For over a decade, DailyForex has been the trusted forex broker authority, establishing an unrivaled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions. Once you’ve explored our in-depth review of Go Markets, discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

GO Markets, founded in 2006, maintains highly competitive trading fees, a quality choice of trading platforms, and a well-balanced asset selection. GO Markets is a good choice for beginners and seasoned traders, and my GO Markets review evaluated its trading conditions. Should you trade with GO Markets?

Overview

GO Markets provides cryptocurrency traders with a high-quality asset selection.

Headquarters | Australia |

|---|---|

Regulators | ASIC, CySEC, FSA, FSC Mauritius |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2006 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, cTrader, Trading View |

Average Trading Cost EUR/USD | 0.2 pips + $5 commission ($7.00) |

Average Trading Cost GBP/USD | 0.2 pips + $5 commission ($10.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.16 |

Average Trading Cost Bitcoin | $25.01 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 |

Minimum Commission for Forex | $5.00 per 1.0 standard round lot |

Funding Methods | 6 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

GO Markets Five Core Takeaways

- 1:500 maximum Forex leverage

- 22+ liquidity providers

- 24/7 cryptocurrency CFD trading

- Volume-based rebates

- Limited payment processors

GO Markets Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend checking claimed licenses with the relevant regulatory authority and checking the provided license against their database. GO Maagainsts has four regulated entities.

Country of the Regulator | Australia, Cyprus, Mauritius, Seychelles |

|---|---|

Name of the Regulator | ASIC, CySEC, FSA, FSC Mauritius |

Regulatory License Number | 254963, 322/17, SD043, GB 19024896 |

Regulatory Tier | 1, 1, 4, 4 |

Is GO Markets Legit and Safe?

My review found no misconduct or malpractice by this broker. Therefore, I recommend GO Markets as it is a legitimate broker.

GO Markets regulation and security components:

- Regulated by the ASIC, CySEC, FSA, FSC

- Founded in 2006

- Segregation of client deposits from corporate funds

- Negative balance protection

What Would I Like GO Markets to Add?

GO Markets is a secure and trustworthy broker. Still, I would like GO Markets to consider membership with the Hong Kong-based Financial Commission, which provides third-party audits and a €20,000 compensation fund per claim to all traders. Additionally, a third-party insurance package to enhance protection and more transparency about its core management team would further increase trust in this broker.

Fees

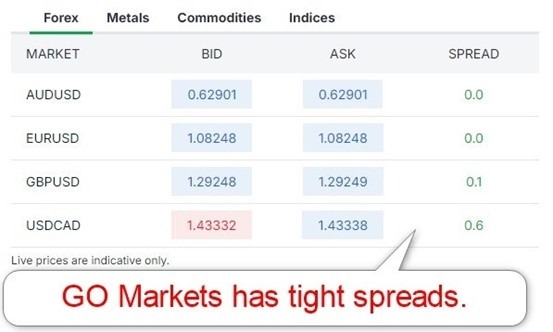

Trading costs are crucial to profitability, so they are worth considering very carefully. GO Markets offers a more expensive commission-free cost structure and an ultra-competitive commission-based alternative.

GO Markets does not levy internal deposit or withdrawal fees, but third-party processing costs and currency conversion fees may apply. An inactivity fee is not applied.

Average Trading Cost EUR/USD | 0.2 pips + $5 commission ($7.00) |

|---|---|

Average Trading Cost GBP/USD | 0.2 pips + $5 commission ($10.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.16 |

Average Trading Cost Bitcoin | $25.01 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 |

Minimum Commission for Forex | $5.00 per 1.0 standard round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

The average trading costs for the EUR/USD at GO Markets are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

1.0 pips (Standard) | $0.00 | $10.00 |

0.2 pips (Raw) | $5.00 | $7.00 |

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategies, they may be the most critical fee for some traders. I always recommend that traders check these before evaluating the total trading costs

Below is a list of trading cost examples when buying and selling the EUR/USD currency pair, keeping the trade open for one night and seven nights in the commission-based GO Plus+ account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the GO Plus+ account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.2 pips | $5.00 | -$6.41 | X | -$13.41 |

0.2 pips | $5.00 | X | $3.69 | -$3.31 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights in the GO Plus+ account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.2 pips | $5.00 | -$44.87 | X | -$51.87 |

0.2 pips | $5.00 | X | $25.83 | $18.83 |

Noteworthy:

- GO Markets sometimes passes on positive swap rates on qualifying assets.

Range of Assets

Traders can achieve cross-asset diversification via the well-balanced GO Markets asset selection, but I would appreciate more exposure to European shares for equity traders.

GO Markets covers the following asset classes:

- Forex

- Cryptocurrencies

- Commodities

- Indices

- Equities

- ETFs

- Bonds

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

GO Markets Leverage

Maximum Retail Leverage | 1:500 |

Maximum Pro Leverage | 1:500 |

What Should Traders Know About GO Markets Leverage?

- Forex, commodity, metals, and index traders get a maximum leverage of 1:500.

- Bond traders get 1:100

- Cryptocurrency, equity, and ETF traders get a maximum leverage of 1:20.

- Negative balance protection exists.

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

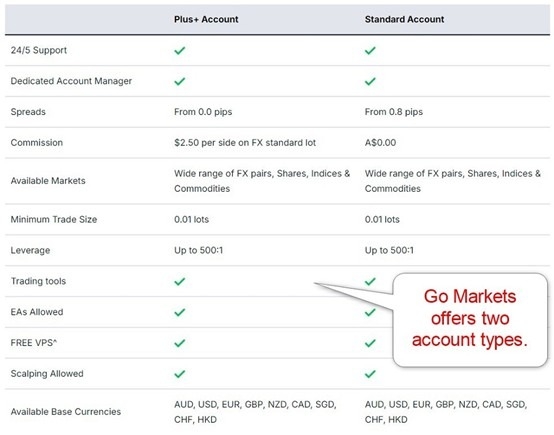

Account Types

Traders can choose between a more expensive commission-free Standard account and an ultra-low-cost commission-based Plus+ alternative. GO Markets also offers a demo account and a swap-free Islamic account.

My observations concerning the GO Markets account types are:

- AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, and HKD as account base currencies

- 1:500 leverage with negative balance protection

- The minimum trade size is 0.01 lots

- Volume-based rebates

GO Markets Demo Account

Demo trading does not grant exposure to the full range of trading psychology and can create unrealistic expectations. Therefore, I want to caution beginner traders against using demo trading as a simulation tool when it is best suited to basic education and earning about a particular broker/platform.

What stands out about the GO Markets demo account?

- A $50,000 default demo balance

- Real-time spreads

- No expiration

Trading Platforms

GO Markets offers MT4/MT5 and cTrader as powerful desktop clients, lightweight web-based alternatives, and popular mobile apps. I recommend the MT4/MT5 desktop clients, which feature all the functions, including algorithmic trading. Traders can upgrade MT4 with 25,000+ custom indicators, templates, and EAs and MT5 with 10,000+. TradingView is also available.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

The four unique features that stood out to me are the MT4/MT5 Genesis upgrade, PAMM accounts for traditional account management, volume-based rebates, and free VPS hosting.

Research & Education

GO Markets publishes trading ideas but no actionable trading recommendations.

The Education hub offers a quality introduction to Forex trading, including courses that require free enrollment.

My conclusion:

- Beginners can start with the GO Markets Education hub.

- Traders should also seek in-depth education from third parties, starting with trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

Customer Support

GO Markets offers 24/7 customer support via e-mail and phone, but I recommend that traders browse the FAQs before contacting support.

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |               |

Bonuses and Promotions

No bonuses or promotions were available when this GO Markets review was written.

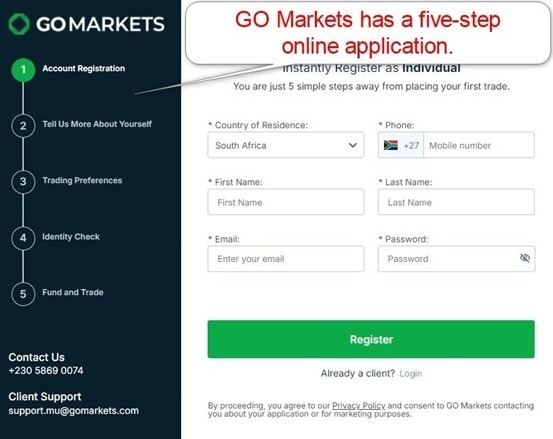

Opening an Account

GO Markets has a swift online application.

What Should Traders Know About the GO Markets Account Opening Process?

- GO Markets complies with global AML/KYC requirements

- Account verification is mandatory

- Most traders pass verification by uploading a copy of a government-issued ID and one proof of residency document.

- GO Markets may ask for additional information on a case-by-case basis.

Minimum Deposit

GO Markets has no minimum deposit.

Payment Methods

GO Markets accepts bank wires, credit/debit cards, Skrill, and Neteller. Payments can also be made in cryptocurrencies and there are local payment processor options available depending upon country of residence.

Withdrawal options |      |

|---|---|

Deposit options |        |

Accepted Countries

During my GO Markets review, the broker stated: "The information on this site is not directed to residents of any country or jurisdiction where such distribution or use would be contrary to local laws or regulations."

Deposits and Withdrawals

The secure GO Markets back office handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at GO Markets?

- Accepted deposit currencies are AUD, USD, GBP, EUR, AED, SGD, CAD, CHF, HKD, and NZD.

- Deposit processing times are one to two hours, except for bank wires, which can take one to two business days.

- GO Markets does not list a minimum withdrawal amount.

- First-time deposits and withdrawals take between one and three business days.

- Traders must submit their wire transfers by 7 a.m. MUT for same-day processing.

- Third-party payment processing costs and currency conversion fees may apply.

- The payment processor's name and GO Markets trading account must match and comply with AML regulations.

Is GO Markets a good broker?

I like the trading environment at GO Markets for its ultra-low trading fees in the Go Plus+ account, deep liquidity from 22+ liquidity providers, and well-balanced asset selection. PAMM accounts cater to traditional account management. Copy traders can use embedded MetaTrader and cTrader services, and social traders can connect with 50M+ peers at TradingView. Therefore, I rank GO Markets among the best Forex brokers. GO Markets has no minimum deposit. The ASIC, CySEC, FSA, and FSC regulate GO Markets. GO Markets processes withdrawals the same day if traders submit their requests by 7 a.m. MUT. GO Markets ranks among the best Forex brokers with ultra-low trading fees in the Go Plus+ account, deep liquidity from 22+ liquidity providers, a well-balanced asset selection, and cutting-edge trading platforms.FAQs

What is the minimum deposit for GO Markets?

Is Go Markets regulated?

How long does it take to withdraw money from GO Markets?

Is GO Markets a good broker?