Editor’s Verdict

Social trading-focused broker NAGA remains the most successful IPO in Germany in 2017, issued a cryptocurrency coin, and remains backed by well-known investors. Besides its popular mobile app and payment solution, traders get a low-cost trading environment and a balanced asset selection. I reviewed this broker to determine if its social-trading and mobile-only approach deliver the promised simplicity. Should you consider NAGA as your next social trading broker?

Overview

Launched in 2015, NAGA Group AG is a German based FinTech company publicly listed on the Frankfurt stock exchange. The company has built a powerful finance app, hoping to attract those who are interested in a wide range of tradable assets. NAGA Group AG is the holding company of several companies, including NAGA Markets Europe Ltd, NAGA Global LLC, NAGA Technology GmbH, NAGA Pay GmbH and has a close link with NAGAX Europe OÜ. NAGA Markets Europe Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) under licence No. 204/13. The registered address of NAGA Markets Europe Ltd is 7, Ariadnis Street, Mouttagiaka, 4531, Limassol, Cyprus. NAGA Global is incorporated under the laws of St. Vincent and the Grenadines as a Limited Liability Company (1189 LLC 2021).

Review

Headquarters | Germany |

|---|---|

Regulators | CySEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2009 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $50 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 1.5 pips ($15.00) |

Average Trading Cost GBP/USD | 1.5 pips ($15.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.38 |

Average Trading Cost Bitcoin | $124.70 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the copy trading infrastructure at NAGA Group AG . In 2017, the company completed its initial public offering (IPO) on the Frankfurt Stock Exchange, making it the most successful one that year. It also issued its cryptocurrency, the NAGA coin, raising over $50,000,000 from more than 63,000 backers, resulting in one of the Top 50 initial coin offerings (ICO).

NAGA focuses on social trading and offers over 1,000 assets to over 1M+ trading accounts. It secured financing from Hauck & Aufhäuser, one of the oldest German private banks, and Chinese conglomerate FOSUN. Due to its phenomenal growth track, it remains one of a few FinTech companies disrupting the brokerage industry.

Retail Loss Rate | 84.69% |

Regulation | Yes |

Average Raw Spreads | 0.5 pips |

Average Standard Spreads | 1.2 pips |

Minimum Commission for Forex | None |

Commission for CFDs / DMA | €5.00 / €1.98 / 0.2% |

Cashback Rebates | No |

Minimum Deposit | $50 |

Inactivity Fee | No |

Deposit Fee | No |

Withdrawal Fee | Yes |

Funding Methods | 17+ |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. NAGA offers services through a regulated entity and maintains an overall secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

Cyprus | Cyprus Securities and Exchange Commission | 204/13 |

St. Vincent and the Grenadines | Financial Services Authority | Unregulated |

Is NAGA Legit and Safe?

NAGA Markets Europe Ltd (NAGA Markets), an entity of NAGA Group AG, operates with oversight from the Cyprus Securities and Exchange Commission (CySEC). It is fully compliant with the EU’s Financial Instruments Directive 2014/65/EU or MiFID II and the EU’s 6th Anti-Money Laundering Directive. Per EU Directive 2014/49/EU, the Investor Compensation Fund (CIF) protects deposits, which remain segregated from corporate funds, up to €20,000.

Cross-border regulation across the EU applies.

The publicly listed corporate owner, NAGA Group AG, which remains in full compliance with the Frankfurt Stock Exchange, adds another layer of security. Its majority shareholder, FOSUN, listed on the Hong Kong Exchange with a market cap shy of $100 billion, magnifies the financial security of NAGA.

Restricted regions:

NAGA Markets Europe LTD offers services to residents within the European Economic Area and Switzerland, excluding Belgium. NAGA Markets Europe LTD does not provide investment and ancillary services in the territories of third countries.

Fees

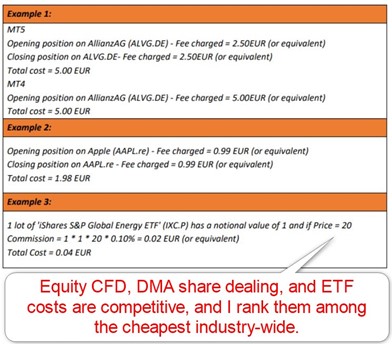

NAGA offers competitive Equity CFD trading with commissions of €5, excellent share dealing costs of €1.98, and ETF fees of 0.20%.

Average Trading Cost EUR/USD | 1.5 pips ($15.00) |

|---|---|

Average Trading Cost GBP/USD | 1.5 pips ($15.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.38 |

Average Trading Cost Bitcoin | $124.70 |

NAGA Markets Europe Ltd charges commissions with regards to specific financial instruments:

- Commissions on CFDs: €2.50 (or equivalent in other currencies) for an in/out transaction. (Example 1)

- Commissions on Stocks: €0.99 (or equivalent in other currencies) for an in/out transaction. (Example 2)

- Commissions on ETFs: 0.2% on notional value. Example: Taking a 12 lots buy/sell position on VTI.P, commission will be: 12*190.32*0.2% = 4.57 USD

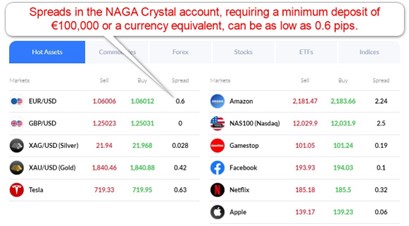

Forex traders with portfolios below €50,000 pay a commission-free average spread of 1.2 pips or $12.00 per round lot, while minimum mark-ups for portfolios below €5,000 are 1.7 pips or $17.00. Above €50,000, the cost decrease to a competitive 0.7 pips or $7.00 per round lot.

Copy traders with profits below €10.00 pay a fixed fee of €0.99 (or equivalent in other currencies), and those above €10.00 will pay €0.99 plus an additional amount of 5% of the total profit.

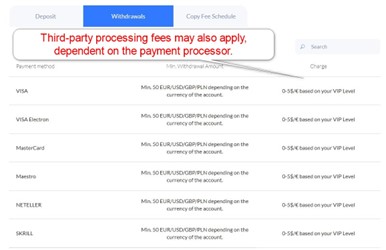

Withdrawal transactions are subject to extra fees. The size depends on the VIP user level and varies from 0 – 5 USD / EUR/ GBP.

User Level | Fee |

Iron | 5 EUR/USD/GBP or equivalent |

Bronze | 4 EUR/USD/GBP or equivalent |

Silver | 3 EUR/USD/GBP or equivalent |

Gold | 2 EUR/USD/GBP or equivalent |

Diamond | 1 EUR/USD/GBP or equivalent |

Crystal | Free |

China clients | Free |

Here is a screenshot of the NAGA quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The minimum trading costs for the EUR/USD in the various account types at NAGA:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

1.5 pips (Iron & Bronze) | $0.00 | $15.00 |

1.00 pips (Silver) | $0.00 | $10.00 |

0.8 pips (Gold) | $0.00 | $8.00 |

0.5 pips (Diamond and Crystal) | $0.00 | $5.00 |

One of the most overlooked trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the Iron account.

Taking a 1.0 standard lot buy/sell position on EUR/USD, at the minimum spread and holding it for 1 night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

1.5 pips | $0.00 | $-5.1 | X | $-20.10 |

1.5 pips | $0.00 | X | -$0.65 | $-15.00 |

Taking a 1.0 standard lot buy/sell position on EUR/USD, at the minimum spread and holding it for 7 nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

1.5 pips | $0.00 | -$5.10 | X | -$50.70 |

1.5 pips | $0.00 | X | -$0.65 | -$19.55 |

NAGA Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 22:05 | Friday 21:55 |

Cryptocurrencies | Sunday 21:00 | Sunday 21:00 |

Commodities | Sunday 23:01 | Friday 21:58 |

Crude Oil | Sunday 23:01 | Friday 21:58 |

Gold | Sunday 23:01 | Friday 21:58 |

Metals | Sunday 23:01 | Friday 21:58 |

Equity Indices | Sunday 23:01 | Friday 21:58 |

Stocks | Monday 08:01 | Friday 20:58 |

Stocks (non-CFDs) | Monday 08:01 | Friday 20:58 |

ETFs | Monday 14:31 | Friday 20:58 |

Futures | Sunday 23:01 | Friday 21:58 |

Range of Assets

NAGA maintains an offering of over 1,000 assets allowing most retail traders to achieve effective cross-asset diversification. The bulk consists of popular equity CFDs trending on social media and direct share dealing. NAGA continues to expand its asset list as it grows its market share and client base, but access depends partially upon geographical location.

Currency Pairs (CFD) | Yes |

Futures (CFD) | Yes |

Real Stocks | Yes |

Commodities (CFD) | Yes |

Indices (CFD) | Yes |

Stocks (CFD) | Yes |

ETFs (CFD) | Yes |

Cryptocurrencies (CFD) | Yes |

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

NAGA Leverage

The maximum NAGA leverage for NAGA Global traders 1:500 and for NAGA Markets Europe retail clients 1:30 due to regulatory restrictions. Negative balance protection is applicable for both entities and I highly recommend this competitive offer for active traders. Due to regulatory restrictions, the NAGA Markets Europe Ltd (NAGA Markets) unit limits retail leverage to 1:30.

NAGA Trading Hours (GMT +3)

Asset Class | From | To |

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Forex | Monday 00:01 | Friday 23:58 |

Commodities | Monday 01:01 | Friday 23:58 |

European CFDs | Monday 10:01 | Friday 18:28 |

US CFDs | Monday 16:31 | Friday 22:58 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, cryptocurrencies, and commodities, which trade non-stop

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

NAGA maintains six account types, and four of the six allow traders to lower fees by having their trades copied by the active community. Another feature I like is that NAGA considers profits for account upgrades, up to 50% of the required minimum deposit. For example, if a trader deposits €12,500 and earns €12,500, they get an upgrade from Silver to Gold. The minimum deposit is €250 or a currency equivalent.

NAGA Demo Account

NAGA notes a $10,000 demo account. I saw no time limit noted, which is ideal, as it indicates respect for potential clients. I recommend a demo account balance similar to their planned real money deposit. I also want to caution beginner traders against using a demo account as an educational tool. It creates unrealistic trading expectations, and the absence of trading psychology negates the educational value.

Trading Platforms

NAGA offers out-of-the-box versions of MT4 and MT5, plus its NAGA Web app, designed for social trading. The former two support automated trading solutions and are ideal for advanced traders. An investment into third-party add-ons is required to fully unlock the potential of both MT trading platforms. The latter is designed similarly to a social media platform, supporting NAGA social trading and auto-copy. MT4 does not support real stock trading, MT5 grants access to all assets, and the NAGA Web app gives traders access to all services.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

NAGA Group AG Unique Features

Social traders using the NAGA Autocopy service will appreciate the NAGA Feed, where traders can interact with each other and share ideas, like a social media platform. Besides the NAGA Autocopy feature, users can also get rewarded with Copy Premium.

I also like that NAGA offers cryptocurrency trading via its NAGAX subsidiary, where it maintains over 700 cryptocurrencies available for storing purposes, over 100 cryptocurrencies available for purchase, and a dedicated NFT marketplace. NAGA incorporates the latest asset classes.

The NAGA Pay App is another interesting service, offering a competitive one-stop solution for mobile traders.

Research and Education

NAGA provides neither in-house nor third-party research. Trading signals remain entirely dependent on the community, but traders should consider the retail loss rate. This broker focuses on social trading as a primary service. The NAGA blog features quality market commentary and trading suggestions in a watch-out-for format without actionable data.

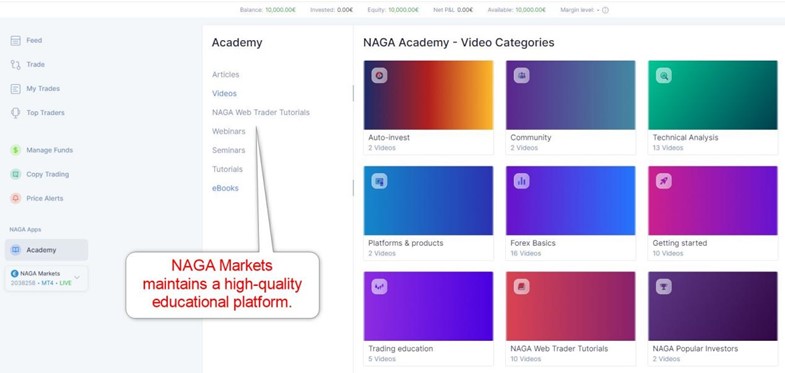

While NAGA does not provide research, it maintains an educational section. The Academy consists of articles, videos, webinars, e-books, and tutorials. New traders have access to a broad collection of quality educational content, and the posts cover several topics. Most videos explain how to use features offered by NAGA and touch on the basics of trading, but the webinars add value and tackle more complex issues. This broker does not extend in-depth courses or lessons, but the basic introduction is excellent.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | M - F, 09:00 - 24:00 |

Website Languages |            |

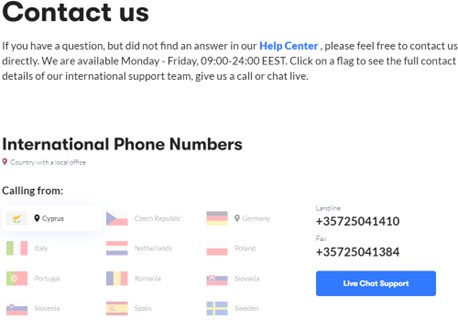

NAGA support is available from Monday through Friday between 09:00 and 24:00. Clients may contact multi-lingual customer support via e-mail, phone, or live chat. The FAQ section answers the most frequent questions, which reduces the need to contact customer support. NAGA explains its products and services in detail, and most traders will be unlikely to require any additional assistance.

A direct line to the finance department where most issues may arise is missing, but I recommend phone support where traders need it. Live chat is ideal for non-urgent matters.

NAGA Copy Premium

NAGA has a program labelled Copy Premium, a reward for signal providers to generate research for the community. Copy Premium is an attractive reward for being a signal provider with followers comparable to lead generation, which increases with the account level.

Opening an Account

An online form processes new account applications per established industry standards. New clients start the process by selecting their country of residence and providing a valid mobile phone number.

NAGA adheres to AML/KYC stipulations, and account verification is mandatory. A copy of the trader’s ID and one proof of residency document generally satisfies the last step.

Minimum Deposit

The minimum deposit at NAGA Markets Europe is $50, while the minimum deposit at NAGA Global is $250.

Payment Methods

NAGA Markets accepts various payment methods such as Credit/Debit cards, bank wires from across Europe, Skrill, Neteller, PayPal, P24, iDeal, GiroPay, Sofort,and Paysafe cards.

NAGA Global accepts various payment methods such as Credit/Debit cards, P24, iDeal, Sofort, GiroPay, Paysafe Card, PayRetailers, and various E-Wallets such as MTN and Vodaphone.

Deposits and Withdrawals

The minimum deposit at NAGA Markets Europe is $50, while the minimum deposit at NAGA Global is $250. NAGA does not charge internal deposit fees, but third-party processing costs may apply, dependent upon the payment processor used. NAGA levies an internal withdrawal fee, between €0 and €5, dependent on the account level, while third-party costs may apply.

Withdrawal times vary per payment processor. Most online options are instant, and bank wires take two to five business days. Only verified accounts may request withdrawals. Not all options are available to all traders, but I like the abundance of choices available at NAGA.

Is NAGA a Good Broker?

I like the trading environment at NAGA for social traders and signal providers due to its active trading community of 1M+ traders and the compensation plan per copied trade, which increases with the account level. NAGA is a relatively young broker, owned by a German FinTech company, listed on the Frankfurt Stock Exchange with a Chinese majority shareholder, but displayed remarkable growth, which looks likely to accelerate. Clients can have faith in the financial stability of NAGA, earning the title of best IPO in Germany for 2017 while also ranking among the fifty biggest ICOs after the launch of its cryptocurrency project, NAGA coin.

NAGA Markets Europe LTD is the CySEC-regulated subsidiary. NAGAX operates with an Estonian license, and the NAGA Pay App offers services by UK-regulated Contis Financial Services LTD, also authorized by the Bank of Lithuania. NAGA represents a genuine competitor to well-established social trading brokers, with a superior cost structure. Adding a significant advantage over its social trading competitors is the wide range of additional features. Those seeking an excellent, market-disrupting, social trading broker should consider NAGA as their first choice. NAGA primarily earns money via spreads and commissions. Investing in NAGA is possible via stockbrokers who list German equities, ETFs that include NAGA, or through the NAGA coin. NAGA has regulatory license in Cyprus. NAGAX caters to cryptocurrency traders and operates with an Estonian license. The NAGA coin ranks among the fifty biggest ICOs, making it a legit crypto broker. NAGA has a regulatory license in Cyprus, while the parent company is publicly listed on the Frankfurt Stock Exchange | WKN: A161NR | ISIN: DE000A161NR7. NAGA also has a clean track record and is a trustworthy broker.FAQs

How does NAGA make money?

How can I invest in NAGA?

Is NAGA a regulated broker?

Is NAGA crypto legit?

How trustworthy is NAGA?