Editor’s Verdict

Libertex is a broker and a member of Libertex Group, operating since 1997, uses its Libertex trading platform with more than 2.2M customers in different countries. I conducted a review of this broker to determine its trading conditions. Should you trust Libertex?

Overview

A CFD Broker with Commission-Free Cryptocurrency CFD Trading

Cyprus 1997 Market Maker 100$ MetaTrader 4, MetaTrader 5, Web-based Undisclosed Not applicable 0.1 pips 0.0003% 5 (Bank wires, credit/debit cards, Skrill, Neteller, and cryptocurrencies)

I like the cryptocurrency CFDs selection and the competitive commission-free trading crypto CFDs environment at Libertex. Beginner traders get educational materials, and I recommend they consider them.

Libertex Regulation and Security

I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database.

Is Libertex Legit and Safe?

Libertex offers its services from St.Vincent and the Grenadines as an unregulated but duly registered company. Its partner, MAEX LIMITED, is a registered company in Mauritius.

The Libertex platform has over 2.2 million traders from various countries. It has stood the test of time.

Fees

I rank trading costs among the most defining aspects when evaluating an exchange, as they directly impact profitability. Libertex offers Forex spreads from 0.1 pips or $1.00 per standard lot. Minimum CFD commissions are 0.0003%, and cryptocurrency CFDs remain commission-free.

Minimum Raw Spreads | Not applicable |

|---|---|

Minimum Standard Spreads | 0.1 pips |

Minimum Commission for Forex | 0.0003% |

Deposit Fee | |

Withdrawal Fee |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Range of Assets

Libertex offers CFDs on 50 currency pairs, 73 cryptocurrency pairs, 17 commodities, 26 indices, 132 equity, and ten ETFs. The underlying assets selection is typical, except for cryptocurrencies CFDs, where Libertex ranks among the top 20 in the industry. It also features a commission-free investment account ideal for long-term investors seeking to build dividend-paying portfolios via share purchases.

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

Libertex Leverage

Libertex grants maximum leverage up to 1:999, which I find competitive for active traders, as it expands their flexibility. Negative balance protection exists, an essential tool for leveraged trading, as it ensures traders cannot lose more than they deposit.

Libertex Trading Hours

You can trade CFDs 24/7 with Libertex.

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

I like that Libertex treats all traders equally. Each one gets the same account type and trading conditions, and there is no upgrade for more substantial deposits. Note that the minimum deposit is only $100.

Libertex Demo Account

Traders may open a demo account directly from the MT4/MT5 trading platforms, and I did not find a time limit or any other restrictions, which is good.

Trading Platforms

Traders can use the MT4/MT5 trading platforms or Libertex Platform, web-based and mobile alternatives. Unfortunately, Libertex does not offer any add-ons for MT4/MT5. MT4 remains the market leader for algorithmic trading, and MT4/MT5 has an integrated copy trading system. The Libertex trading platform features a user-friendly interface. I like the information provided for each underlying asset.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

I want to single out the competitive commission-free pricing for the crypto CFDs environment and the cryptocurrency CFDs selection at Libertex.

Research and Education

Libertex introduced a research and market reviews section but only has three articles. At the time this review was written, no research. Given the abundance of free and paid-for providers online, I do not consider the absence a negative, but it is provided by many competitors.

Beginner traders get written educational content, usually published on the Libertex blog. Libertex hosted webinars, but the last one was two years ago, and regrettably, it does not grant access to past ones. I recommend beginners seek their education from trusted third-party sources available online free of charge.

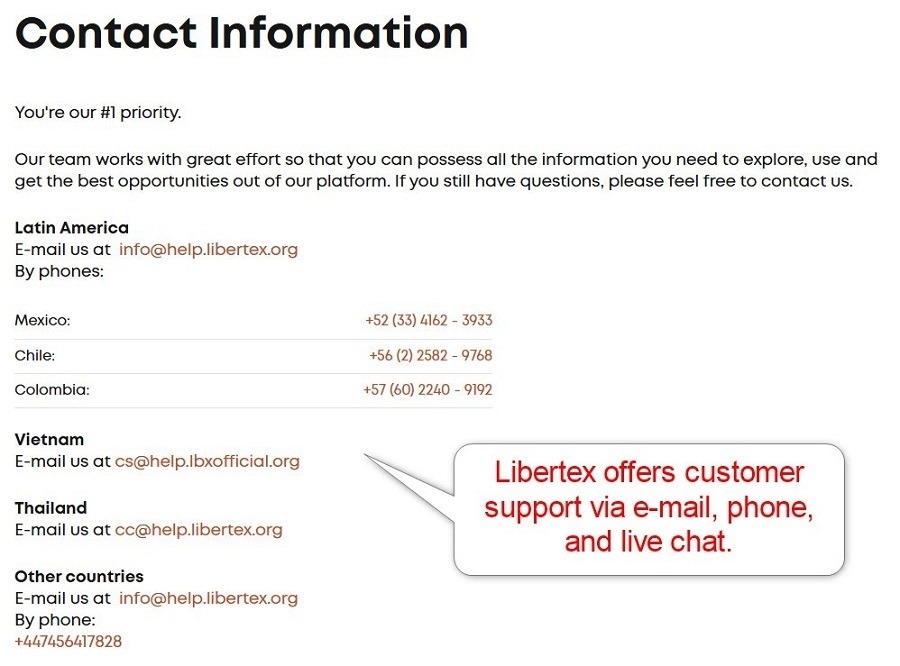

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | Monday to Friday 9-19 |

Website Languages |     |

Customer support is available via e-mail and phone. The FAQ section answers a range of questions, and Libertex states its response time as one business day for e-mail queries. A separate help and support section exists, but the separation from the FAQ section is not ideal. A direct line to the finance department would be an improvement.

Bonuses and Promotions

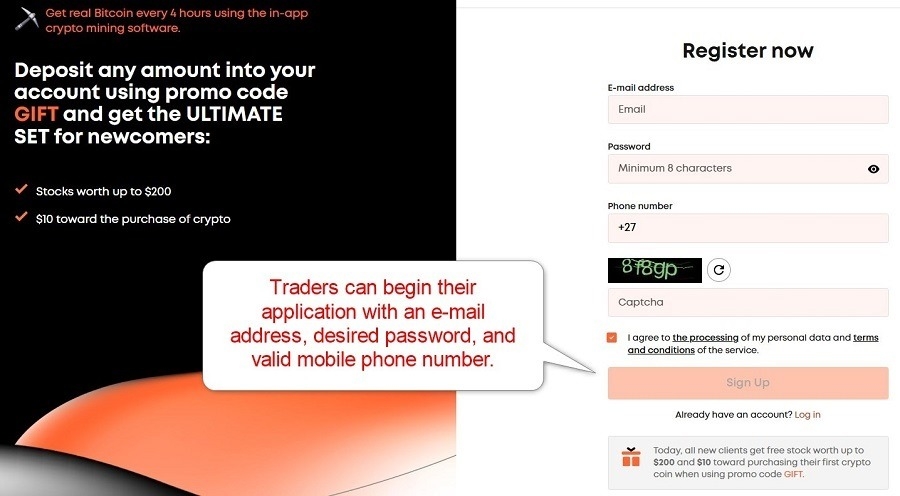

During my Libertex review, traders received a 100% Welcome Bonus. The maximum bonus amount is $10,000, and traders receive it in 10% installments during the validity period if they meet volume trading requirements. New traders will also receive a gift of up to $200 and $10 towards cryptocurrency purchases. Please note that terms and conditions apply. I urge traders to read and understand them before participating in promotional offers.

Awards

Libertex has received 40+ industry awards from well-respected sources. They are a statement of the ongoing efforts by Libertex to maintain a competitive edge for its clients.

Highlighted awards:

- Best Trading Platform - World Finance 2020

- Best Trading Platform - FX Report Awards 2020

- Best Trading Platform - European CEO Awards 2020

- Best FX Broker - European CEO Awards 2021

- Best Trading Platform - FX Report Awards 2021

Opening an Account

Opening an account at Libertex requires only a valid e-mail. This grants access to the back office, where traders must confirm their e-mail, phone number, and trading account. Traders must send a copy of their ID and one proof of residency document to pass AML/KYC regulations.

Minimum Deposit

The minimum deposit at Libertex is only $100. I like the flexibility Libertex grants traders when constructing their deposit and portfolio-building strategies.

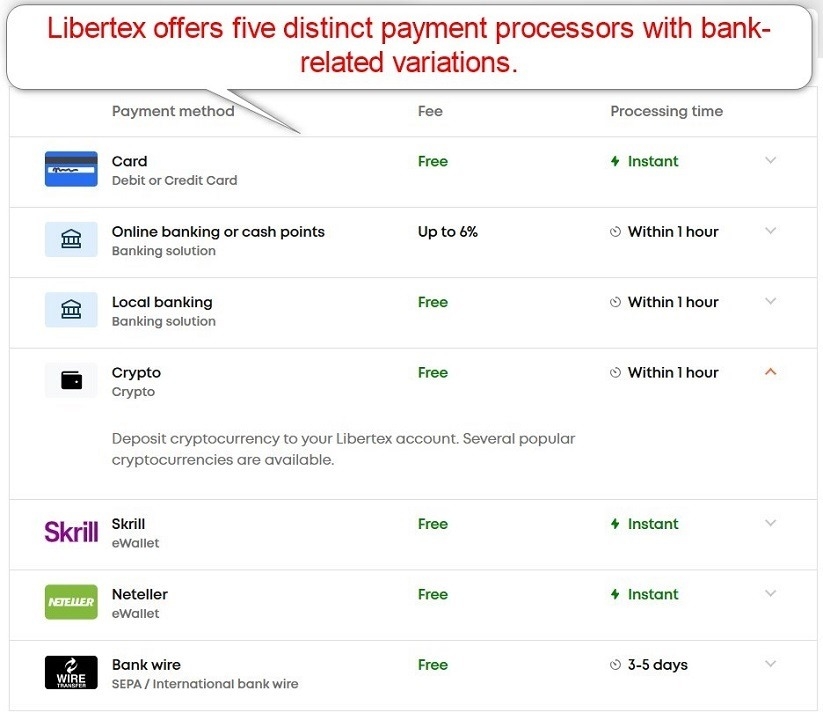

Payment Methods

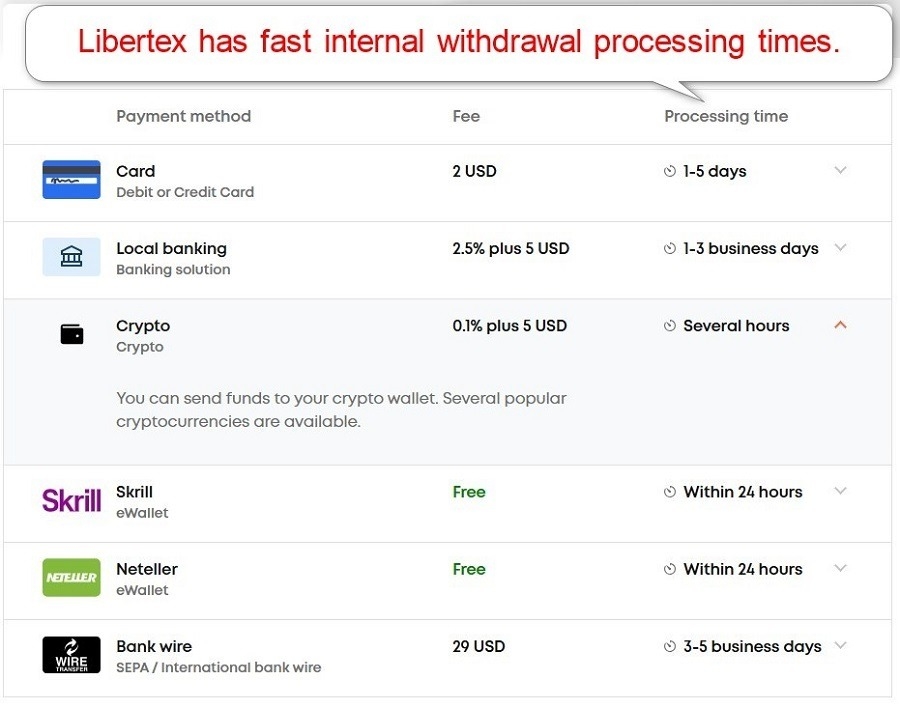

Libertex accepts bank wires, credit/debit cards, Skrill, Neteller, and cryptocurrencies.

Accepted Countries

Libertex accepts traders from many countries, but its website lists the countries below as ineligible to open Libertex trading accounts.

Afghanistan | Algeria | American Samoa | Angola | Aruba |

Austria | Bangladesh | Belarus | Belgium | Bosnia and Herzegovina |

Brazil | Bulgaria | Burundi | Canada | Central African Republic |

Croatia | Cyprus | Czechia | Democratic Republic of the Congo | Denmark |

Egypt | Eritrea | Estonia | Finland | France |

Gabon | Germany | Great Britain | Greece | Guam |

Guinea | Guinea-Bissau | Haiti | Hungary | Iran |

Iraq | Ireland | Italy | Kuwait | Latvia |

Lebanon | Libya | Lithuania | Luxembourg | Mali |

Malta | Myanmar (Burma) | The Netherlands | Nicaragua | North Korea |

Northern Mariana Islands | Oman | Pakistan | Palestinian Territories | Poland |

Portugal | Romania | Russia | Senegal | Serbia |

Slovakia | Slovenia | Somalia | South Sudan | Spain |

Sri Lanka | Sudan | Sweden | Syria | Tunisia |

Uganda | United States of America | United States Virgin Islands | Yemen | Zimbabwe |

Libertex also states “This list is not exhaustive and additional countries can be added to the list at any time.”

Deposits and Withdrawals

Libertex does not charge internal deposit fees but applies withdrawal costs on several payment processors, and traders should also consider any applicable third-party charges. The minimum deposit required to open an account is $100. Processing times vary from instant to five business days, payment processor dependent.

Libertex does not charge internal deposit fees, but applies withdrawal costs on several payment processors, and traders should also consider any applicable third-party charges. The minimum deposit required to open an account is €100. Processing times vary from instant to five business days, payment processor dependent.

Only verified accounts may request withdrawals, and they must revert to the deposit method, with any access available via bank wires. Not all options are available to every trader, dependent on their geographic location.

Is Libertex a good broker?

I like the trading experience at Libertex due to its competitive, commission-free trading costs for Crypto CFD trading and its superb cryptocurrency CFDs selection. It is a regulated broker with a great reputation and years of experience working in a range of different countries.

FAQs

How do I withdraw from Libertex?

The back office handles withdrawal requests at Libertex, including Skrill, Neteller, and cryptocurrencies.

Is Libertex legal?

Libertex operates as a legal and duly registered but unregulated company.

Is Libertex reputable?

Yes, they have years of experience, a long regulatory record, and are a member of the Libertex Group established in 1997.