Editor’s Verdict

InvestMarkets is a relatively new broker operational since 2020 that is operated by professionals with long experience in the online trading industry. The brokerage has a clean, intuitive design that is welcoming for traders of all levels. Read this full InvestMarkets review to see why we think this up and coming broker will likely become a shining star.

Overview

A broker with PAMM accounts and copy trading for mobile traders

Headquarters | Cyprus |

|---|---|

Regulators | FSC Belize |

Year Established | 2020 |

Minimum Deposit | 250$ |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

As of October 2021, this broker is no longer accepting new traders. To find a reliable, regulated Forex broker, check out our top Forex brokers list. Thank you!

InvestMarkets is a relatively new broker operational since 2020 that is operated by professionals with long experience in the online trading industry. The brokerage has a clean, intuitive design that is welcoming for traders of all levels. Read this full InvestMarkets review to see why we think this up and coming broker will likely become a shining star.

Regulation and Security

The Belize International Financial Services Commission (IFSC) is the sole regulator of InvestMarkets. It presents a business-friendly option for brokers and results in the creation of a trustworthy and competitive trading environment for clients.

On its website the company commits to keeping client funds segregated and to adhering to competitive security standards on its website which should ensure that traders' personal information and funding is secure.

Fees

InvestMarkets offers a commission-free pricing structure. Spreads in the company's Basic Account start at 3.2 pips which equals $32 per 1.0 standard lot which is quite high and puts the brokerage at a competitive disadvantage.

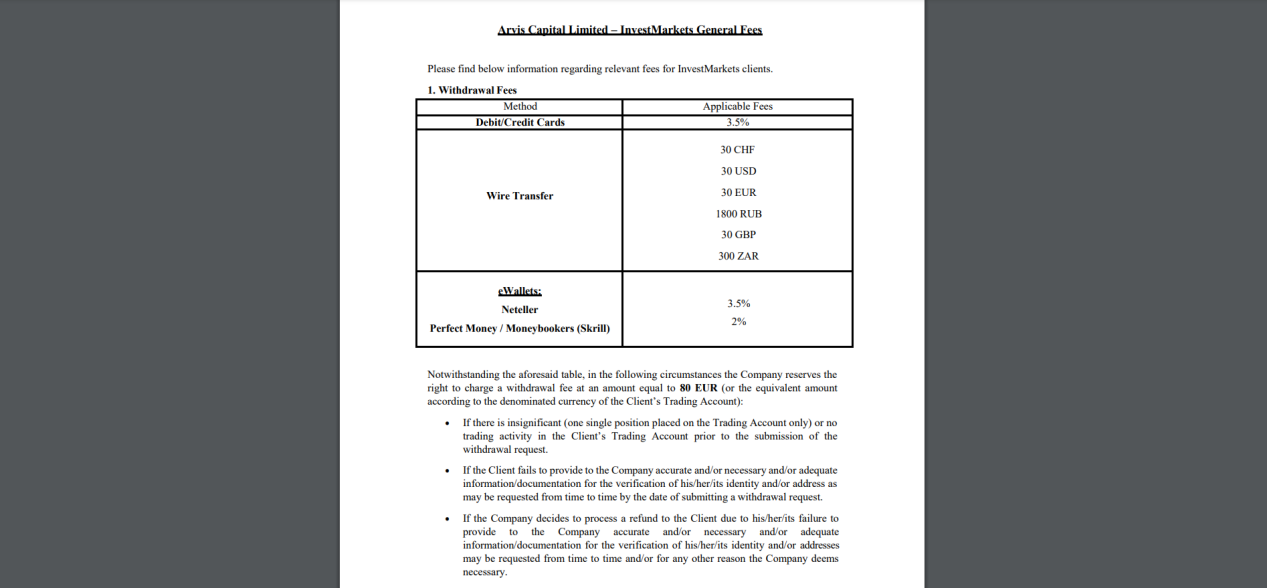

After one month of dormancy, InvestMarkets charges an €80 pound monthly fee which progresses to €1,000 per month. It seems that a €2,000 reactivation fee is required to begin trading. InvestMarkets also reserves the right to levy a withdrawal fee of €80 if traders do not satisfy certain conditions. Third-party deposit and withdrawal charges also apply.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

What Can I Trade?

All assets available at InvestMarkets are shown when you click the TRADE button in the website's top navigation. At the time of this InvestMarkets review there were 48 currency pairs, 43 cryptocurrency pairs including mini alternatives, and 23 commodities. InvestMarkets also presents over 100 equity CFDs, two ETFs, and 21 index CFDs. Overall, the broad asset selection presents a quality mix of assets that is truly excellent for new retail traders.

The cryptocurrency and commodity choices represent a competitive offer compared to all brokers. The mini CFDs on cryptocurrencies remain excellent for traders with smaller portfolios. A detailed asset list would be an added value at InvestMarkets so that traders can see at a glance what the broker offers (luckily, in this case, we've already done the hard work for you!).

Account Types

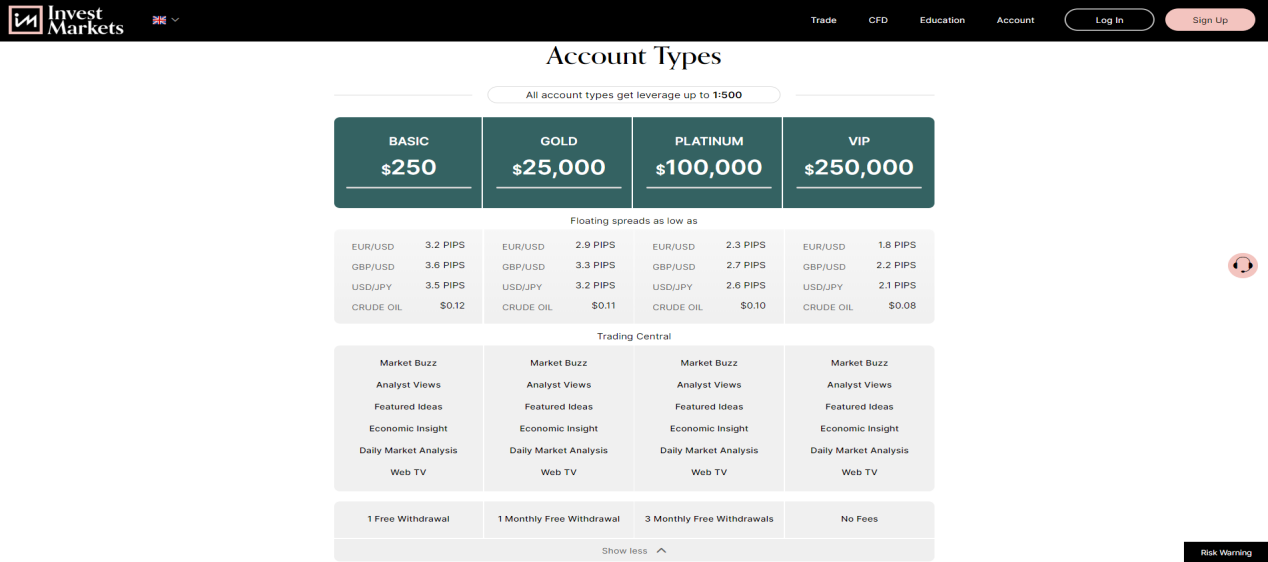

Retail traders only qualify for the Basic account for a minimum deposit of $250 and maximum leverage of 1:500. Though other brokers offer a lower minimum deposit, in practice, trading with less than $100 is ill-advised and not sustainable for anyone looking to find real profits, and a $250 starting point is a valid request. Leverage of 1:500 is possible due to the Belizean regulation and provides a significant advantage over EU-regulated brokers whose leverage is limited to 1:30.

The starting spread of 3.2 pips on the company's Basic account makes short-term trading strategies like scalping or high-frequency trading nearly impossible with this account type. The other three account tiers require deposits of $25,000, $100,000, and $250,000. We would have liked to see some account types for mid-level deposits.

InvestMarkets deploys a unique account structure.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

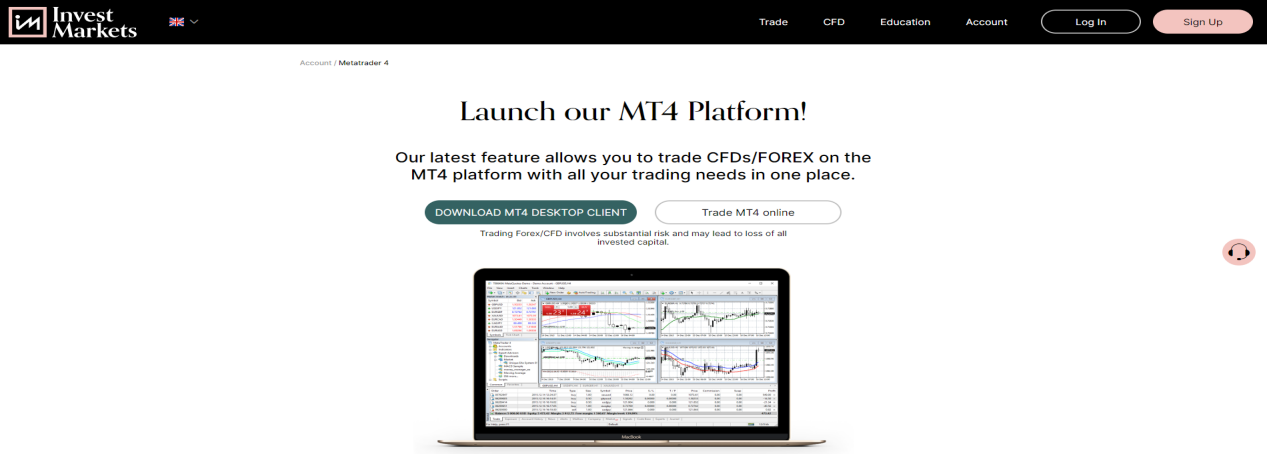

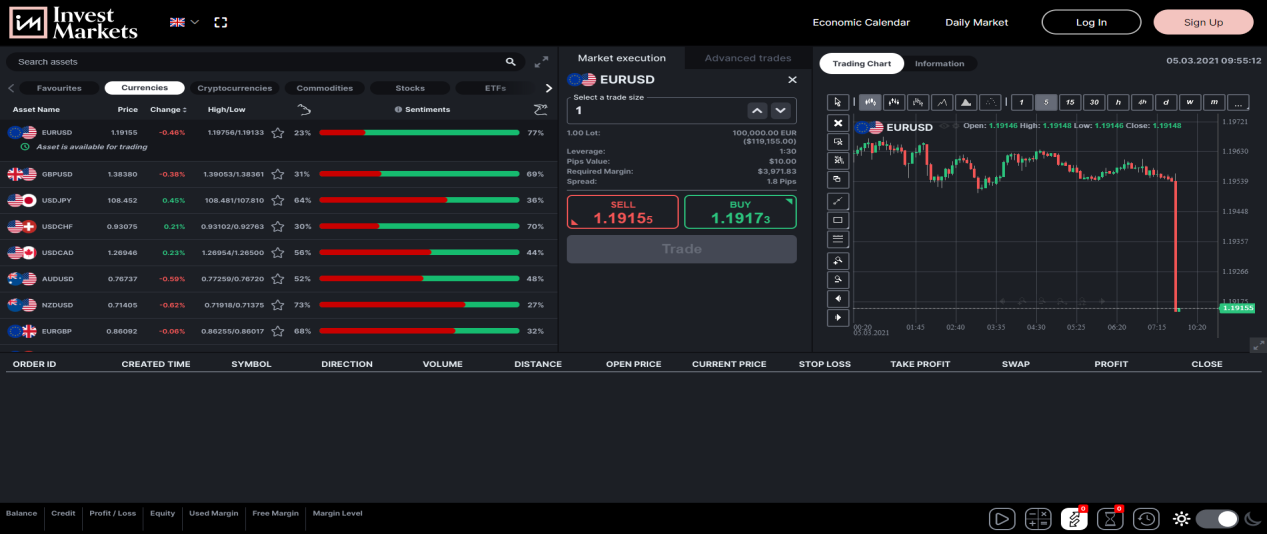

InvestMarkets offers clients the core MT4 trading platform. It also features its proprietary webtrader though information about the platform is lacking. That being said, the fact that the brokerage went to the expense to develop its own proprietary platform indicates not only that the brand is here to stay but that they want traders to have an upgraded trading experience. Interested clients can load the InvestMarkets webtarder without registration to check out its functionality and explore the asset selection. MT4 supports automated trading and comes with an integrated signal service, while the proprietary webtrader caters to manual traders only. New retail traders have enough to get started and learn how to trade. They can purchase upgrades once needed and also sell their signals to other MT4 traders.

Overall, the platform selection at InvestMarkets remains above that offered by most newer brokers who offer MT4 only.

The out-of-the-box MT4 trading platform is available at InvestMarkets.

Unique Features

The cryptocurrency selection, including the mini CFD contracts, stands out as a positive feature at InvestMarkets. The company's proprietary platform, though sparsely outlined, may also be seen as a unique feature, as it certainly looks easier to use and less overwhelming than the MT4 for most new traders.

Research and Education

The most valuable asset at InvestMarkets remains the research and educational services by Trading Central. Traders get competitive trading tools consisting of Analyst Views, Daily Market Analysis, Economic Insight, Featured Ideas, Strategy Newsletters, TC Market Buzz, TC Research Platform, and Web TV. InvestMarkets published several posts intended for education, most of which elucidate on industry buzzwords and offer brief introductions to important topics. Another standout feature of this brokerage is the frequent webinars, where new traders may get the most educational content at this broker.

Overall, for a new broker, InvestMarkets has clearly set a solid tone for its educational offerings and market insights.

Traders get competitive trading tools provided by Trading Central.

.jpg)

Most educational posts remain brief and fail to add value.

New traders may get the most value from the frequently hosted webinars.

.jpg)

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |       |

The most convenient approach to reach customer support is the live chat function. InvestMarkets also lists three phone numbers and an e-mail address where traders can turn with questions. Likewise, the FAQ section provides answers to some of the most asked questions.

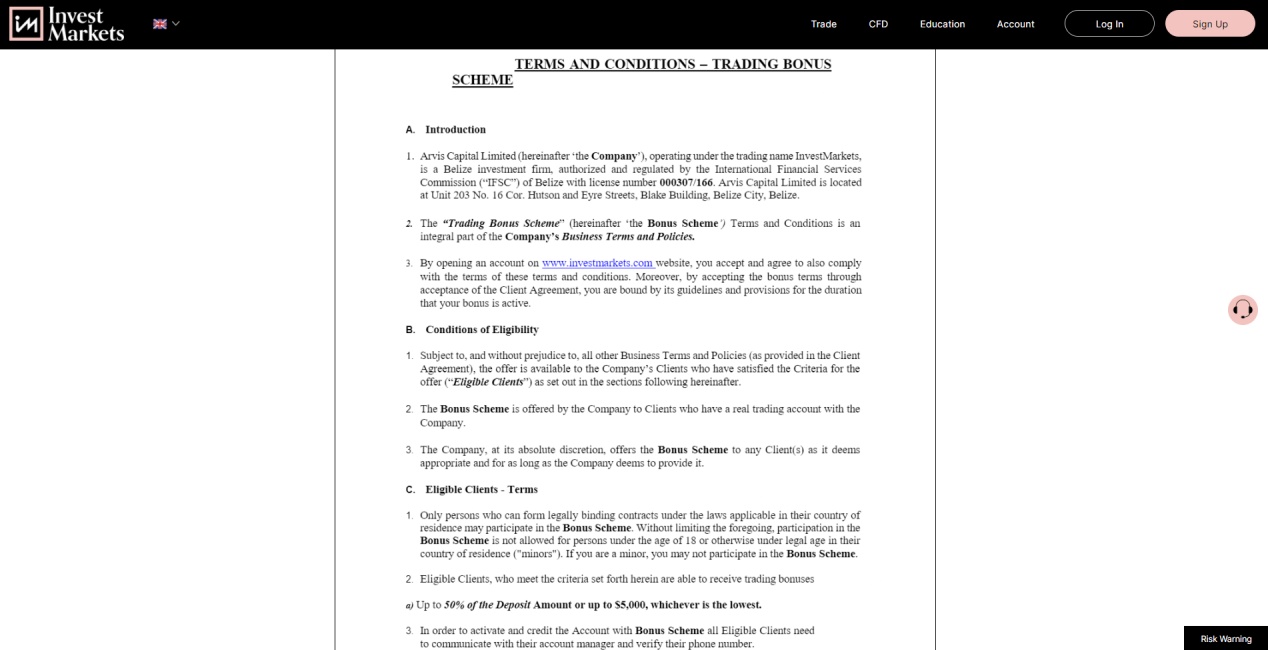

Bonuses and Promotions

InvestMarkets does not specify a bonus on its website, but the Legal section has a dedicated PDF with the applicable terms and conditions. It reveals a 50% deposit bonus of up to $5,000. Bonuses are another advantage of IFSC regulation, as EU-regulated brokers do not allow bonuses.

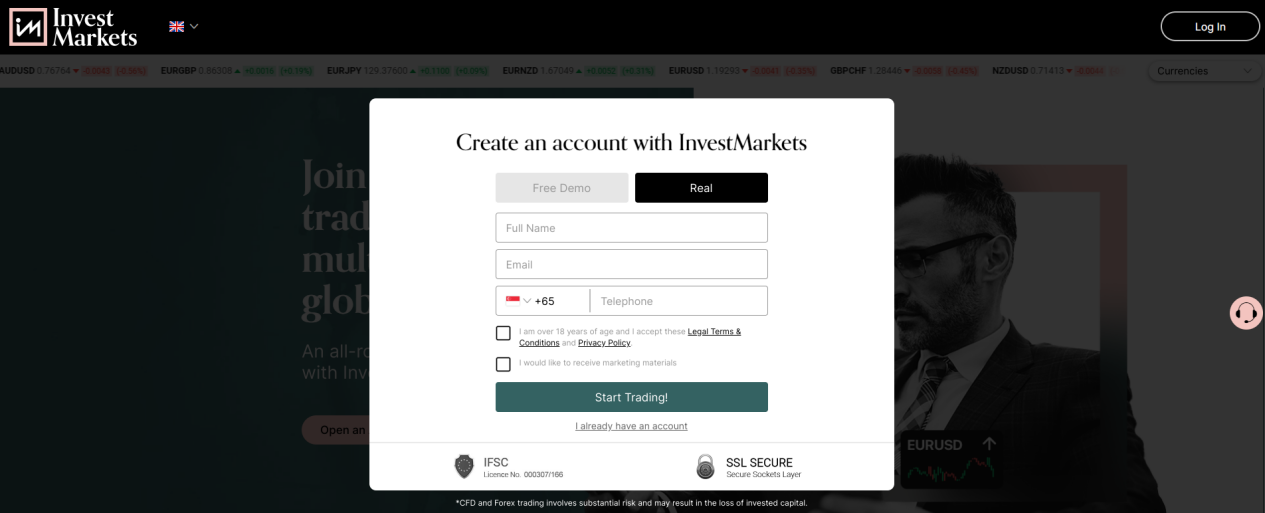

Opening an Account

A name, e-mail, and phone number are all the requirements to open an account at InvestMarkets. Verification remains a mandatory step to comply with regulatory AML/KYC stipulations. New traders must submit a copy of their ID and one proof of residency document.

Deposits and Withdrawals

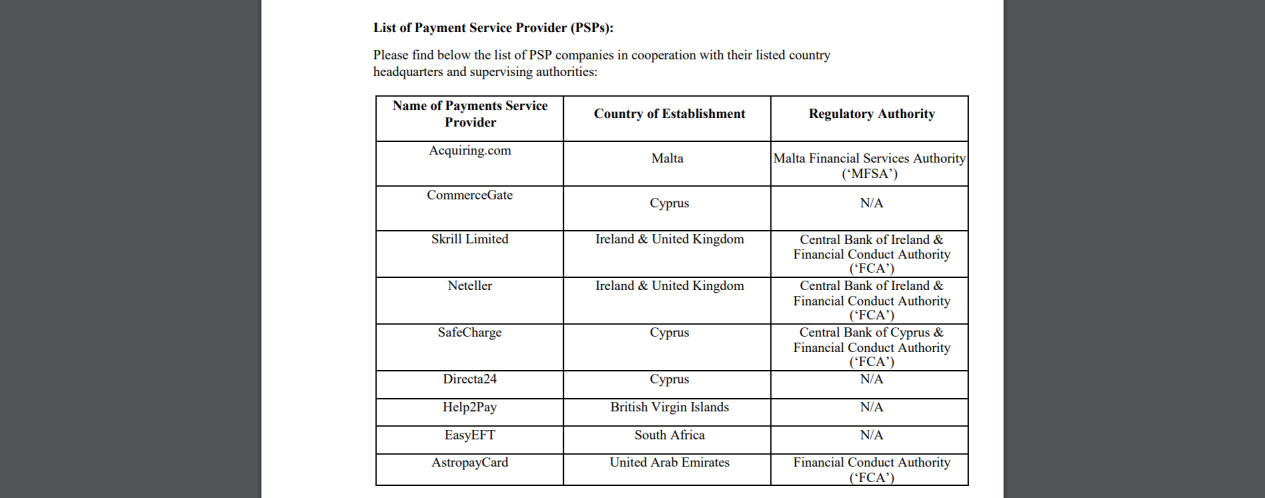

InvestMarkets does not maintain a dedicated deposit and withdrawal section, though the information is clearly available in the FAQ and LEGAL sections of the website. The General Fees legal document lists Acquiring.com, CommerceGate, Skrill, Neteller, SafeCharge, Directa24, Help2Pay, EasyEFT, and AstropayCard, as online payment processors. Bank wires and credit/debit card payments are also available. InvestMarkets processes withdrawal requests within 24 hours, but it may take up to five business days for clients to receive their funds. Credit/debit cards and Neteller incur a 3.5% fee, Skrill a 2.0% surcharge, and bank wires a cost of $30 or currency equivalent.

InvestMarkets lists nine online payment processors.

Various fees apply, depending on the payment option. InvestMarkets may add an internal €80 cost.

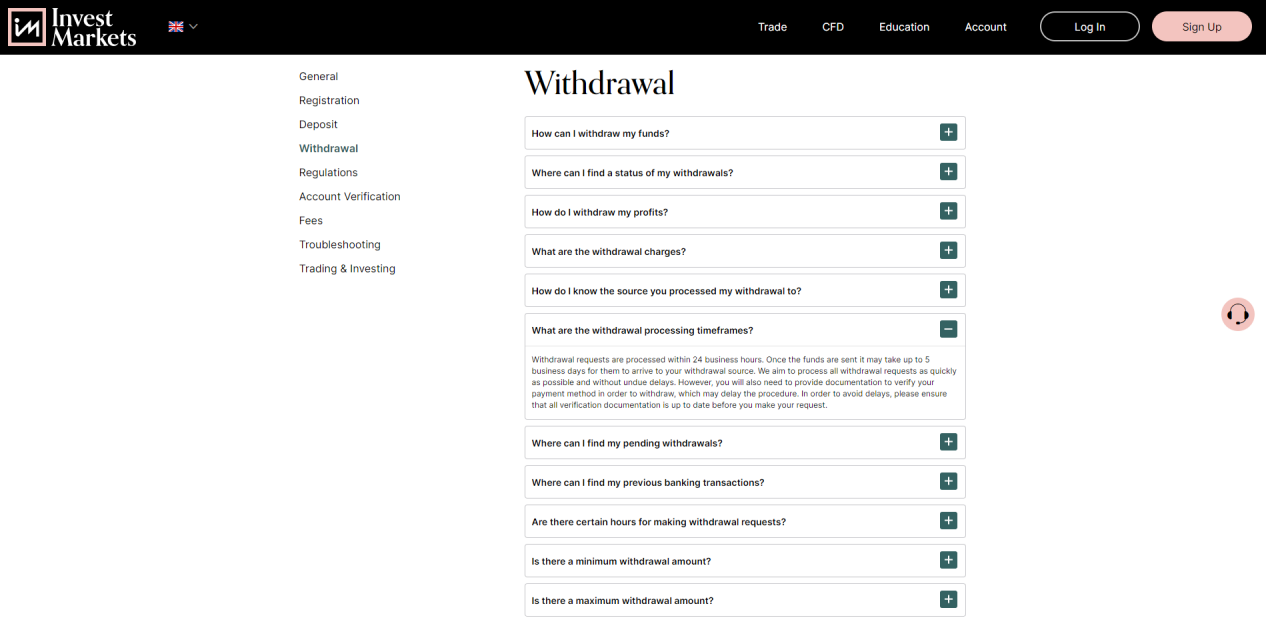

Internal processing times remain within 24 hours, but it may take up to five business days for withdrawals to arrive.

Summary

InvestMarkets became operational in July 2020. It has an unexplained affiliation with 24Option, the faltering broker that tried to transition from binary options to CFDs. It may also have a relationship with other brokers under the same management team, and InvestMarkets must become more transparent. The account structure is misguided, and InvestMarkets provides one of the most expensive pricing environments among all brokers. The cryptocurrency selection and services by Trading Central remain two tremendous assets from where this broker can grow, but it has to address the red flags first. Until then, traders should remain patient and cautious.

InvestMarkets operates under the oversight of the IFSC in Belize as a legit broker. InvestMarkets is a new broker operational since 2020 with an experienced management team. Though the website was lacking some information that would have helped provide more transparency, we found no evidence that InvestMarkets is a scam. InvestMarkets does not have sufficient operating experience for a proper assessment regarding its safety. InvestMarkets processes withdrawals within 24 hours, but traders may wait up to five business days before receiving their funds which is fairly common for all bank wires.FAQs

Is InvestMarkets legit?

What is InvestMarkets?

Is InvestMarkets a scam?

Is InvestMarkets safe?

How long does it take to withdraw money from InvestMarkets?