Editor’s Verdict

LiteFinance, previously known as LiteForex, was founded in 2005. It offers traders the core MT4/MT5 trading platforms, quality third-party research, and a continuously expanding asset selection, especially cryptocurrencies. With a minimum deposit of $50, maximum leverage of 1:500, and its proprietary copy trading platform, I conducted an in-depth review of rebranded LiteFinance. Does it maintain a competitive and trustworthy trading environment, or should you stay clear of LiteFinance?

Overview

An expanding cryptocurrency selection and a proprietary copy-trading service

LiteFinance, previously known as LiteForex, was founded in 2005. It offers traders the core MT4/MT5 trading platforms, quality third-party research, and a continuously expanding asset selection, especially cryptocurrencies. With a minimum deposit of $50, maximum leverage of 1:500, and its proprietary copy trading platform, I conducted an in-depth review of rebranded LiteFinance. Does it maintain a competitive and trustworthy trading environment, or should you stay clear of LiteFinance?

Summary

Headquarters | Marshall Islands |

|---|---|

Regulators | CySEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2005 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $50 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Web-based |

Average Trading Cost EUR/USD | 0.0 pips ($0.00) |

Average Trading Cost GBP/USD | 0.0 pips ($0.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $0.01 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

LiteFinance - The first look:

- Light-weight web-based trading platform with user-friendly interface

- Broad-based cryptocurrency selection for a Forex broker, which continues to expand

- Research by third-party provider Claws & Horns

- Bitcoin accepted as a payment method

- Acceptable minimum deposit with high leverage for non-EEA traders

- CySEC subsidiary for EEA-based clients

- Proprietary copy-trading service embedded in its web-based trading platform

- Since rebranding from LiteForex to LiteFinance, the website lacks transparency in describing its products and services, including ECN trading costs

- Customer service unavailable and an FAQ section is missing

- Ongoing technical issues, reports of canceled withdrawals, and rise in fraud claims against LiteFinance, previously known as LiteForex

- An unexplained move of its headquarters from the Marshall Islands to St. Vincent and the Grenadines around the time fraud claims skyrocketed

Retail Loss Rate | 80.00% |

|---|---|

Regulation | Yes (for EEA-based traders only) |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.8 pips |

Minimum Commission for Forex | $10.00 per round lot |

Commission for CFDs/DMA | $0.25 per share |

Commission Rebates | No |

Minimum Deposit | $50 |

Demo Account | Yes |

Managed Account | Yes |

Islamic Account | Yes |

Inactivity Fee | No |

Deposit Fee | Third-party |

Withdrawal Fee | Third-party |

Funding Methods | 7 |

Regulation and Security

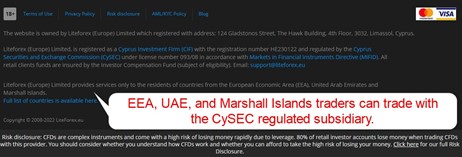

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. LiteFinance maintains one regulated subsidiary for EEA, UAE, and Marshall Islands-based traders.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | License Number 093/08 |

Please Note:

- All non-EEA, non-UAE traders will deal with the brokerage in St. Vincent and the Grenadines, operating a duly registered business with registration number 931 LLC 2021 but also an unregulated entity

Facts to consider concerning the brokerage operating from St. Vincent and the Grenadines:

- Higher leverage

- Segregation of client deposits from corporate funds

- Flexible trading conditions

What is missing?

- Third-party insurance or

- Financial Commission membership

- Profiles of core management team

Noteworthy:

- Transparency remains an issue at LiteFinance since rebranding from LiteForex

- Negative balance protection was unavailable at LiteForex unless traders opted for the CySEC subsidiary, where LiteForex did not guarantee it, and the same likely applies at LiteFinance, where transparency is unavailable, and the brokerage removed previously existing explanations

- Alleged scam reports have surged over the past year, with a growing number of traders reporting withdrawal issues, like canceled withdrawals or withdrawal options

- The CySEC subsidiary exclusively caters to EEA, UAE, and Marshall Islands traders, where LiteFinance maintains insignificant operations, pointing towards potential issues as LiteForex

- LiteFinance Global LLC, operational since 2021, became the new primary brokerage of the group, headquartered in St. Vincent and the Grenadines, after moving from the Marshall Islands

Despite 16 years as a brokerage, LiteFinance, previously known as LiteForex, appears to undergo unfavorable changes. It could explain its corporate headquarters move and expansion into less-regulated cryptocurrency activities. It is also becoming less transparent with its relaunched website. Regrettably, none had a positive impact, making LiteFinance a less transparent, secure, and trustworthy brokerage.

I recommend traders evaluate LiteFinance as a new broker with limited experience and dismiss any goodwill and trust LiteForex created over 15 years. The most recent developments, starting with the launch of LiteFinance Global LLC, raise notable concerns.

Fees

Average Trading Cost EUR/USD | 0.0 pips ($0.00) |

|---|---|

Average Trading Cost GBP/USD | 0.0 pips ($0.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $0.01 |

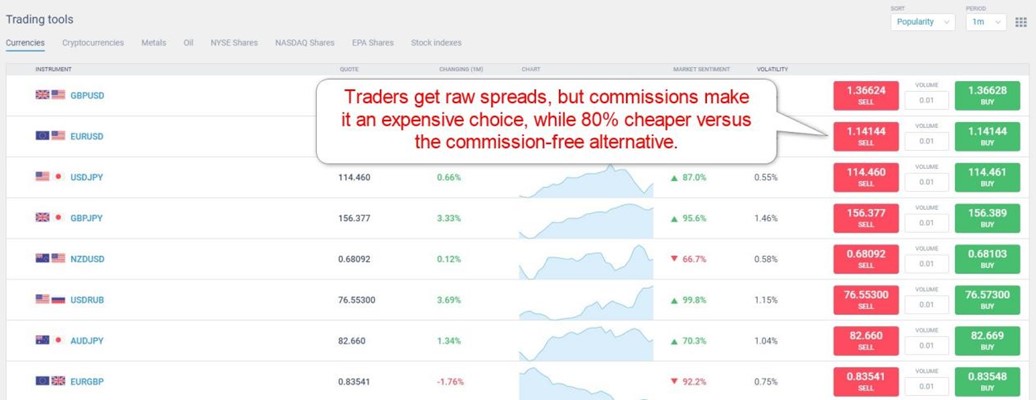

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability. Unfortunately, LiteFinance became less transparent about its current trading fees. The most likely scenario is that LiteFinance maintained the pricing environment previously available at LiteForex.

LiteFinance offers traders the following cost structures:

- Commission-free trading costs in its Classic account with an expensive minimum spread of 1.8 pips or $18.00 per round lot

- The ECN account shows raw spreads of 0.0 pips, but for a commission between $10.00 and $30.00 per 1.0 round lot

- Cryptocurrencies face a 0.12% fixed commission

- Commodity CFDs cost between $0.50 and $20.00, while equity CFD fees are $0.25 per share.

Noteworthy:

- Trading costs at LiteFinance are at least twice as expensive as its average competitor

- The ECN account offers raw spreads, but the high commissions make it expensive

- LiteFinance lacks pricing transparency, and the noted costs carried over from LiteForex, which most likely remain in place since the rebranding

Which pricing environment should Forex traders select?

I recommend the following:

- Both cost structures are expensive, but the ECN account is at least 80% cheaper than the commission-free Classic account

What is missing at LiteFinance?

- A volume-based rebate program

- Pricing transparency

Here is a screenshot of quotes at LiteFinance during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The average trading costs for the EUR/USD in the commission based LiteFinance ECN account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.0 pips | $10.00 | $10.00 |

Noteworthy:

- The ECN account is almost twice as expensive as its competition, but 80% cheaper than the commission-free alternative

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Swap rates are higher versus many brokers, confirming internal mark-ups by LiteFinance

- Like many brokers, LiteFinance manipulates swap rates in its favor, most notably when positive swap rates apply, like in the EUR/USD, as this broker does not pass them on but pockets the income

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission based LiteFinance ECN account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $10.00 | -$5.616 | X | $15.616 |

0.0 pips | $10.00 | X | -$0.156 | $10.156 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $10.00 | -$39.312 | X | $49.312 |

0.0 pips | $10.00 | X | -$1.092 | $11.092 |

My additional comments on trading costs at LiteFinance:

- Trading costs remain unacceptably high, especially for leveraged traders, where LiteFinance adds excessive internal mark-ups to swap rates across the board

- LiteFinance does not list currency conversion costs or an inactivity fee

What Can I Trade

LiteFinance maintains a wide range of trading instruments, advertising 145+ on its website, offering 225. Over the past twelve months, it made the most notable expansion in cryptocurrencies, where it offers 53 assets, including crypto-to-crypto crosses.

Equity traders get access to large-cap names trending on social media. They are suitable for most retail traders, but seasoned traders require higher quantities. While the 225 assets offer new traders acceptable entry-level exposure, advanced traders will find it inadequate for proper cross-asset diversification.

What is missing?

- I am missing mid-cap and small-cap alternatives from the equity CFD list

- A broader selection of commodity CFDs

- LiteFinance does not offer ETFs

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

LiteFinance Leverage

LiteFinance offers maximum leverage of 1:500 for Forex traders, which I find suitable for active traders as it may present more overall trading flexibility, which can influence profitability.

Other things I want to note about LiteFinance leverage:

- The Cyprus subsidiary limits maximum leverage to 1:30, due to regulatory restrictions

- LiteFinance remains unclear about negative balance protection

LiteFinance Trading Hours (GMT +2 Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Forex | Monday 00:00 | Friday 24:00 |

Commodities | Monday 01:00 | Friday 24:00 |

European CFDs | Monday 10:05 | Friday 18:30 |

US CFDs | Monday 16:35 | Friday 23:00 |

Noteworthy:

- Equity markets open and close each trading day and are not operational continuously like Forex and cryptocurrencies

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

LiteFinance became less transparent concerning its account types, an unfortunate step backward.

Traders must decide between the following:

- Commission-free versus commission-based account

My observations concerning the LiteFinance account types:

- The minimum deposit is $50 for either option with maximum leverage of 1:500

- Traders who opt for the Classic account qualify for a 30% deposit bonus, but minimum spreads commence at 1.8 pips or $18.00 per round lot

- The ECN account has no incentives, raw spreads are from 0.0 pips, but commissions range between $10.00 and $30.00 per round lot

- LiteFinance lists no restrictions on trading strategies

- Islamic accounts were available, but traders must contact customer support to confirm their status, as LiteFinance became notably less transparent since its rebranding

My recommendation:

- Neither account choice offers traders a low-cost pricing environment, but the ECN option lowers trading costs by a minimum of 80%.

LiteFinance Demo Account

LiteFinance offers unlimited MT4/MT5 demo accounts. It presents traders with an ideal environment to test EAs and new strategies. The web-based trading platform allows a $10,000 demo account without registration, a convenient method to get familiar with its functionality. I caution beginner traders about using a demo account as an educational tool. It can create unrealistic trading expectations, and the absence of trading psychology negates the educational value.

My recommendation:

- MT4/MT5 offer flexible nominal demo account size, and traders should select one similar to what they plan to deposit into a live trading account

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

LiteFinance maintains the out-of-the-box MT4/MT5 trading platforms, but no introduction exists. LiteForex merely presents them as two buttons and clicking on them redirects to an account opening page. Both are available as desktop clients, webtrader, and mobile apps. LiteFinance also offers a lightweight web-based browser with a user-friendly interface. It is ideal for manual traders and superior to the MT4/MT5 web-based alternatives.

LiteFinance does not provide any of the necessary third-party add-ons to unlock the full functionality of MT4/MT5 and improve the trading environment. The present choices will leave traders with an incomplete and sub-standard experience unless they are willing to invest in upgrades.

What is missing?

- LiteFinance lacks transparency and should consider a proper introduction of its trading platforms

- Third-party plugins to upgrade MT4/MT5

- VPS hosting and API trading for algorithmic traders

My observations:

- Traders with MT4/MT5 EAs must use the desktop client

- The web-based trading platform is ideal for manual traders and remains a better overall choice than the MT4/MT5 web-based version

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | Yes |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | Yes |

Social Trading / Copy Trading | Yes |

MT4/MT5 Add-Ons/Upgrades | No |

Guaranteed Stop Loss | No |

Negative Balance Protection | Unclear |

Unique Feature One | User-friendly web-based trading platform |

Unique Feature Two | Competitive cryptocurrency selection |

Unique Features

I like that LiteFinance deploys its proprietary copy trading service embedded within the web-based trading platform. It provides a risk score, all-time percentage-based profitability, how many traders follow the strategy, and the assets under management, as LiteFinance refers to the followed capital of each signal provider. LiteFinance pays strategy providers, adding an attractive revenue stream for successful traders.

Research and Education

A combination of in-house research and third-party analytics by Claws & Horns offers traders comprehensive market coverage and trading ideas. LiteFinance maintains a blog where analysts provide research and trading signals.

LiteFinance features a Beginner section on its blog, where it presents educational content featuring dozens of quality articles. I recommend traders use it as part of their education before opening an account.

My takeaways:

- LiteFinance updates the content multiple times daily

- Via the partnership with Claws & Horns, traders receive independent analytics and market coverage from an established source, complementing the quality research division

- The educational content offers beginner traders a quality introduction to trading

My recommendations:

- Traders may evaluate copy trading features embedded within MT4/MT5 and the proprietary LiteFinance copy trading service

- MT4/MT5 have thousands of EAs, and traders may explore them to determine if they suit their trading style

- Traders may source additional research online free of charge

- Manual traders get quality trading signals from Claws & Horns and the LiteFinance blog

- Beginner traders may start their education at the LiteFinance blog but should source in-depth educational content elsewhere before trading at LiteFinance

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |              |

LiteFinance offers a phone number but does not have a dedicated Contact Us or Support section. No further information is available.

My observations:

- The live chat feature opens the web-based trading platform but does not connect to a customer support representative

- An FAQ section is missing

- Customer support is nearly impossible to contact

- The previous support site lists a Telegram account

- Responses to negative reviews sometimes include an e-mail address, and one is available at the bottom of the website

- Dedicated access to the finance department is not available

Bonuses and Promotions

LiteFinance notes a 30% deposit bonus for the Classic account, where trading costs are 80% higher than its ECN account. LiteFinance offers three partnership programs, but limited information exists. Clicking on each merely loads the web-based trading platform.

My observations:

- Terms and conditions apply, but LiteFinance does not disclose them transparently

- ECN accounts do not qualify for bonuses

Opening an Account

Online registration merely requires an e-mail address or phone number and a password. Traders may also sign-up through their Google or Facebook accounts. Since LiteFinance claims to adhere to AML regulations, verification is mandatory. It is generally satisfied by a copy of the trader’s ID and one proof of residency document.

Minimum Deposit

The LiteFinance minimum deposit is $50 for the Classic and ECN accounts.

Payment Methods

LiteFinance offers bank wires, credit/debit cards, Skrill, Neteller, Perfect Money, QIWI, and Bitcoin.

Accepted Countries

LiteFinance caters to most international traders, including the UK, the Philippines, Malaysia, and Nigeria. Like most international brokers, LiteFinance does not accept traders from the US.

Deposits and Withdrawals

Traders will conduct all financial transactions from the secure back office of LiteFinance. I find the deposit and withdrawal methods sufficient for most traders and appreciate the inclusion of cryptocurrencies.

My observations:

- LiteFinance lacks transparency since rebranding from LiteForex and makes no mention about deposit and withdrawals, except displaying the logos of supported methods

My recommendations:

- Before opening a trading account, traders should reach out to customer support and confirm the deposit and withdrawal process

- The lack of transparency since rebranding to LiteFinance and unexplained move of its headquarters raises red flags

- Traders should select the payment processor with the lowest fees

- I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations

The Bottom Line

I like the trading environment at LiteFinance for cryptocurrency traders who seek a copy trading service. LiteFinance, previously known as LiteForex, faces technical issues and experiences a rise in fraud claims. The unexplained move of its headquarters from one unregulated Forex jurisdiction to another raises red flags. Since rebranding, LiteFinance lacks transparency across its core trading environment. Until this broker fixes its issues and returns to the same standards established over 15 years as LiteForex, I advise extreme caution. LiteFinance is a business registered in St. Vincent and the Grenadines, with a subsidiary regulated in Cyprus. LiteFinance is an unregulated Forex and CFD broker operational since 2021 out of St. Vincent and the Grenadines, with a subsidiary regulated in Cyprus. It operated out of the Marshall Islands as LiteForex before its relocation. The brokerage operating from St. Vincent and the Grenadines remains unregulated. A CySEC-regulated entity caters to EEA, UAE, and Marshall Islands traders. LiteFinance has attracted many allegations of cancelled withdrawals. The minimum deposit to open an account with LiteFinance is $50. Since rebranding from LiteForex to LiteFinance, transparency dropped, and issues arose. The high trading costs remain, and at its present state, LiteFinance cannot be said to be a good broker. LiteFinance does not advertise its deposit and withdrawal policies, but some traders have reported issues and cancellations. Most traders will deal with the primary unregulated brokerage from St. Vincent and the Grenadines. A CySEC licensed subsidiary exists for the EEA, the UAE, and the Marshall Islands traders.FAQs

Is LiteFinance legit?

What is LiteFinance?

Is LiteFinance regulated?

Is LiteFinance a scam?

What is the LiteFinance minimum deposit?

Is LiteFinance a good broker?

How long does it take to withdraw money from LiteFinance?

Is LiteFinance licensed?