OANDA Editor’s Verdict

Oanda presents traders with a trustworthy and reliable Forex broker and 69 currency pairs from an upgraded MT4 trading platform. Alternatively, the proprietary Oanda Trade trading platform features a clean user interface equipped with streaming news and performance tools.

Does Oanda provide the trading conditions to support profitable traders globally?

Overview

Competitive Cost Structure with an Upgraded MT4 Trading Platform

Headquarters | British Virgin Islands |

|---|---|

Regulators | ASIC, BVIFSC, CFTC, CIRO, FCA, FSA, MAS, MFSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1996 |

Execution Type(s) | ECN/STP, Matched Principal Broker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform, Trading View |

Average Trading Cost EUR/USD | 0.9 pips |

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $62 |

Retail Loss Rate | 78.3% |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for Forex | $5.00 per round lot |

Funding Methods | 3-5 (dependent on geographic location) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the asset selection for Forex traders, but a choice of equity CFDs is absent Oanda also offers gold and silver against numerous currency pairs, making it an attractive choice for commodity traders who seek cross-currency exposure and diversification.

Oanda Group - The first look:

- Upgraded MT4 trading platform plus a user-friendly proprietary alternative for manual traders

- The MultiCharts suite of services, available via API or the Oanda Trade plug-in featuring professional trading tools, offers full support for algorithmic trading and 300+ strategies

- Advanced charting analysis by MotiveWave with 30+ build-in strategies and 250+ studies/indicators

- Technical analysis from Autochartist

- Real-time news from Dow Jones FX Select

- VPS hosting in partnership with BeeksFX and Liquidity Connects.

- Order execution and processing power of the CQG FX Platform

- Quality in-house market commentary

- CVC Capital Partners acquired Oanda in 2018

- Oanda bought Polish brokerage firm Dom Maklerski TMS Brokers in 2020 to expand across Eastern Europe and the Baltics

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Oanda presents clients with eight well-regulated entities, including several tier 1 jurisdictions.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Canada | Investment Industry Regulatory Organization of Canada (IIROC) | Undisclosed |

US | US Securities and Exchange Commission (SEC) | NFA 0325821 |

UK | Financial Conduct Authority (FCA) | 542574 |

Malta | Malta Financial Services Authority (MFSA) | C95813 |

Australia | Australian Securities and Investments Commission (ASIC) | 412981 |

Japan | Japan Securities Dealers Association (JSDA) | 2137 |

Singapore | Monetary Authority of Singapore (MAS) | CMS100122-4 |

The British Virgin Islands | Financial Services Commission (FSC) | SIBA/L/20/1130 |

What could be better?

- Provision of third-party insurance

Noteworthy:

- Oanda has a clean regulatory track record

OANDA remains well-regulated and compliant with eight regulators.

Regulation fulfills a central role, but it should not harm the competitive advantage under misguided ideas of trader protection. Overall, Oanda delivers well on security.

Does OANDA accept US clients?

Yes, OANDA is one of the most trusted brokers licensed by both the CFTC and NFA, and fully supports U.S. clients. Explore more CFTC-regulated forex brokers.

Fees

Average Trading Cost EUR/USD | 0.9 pips |

|---|---|

Average Trading Cost GBP/USD | 1.3 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.30 |

Average Trading Cost Bitcoin | $62 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 0.6 pips |

Minimum Commission for Forex | $5.00 per round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $10 monhtly after 12 months |

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

Oanda offers traders a choice between two cost structures:

- Commission-free trading costs start at 0.6 pips or $6.00 per 1 standard round lot. This is the Premium+ account which requires a minimum national trade volume of at least $50 million monthly and $200 million quarterly to qualify. This account qualifies for spread rebates and spread discounts.

- Commission-based accounts commence with a minimum spread of 0.0 pips and a commission of $50.00 per $1,000,0000 in nominal trading value, comparable to $5.00 per lot.

Noteworthy:

- Traders who transact $50,000,000 monthly and have a balance exceeding $10,000 qualify for a volume-based rebate of $6.00 per $1,000,000 traded.

- Traders who transact $10,000,000 monthly and have a balance exceeding $10,000 qualify for a volume-based rebate of $4.00 per $1,000,000 traded.

- Not all core trading costs are similar across operating subsidiaries, and traders should evaluate them carefully before selecting where at Oanda to trade.

Which pricing environment should Forex traders select?

I recommend the following:

- The commission-based pricing environment is notably cheaper, especially for high-frequency traders, but requires a minimum deposit of $10,000 and monthly trade volume of at least $10 million.

What is missing at Oanda?

- Oanda delivers a highly competitive pricing environment, but traders must select the operating subsidiary carefully, and not all traders have access to the same cost structure

Oanda offers floating spreads, and while the minimum trading costs remain excellent, average ones can increase throughout the trading session.

The minimum trading costs for the EUR/USD in the commission-free Oanda account:

Minimum Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.6 pips | $0.00 | $6.00 |

The minimum trading costs for the EUR/USD in the commission based Oanda account:

Minimum Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.0 pips | $5.00 | $5.00 |

Noteworthy:

- Trading costs for high-frequency traders with a minimum account balance of $10,000 and monthly trading volume exceeding $10,000,000 can lower commissions to $4.50 per lot

- Trading costs for high-frequency traders with a minimum account balance of $100,000 and monthly trading volume exceeding $100,000,000 can decrease commissions to $4.00 per lot

- Trading costs for high-frequency traders with a minimum account balance of $250,000 and monthly trading volume exceeding $500,000,000 can lower commissions to $3.50 per lot

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Oanda sometimes offers positive swaps on certain positions, meaning traders can get paid money to hold trades overnight

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night or seven nights, with the commission based Oanda account.

Taking a 1 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $5.00 | -$4.7000 | X | $9.7000 |

0.0 pips | $5.00 | X | -$0.1300 | $5.1300 |

Taking a 1 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $5.00 | -$32.9000 | X | $37.9000 |

0.0 pips | $5.00 | X | -$0.9100 | $5.9100 |

My additional comments concerning trading costs at Oanda:

- Oanda levies a $10 monthly inactivity fee after twelve months

- A 0.50% currency conversion fee applies

What Can I Trade?

The asset selection at Oanda remains focused on Forex, where it delivers an average choice of currency pairs. Oanda expanded into cryptocurrencies by offering CFDs for Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. The overall list of trading instruments is sufficient to allow new traders to learn how to trade.

What is missing?

- Equities are missing, presenting the most notable disappointment

- ETFs are not available, another significant oversight at Oanda

- The cryptocurrency selection is limited

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Oanda Leverage

Oanda restricts retail leverage to 1:20, and professionals get 1:100.

Other things I want to note about Oanda leverage:

- Various assets have lower maximum leverage, which Oanda lists on its website

Oanda Trading Hours (GMT +2 Server Time)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 23:03 | Saturday 00:58 |

Cryptocurrencies | Sunday 00:00 | Saturday 24:00 |

Commodities | Monday 00:03 | Saturday 00:58 |

Crude Oil | Monday 02:00 | Saturday 00:00 |

Gold | Monday 00:03 | Saturday 00:58 |

Metals | Monday 00:00 | Friday 23:00 |

Equity Indices | Monday 00:00 | Friday 23:00 |

Noteworthy:

- Equity markets open and close each trading and are not operational continuously like Forex or cryptocurrencies

- Oanda does not offer 24/7 cryptocurrency trading, limiting Saturday and Sunday to seven-minute sessions

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

Oanda offers two account types, but traders must also consider the differences and limitations of each regulatory environment.

Traders must decide between the following:

- Commission-free versus commission-based account

- The regulatory environment

My observations concerning the Oanda account types:

- Most retail traders will manage their portfolios in the commission-free account, but the overall pricing environment remains competitive in both

- There is no minimum deposit for the Standard account, while conditions for the Premium vary based on the regulatory jurisdiction

- The core trading conditions are identical for both account types, but the commission-based one qualifies for volume-based rebates and free VPS hosting

- Corporate accounts are available

My recommendation:

- Active traders should opt for the commission-based account, as trading costs remain lower once traders satisfy the requirements

Oanda Demo Account

Oanda offers unlimited demo accounts, ideal for testing algorithmic trading solutions and new strategies. I want to caution beginner traders against using a demo account as an educational tool. It creates unrealistic trading expectations, and the absence of trading psychology negates the educational value.

My recommendation:

- MT4 offer flexible deposits, and traders should select one similar to what they plan for their live trading account

Trading Platforms

Traders can manage their accounts with the MT4 trading platform, the market leader in automated trading solutions. Additionally, they may try the proprietary Oanda Trade platform as a competitive alternative, supporting algorithmic trading following its partnerships with MultiCharts and MotiveWave.

Despite developing a proprietary trading platform, Oanda delivers one of the best MT4 upgrade packages with 28 plug-ins.

What could be better?

- Oanda delivers across the board except for asset for management modules

My observations:

- Traders with MT4 EAs must use the desktop client

- Oanda offers API trading and VPS hosting for algorithmic traders

- Its recent partnerships display a commitment to automated trading solutions, which continue to gain overall market share

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Besides the MT4 upgrade, and services provided by MultiCharts and MotiveWave, Oanda also features technical analysis from Autochartist, an established third-party tool. Regrettably, Oanda does not have the MT4 plug-in.

VPS hosting for automated trading solutions is also available, and Oanda has an API, allowing third-party developers to connect advanced trading solutions to the Oanda infrastructure. The trading tools at Oanda ensure that traders have a competitive edge in financial markets.

Research and Education

Oanda offers competitive research, both in-house on its MarketPulse blog and in partnership with third-party providers. Clients have access to daily market commentary and trading recommendations.

The educational section for beginner traders remains below average and insufficient. The content lacks depth, and a classroom-style approach with well-structured lessons and courses is not available. Oanda hosts live webinars, but the overall educational value trails competitors with an excellent educational offering.

My takeaways:

- Oanda maintains an excellent research service via Autochartist and its in-house analyst

- Services provided by MultiCharts, and MotiveWave offers a competitive toolset for manual and algorithmic traders

- Beginner traders get entry-level content, but an in-depth educational section is missing

My recommendations:

- MT4 has thousands of EAs, and traders may explore them to determine if they suit their trading style

- MultiCharts and MotiveWave are excellent trading tools

- Traders can also access numerous free research available online and should seek educational material before trading at Oanda

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |      |

Oanda customer support is available 24/5 but fails to list phone numbers. It relies heavily on its FAQ section, while the live chat appears as a chatbot without human assistance. An e-mail button exists, but Oanda fails to maintain a quality customer support portal.

My recommendations and observations:

- Traders should read through the FAQ section before reaching out to a customer service representative

- For non-urgent questions, I recommend using live chat

- Oanda fails to provide phone support and access to a dedicated finance department

Bonuses and Promotions

At the time of writing this review, Oanda does not offer any bonuses or promotions. Most of the regulatory jurisdictions prohibit them.

Awards

Since 2013, the Oanda Group has received 62 industry awards. It confirms the commitment to continue investing and improving its trading environment and maintaining a competitive edge for its clients.

Among the most notable 62 awards are:

- International Finance Magazine - Best Retail Trading Provider 2013

- World of Trading Award 2013 - Best FX Broker

- Investment Trends 2014 UK Leveraged Trading Report Best Research Tools

- Investment Trends The 2014 Singapore CFD and FX Report - No.1 FX Broker for High-Value Clients

- ShareInvestor Awards 2015 - Most Preferred Forex Provider

- Investment Trends 2015 Australia FX Report - Value for Money

- e-FX Awards 2016 FX Week - Best Retail FX Platform

- Investment Trends 2016 Australia FX Report - Best Risk Management

- Investment Trends 2017 USA FX Report - Highest Overall Client Satisfaction

- Global Banking & Finance Review Awards - Best CFD Broker APAC 2017

- eFX Awards 2018 - Best Retail FX Platform

- Global Banking & Finance Review Awards - Best CFD Broker Asia Pacific 2019

- Corporate Vision Magazine's 2020 Corporate Excellence Awards - Most Outstanding Retail-Sector FX Trading Platform - 2020

- Best Forex and CFD Broker 2020 - As voted by TradingView clients

- Best FX Data Provider emerging markets - Global Brand Awards 2020

Opening an Account

While the online application takes only a few minutes, Oanda collects more personal data than most brokers. The mandatory account verification, requiring a copy of the trader's ID and proof of residency document, is part of the process. It allows new clients to complete everything in one session.

Oanda introduced a simplified client onboarding process at Oanda Global Markets, the British Virgin Islands subsidiary. Most clients can start trading without submitting documents to verify their identity for deposits up to $9,000. In some cases, Oanda may ask for complete account verification. The process follows leading international cryptocurrency exchanges, which I welcome, as it implements a simplified, trader-friendly approach.

Minimum Deposit

There is no minimum deposit for the Standard account in Oanda, but the Premium requirements can be as high as $20,000, dependent on the jurisdiction.

Payment Methods

Oanda offers bank wires, credit/debit cards, Neteller.

Accepted Countries

Oanda accepts traders resident in a wide range of countries, including Malaysia, the UAE, Bahrain, Taiwan, and Colombia.

Deposits and Withdrawals

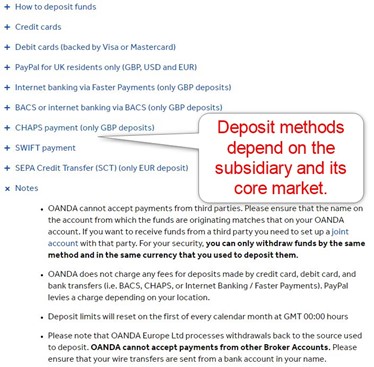

All financial transactions take place in the secure back office of Oanda. The deposit and withdrawal options remain limited.

My observations:

- Most Oanda traders have access to just bank wires, credit/debit cards, and PayPal

- There are no deposit fees, but third-party withdrawal costs may apply

- Oanda fails to offer a wide selection of the most competitive payment processors, but some jurisdictions feature localized alternatives, often related to banks

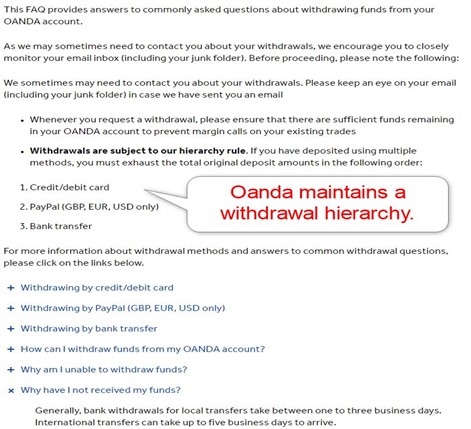

- Traders may swiftly request withdrawals from their back office, where a withdrawal hierarchy exists

- A 0.50% currency conversion fee is charged

My recommendations:

- Traders should select the payment processor with the lowest fees

- I also recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations

The Bottom Line

I like the trading environment at Oanda for its excellent choice of trading platforms and competitive cost structure. Oanda has established itself as a reliable and trustworthy broker, with a very high level of global regulation. I appreciate the third-party partnerships Oanda maintains, as they deliver cutting-edge trading tools. The limited asset selection and absence of modern payment processors are notable.

Oanda remains a primary choice across emerging markets with a promising platform to expand globally by improving its international offering. Oanda complies with seven regulators, has a clean track record, and has a well-regarded corporate owner. Therefore, Oanda ranks among the most trusted brokers in the industry. Oanda maintains a straightforward, affordable, and highly regulated offering with a wide choice of Forex currency pairs, making it very suitable for beginners. There is no minimum deposit for the Standard account, but the Premium requirements can be as high as $20,000, dependent on the jurisdiction. Oanda is well-regulated and provides an excellent choice of trading platforms. The minimum costs in the commission-free account are $6.00 per 1 standard lot and $5.00 in the commission-based alternative. Average trading costs are higher than that, dependent on the asset. Oanda presents traders with a competitive pricing environment and trading platforms but low leverage and a limited asset selection. The infrastructure to make money exists, and the rest is up to the individual trader. Oanda offers tight spreads, delivering a trading cost advantage to clients.FAQs

Is Oanda trustworthy?

Is Oanda good for beginners?

What is the Oanda minimum deposit?

Is Oanda a good broker?

How much does Oanda charge per trade?

Can you make money with Oanda?

Are Oanda spreads high?