Editor’s Verdict

Optimus Futures is an introducing broker for five brokers and offers exclusive futures trading for US residents. Founded in 2004, Optimus Futures offers its proprietary trading platform, MT5, TradingView, and 16 additional choices. The cost structure includes volume-based rebates. Therefore, I consider Optimus Futures a good choice among execution-only brokers for US-resident futures traders. I reviewed this broker to evaluate its trading conditions. Is Optimus Futures the best broker for your futures portfolio?

Overview

Optimus Futures offers a quality trading platform choice with competitive fees.

Headquarters | United States |

|---|---|

Regulators | CFTC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2004 |

Execution Type(s) | Market Maker |

Minimum Deposit | $500 |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 5, Proprietary platform, Trading View |

Average Trading Cost EUR/USD | Undisclosed |

Average Trading Cost GBP/USD | Undisclosed |

Average Trading Cost WTI Crude Oil | Undisclosed |

Average Trading Cost Gold | Undisclosed |

Average Trading Cost Bitcoin | Not applicable |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Funding Methods | 2 |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Optimus Futures Five Core Takeaways:

- $500 minimum deposit requirement

- A balanced asset selection for a pure-play futures broker

- 24-hour trade desk

- Volume-based rebates on commissions

- Only bank-associated payment processors

Optimus Futures Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. Optimus Futures has one regulated entity.

Country of the Regulator | United States |

|---|---|

Name of the Regulator | CFTC |

Regulatory License Number | 0481133 |

Regulatory Tier | 1 |

Is Optimus Futures Legit and Safe?

My Optimus Futures found no misconduct or malpractice by this broker. Therefore, I rate Optimus Futures as a legitimate and safe broker.

Optimus Futures regulation and security components:

- Optimus Futures is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association

- Founded in 2004

- Segregation of client deposits from corporate funds

- No negative balance protection

What would I like Optimus Futures to add?

Optimus Futures lacks investor protection features, which is typical for US-based brokers but does not make it right. I would appreciate it if Optimus Futures offered third-party insurance. I am also missing details concerning the core management team.

Fees

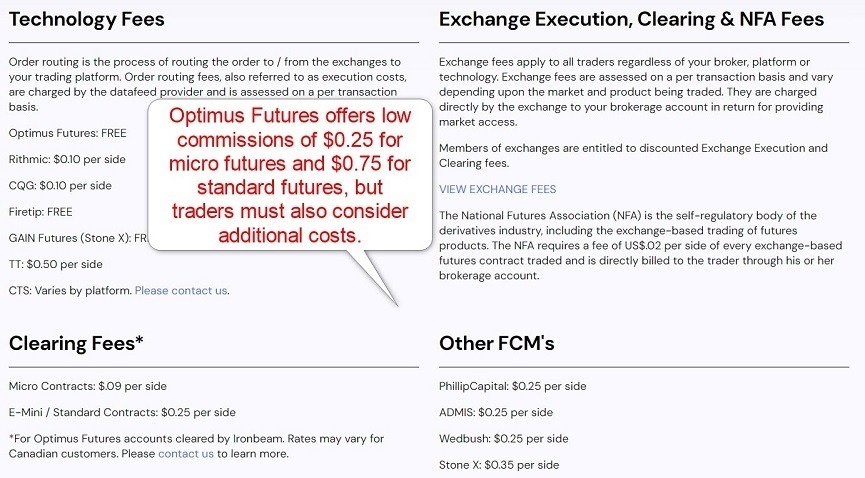

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Optimus Futures offers competitive commissions with volume-based rebates that can decrease commissions to $0.05 per side, but traders must consider additional costs listed transparently on its website.

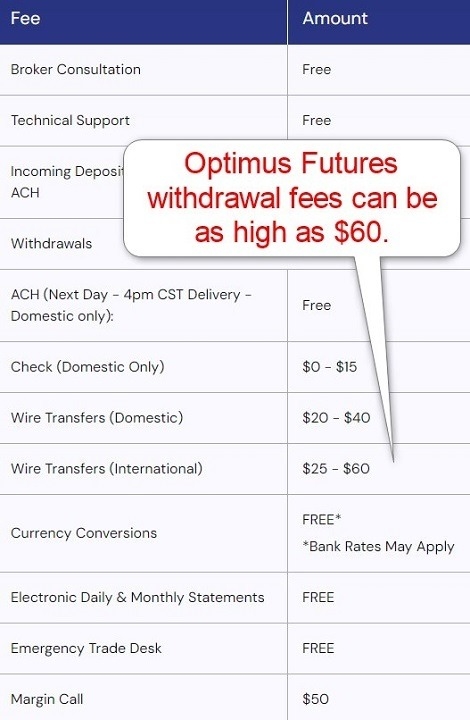

Optimus Futures does not charge deposit fees, but a withdrawal fee of up to $60 may apply, depending on the withdrawal. An inactivity fee does not exist, but traders may pay currency conversion costs at bank rates if required. Optimus Futures also levies a $50.00 fee per margin call.

Average Trading Cost EUR/USD | Undisclosed |

|---|---|

Average Trading Cost GBP/USD | Undisclosed |

Average Trading Cost WTI Crude Oil | Undisclosed |

Average Trading Cost Gold | Undisclosed |

Average Trading Cost Bitcoin | Not applicable |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

Range of Assets

Optimus Futures is a pure-play futures introducing broker. The asset selection is balanced and supports many trading strategies with medium cross-asset diversification.

Optimus Futures offers the following sectors:

- Micro E-mini futures (US indices)

- Equity index futures (global selection)

- Forex futures (including micro futures)

- Energy futures

- Metal futures

- Financial futures

- Grain futures

- Soft commodity futures

- Meat futures

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Optimus Futures Leverage

Optimus Futures does not list margin requirements as a ratio but provides a detailed list of day trading and maintenance margins per contract, which does not change based on the price of the futures contract. Therefore, the margin ratio varies between contracts.

What should traders know about Optimus Futures’s leverage?

- The minimum day trading margin depends on the asset and is as low as $25.00 and as high as $15,720 per contract

- The minimum maintenance margin depends on the asset and is as low as $132 and as high as $15,720 per contract

- Negative balance protection does not exist

- Optimus Futures limits overnight positions to 20 mini or standard contracts and 200 micro contracts (traders can contact Optimus Futures to request an increase)

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses

Account Types

Optimus Futures offers one account type to all traders, including volume-based discounts. Other choices are for specific purposes. Despite low commissions, I urge high-volume and high-frequency traders to consider all trading fees.

Optimus Futures offers the following account types:

- Individual

- Joint

- IRA

- Superannuation

- Corporate

- US Limited Liability Company (LLC)

- Partnership

- Trust

My observations concerning the Optimus Futures account type are:

- A $500 minimum deposit requirement

- Volume-based rebates

- No inactivity fee

- Micro futures with a tick value as low as 0.01

- Nano Bitcoin futures with day trading margins from $25

Optimus Futures Demo Account

Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations.

What stands out about the Optimus Futures demo account?

- A demo account requires registration but no account verification

- Traders can switch between demo and live trading in the proprietary Optimus Futures trading platform

- Optimus Futures does not offer details concerning its demo account

Trading Platforms

Optimus Futures offers an excellent choice of trading platforms, including its proprietary Optimus Flow, the algorithmic trading platform MT5, and the social trading platform TradingView. Traders get 16 additional alternatives, and five trading platforms are free, while the remaining platforms cost between $25 and $775 monthly.

I like the wealth of trading platform choices, as it allows traders to trade futures in the way that suits them best, including algorithmic, copy, and social trading. Optimus Futures ranks among the best brokers in this category.

Notable features of the Optimus Flow trading platform include:

- Visually stunning charts

- 50 prebuilt indicators, drawing tools, and studies for in-depth market analysis

- One-click chart trading

- Eight order types, including OCO (One Cancels-Other) and bracket order orders

- Hot Buttons for faster trade management

- Custom alerts and notifications based on pre-defined conditions

- Volume analysis tool

- DOM Surface for order flow trading

- TPO (Time-Price Opportunity) Profile to analyze the trading activity

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

Optimus Futures’ unique features are its choice of trading platforms, the 24-hour trade desk, and the volume-based rebate program. It places Optimus Futures among the best US futures brokers.

Research & Education

Optimus Futures neither provides in-house research nor sources third-party research, as it is an execution-only futures broker for DIY traders.

What about education at Optimus Futures?

Optimus Futures offers beginners educational content via podcasts and an extensive video library. While Optimus Futures lacks a dedicated classroom-style educational section, it presents beginners with plenty of quality content.

My conclusion:

- First-time traders can browse available content for valuable lessons

- I strongly recommend that beginners seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management

- Avoid paid-for courses and mentors

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Undislcosed |

Website Languages |  |

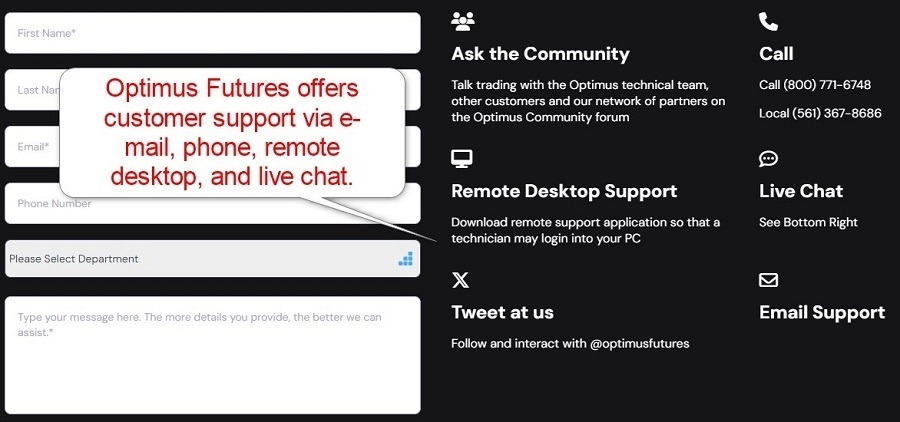

Optimus Futures offers customer support via e-mail, phone, remote desktop, and live chat but does not disclose customer support hours. While Optimus Futures describes its products and services well, with no reason to contact customer support during my Optimus Futures review, I recommend the FAQ section and Optimus Community as the first support method.

Noteworthy:

- Optimus Futures offers phone support, but I miss a direct line to the finance department, where most issues can arise

Bonuses and Promotions

During my Optimus Futures review, neither bonuses nor promotions existed.

Opening an Account

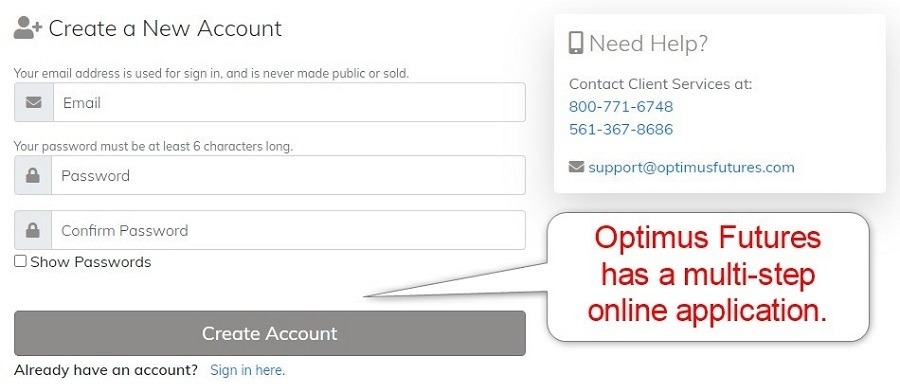

The first step of the Optimus Futures online application asks for an e-mail address and desired password. Clicking “Create Account” continues the application, where traders select their account type and trading objective, followed by personal details and data mining for employment and financial data.

What should traders know about the Optimus Futures account opening process?

- Optimus Futures complies with global AML/KYC requirements

- Account verification is mandatory

- Most traders pass verification by uploading a copy of a government-issued ID and a proof of residency document issued within the past six months

- Optimus Futures may ask for additional information on a case-by-case basis

Minimum Deposit

The minimum deposit requirement is $500.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |   |

Optimus Futures supports bank wires and checks.

Accepted Countries

Optimus Futures only accepts US-resident traders.

Deposits and Withdrawals

The secure Optimus Futures back office handles all financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at Optimus Futures?

- The minimum deposit is $500 for micro futures trading and $2,000 for mini and standard futures

- Optimus Futures does not charge deposit fees

- Optimus Futures is not the custodian of deposits, but traders can choose their preferred futures clearing merchants of Ironbeam, ADMIS, StoneX, Phillip Capital, or Wedbush

- Traders may incur withdrawal fees of up to $60

- External processing times and fees depend on the bank

- In compliance with AML regulations, the name of the trading account and payment processor must be identical

Is Optimus Futures a good broker?

I like the trading environment at Optimus Futures for its trading platform choices, volume-based rebate program, and free 24-hour trading desk support. Commissions are competitive, but traders must consider all transaction fees, including potential data fees, depending on their requirements. The asset selection is well-balanced for a pure-play futures broker, and Optimus Futures is a well-trusted introducing broker with 20+ years of experience. Therefore, I recommend Optimus Futures for demanding futures traders. The minimum deposit at Optimus Futures is $500 for micro-futures trading and $2,000 for mini and standard futures. The US CFTC regulates Optimus Futures, an introducing broker operational since 2004 with a clean track record.FAQs

What is the minimum balance for Optimus Futures?

Is Optimus Futures regulated?