Editor’s Verdict

Kraken is a US-based cryptocurrency exchange established in 2011, just two years after the mining of the first Bitcoin block, the Genesis block. It caters to 10M+ clients from 190+ countries with quarterly trading volume exceeding $200 billion. Cryptocurrency traders can use the mobile app or the advanced Kraken Pro web-based trading platform. I reviewed this cryptocurrency exchange to determine if it is the best place for your cryptocurrency portfolios. Should you trade and invest with Kraken?

Overview

Kraken offers beginner cryptocurrency traders a user-friendly on-ramp to the sector.

I like the security at Kraken and the 24/7 customer support, including phone support, which is rare and ensures peace of mind given the volatile sector and ongoing threat of hacks, thefts, scams, and frauds. I applaud Kraken for security and customer service, as it shows how a cryptocurrency exchange should handle both.

Headquarters | United States |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2011 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Other, Proprietary platform |

Average Trading Cost EUR/USD | Not applicable |

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | 0.00% to 0.26% |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Funding Methods | 6+ |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Kraken Regulation & Security

Trading with a regulated exchange will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Kraken, like all cryptocurrency exchanges, is unregulated but duly registered with the necessary authorization to offer its services.

Is Kraken Legit and Safe?

Kraken, founded in 2011, is a duly registered company with Payward Inc. as its corporate owner. Headquartered in San Francisco, Kraken ranks among the most secure cryptocurrency exchanges globally and the largest Bitcoin exchange for Euro transactions. It was the first to get cryptocurrency prices and volume data displayed on the Bloomberg Terminal, confirming its standing among institutional clients, which shows their trust in Kraken.

The security measures at Kraken remain industry-leading, and it was the first to pass a cryptographically verifiable proof-of-reserves audit. Kraken is also the court-appointed trustee of the Tokyo government and a partner in the first cryptocurrency bank, Fidor Bank, based in Germany and regulated by BaFin.

While some traders reported asset losses amid account hacks, they are usually user errors and not the fault of Kraken. My review did not find any misconduct or malpractice by this cryptocurrency exchange. I confidently recommend Kraken and its excellent security features, as it is a legitimate and safe cryptocurrency exchange.

Fees

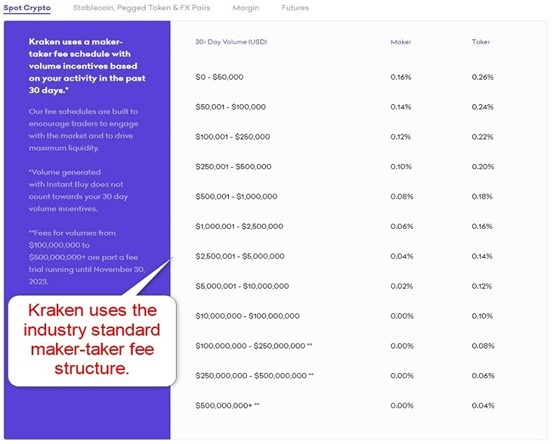

I rank trading costs among the most defining aspects when evaluating a cryptocurrency exchange, as they directly impact profitability. Kraken follows the industry-wide maker-taker model, rewarding liquidity providers and charging higher fees for liquidity drainers. NFT transactions face a 2.00% fee.

Maker fees at Kraken start from 0.16% on standard trading pairs and 0.20% on stablecoins and Forex pairs. It can drop to 0.00%, which depends on the running 30-day trading volume. Taker fees commence from 0.26% on standard trading pairs and 0.20% on stablecoins and Forex pairs. They may decrease to 0.10% and 0.001%, respectively.

The Kraken Instant Buy feature incurs a 0.9% fee for stablecoins and a 1.5% cost for cryptocurrencies. Kraken also charges 3.75% for credit/debit card purchases and 0.50% for bank wires.

Here is a snapshot of Kraken spreads:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Kraken levies a 0.02% margin fee when opening leveraged cryptocurrency positions and 0.015% for Forex pairs. It will repeat the cost every four hours during which a trader maintains a leveraged trading position.

Range of Assets

Kraken advertises 200+ cryptocurrency pairs, Forex pairs, stablecoins, and meme coins. NFTs are also available, and the marketplace continues to expand. While the asset selection is not overwhelming, it consists of highly liquid assets and covers the Top 100 cryptocurrency assets by market capitalization, which suffices for most traders.

Kraken Leverage

Maximum Retail Leverage | 1:5 |

|---|---|

Maximum Pro Leverage | 1:5 |

Kraken offers a maximum cryptocurrency leverage of 1:5, and unlike most US-based brokers or exchanges, negative balance protection exists. Kraken labels it the Equity Protection Process, which ensures traders cannot lose more than their deposits. Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Account Types

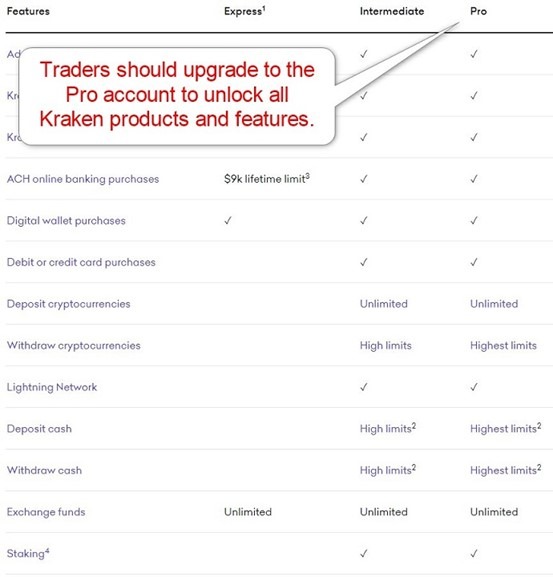

Kraken offers one account type with three verification levels: Express, Intermediate, and Pro. No minimum deposit requirement exists at Kraken, but it notes $10 on its homepage as a starting balance. Payment processors have minimum transaction volumes starting from $1.

I recommend traders pass the verification process to upgrade to Pro to unlock all features. Express has a lifetime deposit maximum of $9,000 but lacks core features like cryptocurrency deposits, staking, margin trading, access to the OTC desk, and dark pool trading.

Kraken Demo Account

Kraken offers a demo account for its futures trading platform, which supports API trading. It suffices to evaluate the trading platform and conditions or to test APIs but falls short of a traditional demo account as brokers offer in the MT4/MT5/cTrader trading platforms.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not give full exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

Kraken relies on its user-friendly mobile app for casual cryptocurrency traders who follow social trading trends to buy, sell, and exchange cryptocurrencies. The Kraken Pro web-based trading platform caters to traders who wish to conduct technical analysis and get Level 2 data. While it meets the basic requirements, the lack of support for algorithmic trading is notable. Copy or social trading is unavailable.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Besides the excellent security, I want to note the ability to trade in dark pools, to connect advanced trading solutions to the Kraken infrastructure via APIs, and the OTC trading desk caters to high net-worth traders. The NFT Marketplace is another excellent feature, and Kraken offers margin and futures trading. Kraken aims to cover most aspects of the cryptocurrency sector and does a superb job with its product and services portfolio.

Research & Education

Kraken is a cryptocurrency exchange and does not provide research. It creates a service gap versus competitors that offer it. Given the abundance of free and paid-for research online, I do not consider its absence at Kraken against it.

Kraken offers a quality educational portal with well-written content in seven segments: Bitcoin, Blockchain, Cryptocurrency, NFTs, DeFi, Trading, and Crypto Guides. I highly recommend it to beginners, as the content available at Kraken will pour a deep knowledge foundation essential for successful trading. I advise beginners to start their education at Kraken. I also recommend additional in-depth education covering trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors, as Kraken does not cover those topics.

Customer Support

Kraken customer support is available 24/7 via e-mail, phone, or live chat, but I miss a direct line to the finance department, where most issues can arise. Kraken explains its products and services well, and the Support Center answers most questions. I appreciate the effort by Kraken to fix its customer support following many complaints on review sites like Trustpilot.

Bonuses and Promotions

Kraken offered no bonuses or promotions at the time this review was made. It used to have a low-paying refer-a-friend program and may introduce special promotions in the future.

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |       |

Opening an Account

Kraken has a fast online application asking for an e-mail, username, desired password, and country of residence. There are no unnecessary steps, and I appreciate the absence of data mining.

Account verification at Kraken depends on the desired verification level. Traders who wish to use all products and services must pass the Pro verification process, which includes sending a copy of their government-issued ID and one proof of residency document.

Minimum Deposit

Kraken has no minimum deposit requirement.

Payment Methods

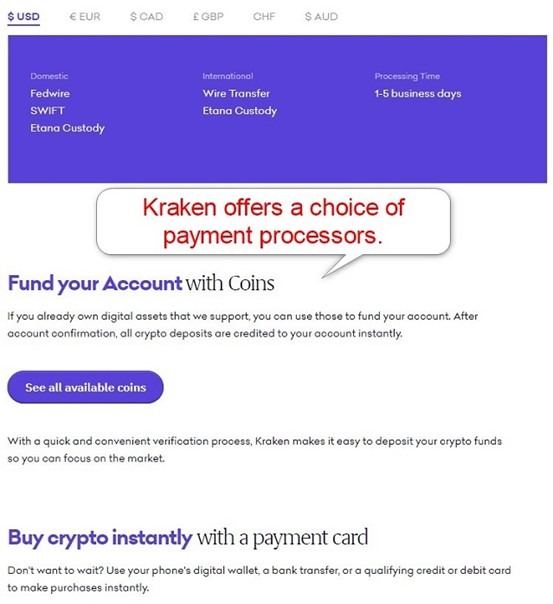

Kraken payment methods include bank wires, credit/debit cards, PayPal, Google Pay, Apple Pay, and cryptocurrencies. Localized payment processors also exist, like ACH in the US, SEPA in the EU, and BACS in the UK.

Accepted Countries

Kraken has clients resident in 190 countries but lists Crimea, Donetsk, Cuba, Iran, Luhansk, North Korea, and Syria as restricted countries. It notes that “few specific exceptions due to international and local financial & cryptocurrency regulations” exist and that some payment processors may limit or restrict transactions to Kraken.

Deposits and Withdrawals

The secure Kraken back office or mobile app handles all financial transactions for verified clients.

Kraken accepts cryptocurrency deposits and fiat currencies as deposit and withdrawal methods. The latter consists of USD, EUR, CAD, AUD, GBP, CHF, and JPY. Kraken notes deposit fees apply to the amount Kraken has to pay to accept the deposit. Most cryptocurrency deposits are free. Withdrawal fees and minimum withdrawal amounts depend on the currency, and Kraken provides a detailed list on its website. For example, the Bitcoin minimum fee and withdrawal amounts are 0.00005 BTC and 0.0001 BTC, respectively.

Etana Custody is available in most countries where a supported fiat currency is the national currency, but it has a $150 minimum withdrawal amount and a $35 withdrawal fee. Therefore, I advise traders to browse the detailed Kraken section outlining all payment processors and choose the most convenient one. Geographic restrictions apply, but I recommend using cryptocurrencies for deposits and withdrawals.

Processing times depend on the payment processor and geographic location of traders and range from instant to five business days. Kraken places a 72-hour hold on withdrawal for selected payment processors like credit/debit card deposits for security purposes. The confirmation page will always list the final fees, and Kraken does not levy hidden costs.

Withdrawal options |     |

|---|---|

Deposit options |     |

Is Kraken a good cryptocurrency exchange?

I like the trading environment at Kraken for its deep liquidity, including dark pools, API trading, OTC trading desk, and NFT Marketplace. The asset selection is acceptable and covers 200+ assets, while beginners get high-quality educational content. I also appreciate the 24/7 customer support, which includes phone support, and rate the security among the best in the industry.

The trading platform fulfills the basic functions but lacks advanced features. The absence of algorithmic trading is notable but not uncommon. I rate Kraken as an excellent overall exchange with reasonable fees, except for its ill-priced Instant Buy function. I highly recommend it to cryptocurrency traders.

FAQs

How much does Kraken charge to withdraw?

The withdrawal fees depend on the payment processor and geographic location of clients.

Can I withdraw from Kraken to my bank account?

Yes, Kraken allows clients to withdraw to their bank account.

Who owns Kraken?

Payward Inc. owns Kraken.

How risky is Kraken?

Kraken has an excellent security team with industry-leading security measures, making it one of the least risky cryptocurrency exchanges.

Why are Kraken fees so high?

Kraken only has high fees for its Instant Buy function, but other costs are reasonable.

Is Kraken a Chinese company?

No, Kraken is a US cryptocurrency exchange.