For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

The IFCM Group, founded in 2006, consists of several operating subsidiaries. It includes two brokerage divisions and one FinTech company, which developed the proprietary trading platform at IFC Markets. Over 210,000+ traders from 80+ countries enjoy more than 650+ liquid assets in a competitively priced trading environment. Through the unique Portfolio Quoting Method, traders can create synthetic assets, generating many trading opportunities. PAMM accounts cater to traditional account management services. I reviewed this broker to evaluate the competitiveness of its trading environment. Is IFC Markets the best broker for you?

IFC Markets Video Review

Overview

IFC Markets is a leader in synthetic assets with more than 30,000 instruments.

Headquarters | Malaysia, South Africa, Labuan |

|---|---|

Regulators | BVI, FSCA, LFSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2006 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $1 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform, NetTradeX |

Average Trading Cost EUR/USD | $4.00 |

Average Trading Cost GBP/USD | $24.00 |

Average Trading Cost WTI Crude Oil | $0.06 |

Average Trading Cost Gold | $45.00 |

Average Trading Cost Bitcoin | $100.00 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.4 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 14 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

IFC Markets Five Core Takeaways:

- Excellent choice of trading platforms, led by its proprietary NetTradeX trading platform, followed by MT4 and MT5

- Competitive commission-free cost structure for major currency pairs

- Fast order execution, ideal for scalpers and high-frequency traders

- Third-party insurance for superior client protection

- MT4 traders must accept notably higher trading costs

IFC Markets Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. IFC Markets has three regulated subsidiaries with a clean track record.

Country of the Regulator | British Virgin Islands, South Africa, Labuan |

|---|---|

Name of the Regulator | BVI, FSCA, LFSA |

Regulatory License Number | Undisclosed, SIBA/L/14/1073,2021/682339/07 |

Regulatory Tier | 2, 4, 2 |

Is IFC Markets Legit and Safe?

My IFC Markets review found no verifiable misconduct or malpractice by this broker, founded in 2006. Therefore, I can recommend IFC Markets as a legitimate and safe broker.

IFC Markets regulation and security components:

- Regulated by the Financial Sector Conduct Authority of South Africa, the Labuan Financial Services Authority, and the British Virgin Islands Financial Services Commission.

- Founded in 2006

- Third-party insurance by Hamilton Group’s Syndicate 4000

- Segregation of client deposits from corporate funds

- Negative balance protection

- IFC Markets has 18+ years of experience and remains fully compliant with its regulators

South African Resident Traders

- IFC Markets SA (Pty) Ltd is licenced and regulated in the Republic of South Africa under the FAIS Act, by the Financial Sector Conduct Authority (FSCA) with FSP No. 51818.

- Your account will be opened with IFCMARKETS.CORP., a duly licenced BVI company which will be the counterparty and act as a principal to your trades.

- IFCMARKETS.CORP. is not within the South African regulatory framework and the laws and regulations of the British Virgin Islands will apply to your account.

What would I like IFC Markets to add?

IFC Markets ticks most boxes from a security perspective, but I would appreciate more transparency about its core management team and auditors. A trader compensation fund via the Hong Kong-based Financial Commission would be a welcome addition.

Fees

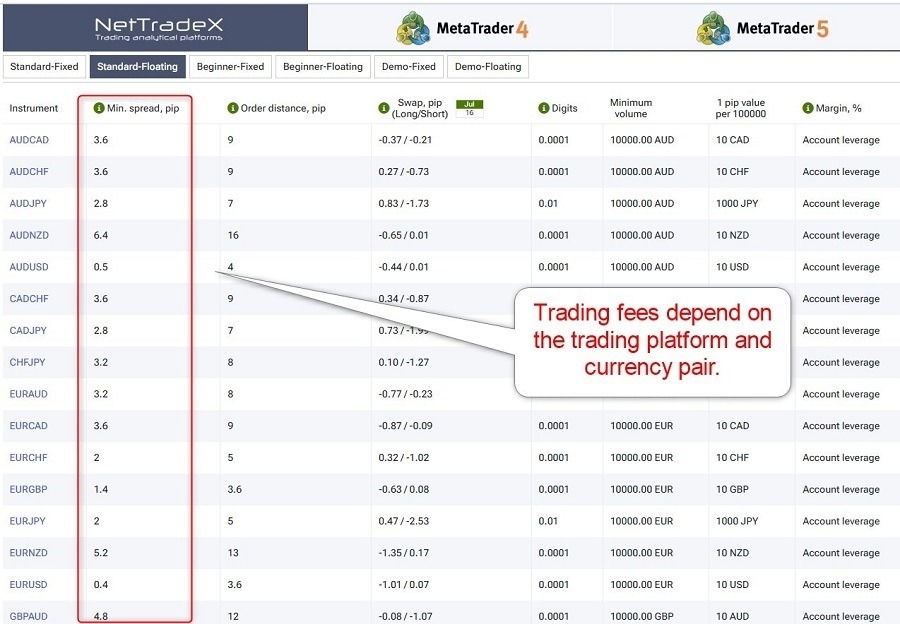

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. IFC Markets offers traders using the proprietary NetTradeX trading platform and MT5 a highly competitive, commission-based pricing environment with floating spreads for the AUD/USD, the EUR/USD, the USD/CAD, the USD/CHF, and the USD/JPY between 0.4 pips and 0.6 pips, but other Forex costs are higher, clocking in above 2.0 pips.

MT4 traders get minimum fixed spreads starting from 1.8 pips.

Commissions for equity CFDs are average, ranging from 0.10% to 0.25%, $0.02, and C$0.03 per share, depending on the market. Cryptocurrency traders get BTC/USD minimum floating spreads of $100.

IFC Markets has some deposit fees, while traders pay withdrawal fees on all payment processors. IFC Markets lists no inactivity fee, and the client agreement lists no currency conversion costs.

Average Trading Cost EUR/USD | $4.00 |

|---|---|

Average Trading Cost GBP/USD | $24.00 |

Average Trading Cost WTI Crude Oil | $0.06 |

Average Trading Cost Gold | $45.00 |

Average Trading Cost Bitcoin | $100.00 |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.4 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee |

The minimum trading costs for the EUR/USD at IFC Markets are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

0.4 pips (NetTradeX) | $0.00 | $4.00 |

1.8 pips (MT4) | $0.00 | $18.00 |

0.4 pips (MT5) | $0.00 | $4.00 |

Here is a snapshot of IFC Market’s minimum NetTradeX spreads:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free IFC Markets NetTradeX account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for one night in the IFC Markets NetTradeX account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.4 pips | $0.00 | $10.10 | X | -$14.10 |

0.4 pips | $0.00 | X | -$0.70 | -$3.70 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for seven nights in the IFC Markets NetTradeX account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.4 pips | $0.00 | $70.70 | X | -$74.70 |

0.4 pips | $0.00 | X | -$4.90 | $0.90 |

Noteworthy:

- IFC Markets offers positive swap rates on qualifying assets, allowing traders to earn money, like in the example above.

IFC Markets Trading Hours (GMT +2 Server Time)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Friday 22:00 |

Cryptocurrencies | Sunday 00:00 | Saturday 24:00 |

Commodities | Monday 00:00 | Friday 22:00 |

Crude Oil | Monday 00:00 | Friday 22:00 |

Gold | Monday 00:00 | Friday 22:00 |

Metals | Monday 00:00 | Friday 22:00 |

Equity Indices | Monday 00:00 | Friday 22:00 |

Stocks | Monday 02:00 | Friday 22:00 |

ETFs | Monday 15:30 | Friday 22:00 |

Futures | Monday 00:00 | Friday 22:00 |

Synthetics | Sunday 00:00 | Saturday 24:00 |

Range of Assets

Asset selection at IFC Markets is well-balanced, with over 650 liquid assets across six categories, including cryptocurrencies, further enhanced via the Portfolio Quoting Method, allowing unlimited asset creation. Over 470 equity CFDs from seven global exchanges allow extensive cross-asset diversification, accounting for most assets, excluding synthetics.

Traders who seek a diversified approach or cross-asset exposure have plenty of choices. IFC Markets also offers continuous index and commodity CFDs, while 30,000+ synthetic assets are available.

IFC Markets offers the following selection of assets:

- 53 currency pairs (including synthetic currency pairs)

- 14 cryptocurrencies

- 46 metals and commodities

- 23 indices (including synthetic indices)

- 4 ETFs

- 470+ equity CFDs listed on seven exchanges

- 20 futures contracts

- 30,000+ synthetic assets

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

IFC Markets Leverage

Maximum Retail Leverage | 1:400 |

Maximum Pro Leverage | 1:200 |

What should traders know about IFC Markets leverage?

- Maximum Forex leverage is 1:200 for standard fixed and floating accounts and 1:400 for beginner fixed accounts

- Most commodities, metals, and indices receive the account leverage

- Equity CFD traders get maximum leverage between 1:5 and 1:20

- ETFs leverage is between 1:5 and 1:10

- Cryptocurrency traders get between 1:4 and 1:10

- Not all assets within a sector qualify for the maximum leverage

- Negative balance protection exists, ensuring traders cannot lose more than their deposit

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses

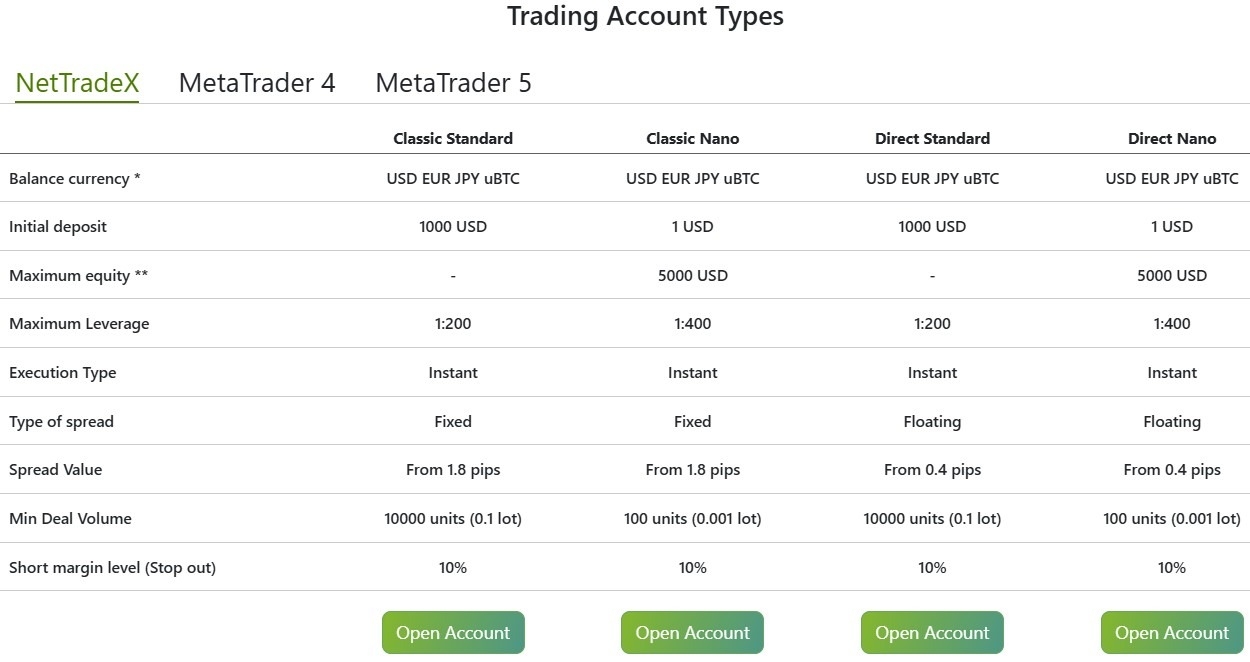

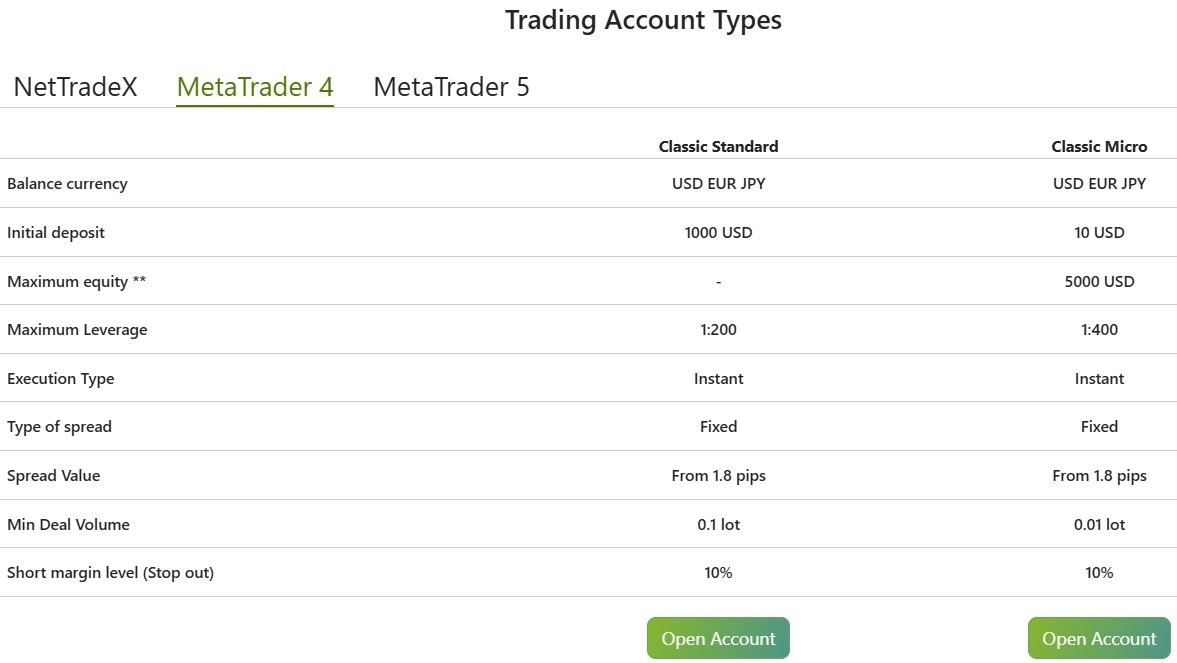

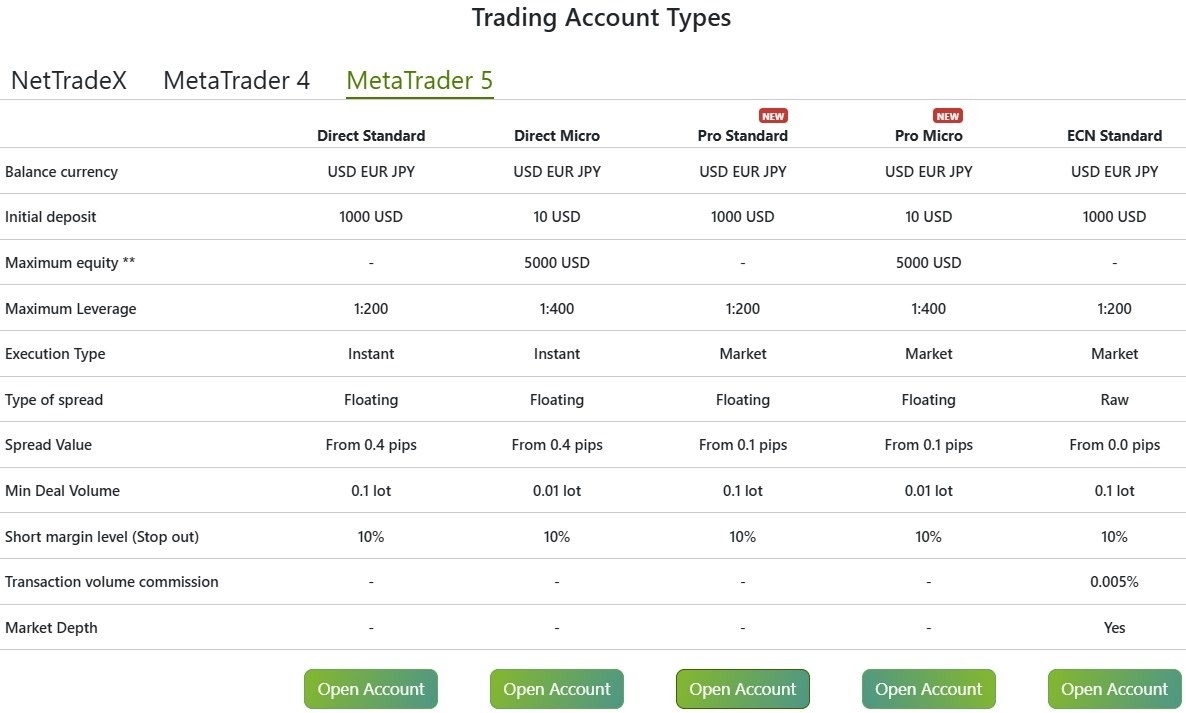

Account Types

Traders at IFC Markets have three choices of trading platform, each of which offers a demo demo account and multiple live account types.

Traders choose between the following:

- NetTradeX versus MT4 versus MT5 account.

- In NetTradeX, fixed or floating spreads, and nano or standard accounts.

- In MT4, micro or standard accounts, with one option for each.

- In MT5, micro or standard accounts:

- Standard accounts have ECN, Direct, or Pro options.

- Micro accounts have Direct or Pro options.

My observations concerning the IFC Markets account types:

- MT4 is only available as a fixed-spread account.

- The minimum deposit for all nano accounts is just $1, and micro accounts only $10, but an above average $1,000 for all standard accounts.

- The account base currencies are USD, EUR, JPY, and BTC.

- IFC Markets offers swap-free Islamic accounts with 14-day time limited positions.

- Micro and nano accounts are limited to an equity value of $5,000.

- Maximum leverage is 1:200 in standard accounts and 1:400 in micro and nano accounts.

- An account balance above $50,000 automatically results in an upgrade to VIP status with preferred trading terms, including free VPS hosting.

- Corporate accounts are also available.

IFC Markets Demo Account

- IFC Markets offers demo accounts for all of its trading platforms, which is a nice feature. This means you can get familiar with the broker in the trading platform of your choice.

- No time limit or deposit limits.

- A demo account requires registration but not account verification.

Trading Platforms

While the MT4 and MT5 trading platforms are available as the most basic version plus the Autochartist plugin, it’s apparent that IFC Markets prefers its traders to use the proprietary NetTradeX. The implemented account structure essentially discourages the use of the MT family. All trading platforms support algorithmic trading.

MT4 and MT5 are available as desktop clients, lightweight web-based alternatives, and popular mobile apps. I recommend the desktop client, as they offer all the functions, including algorithmic trading. Traders can upgrade MT4 via 25,000+ custom indicators, templates, and EAs, while MT5 features 10,000+.

Some of the core features of the NetTradeX trading platform are:

- User-friendly interface

- Balance and lock trading

- Instant order execution

- Server-side trailing stop orders

- OCO orders

- Multimonitor support

- Up to ten instrument percentage changes per chart

- Built-in language NTL+ for automated trading

- Synthetic instruments

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

The most extraordinary feature of this broker is the Portfolio Quoting Method. This allows traders to create unique synthetic assets, including equity versus equity quotations, for which IFC Markets received a patent in the US. The creation of personalized trading instruments is an emerging trend. The Portfolio Quoting Method provides IFC Markets with a distinct competitive advantage, appealing to committed traders and portfolio managers.

IFC Markets provides continuous index and commodity CFD trading. They provide clients 24/5 access to assets, eliminating price gaps between contracts amid ongoing pricing based on the nearest liquid contract.

PAMM accounts for MT4/MT5 are also available, allowing for traditional account management services rather than copy trading.

Research & Education

IFC Markets publishes technical and fundamental analysis in a high quality and professional format throughout each trading session across eleven categories. In-house research consists of brief written analytics and video content, offering manual traders new ideas to consider. IFC Markets recently added two sections, Trading Ideas and Trading Signals, featuring short-format trading signals. I rate the research at IFC Markets among the better ones in the industry.

What about education at IFC Markets?

Education at IFC Markets, with the IFCM Trading Academy at its core, is excellent, presented via comprehensive written content and a wide range of videos. The content features beginner, intermediate, and expert sections. It offers a tremendous benefit at IFC Markets, and new traders should take full advantage of it, starting with the Forex Trading Step-by-Step course.

My conclusion:

- Beginners should start with the IFCM Trading Academy and the Forex Trading Step-by-Step course

- I recommend beginners seek additional in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management

- Avoid paid-for courses and mentors

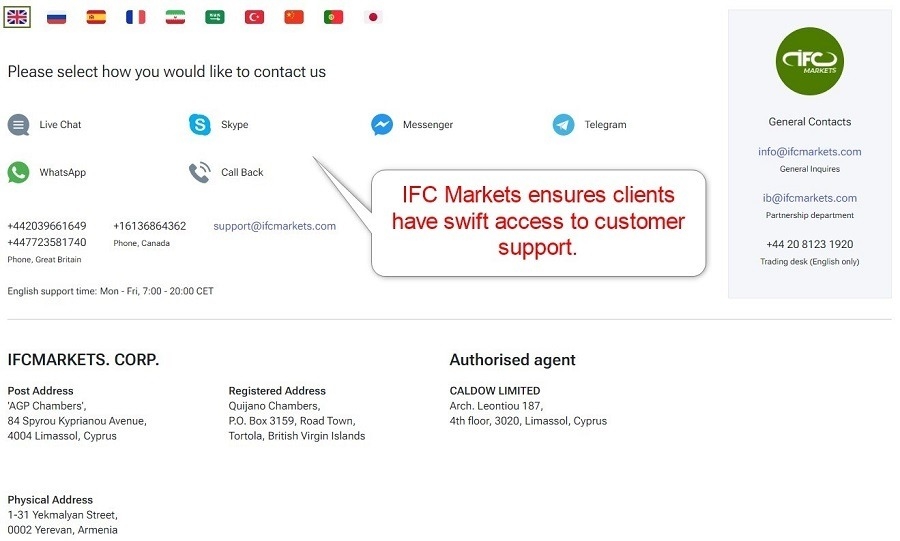

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | M-F, 0700 - 1900 |

Website Languages |              |

English support is available Monday through Friday between 07:00 and 20:00, while its multi-lingual support team has varying hours listed on the IFC Markets website. Traders can call, e-mail, or use live chat. I had no reason to contact customer support during my IFC Markets review, as IFC Markets explains its products and services well.

Noteworthy:

- IFC Markets offers phone support

- IFC Markets also provides a callback feature and lists several phone numbers

- An English-only trading desk is available

- A complaint form is also available

Bonuses and Promotions

During my IFC Markets review, neither bonuses nor promotions were offered. This is refreshing as too often these can be marketing gimmicks.

Awards

IFC Markets has dozens of industry awards. The three most recent ones include the Best MT5 Trading Platform East Asia 2024 award by World Business, The Best Multi-asset CFD Broker Malaysia 2024 award by World Business, and the Best International Forex Broker – Vietnam 2024 award by Gazet International.

Opening an Account

Traders open new accounts via a brief four-step online application, the final two consisting of a deposit and trading platform download.

What should traders know about the IFC Markets account opening process?

- IFC Markets complies with global AML/KYC requirements

- Account verification is mandatory

- Most traders pass verification by uploading a copy of a government-issued ID and one proof of residency document

- IFC Markets may ask for additional information on a case-by-case basis

Minimum Deposit

The minimum deposit for the IFC Markets Beginner account is $1, but the Standard alternative requires $1,000.

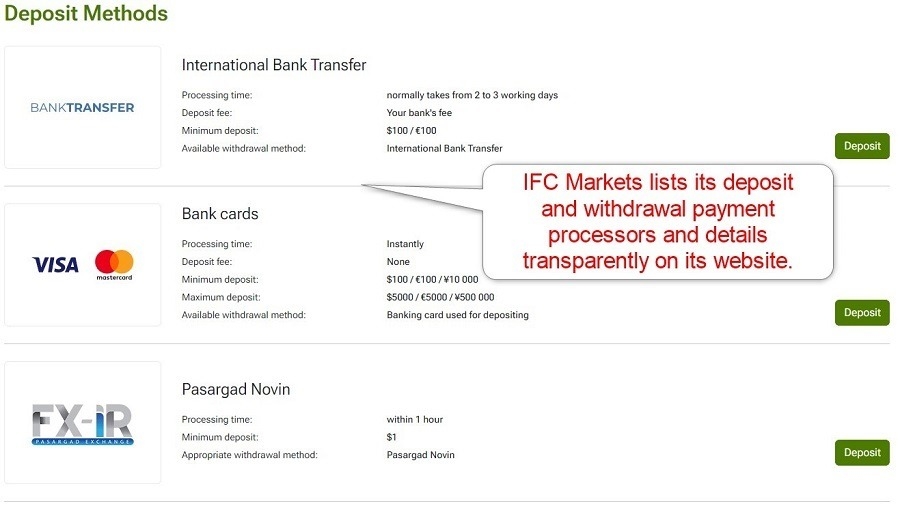

Payment Methods

Withdrawal options |      |

|---|---|

Deposit options |      |

IFC Markets offers international bank wires, credit/debit cards (Visa and Mastercard), Pasargad Novin, Mobile Money/M-Pesa, African Local Bank, cryptocurrencies, TopChange, Perfect Money, Bitwallet, WebMoney, ADVCash, Domestic Transfer, Interac e-transfer, and SticPay.

Accepted Countries

IFC Markets does not provide a detailed list of accepted countries, but the footer of its homepage lists the United States, the Russian Federation, BVI, and Japan as restricted countries.

Deposits and Withdrawals

The secure IFC Markets back office handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at IFC Markets?

- The minimum deposit and withdrawal amounts, processing times, and fees depend on the payment processor

- Per the FAQ section, IFC Markets compensates commissions paid by clients on select payment processors

- Most deposits remain free of charge, but third-party costs may apply

- Traders can make deposit and withdrawal requests 24/7, but IFC Markets processes them from Monday to Friday, 07:00 AM to 07:00 PM (CET)

- In compliance with AML regulations, the name of the trading account and payment processor must be identical

- IFC Markets lists the details of each payment processor transparently on its website

Is IFC Markets a Good Broker?

I like the trading environment at IFC Markets, as it supports algorithmic trading on all its trading platforms. It also offers the ability to create synthetic assets via its patented Portfolio Quoting Method. Traders benefit from competitive leverage, excellent research, and quality education but must deposit a minimum of $1,000. IFC Markets offers traders a competitively priced environment if they are willing to trade on the proprietary NetTradeX platform or MT5. IFC Markets is a genuine choice for traders seeking to diversify their overall portfolio, while new traders will find this broker offers exceptional educational value.

FAQs

How do I withdraw money from IFC Markets?

IFC Markets offers international bank wires, credit/debit cards (Visa and Mastercard), Pasargad Novin, Mobile Money/M-Pesa, African Local Bank, cryptocurrencies, TopChange, Perfect Money, Bitwallet, WebMoney, ADVCash, Domestic Transfer, Interac e-transfer, and SticPay.

What is the minimum deposit for IFC Markets?

The minimum deposit requirement is $1 for micro accounts and $1,000 for Standard ones.

Is IFC Markets legit?

IFC Markets has catered to clients for 18+ years and complies with two regulators. It is a legit international multi-asset broker with a clean regulatory track record.

Is IFC Markets regulated?

IFC Markets holds licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Labuan Financial Services Authority (LFSA).