Investous Editor’s Verdict

Investous, owned by Belize investment firm IOS INVESTMENTS Limited, offers traders a competitive selection of cryptocurrency CFDs from its web-based trading platform. It also presents the trusted MT4 platform and features trading tools from TipRanks and Trading Central. I reviewed this broker to determine if Investous delivers on its claim concerning its simplistic, user-friendly trading platform. Should you trade at Investous?

Overview

As of October 2021, this broker is no longer accepting new traders. To find a reliable, regulated Forex broker, check out our top Forex brokers list. Thank you!

Summary

Investous Overview - A Beginner-Friendly Broker with Competitive Trading Tools

Headquarters | Belize |

|---|---|

Regulators | CySEC, FSC Belize |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2018 |

Execution Type(s) | Market Maker |

Minimum Deposit | $250 |

Trading Platform(s) | MetaTrader 4, Web-based |

Average Trading Cost EUR/USD | 2.3 pips ($23.00) |

Average Trading Cost GBP/USD | 2.5 pips ($25.00) |

Average Trading Cost WTI Crude Oil | $0.08 |

Average Trading Cost Gold | $0.59 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Beginner traders will like the user-friendly web-trading platform at Investous, but I like a more in-depth educational offering. Investous is also an ideal broker for cryptocurrency CFD trading, where it maintains a broader list than many competitors.

Investous Main Features

Retail Loss Rate | 75.12% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | Not applicable |

Minimum Deposit | $250 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | €80 monthly after one month |

Deposit Fee | No |

Withdrawal Fee | Yes + Third-party |

Funding Methods | 4 |

Regulation and Security

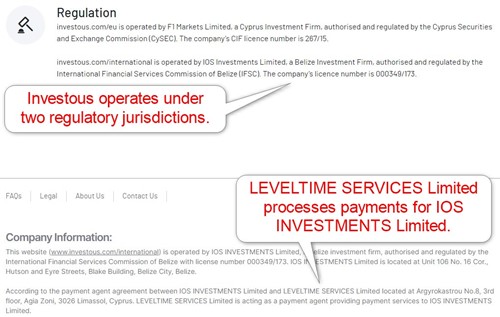

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Investous presents clients with two well-regulated entities.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Belize | International Financial Services Commission | License Number 000349/173 |

Cyprus | Cyprus Securities and Exchange Commission | License Number 267/15 |

All traders outside the European Economic Area (EEA) will trade with the Belize subsidiary, operated by IOS INVESTMENTS Limited. The International Financial Services Commission (IFSC) is a trusted regulator offering more competitive trading conditions, but Investous opted to align them with its Cyprus subsidiary operated by F1 Markets Limited.

While the IFSC provides a trusted framework, I am missing the investor protection via a compensation fund offered by regulators like the Cyprus Securities and Exchange Commission (CySEC). Investous could increase client security via membership with the Hong Kong-based Financial Commission or third-party insurance. Cyprus-based LEVELTIME SERVICES Limited offers payment services to IOS INVESTMENTS Limited.

EEA traders will manage their portfolios with the CySEC subsidiary, compliant with MiFID II, where a €20,000 investor compensation fund protects deposits in the case of default by Investous.

Both entities segregate client deposits from corporate funds and offer negative balance protection, which I consider a requirement for leveraged trading. Investous maintains a clean track record but lacks operational experience. It is on the right track, as it slowly gains the trust of its growing client base.

Fees

Average Trading Cost EUR/USD | 2.3 pips ($23.00) |

|---|---|

Average Trading Cost GBP/USD | 2.5 pips ($25.00) |

Average Trading Cost WTI Crude Oil | $0.08 |

Average Trading Cost Gold | $0.59 |

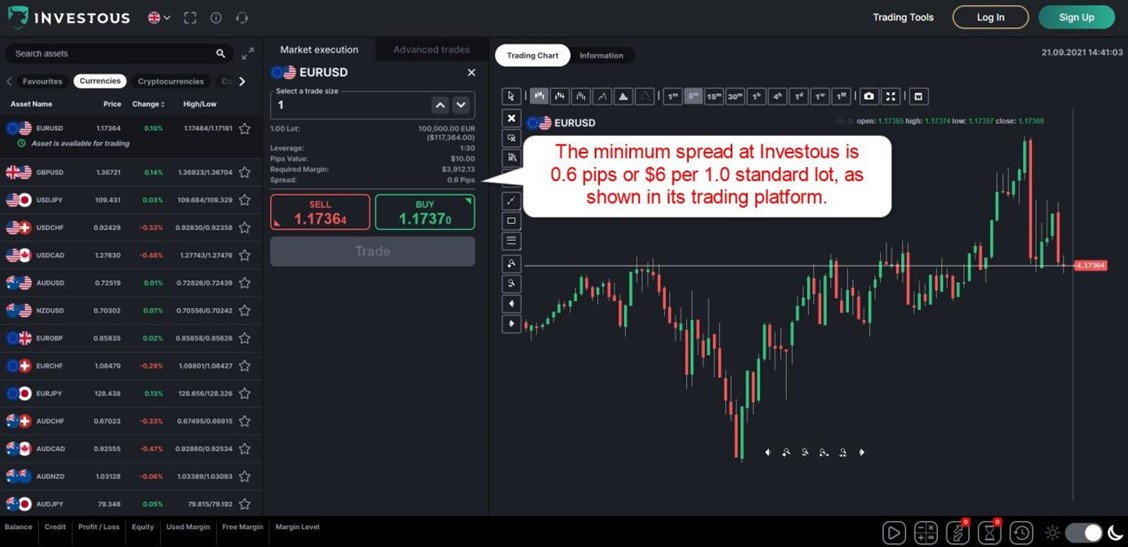

Investous lists spreads on its website under the account section, ranging between 1.6 pips and 3.0 pips or $16 to $30 per round lot. Both trading platforms show it as 0.6 pips or $6 per lot, making it a competitive commission-free offer, and I will use it in this review but prefer more clarity.

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.6 pips | $0.00 | $6.00 |

Here is a screenshot of the Investous web-based trading platform during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free Investous account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.6 pips | $0.00 | -$4.82 | X | $10.82 |

0.6 pips | $0.00 | X | -$3.21 | $9.21 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.6 pips | $0.00 | -$33.74 | X | $39.74 |

0.6 pips | $0.00 | X | $22.47 | $28.47 |

I like the swap rates for buy orders at Investous, which remains among the best versus all brokers. Countering them are more expensive financing fees for sell orders, but the combination plus commission-free Forex spreads create an overall favorable pricing environment for most traders.

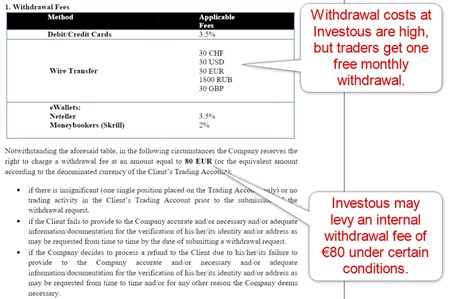

The only thing I dislike about costs at Investous is the inactivity fee, which kicks in after just one month at €80 monthly. It can increase trading pressure and increase trading losses, particularly for beginner traders. There are also certain withdrawal conditions allowing Investous to levy an internal cost of €80.

What Can I Trade

Investous offers traders 55 currency pairs, 46 cryptocurrency pairs, 21 commodities, 39 index CFDs, 125 equity CFDs, and two ETFs. The choice of currency pairs is average, and Equity traders get access to some of the most traded and discussed names on social media. Investous maintains a competitive selection of cryptocurrency pairs, commodities, and index CFDs.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Investous Leverage

Retail traders get maximum leverage of 1:30 at both subsidiaries, in line with ESMA restrictions. While the website lists leverage as high as 1:500 for the IFSC entity, the trading platform does not show one above 1:30.

Investous Trading Hours (GMT +2 Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Sunday 23:00 | Friday 22:59 |

Forex | Sunday 23:00 | Friday 22:59 |

Commodities | Monday 00:00 | Friday 22:59 |

European CFDs | Monday 09:00 | Friday 17:30 |

US CFDs | Monday 15:30 | Friday 22:00 |

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

Investous lists four account types on its website, but only one is within reach of retail traders for an above-average minimum deposit of $250. Traders get one free monthly withdrawal, which I like, and despite the date four-tier account structure, most conditions are identical.

The minimum spread listed is 3.0 pips, while the VIP account has a 1.6 pip versus the 0.6 pips in the web-based trading platform and MT4.

Investous Demo Account

A demo account is available for both trading accounts, and Investous does not list a time limit. I prefer the flexibility of MT4, as traders can create closer conditions to live trading conditions. They are ideal for testing new strategies and algorithmic trading solutions (EAs).

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Traders using algorithmic trading solutions will enjoy the familiarity of MT4, which I recommend, as it provides the best trading experience at Investous. Only the out-of-the-box version is available, as Investous embeds trading services from Trading Central and TipRanks into its web-based trading platform only.

Beginner traders may prefer the web-based trading platform, as it features a better user interface but reduced functionality. MT4 also has an integrated copy trading platform, a service many new traders prefer. Traders may use either one as a mobile app.

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | No |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | Yes (MT4 only) |

Social Trading / Copy Trading | Yes (embedded in MT4) |

MT4/MT5 Add-Ons | No |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | Trading Central |

Unique Feature Two | TipRanks |

Unique Features

The two unique services at Investous are Trading Central and TipRanks. The former offers trading signals and market commentary, while the latter provides recommendations primarily for the equity markets. Given the asset selection at Investous, both services cover almost every asset available.

Research and Education

Investous relies on Trading Central and TipRanks for research and market commentary. I consider it an acceptable solution, as it provides traders with unbiased trading ideas from trusted third-party sources and allows Investous to focus on core operations.

The educational section for beginners is sub-standard and consists of a few brief articles. The best educational value exists by understanding the content provided by Trading Central and TipRanks. I recommend new traders take advantage of high-quality education available online and free of charge.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |     |

I recommend traders consult the FAQ section before reaching out to support. Investous provided an e-mail address, phone number, and live chat, which I recommend for most non-sensitive issues. Investous does not list support hours, but regular business hours in Belize should apply.

Bonuses and Promotions

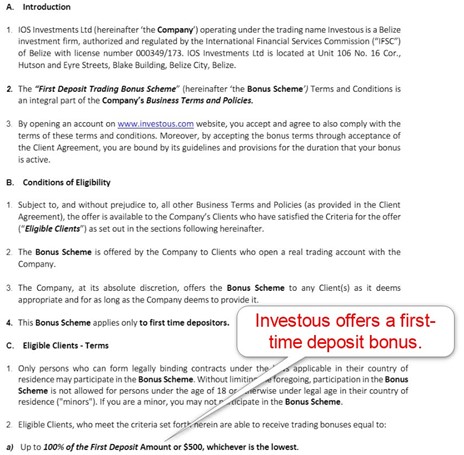

While Investous does not list a bonus on its website, the legal section outlines terms and conditions for a first deposit bonus up to 100% limited to $500. It only applies to the Belize subsidiary, as bonuses and promotions are illegal under the ESMA framework. Therefore, EEA traders under the Cyprus subsidiary cannot participate. Terms and conditions apply, and I recommend traders read and understand them before requesting a bonus.

Opening an Account

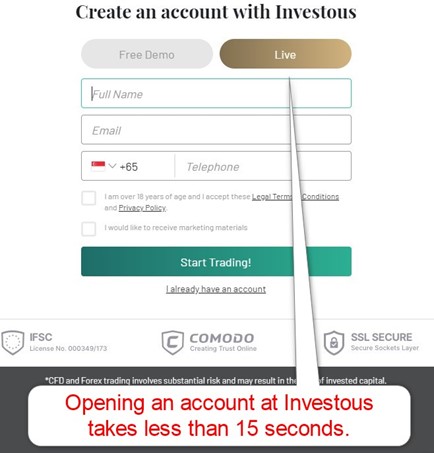

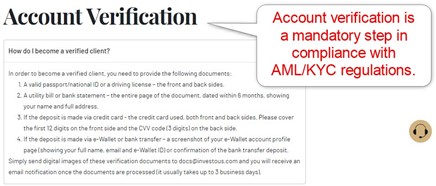

I like the swift onboarding process at Investous. The first step takes less than 15 seconds and only requires a name, e-mail, and phone number. I recommend traders change the password Investous e-mails them. As a regulated and compliant broker, account verification at Investous is mandatory. Traders can upload the necessary documents from the back office under Profile and may use their smartphones.

Minimum Deposit

The minimum deposit at Investous is $250, higher than most brokers but within a reasonable range.

Payment Methods

Investous offers bank wires, credit/debit cards, Skrill, and Neteller. I would like to see more payment processors to grant traders from various geographic locations broader choices.

Accepted Countries

Investous caters to most international traders from its Belize subsidiary, including clients from the UAE. EEA residents must trade from their Cyprus unit, but neither one accepts traders from the UK.

Deposits and Withdrawals

The back office handles all financial transactions, and Investous grants one free withdrawal monthly. I believe it is enough and caution against more than one monthly withdrawal. Withdrawal fees are high, at 3.5% for credit/debit cards and Neteller, 2.0% for Skrill, and $30 or a currency equivalent for bank wires.

Investous processes withdrawal requests within 24 hours, but it may take up to five business days for traders to receive their funds. Under certain conditions, Investous reserves the right to levy an internal withdrawal fee of €80, which I find excessive.

Bottom Line

I like the trading environment at Investous for beginner traders, those who seek broader cryptocurrency CFD exposure from a trusted Forex broker and leveraged traders. The commission-free cost structure remains competitive, and financing costs for leveraged traders are low, resulting in higher profit potential. Trading services by Trading Central and TipRanks offer excellent third-party resources.

Beginner traders may prefer the web-based trading platform due to its simplicity and user interface, but Investous also offers MT4 for algorithmic traders. It also features an embedded copy trading platform. Investous does not provide meaningful educational content but remains an overall competitive broker, especially for cryptocurrency CFD traders who want leverage with low financing costs. The Belize International Financial Services Commission (IFSC) provides regulatory oversight, which adds a layer of protection for traders. Investous is a CFD broker operating out of Belize. No, it is a legit broker. The broker remains compliant with its regulator. Yes. Investous presents traders with 270 assets across six categories and two trading platform options. Withdrawals are processed within 24 hours and may take up to five business days. Credit/debit cards face a 3.5% charge, and wire transfers are assessed 30 units of the base currency plus an additional €80 at the discretion of the broker.FAQs

Is Investous safe?

What is Investous?

Is Investous a scam?

Is Investous a good broker?

What is the Investous withdrawal policy?