Editor’s Verdict

Overview

Review

Headquarters | South Africa |

|---|---|

Regulators | FSA |

Year Established | 2018 |

Execution Type(s) | Market Maker |

Minimum Deposit | $250 |

Trading Platform(s) | MetaTrader 4, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Oinvest, which operates out of the Republic of Seychelles, is a very new broker, founded just a few years ago in 2018. Despite the lack of operational experience, this broker describes itself as a leading broker with thousands of international clients. Over 350 assets are available from the MT4 trading platform, while three account types exist. Per its own account, education fulfills a central role at Oinvest, which received numerous awards as the fastest growing online broker in 2019 and 2020. The pricing environment remains elevated, but traders have access to maximum leverage of 1:400 and a minimum deposit of $250, facts which are not prominently listed on the Oinvest website. Numerous reports indicate that a South African entity once existed, but it is no longer in operation.

Regulation and Security

Aronex Corporation LTD, the owner of Oinvest, operates in the Republic of Seychelles with oversight from the Financial Services Authority (FSA). An investor compensation fund is not available, nor has this broker taken any steps to ensure one is made available (say, via membership of the Hong Kong based Financial Commission). Many reputable brokers will opt for a business-friendly regulator to help grow their business and to enhance client protection via alternate steps. Regrettably, Oinvest chose to forgo this essential measure. Client accounts do remain segregated, but this broker does not reveal the custodian banks. Additional security measures such as independent audits from respected international accountants or even an insurance policy against default are also absent. Traders need to assess if the current trading environment at Oinvest will satisfy their security needs.

The FSA regulates Oinvest, while Cypriot firm Habonix Solutions operates the website.

Client funds remain segregated, but Oinvest does not disclose the custodian banks.

Fees

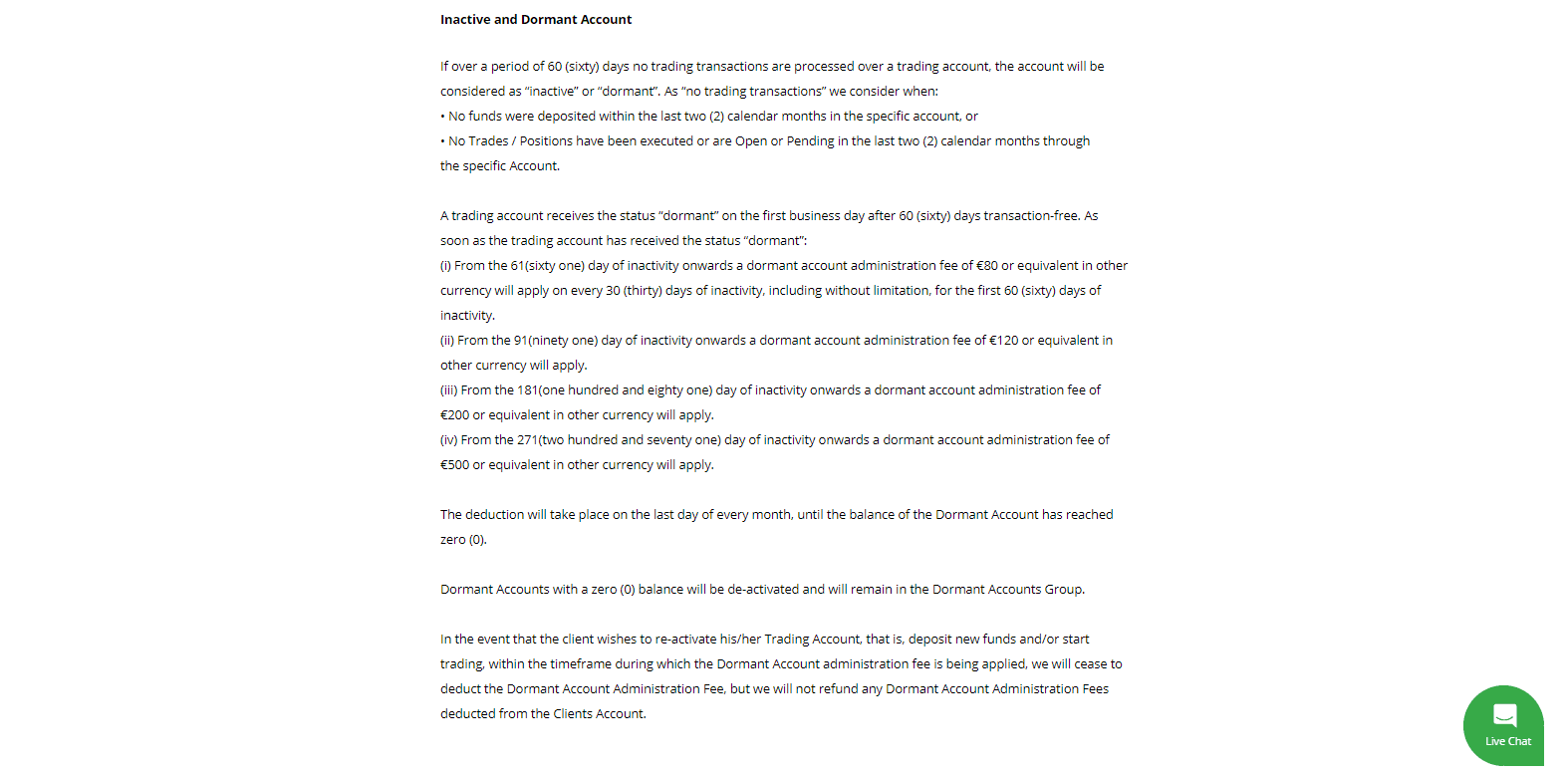

This market maker derives its income from spreads across all assets and from losses of its traders. While no commissions apply, the above-average costs make up for their absence. The EUR/USD commences from 2.2 pips, lowered to 0.7 pips in the Platinum account. Swap rates on leveraged overnight positions apply; while Oinvest fails to note them transparently, the Terms & Conditions page does reference them. Corporate actions, such as dividends, mergers, and splits, impact equity and index CFDs, and this broker credits/debits the corresponding amount from or to affected client portfolios. A monthly inactivity fee will apply after 60 days of dormancy at a rate of €80, or a currency equivalent; that inactivity fee progresses towards an alarming €500 per month after nine months of dormancy. Oinvest does not charge deposit fees, but traders should consider third-party charges; a €50 withdrawal cost may apply. The overall cost structure remains elevated.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

Oinvest notes swap rates in their Terms & Conditions but fails to list them on their website openly.

Likewise, this broker discloses the handling of corporate actions in the Terms & Conditions. A more transparent upfront approach is essential in building trust with new traders but ignored by Oinvest.

The excessive and progressive inactivity fee structure is unacceptable.

What Can I Trade

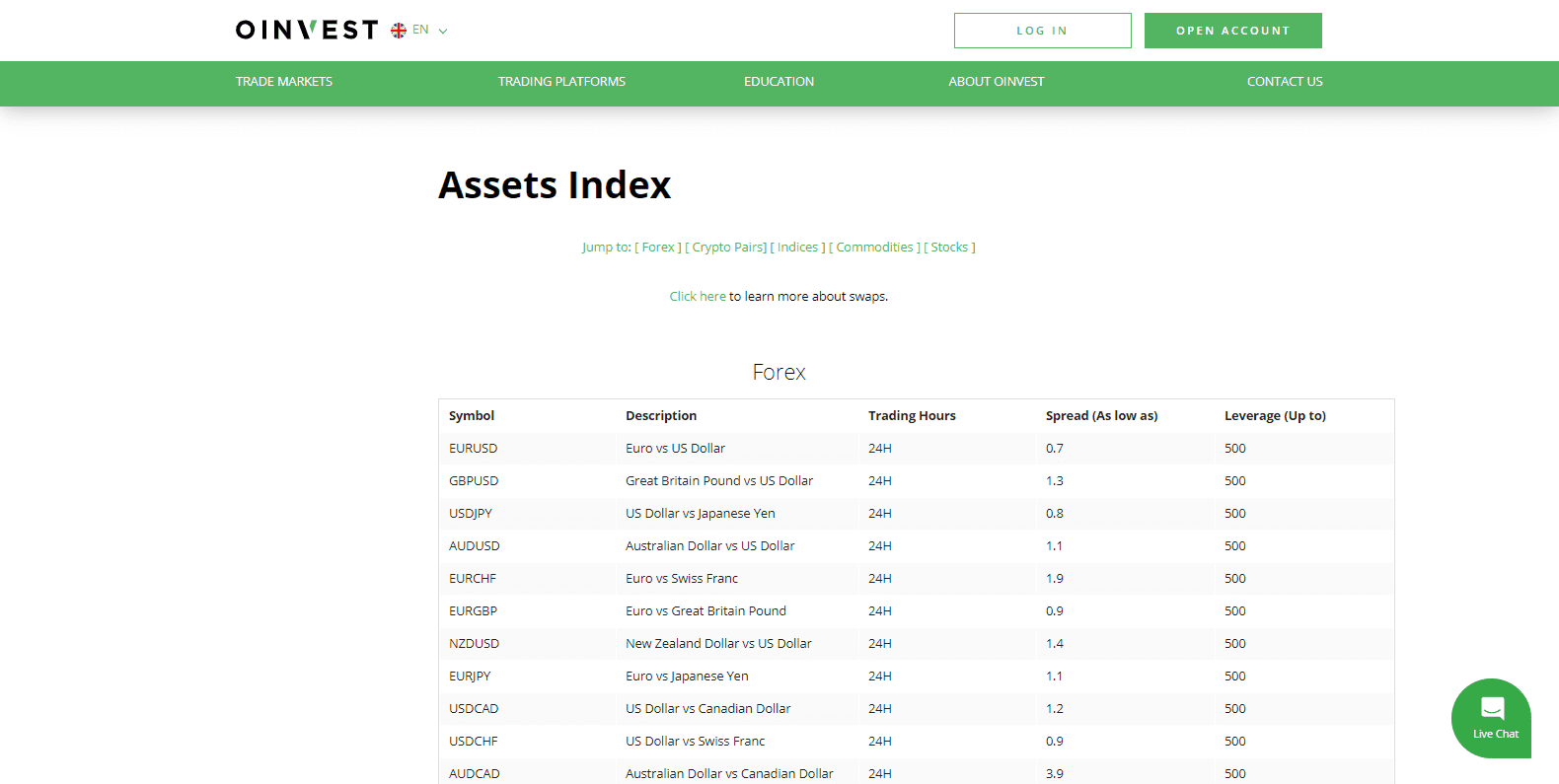

Traders have access to 47 currency pairs, 33 cryptocurrency pairs, and 17 commodities. With 194 equity CFDs and 15 index CFDs, equity traders have acceptable coverage from a new broker, which is likely to expand as Oinvest matures. Most retail traders have good choices with 306 assets across five sectors, with a notable cryptocurrency selection. This broker has done an excellent job sourcing a competitive asset mix from where it can grow its market share.

Oinvest maintains 306 assets across five sectors.

Account Types

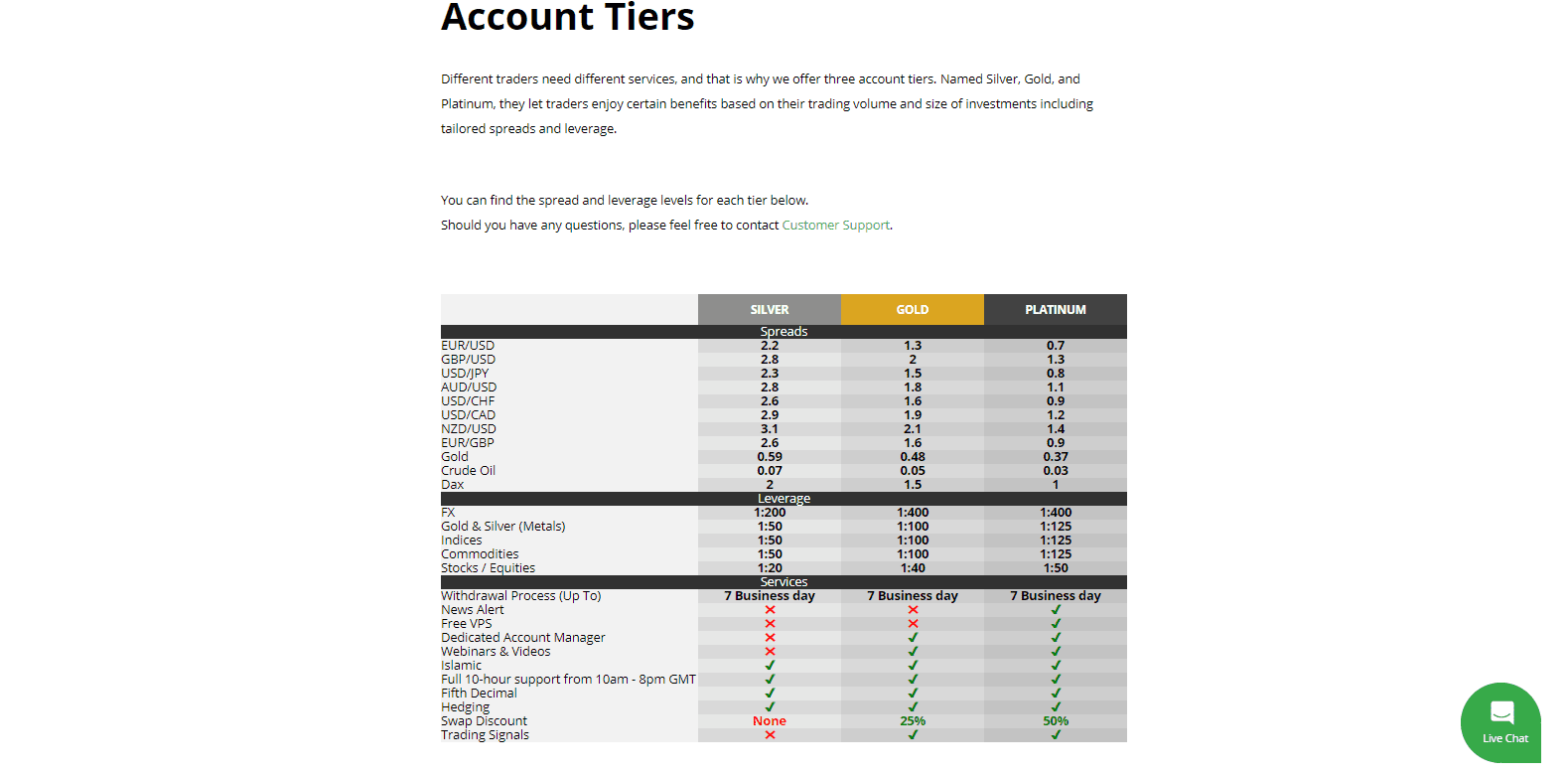

Oinvest lists three account tiers on its website but fails to specify how to achieve each of them; presumably, the value of deposits will unlock a higher level. The Silver account commences with a spread of 2.2 pips for the EUR/USD, lowered to 1.3 pips and 0.7 pips in the Gold and Platinum tiers, respectively. Forex traders have maximum leverage of 1:200, while equities traders get 1:20, in the Silver account. The Gold and Platinum accounts show a respective rise in Forex and equities trade to 1:400 and 1:40 and 1:400 and 1:50. Trading signals are offered to holders of Gold and Platinum accounts; regrettably, news alerts require a Platinum account. Also regrettably, education is not available for Silver accounts, where most new retail traders—who have the most urgent need for education—will likely manage their accounts. Oinvest needs to be more transparent on how to qualify for each tier. Presently, they ask inquiries to be directed to customer support, a significant oversight for a fundamental data point.

Three account tiers exist, but Oinvest fails to specify the requirements for each.

Trading Platforms

The lack of proper introduction of core trading elements and the absence of transparency continues with trading platforms. Oinvest offers the out-of-the-box MT4 trading platform and limits its introduction to a brief content-only page, which fails to list some of the most relevant features. The approach has a distinct lack of professionalism, magnified by the availability of MT4 marketing material. Oinvest's management team's lack of experience, or worse, its lack of desire (or a combination of both), remains dominant.

This broker additionally offers a webtrader, marketed as state-of-the-art, without providing details or descriptions. It grants only a 14-day demo account, which is unacceptable. Trading cubes and visual trends appear to be core features, but no examples exist. The same process repeats itself with the mobile platform, where it fails to disclose whether it is the mobile version of the MT4 or the webtrader version. Clicking on the download link reveals that it is the MT4, but the entire presentation of its trading platform requires a complete overhaul.

Oinvest maintains the core MT4 trading platform without any of the required third-party add-ons.

An apparent proprietary webtrader exists, without additional details.

Traders may use the mobile version of the MT4, though that is unclear from the presentation.

Unique Features

Regrettably, the dominant “unique” features at this broker remain the absence of a proper introduction of core elements, as well as the lack of transparency and effort on the part of the Oinvest management team. Being a relatively new broker without experience is no excuse to neglect essential aspects of the business.

Research and Education

Oinvest notes trading signals, but registration is mandatory and this broker, once again, fails to present it. The blurred background screen shows a potentially well-delivered service, but without details, it is impossible to assess it accurately.

Trading signals could represent a valuable add-on service, but Oinvest fails to offer details.

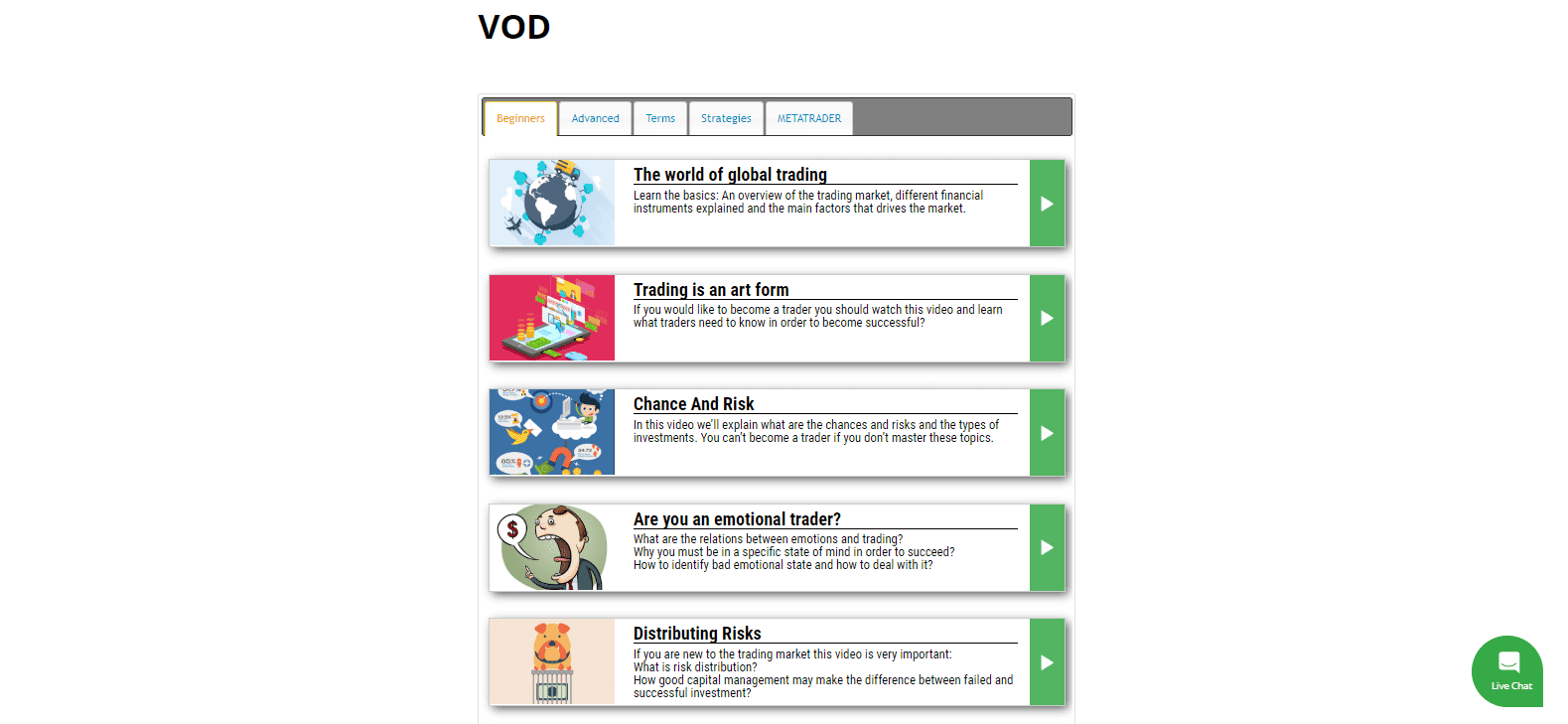

New traders have access to multiple educational tools, in what appears the best-developed section at Oinvest. The video on demand (VOD) library consists of five categories, filled with short but descriptive videos, which represent an excellent starting point into an educational session. Eleven eBooks add value, covering essential topics like psychology and risk management. Two MT4 tutorials and two courses are equally available, though one of them is a duplicate from the eBooks section. Oinvest hosts frequent webinars, completing the educational section. This broker reveals unlocked possibilities and could turn into a significantly better destination for new retail traders if the management team makes necessary adjustments and improvements.

The VOD library consists of numerous quick educational videos.

Eleven eBooks are available at Oinvest.

Two MT4 tutorials cover the basics of the trading platform.

Oinvest offers two courses, one a duplicate from the eBook section.

Webinars add educational value.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | M-F 5 am - 5 pm |

Website Languages |        |

Customer support is available from Monday through Friday, between 5 am and 5 pm, for 12/5 service. Clients may e-mail, call, fill out the web form, or engage via live chat. A dedicated management contact form is maintained. There is a high probability that the Oinvest customer support team is significantly busier on a per-client basis than customer support at well-established brokers. That would be a result of a number of factors, including the inexplicable (and inexcusable) absence of an FAQ section, the lack of proper introduction of core trading features, and general low degree of transparency throughout.

Traders have access to customer support 12/5.

Oinvest offers a separate management contact form.

Bonuses and Promotions

Oinvest grants a reduction in swap rates for Gold and Platinum account holders, but more details are not available.

Opening an Account

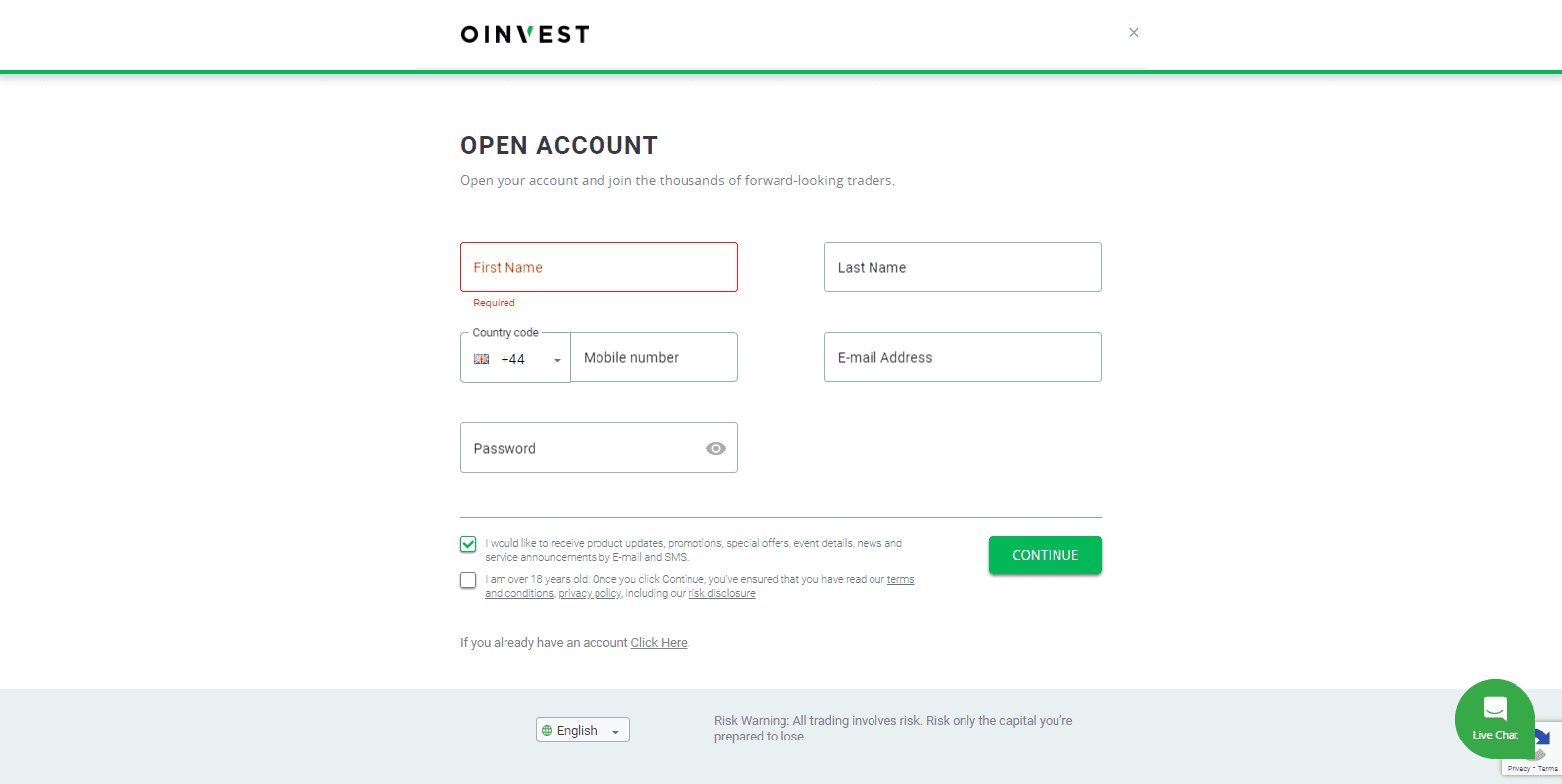

An online form processes new account applications, per established industry standards. The first step consists of a name, e-mail, password, and valid phone number. Since the Financial Services Authority (FSA) of the Republic of Seychelles regulates Oinvest, this broker adheres to AML/KYC requirements. Therefore, account verification is a mandatory second step to comply with stipulated rules; a copy of the trader’s ID and one proof of residency document generally satisfies this step.

The Account Opening process is standard for the industry.

Deposits and Withdrawals

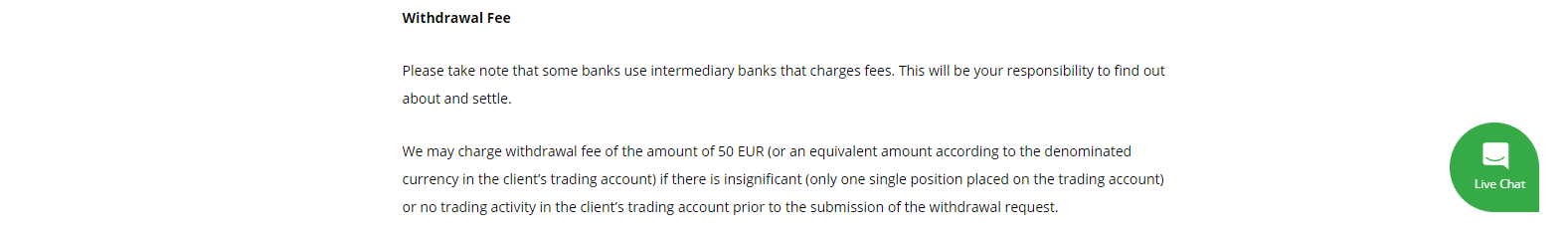

Continuing with the well-established pattern of a decided lack of transparency, Oinvest fails to mention deposit and withdrawal methods. The bottom of the homepage reveals icons for credit/debit cards, Skrill, Neteller, and V Pay. This broker does list a Withdrawal and Refund Policy segment, where bank wires are also noted, together with a withdrawal processing time of seven business days, which is excessive, especially for online payment processors.

While this broker does not list a minimum deposit, the minimum withdrawal is $100. The name of the payment processor and the Oinvest account holder must be identical, in line with AML requirements. It should be noted that Oinvest maintains that they reserve the right to charge a fee of €50 if traders do not place enough transactions before requesting a withdrawal; that is unacceptable. Such a “right” ties freedom of client deposits to trading volume, thus increasing the risk of a total loss, particularly by new traders. As a market maker, client losses equal broker profits.

A $100 minimum withdrawal applies.

Oinvest can charge a €50 withdrawal fee at its discretion.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

Oinvest is a relatively new broker and lacks operational experience, which is evident across the presentation of core trading elements and lack of open transparency. While the broker's Terms & Conditions reveal many aspects, this approach to disclosure is simply not acceptable. This market maker left the South African Financial Sector Conduct Authority (FSCA) regulatory environment; now, it serves all clients from under the authorization of the Financial Services Authority (FSA) of the Republic of Seychelles.

Traders have access to 306 assets across five sectors, sufficient for most retail traders, and the combination remains competitive. An elevated cost structure and unacceptable withdrawal fee policy counter it. In-house trading signals exist, but no further information is available. Oinvest made a genuine attempt at education, its best-developed feature. While this new broker has potential, the present execution is insufficient to develop a good reputation and trust with new traders. Oinvest remains an interesting broker to monitor, but for now, this broker remains distinctively behind its competitors.

Oinvest is regulated by and compliant with the Financial Services Authority (FSA) of the Republic of Seychelles. Given the lack of transparency and its limited operating history, coupled with its withdrawal from the regulatory environment of the South African Financial Sector Conduct Authority (FSCA), traders will need to carefully determine if this broker is safe enough for them. Oinvest is a legit broker, operating with FSA authorization. Oinvest is a Forex and CFD broker operating out of Seychelles since 2018. The same as with other brokers; open and verify your account, make a deposit, and trade. Yes, it is, but the South African FSCA no longer regulates Oinvest. The FSA remains the sole regulator, granting this broker operational freedom globally with few geographical restrictions.FAQs

Is Oinvest safe?

How legit is Oinvest?

What is Oinvest?

How do you trade on Oinvest?

Is Oinvest legit in South Africa?