Editor’s Verdict

Overview

Review

Headquarters | New Zealand |

|---|---|

Regulators | ASIC, FCA, FMA |

Year Established | 2010 |

Execution Type(s) | Market Maker |

Trading Platform(s) | MetaTrader 4, Proprietary platform |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

MahiFX, founded in 2012, is a Forex market maker with offices in Christchurch, New Zealand and London. The MahiFX trading platform was named the winner for 2013 Best Trading System at the 13th annual FStech Awards recognizing excellence and innovation in the field of information technology within the UK and EMEA financial services sector. MahiFX is regulated by ASIC.

It is also the winner of the UK Forex Award 2014.

Accounts

There is two trading account at MahiFx—the MahiFX and the MahiFx+MT4. They have identical spreads, for example 0.8 pips in EURUSD, EURGBP and USDJPY, are offered across all platforms, with no account fees, commissions or minimum deposits. There are over 110 instruments to choose from and there is no minimum deposit or commission. Leverage is now available at 30:1. The MahiFX account allows trading on the web based platform and is Mac compatible and it offers Expert Advisors which the MahiFx+MT4 does not. MahiFX traders can place a quick order, a feature not available to MahiFx+MT4 account holders. But the MahiFx+MT4 account allows trading on Mobile devices and Tablets.

I was pleased to see that MahiFX offers a demo account.

Features

Developed by a team of ex-interbank traders, analysts, statisticians and developers, MahiFX provides retail FX customers access to the same tight spreads and cutting edge technology as institutional FX traders. Prices are tradable – there are no ‘from’ prices, hidden costs, slippage, re-quotes or minimum trade sizes.

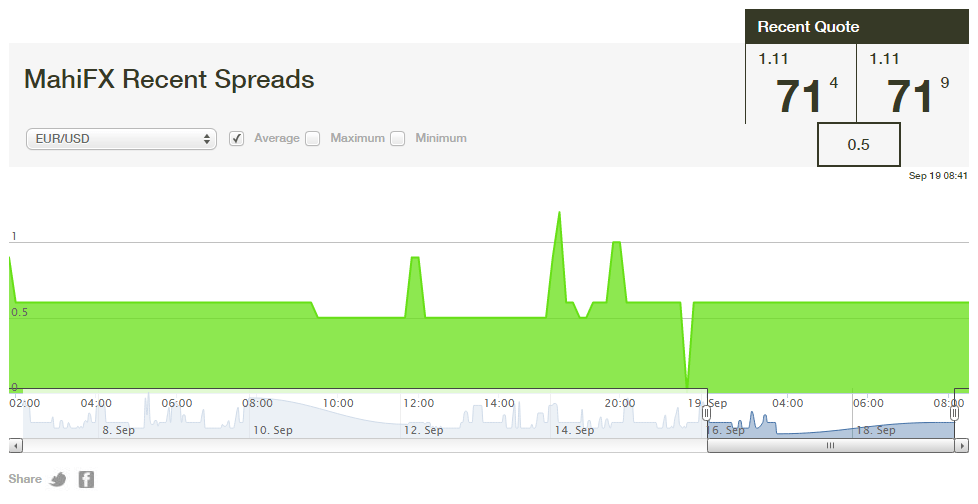

MahiFx is proud of its super low spreads and posts a spreads chart so traders can compare the spreads of some top Forex brokers.

MahiFX Spreads

Like other currency trading platforms MahiFX offers trading tools such as charting and practice accounts but brings to the mix new sophisticated tools and functionality that include volume volatility measuring and near instant 1 click trading capabilities.

MT4 is available in 30 different languages.

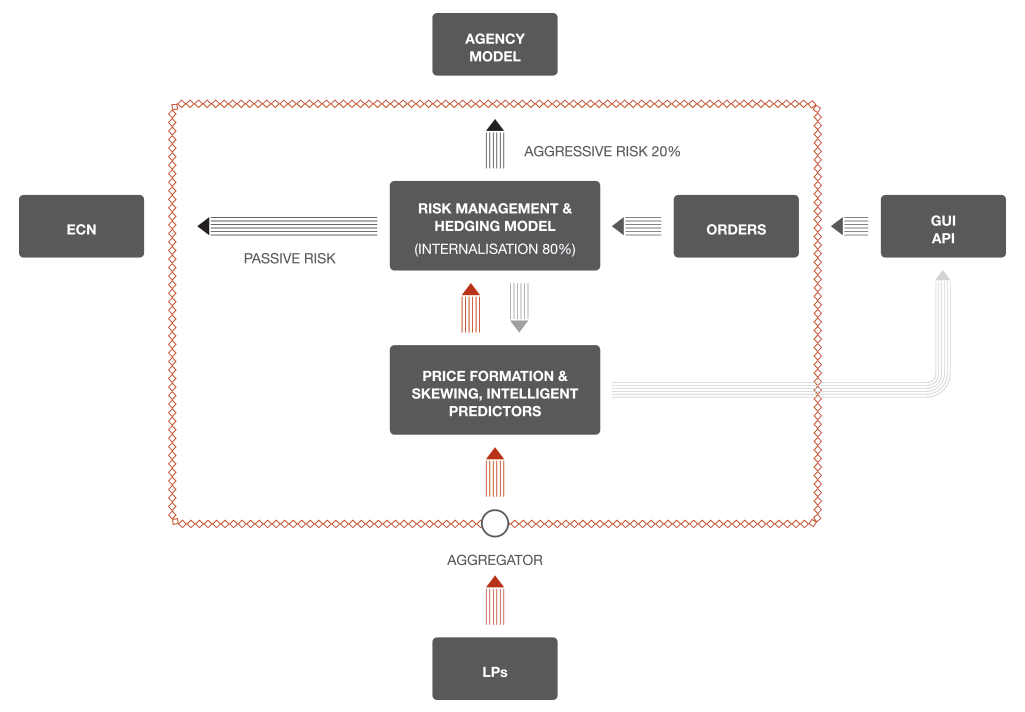

A unique feature for banks and businesses at MahiFX is its MFX Compass, an institutional tool touted as a complete e-FX survival kit. MFX Compass provides all the tools needed to enable them to achieve the same success levels as e-FX banks at a fraction of the cost and time. MFX Compass includes such features as price formation, portfolio based skewing, algorithmic hedging, risk and real time analytics, system administration, spread setting, visualization of trades, risk and real time analytics and successful commercialization and distribution of product.

MFX Compass Technology

Unfortunately, the MFX Compass section takes up a good part of the MahiFX website and seems to be one of their biggest selling points. The information devoted to this feature almost outweighs what is provided for regular Forex traders.

Education

The Trading Tips section and the education offering of the site seem to combine and offer the trader a host of different features including sections on technical and fundamental analysis, support and resistance, risk management, developing a trading plan, placing trade orders, chart patterns, leverage and how to avoid common mistakes.

Trading Tips

Under the FX Gym tab, traders can read clear presentations on tips for the various calculators--margin, profit, pip value and swap—as well an explanation of total equity/NAV. Examples of each of these topics are provided.

There is a currency converter, a financial glossary and a wide selection of videos on a variety of different subjects. In addition, MahiFX offers a large suite of indicators in the charting area of the platform to help users analyze their favorite currencies. They can examine trends by deploying any one of the trend-following Moving Averages such as the Exponential Moving Average (EMA) or the Weighted Moving Average (WMA), or alternatively use other trend indicators such as the Parabolic Stop and Reverse system (PSAR) and Donchian Channels.

In addition, there are Momentum indicators such as the Relative Strength Index (RSI) and Rate of Change (ROC) amongst many others

Traders also have access to market news and economic updated often, trader stories and blogs.

MahiFx Blog

Bonuses/Promotions

The only promotion taking place when doing this review was the Refer-a-Friend bonus. But this was far more generous and expansive than many other such promotions offered by brokers. When a friend accepts the invitation from a trader, he/she will receive $100 USD bonus when they sign up for a live trading account and deposit $250. The referrer receives a bonus up to $200 when the friend turns over $5 million in 90 days.

Deposits/Withdrawals

Funding accounts at MahiFX can be done by credit card or bank wire. The is no minimum deposit for credit card deposits and there is a daily deposit limit of 15,000 units of currency and a deposit fees of 2.5% for any currency. With bank transfers there is no minimum or maximum deposit and no fees.

The maximum daily withdrawal via a credit card is 25,000 units of currency; there is no maximum withdrawal when using a bank transfer.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

A London help desk number connects traders with a MahiFX support representative. There is also an online help request form and Chat is available during trading hours. The FAQ section is divided into different sectors and is well presented.

Conclusion

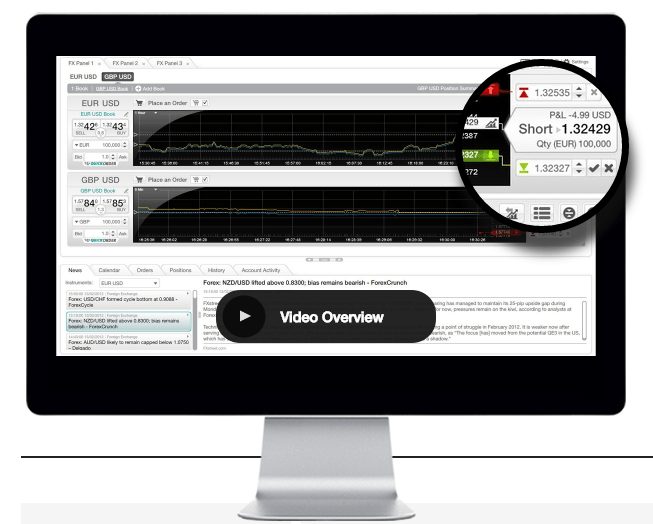

The website at MahiFX is user-friendly and easy to navigate. I liked the fact that even before even opening an account with MahiFX, traders can learn all about the company and how to trade Forex by clicking on the video overview that is offered on each of the pages of the website. This video is very enlightening and introduces traders to MahiFX and the world of trading.

Features

Every broker should have at least one outstanding feature that acts as an attraction for new clients. At MahiFX, it is obvious that the main allure is their MFX Compass. This is a program that is offered to banks and business owners to assist them to achieve the same degree of success as e-FX banks at a lower cost and in less time. This feature overpowers the choice of two different accounts and the use of the popular MetaTrader 4 platform.

Platforms

Proprietary

MahiFX offers its own proprietary platform with all the tools necessary for Forex trading. Trades can be placed as three different orders: market orders, limit orders and stop loss/take profit orders. Quick orders can also be placed. Traders using this platform can choose among several other options as well such as deciding the upper and lower limits of a trade.

MFXTrade Platform

The proprietary platform allows several positions to be rung at the same time

MetaTrader 4

MahiFX is offers the popular MetaTrader 4 (MT4) platform. As of August 2013, trading done via the MT4 trading application is enabled through a MahiFX custom-built bridge. The technology links MahiFX’s award-winning trading engine to the MT4 platform, offering retail FX investors automated trading capabilities and access to a wide range of tools and resources to analyze price and place orders and manage trades employing Expert Advisors (EA’s), custom indicators and scripts.

There are two types of execution in MT4 – ‘Instant’ and ‘Market’. They operate the MahiFX+MT4 offering in instant execution mode. With instant execution the trader is able to control slippage on a market order by specifying the maximum tolerated pips deviation from the ask price in the case of a buy, or the bid price in the case of a sell. If the trade server is unable to fill within that deviation, the trade is rejected and a re-quote message is returned.

Mobile

The MahiFX MT4 platform is available on Apple and Android devices.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |