Editor’s Verdict

Overview

Review

Headquarters | Saint Vincent and the Grenadines |

|---|---|

Year Established | 2014 |

Execution Type(s) | Market Maker |

Minimum Deposit | 10$ |

Trading Platform(s) | Proprietary platform |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

OlympTrade is an online options broker owned by Saledo Global LLC that has been operational since 2014. The company is registered in Saint Vincent and the Grenadines with the registration number 25161 IBC 2018. According to its own statistics published on their website, over 25,000 “users” are trading every day and 247,256 “users” traded last month. We have not followed up to see if this statistic changes monthly, nor can we ascertain its accuracy. The binary options market went through a phase were many providers collapsed as regulators clamped down on industry practices where false advertising, fraud and scam was on the daily agenda. The promise of big payout from micro-investments without any knowledge boosted demand which quickly faded. That being said, OlympTrade has weathered the storm, so that may a sign that traders should feel more comfortable about trading with this broker.

OlympTrade seems to be geared towards new traders who are interested in trading more as a hobby than a profession. The website lists the average trade size for the “last month” as $4.7 with 37,990,740 closed trades for a total trading volume of $171,236,104. This would leave the average trade size at $4.5. It does show that there appears to plenty of trading activity from the retail crowd. Binary options trading offers traders a different way to navigate the market as payout ratios are set and the traders only needs to get the direction of price action at the time of expiry right in order to receive the full payout.

With competition dwindling and only a handful of brokers operational, OlympTrade is carving out a position at the top of this niche market. It is worth noting that registrations from inside the European Union are prohibited and this may apply to other jurisdictions which strict regulatory environments

Regulation and Security

Saledo Global LLC, became the new owner of OlympTrade in March 2020.

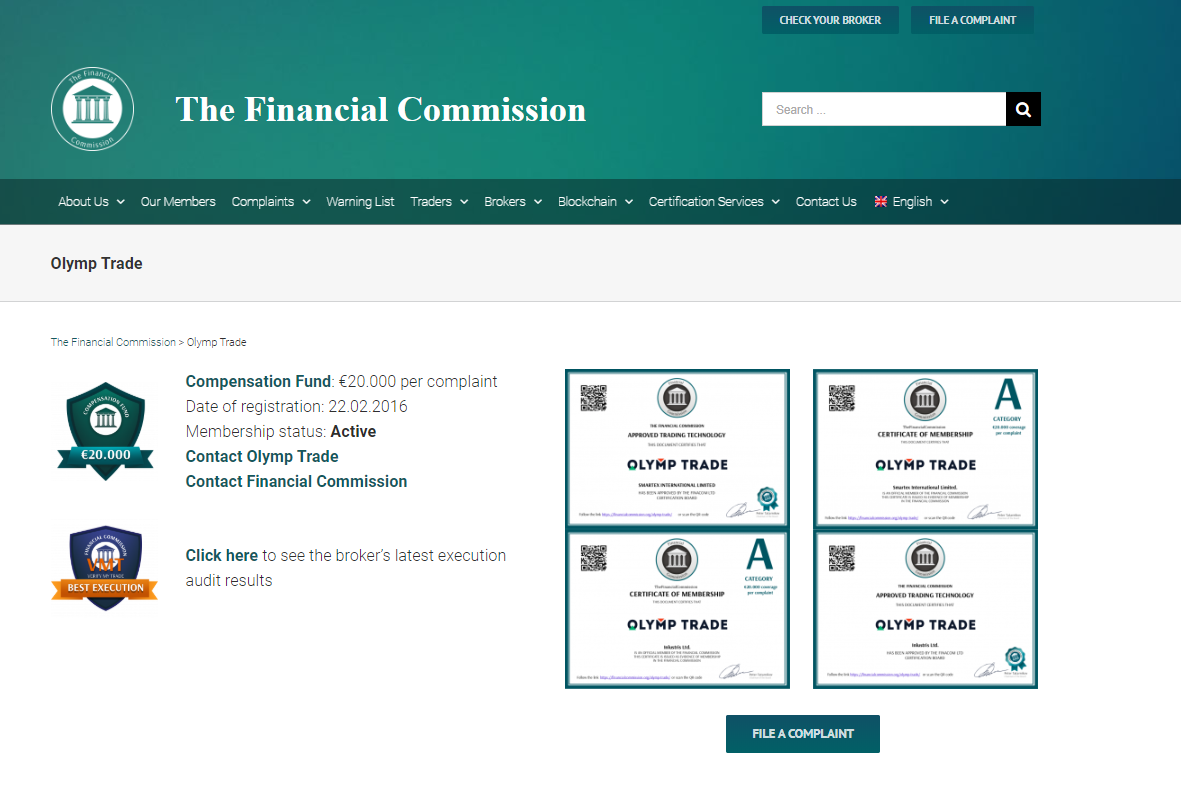

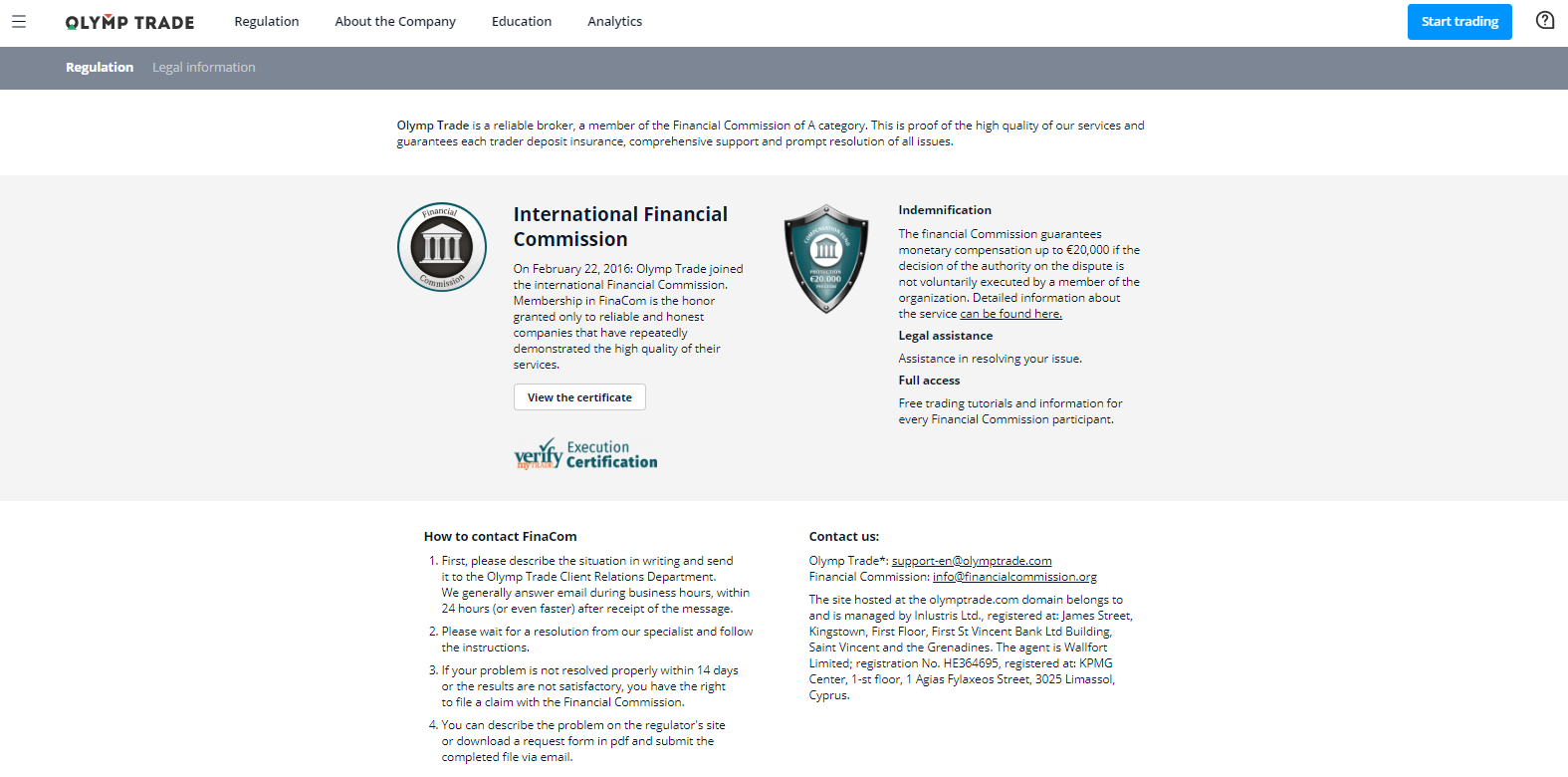

OlympTrade is a member of The Financial Commission which is the first independent self-regulatory organization and external dispute resolution (EDR) body for the Forex market. It is referred to as FinaCom and based in Hong Kong. FinaCom (aka Verify My Trade) makes it clear that it is not regulated or registered as an EDR in any jurisdiction. Forex traders should not confuse this with a government regulator who has enforcement capabilities but view it as a loose layer of protection in case something goes wrong.

The full company registration can be viewed here:

OlympTrade became an official member of FinaCom on February 22nd 2016, under its previous owner Smartex International LTD. Commission Chairman Peter Tatarnikov stated on the same day that “Binary Options are considered a new and highly automated products, with all trading done on electronic platform. Unfortunately, there is no singular standard that binary options shall adhere to and this is why trading technology certification is a crucial point in obtaining the status with the Financial Commission. In order to provide clients with fair dispute resolution we must fully understand system’s execution mechanism and price determination process. Today we gladly welcome OlympTrade to our organization and believe it is a great step for the broker to leverage its credibility and grow its business globally.”

Taking it one step further, OlympTrade is a member of The Financial Commission which is the first independent self-regulatory organization and external dispute resolution (EDR) body for the Forex market. It is referred to as FinaCom and based in Hong Kong. FinaCom makes it clear that it is not regulated or registered as an EDR in any jurisdiction. Forex traders should not confuse this with a government regulator who has enforcement capabilities but view it as a loose layer of protection in case something goes wrong.

OlympTrade became an official member of FinaCom on February 22nd 2016, under its previous owner Smartex International LTD. Commission Chairman Peter Tatarnikov stated on the same day that “Binary Options are considered a new and highly automated products, with all trading done on electronic platform. Unfortunately, there is no singular standard that binary options shall adhere to and this is why trading technology certification is a crucial point in obtaining the status with the Financial Commission. In order to provide clients with fair dispute resolution we must fully understand system’s execution mechanism and price determination process. Today we gladly welcome OlympTrade to our organization and believe it is a great step for the broker to leverage its credibility and grow its business globally.”

As a member of FinaCom, OlympTrade “users” as the company refers to its traders, are covered up to €20,000 per complaint as per guidelines of the FinaCom Compensation Fund.

The payment agent is listed as Wallfort LTD, registered in Cyprus with registration number HE364695. This doesn’t mean that OlympTrade is governed by the regulatory framework of the EU and Cyprus, only the registered payment agent. A search on Cyprus Company House did reveal the existence of Wallfort LTD, same address with a different registration number.

OlympTrade does ask its “users” to contact the company first in order to resolve any issues within 14 days which makes perfect sense. Likewise, some may argue that client protection is better with the current set-up than with many smaller regulators in island nations and the lack of any major misconduct by OlympTrade suggests that “users” should be alright trading here.

When it comes down to the wire, each individual needs to decide if the offered framework is sufficient or not. The conclusion of this OlympTrade review is that it is comparable to most government regulatory bodies without the enforcement capabilities, but with a better approach and more flexibility. The ultimate verdict needs to be evaluated on a case-by-case basis, but OlympTrade did take the proper steps in what could be a model for a future regulatory approach of broker which commands respect.

Fees

Binary option brokers are the direct counter-party to each trade which means that 100% of trader losses are booked as profits by the broker. Orders are usually kept purely in-house so items such as liquidity do not apply. Traders will need to predict the price of an option by the expiration time in order to earn a profit. Each option has a payout ratio and if the prediction was correct even by just one pipette, the fifth decimal place of a currency quote, the trader will get the payout plus the original trade balance.

This has been one of the biggest controversies of binary option trading, as the brokers earn a profit no matter the outcome. Here is an example on a $100 binary option which carries a payout ration of 82%:

- In case the prediction is incorrect, the trader will lose $100 which the broker books as a profit.

- In case the prediction is correct, the trader will receive the $100 back plus $82 while the broker theoretically books $18 in profits.

- A trader who places two $100 trades, gets one wrong and one right with the same payout ratio, will be left with a net loss of $18. Since most traders run their accounts at a loss, the math tends to always work in favor of the broker who rarely, if ever, has to provide working capital for withdrawals.

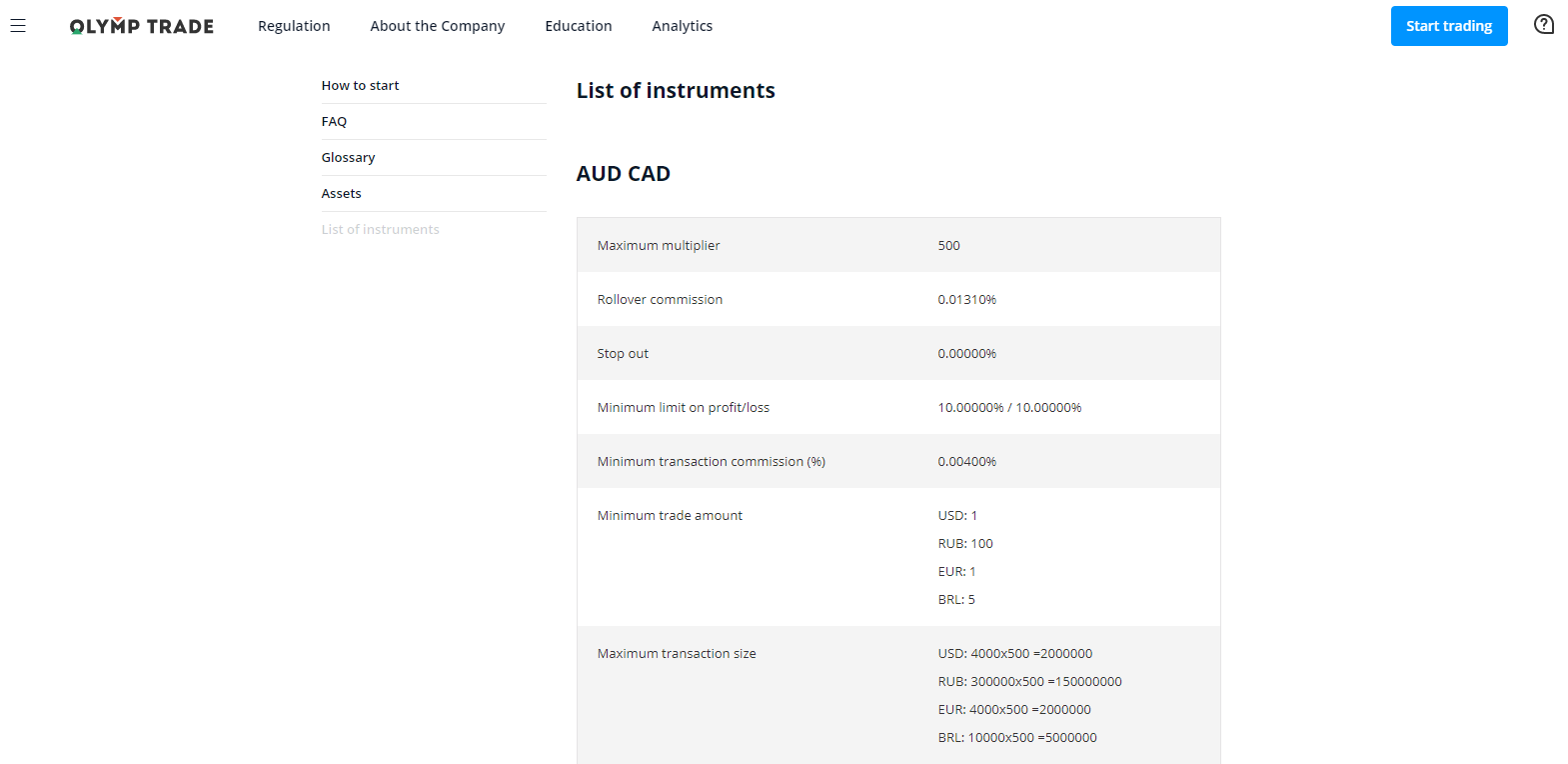

OlympTrade also charges a minimum transaction commission which is listed as 0.0040% as well as a rollover commission which is dependent on the traded asset; this should apply to Forex trades only which are also offered by this broker. An account inactivity fee of $/€10 will be applied after 180 days as per their Non-trading Transaction Policy.

OlympTrade provides a nice and quick overview of trading costs associated with each asset which follows the sample below.

It is very important to note that traders can sell their option before its expiry and return part of the investment if they see it’s headed for a loss. This will help mitigate the risks of the trade.

What Can I Trade

OlympTrade offers a good mix of assets across currency pairs, commodities, ETFs, CFDs, cryptocurrencies, stocks and indices. The selection was a nice surprise and allows traders to diversify their portfolio well. Every tradable asset is clearly listed on the company’s website, so traders can see at a glance if their preferred assets are available. In addition to standard currency pairs like the EUR/USD and GBP/JPY, OlympTrade offers trading of popular stocks such as Facebook, Google, Microsoft, and Coca Cola. It should be noted that when trading stocks with OlympTrade, the trader does not own physical shares of the stock (or any asset).

Account Types

OlympTrade offers only one account type to all its traders with a minimum deposit of $/€10. Maximum leverage is 1:500 and the minimum trade size is $/€1 or account equivalent. Accounts are available in USD, EUR, Russian Rubble and Brazilian Real which suggests that Russian clients as well as Latin American clients appear to make up a decent size of its total client base. No further details about account types were available.

Trading Platforms

OlympTrade offers its own trading platform which is available as a web version or a desktop version and it also comes as a mobile version. Unfortunately, no online demo preview is available. Access to MT4 is also available, but the terms of the usage remain unclear.

Unique Features

The OlympTrade blog offers traders a very nice mix of everything related to trading and a bit more. It is well organized and nicely operated which will keep traders coming back for more. It is clear that plenty of attention has gone into this blog. It is split into the following categories: Analytics, Platform News, Education, FAQ and Lifestyle. OlympTrade uses this blog to communicate with its “users”, engage with them and inform them about everything that’s going on with the company. Job well done!

Analytics

This section provides traders with daily market analysis and commentary which is well presented.

Platform News

This is where the broker shares developments with regard to operations, updates, promotions and other content largely related to the back-office operations of the trading account.

Education

Educational material is provided in this section, this is different than the “Education” section and offers more fundamental as well as inspirational content.

FAQ

Besides answering basic questions more broadly than in the website’s FAQ section, OlympTrade uses this to highlight special discussions where a VIP account is also mentioned. In order to find out more about the account upgrade, traders should contact support.

Lifestyle

This space is dedicated for everything around trading without talking about trading itself. A nice idea and an interesting read no matter what type of trader you are.

Research and Education

There is an “Analytics” section on the website which has the following three categories: Economic Calendar, Trading signals and Volatility. The Analytics section is rather disappointing with a blank page under Economic Calendar, a description on how to get trading signals from inside the trading platform under Trading signals and an article on trading hours under Volatility. The content on the blog is by far superior.

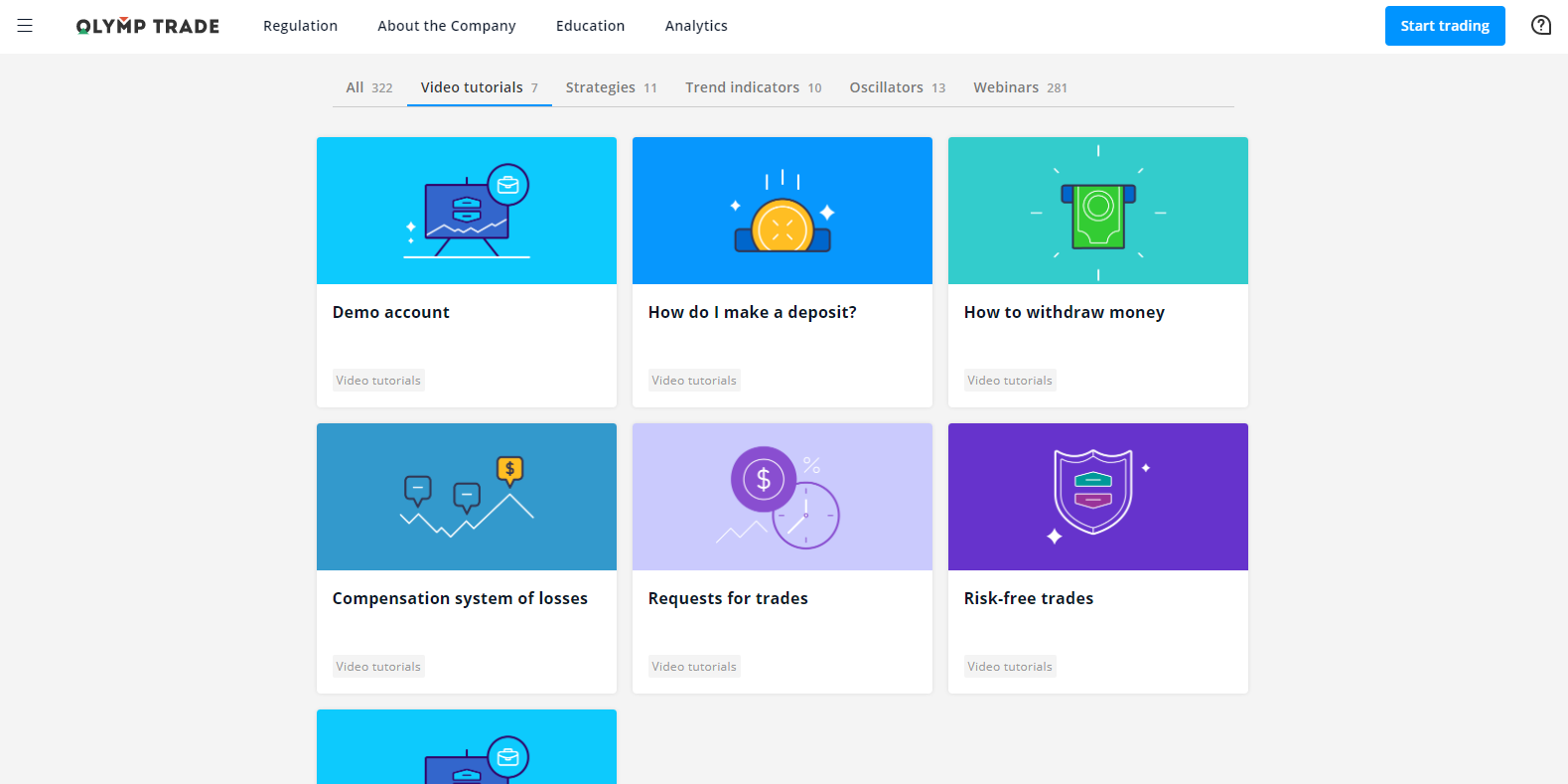

The “Education” section is the opposite of the “Analytics” section and offers great content with plenty of trading lessons. It is broken down into the following categories: Video tutorials, Strategies, Trend indicators, Oscillators and Webinars. Great, quality content!

Trading signals

Education

OlympTrade takes education seriously which is a great thing and the final result shows the hard work which went into it. The presentation is excellent, traders can click in a topic which then zoom into focus and by clicking learn more a sidebar opens which discusses the topic and gives examples. This is an overall great educational course for new traders!

Video Tutorials

Seven videos talk traders through the basics of trading at OlympTrade, it would be nice if more videos are added in the future.

Strategies

11 different strategies were described at the time of this OlympTrade review. The combination of written content and videos offer the right mix and the final product is a great introduction to trading strategies.

Trend Indicators

The same principal applies as before minus the videos and 10 different indicators are introduced to new traders.

Oscillators

This picks up where the previous section ended and further enhances on the topic of technical analysis.

Webinars

This section comes packed with 281 webinars and counting. Several are held and uploaded every week which is definitely a great feature and keeps traders coming back for more. OlympTrade did an excellent job here.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

Customer support is available 24/7 and clients can either call two hotlines, send an e-mail or open a chat client. Most questions are already answered in the blog or the FAQ section.

Bonuses and Promotions

At the time of this review no bonuses or promotions were offered.

Opening an Account

Opening an account at OlympTrade is done online which is standard operating procedure. As far as verification is concerned, their FAQ states that it is available upon request. Apparently, it is not a requirement and it is unclear what benefits come with verification. Under “Legal Information”, KYC and AML guidelines are mentioned which would require client verification. This suggests that the FAQ part could be a typo, but more clarity would be welcomed.

Deposits and Withdrawals

In order to get the deposit and withdrawal options, an account is required which is rather disappointing as this information should be readily available. OlympTrade claims that it covers all commissions, but this may exclude third party wire charges if this is an option. The minimum deposit or withdrawal amount is $/€10. The maximum withdrawal period is listed as 5 days with 90% of requests processed within 24 hours.In order to get the deposit and withdrawal options, an account is required which is rather disappointing as this information should be readily available. OlympTrade claims that it covers all commissions, but this may exclude third party wire charges if this is an option. The minimum deposit or withdrawal amount is $/€10. The maximum withdrawal period is listed as 5 days with 90% of requests processed within 24 hours.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

OlympTrade is an interesting broker to start with. It survived the binary option purge and is now expanding its business with little competition. The broker remains officially unregulated but has two non-government outlets which certified this broker. It offers the same investor compensation coverage as a CySEC registered broker without enforcement capabilities. Owners have changed after the previous one was under investigation due to marketing related companies it doesn’t offer services for EU member countries or Russian citizens as a result of the investigation.

Despite its spotted past, this broker has gone to lengths to demonstrate its goodwill and fair practices as evident by its membership of FMRRC based in Russia and FinaCom based in Hong Kong; both are self-regulated bodies which aim to promote a fair trading environment. This can be compared to hybrid approach to regulation and may very well be the future. OlympTrade has a nice selection of assets and the educational material is excellent. Another highlight is its blog which is managed very well.

Traders who are interested in binary options trading should definitely consider OlympTrade which appears to be in the running to carve out a top spot in this thinned niche market of the financial world. The low minimum deposit makes it attractive for all types of new retail traders as long as they are located in a country which is served by this binary options OlympTrade is based in Saint Vincent and the Grenadines. OlympTrade is the counter-party to each placed trade and generates its income through losses by traders. It also offers Forex trading where it charges a commission and a rollover commission. OlympTrade claims to offer various methods, but no details are provided in their website. More information is available after an account is opened. OlympTrade has a minimum trade size requirement of $/€1. OlympTrade enforces a stop out at a 0% Equity-to-Margin ratio. OlympTrade is currently not regulated by a government entity, but it is registered with two non-government bodies which provideda similar framework and investor protection/compensation than a regulated broker, without the enforcement capabilities. OlympTrade offers a maximum leverage of 1:500 in all accounts. OlympTrade offers an online application form. No, OlympTrade offers its own trading platform.FAQs

Where is OlympTrade based?

How does OlympTrade make money?

How can I deposit into an OlympTrade account?

What is the minimum trade size at OlympTrade?

When does a stop out take place at OlympTrade?

Is OlympTrade regulated?

What is the maximum leverage offered by OlympTrade?

How do I open an account with OlympTrade?

Does OlympTrade offer the MetaTrader Trading Platform?