Editor’s Verdict

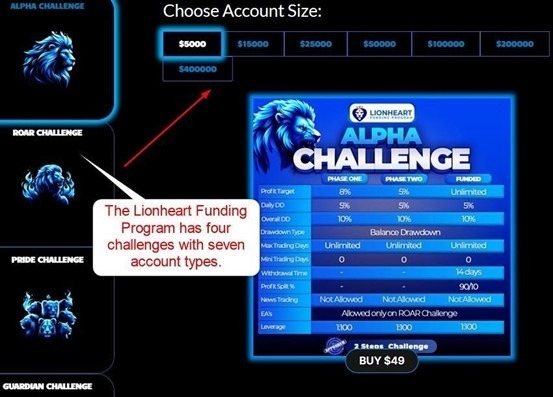

Lionheart Funding Program, founded in 2023, shines with its low-cost three-phase funding challenge and one-phase and two-phase alternatives. With four challenge types and seven funded account options, the Lionheart Funding Program brings plenty of choices. My Lionheart Funding Program review looked at all choices. Should you start an evaluation at the Lionheart Funding Program?

Overview

Headquarters | South Africa |

|---|---|

Year Established | 2023 |

Trading Platform(s) | DX Trade |

Minimum Evaluation Fee | $49 |

Profit-share | 90% |

Daily Loss Limit | 3% - 5% |

Maximum Trailing Drawdown | 6% - 10% |

Funded Account Options | 7 |

Minimum Funded Account | $5,000 |

Maximum Funded Account | $400,000 |

Lionheart Funding Program offers prop traders a choice of funding challenges.

I like that Lionheart Funding Program has several options for prop traders to conduct a challenge, and the minimum evaluation fees rank among the lowest of all the prop firms I have reviewed. By offering Eightcap platforms, Lionheart Funding Program ensures competitive trading conditions and a trusted trading environment. I also appreciate the absence of a time limit during the evaluation period, as it eliminates unnecessary time pressure on top of performance pressure.

Lionheart Funding Program Trustworthiness & Reputation

Trading with a prop firm, an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts and that the prop firm maintains an excellent reputation among its prop traders. Through its provision of Eightcap, platforms, Lionheart customers can access the benefits of a trusted broker.

Is the Lionheart Funding Program Legit and Safe?

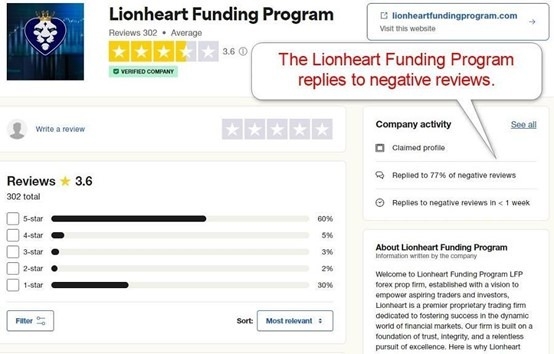

Lionheart Funding Program is an established retail prop trading firm and has a compelling value proposition for traders. It has a 3.6 out of 5.0 rating on Trustpilot based on 202 reviews.

Lionheart Funding Program responded quickly to a negative Trustpilot review and is responsive to online comments. I advise traders to consider any negative comments skeptically, as they could come from traders who have failed the paid-for evaluation challenge or violated trading rules. Therefore, they are a prop trading firm that interested traders can try to establish a rapport with.

Lionheart Funding Program Features

The Lionheart Funding Program follows best practices established across the prop firm industry, an expanding sub-sector of the retail financial sector.

The most notable features of the Lionheart Funding Program are:

- No minimum or maximum trading days during the evaluation.

- One-phase evaluation with a maximum drawdown of 6% and a profit target of 10%.

- Two-phase evaluation with a maximum drawdown of 10% with an 8%-5% and a 10%-5% profit target.

- Three-phase evaluation with a maximum drawdown of 8% with a 6%-5%-4% profit target.

- Access to the multi-asset, multi-market DX Trade trading platform, facilitated by Eightcap.

- 90% profit share.

- 1:100 leverage.

- Cryptocurrency withdrawals.

- Profit consistency rule.

- Lot size consistency rule.

- Account sizes up to $400,000, with a maximum of $600,000 total exposure per trader.

Evaluation Fees & Profit-Share

Minimum Evaluation Fee | $49 |

|---|---|

Maximum Evaluation Fee | $1,959 |

Profit-share | 90% |

The Lionheart Funding Program evaluation fee depends on the desired funded account size. Traders pay between $49 and $1,959 per challenge .

Traders can choose from seven funded account options, and the profit share is 90%. Please note that traders cannot change the account value once approved, meaning if they qualify on a $5,000 account, they will manage a $5,000 portfolio

The minimum evaluation fee at Lionheart Funding Program for a $5,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $49 |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | $0 |

Double leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $5,000 account | $49 |

Account Types

The Lionheart Funding Program offers four challenge types with seven account options. Traders can qualify to manage the following portfolio sizes: $5,000, $15,000, $25,000, $50,000, $100,000, $200,000, and $400,000. Each challenge type has trading conditions that traders should understand to avoid disqualification.

All accounts are provided via Eightcap Global, which offers access to the multi-asset, multi-market DX Trade trading platform for Lionheart clients.

What are the Trading Rules at Lionheart Funding Program?

The Lionheart Funding Program evaluation begins after prospective prop traders choose their preferred evaluation account and pay the one-time evaluation fee. No time limit exists, and the profit target ranges between 6% and 10%, depending on the challenge.

Violating the maximum overall loss rule results in a hard breach and cancellation of the evaluation.

The trading rules for the Lionheart Funding Program evaluation are:

- 6% to 10% maximum loss from the starting balance.

- 3% to 5% daily loss limit.

- Using copy trading software is not permitted.

- Sharing account details is not permitted.

Trading Platforms

Traders can use the multi-asset, multi-market DX Trade trading platform powered by Eightcap. The maximum leverage is 1:100, and Eightcap trading fees apply, which rank among the more competitive ones.

Education

The Lionheart Funding Program's blog offers educational content geared towards younger traders, which many traders may appreciate.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

The Lionheart Funding Program offers 24/7 customer support through a chatbot or e-mail. I did not need to contact customer support during my review, but I recommend the FAQ section on the website and within the chatbot.

How to Get Started with the Lionheart Funding Program

Interested prop traders can start the evaluation after selecting their desired package and paying the one-time fee.

Minimum Evaluation Fee

The minimum evaluation fee at the Lionheart Funding Program is $49 for the $5,000 evaluation.

Payment Methods

Withdrawal options |    |

|---|---|

Deposit options |   |

Lionheart Funding Program accepts credit/debit cards and cryptocurrency transactions.

Accepted Countries

The Lionheart Funding Program lists the following countries as ineligible for its services: Cuba, Iran, North Korea, Myanmar, Russia (or the Crimea, Donetsk, or Luhansk regions of Ukraine), Somalia and Syria.

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via credit/debit cards and cryptocurrencies. Please note that withdrawals are available via bank wires and cryptocurrencies.

The Bottom Line - Is the Lionheart Funding Program a Good Prop Firm?

I like the Lionheart Funding Program for its diverse challenges and account sizes, low evaluation fees, and for providing access to Eightcap trading platforms. The evaluation conditions match established industry standards without time pressure and have several options to fit various trading styles and risk behaviors. News trading is available, but the Lionheart Funding Program does not allow algorithmic trading in live accounts. Therefore, I recommend the Lionheart Funding Program to prop traders who have a manual trading strategy. My Lionheart Funding Program review found no verifiable claims of fraud, scam, or malpractice, and the owner of the Lionheart Funding Program is a duly registered company in Melbourne, Australia. Therefore, traders may consider the Lionheart Funding Program safe. Retail prop traders can withdraw their profit share through bank wires or cryptocurrencies after being a funded trader for 30 days. Like all prop trading firms, the Lionheart Funding Program is unregulated. However, it is owned by a duly registered Australian-based company that owns multiple retail prop trading firms, and offers the trading platforms of regulated brokerage, Eightcap. The Lionheart Funding Program is a legitimate company owned by Australian-based FinTech company PropTradeTech.FAQs

Is the Lionheart Funding Program safe?

How can I withdraw from the Lionheart Funding Program?

Is the Lionheart Funding Program regulated?

Is the Lionheart Funding Program legit?