Editor’s Verdict

Merrill Edge, owned by Bank of America, established itself as a competent broker bank for long-term investors, retirement planners, and casual traders. It offers a one-stop solution that appeals to many clients and maintains fee-based investment advisory programs and quality trading tools. It also excels with its award-winning customer service and the Preferred Rewards program by Bank of America, which offers perks at Merrill Edge. I conducted this Merrill Edge review to evaluate its investment environment, which, while offering some impressive features, also has notable drawbacks for active traders.

Merrill Edge is a great broker for long-term investors who trade infrequently.

Read on to find out more.

Overview

Merrill Edge provides long-term investors with a competitive product portfolio.

Headquarters | United States |

|---|---|

Regulators | SEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2010 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform |

Funding Methods | 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Merrill Edge Five Core Takeaways

- Well-established financial company for US clients

- Commission-free investing for DIY investors

- Low minimums for advisory and robo-advisory services

- Inadequate environment for active traders

- Limited asset selection and no algorithmic trading capabilities

Merrill Edge Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Merrill Edge owner Bank of America is a US-listed public company.

Country of the Regulator | United States |

|---|---|

Name of the Regulator | SEC |

Regulatory License Number | 7691, 801-14235,8-7221 |

Regulatory Tier | 1, 1 |

Is Merrill Edge Legit and Safe?

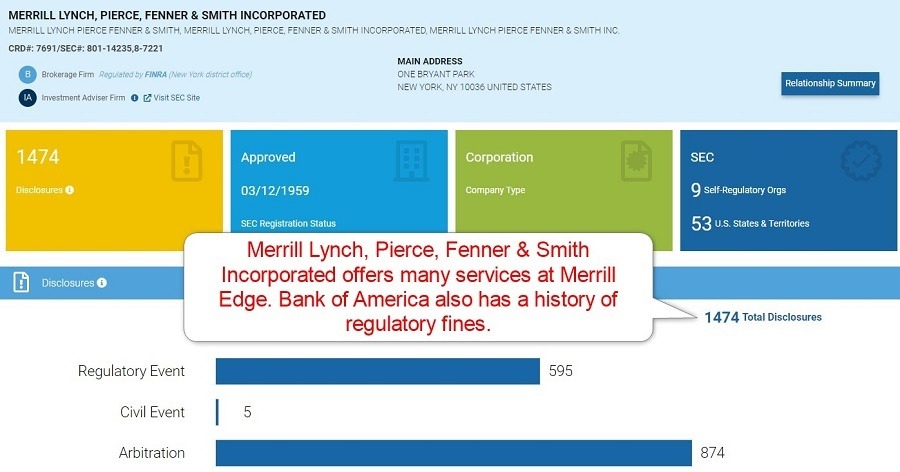

My Merrill Edge review found no misconduct or malpractice by this broker. Merrill Lynch, Pierce, Fenner & Smith Incorporated, which provides many broker's services, has 595 regulatory events, five civil events, and 874 arbitration cases per a FINRA Broker Check. Merrill Edge has no FINRA entry, as Bank of America owns it.

Bank of America has a long history of regulatory fines, which became a standard among US banks. Therefore, Merrill Edge can be considered a legitimate and safe broker by US standards.

Merrill Edge Regulation and Security Components

- Founded in 2010

- Corporate ownership by Bank of America, a publicly listed US bank

- SIPC protection up to $500,000 per client, including a $250,000 cash limit

- $1 billion excess SIPC insurance by Lloyd’s of London

- Lack of transparency

- History of regulatory fines by Bank of America and its subsidiaries, including a recent $250 million fine for junk fees

What Would I Like Merrill Edge to Add?

Merrill Edge should improve its regulatory transparency and security measures. While US brokers are less transparent than their international counterparts, clients should not be required to search for critical security and regulatory data across numerous websites.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability.

Here is a snapshot of Merrill Edge’s core investment fees:

- Stocks and ETFs, self-directed - $0

- Stocks and ETFs, broker-assisted - $29.95

- Options, self-directed - $0 + $0.65

- Options, self-directed - $29.95 + $0.65

- Mutual funds, load-waived - $0

- Mutual funds, no-load, no transaction fee - $0 + $39.95 short-term redemption fee (applicable if investors close the position in less than 90 days)

- Mutual funds, no-load, transaction fee, self-directed - $19.95

- Mutual funds, no-load, transaction fee, broker-assisted - $29.95

- Treasuries, self-directed - $0

- Treasuries, broker-assisted - $29.95

- Secondary trades, Corporate Bonds, Municipal Bonds, and Government agencies, self-directed - $1 per bond, $10 minimum, $250 maximum

- Secondary trades, Corporate Bonds, Municipal Bonds, and Government agencies, broker-assisted - $1 per bond, $10 minimum, $250 maximum + $29.95

Robo-advisory fees are 0.45% annually, and advisory fees are 0.85%. Non-trading fees apply during select circumstances.

Deposit Fee | |

|---|---|

Withdrawal Fee | |

Inactivity Fee | false |

The trading costs that are most commonly ignored are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

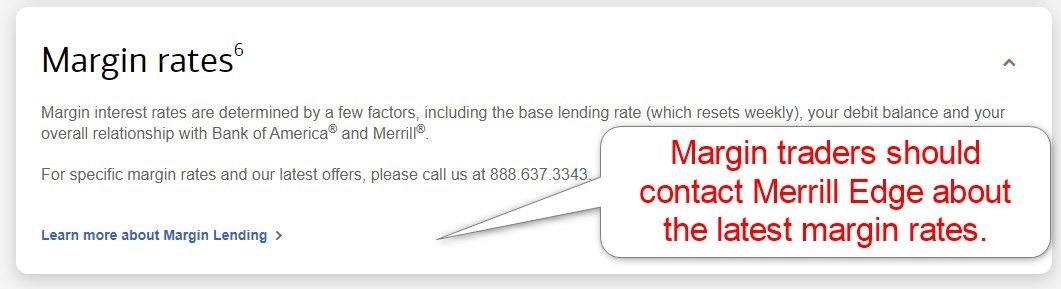

- Merrill Edge offers leveraged trading but does not disclose swap rates, financing, or margin rates.

- Traders can consult Merrill Edge about financing rates, which reset weekly, per information on the Merrill Edge website.

Merrill Edge Trading Hours

Asset Class | From | To |

|---|---|---|

Stocks (non-CFDs) | Monday 09:00 | Friday 17:00 |

Bonds | Monday 07:00 | Friday 20:00 |

ETFs | Monday 07:00 | Friday 20:00 |

Options | Monday 07:00 | Friday 20:00 |

Range of Assets

Merrill Edge caters to US long-term investors with a buy-and-hold strategy, casual traders performing low-frequency transactions, and retirement planners. While it offers margin trading, the infrastructure remains uncompetitive, the asset selection needs to be better, and the sector coverage needs to be improved.

Merrill Edge offers the following assets:

- Stocks

- ETFs

- Mutual funds

- Options

- Fixed income securities

- CDs

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Merrill Edge Leverage

Maximum Retail Leverage | 1:4 |

|---|---|

Maximum Pro Leverage | 1:4 |

What should traders know about Merrill Edge leverage?

- My Merrill Edge review found no leverage details, but the maximum allowed by US regulations derived from more transparent competitors is 1:4.

- Not all assets qualify for margin trading.

- Clients must have a minimum account balance of $2,000 to qualify for margin trading.

- Merrill Edge does not publicly disclose financing rates.

- Traders will receive a margin call if their equity balance drops below 30%.

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

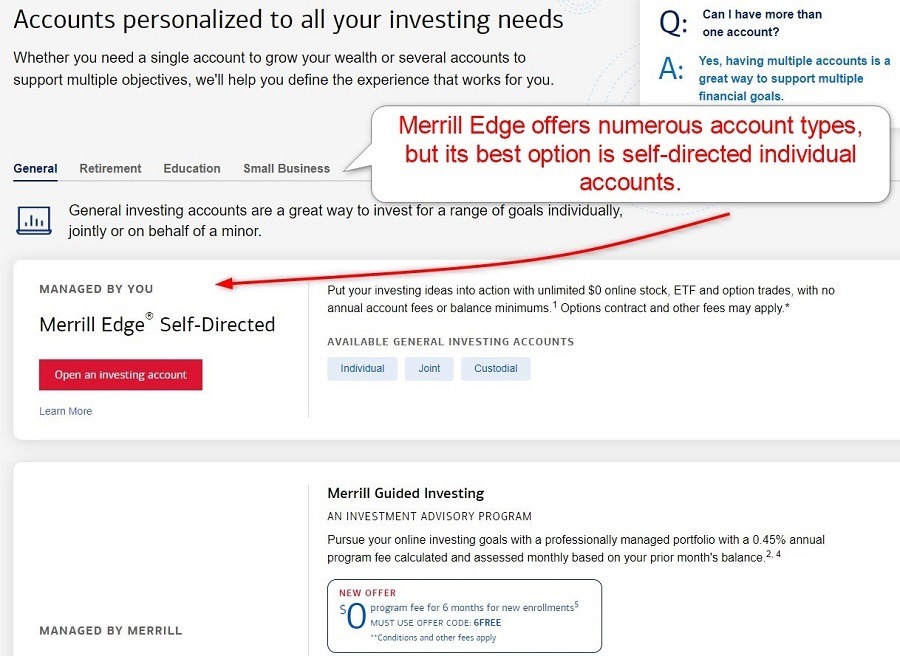

Account Types

Merrill Edge offers many account types, as it aims to provide custom-tailored solutions, but many account classifications deal more with various legal specifications than custom-tailored products.

Merrill Edge has the following account types:

- Merrill Edge Self-Directed (Individual, joint, custodial)

- Merrill Edge Guided Investing (Robo-advisory, minimum balance of $1,000)

- Merrill Edge Guided Investing with an Advisor (Minimum balance of $20,000)

- Retirement (Rollover, Traditional IRA, Roth IRA, Inherited IRA, SEP IRA, SIMPLE IRA)

- Education (NextGen529 Plan, Custodial)

- Small Business (SEP IRA, SIMPLE IRA, Basic, Retirement cash management, Business investor)

Please Note:

- Most account types for retirement, education, and small businesses are also available with both Guided Investing options.

Guided Investing options are available as individual, joint, and custodial accounts.

Merrill Edge Demo Account

Demo trading does not grant exposure to the full range of trading psychology and can create unrealistic expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations.

Merrill Edge does not offer demo accounts, a significant oversight it shares with many US-based bank brokers and a clear indicator that it does not cater to active traders.

Trading Platforms

Merrill Edge offers a web-based investment platform where clients can use screeners to find the assets they wish to add to their portfolios. It is a basic solution, and while some tout the Merrill Edge Dashboard as an AI-driven tool, it is not. Rather, it is a simple reflection of Merrill Edge and Bank of America account balances, including changes to the balance and rudimentary data about preset goals. A mobile app is available for investors who prefer small-screen analytics and decision-making on the go, which could be better for long-term investment planning.

Traders at Merrill Edge get the Merrill Edge MarketPro trading platform, where the best feature is Trading Central. Despite the marketing surrounding Merrill Edge MarketPro, it is a less-than-average platform. It delivers the necessities for traders, like a powerful charting package, Level II data, and a customizable interface. Merrill Edge MarketPro suffices but lacks advanced features, most notably algorithmic trading support, one-click trading, hedging abilities, and advanced order structures.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Idea Builder is a unique feature at Merrill Edge, challenging investors to start with an investment idea rather than a data-driven, analytical approach. Idea Builder presents investors with stocks, ETFs, and mutual funds that fit their criteria. It is a thematic-based approach and the best Merrill Edge service for investors, aside from its robo-advisory and advisory services.

Idea Builder has dozens of themes that allow investors to align their portfolios with a shifting market and disruptive trends.

Research & Education

Merrill Edge offers Trading Central research in its Merrill Edge MarketPro trading platform. It also provides fee-based robo-advisory and advisory services. Clients can also read the “Market & Investing Insights” section or use the Idea Builder. I rate the research capabilities at Merrill Edge as highly competitive among US-based broker banks.

What About Education at Merrill Edge?

Merrill Edge provides quality educational content on its website, but clients can always contact an advisor for assistance. Please note that broker-assisted transactions incur a $29.95 fee. Education at Merrill Edge is a hidden gem, and I recommend beginners take advantage of the well-crafted content.

My conclusion:

- Beginners should start with “Get Started Investing” and “Investing Basics”.

- Merrill Edge offers educational introductory material for investing in stocks, ETFs, mutual funds, options, fixed income, and bonds.

- I also recommend beginners seek in-depth education from third parties, starting with trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

Customer Support

Merrill Edge offers 24/7 customer support via e-mail, phone, and live chat. It also maintains an FAQ section, and I recommend traders read the FAQ section before contacting Merrill Edge. During my Merrill Edge review, most product and service descriptions were detailed and did not require further clarification or customer support. Clients can also schedule in-person meetings, where the benefits of a broker-bank become evident.

Noteworthy:

- Merrill Edge does not offer a direct line to the finance department, where most issues can arise.

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

Bonuses and Promotions

During my Merrill Edge review, new clients for the robo-advisory form received six months of free service. Please note that savings equal $2.25 for a $1,000 minimum account. Merrill Edge clients also qualify for the Preferred Rewards program by Bank of America, which grants discounts to other Bank of America services like savings rates, auto loans, mortgages, and credit cards. Please note that these rewards make sense to high-net-worth clients, while savings for retail clients remain minimal.

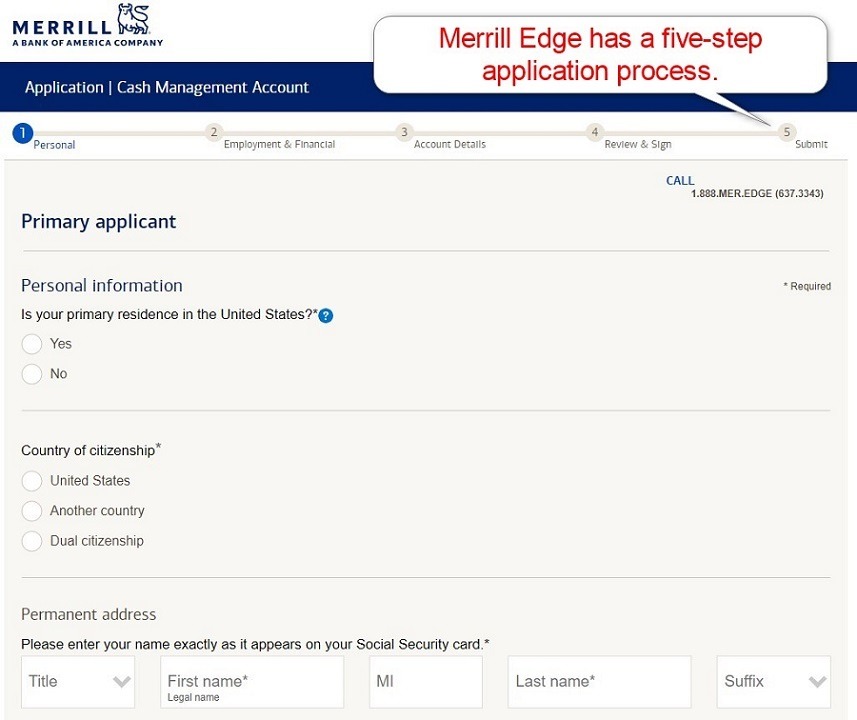

Opening an Account

The Merrill Edge online account application is a five-step process, but it takes numerous clicks to get started. The application follows established US industry practices and data collection.

What should traders know about the Merrill Edge account opening process?

- Merrill Edge complies with global AML/KYC requirements.

- Account verification is mandatory.

- Merrill Edge collects unnecessary data on employment and financial data.

- Most traders pass verification by uploading a copy of their driver’s license or government-issued ID.

- Merrill Edge may ask for additional information on a case-by-case basis.

Minimum Deposit

There is no Merrill Edge minimum deposit requirement, but select services have minimum capital requirements.

Payment Methods

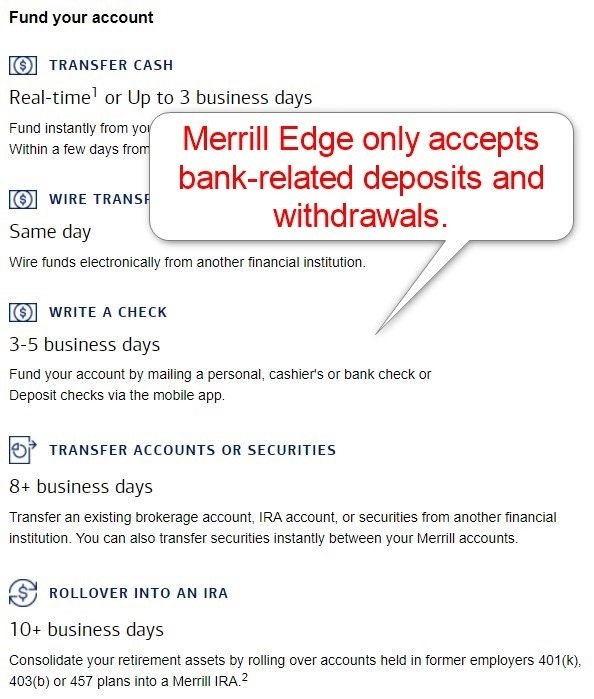

Merrill Edge only accepts bank wires, checks, broker-to-broker transfers, and IRA rollovers from 401(k) plans.

Withdrawal options |     |

|---|---|

Deposit options |     |

Accepted Countries

Merrill Edge caters exclusively to US residents.

Deposits and Withdrawals

The secure Merrill Edge back office handles financial transactions for verified clients.

Is Merrill Edge a Good Broker?

I like the trading environment at Merrill Edge for long-term low-frequency investors because the Idea Builder and fee-based robo-advisory service are excellent tools. Retirement planners will also find that Merrill Edge provides a competitive product and services portfolio. My Merrill Edge review concluded that Merrill Edge is best for existing Bank of America clients, as they can keep all their financial requirements under one roof.

Active traders will find the trading environment disappointing, and I cannot recommend Merrill Edge. However, high-net-worth Bank of America clients will benefit from the Preferred Rewards program. I like the educational offering at Merrill Edge, which I rate as a hidden gem that boosts the overall quality of this broker bank. During my Merrill Edge review, Merrill Edge only accepted US residents as clients. Annual fees apply to advisory services, while self-directed investors have no fees other than investment-related costs. No monthly fees exist at Merrill Edge, but select services have annual fees based on the invested capital. Merrill Edge has costs, but they are reasonably low. It is impossible to offer financial services 100% for free. Merrill Edge is an excellent choice for beginners as it maintains a high-quality educational section, 24/7 customer support, and in-person appointments. Merrill Edge is a safe broker under the Bank of America corporate umbrella.FAQs

Is Merrill Edge only for US citizens?

Does Merrill Edge have an annual fee?

Does Merrill Edge charge a monthly fee?

Is Merrill Edge really free?

Is Merrill Edge good for beginners?

Is Merrill Edge a safe brokerage?