For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

MultiBank Group Editor’s Verdict

MultiBank Group has secured its position as a global leader in margin trading, standing out largely due to its unprecedented regulatory framework (17+ licenses globally) and its massive depth of tradable assets, featuring over 20,000 CFDs. For serious, well-capitalized traders, the ECN account offers institutional-grade execution with spreads from 0.0 pips and a competitive $6.00 round-turn commission. While the minimum deposit for the premium ECN account is high, the overall offering—combining MT4/MT5 support with its own social trading platform—makes it an exceptional choice for highly active traders looking for security and diversification. I've found their commitment to regulatory oversight and segregated client funds to be industry leading.

MultiBank Group Broker Overview

Headquarters | United Arab Emirates |

|---|---|

Regulators | ASIC, AUSTRAC, BaFin, BVIFSC, CIMA, CySEC, ESCA, FMA, MAS, TFG, VFSC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2005 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $50 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, cTrader, Proprietary platform |

Average Trading Cost EUR/USD | 0.1 pips |

Average Trading Cost GBP/USD | 0.5 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.02 |

Average Trading Cost Bitcoin | $33 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | $3.00 per 1.0 lot |

Funding Methods | 12+ |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

MultiBank Group was established in 2005 and has its global headquarters in Dubai, UAE. It operates a Non-Dealing Desk (NDD) model, providing ECN/STP execution to connect clients directly to deep liquidity pools. The entire Group is backed by a paid-up capital exceeding $322 million.

MultiBank Group Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database.

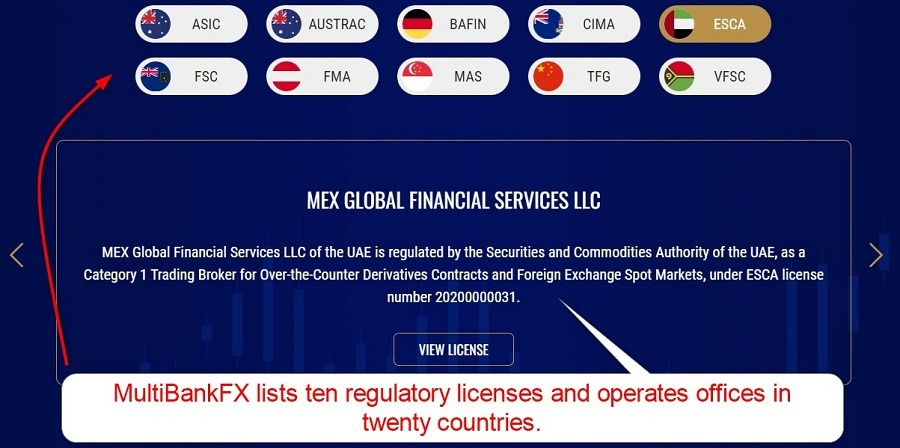

MultiBank Group is comprised of several entities which are regulated by over 10 financial regulators. The Group’s subsidiaries include:

Country of the Regulator | Austria, Australia, China, Cyprus, Germany, Cayman Islands, Singapore, British Virgin Islands, Vanuatu |

|---|---|

Name of the Regulator | ASIC, AUSTRAC, BaFin, BVIFSC, CIMA, CySEC, ESCA, FMA, MAS, TFG, VFSC |

Regulatory License Number | 416279, 73406, 1811316, 491129z, SIBA/L/14/1068, CMS101174, 120000400121019, 700443, 430/23 |

The overall regulatory environment is superb, and MultiBank Group maintains a secure and trustworthy trading environment.

I also like the transparency concerning the paid-up capital at MultiBank Group, which stands at $322 million. Traders get negative balance protection, which I find paramount for leveraged trading, and all client deposits remain segregated from corporate funds.

Is MultiBank Group Legit and Safe?

Yes. MultiBank Group is a legitimate and safe broker. MultiBank Group is considered one of the most heavily regulated brokers globally, with an impeccable track record and compliance across five continents. All funds are held in segregated accounts, and the broker provides Negative Balance Protection.

MultiBank Group regulation and security components:

- Regulated by several global regulators, including tier 1 regulators

- Founded in 2005 with headquarters in Dubai., UAE

- Segregation of client deposits from corporate funds.

- Negative balance protection for retail clients.

MultiBank Group Commission & Fees

MultiBank’s Group fee structure is tiered to reward high-volume traders on the ECN account. No internal fees are charged for deposits or withdrawals.

Average Trading Cost EUR/USD | 0.1 pips |

|---|---|

Average Trading Cost GBP/USD | 0.5 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.02 |

Average Trading Cost Bitcoin | $33 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | $3.00 per 1.0 lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $60 monthly after three months |

EURUSD Trading Costs: ECN Account

Average Spread (EUR/USD) | Commission per Round Lot | Total Cost per 1.0 Standard Lot |

0.1 pips | $3.00 | ~$4.00 |

Noteworthy:

- Swap Fees: Leveraged overnight positions will incur swap fees, which can be positive or negative. Islamic swap-free accounts are available.

- Inactivity Fee: MultiBank Group charges a monthly inactivity fee of €60 per month after 3 months of inactivity

- Deposit/Withdrawal Fees: MultiBank Group does not charge fees for deposits or withdrawals.

- MultiBank Group offers different account types with varying minimum deposits and trading conditions to suit various trading styles and experience.

MultiBank Group offers commission-free Forex mark-ups as low as 0.8 pips or $8.00 per round lot in the Pro account, but the Standard one lists them at 1.5 pips or $15.00. The former is within the upper range of competitive trading costs, but the latter is expensive. The best offer is available in the commission-based ECN account, where traders enjoy raw spreads of 0 pips for a commission of $3.00 per round trip. The cost also applies to commodities, but index and equity CFD trading are commission-free.

Here is the minimum spread for the EUR/USD and the trading costs per 1.0 standard in all three pricing tiers.

Minimum Forex | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.5 pips (Standard) | $0.00 | $15.00 |

0.8 pips (Pro) | $0.00 | $8.00 |

0.0 pips (ECN) | $3.00 | $3.00 |

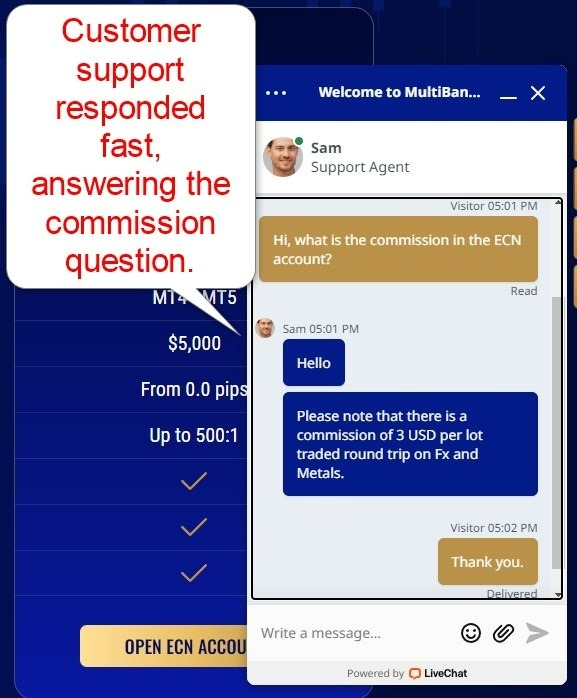

Unfortunately, MultiBank Group does not list commissions for the ECN account on its website, but I obtained them from their live chat customer support function.

One of the most widely ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the MultiBank Group Pro and ECN accounts.

Taking a 1 standard lot buy/sell position in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.8 pips (Pro) 0.0 pips (ECN) | $0.00 $3.00 | -$5.3895 -$5.3895 | X X | $13.3895 $8.3895 |

0.8 pips (Pro) 0.0 pips (ECN) | X X | -$1.0996 -$1.0996 | $9.0996 $4.0996 |

Taking a 1 standard lot buy/sell position in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.8 pips (Pro) 0.0 pips (ECN) | $0.00 $3.00 | -$37.7265 -$37.7265 | X X | $45.7265 $40.7265 |

0.8 pips (Pro) 0.0 pips (ECN) | $0.00 $3.00 | X X | -$7.6972 -$7.6972 | -$15.6972 -$10.6972 |

I like the low swap rates at MultiBank Group, and together with other trading costs, this broker offers traders one of the lowest overall trading costs.

MultiBank Group levies a $60 monthly inactive fee after three months, which active traders will never face. I find it a bit too much and too early compared to the industry average, but it should not be a deal breaker as almost any trader is going to make at least one trade in three months.

What Can I Trade with MultiBank Group

MultiBank Group provides a well-rounded selection of assets, allowing for effective portfolio diversification across different market sectors. Recently, the broker has increased its tradable assets significantly to include a far wider range of instruments than previously available.

Asset List and Leverage Overview

Asset Class | Available? | Examples |

Forex | Yes | 60 Pairs, EUR/USD, AUD/USD, USD/CAD |

Stock CFDs | Yes | Tesla, BHP Group, Alibaba |

Indices | Yes | S&P 500, FTSE 100, AUS 200 |

Energy Commodities | Yes | Brent Crude, WTI Oil, Natural Gas |

Agricultural Commodities | Yes | Coffee, Cocoa, Corn, Soybeans |

Cryptocurrencies | Yes | Bitcoin, Ethereum |

Metals | Yes | Gold, Silver |

Futures CFDs | Yes | Oil, Gas, Indices |

Bonds CFDs | Yes | US T-Note, UK-Gilt, Bund |

ETFs CFDs | Yes | SPDR S&P 500 ETF, Invesco QQQ |

MultiBank Group Leverage

The maximum leverage available is determined by the regulatory entity governing the client's account, allowing up to 1:500 for international accounts. Clients under Tier 1 regulators (like ASIC/CySEC) are typically restricted to 1:30.

Maximum Retail Leverage (EU/Australia) | Maximum Leverage (International) |

1:30 | Up to 1:500 |

What should traders know about MultiBank Group leverage?

- Leverage magnifies both potential profits and potential losses.

- Negative balance protection ensures retail traders cannot lose more than their account balance.

- Always use risk management tools like stop-loss orders when trading with leverage.

MultiBank Group Trading Hours (GMT+3)

Asset Class | From | To |

|---|---|---|

Commodities | Monday 00:00 | Friday 23:55 |

Crude Oil | Monday 00:00 | Friday 23:55 |

Gold | Monday 00:00 | Friday 23:55 |

Metals | Monday 00:00 | Friday 23:55 |

Equity Indices | Monday 10:00 | Friday 23:00 |

Stocks | Monday 10:00 | Friday 23:00 |

Please note that equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies.

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

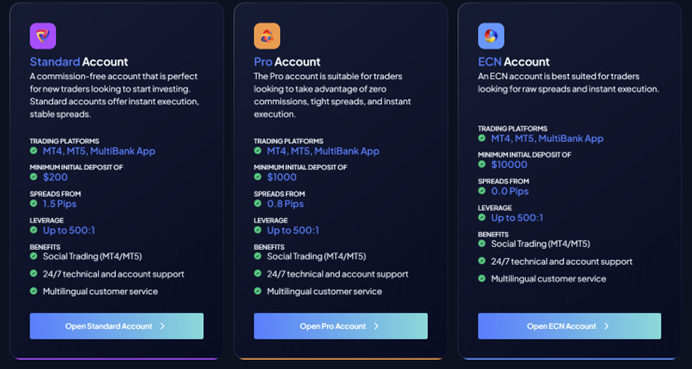

MultiBank Group provides three primary account tiers:

- Standard Account: Spread-only from 1.5 pips with a low $50 minimum deposit.

- Pro Account: Spread-only from 0.8 pips with a $1,000 minimum deposit.

- ECN Account: Raw spreads from 0.0 pips with a commission, requiring a minimum deposit of $5,000.

My observations concerning the MultiBank Group account types are:

- Simple and straightforward three account options.

- Spread only pricing on the standard account.

- Islamic (swap-free) version of the account is available for standard and pro accounts in eligible countries only.

Trading Platforms

MultiBank Group supports all the industry's major platforms and offers its proprietary platform and social trading solution.

- MultiBank Group -Plus (web and mobile): Available as an apple via both the Apple store and Google Play.

- Ctrader: The web and mobile version of the trading platform used by many brokers within the industry.

- MT4/MT5: The broker supports the popular MetaTrader platform and additional add-ons like PAMM and MAMM account functions.

MT4 MT5 cTrader Proprietary Platform Automated Trading DOM? Guaranteed Stop Loss Scalping Hedging One-Click Trading OCO Orders Interest on Margin

Unique Features

Two unique features I want to note are free VPS hosting and FIX API trading. The former supports algorithmic trading, which accounts for 80% of all trades at this broker. The latter allows for the connection of advanced trading solutions to the competitive MultiBank Group trading environment.

Research and Education

MultiBank Group neither offers research nor educational content. Both are readily available online from trusted sources, but MultiBank Group does cater to beginner traders, and it would be nice to see some educational offerings. However, this should not be a deal breaker for anyone as there is plenty of good free educational material available widely on the internet, MultiBank Group also offers newsletters weekly.

Customer Support

Customer Support Methods |    |

|---|---|

Support Hours | 24/7 |

Website Languages |          |

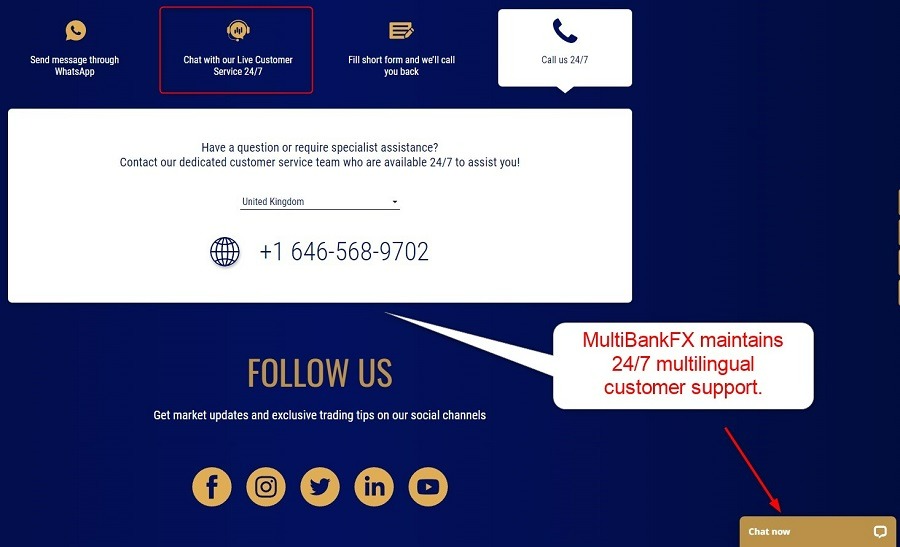

Multilingual customer support is available 24/7. MultiBank Group lists 23 phone numbers, provides live chat, video conferencing via Zoom and Microsoft Teams,WhatsApp and e-mail support. The overall customer support options at MultiBank Group are excellent.

Bonuses and Promotions

MultiBank Group offers a 20% deposit bonus capped at $40,000, subject to trading conditions.

A cashback program, which gives rebates on trading in volume in Forex currency pairs and metals, is also offered.

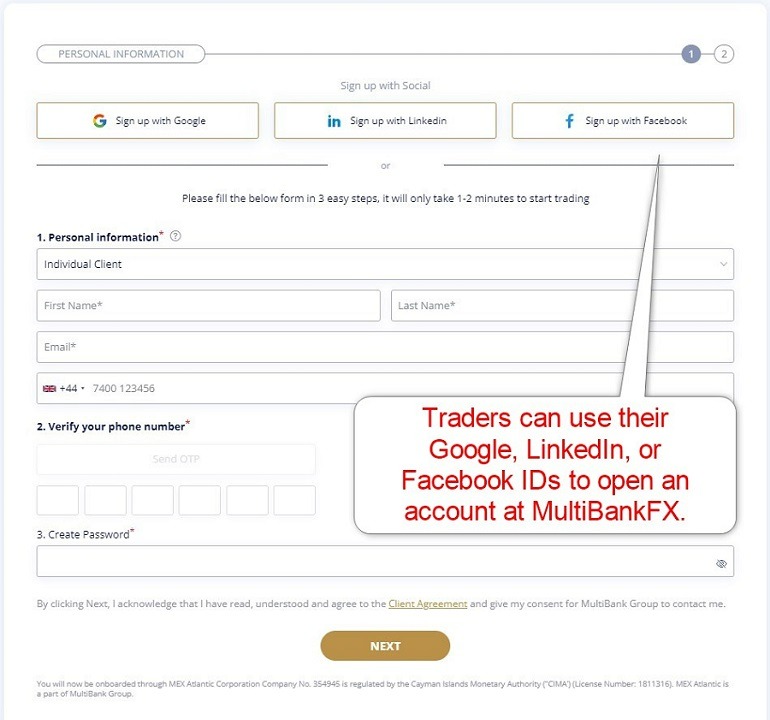

Opening an Account with MultiBank Group

Opening an account at MultiBank Group takes only a few seconds and requires a name, e-mail, and valid mobile phone number. MultiBank Group will send an OTP via SMS, which is necessary to complete the process. Traders must also select their desired trading platform and account tier. Traders must also select their desired trading platform and account tier. Within less than a minute, a MultiBank Group representative will call. This was an extra thing compared to many brokers, but on the other hand it is always reassuring to see your broker taking extra care over security and this is what MultiBank Group is doing here.

Account verification is a mandatory final step. Most traders will be able to satisfy this step by sending a copy of their ID and one proof of residency document. Then the new account is opened immediately.

MultiBank Group Minimum Deposit

The minimum deposit for the MultiBank Group Standard account is $50 or a currency equivalent. Pro requires $1,000 and ECN $5,000. I strongly recommend the ECN account despite its high deposit requirement. Traders will get the most benefits from it due to excellent trading costs.

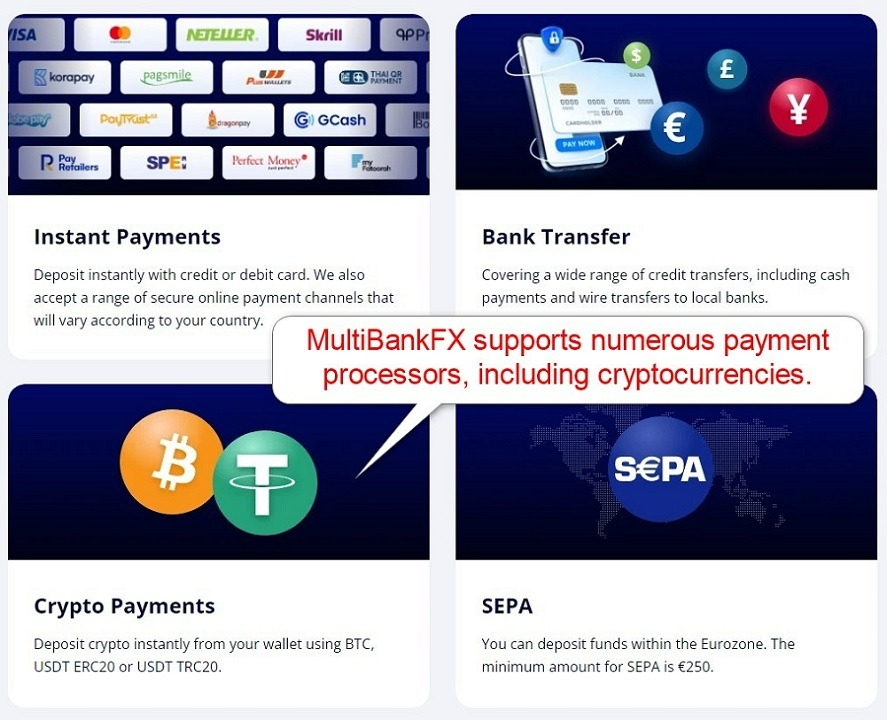

MultiBank Group Payment Methods

MultiBank Group offers bank wires, credit/debit cards, SEPA, Skrill, Neteller, PayTrust, Payment Asia, Globe Pay, ThunderX, Help2Pay, POLi, and cryptocurrencies (Bitcoin and USDT). I like the choice and flexibility concerning financial transactions at MultiBank Group.

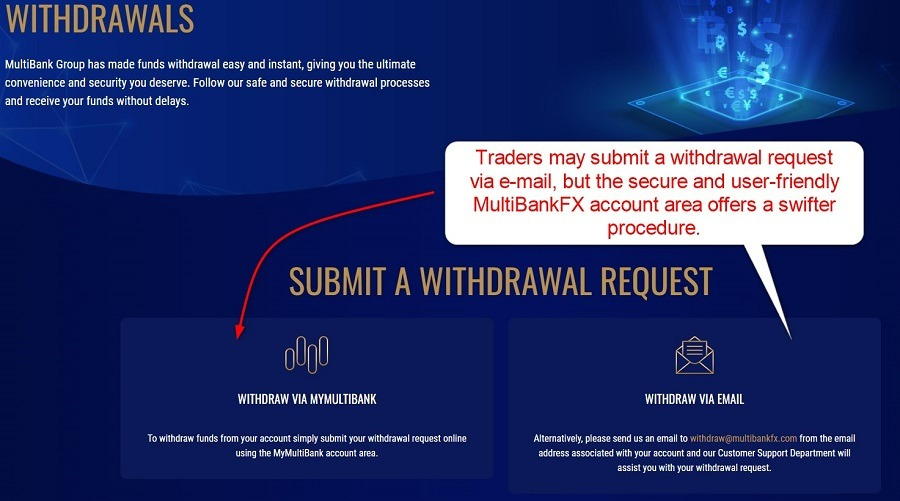

Deposits and Withdrawals

There are no internal deposit or withdrawal fees, but third-part charges apply, which is why I recommend traders check costs. The secure MyMultiBank Group account area handles all financial transactions, and MultiBank Group claims instant processing. It can take several business days for clients to receive funds, dependent on their payment processor.

Payment Methods

Withdrawal options |        |

|---|---|

Deposit options |        |

Is MultiBank Group a good broker?

Yes, MultiBank Group stands out as an extremely safe, heavily regulated broker that delivers a professional trading environment. Its immense asset selection (20,000+ CFDs) and top-tier ECN pricing make it a superior choice for experienced traders with sufficient capital. While the steep inactivity fee and high minimum deposit for the best accounts are minor deterrents for casual traders, MultiBank's Group overall stability, regulatory strength, and diverse platform support solidify its position as a top-tier brokerage for serious financial market participation.