Editor’s Verdict

Just2Trade shines with its asset selection covering 30,000 trading instruments, choice of trading platforms, a proprietary copy trading service, a robo-advisory unit, IPO trading, and in-house managed investment portfolios. I decided to review this broker to evaluate if its advertised low trading fees translate into reality or if actual costs are high. Is Just2Trade the right broker for you?

Overview

A CySEC-regulated broker with a choice of trading platforms and 30,000+ assets.

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Year Established | 2008 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $100 to $200 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based |

Retail Loss Rate | 73.00% |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Forex | $2.00 to $3.00 |

Funding Methods | 17 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like that Just2Trade offers eight trading platforms, which ensures traders and investors get one suitable for their preferred strategy. The choice of trading services is also excellent, offering clients four competitive methods for portfolio management. I also appreciate the high-speed execution of 0.05 seconds.

Just2Trade Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Just2Trade presents clients with one regulated entity.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | 281/15 |

Is Just2Trade Legit and Safe?

Just2Trade was founded in 2007 and obtained its CySEC license in 2015. It segregates client deposits from corporate funds and offers negative balance protection in its standard trading accounts for retail traders. It complies with ESMA guidelines and MiFID II, and the Cyprus investor compensation fund protects deposits up to 90% with a €20,000 limit. My review did not uncover misconduct, scam, or fraud, and I confidently rate Just2Trade as a legit and safe Forex broker.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Just2Trade advertises competitive minimum trading fees, but they regrettably translate into expensive actual costs. I tested the MT5 Global account, where Just2Trade notes raw spreads from 0.0 pips for a commission of $2.00 per lot. During the London-New York crossover session, where Forex spreads are the tightest, the MT5 trading platform quoted the EUR/USD with spreads between 1.0 and 1.3 pips or $11.00 to $13.00 per lot, excluding the $2.00 commission.

Option traders pay $2.50 in commissions, and futures cost between $0.50 and $1.50. Swap rates are competitive, making Just2Trade well-suited for strategies that last seven to ten trading days. In contrast, the actual trading fees discourage high-frequency trading or scalping.

Minimum Raw Spreads | 0.0 pips |

|---|---|

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Forex | $2.00 to $3.00 |

Deposit Fee | |

Withdrawal Fee |

Here is a snapshot of Just2Trade trading fees:

The minimum trading costs for the EUR/USD at Just2Trade are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.50 pips (Forex and CFD Standard) | $0.00 | $5.00 |

0.00 pips (Forex ECN) | $3.00 | $3.00 |

0.00 pips (MT5 Global) | $2.00 | $2.00 |

Please note that actual trading fees are significantly higher. During my review, the average spread for the EUR/USD ranged between 1.0 and 1.3 pips.

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based MT5 Global account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for one night will cost the following (at the time of writing):

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

1.00 pips | $2.00 | -$8.48 | X | $20.48 |

1.00 pips | $2.00 | X | $2.39 | $0.39 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

1.00 pips | $2.00 | -$59.36 | X | $71.36 |

1.00 pips | $2.00 | X | $16.73 | -$4.73 |

Noteworthy:

- Just2Trade offers positive swap rates in qualifying assets, meaning traders can get paid for holding leveraged overnight positions, like in the example above on EUR/USD short positions.

Range of Assets

Just2Trade lists 30,000+ assets. The bulk are equity stocks and CFDs listed on 36 global exchanges, which is an excellent selection. Forex traders get a reasonable selection of 64 currency pairs, and commodity traders can choose from 25 CFDs and futures contracts.

I am missing cryptocurrency CFDs and ETFs. However, the latter may exist on the Sterling Trader platform, where Just2Trade claims to grant access to all US equity and options exchanges. I prefer more clarity concerning available assets, as Just2Trade does not list sectors besides Forex, metals, stocks, options, futures, bonds, and CFDs.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds |

Just2Trade Leverage

The maximum Forex leverage depends on the asset. ESMA rules state retail traders get a more restrictive 1:30 Forex leverage versus the 1:500 international standard, which CySEC brokers offer to professional traders. Just2Trade grants 1:20 equity CFD leverage and 1:3 to bond traders.

Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses. Negative balance protection exists for certain account types at this broker, meaning traders with the right account types can never lose more than their deposits. Still, it does not apply to the Just2Trade Forex ECN account.

Just2Trade Trading Hours (GMT)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Not applicable | Not applicable |

Forex | Sunday 21:05 | Friday 21:00 |

Commodities | Sunday 22:10 | Friday 20:55 |

European Equities | Monday 07:00 | Friday 15:30 |

US Equities | Monday 08:00 | Friday 21:30 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, and commodities, which essentially trade 24/5.

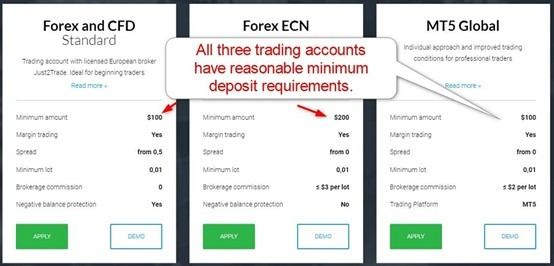

Account Types

Traders can choose between three account types at Just2Trade. The Forex and CFD Standard account offers negative balance protection and commission-free trading, unlike the commission-based Forex ECN alternative, where negative balance protection does not apply. The commission-based MT5 Global account provides traders access to most trading instruments.

The minimum deposit is $100 for the Forex and CFD Standard and MT5 Global account and $200 for the Forex ECN option. All three account types have a minimum lot size requirement of 0.1 lots and five-decimal pricing. The commissions of $2.00 to $3.00 per 1.0 standard round lot are highly competitive, but the spreads make short-term trading styles expensive.

Just2Trade Demo Account

The Just2Trade demo account has an overly high demo account balance of $100,000, but the registration is refreshingly swift. I did not find a time limit, which suggests that Just2Trade understands the requirements of demo trading. I prefer more customization options to ensure demo trading conditions reflect planned live portfolios. Still, I rate the demo account at Just2Trade as sufficient.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to the full range of trading psychology and can create unrealistic expectations.

Trading Platforms

Just2Trade offers MT4/MT5 trading platforms, which fully support algorithmic and copy trading. Trader may use customizable desktop clients, lightweight web-based alternatives, and user-friendly mobile apps. MT4 remains the industry leader with 25,000+ custom indicators, plugins, and EAs, but the quality upgrades are not free. It also has an embedded copy trading service.

Traders may also use CQG Desktop, which is free. CQG Trader costs $25 monthly, CQG QTrader $75 monthly, CQG Integrated Client $595 monthly, Sterling Trader Pro, and Lightspeed Trader. All six cater to professional trading requirements and prop trading groups, featuring Level II data, basket trading, full customization, hot-key support, alerts, real-time scanning tools, and many other functions. Individual traders must transact a monthly minimum of 250,000 shares to qualify.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

Just2Trade delivers several unique features worth noting. Copy traders can diversify via the proprietary J2T Copy service, which requires a low minimum capital requirement of $100. The Robo-Advisor presents an alternative for long-term investors. Just2Trade also features in-house managed investment portfolios, available from a $250 minimum investment and a minimum investment period between three to twelve months.

Clients at Just2Trade may engage in IPO investing, a service I like, as it offers clients a chance to participate in high-risk, high-reward investments. The minimum investment is $1,000 with a 4% participation fee. API trading is available for demanding traders with custom algorithmic trading solutions.

Research & Education

Just2Trade provides massive in-house research for registered clients and via well-trusted third-party provider Trading Central. It remains unclear if Just2Trade offers the MT4/MT5 plugin or provides the services via its back office. A news section and an economic calendar are also available.

While Just2Trade does not maintain a dedicated educational section, and beginners are not its core market, the blog features well-written educational content that I can recommend to first-time traders.

I advise beginner traders to learn how to trade elsewhere via online educational resources available for free and start with trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |            |

Just2Trade offers 24/7 customer support, but an FAQ section needs to be included. A direct line to the trading desk exists, but I am missing one from the finance department, where most issues can arise. Just2Trade explains its products and services well, and I doubt traders will require assistance.

Bonuses and Promotions

During my review, just2Trade neither offered bonuses nor promotions; a quality partnership program exists.

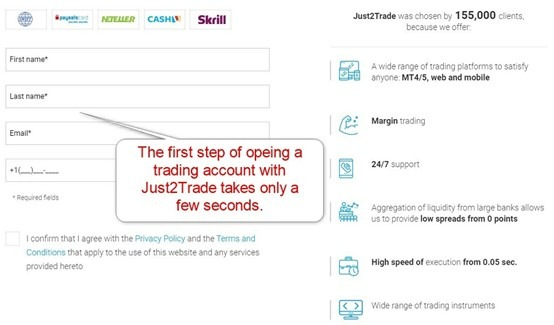

Opening an Account

A fast online application onboards new clients to Just2Trade. It only asks for a name, e-mail, and phone number. As a CySEC-regulated broker, the verification process includes a questionnaire that collects data per regulatory requirements enforced by the ESMA.

Account verification is mandatory as Just2Trade complies with AML/KYC requirements. Most traders will satisfy this by sending a copy of their government-issued ID and one proof of residency document.

Minimum Deposit

Depending on the account type, the Just2Trade minimum deposit is between $100 and $200.

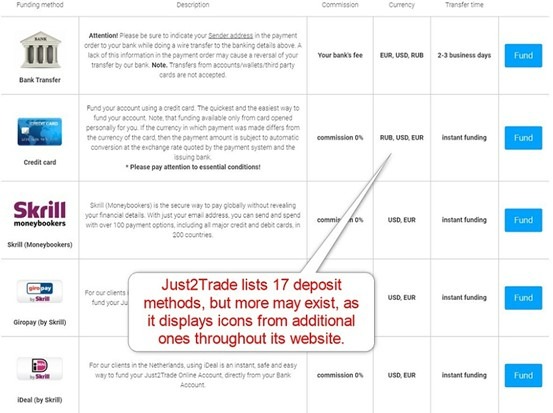

Payment Methods

Just2Trade supports bank wires, credit/debit cards, Skrill, Giropay, iDEAL, Dankort, Nordea, POLi, P24, Neteller, Klarna, Alfa-Bank, PayPal, OXXO, SPEI, Davivienda, 7eleven. Geographic restrictions may apply.

Accepted Countries

Just2Trade only notes the US as a restricted country. Still, it adds that it does not accept clients from countries or "territories where such distribution would be contrary to local law or regulation."

Deposits and Withdrawals

The secure Just2Trade back office handles all financial transactions for verified clients.

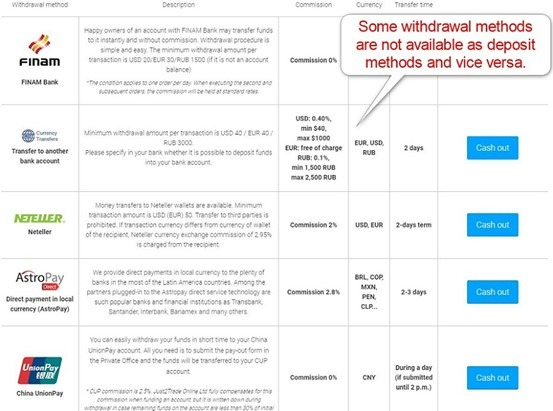

Just2Trade does not levy internal deposit fees; accepted currencies are USD, EUR, RUB, COP, and MXN. Processing times are instant except for bank wires, which take two to three business days. Withdrawal fees and withdrawal processing times depend on the payment processor, which Just2Trade transparently lists on its website and in the back office.

Geographic restrictions apply, and the deposit and withdrawal screen will only list the ones available to traders. Traders should consider potential currency conversion fees and third-party payment processor costs. The name on the payment processor and Just2Trade account must match, as third-party payments remain prohibited by AML rules.

Is Just2Trade a good broker?

I like the Just2Trade trading environment for its choice of trading platforms and services, ranking among the best industry-wide. The choice of payment processors is good, but I still need cryptocurrency deposits and withdrawals. While the 30,000+ asset selection looks good on paper, it focuses on equities and CFDs listed on 36 exchanges, making Just2Trade an excellent choice for equity traders. Forex traders get a reasonable selection of 64 currency pairs. Other sectors need to be included or underrepresented besides the 25 commodity CFDs and futures.

Just2Trade lists notably more deposit methods than withdrawal options, and some are not on both lists, which puzzled me, as traders cannot deposit using China UnionPay, AstroPay, or FINAM Bank, but they can withdraw using those methods. The core trading environment is solid, except for above-average trading fees, which I rate as the primary reason I cannot recommend this broker despite numerous bright spots.

Traders can withdraw money via the secure and user-friendly back office, which lists all available withdrawal methods. Yes, Just2Trade has a regulatory license from CySEC. Depending on the account type, the Just2Trader minimum deposit is between $100 and $200. Just2Trade ranks among the better brokers due to its choice of trading platforms and services, but trading fees are high despite low minimums.FAQs

How do I withdraw money from Just2Trade?

Is Just2Trade regulated?

What is the minimum deposit for Just2Trade?

Is Just2Trade a good broker?