Editor’s Verdict

FXIFY, founded in 2023 and headquartered in the UK, claims $30M+ payouts to its prop traders over the past twelve months, placing it among the most successful prop firms. Traders can choose from eight account types from $5,000 and scale up to $4M with a maximum profit share of 90%. My comprehensive FXIFY review evaluated the trading conditions for you. So, is FXIFY the best prop trading firm for your portfolio?

The Pros and Cons of FXIFY

Traders should consider the pros and cons of FXIFY. I have summarized the ones that stood out the most during my FXIFY review.

Overview

FXIFY allows algorithmic trading, martingale strategies, grid trading, and news trading.

I like the absence of trading restrictions at FXIFY combined with 300+ liquid assets and the ability to scale accounts up to $4M. All accounts are with FXPIG, which handles the trading infrastructure featuring raw spread trading from 0.0 pips and 100% STP execution via 20+ bank and non-bank liquidity providers.

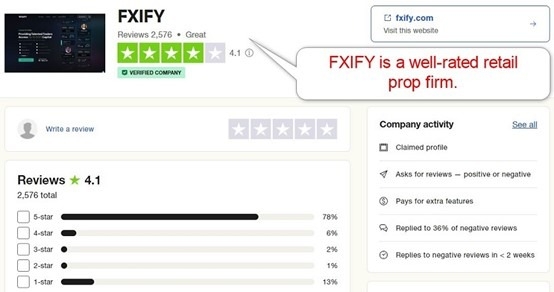

FXIFY Trustworthiness and Reputation

Trading with a prop firm, an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts and that the prop firm maintains an excellent reputation among its prop traders.

Is FXIFY Legit and Safe?

FXIFY, founded in 2023, is a prop trading firm that lacks operational history. It has a 4.1 out of 5.0 rating on Trustpilot based on 2,576 reviews.

My FXIFY review found several negative reviews about account breaches and withdrawals, but I could not verify them. I advise traders to consider the negative comments skeptically, as they could come from traders who have failed the paid-for evaluation challenge or breached trading rules in funded accounts. Therefore, I cautiously rate them as a prop trading firm interested traders could try to establish a rapport with.

FXIFY Features

FXIFY follows the best practices established across the prop firm industry, which continued its rapid expansion.

The most notable features of FXIFY are:

- One-step, two-step, and three-step evaluation

- No time limits during the evaluation process

- A profit target of 10% for the one-step evaluation

- A profit target of 10 and 5% % for the two-step evaluation

- A profit target of 5%, 5%, and 5% % for the three-step evaluation

- A minimum of five trading days during the evaluation

- A maximum daily drawdown between 3% and 5%

- A maximum drawdown between 5% and 10%

- 90% profit share

- Cryptocurrency withdrawals

- Algorithmic trading, martingale strategies, grid trading, news trading, and weekend positions

- Up to $4,000,000 funded accounts per trader

- No consistency rules

- Bi-weekly payouts

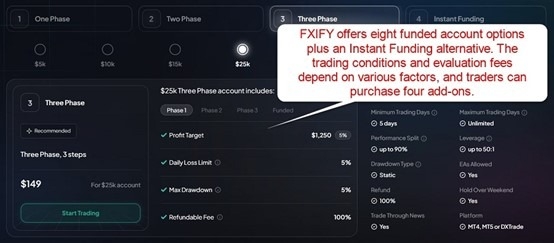

Evaluation Fees and Profit-Share

FXIFY levies a one-time evaluation fee dependent on their desired funded account size and evaluation type. Prop traders can also purchase four add-ons to increase the maximum leverage to 1:50 at the cost of 25% of the evaluation fee, the profit split to 90% for a 20% fee, receive bi-weekly payouts instead of monthly ones for a 5% fee and enable performance protection for an additional 15%.

FXIFY has eight funding options with one-step, two-step, and three-step evaluations with fees, without add-ons, ranging between $39 and $1,999. Please note that traders cannot change the account value once approved, meaning if they qualify on a $5,000 account, they will manage a $5,000 portfolio. The maximum profit share at FXIFY is 90%.

Minimum Evaluation Fee | $39 |

|---|---|

Maximum Evaluation Fee | $1,999 |

Profit-share | 90% |

The minimum evaluation fee at FXIFY for a $5,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $39 |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | $0 |

Increased leverage | 25% of the evaluation fee |

Stop-loss not required at trade entry | $0 |

Total fees for a $5,000 account | $39 ($48.75 with the increased leverage add-on, $64.35 with all available add-ons) |

Account Types

Traders get eight funding options and a choice of one-step, two-step, and three-step evaluations. The funded account types are $5,000, $10,000, $15,000, $25,000, $50,000, $100,000, $200,000, and $400,000. Prop traders can manage a maximum of $4,000,000. The maximum leverage is 1:50 via the add-on or 1:30 without it.

An Instant Funding account is available, which has an 8% daily loss and maximum trailing drawdown, but costs are notably higher. For example, a $25K funded account costs $899 versus $149 for the three-step evaluation alternative.

The maximum daily drawdown is between 3% and 5%, with a maximum drawdown between 5% and 10%, which depends on the evaluation configurations.

What are the Trading Rules at FXIFY?

The FXIFY evaluation begins after prospective prop traders choose their preferred evaluation account and pay the one-time evaluation fee. There is no time limit, and the profit target is 10% for the one-step evaluation, 10% and 5% for the two-step option, and 5%, 5%, and 5% for the three-step alternative.

Violating the maximum overall loss rule results in a hard breach and cancellation of the evaluation.

The trading rules for the FXIFY evaluation are:

- 6% maximum loss from the starting balance for the one-step evaluation

- 10% maximum loss from the starting balance for the two-step evaluation

- 5% maximum loss from the starting balance for the three-step evaluation

- 3% daily loss limit for the one-step evaluation, 4% daily loss limit for the two-step alternative, and 5% daily loss limit for the three-step option

- A minimum of five trading days for the evaluation

Noteworthy:

- FXIFY will not grant access to live trading accounts

- Accepted prop traders will manage demo accounts, and the FXIFY software duplicates them in live trading accounts of FXIFY

- It enhances risk management and compliance for FXIFY

Trading Platforms

FXIFY offers MT4/MT5 to all non-US traders and DXtrade for US-resident traders. All accounts are with FXPIG, featuring raw-spread trading, competitive fees, and no strategy restrictions. FXIFY is one of a few prop firms allowing algorithmic trading, martingale strategies, grid trading, news trading, and weekend positions. Interested prop traders can check the FXPIG website for trading conditions.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

Education

FXIFY does not offer education, and beginners should never consider prop trading. I appreciate the absence of tools to encourage beginners to attempt prop trading.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

During my FXIFY review, 24/5 customer support was available via e-mail and live chat, but I am missing a direct line to the finance department, where most issues could arise. I recommend the FAQ section as the first point of support interaction, as it answers many questions.

How to Get Started with FXIFY

Interested prop traders can start the evaluation after selecting their desired package and paying the one-time fee.

Minimum Evaluation Fee

The minimum evaluation fee at FXIFY is $39 for the $5,000 three-step evaluation.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |    |

FXIFY accepts credit/debit cards and cryptocurrency transactions.

Accepted Countries

FXIFY accepts traders that will pass the Rise AML/KYC process.

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via credit/debit cards and cryptocurrencies.

The Bottom Line - Is FXIFY a Good Prop Firm?

I like FXIFY as it does not restrict prop traders, allowing algorithmic trading, martingale strategies, grid trading, news trading, and weekend positions. I also like the low evaluation fees and competitive trading conditions. The evaluation conditions match established industry standards but exclude time pressure, and prop traders may purchase four add-ons to improve trading and withdrawal conditions. I found the usual complaints about prop firms but could not verify them. Therefore, I can cautiously recommend FXIFY to prop traders who wish to build a rapport with this UK-based retail prop firm. Like all retail prop firms, FXIFY is unregulated but duly registered. All FXIFY accounts are with FXPIG, a regulated broker. The maximum profit split at FXIFY is 90%. FXIFY pays via Rise, bank wires, and cryptocurrencies. FXIFY is a legitimate retail prop trading firm registered in the UK.FAQs

Is FXIFY regulated?

What is the profit split on FXIFY?

How does FXIFY payout work?

Is FXIFY legitimate?