Editor’s Verdict

Overview

Review

Headquarters | Seychelles |

|---|---|

Regulators | FSA |

Year Established | 2008 |

Execution Type(s) | Market Maker |

Minimum Deposit | $1 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Exness is a Forex broker that was founded by a group of finance and information technology experts in 2008. On October 28th, 2019, the company announced the closure of its UK and Cyprus regulated retail operations. As such, information displayed on the respective domains (dot-UK and dot-EU) is no longer applicable, and new account openings are unavailable. The data provided contradicted itself and was flawed, countering the claims of transparency. Exness was, prior to the closures, compliant with its regulators. The broker is now attempting to focus on white label solutions. The Seychelles regulated subsidiary, under the name Nymstar Limited, remains operational in the retail sector; it is currently accepting new accounts, and is accessible under the dot-com domain.

Regulation and Security

Nymstar Limited is the trading name of the Exness Group, and the sole operation in the retail sector. It is registered as a Securities Dealer by the Seychelles Financial Services Authority (FSA) under license number SD025. The FSA provides a light regulatory touch, and in an interview given by Exness UK CEO David Morris, he admitted that the company had decided to shut down its UK and EU based operations amid regulatory changes enforced in those respective jurisdictions.

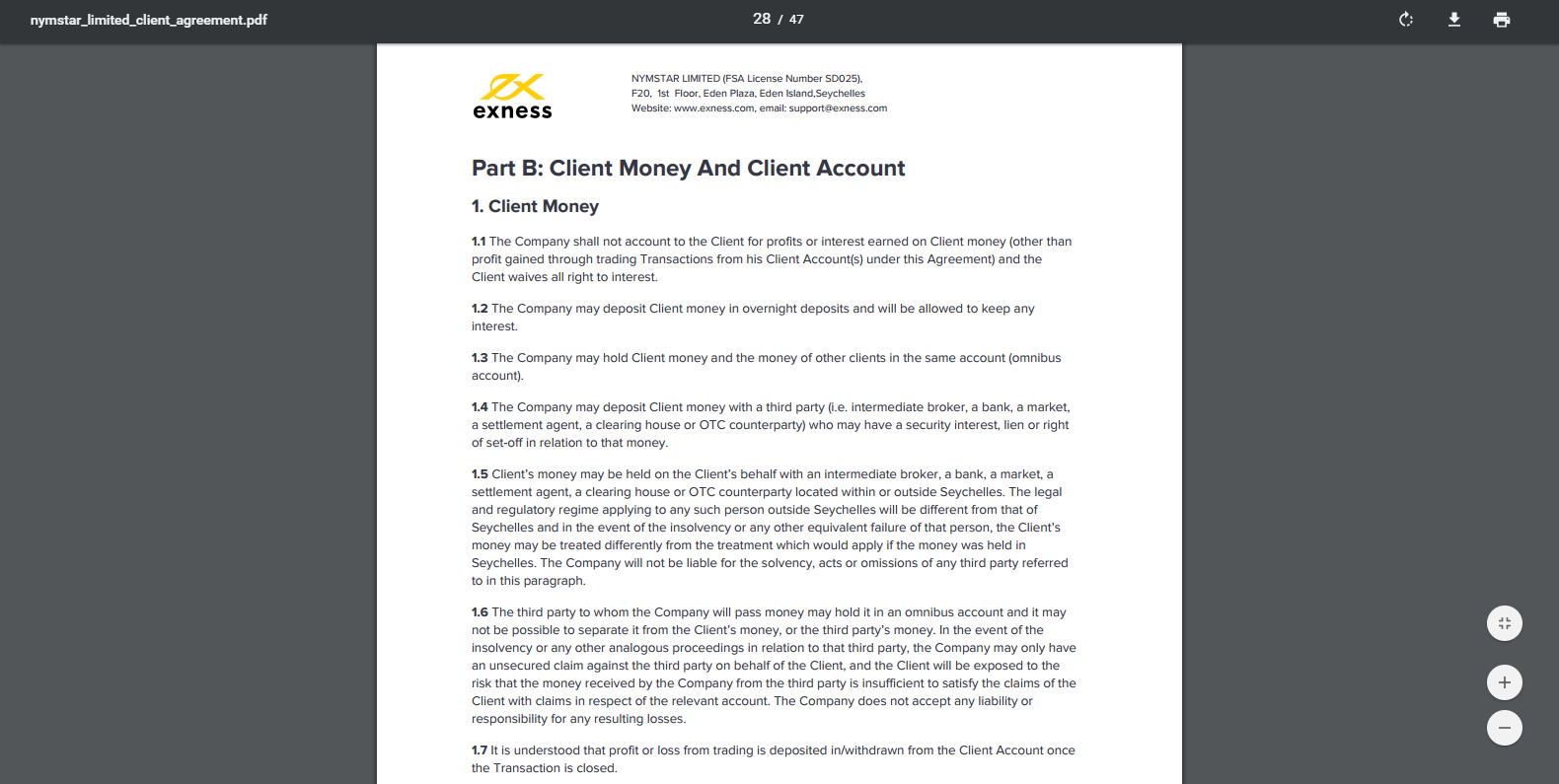

Despite the closure of both entities to the retail sector, the regulators remain listed by Nymstar, creating a false sense of regulatory oversight by the more respected institutions. The broker does not provide relevant information or information to the contrary, but the segregation of funds is not guaranteed. Of note, within the Client Agreement's fine print is a provision which states that deposits may be used by Exness to earn interest from third parties, and that it reserves the right to retain those earnings. That suggests that the trading environment may be simulated, even as Nymstar actively speculates on the deposits of a majority of clients (many of whom operate at a loss). There are quite a number of red flags, and each trader needs to be absolutely certain that they are willing to accept the current conditions, and inherent risks as a result, under this broker.

The Seychelles Financial Services Authority (FSA) is the sole regulator of Nymstar Limited, but the broker heralds a former regulatory environment which is no longer applicable. It represents a red flag, and traders should be aware of it.

This broker specifies that it may use client deposits to earn interest from third parties or other purposes, and that they reserve the right to keep the earnings. Given that, it suggests that the trading environment could be entirely simulated, another red flag.

Fees

The fee structure is a combination of spreads and commissions, but details are scarce. A commission of $3.50 per lot per side is listed on the website, representing an acceptable offer for spreads as low as 0.0 pips. Actual costs are higher without more precise information provided. The commission-free account notes a minimum spread of 0.3 pips. Swap rates on leveraged overnight positions apply, as specified in the Client Agreement, without being mentioned elsewhere. Third-party fees on deposits and withdrawals exist. After 90 days of inactivity, a $5 charge is deducted from the account.

What Can I Trade

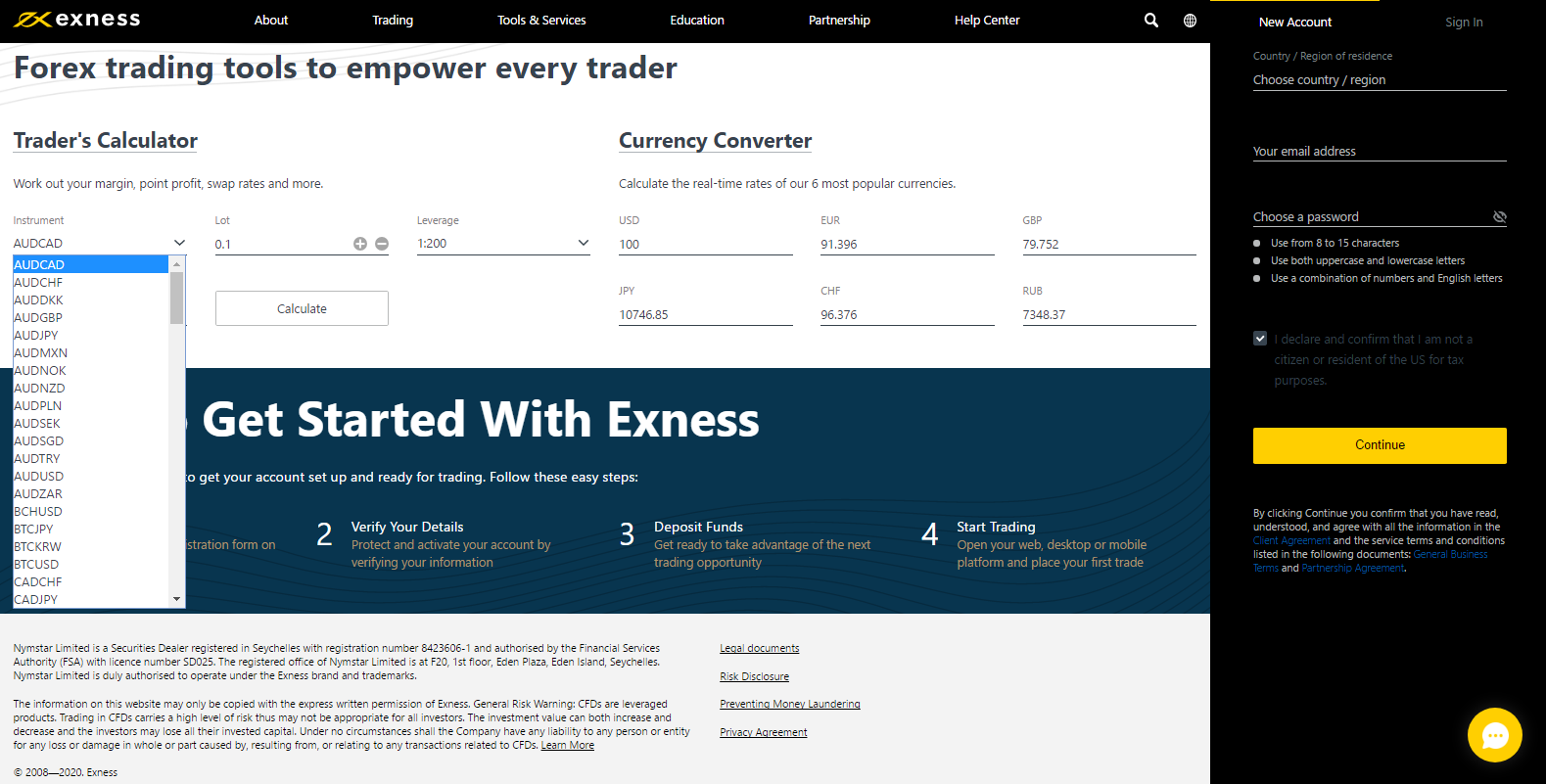

The referenced Contract Specification page is supposed to feature an asset list but returned no results. The Trader’s Calculator represents the single section where an asset selection was accessible. Over 123 currency and commodity pairs were listed, suggesting pure Forex traders will have excellent market coverage. Commodity pairs are limited to gold and silver crosses, while select cryptocurrency pairs are also listed.

The Contract Specifications page failed to return an asset list.

The Trader's Calculator lists all available assets.

Account Types

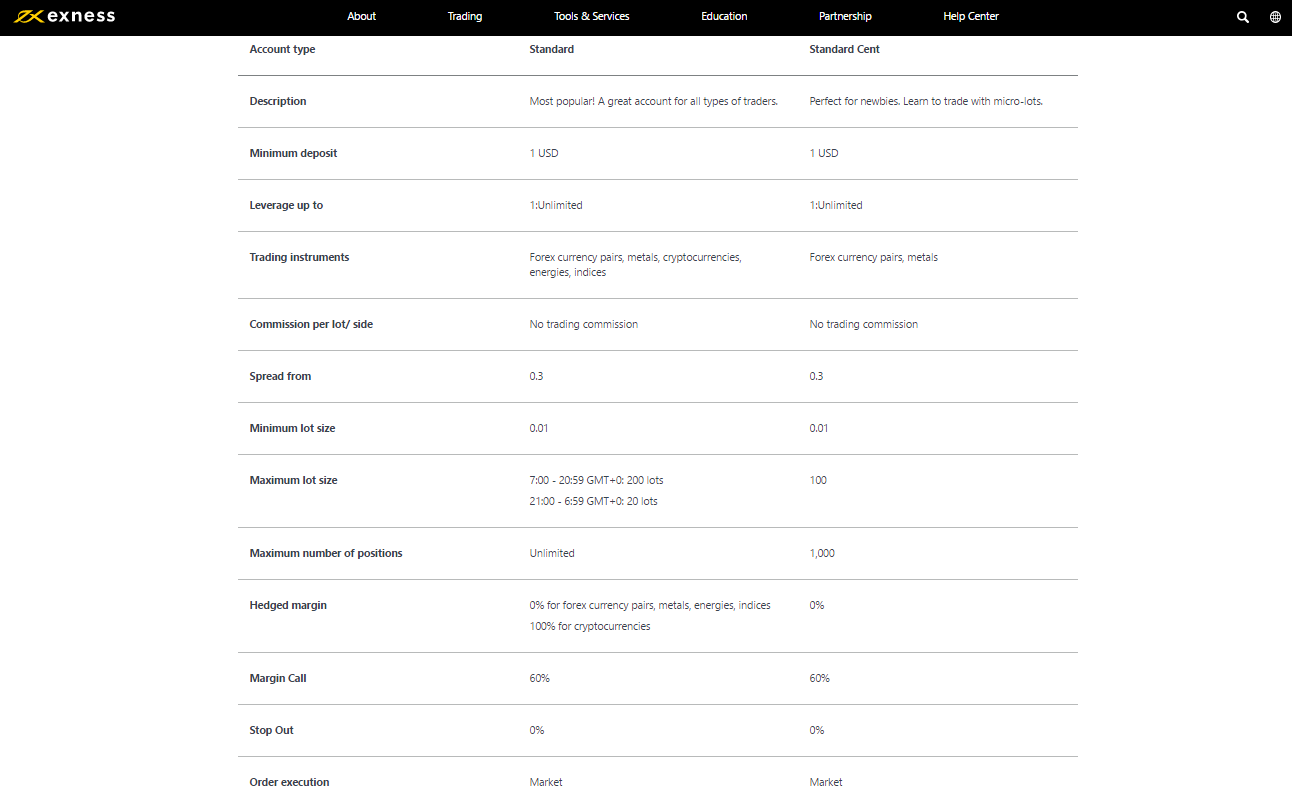

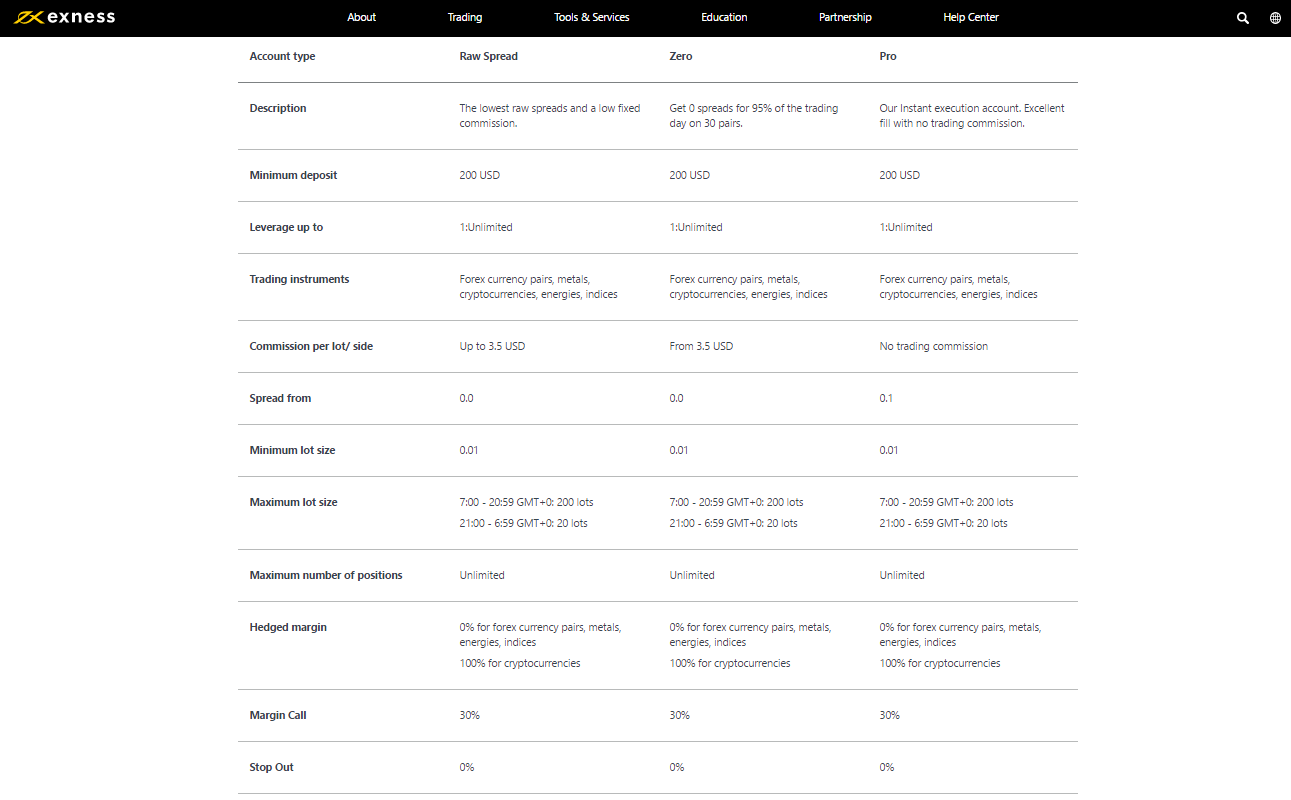

Five account models are listed, but similarities among them narrow the choice down to two. The Standard one, and nearly identical Cent version, is commission-free, possible for a deposit of merely $1 with a minimum spread of 0.3 pips. Nymstar lists three versions of a 0.0 spread account, which require a minimum deposit of $200. While a commission per round lot of $7 applies in the Raw Spread and Zero types, the Pro alternative account carries no fee for what appears to be near identical trading conditions.

The primary difference is the minimum spread of 0.1 pips. The account classification indicates access to a management team, though it appears that no thought was put into providing a proper structure. The Pro account resembles the best offer. Leverage in all accounts is classified as “unlimited” though details are largely absent.

Two versions of a commission-free account are listed.

With three 0.0 spread accounts advertised, the Pro model provides the best trading environment.

Trading Platforms

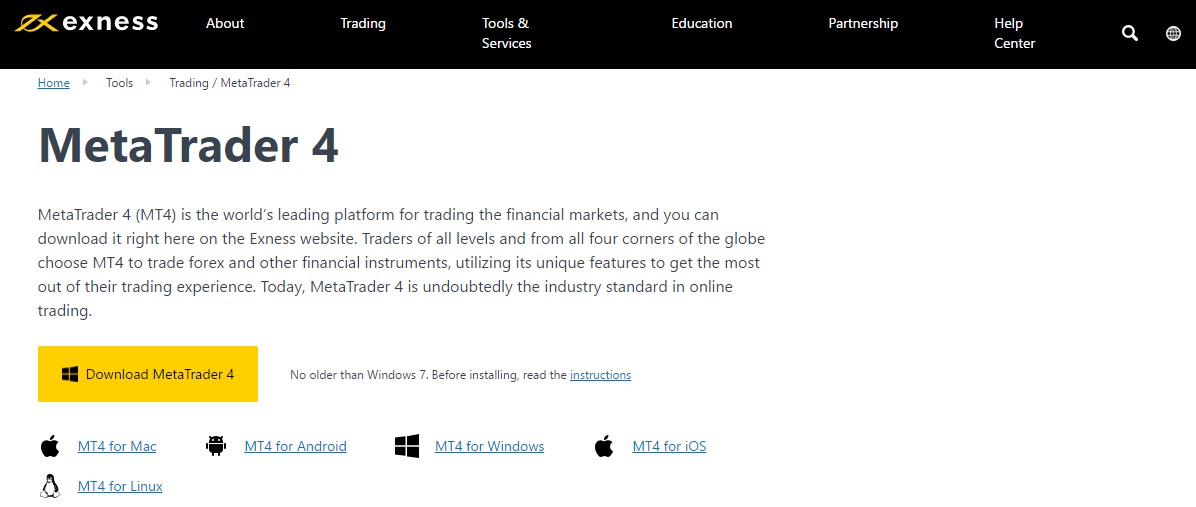

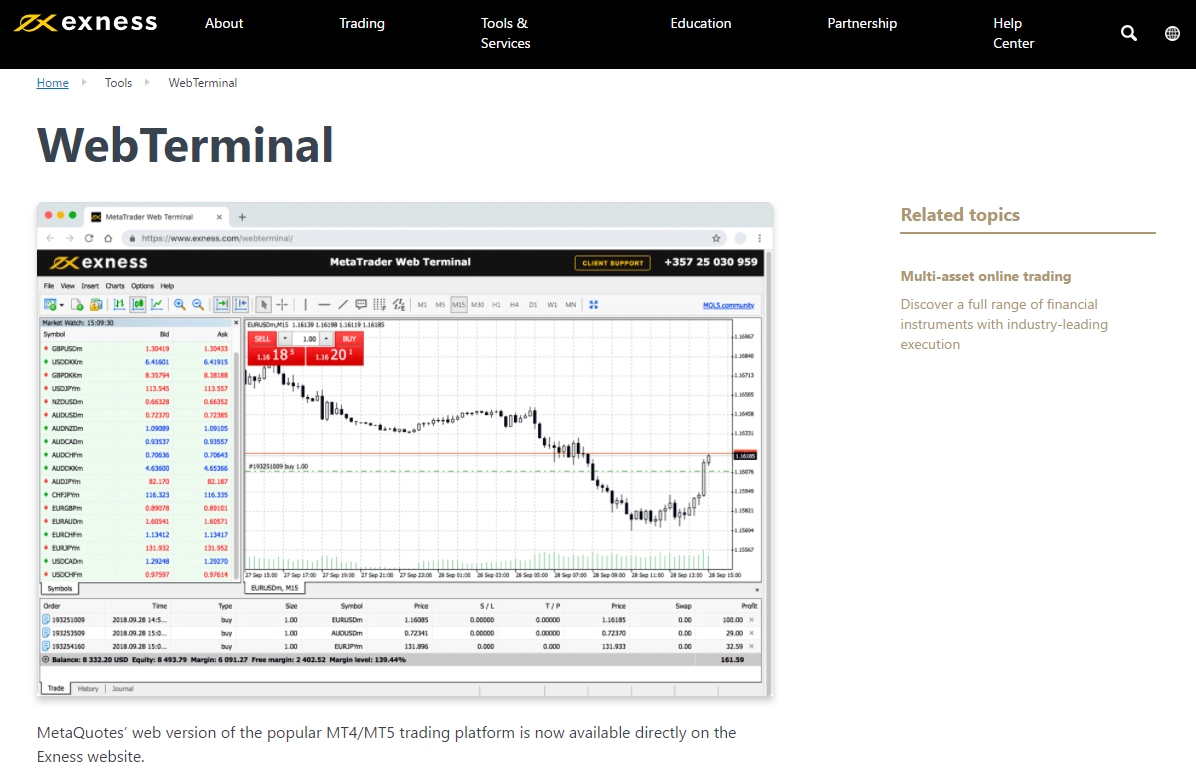

The full suite of the MT4/MT5 trading platforms is available, which includes a desktop version, mobile versions, and a webtrader. The MT4 platform remains the most popular choice in the retail market due to its full support for automated trading, the fastest growing trend in today’s market. The development of custom trading solutions is ongoing, as evident by the massive investment into the required infrastructure. Regrettably, Nymstar merely offers the most basic version of both the MT4 and Mt5 platforms. Without the addition of essential third-party plug-ins, either choice presents an inadequate option, as the full potential cannot be unlocked. This Exness subsidiary limits its trading environment to the bare minimum required.

Only the most basic version of the MT4 platform is available.

Nymstar also offers the failed successor platform, MT5, which lacks backward compatibility.

The webtrader offers an alternative platform but likewise lacks essential features without upgrades.

Unique Features

Nymstar does offer free VPS hosting to support automated trading solutions. A minimum deposit of $500 or a currency equivalent is required to qualify. This service is maintained in-house, as VPS servers are located in the same data center as Exness servers, per this broker's claim. The Exness Group noted its transformation to a FinTech company in Europe, and the VPS service may be part of its future strategy.

Research and Education

A combination of in-house analytics and third-party content defines the research department at Nymstar. The former is a refreshing change; each analysis is well presented and consists of written content and supporting charts. It was a very refreshing and surprising find during our Nymstar review, and it is clearly the most valuable asset Nymstar possesses, distributed under the Exness brand name. Third-party research is available via the Web TV tab, where this broker streams analytics provided by Trading Central. An RSS feed from various sources is provided, but it is poorly designed with unsuitable navigation. A redesign of this category is urgently required.

The in-house research and analytics is the most valuable asset of this broker and the only division suitably executed.

Trading Central powers the Web TV section of this Exness subsidiary.

A poorly designed RSS feed sources select news from various sources.

The Exness Academy is where new traders have access to three distinct categories for educational purposes. Each category consists of a vast selection of sub-modules, written content, and videos. It follows the quality of the published research with attention to detail as well as a well-thought-through instructional course. The quality and presentation are excellent. It is an outstanding source for new traders to build a solid foundation from which to grow.

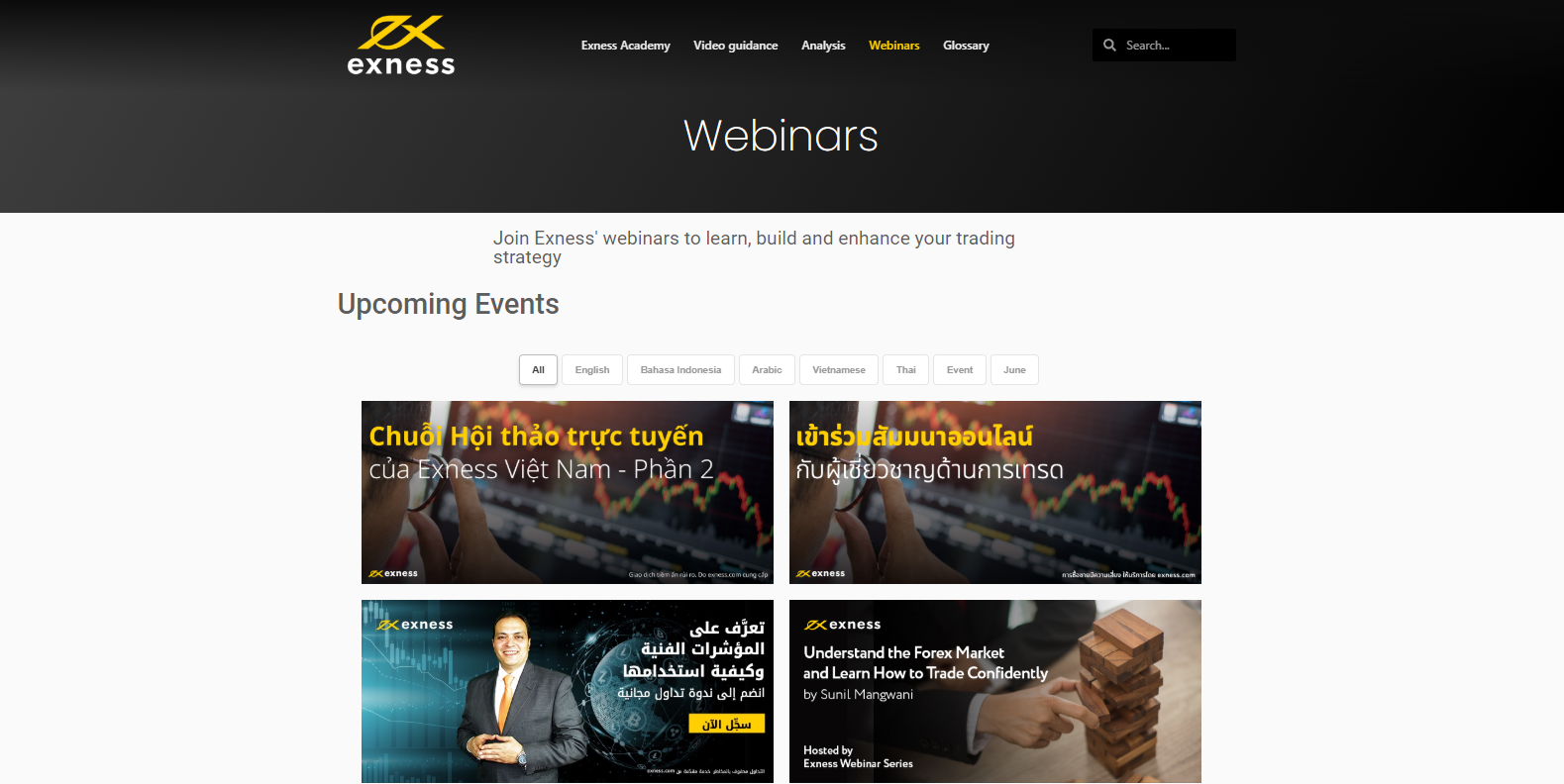

A video library, where basic terms are introduced in five languages, adds additional educational value. Webinars are planned, with one scheduled on risk management at the time of this Nymstar review. Exness Premier, a new service, is advertised without further details provided; interested traders can register for updates. At least here, Nymstar delivers in auxiliary trading services, creating genuine competition for leaders in the brokerage industry.

The Exness Academy presents an excellent entry-point for new traders.

A video library is available in five languages.

Webinars further enhance educational content.

Exness Premier promises a new exclusive service.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |              |

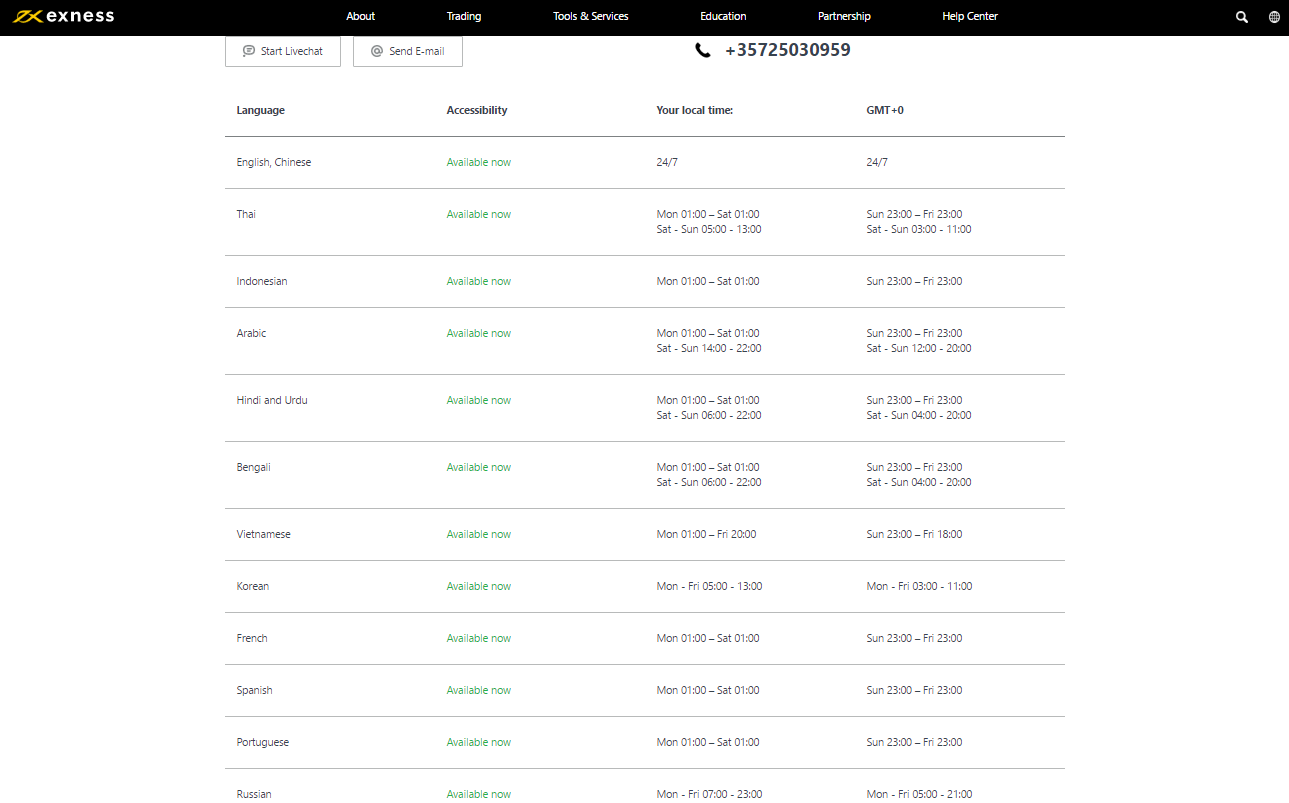

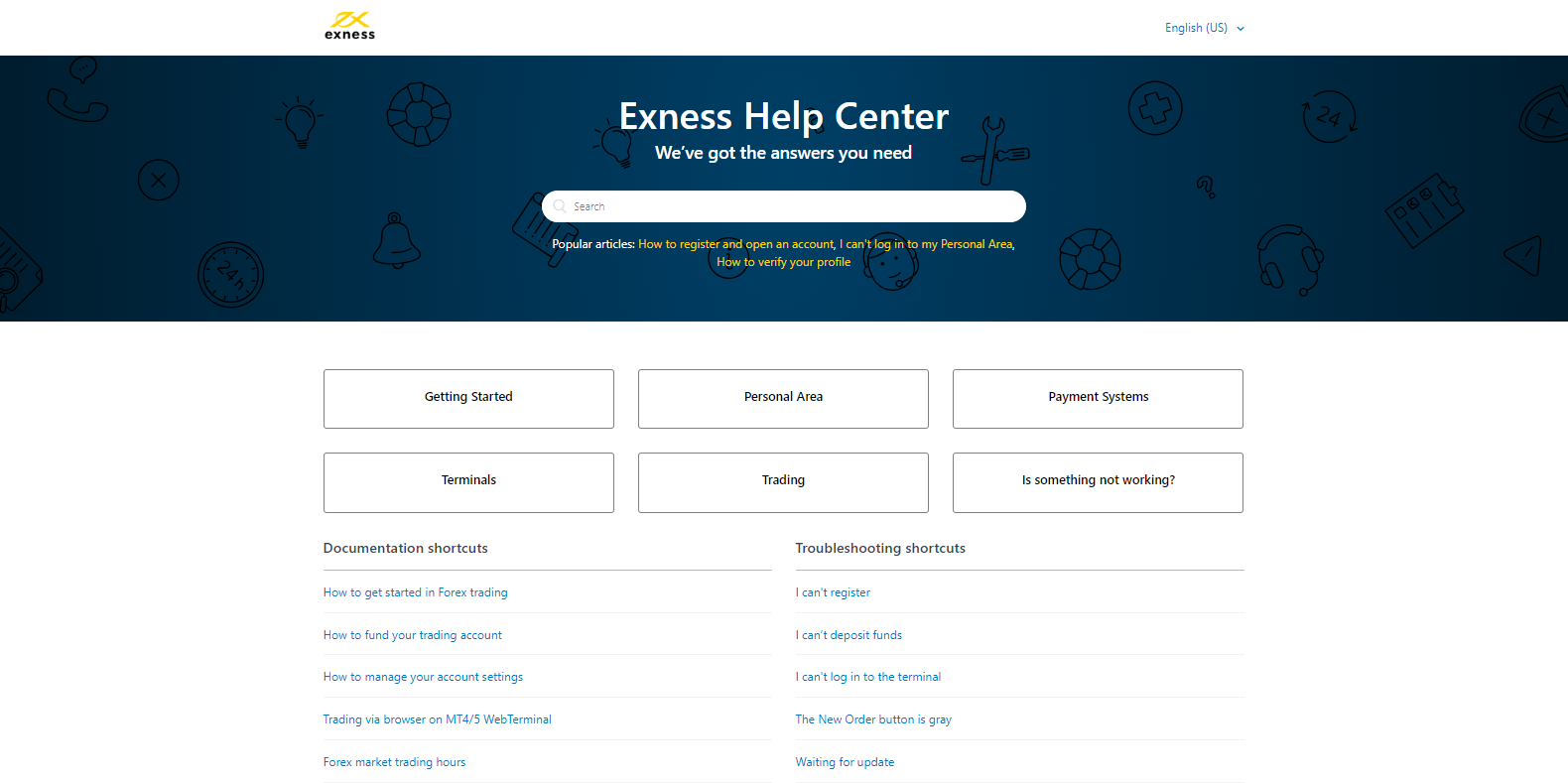

Multilingual support is available 24/7, and Nymstar notes the availability on its website. Clients may also send an e-mail, but the most convenient form of communication is through the live chat feature. The Exness Help Center provides answers to the most common questions. With a mix of questionable practices and excellent auxiliary services, customer support may be required more here than at other brokerages. Nymstar provides easy access to assistance if and when needed.

24/7 customer support may become a staple of services used at this Exness subsidiary.

The Exness Help center attempts to answer the most frequent questions.

Bonuses and Promotions

Nymstar currently hosts a promotion to encourage more trading. Tickets are earned with each traded lot, and Exness vows to donate 20% of revenues earned each Friday to charities. Current prizes include three cars and numerous cash gifts. Promotions like this usually lead to irresponsible trading but do create an excellent marketing opportunity.

Opening an Account

The application form for new accounts is located on the right side of almost all of the website's pages; anchored as it is, it is impossible to click away from and, to put it mildly, is exceptionally irritating. With the anchored account opening screen, this broker is essentially begging for new registrations. The required information is typical of the industry, i.e., geographical location, e-mail, and password. Regulatory stipulations regarding AML/KYC are expected in a second step, requiring account verification; a copy of the trader’s ID and a proof of residency document usually satisfies this. It is important to say again that each potential trader needs to assess the trustworthiness of this broker before submitting personal information.

It is impossible to click the application form away, creating an unpleasant user experience.

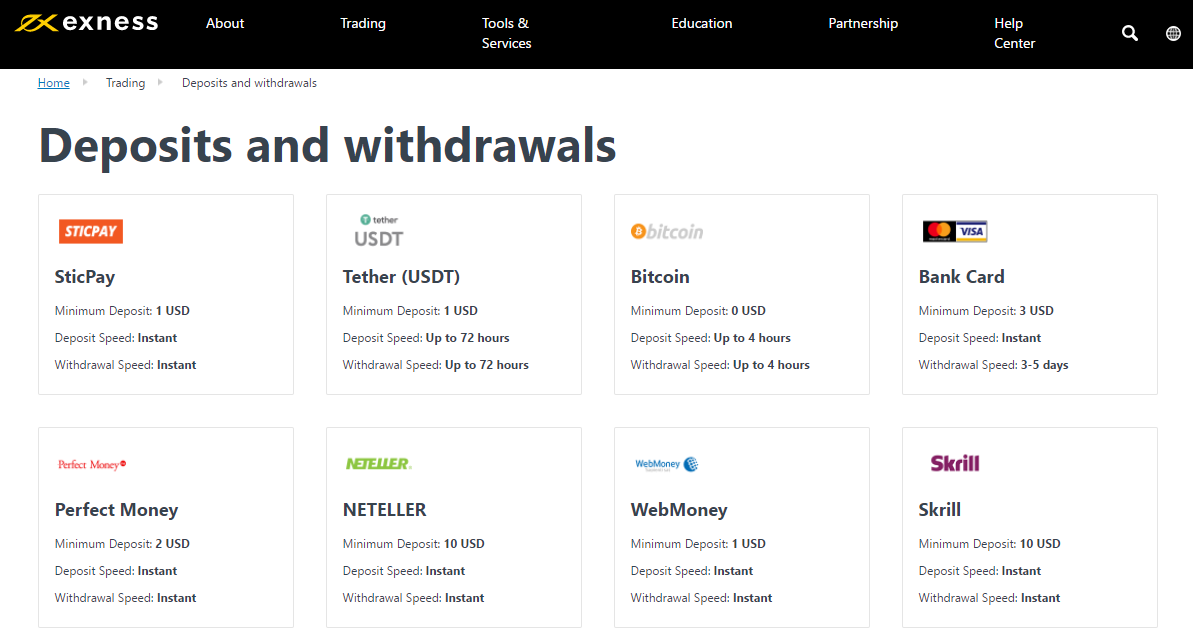

Deposits and Withdrawals

Nymstar supports nine deposit and withdrawal methods, but bank wires are strangely not listed among the options. While the majority of traders do not utilize them due to long processing times and burdensome fees, it is nonetheless illogical not to have them as an option. The absence of a bank wire option raises further questions about the sincerity and veracity of operations at this broker. Credit/debit cards are available as an option, together with popular payment processors Skrill, Neteller, WebMoney, and Perfect Money. Tether and Bitcoin are equally supported. Processing times, in most cases, are noted as instant. Third-party fees may apply, and the name on the trading account and payment processor must be identical. While the overall process is in line with industry standards, the absence of bank wires as an option to deposits and/or withdrawals represents a red flag for traders to consider.

This broker fails to list bank wires as an option to conduct financial transactions.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

Nymstar remains the sole Exness subsidiary providing services to retail traders. Regulated by the Seychelles Financial Services Authority, this broker continues to list UK and Cyprus oversight. While technically correct, it is a questionable practice, and may be masking a different truth. Neither regulator applies to operations of Nymstar, as such, noting them is misleading. It is one of the numerous red flags found throughout this Nymstar review. The Client Agreement's fine print denotes that this broker uses client deposits to earn and retain revenues.

It is unclear if actual trading takes place or if core operations are simulated. Most traders operate at a loss, and are never in a position to request a withdrawal. Since deposits are used by Nymstar to earn revenues, no trades may ever be sent to markets and may be kept entirely in-house. Nymstar does not support bank wires and fails to disclose which banks act as the custodians of deposits. No proof exists that this Exness subsidiary operates as a scam, but the infrastructure is certainly in place to question their veracity.

On paper, trading costs are excellent, but asset selection is limited. The MT4/MT5 trading platforms are available as the most basic versions, representing poor choices for committed traders. Free VPS hosting is rendered in-house in a nod to automated trading solutions.

While Nymstar fails in core trading services, it provides excellent research and education. It is unclear if the motivation is genuine or if it only serves to attract more deposits to the questionable execution at this brokerage. The result is outstanding, nevertheless. Since education is free of charge, new traders are encouraged to take advantage of the lessons covered. The research can also provide well-presented trading ideas, which are better executed here than at other brokers.

Too many red flags exist at Nymstar to qualify it for a legitimate consideration as a broker. Traders will undoubtedly find a more suitable option elsewhere, without the major concerns and apparent issues at this Exness subsidiary. While there is some potential at Nymstar, a near-complete overhaul in execution is necessary. Until then, traders should be cautious with this broker. Exness is a market maker offering CFD trading across multiple markets. After closing its UK and EU operated subsidies, it now exclusively provides brokerage services through its Seychelles registered subsidiary, Nymstar. The two standard account types require a minimum deposit of just $1, while the remaining three account options are available with an initial deposit of $200. No restrictions for scalpers are noted, and the spreads are ideal for this trading strategy. While no deposit bonus exists, Exness is currently hosting a promotion consisting of over 200 prizes. Core trading services are questionable, and at times it appears no trading takes place, merely a simulated environment. Transparency is missing in essential areas. On a positive note, the research and education sections of this broker are outstanding. It will be up to each trader to gauge whether or not this broker's capabilities, presented in its current format, suffices to classify Exness as a “good” Forex broker.FAQs

What type of broker is Exness?

What is the minimum deposit for Exness?

Does Exness allow scalping?

Does Exness have a bonus?

Is Exness a good Forex broker?