Editor’s Verdict

Maunto offers its web-based, user-friendly trading platform, allowing traders to transact in highly liquid assets spanning six sectors. It provides traders with 24/5 customer support, services in six languages with a focus on Asia, and has a $250 minimum deposit requirement. I rate Maunto as best-suited for beginner traders, as it lacks algorithmic trading support and volume-based rebates. I evaluated the Maunto trading environment during my review to see if beginners should consider it. Should you trade with Maunto?

Overview

Maunto offers beginner traders a web-based trading platform with liquid assets.

Headquarters | Saint Lucia |

|---|---|

Regulators | MWALI International Services Authority |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2023 |

Execution Type(s) | Market Maker |

Minimum Deposit | $250 |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 2.5 pips ($25.00) |

Average Trading Cost GBP/USD | 2.8 pips ($28.00) |

Average Trading Cost WTI Crude Oil | $0.14 |

Minimum Raw Spreads | 2.5 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 3+ |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Maunto Five Core Takeaways:

- Secure platform with negative balance protection.

- A small but liquid asset selection.

- A light-weight web-based platform for manual traders.

- 24/5 customer support.

- Beginner education.

Maunto Regulation & Security

Maunto offers beginner traders a web-based trading platform with liquid assets.

Country of the Regulator | Comoros |

|---|---|

Name of the Regulator | MWALI International Services Authority |

Regulatory License Number | T2023409 |

Regulatory Tier | 5 |

Is Maunto Legit and Safe?

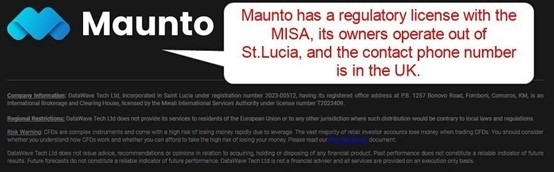

Traders should conduct their due diligence on Maunto and gauge if Maunto classifies as legit and safe. Maunto is a regulated broker.

Maunto regulation and security components:

- Regulated by the Mwali International Services Authority.

- 128-bit SSL encryption.

- Servers in SAS 70 certified area.

- Negative balance protection.

- Maunto owner Datawave Tech LTD is a St. Lucia incorporated company.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Maunto maintains a commission-free trading environment with minimum spreads starting from 2.5 pips or $25.00 per 1.0 standard round lot. Traders qualifying for the VIP account can reduce them to 0.9 pips or $9.00.

Per the client agreement, all traders pay a $10 maintenance fee, irrelevant to activity levels.

Maunto does not charge internal deposit fees but applies a 3.50% withdrawal fee on credit/debit card and e-wallet transactions, a $30 fee on bank wires, and a $10 fee if traders request a withdrawal without trading.

Average Trading Cost EUR/USD | 2.5 pips ($25.00) |

|---|---|

Average Trading Cost GBP/USD | 2.8 pips ($28.00) |

Average Trading Cost WTI Crude Oil | $0.14 |

Minimum Raw Spreads | 2.5 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | true |

Maunto also has the below inactivity fee structure:

- One to two months of inactivity - €100

- Two to six months of inactivity - €250

- Six to twelve months of inactivity - €500

- Above twelve months - Maunto will archive the account

The average trading costs for the EUR/USD at Maunto are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

2.5 pips (Classic) | $0.00 | $25.00 |

2.5 pips (Silver) | $0.00 | $25.00 |

1.8 pips (Gold) | $0.00 | $18.00 |

1.4 pips (Platinum) | $0.00 | $14.00 |

0.9 pips (VIP) | $0.00 | $9.00 |

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free Maunto Silver account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for one night in the Maunto Silver account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Long | Total Trading Costs |

|---|---|---|---|---|

2.5 pips | $0.00 | $47.28 | X | -$70.70 |

2.5 pips | $0.00 | X | $45.70 | -$70.70 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for seven nights in the Maunto Silver account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Long | Total Trading Costs |

|---|---|---|---|---|

2.5 pips | $0.00 | $330.96 | X | -$355.96 |

2.5 pips | $0.00 | X | $319.19 | -$344.90 |

Noteworthy:

Maunto ensures transparent swap rates, providing clarity and predictability for traders on qualifying assets. Maunto publishes its swap rates on its website every day.

Range of Assets

The asset selection at Maunto is comparatively small but consists of highly liquid assets, which is ideal for beginners. Forex traders will also find some less-liquid trading instruments. Commodity traders bet the broadest sector coverage at Maunto through cash and future contracts.

Maunto offers the following quantities by asset class:

- 47 currency pairs

- 10 cryptocurrency pairs

- 12 indices

- 158 stocks

- 6 metals

- 13 commodities

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Maunto Leverage

Maximum Retail Leverage | 1:400 |

Maximum Pro Leverage | 1:400 |

What should traders know about Maunto leverage?

- Maximum retail Forex leverage is 1:400 on all currency pairs, except the Turkish Lira, which maxes out at 1:200.

- Commodity, index, and futures traders get 1:200.

- Cryptocurrency and equity CFD traders get a maximum leverage of 1:5.

- Negative balance protection ensures traders cannot lose more than their deposit.

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Account Types

Maunto has five account types, which feature similar trading conditions except for trading fees, which decrease moving through the higher tiers. Maunto states a minimum deposit requirement of $250 or a currency equivalent. The account base currencies are USD, EUR, JPY, INR, and KRW.

Traders receive a margin call at 100% margin level with an automatic stop-out at 20%. The minimum and maximum Forex trade sizes are 0.01 lots and 50.00 lots, respectively.

Maunto Demo Account

Demo trading offers a valuable opportunity to learn trading mechanics and practice strategies in a risk-free environment. However, it's important for beginner traders to recognize that demo accounts do not fully replicate the psychological pressures and conditions of live trading. Use demo trading to build your skills and confidence but be mindful that transitioning to a live money account will involve different emotional challenges and market dynamics.

What stands out about the Maunto demo account?

- Maunto only offers a demo account to trades who qualify for a live account.

- Seamless one-click switching between demo and live trading.

Trading Platforms

Maunto offers its user-friendly, web-based trading platform, designed for ease of access and convenience.

Beginners will find this trading platform ideal, which includes a clean interface, 60+ technical indicators, and seamless one-click switching between demo and live trading. Since my in-depth Maunto review determined beginners as the core market for this broker, I deem the trading platform sufficient

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform |

Unique Features

Maunto's security measures include encrypted transactions, robust personal data protection, and servers located in certified secure areas. These features provide a secure trading environment.

Research & Education

Maunto offers an extensive, free educational suite accessible once users create an account, even with a demo account. The platform includes introductory courses on basic trading concepts and advanced market theories. Additionally, a selection of detailed eBooks covers trading strategies, market analysis, trading psychology, and more.

My conclusion:

Maunto's educational offerings support traders at all levels. Those looking for further depth can still benefit from reputable external sources to enhance their understanding.

Avoid paid-for courses and mentors.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Monday to Friday, 12:00 to 21:00 (GMT) |

Website Languages |     |

Maunto offers 24/5 customer support via live chat, and traders can also send an e-mail or call.

Noteworthy:

- Maunto offers phone support.

Bonuses and Promotions

At the time of my Maunto review, Maunto neither offered bonuses nor promotions.

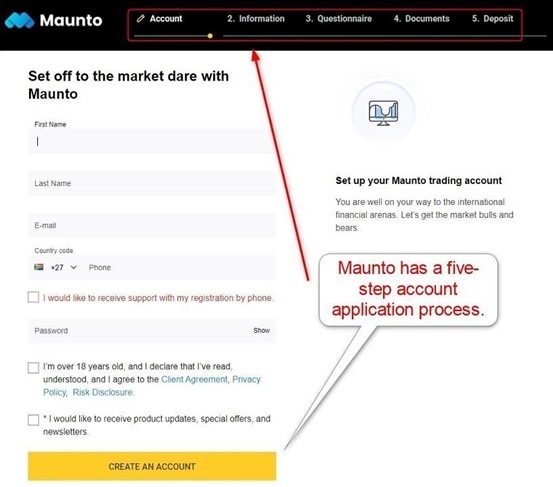

Opening an Account

Maunto has a five-step account application, which follows account application procedures and data mining from ESMA-compliant brokers. Traders should gauge if they agree with the requirements before proceeding.

What should traders know about the Maunto account opening process?

- Maunto complies with global AML/KYC requirements.

- Account verification is mandatory.

- Most traders can pass verification by uploading a copy of a government-issued ID and one proof of residency document.

- Maunto may ask for additional information on a case-by-case basis.

Minimum Deposit

The Maunto minimum deposit requirement is $250 or a currency equivalent.

Payment Methods

Maunto accepts Credit/Debit Cards, Wire Transfer and APMs. Maunto accepts Credit/Debit Cards, Wire Transfer and APMs.

Withdrawal options |    |

|---|---|

Deposit options |    |

Accepted Countries

Maunto does not have a list of accepted or restricted countries, except for noting that EU-resident traders cannot open accounts, and those residing in countries where trading would violate local rules and regulations.

Deposits and Withdrawals

The Maunto back office handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at Maunto?

- Maunto does not levy an internal deposit fee.

- The minimum deposit requirement is $250 or a currency equivalent.

- Traders can deposit USD, EUR, JPY, INR, and KRW.

- Bank wire withdrawals face a Maunto withdrawal fee of $30.

- Maunto charges a 3.5% withdrawal fee on credit/debit card and e-wallet transactions.

- Traders requesting a withdrawal without trading incur a $10 withdrawal fee.

- The Maunto minimum withdrawal is $10 for credit/debit cards, $100 for bank wires, and must cover the withdrawal fee for e-wallets.

- Maunto states withdrawal processing times are between eight and ten business days.

- A currency conversion fee may apply if the deposit currency mismatches the account base currency.

- Traders may face third-party payment processing charges.

- The availability of payment processors depends on the geographic location of traders.

- The name on the payment processor and Maunto trading account must match in compliance with AML regulations.

Is Maunto a good broker?

Maunto offers a user-friendly, web-based trading platform that is ideal for beginners, featuring a selection of highly liquid assets. Traders can benefit from assessing the trading fees in relation to the provided trading environment. While Maunto currently does not support algorithmic trading, making it less suitable for advanced traders, it is a promising new broker with the potential to expand its product and services portfolio. Despite being new in an ultra-competitive market, Maunto's focus on core trading features is commendable, and with continuous evaluation and enhancement of their business model and platform, they can further strengthen their position. Maunto withdrawals take between eight and ten business days. Maunto has a regulatory license issued by the MISA in Mwali, Comoros. Maunto has a $250 minimum deposit requirement.FAQs

How long does it take to withdraw money from Maunto?

Is Maunto regulated?

What is the Maunto minimum deposit requirement?