Editor’s Verdict

Overview

Review

As of October 2021, this broker is no longer accepting new traders. To find a reliable, regulated Forex broker, check out our top Forex brokers list. Thank you!

OBRinvest established itself as a competitive choice for Forex traders with an appetite for cryptocurrency trading. It also offers trading tools from Trading Central and TipRanks, embedded in its web-based trading platform, deployed alongside MT4. Can OBRinvest deliver an edge to its traders and increase their profitability with its commission-free trading environment? We have conducted an in-depth review of OBRinvest to help you decide.

Pros | Cons |

|---|---|

User-friendly web-based trading platform alongside MT4 | Limited leverage for retail traders |

Competitive trading tools via Trading Central and TipRanks | The educational section lacks depth and content |

Excellent cryptocurrency selection for a non-crypto broker | High €80 inactivity fee after one month |

CySEC License since 2013 |

OBRinvest Snapshot: Excellent Cryptocurrency Selection and Competitive Trading Tools

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Year Established | 2013 |

Execution Type(s) | Market Maker |

Minimum Deposit | € 250 |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

The rise in popularity among retail traders for cryptocurrency has not gone unnoticed. We like the cryptocurrency asset selection at OBRinvest. While only twelve different ones are available, OBRinvest quotes them in US dollars, euros and the British pound. It also offers mini contracts, ideally for investors with smaller portfolios. Having quotes in various currencies also ties cryptocurrency trading into a theme for Forex brokers. The web-based trading platform has a clean user interface but only supports manual trading which gives traders full control over every trade they place.

OBRinvest Overview of Main Features

Retail Loss Rate | Undisclosed |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.7 pips |

Minimum Commission for Forex | Not applicable |

Commission for CFDs/DMA | Not applicable |

Commission Rebates | Not applicable |

Minimum Deposit | €250 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | Yes |

Deposit Fee | No |

Withdrawal Fee | Yes + Third-Party |

Funding Methods | 2 (confirmed) |

Regulation and Security

OBR Investments Limited, owner and operator of OBRinvest, is a Cyprus Investment Firm (CIF). Therefore, the Cyprus Securities and Exchange Commission (CySEC) is the regulator of OBRinvest. Per the CySEC website, it granted the license in 2013, while a summary notes 2014, with a modification in 2021. This broker must comply with the European Union Markets in Financial Instruments Directive (MiFID), and the Cyprus Investor Compensation Fund (ICF) protects client deposits up to €20,000. Negative balance protection also applies.

It should be noted that in keeping with CySEC allowances, a professional account is available that provides 1:500, subject to certain requirements. I can only recommend that traders understand that leverage has essentially no impact on risk and that risk management, or rather the absence of it, remains the problem. Before starting to trade, I urge beginner traders to educate themselves on risk management, irrelevant of the leverage used.

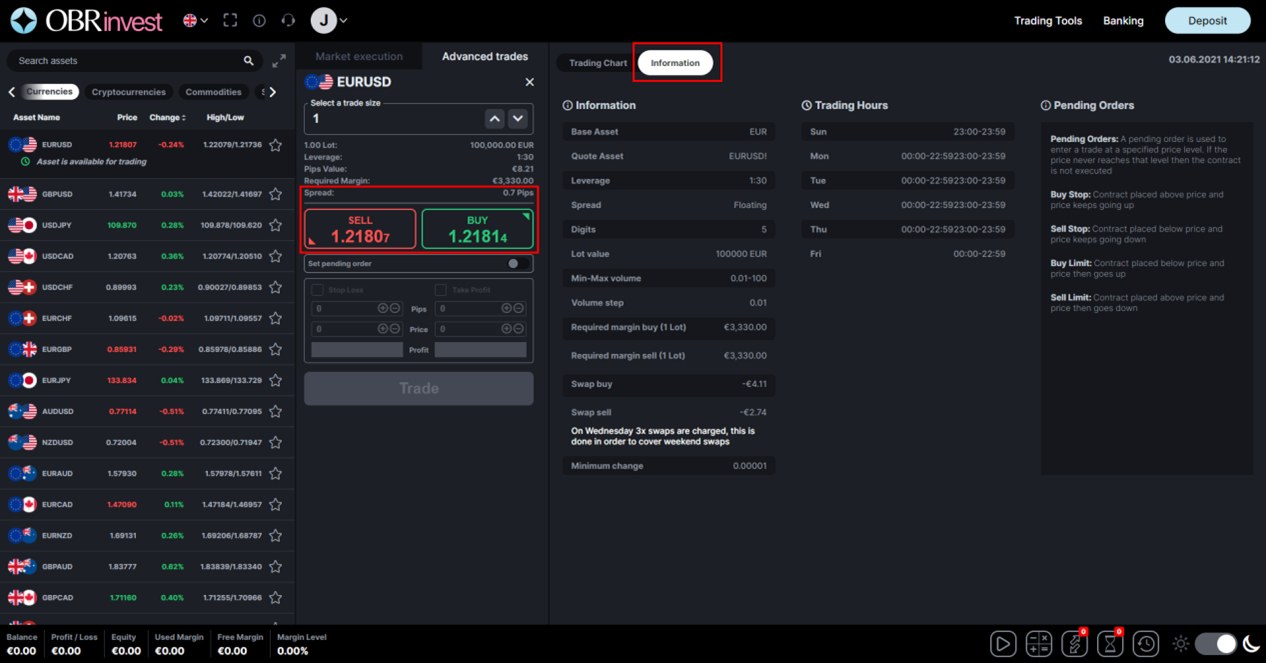

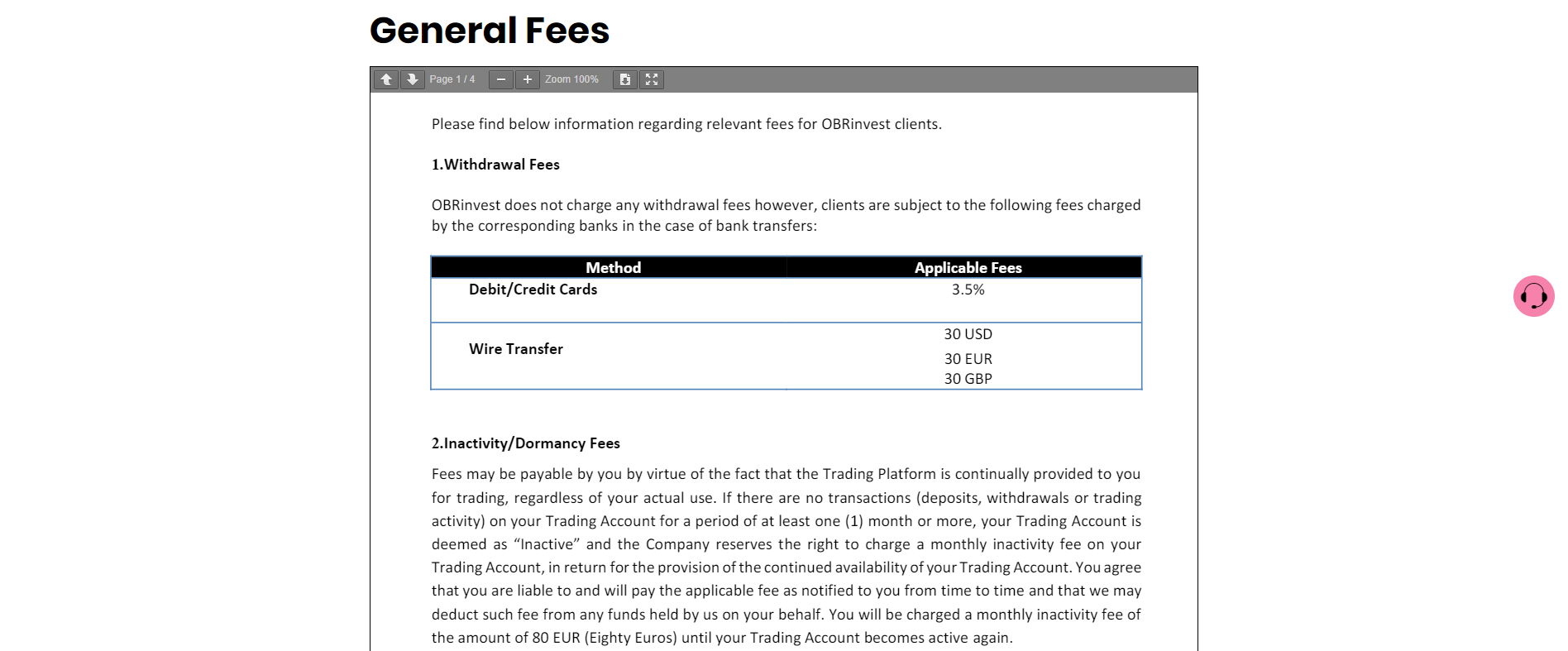

Fees

Trading fees have the most direct impact on any trading strategy. OBRinvest offers a commission-free trading environment, relying primarily on mark-ups on spreads. It lists the minimum mark-up on its website between 1.8 pips and 3.2 pips, dependent on the account type. It results in a cost ranging from €18 to €32 per 1.0 standard lot. After my account was open, I was positively surprised that the spread in the EUR/USD was only 0.7 pips or €7 per lot. It places it within a competitive commission-free mark-up, and one I can recommend trading if you are a low-frequency trader. Other currency pairs show a reasonable mark-up. Traders will also pay swap rates on leveraged overnight positions, accessible from within both trading platforms. There is an €80 inactivity fee after one month.

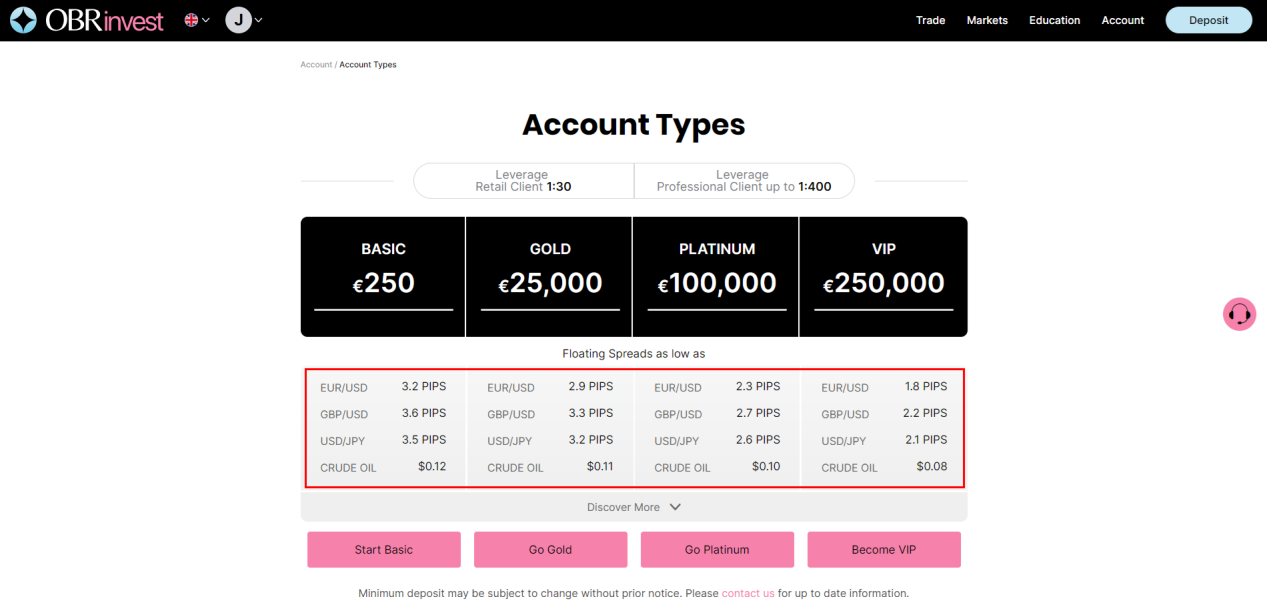

The website notes minimum spreads between 1.8 pips and 3.2 pips.

Inside the trading platform, I received quotes as low as 0.7 pips. Clicking on "Information" highlighted in red will display all necessary trade data and swap rates for each asset transparently.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free OBRinvest.com trading account:

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for one night will cost the following:

€7.00 Spread + €4.11 swap rate = €11.11

€7.00 Spread + €2.74 swap rate = €9.74

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

€7.00 Spread + €28.77 swap rate = €35.77

€7.00 Spread + €19.18 swap rate = €26.18

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

What Can I Trade?

OBRinvest.com presents Forex traders with various currency pairs and a competitive mix of cryptocurrency pairs, which I appreciated as the best features in its asset selection. Traders will also get a nice mix of commodities and index CFDs, while OBRinvest.com presents a good introductory selection of equity CFDs. I think the overall asset selection suits traders well.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

Account Types

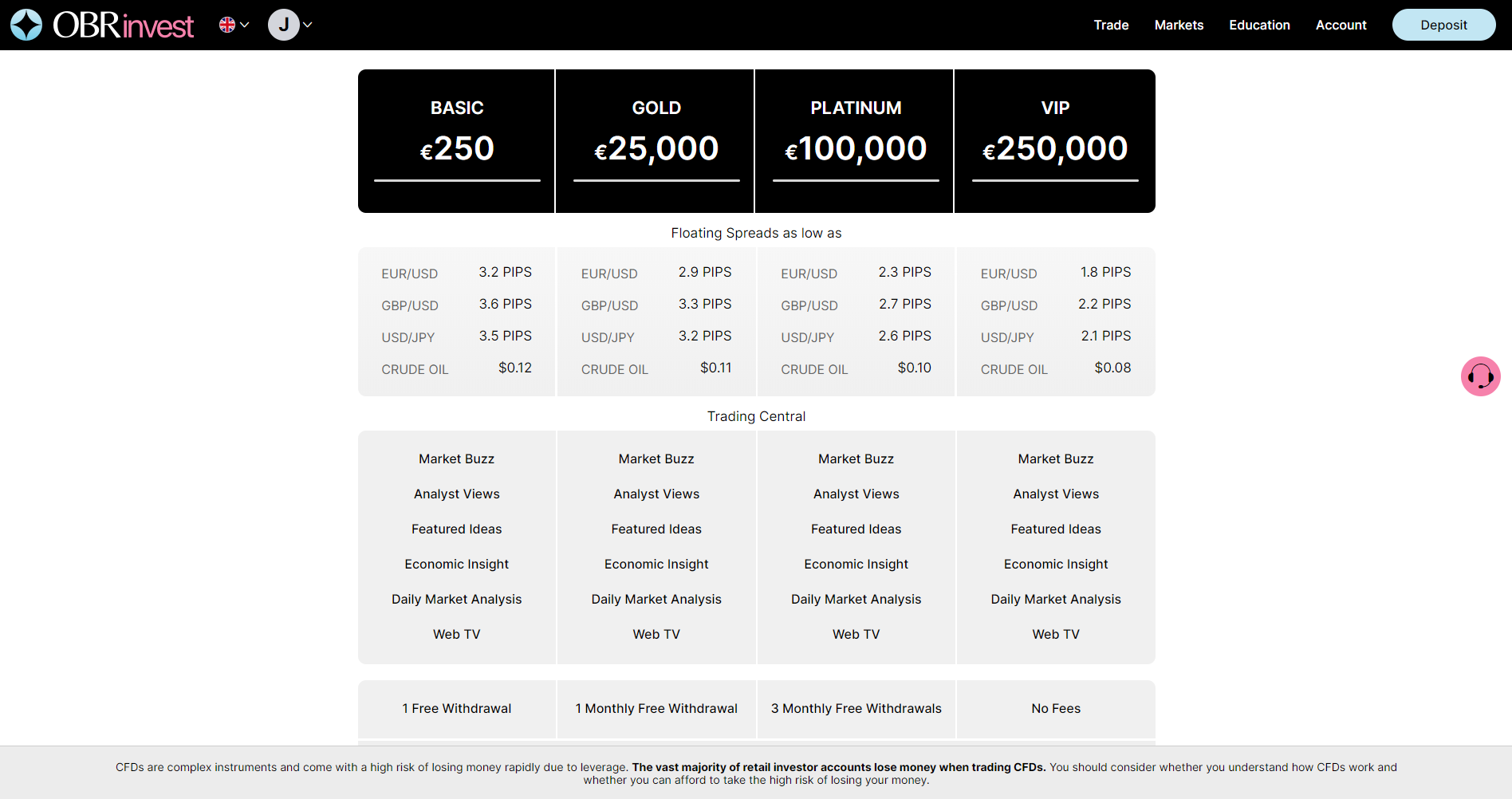

Traders have four account types plus a demo account. The minimum deposit is €250. OBRinvest has three additional choices, with minimum deposits of €25,000, €100,000, and €250,000. OBRinvest does have a risk warning in place. Trading costs decrease with higher-tiered accounts, and clients get more free withdrawals.

OBRinvest offers a free demo account, but it does not give traders a choice to make any selections concerning the size. Everyone gets a €100,000 virtual portfolio balance. Though this is fairly common among brokers, I always recommend beginner traders select a demo account close to the desired deposit sum in the live portfolio.

Traders have four account choices at OBRinvest.

There is a €100,000 virtual demo account.

There is a €100,000 virtual demo account.

.jpg) Retail traders remain limited to a leverage of 1:30, as per regulations.

Retail traders remain limited to a leverage of 1:30, as per regulations.

.jpg)

Trading Platforms

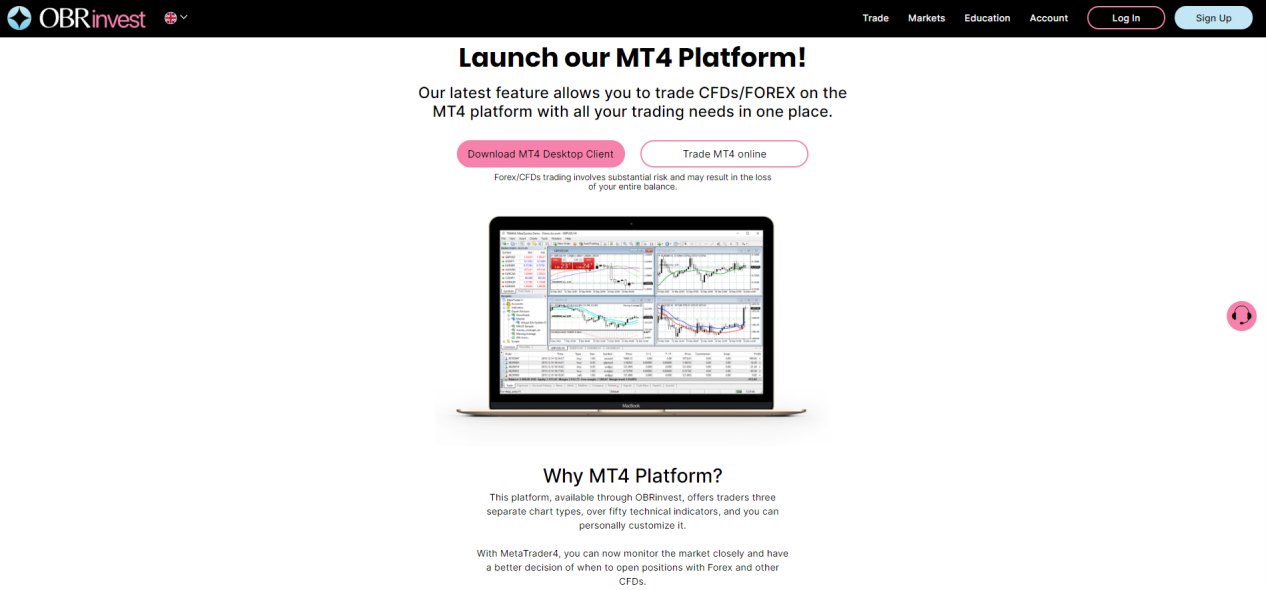

While the MT4 trading platform is available at OBRinvest, manual traders will find the web-based proprietary trading platform a better choice. It includes all the trading tools, features a better user interface, and presents a good charting package. Automated traders will find the familiar and versatile MT4 trading infrastructure a superior choice. I found the web-based trader an overall competitive solution for manual traders to consider. The learning curve is short, and traders will understand how to navigate and use it within less than 15 minutes.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

OBRinvest offers the out-of-the-box MT4 trading platform, ideal for automated traders.

Manual traders will benefit from the proprietary web-based trading platform, available in eight languages.

.jpg)

It features a sentiment indicator, the order ticket provides traders with all the necessities, and the Information tab presents all required trade details.

.jpg)

Unique Features

I think two unique features traders should evaluate remain trading signals by Trading Central and equity recommendations by TipRanks. Both improve the trading conditions at OBRinvest, embedded within the web-based trading platform. Partnering with two leading third-party sources to deliver value-added services to traders is one of the best decisions the OBRinvest management team took.

Traders at OBRinvest have access to trading tools from Trading Central and TipRanks.

.jpg)

Research and Education

OBRinvest does not provide in-house research, instead outsourcing it to Trading Central and TipRanks. I think that is perfectly fine, and the outcome is positive as these are among the most respected names in the industry. OBRinvest provides education through five posts which deliver sufficient educational value.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |         |

I think the most convenient way to reach customer support is via live chat, but OBRinvest also provides its address, phone number, and e-mail address. I would like to see the customer support operating hours listed transparently, but the FAQ section answers many of the most common questions.

Bonuses and Promotions

XM remains one of the most trusted names in Forex. XM offers traders more than 1,000 competitively priced assets, excellent leverage, trading bonuses, plus a loyalty program and an upgraded MT4/MT5 trading platform. Should you take advantage of the trading environment at XM? Are there any pitfalls worth considering first? I set out a detailed researched review below to help you decide.

Opening an Account

I found the account opening process at OBRinvest hassle-free and straightforward. The online application took me less than 20 seconds to complete, as it only required my name, e-mail and phone number. As a CySEC-regulated broker, OBRinvest requires account verification. New traders can comply from within the web-based trading platform by uploading an ID and proof-of-residency document.

The online application takes less than 20 seconds to complete.

.jpg)

New traders must use the OBRinvest Verification Centre to verify their accounts per regulatory requirements.

(1).jpg)

Deposits and Withdrawals

Traders will make all deposit and withdrawal requests via the web-based trading platform. Bank wires and credit cards are guaranteed, and the FAQ section specifies e-wallets. It also states that OBRinvest processes withdrawal requests within 24 hours. There are internal withdrawal fees of 3.5% for credit/debit cards and €30 for bank wires.

OBRinvest supports bank wires and credit/debit cards, while some traders may have access to e-wallets.

The 24-hour withdrawal processing times are within industry standards.

(1).jpg)

The ease of withdrawals is accompanied by internal fees.

The Bottom Line

OBRinvest uses a minimalist presentation on its website, which some traders may enjoy. The live trading account displays better spreads than the excessive ones listed online, with the EUR/USD at a commission-free mark-up of 0.7 pips. I did notice the occasional dip to 0.6 pips, but most currency pairs and all other assets remain priced on the high-end of the spectrum. For me, the best feature is the cryptocurrency selection, where OBRinvest maintains 45 trading instruments. It only has twelve distinct cryptocurrencies but quotes them in the US dollar, euro and British pound. It also has mini contracts, making it an excellent choice for traders with smaller portfolios. Offering quotes in multiple currencies ties Forex trading and cryptocurrency trading into a well-executed theme. The trading tools provided in partnership with Trading Central and TipRanks offer manual traders a competitive edge from the web-based proprietary trading platform, which I believe provides traders with a solid trading portal. While areas of improvement remain with any broker, it appears that OBRinvest offers an overall excellent trading environment. The minimum deposit at OBRinvest is €250. The login button is in the top right-hand corner of the OBRinvest homepage. There is a €100,000 demo account available. OBRinvest offers Forex, cryptocurrencies, commodities, indices, ETFs, and equity CFDs. The easiest way to contact OBRinvest is via live chat. A phone number and an e-mail address are also listed.FAQs

What Is the minimum deposit to open an account with OBRinvest?

How can I log in to my OBRinvest trading account?

Does OBRinvest offer a demo account?

Which instruments are available with OBRinvest?

How can I contact OBRinvest?