Editor’s Verdict

MEXEM is a CySEC-regulated multi-asset broker and White Label solution of US-headquartered Interactive Brokers. It features the excellent asset selection of Interactive Brokers and account management services. At the same time, it added a copy trading solution to its offering. I reviewed this broker to determine if traders should consider it, given the raft of negative client experiences. Is MEXEM the right broker for you?

Overview

Quality trading services from an IBKR White Label broker with expensive fees.

Headquarters | Belgium |

|---|---|

Regulators | CySEC |

Year Established | 2017 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Trading Platform(s) | Proprietary platform |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Undisclosed |

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | 0.005% |

Funding Methods | 1 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the MEXEM asset selection and trading services consisting of trading signals for beginners delivered via its mobile app, account management services, and copy trading platform. I also like free phone-assisted trading. MEMEX developed its mobile app MEMEX Lite, which is ideal for copy traders. Still, the overall trading environment includes high trading fees, and MEMEX only supports bank wires. I am wary of the growing number of reported negative client experiences and wonder if the positive Trust Pilot reviews are fake.

MEXEM Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. MEXEM presents clients with one regulated entity.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | 325/17 |

Is MEXEM Legit and Safe?

MEXEM received its regulatory license from CySEC in 2017, following MiFID II and other ESMA guidelines. All client deposits remain segregated from corporate funds, and retail traders get negative balance protection. The Cyprus investor compensation fund protects deposits up to 90% with a €20,000 maximum. MEXME lost its UK FCA license, and a growing number of concerning reviews from 2023 counter a positive Trust Pilot rating. Another red flag is that MEXEM does not disclose its retail trader loss percentage, a regulatory requirement for all ESMA brokers. I trust Interactive Brokers and who they choose as White Label partners. However, IBKR is not responsible if their partners act maliciously. While my review could not verify claims of malpractice or fraud, I cannot recommend MEXEM and urge caution before proceeding with them.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. MEXEM claims transparency but fails to deliver, as it only lists commissions without referencing spreads or swap rates on leveraged overnight positions.

Forex traders pay a commission of 0.005% or $5.00 per 1.0 standard round lot. Equity traders have a mix of competitive 0.06% commissions up to 0.15% or $0.005 per share for US equities and $0.01 for Canadian ones.

Minimum Raw Spreads | Undisclosed |

|---|---|

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | 0.005% |

Deposit Fee | |

Withdrawal Fee |

Here is a snapshot of MEXEM commissions:

Asset | Minimum Commission |

|---|---|

Forex | 0.005% / $5.00 minimum |

Equities | 0.005% - 0.15% / $0.005 - 0.01/share |

Stock and Index Options (US) | $2.00 |

Futures Options (US) | $3.50 |

Futures (US) | $1.00 |

Mutual Funds (EU) | 0.10% / €5.00 minimum |

Bonds (US) | 0.15% / $8.00 minimum |

Metals (US) | 0.0035% / $3.00 minimum |

Warrants (EU) | 0.20% / €5.00 minimum |

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Range of Assets

MEXEM offers 150 markets from 35 countries in 23 currencies, providing traders with the entire range of what Interactive Brokers has. While it does not note specifics, traders get access to all asset classes except cryptocurrencies. This makes MEXEM ideal for most strategies from a quantity and sector coverage perspective.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds | |

ETFs |

MEXEM Leverage

MEXEM offers leverage to margin accounts, copying the US requirement of a $2,000 minimum deposit, countering its regulatory environment and conditions, but does not offer specifics. As a CySEC-regulated brokerage, it should restrict retail leverage to 1:30 for Forex traders and provide Pro clients with 1:500. My review could not confirm this. Given the red flags and regulatory violations, it may have different parameters, potentially copying what Interactive Brokers implements, which would violate CySEC regulations.

MEXEM Trading Hours

MEXEM does not provide details about trading hours.

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which essentially trade 24/5

Account Types

The account types at MEXEM consist of Individual, Joint, Family Office, Friend & Family, Small Business, Advisor, Funding Manager, Copyright Trading Group, Hedge & Mutual Fund, and Compliance Officers. MEXEM provides limited information on each, but sufficient to explain each account type, except for minimum deposit requirements, which do not exist for the Individual option but should apply to most others. I am missing details concerning leverage, minimum transaction size, margin call levels, automatic stop-out levels, and account base currencies. The overall approach to introducing account types at MEMEX is unacceptable and trails competitors.

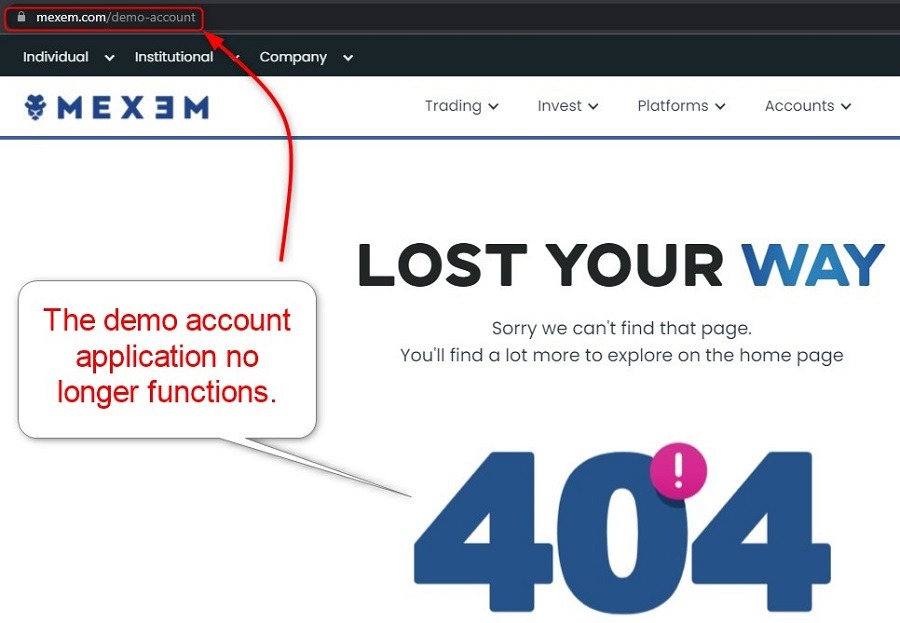

MEXEM Demo Account

A MEXEM demo account exists on the website, but I received a 404 error during my review. The TWS trading platform features paper trading, which MEXEM needs to introduce.

Trading Platforms

The TWS desktop client is at the core of the MEXEM trading environment. It is a cutting-edge trading solution featuring Book Trader, Risk Navigator, Option Trader, Basket Trader, Scale Trader, Integrated Stock Window, Chart Trader, and Probability Lab. TWS Mosaic grants an out-of-the-box setup many beginners should consider unless they prefer the simplified TWS Classic. While TWS supports algorithmic trading, the absence of MT4, the leading algorithmic trading platform, is notable.

Traders may also use the web-based client portal, and a mobile app exists. Still, I recommend the MEXEM Light as an alternative for mobile trading. I appreciate that MEXEM supports API trading, allowing clients with advanced algorithmic solutions to connect to the MEXEM, or rather the Interactive Brokers, trading infrastructure.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Scalping | |

Hedging | |

Interest on Margin |

Unique Features

MEXEM offers the Collective2 copy trading service, which traders can test via the C2 Simulation tool. A traditional in-house asset management service exists with four portfolios. Still, the returns are sub-standard, and I cannot recommend either to long-term investors. Another option is the MEXEM Recurring Investment Plan, which MEXEM sometimes markets as a savings plan, I believe wrongly. It uses dollar-cost averaging for buy-and-hold investors on autopilot.

An ESG-focused service is available, but investors must carefully consider if available portfolios follow ESG guidelines. It includes the MEXEM ESG score, which traders should use cautiously. I like the ETF Zone, which assists ETF investors and traders. An interesting tool is the investment funds/ETF replicator. I recommend traders evaluate this service, as it scans the market for similarly performing ETFs and suggests specific stocks to buy to achieve the desired performance.

Research & Education

MEXEM provides a signal service, delivering actionable trading recommendations via WhatsApp. It also publishes research, market news, and video content, which I found needed improvement. While the research section cannot compete with well-established brokers and often feels like an afterthought, it suffices as a news feed.

MEXEM does not offer education, as beginners are not its core market. Therefore, I advise beginners to learn how to trade elsewhere via online educational resources available for free and start with trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

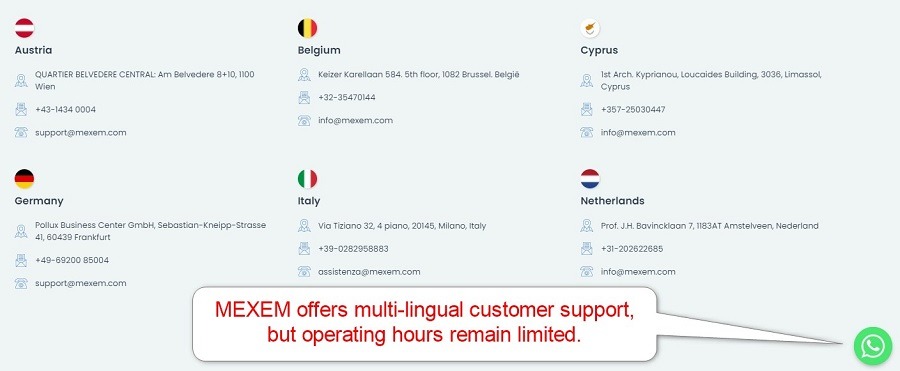

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | M - T / 08:30 - 20:00, F 08:30 - 17:30 |

Website Languages |          |

MEXEM limits customer support availability, but when it is available, customer support representatives offer multi-lingual support in English, Dutch, Italian, Spanish, German, Greek, and Hebrew. Traders can e-mail, call, or engage via WhatsApp. The FAQ section answers some questions. However, MEXEM needs to explain its products and services better, and traders may require more customer support than transparent brokers.

Phone support exists, but I need a direct line to the finance department, where most issues can arise. I like MEXEM’s offer of phone-assisted trading for free.

Bonuses and Promotions

MEXEM neither offers bonuses nor promotions, as they remain prohibited in the EU due to ESMA restrictions.

Opening an Account

The MEXEM account registration starts with a phone number. I could not proceed throughout my review, as I constantly received an error and a message to contact customer support. It mirrors the 404 error for its demo account and the "About Us" page that no longer works. ESMA and CySEC brokers usually feature a lengthy, multi-step account application with data mining about employment, experience, and finances. Since traders can answer at will without providing proof, except for Pro and corporate account applications, it creates a pointless data collection exercise.

MEXEM requires account verification in compliance with global AML/KYC requirements enforced by regulators. Uploading a copy of their government-issued ID and one proof of residency document dated within six months suffices for most traders to pass mandatory account verification. MEXEM may ask for additional information on a case-by-case basis.

Minimum Deposit

There is no MEXEM minimum deposit for individual accounts, but MEXEM applies the typical US standard minimum deposit of $2,000 for margin trading.

Payment Methods

MEXEM only allows bank wire as a payment method.

Accepted Countries

MEXEM does not list any restricted countries except for Belgium. US persons and residents of North Korea and Syria are not accepted as clients, and likely certain other countries also.

Deposits and Withdrawals

The secure MEXEM back office handles all financial transactions for verified clients.

Since MEXEM only offers bank wires, traders should consider banking fees and potential currency conversion fees. Deposits are free, and one free withdrawal exists every 30 days, while MEXEM levies an internal withdrawal fee for additional transactions. I find the absence of other payment processors, including credit/debit cards, unacceptable.

Withdrawal limits apply based on the Secure Login System, where a few options exist. MEXEM does not list deposit or withdrawal processing times, but bank wires remain the slowest and most expensive payment processors. Per AML rules, the name of the bank account and the MEXEM trading account must match.

Is MEXEM a good broker?

MEXEM is a White Label solution for Interactive Brokers with few bright spots, which have nothing to do with MEXEM. I rate MEXEM as a watered-down and significantly inferior option to Interactive Brokers, with the EU as its core market. Some equity commissions are competitive, but MEXEM lacks pricing transparency and does not provide spreads or references to swap rates. Since 202, a rise in negative client experiences, with some outright scam allegations, has emerged. While I could not confirm them, they did not surprise me, given how MEXEM presented itself during my review. Therefore, I cannot recommend this broker. My review did not uncover a confirmed founder of MEXEM. Still, one reference suggested Enosh Aharoni or Itai Liptz as the potential founder. MEXEM is a White Label Solution for Interactive Brokers. The MEXEM headquarters is in Cyprus. Yes, CySEC has regulated MEXEM since 2017.FAQs

Who is the founder of MEXEM?

Is MEXEM part of Interactive Brokers?

Where is MEXEM based?

Is MEXEM regulated?