For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

PipFarm was founded in 2023. It is operated by ECI Ventures Pte. Ltd. (UEN 202329954C) in Singapore. PipFarm's scaling program is notable, covering profit share and maximum funds under management. Traders can choose from 7 funded account options with generous trading conditions. My PipFarm review evaluates this retail prop trading firm’s scaling and trading conditions. Is PipFarm the best retail prop firm for your strategy?

Overview

Year Established | 2023 |

|---|---|

Trading Platform(s) | cTrader |

Minimum Evaluation Fee | 50$ |

Profit-share | 70% - 95% |

Daily Loss Limit | 3% |

Minimum Funded Account | $5,000 |

Maximum Funded Account | $300,000 |

The Pros & Cons of the PipFarm

Traders should consider the pros and cons of PipFarm. I have summarized the ones that stood out the most during my review.

PipFarm offers industry-leading scalability for profitable traders. |

I like that PipFarm offers traders the ability to scale their profit share from 70% to 95% and their maximum assets under management from $300,000 to $1,500,000 via the five-tier rank promotions. The smallest challenge amount starts from $5,000 and scales to $15,000. The minimum evaluation fee at PipFarm ranks among the lowest among all prop firms I have reviewed, and existing prop traders praise the management team and customer support.

PipFarm partnered with a quality broker, TopFX. I also appreciate the maximum time limit of 365 days during the evaluation period, as it eliminates unnecessary time pressure on top of performance pressure.

PipFarm Trustworthiness & Reputation

Trading with a prop firm, an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts and that the prop firm maintains an excellent reputation among its prop traders.

Is the PipFarm Legit and Safe?

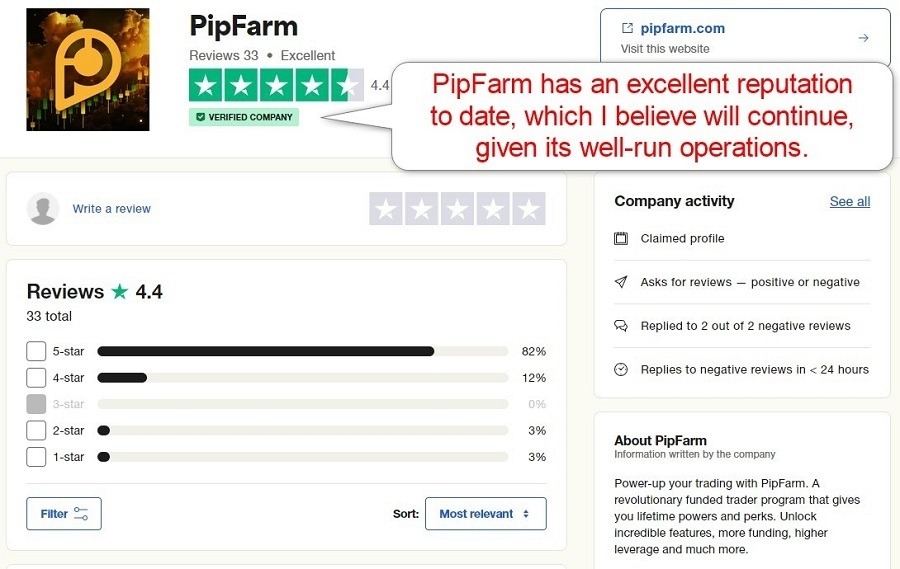

PipFarm is an established retail prop trading firm founded in 2023 in Singapore and operated by ECI Ventures Pte. Ltd. (UEN 202329954C). I rank them among the best-run among the dozens of prop firms I have reviewed. It has a 4.4 out of 5.0 rating on Trustpilot based on 33 reviews.

PipFarm responded quickly to the two negative reviews on Trustpilot when I wrote my review. I advise traders to consider the negative comments sceptically, as they could come from traders who have failed the paid-for evaluation challenge or violated trading rules. Therefore, I rate PipFarm as a prop trading firm interested traders should consider.

PipFarm Features

PipFarm follows best practices established across the prop firm industry, an expanding sub-sector of the retail financial sector.

The most notable features of the PipFarm are:

- 3 minimum trading days during the evaluation with 365 maximum trading days.

- One-phase evaluation with a trailing maximum drawdown of 12% and a profit target of 12%.

- Two-phase evaluation with a static maximum drawdown of 9% and a 6%-6% profit target.

- A 3% daily loss limit.

- Popular cTrader platform

- Market data provided by TopFX

- Up to 95% profit share.

- 1:50 leverage

- Multiple payout methods, including via USDT.

- Up to $1,500,000 funding per trader.

- Five-tier rank promotions that improve trading conditions.

Evaluation Fees & Profit-Share

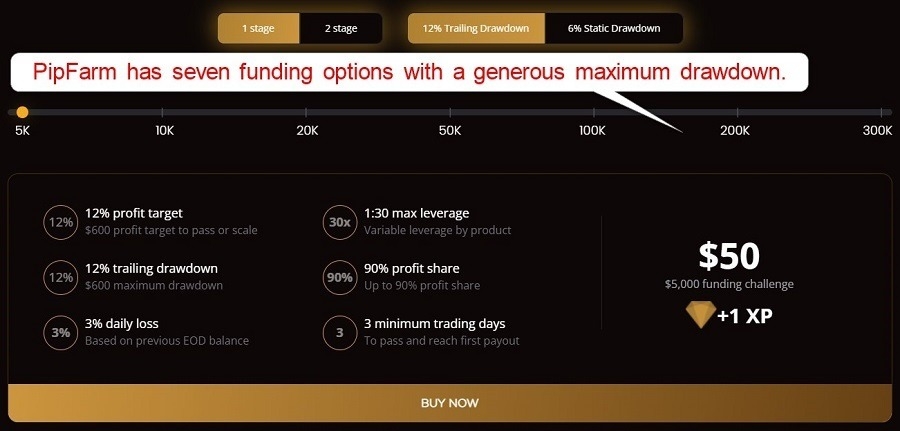

Notably, PipFarm does not charge for add-ons, but PipFarm evaluation fees depend on the desired funded account size. Traders pay between $50 and $1,550 per challenge, regardless of whether they opt for the one-step or two-step evaluation challenge.

Traders can choose between 7 funded account options and scale the profit share from 70% to 95%. Please note that traders cannot change the account value once approved, meaning if they qualify on a $5,000 account, they will manage a $5,000 portfolio.

The minimum evaluation fee at PipFarm for a $5,000 account is: set out below. Note that the maximum exposure on a $5,000 account with 1:30 leverage is 1.5 lots of USD/XXX.

Type of fee | Fee (without discounts) |

One-time evaluation fee | $50 |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | $0 |

Double leveraged | Not applicable |

Stop-loss is not required at trade entry. | $0 |

Total fees for a $5,000 account | $50 |

Account Types

PipFarm offers a one-step or a two-step evaluation with 7 account options. Traders can qualify to manage the following portfolio sizes: $5,000, $10,000, $20,000, $50,000, $100,000, $200,000, and $300,000. For the one-step evaluation, traders can opt for a trailing or static maximum drawdown.

The evaluation challenge has trading conditions that traders should understand to avoid disqualification. Traders may use cBots in the cTrader trading platforms with a maximum leverage of 1:30. All accounts use market data provided by TopFX.

What are the Trading Rules at PipFarm?

PipFarm evaluation begins after prospective prop traders choose their preferred evaluation account and pay the non-refundable one-time evaluation fee. Traders must reach the 12% profit target within 365 days, but they must trade for at least 3 days. The profit target is 12%, split into 6% and 6% for the two-step evaluation.

Violating the maximum overall loss or daily loss rules results in a hard breach and cancellation of the evaluation.

The trading rules for the PipFarm evaluation are:

- 9% to 12% maximum loss from the starting balance. There are various maximum loss options to choose from within these parameters.

- 3% daily loss limit.

- No copy trading software connected to copy other PipFarm traders.

- No high-frequency trading.

- No sharing of account details.

- No account hedging between PipFarm evaluation accounts.

- No aggressive all-in trading mentality.

Noteworthy:

- If you breach your funded account, you can still keep the profits (other firms make you forfeit the profits).

- No news trading restrictions

- No max lots rule

- No scalping regulations

- Swing trading is permitted

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

PipFarm offers cTrader and permits algorithmic trading via cBots. The maximum leverage is 1:30, and TopFX trading fees apply, which include $6.00 commissions per 1.0 standard round lot. Traders can lower them to $3.00 with the first level of the five-tier rank promotions. PipFarm lists trading conditions transparently on its website. cTrader is a quality trading platform, for several reasons:

- It is a very transparent trading platform with detailed trade receipts and execution reports.

It has excellent risk management tools, including detailed calculators, warnings and tools tips.

Education

PipFarm does not offer education, and beginners should never consider prop trading. I like the fact that PipFarm does not target beginners. During my PipFarm review, the blog explained how PipFarm functions and offered FAQ-style posts and corporate updates but no educational content. PipFarm will soon be launching courses here related to wellness and psychology, specifically for enhancing performance.

Customer Support

Website Languages |  |

|---|

PipFarm provides customer support via e-mail, live chat, and phone, but I recommend the FAQ section on the website as the first support method. PipFarm’s customer support team are all traders and well-trained on PipFarm’s offering, so are able to handle any issue. PipFarm has a strong community in Discord where thousands of active traders support each other’s endeavours.

How to Get Started with the PipFarm

Minimum Evaluation Fee

The minimum evaluation fee at PipFarm is $50 for the $5,000 evaluation.

Payment Methods

PipFarm accepts credit/debit cards, Skrill, Rapid Transfer, Klarna, MBWay, Multibanco, MyBank, ePay, Przelewy24, Blik, Boleto, PIX, Payco, PayPal, Coinbase Commerce and various cryptocurrencies.

Accepted Countries

The PipFarm lists the following countries of residence as ineligible for its services: Afghanistan, the Central African Republic, the Congo Republic, Crimea, the Democratic Republic of Congo, Iran, Libya, North Korea, Somalia, South Sudan, Sudan, Syria, the United States of America and Yemen.

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via credit/debit cards, Skrill, Rapid Transfer, Klarna, MBWay, Multibanco, MyBank, ePay, Przelewy24, Blik, Boleto, PIX, PayPal, Coinbase Commerce and various cryptocurrencies. Please note that withdrawals are also available via Risework.

PipFarm Payouts

PipFarm has paid out over $100K to its traders, all verifiable by blockchain. Qualified payouts are made within hours of their qualification.

The Bottom Line - Is the PipFarm a Good Prop Firm?

I like PipFarm as it presents a well-run company with good management, high-quality, responsive customer support, and excellent scalability via five-tier rank promotions. The one-time evaluation fee ranks among the cheapest I have reviewed from dozens of prop firms, and the evaluation conditions are generous. PipFarm partnered with TopFX as its broker and has few trading restrictions. Algorithmic trading is allowed on cTrader using cBots. Therefore, I recommend PipFarm to prop traders who are genuine about increasing their assets under management and improving their trading conditions by delivering consistent performance. I rank PipFarm among the best retail Forex prop firms.

Traders may consider PipFarm safe, and I rank it among the best retail prop firms in the industry. My PipFarm review found no verifiable claims of fraud, scam, or malpractice, and the owner is a duly registered company in Singapore. Retail prop traders can withdraw their profit share through a payment system called Riseworks, which pays out profits via local bank transfer or USDC. Alternatively, you can request payout via Skrill, Binance Pay or USDT. Like all prop trading firms, PipFarm is unregulated but owned by a duly registered Singapore-based company partnered with TopFX. PipFarm has a proven record of always paying any qualified payout where there has been no applicable breach of challenge rules. PipFarm is a legitimate company registered in Singapore and operated by ECI Ventures Pte. Ltd. (UEN 202329954C). The CEO has over a decade of experience leading fintech companies.FAQs

Is PipFarm safe?

How can I withdraw from PipFarm?

Is PipFarm regulated?

Are PipFarm payouts guaranteed?

Is PipFarm legit?