Editor’s Verdict

Overview

Review

As of October 2021, this broker is no longer accepting new traders. To find a reliable, regulated Forex broker, check out our top Forex brokers list. Thank you!

Greece-based broker LiquidityX is owned by Capital Securities SA, founded in 1994 and presents a competitive selection of cryptocurrency CFDs. It offers traders a web-based trading platform and the well-known MT4 platform. LiquidityX additionally provides clients with trading tools from TipRanks and Trading Central. This broker promises to craft the future of trading, and I reviewed LiquidityX to determine if the 25+ years of experience in financial markets suffice for it to deliver. Can trading at LiquidityX make you a better trader?

Summary

LiquidityX Overview: An Experienced Broker with Competitive Trading Tools

Headquarters | Greece |

|---|---|

Regulators | HCMC |

Year Established | 1994 |

Execution Type(s) | Market Maker |

Minimum Deposit | $250 |

Trading Platform(s) | MetaTrader 4, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

The trading tools at LiquidityX make this broker a considerable choice for beginner traders, together with the user-friendly web-based trading platform. I would like to see more on the educational side, which would add extra value for beginner traders. The core offering at LiquidityX remains attractive, especially for cryptocurrency CFD traders.

LiquidityX Main Features

Retail Loss Rate | 74.00% - 89.00% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 1.8 pips |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | Not applicable |

Minimum Deposit | $250 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | €80 monthly after one month |

Deposit Fee | No |

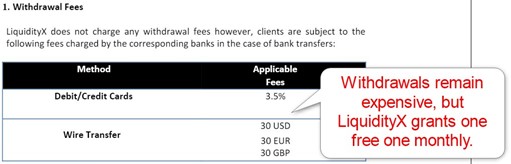

Withdrawal Fee | Third-party |

Funding Methods | 8 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. LiquidityX presents clients with a well-regulated entity.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Greece | Hellenic Capital Market Commission | HCMC Number 2/11/24.5.1994 |

The Hellenic Capital Market Commission (HCMC) is a lesser-known regulator. It operates under the framework of the European Securities and Markets Authority (ESMA). Therefore, it has to comply with MiFID II. Client deposits remain segregated from corporate funds, and the Guarantee Fund, the investor compensation fund of Greece, protects clients against default with a limit of €100,000.

Negative balance protection also exists, which I deem necessary for margin trading. While the HCMC is not a tier-1 regulator, it remains a capable one. Capital Securities SA has a clean regulatory record plus more than 25 years of experience as a financial firm.

Fees

On the account section of LiquidityX’s website, the spreads range between 1.8 pips and 3.2 pips or $18 to $32 per 1.0 standard lot. The MT4 trading platform and the web-based alternative reveal a mark-up of only 0.6 pips or $6.00 per lot. They rank among the most competitive ones for a commission-based pricing environment.

Since most traders use MT4, I would use the minimum spread of 0.6 pips I noticed.

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.6 pips | $0.00 | $6.00 |

Here is a screenshot of the LiquidityX MT4 trading account during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs. LiquidityX offers a positive swap on EUR/USD short positions, meaning traders get paid money.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free LiquidityX account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.6 pips | $0.00 | -$6.94 | X | $12.94 |

0.6 pips | $0.00 | X | $1.39 | $4.61 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.6 pips | $0.00 | -$48.58 | X | $54.58 |

0.6 pips | $0.00 | X | $9.73 | -$3.73 |

The commission-free Forex pricing environment remains among the most competitive ones, and I recommend traders consider them. I like that LiquidityX does not manipulate financing costs and passes positive swaps onto client portfolios.

The inactivity fee at LiquidityX applies after one month of dormancy at a rate of €80 monthly.

What Can I Trade?

LiquidityX provides traders with 55 currency pairs, 45 cryptocurrency pairs, 21 commodities, and 36 index CFDs. Equity traders have access to 232 assets, catering to retail traders who prefer following trending names on social media.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

LiquidityX Leverage

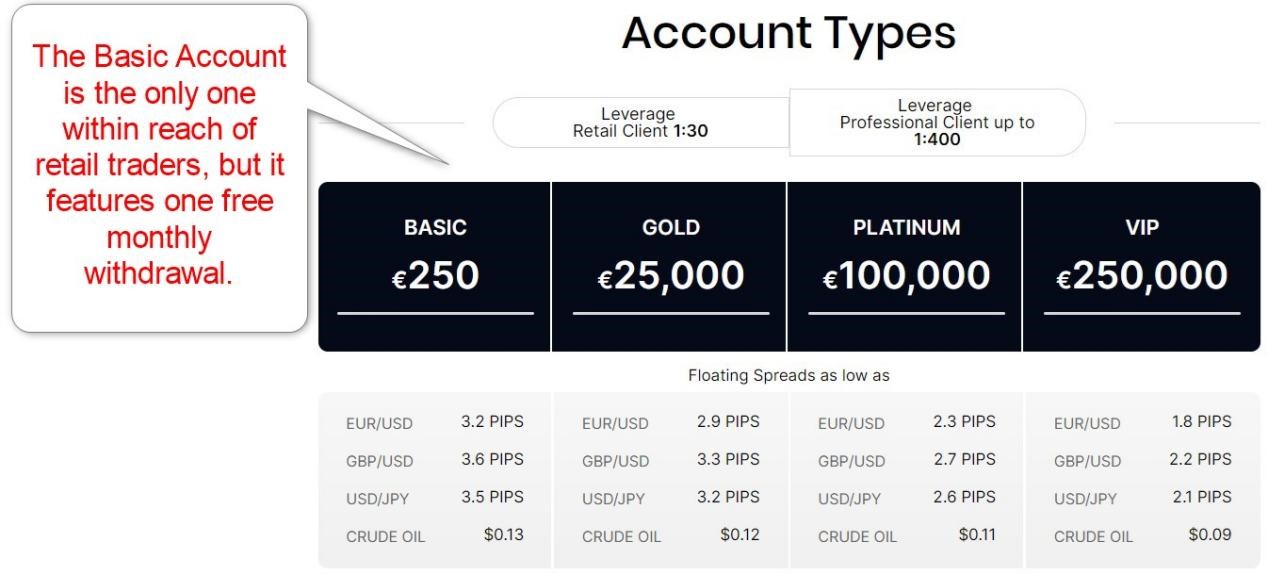

Retail traders get maximum leverage of 1:30, in line with ESMA restrictions. Professional clients can use 1:400 if they qualify.

LiquidityX Trading Hours (GMT +3 Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Forex | Monday 00:00 | Friday 24:00 |

Commodities | Monday 01:00 | Friday 24:00 |

European CFDs | Monday 10:00 | Friday 18:30 |

US CFDs | Monday 16:30 | Friday 23:00 |

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

LiquidityX implements a tiered account structure, but most trading services remain identical. The minimum deposit is $250 and in reach of retail traders. It comes with one free monthly withdrawal, which I appreciate.

The minimum spread of 3.2 pips or $32 per 1.0 standard lot is expensive, but as the MT4 and the web-based trading platforms showed, a 0.6 mark-up is available. Given the trading tools and the free monthly withdrawal, I determine the $250 minimum deposit acceptable.

LiquidityX Demo Account

Clients can open a free demo account for both trading platforms, and I like the flexibility offered in MT4, allowing traders to create conditions nearly identical to live deposits. I did not find a time limit on the LiquidityX demo account, making it ideal for testing purposes. The demo account for the web-based trading platform is €100,000, which I find a bit unrealistic.

Trading Platforms

LiquidityX provides clients with the trusted MT4 trading platform as a core version. While Trading Central services are available, I was unable to locate the MT4 plugin. They remain embedded with the web-based trading platform, ideally suited for beginner traders who trade manually.

For automated trading, MT4 remains the go-to option. It also includes an embedded copy trading platform. While the web-based alternative features a cleaner user interface, it fails to compete with the functionality and versatility of MT4. Both trading platforms are also available as mobile apps.

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | No |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | Yes (MT4 only) |

Social Trading / Copy Trading | Yes (embedded in MT4) |

MT4/MT5 Add-Ons | No |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | Trading Central |

Unique Feature Two | TipRanks |

Unique Features

Services by Trading Central and TipRanks present the two unique features I like to point out at LiquidityX. They are excellent trading tools for beginner traders and provide trusted third-party research. Since LiquidityX maintains the most traded equity CFDs, TipRanks essentially provides trading recommendations for all of them, providing traders a valuable tool.

Research and Education

The available research at LiquidityX comes from third-party providers Trading Central and TipRanks, which I find perfectly fine. Both remain trusted sources of unbiased information and present traders with quality research and trading ideas.

Beginner traders have access to educational content, consisting of articles and eleven eBooks provided by MTE Media. I recommend committed traders take advantage of all educational content, including understanding the trading recommendations presented by Trading Central.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |          |

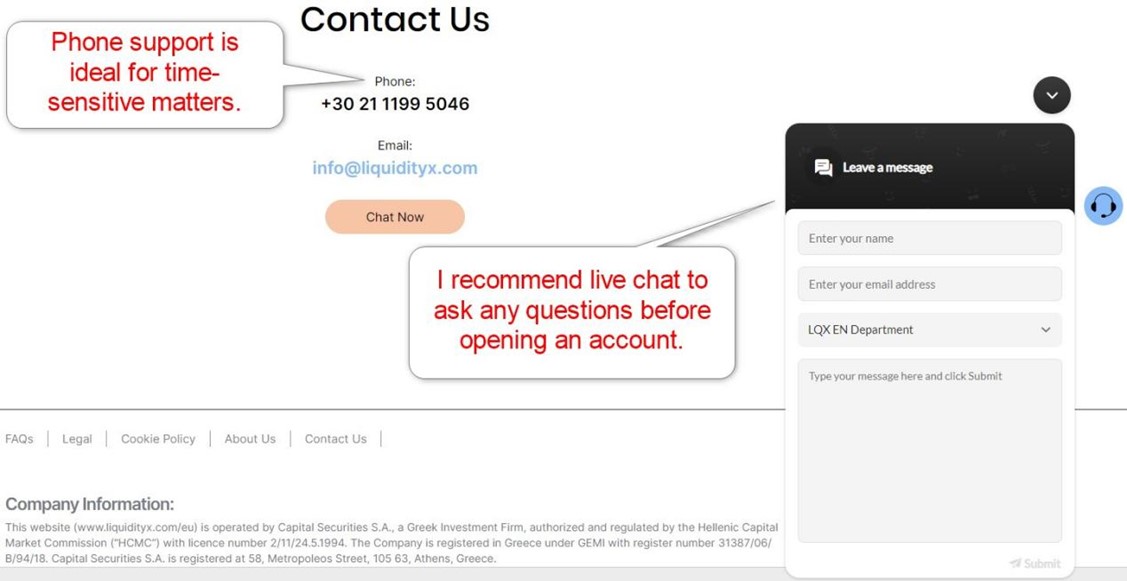

The FAQ section answers many questions, and I recommend live chat for anything else. LiquidityX also provides an e-mail address and phone number, the latter ideal for time-sensitive issues, together with its registered address. LiquidityX does not list customer support operating hours, suggesting that regular business hours apply in the local time in Greece.

Bonuses and Promotions

LiquidityX neither offers bonuses nor promotions to traders, as they are illegal under the ESMA framework. Since Greece and the HCMC are members of the EU, LiquidityX falls under the rules and regulations of the ESMA.

Opening an Account

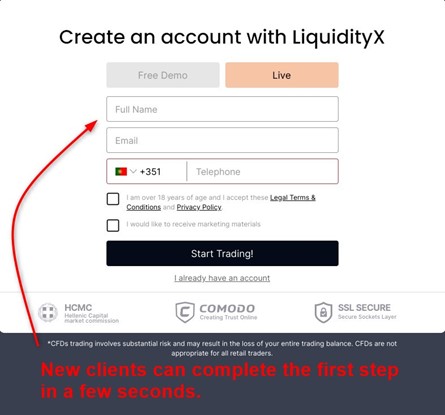

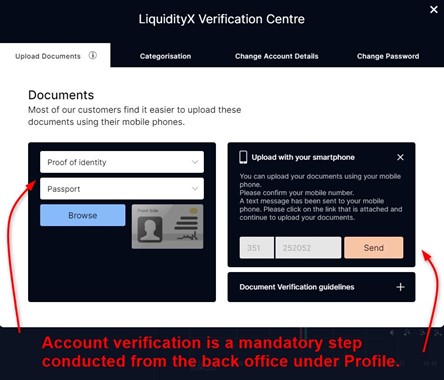

Opening an account at LiquidityX remains a swift two-step process, which takes less than two minutes to complete. The first step only asks for a name, e-mail, and phone number. LiquidityX will then e-mail log-in details, and traders should change the provided password immediately. Account verification remains a mandatory final step in compliance with AML/KYC regulations. It is available from the back office under Profile, and traders may use their smartphones to complete this step. I found the process swift and hassle-free, without unnecessary steps or questions.

Minimum Deposit

The minimum deposit at LiquidityX is $250, which is reasonable.

Payment Methods

LiquidtyX offers bank wires and credit/debit cards. On its website, it shows banners for Sofort, eps, Euteller, GiroPay, iDEAL, and P24. The back office only allows the addition of credit cards for withdrawals.

Accepted Countries

LiquidityX caters to traders from the European Economic Area, excluding Belgium and Switzerland. It includes Germany, France, Spain, Italy, the Netherlands, Poland, and Portugal.

Deposits and Withdrawals

Clients must enter all withdrawal requests from the back office, and LiquidityX grants one free withdrawal monthly, which I believe is more than enough. A 3.50% fee applies to credit/debit card withdrawals and €30 for bank wires. Traders may also face third-party fees. Since one free one is available, there should be no issues. I advise against making more than one withdrawal monthly.

Withdrawal processing times are within 24 hours, but it may take up to five business days for clients to receive funds. While LiquidityX notes options besides credit/debit cards and bank wires, it offers no details.

The Bottom Line

I like the trading experience at LiquidityX for its trading tools provided by Trading Central and TipRanks. They offer beginner traders quality resources. The LiquidityX ownership has more than 25 years of experience as a financial firm out of Greece. It uses a tried-and-tested business model and product and services portfolio. Traders get the trusted MT4 trading platform and a web-based alternative.

The minimum deposit of $250 or a currency equivalent is remains within a reasonable demand and includes one free monthly withdrawal. LiquidityX caters to traders from the European Economic Area, excluding Belgium and Switzerland. For them, LiquidityX presents an excellent broker to consider.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |