Nadex Broker Editor’s Verdict

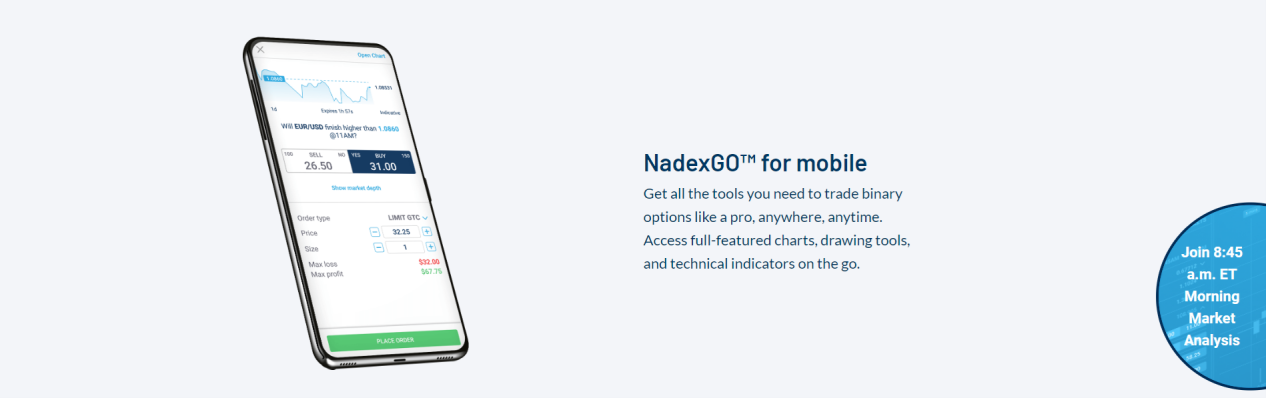

Nadex, acronymous for the Northern American Derivatives Exchange, formerly known as HedgeStreet, is a US-based binary options exchange. Nadex became the primary binary options, call spreads and knock-outs broker in the US. It offers clients its proprietary trading platform, also available as a mobile app, popular among millennial traders.

Overview

The asset selection is limited to Forex, commodities, indices, and events.

United States CFTC 2004 Market Maker $0 Proprietary platform, Web-based $2 round trip per contract

Nadex Regulation and Security

Nadex is regulated by the US Commodity Futures Trading Commission (CFTC), which grants licensure only to the most reliable brokers and allows for trading in the US. Client deposits remain segregated from corporate funds held at two US banks, BMO Harris Bank and Fifth Third Bank. The regulatory framework creates conditions allowing trading Nadex for a living and speaks to the trustworthiness of this broker, who remains highly regulated and trusted in an industry that was found to be fraught with fraud.

Nadex operates under the oversight of the CFTC.

Nadex Fees & Commissions

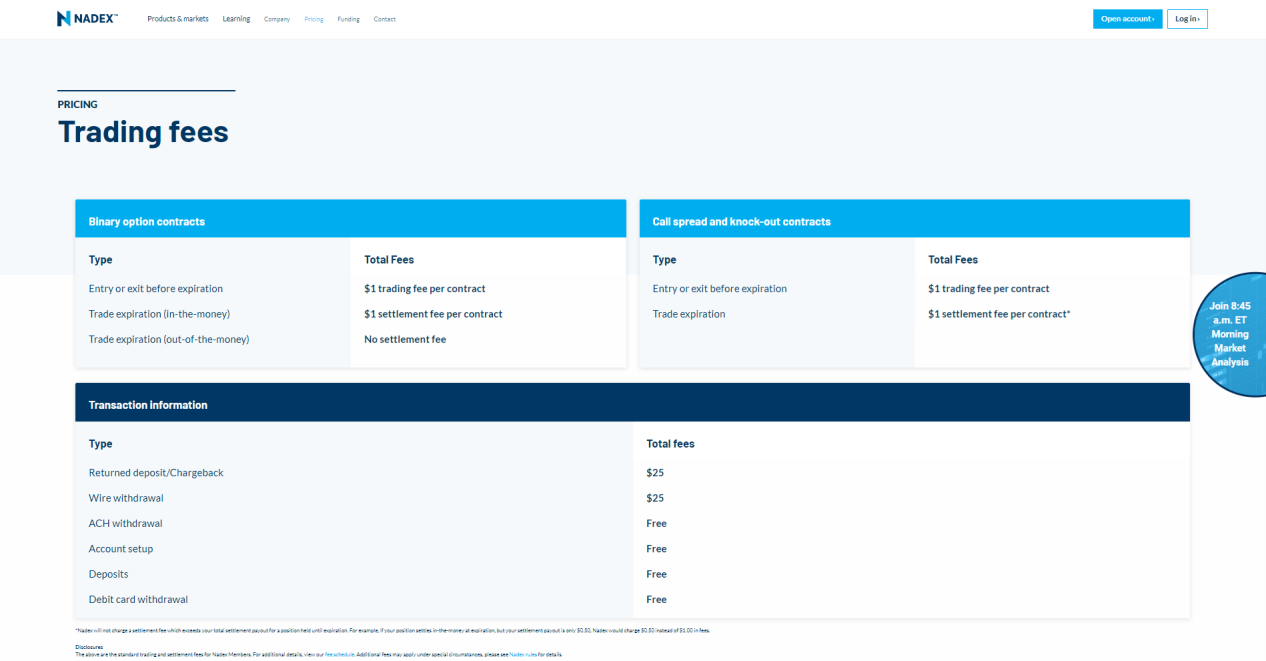

Deposit & Withdrawl fee | Free via Automated Clearing House (ACH) $25 per wire withdrawal |

|---|---|

Call spreads commissions | Entry or exit: $1 per contractTrade expiration: $1 per contract |

| Inactivity fee | If your account is inactive for twelve (12) consecutive months and still holds funds, you will be charged a rolling, monthly, inactivity fee of $10.00. |

Minimum Commission for Forex | $2 round trip per contract |

|---|---|

Withdrawal Fee | |

Inactivity Fee | $10 per month after 12 months if account funded |

Nadex charges $1 per entry of a binary options contract and exit before the expiry of it. A contract that expires in-the-money, when a client earns from a trade, faces an additional $1 settlement fee. An out-of-the-money transaction, when a trader faces a loss, incurs no further costs. Spread and knock-out contracts carry the same $1 cost structure per contract and a $1 settlement levy on expiry, irrelevant of the outcome.

The only other fee listed is a $25 charge on bank wires, which is not uncommon for US-based banks and other financial institutions. The minimum tick size for spot Forex trades is 0.25, resulting in a tick value of $0.25 for binary options and $1 for call spread and knock-out contracts. A $10 monthly inactivity levy applies after twelve months. Overall, the pricing environment is acceptable, especially for traders using larger lot sizes, and traders can see all spreads and fees clearly on the company's website.

All costs remain listed and explained on the Nadex website, including the Nadex spreads, available under contract specifications.

Nadex Trading Hours

Asset Class | From | To |

|---|---|---|

Options | Sunday 18:00 | Friday 15:00 |

What Can I Trade?

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Traders have access to Forex, commodities, indices and events contracts. The contract specifications show eleven currency pairs with up to ten expiry options, depending on if traders prefer binary options, spreads, or knock-outs. Seven commodities with a maximum of three expiry times and eight indices featuring up to five expiration times are also available. Completing the asset selection are four US economic events contracts with a single expiry time. New traders may consider a Nadex demo vs. live account to discover the complete functionality.

Account Types

Nadex offers all traders the same account type, allowing the trading of binary options, spreads, and knock-out contracts. The minimum initial deposit is $250, suggesting follow-on transactions may have smaller amounts. There is no leveraged trading at Nadex, but a $10,000 demo account is available. Nadex accepts clients from a few dozen countries listed on its website. US-based entities may also open an account with Nadex.

NADEX Demo Account

NADEX offers a $10,000 demo account. NADEX describes its demo account features as an opportunity to practice trading for free, get ready for markets, test their mobile trading app, test trading strategies, define risk management parameters, and become better traders. The NADEX demo account is available for the browser-based trading platform and the mobile app NADEXGo.

I recommend a demo account balance similar to their planned live deposit. I also want to caution beginner traders against assuming a demo account replicates real market and psychological conditions fully. This can create unrealistic trading expectations, and the absence of trading psychology can negate some of the educational value.

NADEX Leverage

NADEX does not offer leveraged trading but focuses on facilitating short-term trading strategies using binary options, knockouts, and call spreads. All NADEX trading instruments ensure traders have limited risk exposure displayed on the order ticket and eliminate the potential for margin calls.

Before NADEX executes a trade, clients must have 100% of the maximum risk amount as collateral in their trading account. Traders can never lose more than the amount noted on the order ticket. This eliminates the market risk for NADEX, as all traders remain entirely backed by client capital with no exposure to NADEX. The drawback is that traders manage portfolios in a less competitive trading environment than brokers offering leveraged trading.

NADEX Trading Hours

NADEX trading hours begin Sunday 18:00 (EST) and run continuously until Friday 16:15 (EST). Due to end-of-day processing hours, trading is unavailable Monday through Friday between 17:00 and 18:00. Each asset has various trading hours, dependent on expiration, and NADEX maintains a transparent list on its website. While times may differ, they all fall within the general trading hours. US holidays will impact trading hours, irrelevant of the trading instrument, even Forex contracts, but NADEX will post them on its Notices pages before the holiday.

All Nadex clients trade from the same account type. Traders may opt for a $10,000 Nadex demo vs. live account to evaluate the features

Traders from a few dozen countries may open an account with Nadex, listed in alphabetical order on its website.

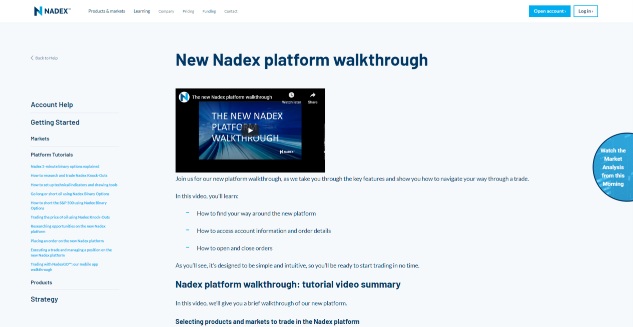

Nadex Trading Platforms

The Nadex trading software consists of a proprietary trading platform. It is also available as the Nadex app for mobile devices, NadexGO, which is popular with mobile and millennial traders. Nadex introduces its platform and Nadex charting software in a short, informative video. Several other videos cover select topics. Nadex also provides FAQs, which discuss its trading platform and features.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

One-Click Trading |

Unique Features

Two unique features are the excellent corporate ownership of NADEX under Singapore-based Crypto.com, and the variety of contracts despite a smaller asset selection. It allows traders the flexibility they require to trade short-term, liquid contracts. I also like the fifteen event-based trading instruments, allowing traders to speculate on fundamental news releases.

The fundamental contracts consist of:

- Non-farm Payrolls report

- Initial Jobless Claims report

- Unemployment Rate

- US GDP

- CPI - Overall

- CPI - Core

- CPI - Food at Home

- CPI - Food Away from Home

- New Home Sales

- Corn Yields

- Soybean Yields

- Retail Sales Change

- Crude Oil Inventories Change

- Natural Gas Stocks Change

- Fed Balance Sheet Total Assets (Millions)

Research and Education

Nadex maintains a robust blog where it publishes market commentary, ideas about trading strategies, and updates featuring bonus campaigns. Nadex for beginners hosts live webinars, once or twice a week, which provide valuable trading insights to traders. Each webinar starts at noon EST and lasts for one hour. It is where traders get most valuable information. The Learning Center is a combination of FAQs and educational content. It often features a brief video together with written content, providing educational value to new traders.

The Nadex blog offers quality articles covering various topics.

The live webinars at Nadex deliver a valuable service at this broker.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | Undisclosed |

Website Languages |  |

Nadex lists live chat and e-mail as methods to reach out to a customer support representative, which it provides on its website. Nadex also lists its trading hours and provides its physical address in compliance with regulatory requirements.

Bonuses and Promotions

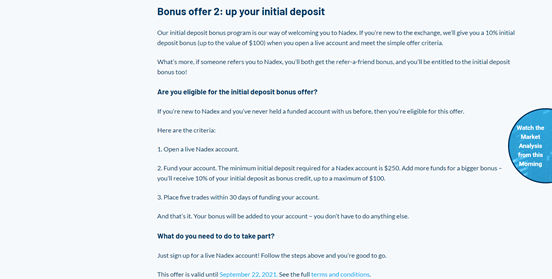

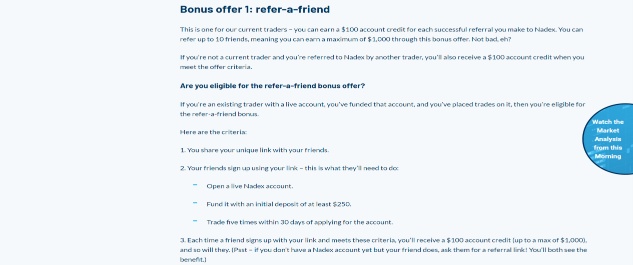

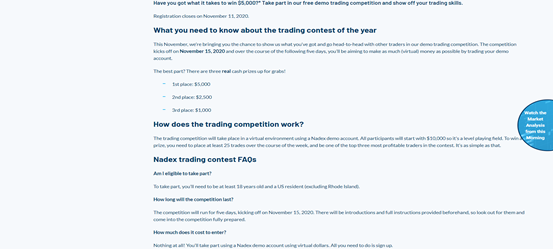

Nadex offers a 10% initial deposit bonus limited to $100, which is generous compared to many EU-based brokers, who offer no bonus at all. The refer-a-friend program pays out $100 per qualifying referral, up to 10 per client. Terms and conditions apply, and traders should understand them before participating. Nadex occasionally hosts a free demo trading contest and awards real cash prizes. The demo trading contest is available to US residents only, except for Rhode Island.

The refer-a-friend campaign is also generous, with payouts for up to 10 referrals.

The occasional demo trading contest continues with real cash prizes.

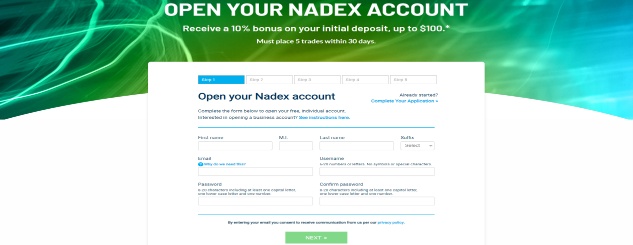

Opening an Account

A five-step online application caters to new account registrations. Since Nadex operates under CFTC oversight and complies with all regulations, new traders will need to verify their trading account.

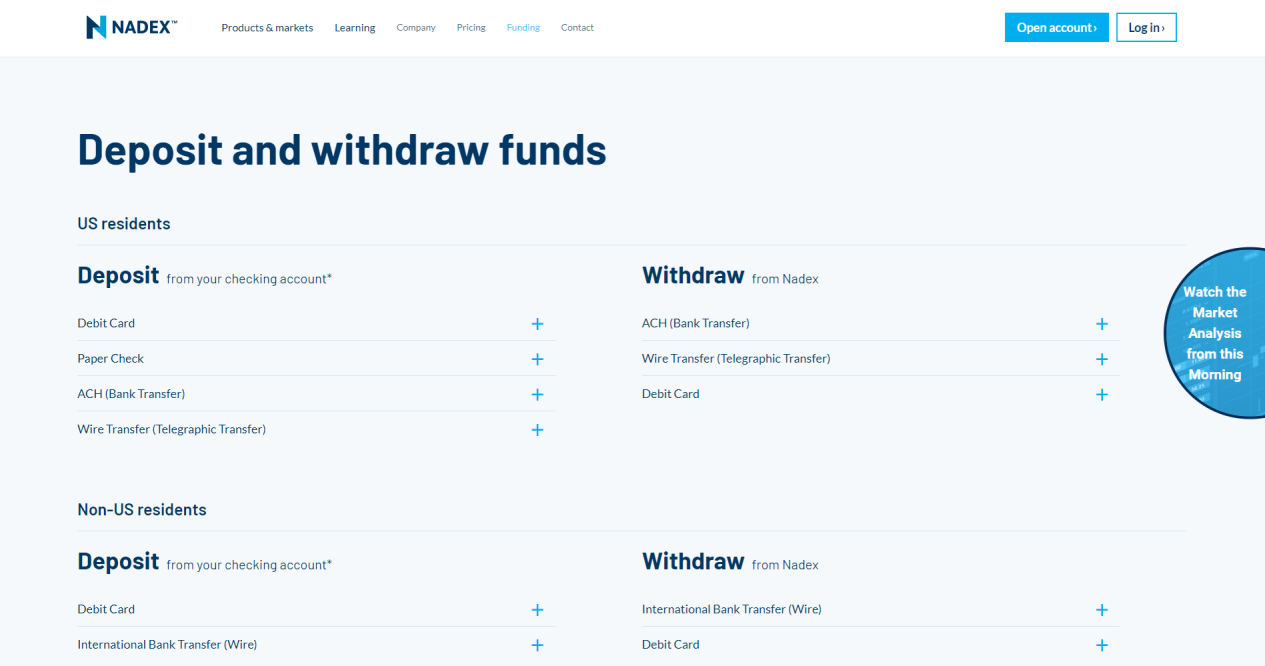

Nadex Broker Deposits and Withdrawals

The deposit and withdrawal options at NADEX are restricted to bank wires and debit/credit cards to limit the risk of fraud. US-based brokers usually do not provide clients with all choices offered by international brokers in compliance with best practices of safety and regulation. Processing times and costs depend on the payment processor.

NADEX Deposit Methods:

- Debit Cards (available for the US and international clients): no internal fees, and immediate availability of funds, but NADEX may require debit card owner verification before withdrawals

- Paper Check (available for US clients): mailed to NADEX, takes up to five business days before the check clears and NADEX deposits funds into the trading account

- ACH Bank Transfer (available for US clients): deposits appear within one business day, but it may take up to five business days before funds arrive at NADEX, which is why there is a five-day hold on withdrawal requests

- Wire Transfer (available for the US and international clients): domestic transactions usually clear within 24 hours, international ones can take between 24 hours and five business days, dependent on the banks and geographic location plus potential involvement of intermediary banks

NADEX Withdrawal Methods:

- Debit cards (available for the US and international clients): withdrawals remain limited to the deposit amount via debit cards, restricted to $10,000 to $50,000 daily, and US clients may request withdrawals of excess capital via ACH Bank Transfer or domestic wire transfer, while non-US clients via international wire transfers

- ACH Bank Transfer (available for US clients): which requires three to five business days to receive funds, and NADEX may ask for verification of account ownership

- Wire Transfer (available for the US and international clients): which faces a $25 processing fee, NADEX processes requests the same day if received before 1615 (EST) Monday through Thursday or 1500 on Friday, and the following business day for all requests received after the cut-off time, it may take three to seven business days to receive funds

Summary

Nadex offers traders binary options, call spreads and knock-out trading from its proprietary trading platform. It is regulated by the CFTC, which is a regulator reserved only for the most reliable brokers. It charges binary options traders a $1 fee if they earn money from their trade and allows them the ability to exit the trade before expiry to safeguard against large losses. Nadex features a healthy asset selection. It also offers weekly live webinars to educate its traders and maintains quality educational material on its blog. The bonuses remain generous and attractive. The available offer supports trading Nadex for a living. Nadex is a US-based broker with rare oversight from the CFTC. It complies with the rules and regulations and has a clean track record. Therefore, Nadex operates as a legitimate and trustworthy broker. Clients must request withdrawals from inside their trading account. They can locate the option under My Account. Nadex may ask for additional documents from traders to confirm ownership of the bank account or credit/debit card. The Nadex trading platform is straightforward. Traders have to select the asset, direction and expiration time. A five-minute video tutorial is available that delivers a step-by-step instruction on how to place a binary options trade on the Nadex trading platform. Nadex call spreads follow the call spread strategy, which includes buying and selling a call spread simultaneously. The Nadex call spread represents a single unit with short contract durations and is available in small contract sizes. They have a built-in floor and ceiling, offering more risk transparency, and the pattern day trader rule does not apply. There is no minimum deposit at NADEX, granting traders the flexibility to manage portfolios. Traders must have sufficient capital to cover the maximum risk per trade and associated fees. Making money depends on the individual, and NADEX maintains the required infrastructure, enabling traders to make money. NADEX is a safe and legit broker with excellent corporate ownership, fully compliant with its regulator, and a clean NFA track record. It segregates client deposits from corporate funds, is well-capitalized, and is also the leading US exchange for binary options, call spreads and knockouts. Traders may use the NADEXGo mobile app. The US Commodity Futures Trading Commission (CFTC) regulates NADEX. The shortest expiry on NADEX is five minutes (300 seconds). NADEX has its headquarters in Chicago, Illinois, US. NADEX has rollovers on select contracts, outlined on its website under contract specifications and Notices. NADEX offers debit cards, checks, and wire transfers as deposit methods. NADEX processes withdrawals the same day if traders request them before the daily cut-off time, otherwise the following business day. It can take up to five business days for a domestic withdrawal, potentially longer for an international one, until traders receive their funds, dependent on the payment processor. It depends on individual requirements and preferences. NADEX caters well to options traders, while Forex.com features a highly competitive Forex trading environment. Both brokers serve their core market extraordinarily well.FAQs

Is Nadex legitimate?

How to withdraw money from Nadex?

How to use the Nadex platform?

How do Nadex spreads work?

What is the minimum deposit for NADEX?

Can you make money on NADEX?

Is NADEX safe and legit?

Does NADEX have an app?

Is NADEX regulated?

Does NADEX have 60-second options?

Where is NADEX located?

Does NADEX have rollover?

How do I deposit money into NADEX?

How long does NADEX withdrawal take?

Is NADEX better than Forex.com?