $2,000,000 funded accounts per trader

- Weekly payouts (via add-ons)

- Average payout time of 24 hours

Evaluation Fees & Profit-Share

Minimum Evaluation Fee | $50 |

|---|---|

Maximum Evaluation Fee | $3,000 |

Profit-share | 100% |

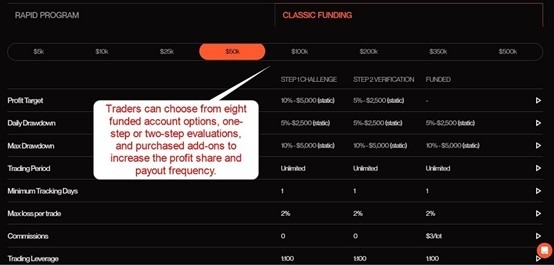

Prospective prop traders pay a one-time evaluation fee dependent on their desired funded account size and evaluation type. Funding Traders also offers add-ons to increase the maximum profit split to 90% or 100% and decrease the payout frequency to weekly.

Funding Traders has eight funding options with one-step and two-step evaluations with fees, without add-ons, ranging between $50 and $3,000. Please note that traders cannot change the account value once approved, meaning if they qualify on a $5,000 account, they will manage a $5,000 portfolio. The profit share without add-ons at Funding Traders is 80%.

The minimum evaluation fee at Funding Traders for a $5,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $50 |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | $0 |

Increased leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $5,000 account | $50 ($57.50 with 90% profit share, $65.00 with 100% profit share, $77.50 with 100% profit share and weekly payouts) |

Account Types

Funding Traders has eight funding options and a choice of one-step and two-step evaluations. Prop traders can choose account types of $5,000, $10,000, $25,000, $50,000, $100,000, $200,000, $350,000, and $500,000. Prop traders can manage a maximum of $2,000,000. The maximum leverage is 1:100 for Forex traders, 1:50 for metals and indices, and 1:5 for cryptocurrencies.

The maximum daily drawdown is 4% for the one-step evaluation and 5% for the two-step alternative, with a maximum drawdown of 5% and 10%, respectively.

The scaling plan allows traders to increase their account balance by 25% every two months if they achieve a monthly profit of 8%+. It also includes gold and platinum levels, with added perks for prop traders.

What are the Trading Rules at Funding Traders?

The Funding Traders evaluation begins after prospective prop traders choose their preferred evaluation account and pay the one-time evaluation fee. There is no time limit, and the profit target is 10% for the one-step evaluation and 10% and 5% for the two-step option. Funding Traders also has a 2% maximum loss rule per trade, and I want to alert traders to consider the 2% rule, as many failed challenges occur from breaching this rule.

Violating the maximum overall loss rule or the 2% rule results in a hard breach and cancellation of the evaluation.

The trading rules for the Funding Traders evaluation are:

- 5% maximum loss from the starting balance for the one-step evaluation

- 10% maximum loss from the starting balance for the two-step evaluation

- 4% daily loss limit for the one-step evaluation and 5% daily loss limit for the two-step

- No trade can lose more than 2% of the account balance

- A minimum of one trading day for the evaluation

Noteworthy:

- Funding Traders will not grant access to live trading accounts

- Accepted prop traders will manage demo accounts, and the Funding Traders software duplicates them in live trading accounts of Funding Traders

- It enhances risk management and compliance for Funding Traders

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

Funding Traders offers MT5 to all non-US traders and TradeLocker and DXtrade for all traders. Regrettably, Funding Traders does not disclose which broker or brokers it uses. Traders pay a $3.00 commission per lot, which I assume applies per side, and raw spreads trading from 0.0 pips, but I would like Funding Traders to be more transparent in this category on its website. It provides login details for TradeLocker and DXtrade accounts, allowing interested traders to evaluate spreads, slippage, and order execution speed.

Education

Funding Traders does not offer education, and beginners should never consider prop trading. I appreciate the absence of tools to encourage beginners to attempt prop trading. I also like that prop traders who scale their portfolios receive benefits, including professional trading psychologists and performance coaches.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

During my Funding Traders review, prop traders received 24/7 customer support e-mail, Discord, and live chat. I recommend the FAQ section as the first point of support interaction, as it answers many questions. Despite available customer support methods, I am missing a direct line to the finance department, where most issues could arise.

How to Get Started with Funding Traders

Interested prop traders can start the evaluation after selecting their desired package and paying the one-time fee.

Minimum Evaluation Fee

The minimum evaluation fee at Funding Traders is $50 for the $5,000 account.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |    |

Funding Traders accepts credit/debit cards and cryptocurrency transactions.

Accepted Countries

Funding Traders does not list accepted or restricted countries on its website.

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via credit/debit cards and cryptocurrencies.

The Bottom Line - Is Funding Traders a Good Prop Firm?

I like Funding Traders as it allows traders to purchase and add-on to increase the maximum profit share to 100%, but I want to caution traders to consider the 2% risk management rule. It states that no one trade can lose more than 2% of the account balance. The trading conditions are competitive, and Funding Traders allows algorithmic trading solutions. The evaluation conditions match established industry standards but exclude time pressure. I found the usual complaints about prop firms but could not verify them. Therefore, I can cautiously recommend Funding Traders to prop traders who wish to build a rapport with this Hong Kong-based retail prop firm. The 2% rule states that no one trade can lose more than 2% of the portfolio value.FAQs

What is the 2% rule in Funding Traders?