LQDFX Editor’s Verdict

LQDFX presents a competitive STP/ECN MT4 trading environment, but traders must deposit a minimum of $500 to qualify, while asset managers get the PAMM module. Beginner traders have access to limited educational content but daily trading recommendations. I decide on an in-depth review of LQDFX to test the core trading environment, where this broker focuses its resources. Can LQDFX provide the edge you need in the Forex market?

Overview

This broker does not provide any regulatory information, suggesting it is an unregulated one.

Review

Headquarters | Marshall Islands |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2015 |

Execution Type(s) | ECN/STP, No Dealing Desk |

Minimum Deposit | $20 |

Trading Platform(s) | MetaTrader 4 |

Average Trading Cost EUR/USD | 1.1 pips ($11.00) |

Average Trading Cost GBP/USD | 1.4 pips ($11.00) |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.23 |

Average Trading Cost Bitcoin | $20.25 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Regulation and Security

LQDFX appears to operate as an international business company (IBC) out of the Marshall Islands, with the registration number MH96960. Traders need to consider that LQDFX remains an unregulated broker and fails to take any of the steps other IBCs generally take to ensure that clients operate under a trustworthy trading environment, with a functioning dispute resolution mechanism. The legal section contains six PDFs, where LQDFX outlines its policies and notes compliance with AML regulations. While this broker states that client deposits remain segregated from corporate funds, there is no guaranteed of that assertion, given the absence of oversight and enforcement. Each trader needs to determine if what LQDFX presents is sufficient to trust this broker.

LQDFX is an unregulated Forex broker out of the Marshall Islands.

The legal section consists of just six PDFs.

While LQDFX claims security of funds, there is no oversight and assurance of that.

Fees

Average Trading Cost EUR/USD | 1.1 pips ($11.00) |

|---|---|

Average Trading Cost GBP/USD | 1.4 pips ($11.00) |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.23 |

Average Trading Cost Bitcoin | $20.25 |

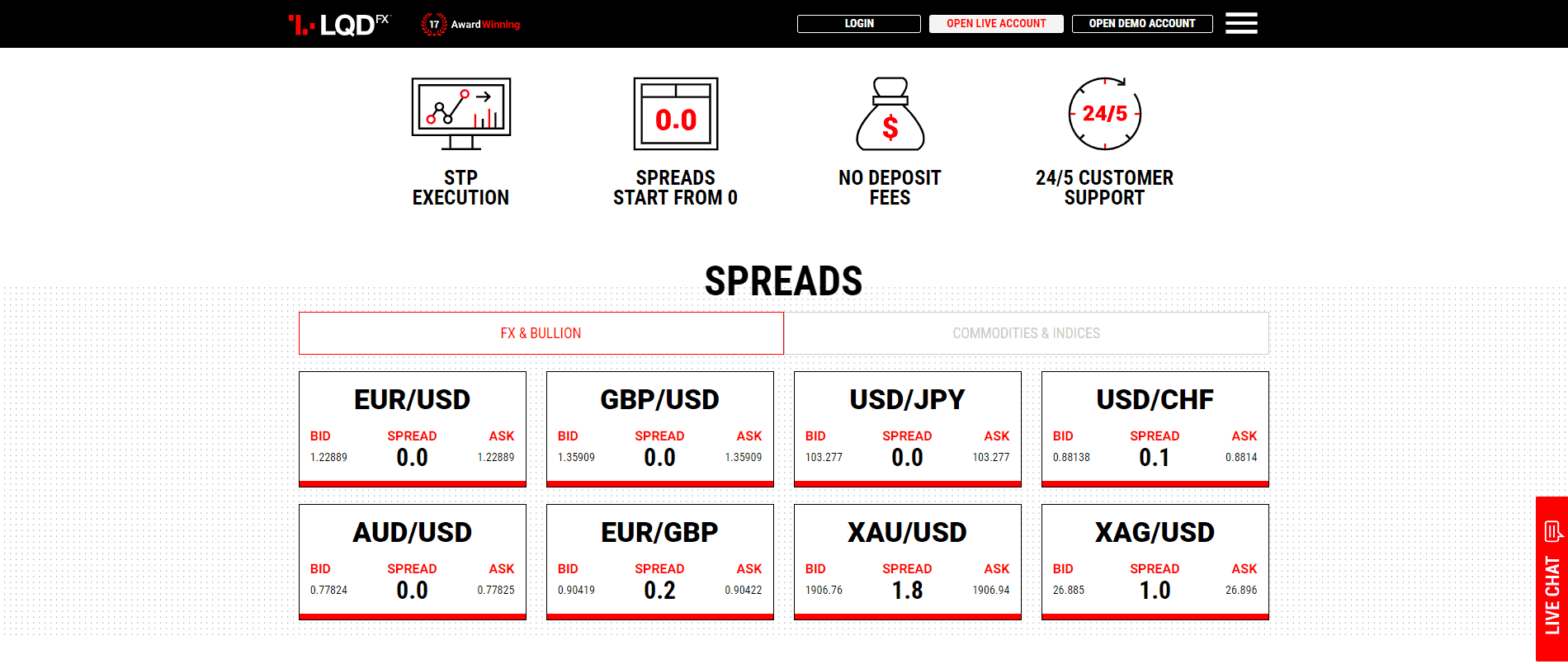

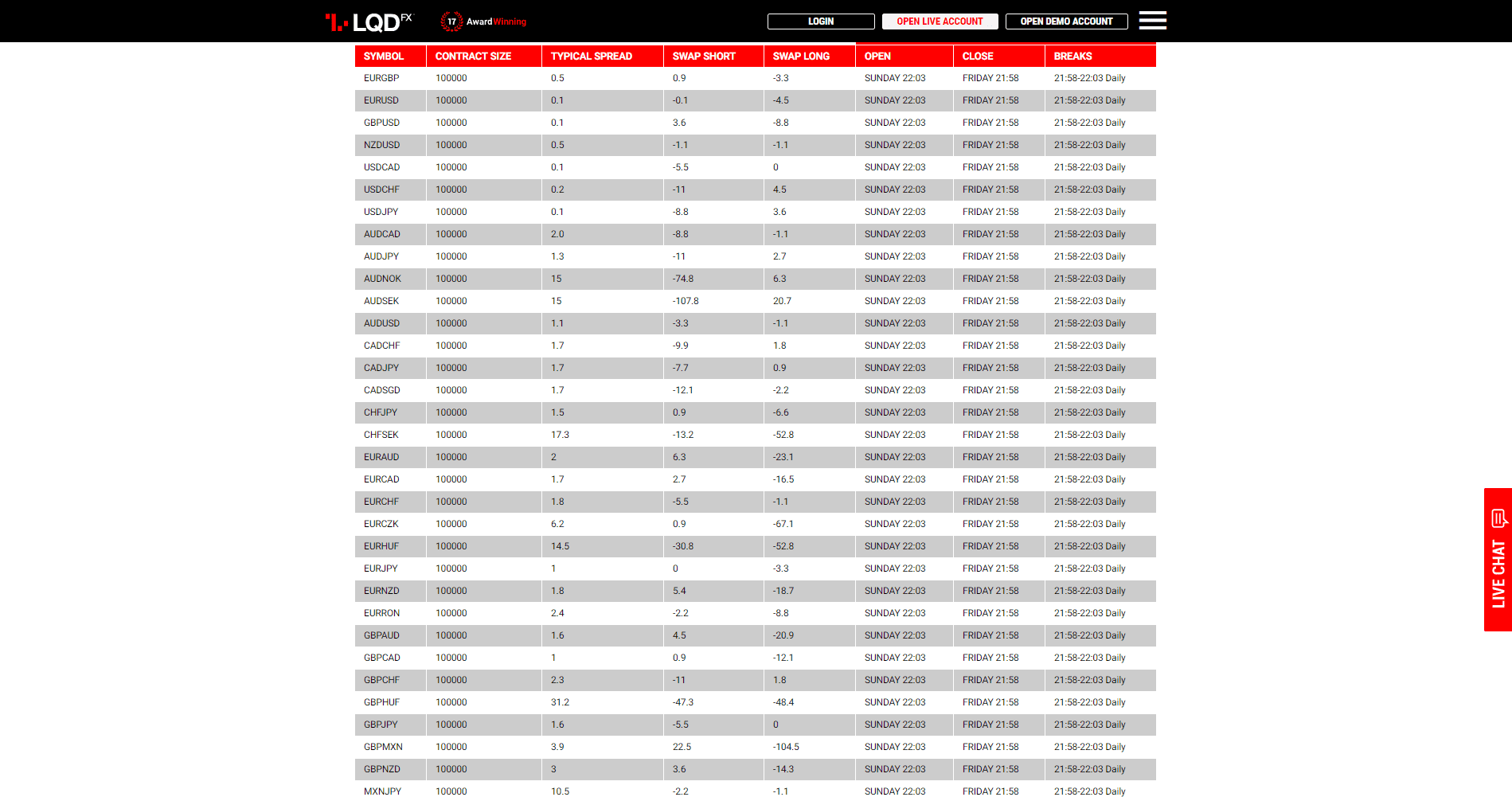

A combination of spreads and commissions exist at LQDFX, depending on the preferred account type. The commission-free Micro Account commences with 1.0 pips, lower than many brokers grant in their standard ones. The mark-up is 0.7 pips in the Gold Account and Islamic Account, which places LQDFX in a competitive position. LQDFX presents improved conditions in its commission-based ECN Account and VIP Account, where traders have access to a spread of 0.1 pips for a commission of $3.50 and $2.50 per lot, or $7.00 and $5.00 per round lot, respectively. Swap rates on leveraged overnight positions apply.

LQDFX does not specify how it handles corporate actions that might impact index CFDs. Deposit fees on wire transfers below $500 apply, together with a $10 withdrawal fee to credit/debit cards. All other methods remain free of costs. No mention of an inactivity and currency conversion charge exists, but a $5 monthly fee applies if LQDFX freezes the account amid missing or incomplete documentation to verify the trading account. The overall cost structure at LQDFX remains competitive and one of its best assets.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

LQDFX maintains competitive spreads in its ECN account.

What Can I Trade

LQDFX provides Forex traders with 71 currency pairs, an above-average selection, and the bulk of its assets. Completing the list is 24 commodities and 12 index CFDs. The total asset selection of 107 makes LQDFX one of the brokers with the fewest assets, but pure Forex traders will find it an attractive choice. Those traders seeking more in-depth cross-asset diversification will find this broker does not have sufficient assets to achieve it.

LQDFX is primarily a Forex broker, where it delivers above-average asset coverage.

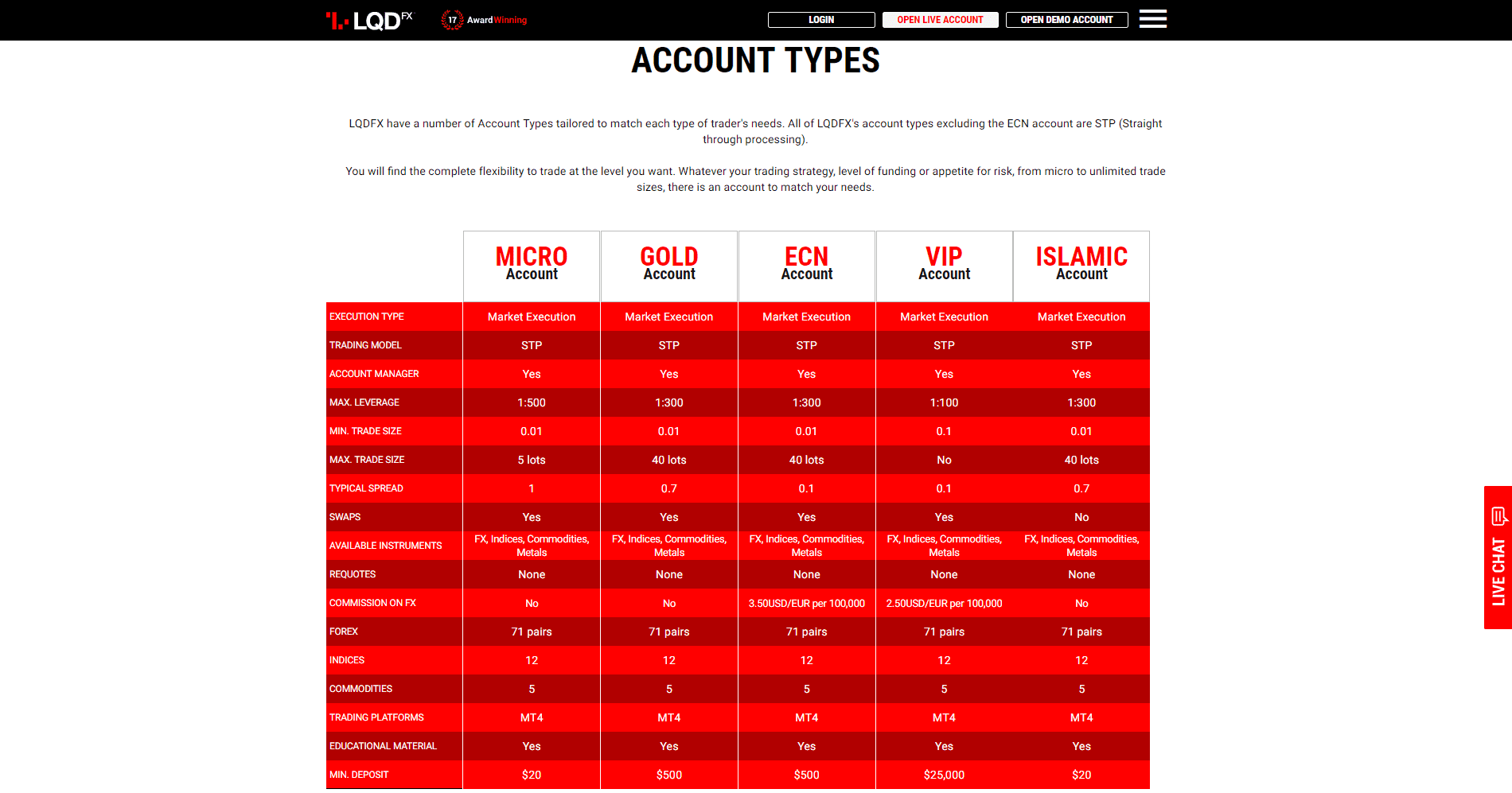

Account Types

Traders may choose between two account types, commission-free and commission-based, each consisting of two choices. New traders may test LQDFX with the Micro Account for a minimum deposit of just $20 with a minimum spread of 1.0 pips. The Gold Account requires an above-average $500 deposit, and the mark-up is as low as 0.7 pips. Active traders have the best trading conditions in the ECN Account, for a minimum deposit of $500, where the spread is 0.1 pips for a commission of $7.00 per round lot. The VIP Account lowers that to $5.00, but traders must deposit $25,000. An Islamic Account is equally available from only $20, with a minimum mark-up of 0.7 pips. The maximum leverage is 1:300 in the Islamic, Gold and ECN accounts, and it is 1:500 in the Micro Account; in the VIP Account, LQDFX caps it at 1:100.

The ECN Account offers the best trading conditions for most traders but requires a minimum deposit of $500.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

LQDFX only provides the out-of-the-box MT4 trading platform, without any of the required third-party add-ons to upgrade the below-average core version to a competitive one. While the MT4 infrastructure allows it to become a cutting-edge solution, the version available at LQDFX required traders to purchase upgrades or else trade with MT4 as is, placing them at a disadvantage. MT4 fully supports automated trading and remains the most-deployed trading platform due to its versatility, but LQDFX does not offer VPS hosting to support automated trading solutions.

Traders have the MT4 trading platform available, albeit without any of the required upgrades.

Unique Features

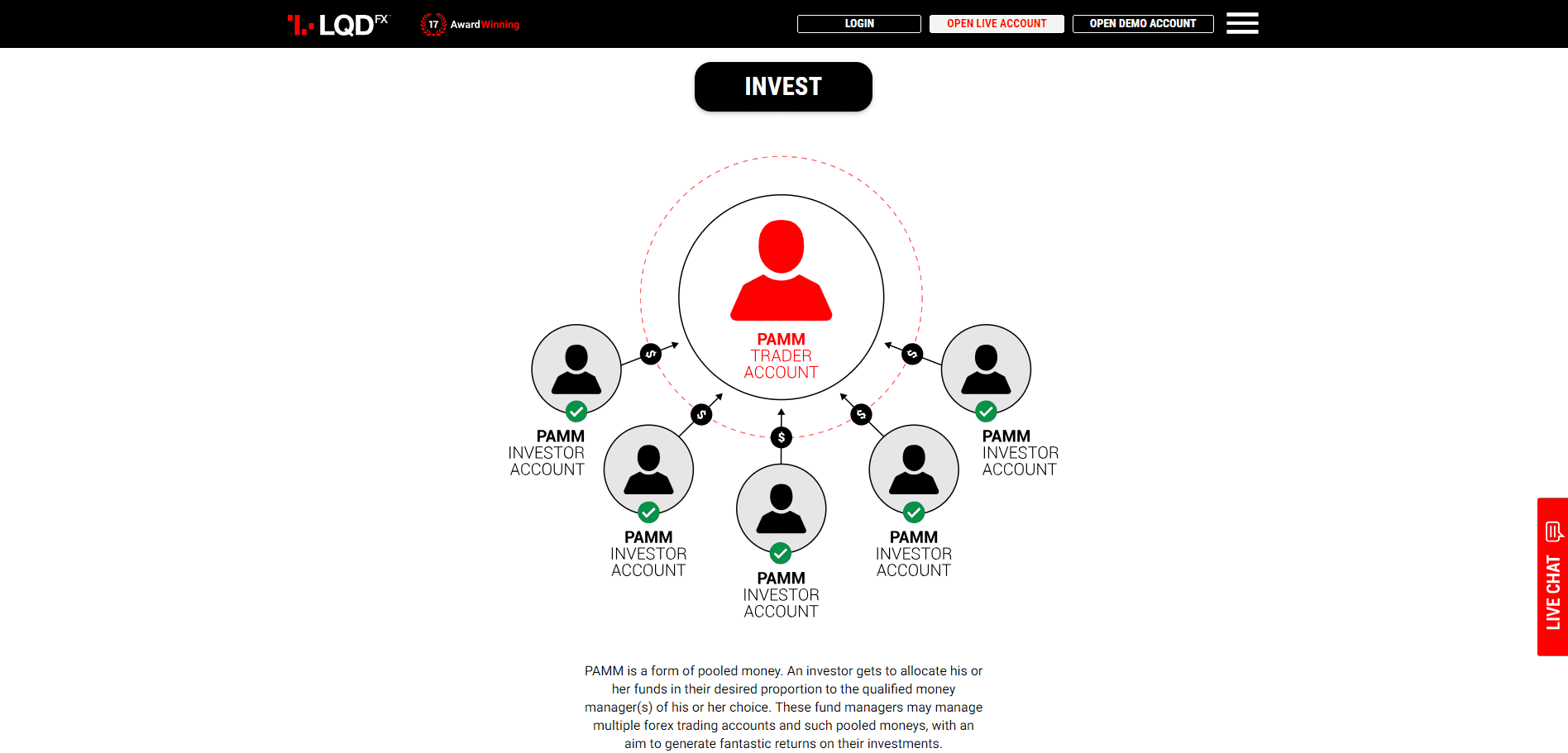

LQDFX supports retail account management via PAMM. It provides clients with profitable trading strategies an opportunity to increase their income from the Forex market, even if their accounts feature smaller balances. Fund managers receive a performance bonus, aligning their interests with investors. Traders with less or no time to trade may select several PAMM managers and use a passive trading approach. Since LQDFX maintains a competitive cost structure, the PAMM system provides fund managers and investors with an excellent tool.

The LQDFX PAMM system benefits from competitive trading costs at this broker.

Research and Education

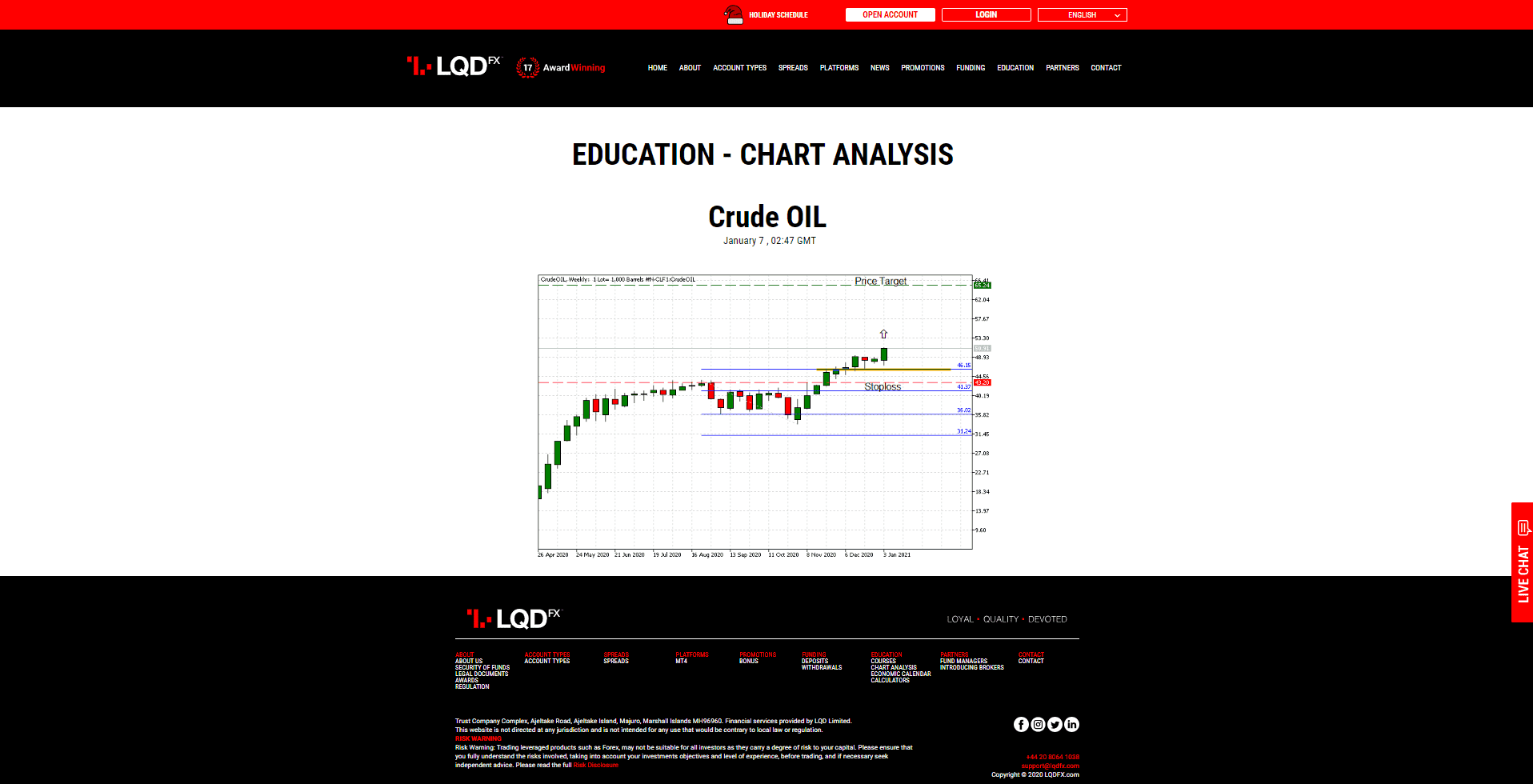

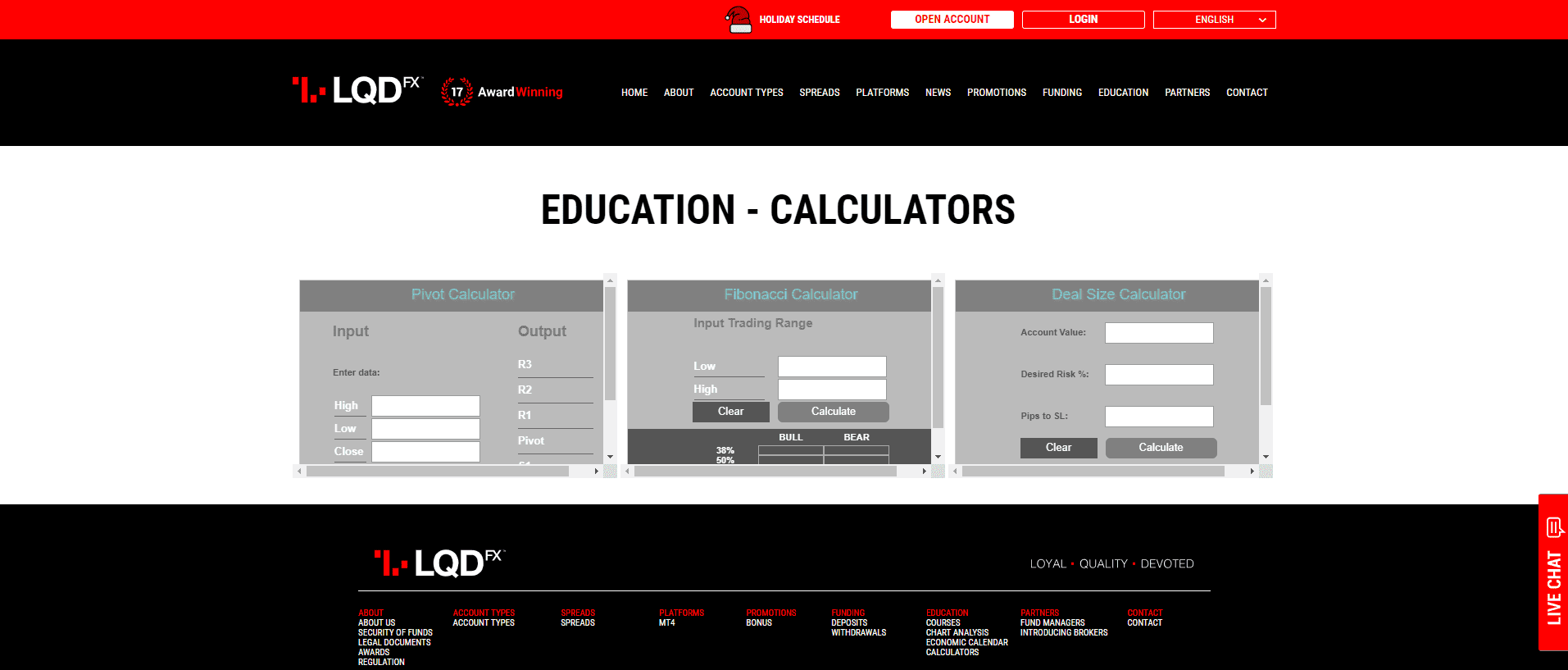

LQDFX provides over half a dozen trading signals per day, but they only consist of charts. While each piece provides all the information necessary to place a trade, including stop loss and take profit levels, it is unacceptable for any signal provider to only provide a chart. The three calculators available on the website are of little use to active traders. LQDFX should make the minimal investment to offer them as MT4 plugins, which would make them beneficial to clients, and upgrade the trading platform.

Over half a dozen daily trading ideas are available at LQDFX.

Regrettably, the quality of the chart analysis is not acceptable for any signal provider.

The three calculators add little value, and LQDFX should offer them as MT4 plugins.

The educational section at LQDFX offers traders six video courses with numerous short videos. It caters primarily to millennial traders who prefer to watch one-to-two minutes videos rather than read in-depth material. One eBook on Forex trading is also available. New traders will not receive a comprehensive introduction to trading, but the presented content does grant a brief overview.

LQDFX offers 36 video lessons, sourced from a third-party.

Traders may discover a mix of educational content and trading ideas in the LQDFX blog.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |      |

Customer service is available 24/5 at LQDFX and live chat is the easiest way to connect. Clients may also send an e-mail, use the webform, call, or request a callback. Since an FAQ section is not available, clients may need to rely on customer support more here than they might have to at other brokers. LQDFX explains its products and services well-enough to limit additional assistance.

Customer Support is available 24/5, via numerous channels; regrettably, there is no FAQ section.

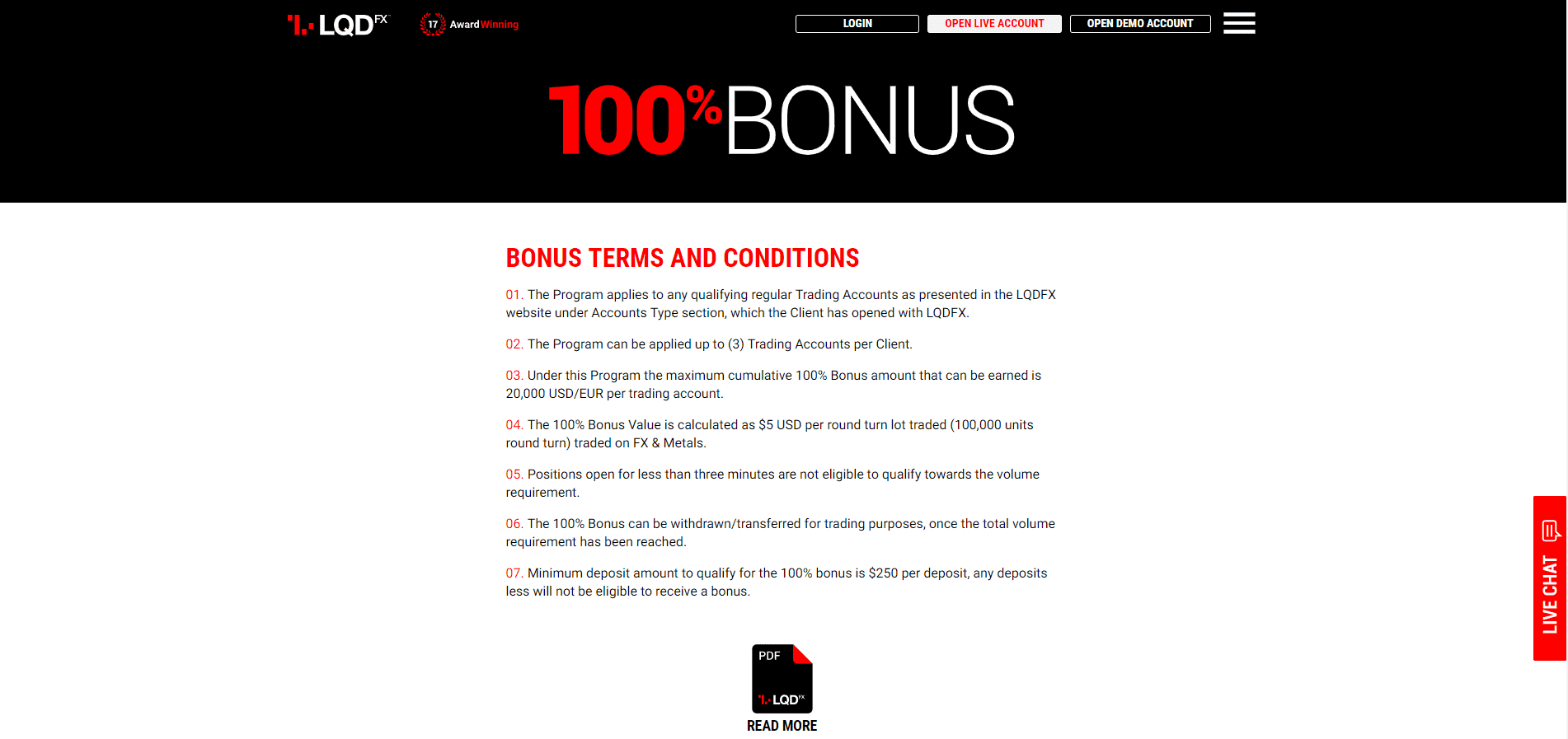

Bonuses and Promotions

LQDFX offers a generous 100% deposit bonus on all deposits from $250 up to a maximum of $20,000. Each trader may have three bonus accounts at LQDFX, excluding PAMM accounts. Terms and conditions do apply, but they are fair, transparent, and acceptable. It allows clients with a long-term time horizon to accelerate their portfolio growth strategy. Any interested trader should ensure they understand the terms and conditions before accepting it.

Traders may take advantage of a 100% deposit bonus.

The terms and conditions are acceptable, allowing traders with deposits above $250 to accelerate their growth strategy.

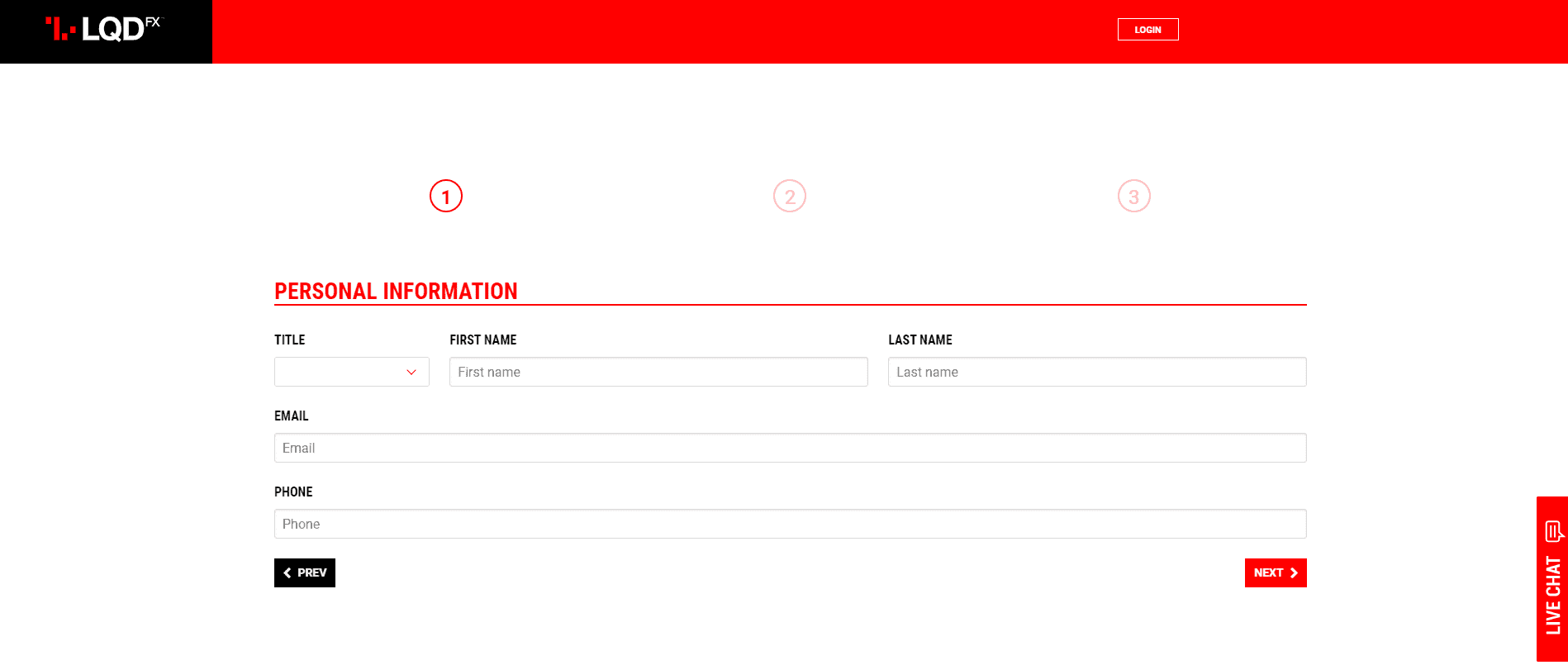

Opening an Account

A three-step online application handles new account applications. The process follows industry standards and remains swift. Despite being unregulated, LQDFX follows AML stipulations, and clients must verify their trading accounts. A copy of their ID and one proof of residency document issued within the last three months generally satisfies mandatory account verification.

The Account Opening procedure complies with industry standards.

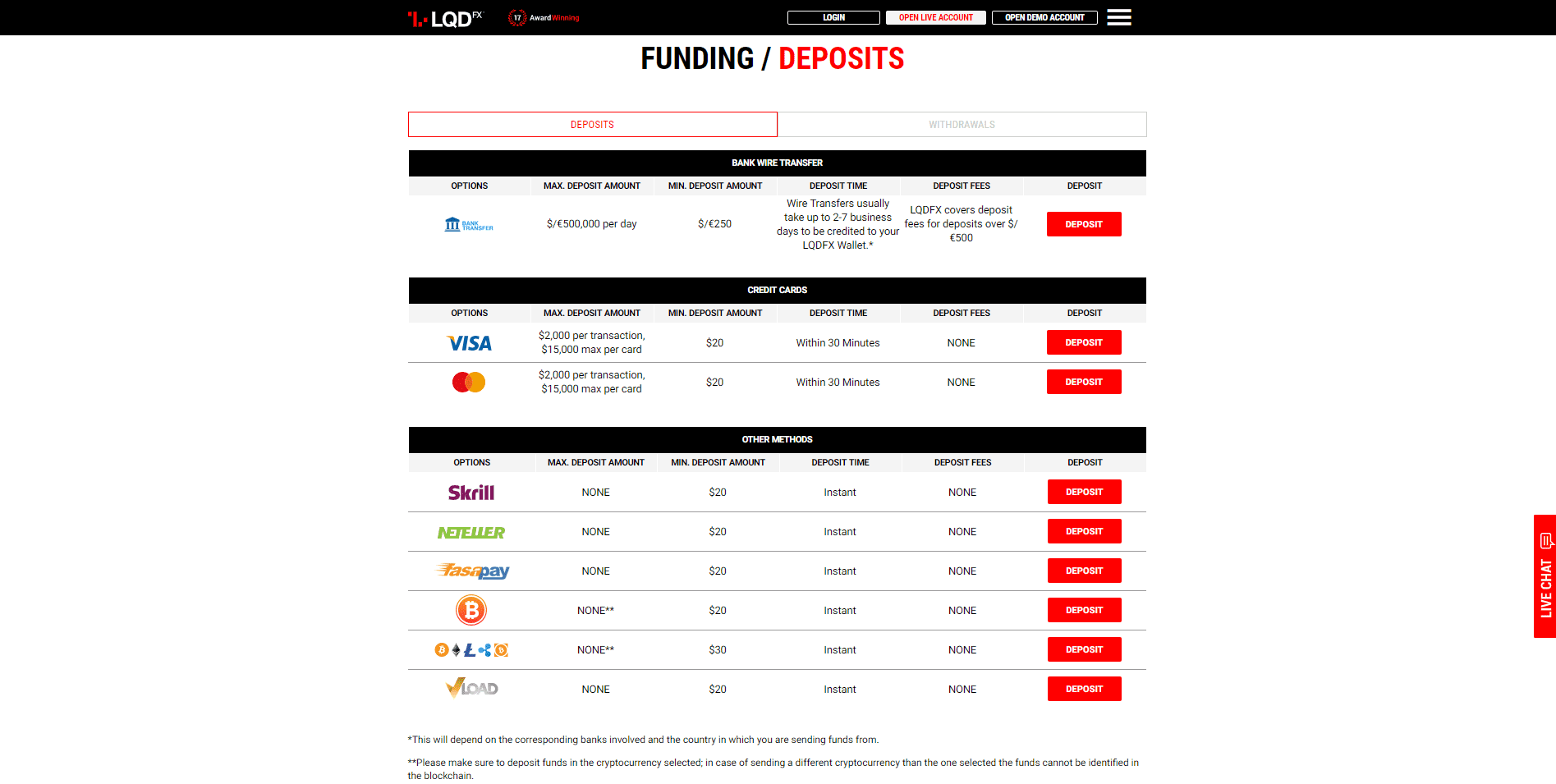

Deposits and Withdrawals

LQDFX supports bank wires, credit/debit cards, Skrill, Neteller, FasaPay, Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, and VLoad as deposit and withdrawal methods. Except for bank wires, where the minimum deposit is $250, the minimum deposit is $20, matching the one required for the Micro Account. Deposit processing times are instant across the board, except for credit/debit cards, which are generally within thirty minutes, and for bank wires, where it can take up to seven business days. No deposit fees apply except for bank wires below $500. Clients pay no withdrawal fees unless they request one to their credit/debit card, where a $10 cost applies. Bank wires remain the most expensive options. The minimum withdrawal amount depends on the payment processor and ranges from $5 to $100. Withdrawal processing times vary between one to ten business days, depending on the processor.

LQDFX supports a range of cryptocurrencies as deposit methods.

Withdrawal requests are processed swiftly.

Summary

LQDFX is an unregulated Forex broker operating as an international business company out of the Marshall Islands; the individuals behind the company and their locations remain unknown. The absence of regulation does not in and of itself suggest a scam, fraud, or malpractice, but traders do need to understand what the lack of regulation represents. LQDFX has over five years of experience and received two awards in 2017. It appears that despite the unregulated trading environment, LQDFX operates a legit and honest operation.

Forex traders will benefit from a competitive cost structure and the STP/NDD execution model. The 100% deposit bonus adds appeal and comes with acceptable terms and conditions. Active traders will find the best offer in the ECN Account for a minimum deposit of $500 and with a maximum leverage of 1:300. Low-quality in-house research mixes with acceptable content on the blog and an introduction via 36 short videos into trading. Pure Forex traders have 71 currency pairs to diversify their portfolio, but the overall asset selection of 107 is one of the fewest among online brokers. LQDFX presents a competitive core from where it can grow into a superior broker if the management team takes the necessary steps to upgrade its product and services portfolio.

LQDFX is an unregulated broker, and each trader must determine if what this broker presents fulfills their requirements of a safe broker. Traders must request all withdrawals from the secure client area. LQDFX supports multiple low-cost and swift payment processors. While LQDFX is unregulated, no signs of a scam, fraud or malpractice exist. LQDFX is a duly registered international business company (IBC) located in the Marshall Islands. No, LQDFX does not accept clients from the US or other jurisdictions where local laws and regulations prohibit them from opening accounts with offshore brokers. Despite being unregulated, LQDFX has five years of experience and appears to treat its growing client base fairly. Therefore, it can be considered a legit unregulated online broker.FAQs

Is LQDFX safe?

How do I withdraw from LQDFX?

Is LQDFX a scam?

Can I register with LQDFX in the US?

Is LQDFX a legit online broker?