Editor’s Verdict

Overview

Review

Headquarters | United Kingdom |

|---|---|

Regulators | CIMA, CySEC, DFSA, FCA |

Year Established | 1997 |

Execution Type(s) | Market Maker |

Minimum Deposit | $20 ($100 for account opening) |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

HYCM, part of the Henyep Group, which has provided trading services from Hong Kong since 1977, has been operating under a UK license since 1998. The group is active globally, with a focus on Asia, Europe, and the Middle East. HYCM processes over 25,000 orders daily, offers spreads as low as 0.2 pips, and has an average execution time of 12 milliseconds. This broker offers clients a well-regulated trading environment with over 300 assets across five sectors.

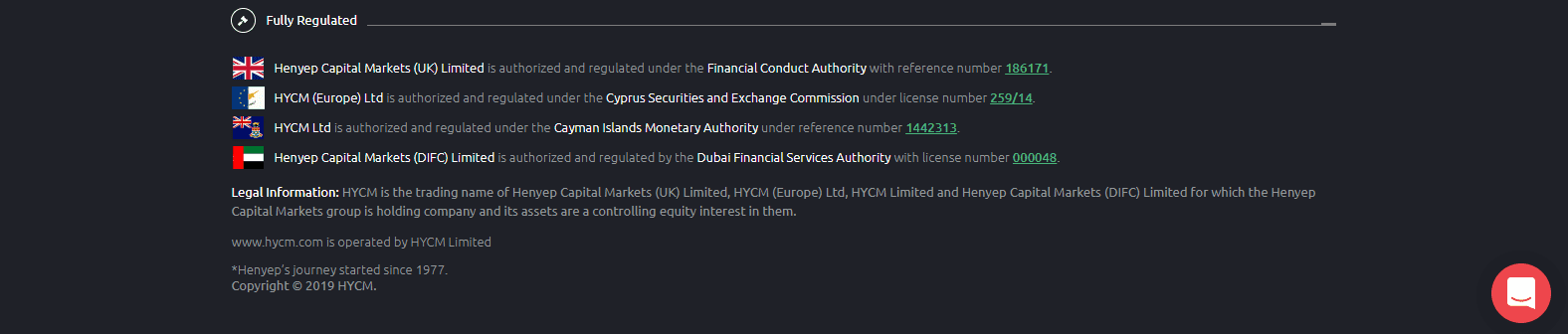

Regulation and Security

Henyep Capital Markets (UK) Limited, the UK subsidiary, is regulated by the Financial Conduct Authority (FCA), where the Financial Services Compensation Scheme (FSCS) protects deposits up to £85,000. The European division operates under the oversight of the Cyprus Securities and Exchange Commission (CySEC), and the Investor Compensation Fund (CIF) provides deposit protection up to €20,000.

The Cayman Islands Monetary Authority (CIMA) and the Dubai Financial Services Authority (DFSA) regulated HYCM Ltd and Henyep Capital Markets (DIFC) Limited, respectively. HYCM Limited is an International Business Company registered in Saint Vincent and the Grenadines. Tier-1 banks are the custodians of segregated client deposits, negative balance protection exits, and HYCM maintains a clean regulatory track record in all jurisdictions.

HYCM provides traders with a trustworthy and secure trading environment.

Fees

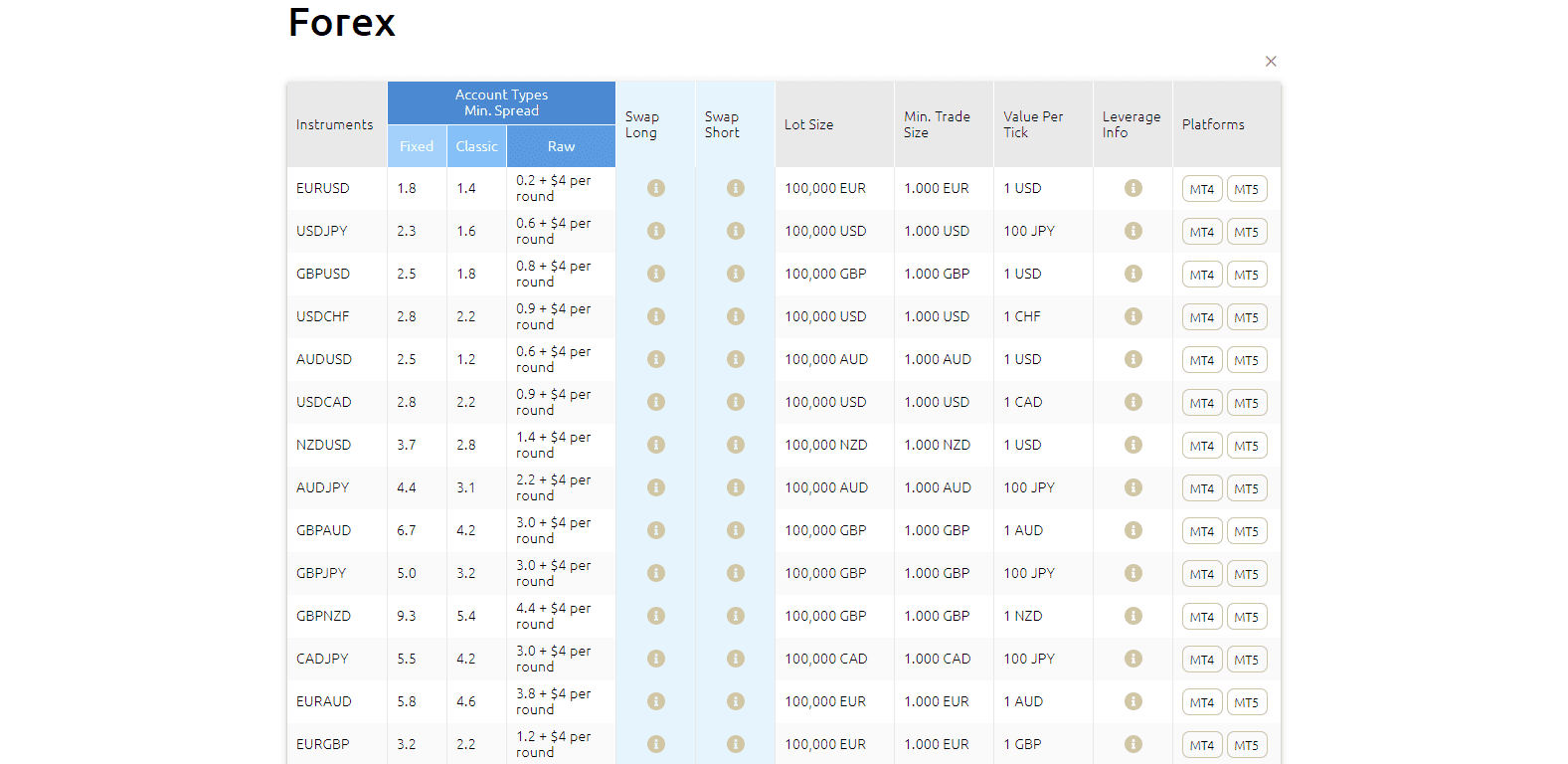

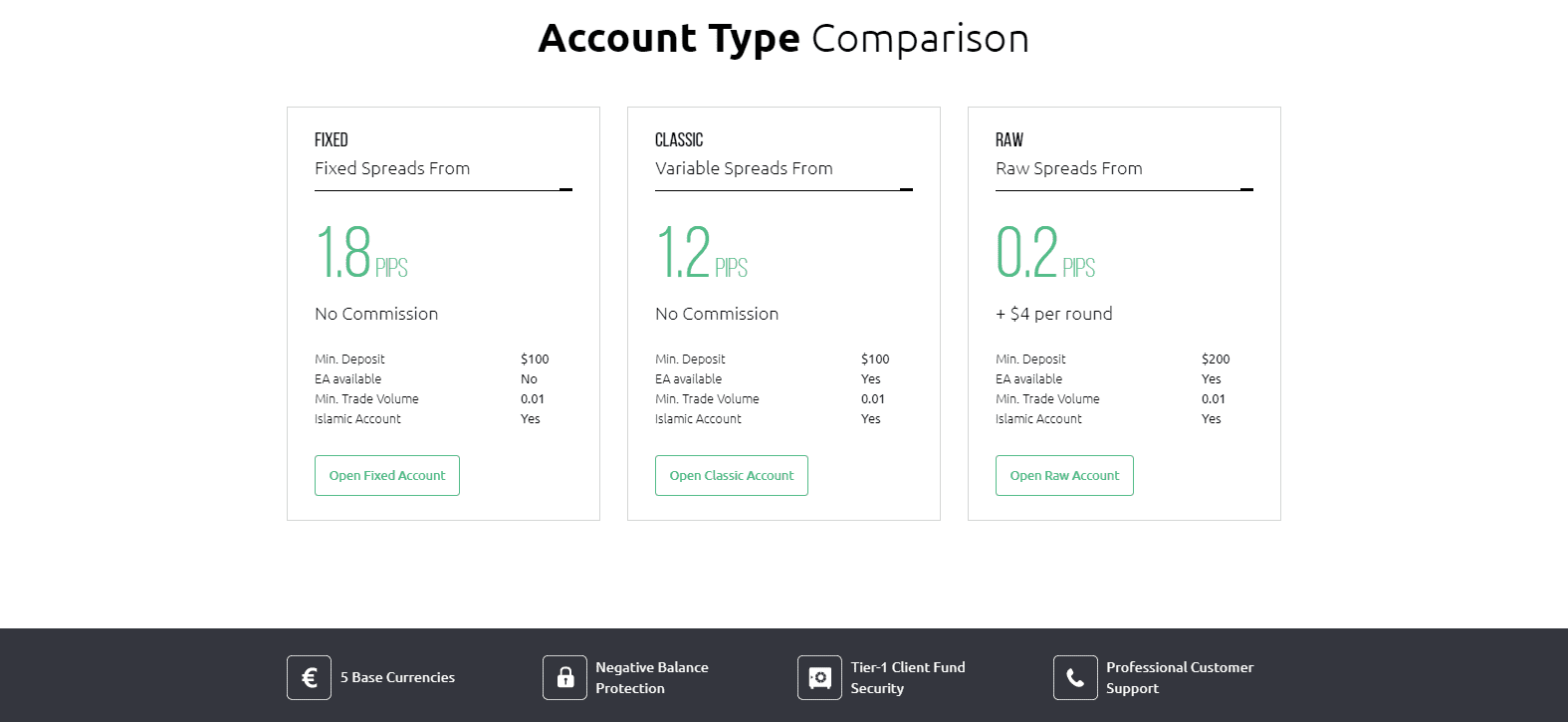

The Fixed and Classic accounts both offer commission-free trading, but spreads are excessive. The former consists of a minimum fixed spread of 1.8 pips and the latter of a minimum variable spread of 1.2 pips. The Raw account grants traders a competitive price structure with a minimum cost of 0.2 pips for a commission of $4 per round lot. Corporate actions such as dividends and mergers impact equity, index, and ETF CFDs, but no detailed information exists on how this market maker processes them. Swap rates on overnight positions apply, a currency conversion cost is applicable, and HYCM levies a $10 monthly inactivity fee.

Only the raw spread account provides an attractive pricing environment.

What Can I Trade

Forex traders have adequate exposure with 69 currency pairs, enhanced through 64 cryptocurrency pairs, which include identical base crypto assets with different fiat quote currencies, and 17 commodities. Equity traders have access to just 61 blue-chip names, while 28 index CFDs and 20 ETFs complete the asset selection. Overall, it remains a rather thin choice, and likely an inadequate one for more advanced traders.

Besides an acceptable Forex selection, the asset choice remains unsatisfactory.

Account Types

HYCM offers a commission-free fixed spread account but disables automated trading. The variable spread account, also commission-free, allows the use of automated trading solutions. Regrettably, the minimum spread of 1.2 pips in the variable spread account and 1.8 pips in the fixed version renders either an unacceptable choice. The deposit requirement is $100, raised to $200 for the raw spread account, where starting spreads commence from 0.2 pips for a commission of $4 per round lot. While the maximum leverage is 1:500, that is wholly dependent on the operating subsidiary. An Islamic account is available for all three options, while VIP and corporate accounts exist for high-frequency traders and asset managers.

Only the raw spread account delivers a suitable trading environment.

Trading Platforms

Traders have the choice between the retail-favorite MT4 and its failed successor MT5. Though both fully support automated trading, HYCM merely maintains the most basic version. Without the necessary third-party plugins to unlock full functionality, the trading platform remains sub-standard. Clients may opt for the mobile version, while the webtrader is not listed. Traders would have to upgrade the available options with their capital or else trade at a disadvantage; either choice is unacceptable.

With no additional features, the MT4/MT5 platforms are a disappointment.

Unique Features

Unfortunately, the long operating history of the corporate owner, the Henyep Group, is the sole “unique” feature of this broker. HYCM focuses on the essentials to remain operational but maintains a sub-standard core trading environment.

The corporate owner provides the sole unique feature with a strong operating history and financial stability.

Research and Education

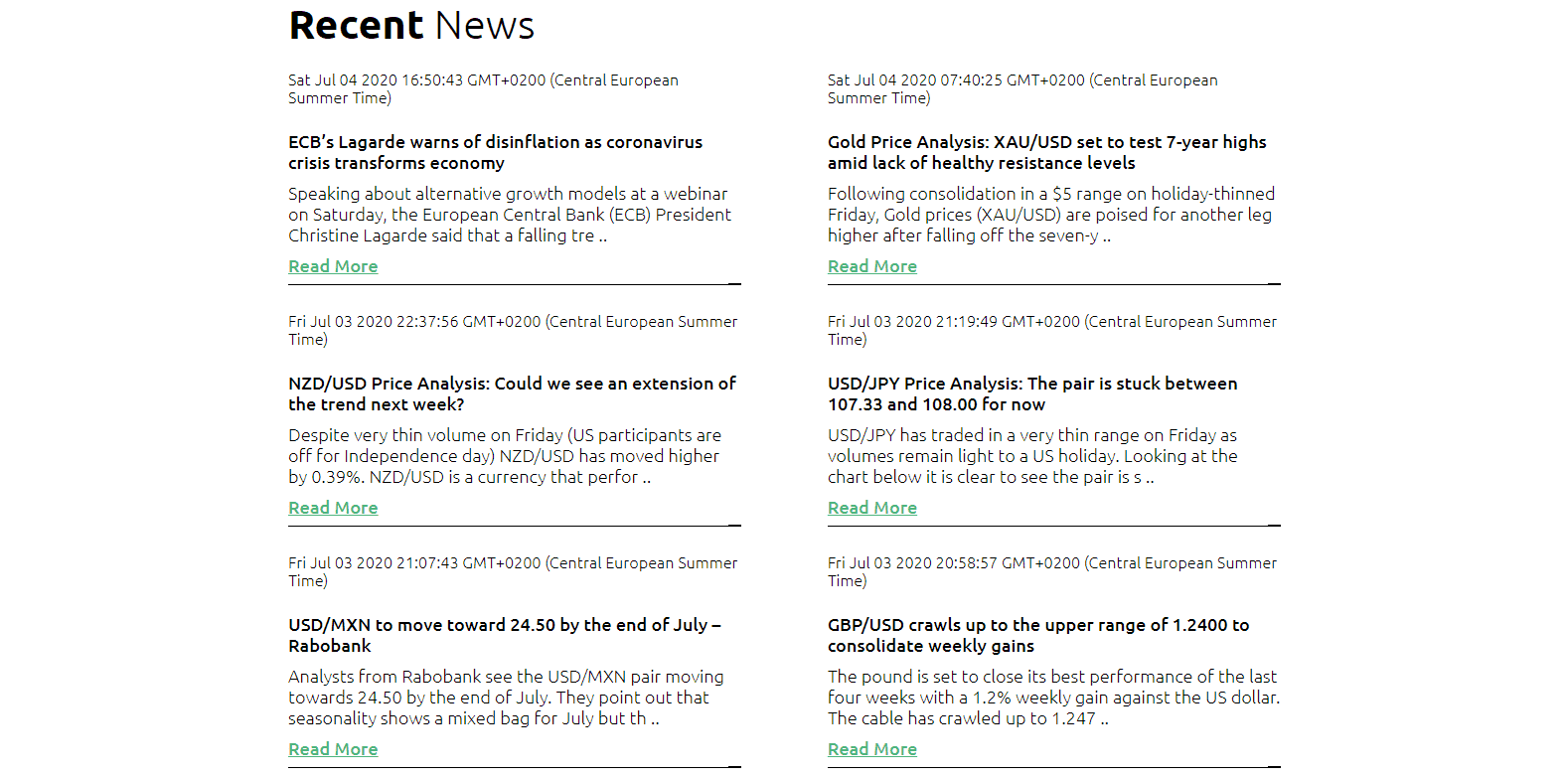

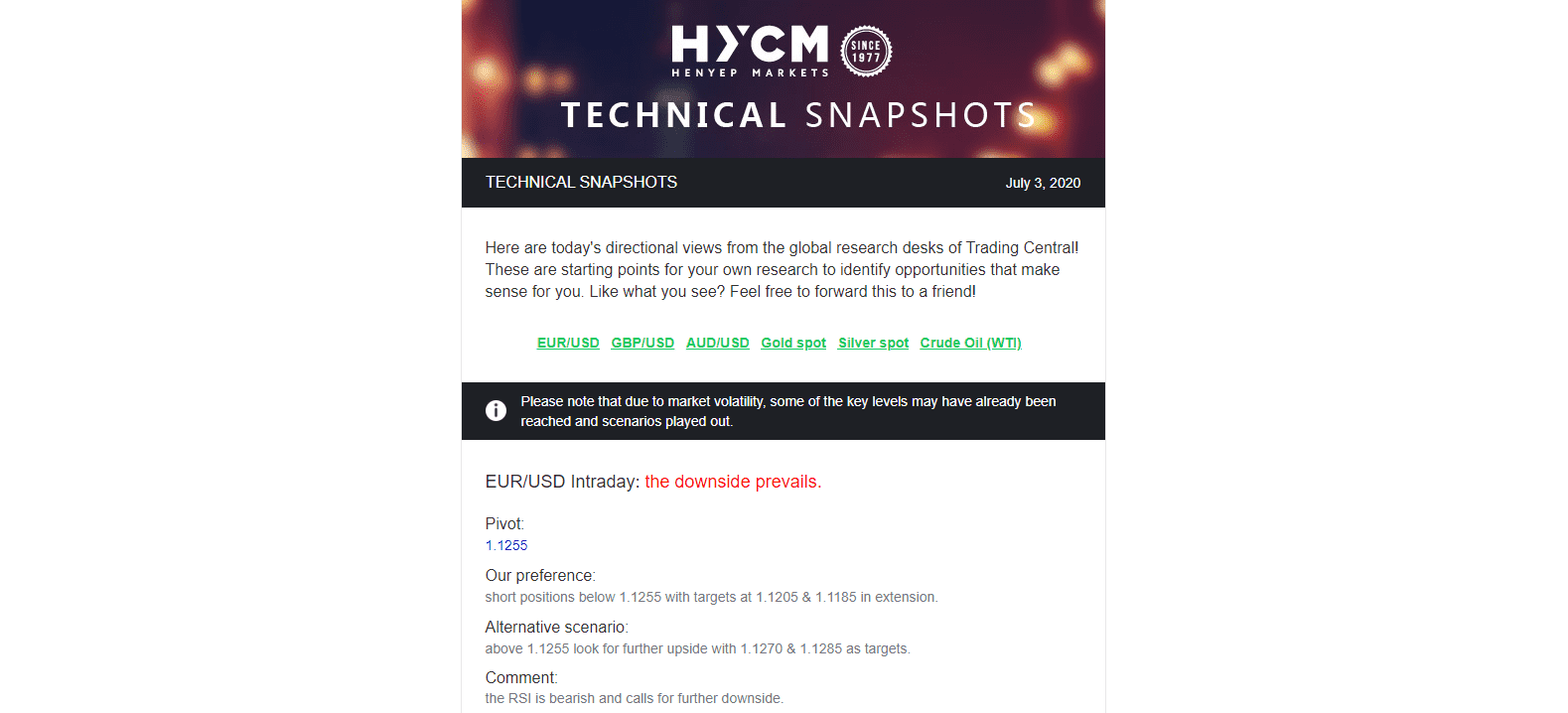

HYCM generates in-house research, published under the News category of the website. The market analysis is acceptable, and offers traders a well-explained trading set-up. Sourced market commentary is also available, while a newsletter, in partnership with Trading Central, provides additional trading ideas. Education is where this broker delivers, as a comprehensive Forex education knowledge base is available. The mix of written content, video tutorials, eBooks, and courses represent an excellent approach and mark the most valuable asset at HYCM. Webinars, workshops, and seminars enhance the educational value.

Clients will find in-house trading-set-ups in the News section.

Trading Central grants additional trading ideas.

The Forex knowledge base represents an exceptional educational category.

Webinars and workshops further enhance education.

HYMC also hosts seminars in essential markets.

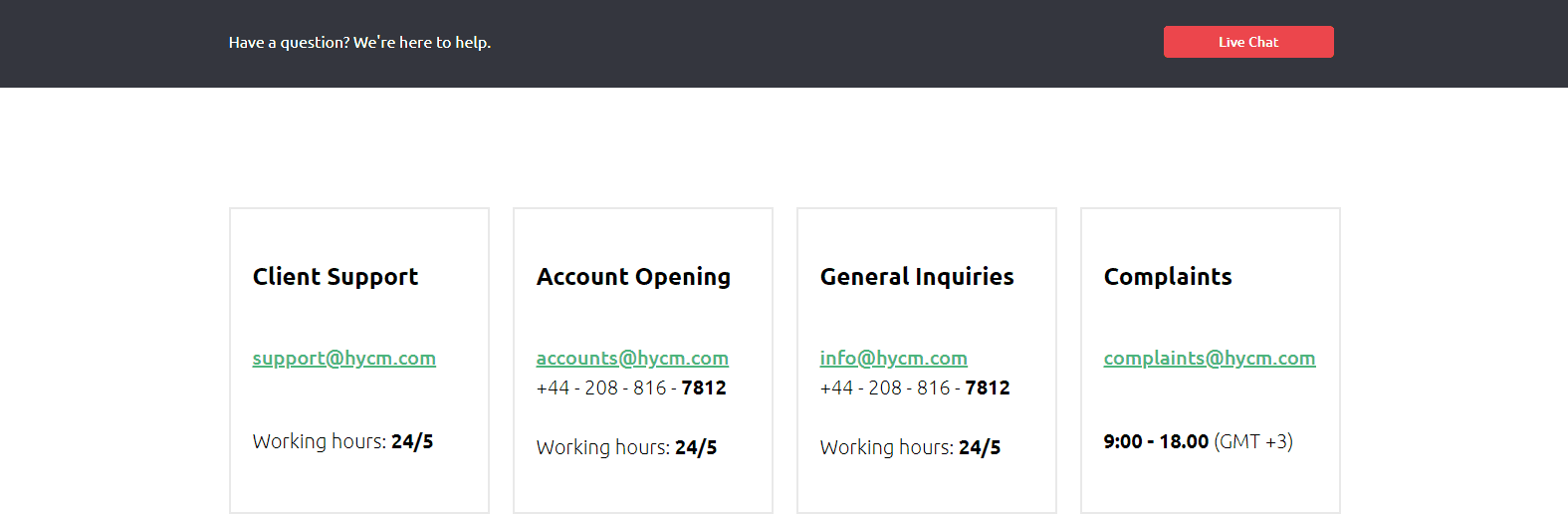

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |            |

Customer support is provided 24/5 via e-mail, phone, and live chat. The Help Center, which includes an FAQ section, attempts to answer the most basic questions.

Bonuses and Promotions

HYCM neither offers bonuses nor hosts special promotions.

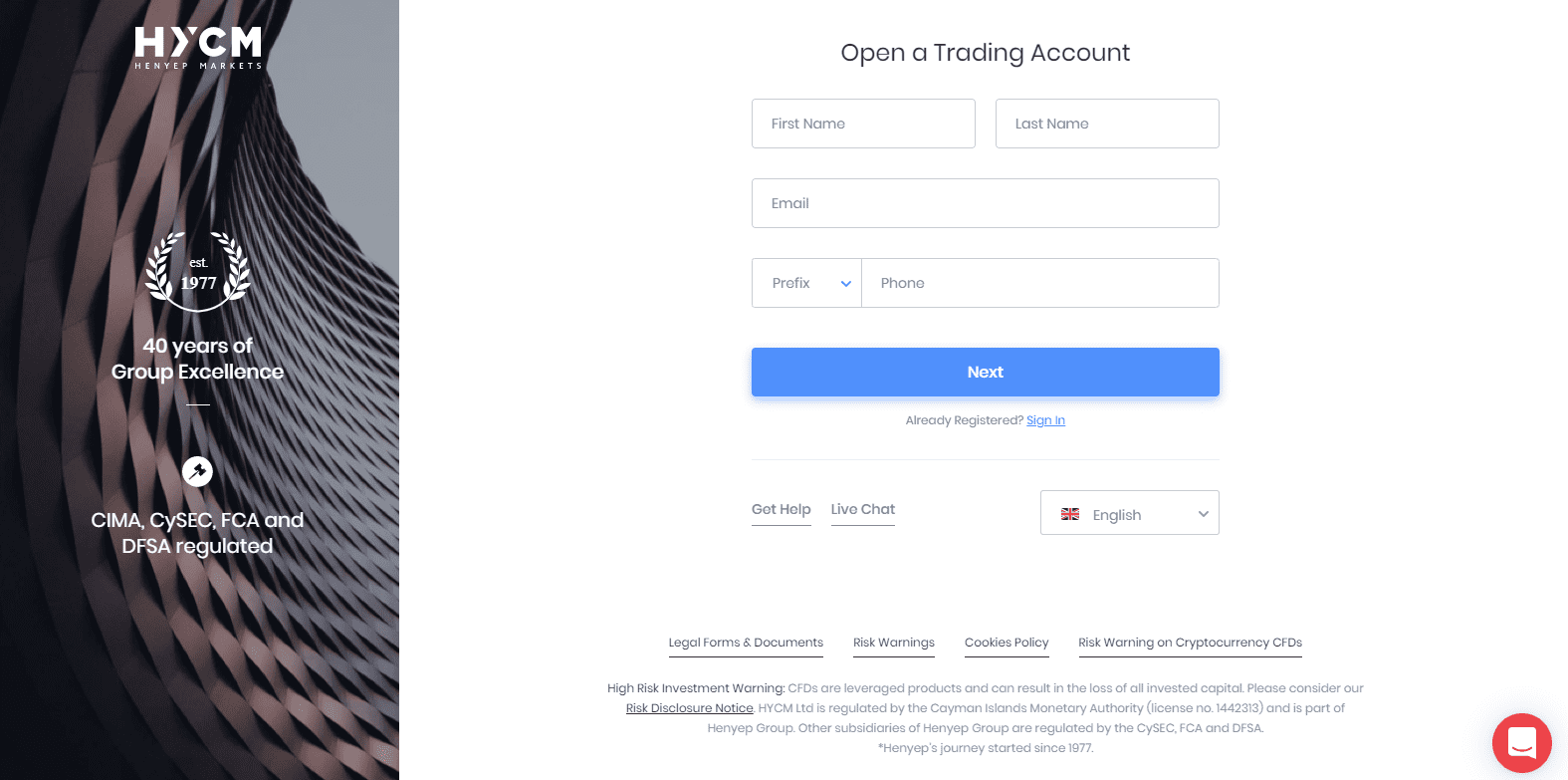

Opening an Account

A name, e-mail, and phone number completes the first online account opening step. Verification to comply with AML/KYC requirements is mandatory; that usually consists of providing a copy of the trader’s ID and one proof of residency document.

The account opening process is in accord with industry standards

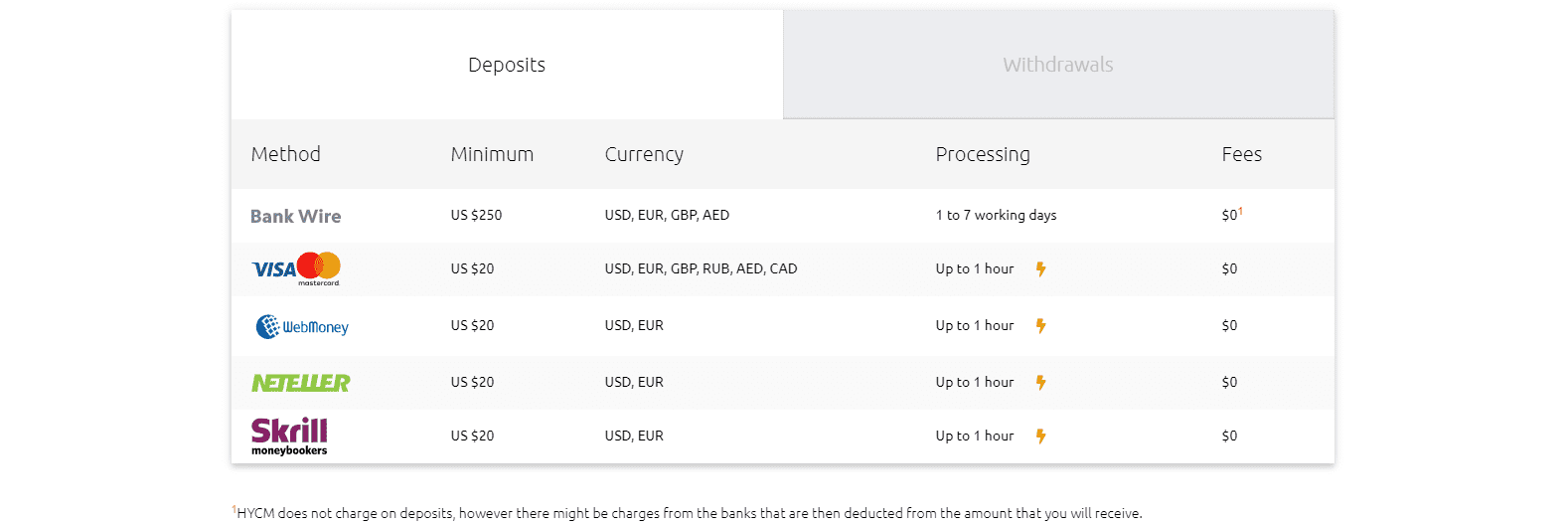

Deposits and Withdrawals

Bank wires, credit/debit cards, WebMoney, Neteller, and Skrill, are supported. Processing times may take up to one hour. The minimum amount is $20 for deposits and withdrawals, while bank wires are the exception. HYCM does not charge a fee for deposits or withdrawals, but third-party costs apply.

HYCM Deposit and Withdrawal Options are Satisfactory

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

HYCM is a well-regulated and trustworthy broker, owned by the Hong Kong-based Henyep Group, which has served traders since 1977. Regrettably, the overall trading environment remains sub-standard and disappointing. Only the most basic MT4/MT5 trading platforms are available, the asset selection, aside from the Forex markets, is insufficient, and merely the raw spread account features an acceptable cost structure. The presentation of in-house research lacks in quality as compared to competitors. One area where HYCM shines is education, the primary asset of this broker. While there is nothing structurally wrong, HYCM under-delivers across the core categories, making it an unsuitable choice for advanced traders and professionals. Given its excellent educational course, however, new retail traders may consider receiving access to it in the raw spread account for a minimum deposit of $200. HYCM is a market maker, providing trading services to clients. The UK’s FCA, the EU’s CySEC, the Cayman Island’s CIMA, and Dubai’s DFSA provide the regulatory framework for HYCM. HYCM maintains a sub-standard core trading environment but is backed by a well-established corporate owner, the Hong Kong-based Henyep Group. The minimum deposit at HYCM is $20, but the initial deposit is $100. Withdrawals methods consist of Bank wires, credit/debit cards, WebMoney, Neteller, and Skrill.FAQs

What is HYCM?

Is HYCM regulated?

Is HYCM a good broker?

What is the minimum deposit for HYCM?

How do I withdraw money from HYCM?