Editor’s Verdict

Fusion Markets features a highly competitive Forex cost structure, commission-free US equity trading and no non-trading fees. Traders get the MT4/MT5 trading platform, VPS hosting, and a choice of copy trading services, including a proprietary option. I conducted an in-depth review to evaluate if traders get a competitive edge at this broker. Does Fusion Market offer the best trading conditions for your Forex portfolio?

Overview

Ultra-low trading fees and quality trading tools with a choice of copy trading services.

Headquarters | Australia |

|---|---|

Regulators | ASIC, FSA, VFSC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2017 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $0 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | 0.3 pips ($3.00) |

Average Trading Cost GBP/USD | 1.4 pips ($14.00) |

Average Trading Cost WTI Crude Oil | $0.02 |

Average Trading Cost Gold | $0.11 |

Average Trading Cost Bitcoin | $48.00 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.9 pips |

Minimum Commission for Forex | $4.50 per lot |

Funding Methods | 22 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the trading fees, 90+ currency pairs, and choice of payment processors at Fusion Markets. Traders also benefit from high leverage with negative balance protection, quality trading tools, and VPS hosting for 24/5 low latency algorithmic trading, while copy traders get five copy trading services. The choice of products and services places Fusion Markets among the most competitive Forex brokers.

Fusion Markets Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Fusion Markets presents clients with three regulated entities and maintains a secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Australia | Australian Securities and Investment Commission | 226199 |

Seychelles | Financial Services Authority | SD096 |

Vanuatu | Vanuatu Financial Services Commission | 40256 |

Is Fusion Markets Legit and Safe?

Fusion Markets, founded in 2017, began accepting clients in 2019, and it serves them from three well-regulated subsidiaries, where Fusion Markets maintains a spotless regulatory record. It segregates client deposits from corporate funds held at HSBC and National Australia Bank and offers negative balance protection. While it lacks the operational history, my review found no signs of misconduct. I trust that Fusion Markets will continue to provide its clients with a trustworthy and safe trading environment as it increases its market share and rank it among the safest Forex brokers.

Does Fusion Markets accept US clients?

No, Fusion Markets is not licensed in the U.S. and is not configured to accept US persons as clients. Check out the best forex platforms in the USA available to US traders.

Fees

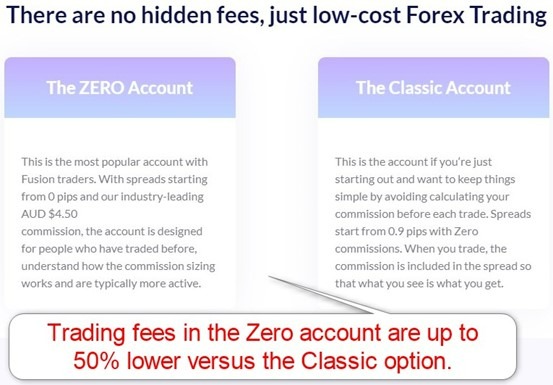

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Traders at Fusion Markets will benefit from one of the lowest cost structures with raw spreads from 0.0 pips for a commission of $4.50 per 1.0 standard round lot. I advise against the commission-free alternative, where costs are twice as high at 0.9 pips or $9.00. Equity CFD trading is commission-free, and Fusion Markets also offers low swap rates on leveraged overnight positions. I also like the absence of non-trading fees, making Fusion Markets one of the cheapest brokers I have reviewed, fulfilling their mission statement.

Average Trading Cost EUR/USD | 0.3 pips ($3.00) |

|---|---|

Average Trading Cost GBP/USD | 1.4 pips ($14.00) |

Average Trading Cost WTI Crude Oil | $0.02 |

Average Trading Cost Gold | $0.11 |

Average Trading Cost Bitcoin | $48.00 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.9 pips |

Minimum Commission for Forex | $4.50 per lot |

Deposit Fee | |

Withdrawal Fee |

The minimum trading costs for the EUR/USD at Fusion Markets are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.9 pips (Classic) | $0.00 | $9.00 |

0.0 pips (Zero) | $4.50 | $4.50 |

Here is a snapshot of Fusion Markets trading fees:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based Zero account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.0 pips | $4.50 | -$8.09 | X | $12.56 |

0.0 pips | $4.50 | X | $4.39 | $0.11 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.0 pips | $4.50 | -$56.63 | X | $61.13 |

0.0 pips | $4.50 | X | $30.73 | -$26.23 |

Noteworthy:

- Fusion Markets offers positive swap rates in qualifying assets, meaning traders get paid for holding leveraged overnight positions, like in the example above on EUR/USD short positions

Range of Assets

Forex traders at Fusion Markets get 90+ currency pairs, which ranks among the broadest sector selections industry-wide. Traders can diversify their portfolios with 14 cryptocurrencies, 22 commodities, 15 index CFDs, and 110 US equity CFDs. I like the asset selection, especially for Forex traders. The choice of equities focuses on large-cap blue-chip stocks, but I am missing international ones and ETFs. While the selection suffices for traders seeking highly liquid stocks and those trading names trending on social media, it remains insufficient to manage diversified equity portfolios.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

Fusion Markets Leverage

The maximum Forex leverage at Fusion Markets is 1:500, in line with international standards in business-friendly and well-regulated trading environments. Traders with the Australian subsidiary get 1:30, per ASIC restrictions. Index leverage is 1:100 but can increase to 1:200 after three to four weeks, dependent on the trading history. Commodities max out at 1:100 for metals and 1:500 for soft commodities, equity CFDS at 1:20, and cryptocurrency traders get 1:10.

I like the four-tier leverage table, where Fusion Markets lower the maximum based on the account equity. It is an excellent mechanism aiding risk management for traders and Fusion Markets. Traders must ensure they deploy proper risk management to avoid magnified trading losses. Negative balance protection exists, meaning traders can never lose more than their deposits.

Fusion Markets Trading Hours (GMT +2)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:02 | Sunday 23:59 |

Forex | Monday 00:02 | Friday 23:59 |

Commodities | Monday 01:00 | Friday 23:59 |

European Equities | Not applicable | Not applicable |

US Equities | Monday 16:30 | Friday 23:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, and commodities, which essentially trade 24/5, and cryptocurrencies which trade 24/7

Account Types

Fusion Markets offers two account types, the commission-free Classic, and the commission-based Zero option. Since there is no minimum deposit requirement, Fusion Markets notes the client average is $1,500+. I highly recommend the Zero account, as trading fees are up to 50% cheaper. Supported account base currencies are AUD, CAD, EUR, GBP, JPY, THB, SGD, and USD.

A swap-free Islamic account exists, but minimum commission-free trading fees increase to 1.4 pips or $14.00 per lot versus $9.00 in the Classic account. After seven days, Fusion Markets applies an admin fee between $15 and $30.

Fusion Markets Demo Account

The Fusion Markets demo account is fully customizable, and I did not find a time restriction, making it ideal for all traders. Traders can open more than one and manage them from the back office, Fusion Hub. I recommend traders select demo account settings similar to their planned live deposits to create the most realistic demo trading experience.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to the full range of trading psychology and can create unrealistic trading expectations.

Trading Platforms

Traders get out-of-the-box MT4/MT5 trading platforms as customizable desktop clients, lightweight web-based alternatives, and user-friendly mobile apps. They fully support algorithmic trading and have embedded copy trading services. MT4 remains the industry leader with 25,000+ custom indicators, plugins, and EAs available for MT4, but the quality upgrades are not free.

Fusion Markets offers one MT4/MT5 indicator providing actionable trading recommendations. It also has cutting-edge trading tools accessible from the back office. Traders may use them with MT4/MT5, but it creates a less efficient trading environment than having access directly from the trading platforms.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Besides the embedded MT4/MT5 copy trading services, Fusion Markets offers Myfxbook Autotrade and DupliTrade. Alternatively, traders can consider the proprietary Fusion+ service, where Fusion Markets limits performance fees to 30%. The service costs $10 monthly unless the signal provider and follower accounts accumulate monthly volumes of 2.5 lots of Forex and commodity trades.

Fusion Markets partnered with NYC Servers for MT4 and MetaQuotes, the developer of MT4/MT5, for MT5 VPS hosting. It ensures algorithmic traders get low latency 24/5 market access. VPS hosting at Fusion Markets is complimentary if traders exceed 20.0 lots in Forex and commodity trading volume over 30 days.

MT4 MAM accounts are available for licensed asset managers, but their client accounts must commit to a non-negotiable minimum account balance of $5,000.

Research & Education

Fusion Markets offers research and actionable trading signals in partnership with third-party providers, which is an efficient approach. The only issue I have is that traders must access them via Fusion Hub, the back office of Fusion Markets, as I would prefer them inside the trading platform.

The three research tools are Analyst View, a combination of fundamental and technical analysis and trading set-ups which are easy to follow and add to trading accounts, Technical Insights, which offers a balanced analysis that may highlight trading opportunities and Market Buzz, an AI-assisted service sourcing through thousands of articles to determine trends with automated events detection.

Fusion Markets does not provide meaningful education to beginners. While its blog and the Technical Insights section include educational content, it does not substitute for a well-thought-through course to help beginners start their Forex journey. I do not consider the absence of education a negative, but it creates a services gap compared to established brokers.

I recommend beginners learn how to trade elsewhere via online educational sources available for free and start with trading psychology while avoiding paid-for courses and mentors.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |       |

Fusion Markets notes 24/5 customer support in 30+ languages, but I only came across e-mail support during my review. The FAQ section left me unsatisfied and searching for answers elsewhere. Live chat is supposed to exist, but I could not access it anywhere. Additionally, I am missing a direct phone line to the finance department, where most issues can arise.

Bonuses and Promotions

Fusion Markets neither offered bonuses nor promotions during my review. It has three partnership programs for passive income opportunities.

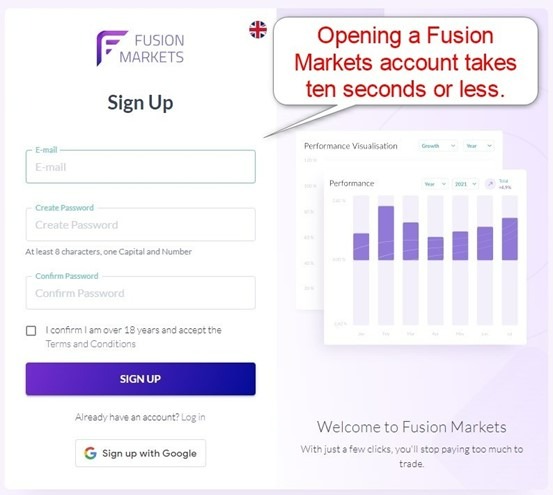

Opening an Account

The online application at Fusion Markets only asks for an e-mail and desired password. Traders may also use their Google account to complete this step, which grants access to Fusion Hub, the secure and user-friendly back office of Fusion Markets. I like that Fusion Markets does not ask unnecessary questions or engage in data collection for its international traders. Clients at the ASIC subsidiary may have to fill out a questionnaire where Fusion Markets asks additional questions about their finances and trading history.

Account verification is mandatory, as Fusion Markets complies with strict AML/KYC requirements stipulated by its three regulators. Uploading a copy of their government-issued ID and one proof of residency document satisfies it for most traders. Fusion Markets might ask for additional information on a case-by-case basis.

Minimum Deposit

Fusion Markets does not have a minimum deposit requirement, but its FAQ section notes the average deposit is $1,500+.

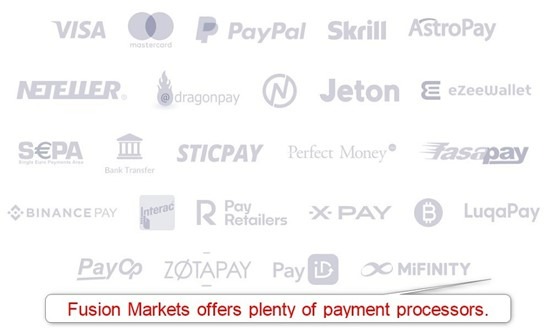

Payment Methods

Fusion Markets supports bank wires, credit/debit cards, PayPal, Skrill, Neteller, FasaPay, Jeton Wallet, Perfect Money, Online Naira, Doku, STIC Pay, Xpay, Pay Retailers, and several cryptocurrency processors. Geographic restrictions may apply.

Accepted Countries

Fusion Markets accepts traders from many countries except Afghanistan, Congo, Iran, Iraq, Myanmar, New Zealand, North Korea, Palestine, Russia, Somalia, Sudan, Syria, Ukraine, Yemen, and the United States or its territories.

Deposits and Withdrawals

The secure Fusion Hub handles all financial transactions for verified clients.

Fusion Markets has no minimum deposit or withdrawal amounts or internal processing costs. International bank wires face a $20 to $30 fee, and traders should consider potential third-party charges or currency conversion fees. I like the choice of payment processors, but many have geographic restrictions. The Fusion Hub will only list the ones available to traders.

Only verified trading accounts can deposit and withdraw, and the name on the payment processor must match the Fusion Markets account name. Fusion Market does not have a transparent table for its deposit and withdrawal methods, where it lists all necessary details, like internal processing times or supported currencies, which I determine as a regrettable oversight.

Is Fusion Markets a good broker?

I like the trading environment at Fusion Markets for its low trading fees and choice of payment processors. Fusion Markets is ideal for algorithmic traders, who benefit from high leverage, deep liquidity, and free VPS hosting. Copy traders can diversify via five providers, and manual traders get three quality trading tools. I also like the asset selection for Forex traders with 90+ currency pairs. I cannot recommend this broker for equity traders who require a balanced asset selection, and I find the absence of ETFs notable. Overall, I rank Fusion Markets among the best Forex brokers. Fusion Markets does not state its trade execution time. Fusion Markets does not levy internal deposit fees. Fusion Markets is a market maker / ECN hybrid broker. Phil Horner founded Fusion Markets and is its CEO, but the complete ownership structure is unknown as Fusion Markets is a private company. There is no minimum deposit requirement at Fusion Markets. Fusion Market complies with three regulators and has a spotless operational record. I rank Fusion Markets among the trustworthy Forex brokers.FAQs

How long does Fusion Markets’ trade execution take?

How much is Fusion Markets’ deposit fee?

Is Fusion Markets an ECN broker?

Who owns Fusion Markets?

What is the minimum deposit at Fusion Markets?

Is Fusion Markets trustworthy?