For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Certain products & services may or may not be available to all clients depending on which HFM Group entity their trading account(s) adheres to.

Editor’s Verdict

HFM offers clients upgraded MT4/MT5 trading platforms, PAMM accounts, and a proprietary copy trading service. The core trading environment consists of cutting-edge trading tools, low trading costs, a balanced asset selection, and high leverage. Quality education and research are also available. I reviewed this broker to determine if it provides demanding traders with an edge. Should you trade with HFM?

Overview

One of the Most Competitive Overall Trading Environments.

Headquarters | Cyprus |

|---|---|

Regulators | CMA, DFSA, FCA, FSA, FSC Mauritius, FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2010 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $0 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Average Trading Cost EUR/USD | 1.3 pips |

Average Trading Cost GBP/USD | 1.9 pips |

Average Trading Cost WTI Crude Oil | $0.06 |

Average Trading Cost Gold | $0.27 |

Average Trading Cost Bitcoin | $76 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the range of products HFM provides, starting with the 12-plugin upgrade for MT4/MT5. HFM also understands the importance of competitive regulation, leverage, and loyalty programs. With more than 2,500,000 live accounts supporting 27+ languages, HFM understands the needs and requirements of profitable traders, for which I applaud and recommend them.

HFM Group Regulation and Security

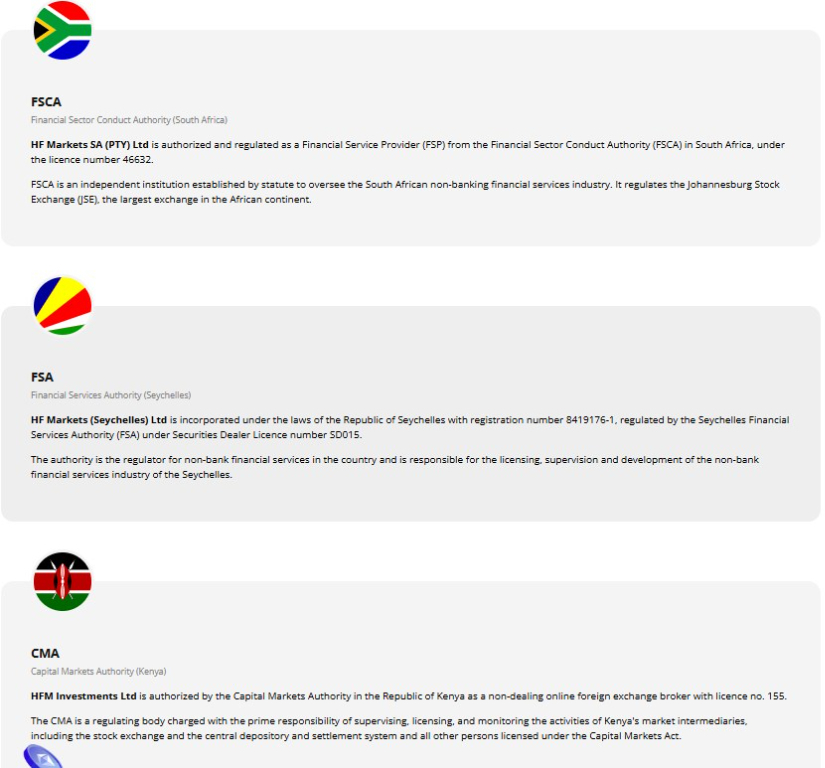

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check regulation and verify it with the regulator by checking the provided license with their database. HFM presents clients with six well-regulated entities.

Country of the Regulator | United Arab Emirates, Kenya, Mauritius, Seychelles, United Kingdom, South Africa |

|---|---|

Name of the Regulator | CMA, DFSA, FCA, FSA, FSC Mauritius, FSCA |

Regulatory License Number | 801701, F004885, 46632, SD015, C110008214, 155 |

Regulatory Tier | 1, 2, 2, 4, 4, 2 |

Is HFM Group Legit and Safe?

The bulk of business derives from HF Markets (SV) Ltd, registered as an International Business Company (IBC) in St. Vincent & the Grenadines, registration number 22747 IBC 2015. It remains an unregulated but duly registered subsidiary. Since HFM Group has licenses from multiple world-class Forex regulators, I can confidently suggest that traders manage their portfolios at HF Markets (SV) Ltd.

Fees

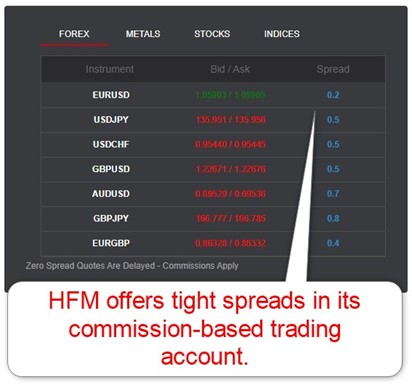

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. HFM offers traders commission-free Forex trading with higher spreads, a highly competitive commission-based alternative.

Average Trading Cost EUR/USD | 1.3 pips |

|---|---|

Average Trading Cost GBP/USD | 1.9 pips |

Average Trading Cost WTI Crude Oil | $0.06 |

Average Trading Cost Gold | $0.27 |

Average Trading Cost Bitcoin | $76 |

The commission-free trading account lists a minimum spread of 0.5 pips but carries an average one of 1.4 pips or $14 per 1.0 standard lot. The commission-based alternative commences with a raw spread of 0.0 pips and average spreads of 0.2 pips for a commission of $6.00 per lot or total costs of $8.00 for major currency pairs.

Active traders can lower expenses via the volume-based loyalty program. Equity CFD commissions of 0.10% and trading costs on commodities, indices, ETFs, and bonds remain equally competitive. HFM also maintains commission-free direct share dealing.

Here is a screenshot of HFM quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The average trading costs for the EUR/USD at HFM in the commission-free and commission-based trading accounts:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.4 pips | $0.00 | $14.00 |

0 pips | $6.00 | $6.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- HFM offers a positive swap on qualifying short positions, so traders can be paid money to hold trades open overnight

- HFM offers swap free trading, on selected accounts and instruments.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-based account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

0.2 pips | $6.00 | -$5.80 | X | $13.80 |

0.2 pips | $6.00 | X | $0.00 | $8.00 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

0.2 pips | $6.00 | -$40.60 | X | $48.60 |

0.2 pips | $6.00 | X | $0.00 | $8.00 |

Range of Assets

HFM maintains CFDs on over 500 assets covering Forex, cryptocurrencies, commodities, equity CFDs, indices, ETFs, metals, energies, stocks and bonds.

Asset List Overview

Cryptocurrencies | |

|---|---|

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

HFM Leverage

The maximum HFM leverage for Forex retail traders is a highly competitive 1:2000. Commodity and index traders get up to 1:200, while equity CFDs max out at an above average 1:25. Overall, the HFM maximum leverage ranks among the most generous ones, providing traders with a potential edge. Negative balance protection ensures traders cannot lose more than their deposit, but they must deploy proper risk management to avoid magnified trading losses.

HFM Trading Hours (GMT +3)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:05 | Friday 23:55 |

Commodities | Monday 01:00 | Friday 24:00 |

Crude Oil | Monday 01:00 | Friday 24:00 |

Gold | Monday 01:00 | Friday 23:45 |

Metals | Monday 01:00 | Friday 23:45 |

Equity Indices | Monday 01:00 | Friday 24:00 |

Stocks | Monday 10:01 | Friday 22:55 |

Bonds | Monday 01:02 | Friday 22:55 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which essentially trade 24/5

With minimum deposits between $0 and $100 and maximum leverage up to 1:2000, HFM maintains a competitive mix of account types.

Disclaimer: Certain products & services may or may not be available to all clients depending on which HFM Group entity their trading account(s) adheres to.

Trading Platforms

HFM offers traders MT4/MT5 and upgrades them with 12 trading tools by FX Blue Labs plus Autochartist. They are available as a desktop client, a webtrader, and a mobile app, while MT4 comes with the PAMM module. The upgrades result in a very competitive solution, and HFM also developed its proprietary mobile app, HFM App.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

HFM offer their proprietary online trading app, which is available for both Android and iOS. Clients can access their accounts through the app and trade more than 500 CFDs.

Unique Features

Besides the 12-plugin MT4/MT5 upgrade and the Autochartist plugin, HFM offers VPS hosting, supporting 24/5 algorithmic trading and API trading, allowing demanding clients to connect advanced trading solutions to the HFM infrastructure, plus a sentiment index. The HFM Trader’s Board has data on how HFM clients trade and a lucrative partnership program is also available.

Research and Education

A nine-member team provides additional market commentary and analytics. Real-time market news from FXStreet completes the research tools. I value the HFM investment made using AI and big data to help clients navigate financial markets, especially with more than 500 CFD assets available to trade.

HFM maintains a valuable educational section for beginners. I recommend new traders begin with the Forex education videos. The How-To videos explain essential functions of the myHF back office and the MT4/MT5 trading platforms. Webinars, podcasts, and live events add a personalized touch and interactive educational experience. HFM’s free webinars also enhance the overall approach to educating beginner traders.

Disclaimer: Certain products & services may or may not be available to all clients depending on which HFM Group entity their trading account(s) adheres to.

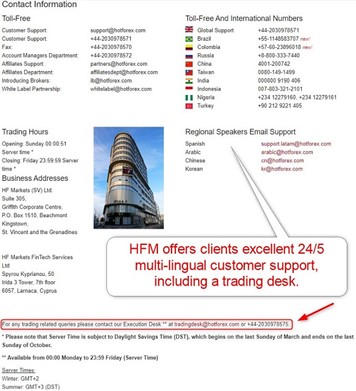

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |          |

Multi-lingual customer support is available 24/5, and HFM transparently lists all contact methods on its website. It also maintains a trading desk for phone-assisted trades. HFM describes its products and services well, and it has plenty of videos and a well-structured FAQ section. It limits the need for customer support. I recommend live chat should traders require assistance for non-urgent matters and phone support for emergencies.

A direct line to the finance department where most issues may arise is missing, but phone support exists.

Bonuses and Promotions

HFM offers a deposit bonus for each deposit, the HFM Traders Awards, and trading contests for live and demo accounts also exist. Terms and conditions apply, and traders should understand them fully before participating in bonuses and promotions. I recommend caution with trading contests, as they may promote reckless trading habits, especially among beginner traders chasing a prize rather than learning to trade.

Disclaimer: Certain products & services may or may not be available to all clients depending on which HFM Group entity their trading account(s) adheres to.

Awards

HFM has received 60+ industry awards from well-respected sources. They are a statement of the ongoing efforts by HFM to maintain a competitive edge for its clients.

Among the HFM awards are:

- Best Forex Affiliate Program - Global Banking and Finance 2012

- Best Online Broker Asia - World Finance Magazine 2013

- Best Client Fund Security - Global Financial Market 2014

- Best FX Online Broker - New Europe Magazine 2015

- Best Forex News & Analysis Provider - MENA Dubai FX Show 2016

- The Bizz 2017 Peak of Success - World Confederation of Businesses 2017

- Best Global Forex Trading Education Provider - Global Brands Magazine 2018

- Best Global Forex Copy Trading Platform - Global Forex Awards 2019

- Best Forex Trading Conditions Global - International Business Magazine 2020

- Best CFD Trading Conditions - World Economic Magazine 2021

I like to note the awards for best trading conditions and client security, as they belong to the HFM core offering to traders, where HFM excels.

Opening an Account

The only application form typically takes less than 20 seconds to complete, asking for country of residence, e-mail, and the desired password, which grants access to the myHF back office. HFM does not ask unnecessary questions, the process is hassle-free, and the back-office user friendly.

I like the trading environment at HFM for both beginner and advanced traders. Beginner traders get a well-thought-out introduction to trading and high-quality research, and advanced traders benefit from a trading environment supportive of manual, algorithmic, social, and copy trading. High leverage, generous bonuses, a loyalty program, and interest on free margin complement cutting-edge trading tools and ensure HFM clients have a notable edge in financial markets.

Minimum Deposit The minimum deposit at HFM is between $0 and $100, depending on the account type.

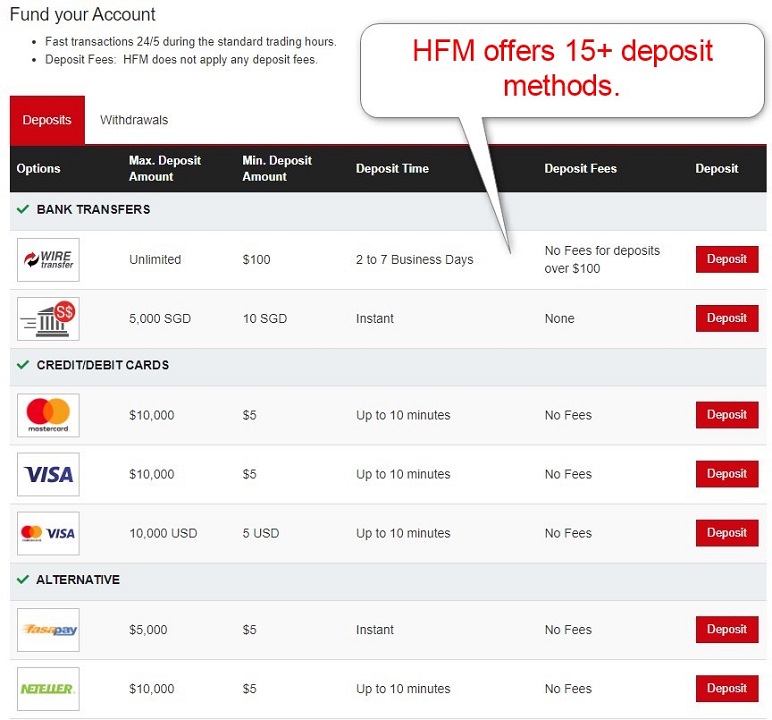

Payment Methods

Withdrawal options |    |

|---|---|

Deposit options |     |

HFM accepts bank wires, credit/debit cards, Skrill, Neteller, FasaPay, PayRedeem, and cryptocurrencies (Crypto / BitPay).

Accepted Countries

HFM caters to traders resident in most countries, except the USA, Canada, Sudan, Syria, North Korea, Iran, Iraq, Mauritius, Myanmar, Yemen, Afghanistan, and Vanuatu. Please note that EEA traders must trade with the less competitive Cyprus subsidiary as HFM does not accept them via its international brokerages.

Deposits and Withdrawals

The secure myHF back office handles all financial transactions for verified clients

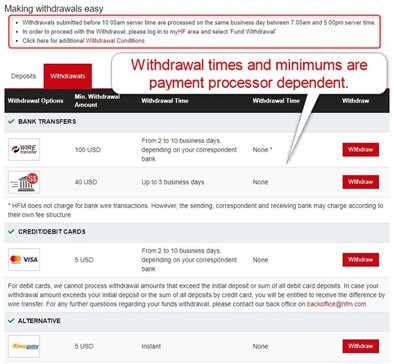

The minimum deposit is $5 for most payment processors, except for Skrill, SGD wire transfers, and PayRedeem, where it is $10, and bank wires, which require $100. HFM does not charge internal deposit or withdrawal fees, except for a 1% levy on cryptocurrency withdrawals, but third-party costs apply. Processing times remain dependent on the payment processor and geographic location of traders, ranging between instant and ten business days. HFM processes all withdrawal requests received before 10:00 a.m. during the same business day between 7:00 a.m. and 5:00 p.m. (GMT +3). Otherwise, it will process them the following business day. Not all payment processors are available to every client, restricted by geographic location, and HFM sends withdrawals to clients via the deposit path and any access via bank wire. Clients can review the entire withdrawal conditions on the HFM website, where HFM transparently posts them.

Is HFM a Good Broker?

I like the trading environment at HFM for both beginner and advanced traders. Beginner traders get one of the most comprehensive educational services industry-wide, and the advanced traders benefit from a trading environment supportive of manual, algorithmic, social, and copy trading. High leverage, generous bonuses, a loyalty program, and interest on free margin complement cutting-edge trading tools and ensure HFM clients have a notable edge in financial markets. HFM offers a well-balanced asset selection in an excellent trading environment.

FAQs

Is HFM a South African broker?

HFM has a license from the South African FSCA, where it also maintains a representative office.

What is the minimum deposit for HFM?

The minimum deposit is $0, but it takes $100 for the most competitive trading account.

How long does it take to withdraw money from HFM?

The withdrawal times at HFM depend on the payment processor and range between instant and ten business days.

How do I withdraw from HFM?

The myHF back office handles all withdrawal requests in a straightforward and timely manner.

Does HFM charge an inactivity fee?

HFM charges a $5 dormant fee after six months of inactivity.

Is HFM an ECN broker?

Yes, HFM is a market maker / ECN hybrid.

Is HFM good for beginners?

Yes, HFM is good for beginners as it offers high-quality research, a well-thought-out introduction to trading, accounts with no minimum deposit, and a trustworthy trading environment.

Where is HFM located?

HFM has offices in each country where it maintains a regulatory license.

Does HFM use MT5?

Yes, HFM offers MT5, including thirteen platform upgrades.

Is HFM a regulated broker?

Yes, HFM is a brand name under the HFM Group, which is regulated and licensed by the FCA, CySEC, DFSA, FSCA, FSA, FSC, and CMA.

What is the HFM trading platform?

HFM offers upgraded MT4/MT5 trading platforms and its proprietary mobile trading app.

Is HFM a good broker?

HFM has established itself among the most competitive Forex brokers with a quality mix of products and services. It enables all trading strategies with a cutting-edge trading environment and competitive fees.