Editor’s Verdict

Plus500 Futures is the US-based futures broker subsidiary of international multi-asset broker Plus500, aiming to simplify futures trading in the US with its low-cost trading environment. Besides standard contracts, Plus500 Futures offers mini and micro contracts from its user-friendly trading platform. I reviewed this futures broker to evaluate if it fulfills its promise of simple, fast, and accessible futures trading. Should you download the Plus500 Futures trading app today?

Pros

- Trusted broker

- Reasonable spreads and commissions

- User-friendly trading app

- Educational content and tools for beginners

Cons

- No negative balance protection

Overview

A reasonably priced US futures broker with a user-friendly mobile trading app and tools.

Headquarters | US |

|---|---|

Regulation | CFTC |

Year Established | 2022 |

Execution Type | Market Maker |

Minimum Deposit | $100 |

Trading Platform(s) | Proprietary trading platform |

Signals | No |

US Persons Accepted | Yes |

Islamic Account | No |

Segregated Account | Yes |

Managed Accounts | No |

Support Hours | 24/7 |

Customer Support | E-mail, live chat |

Demo Account | Yes |

Plus500 Futures brings its well-known proprietary trading platform to the US, including its mobile app. It offers seamless switching between live and demo accounts but only supports manual trading.

Retail Loss Rate | Undisclosed |

|---|---|

Regulation | CFTC |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Futures | $0.49 (mini) / $0.89 (standard) per side |

Commission for CFDs / DMA | Not applicable |

Cashback Rebates | No |

Minimum Deposit | $100 |

Inactivity Fee | No |

Deposit Fee | Third-Party |

Withdrawal Fee | $20 (bank wire) |

Funding Methods | 2 |

Plus500 Futures Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Plus500 Futures presents clients with one regulated entity and maintains a secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

US | Commodity Futures Trading Commission / NFA | 0001398 |

Is Plus500 Futures Legit and Safe?

Plus500 Futures launched in 2022, but its parent company Plus500 is a publicly listed UK company operational since 2008 and an FTSE 250 constituent. Since becoming publicly listed, Plus500 has had a clean regulatory track record and complies with numerous regulators globally. I trust it will bring the same expertise and operational excellence to the US and rank Plus500 Futures equally legit and safe as the rest of the Plus500 family.

Cunningham Commodities LLC, the wholly owned subsidiary of Plus500 Inc., provides the services of Plus500 Futures.

Fees

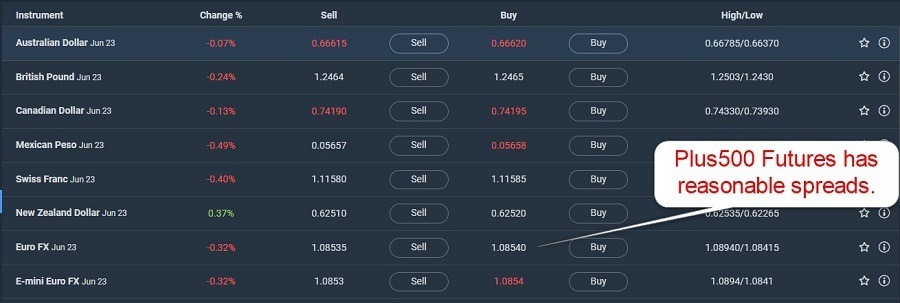

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Plus500 Futures shows minimum Forex futures spreads of 0.5 pips and minimum commissions between $0.49 and $0.89 per side per futures contract. The trading platform transparently lists all trading fees per contract in the order ticket. The Plus500 Futures cost structure places it among the cheaper ones for retail traders.

Here is a snapshot of Plus500 Futures spreads:

Deposit Fee | Third-Party |

|---|---|

Withdrawal Fee | $20 (bank wire) |

Inactivity Fee | No |

Minimum Commissions / Spreads | $0.49 - $0.89 per side / 0.5 - 1.0 pips |

Withdrawal Options | Bank wires, credit/debit cards |

Deposit Options | Bank wires, credit/debit cards |

Range of Assets

Traders are offered a selection of futures contracts, including mini and micro futures, covering 13 Forex pairs, 2 cryptocurrencies, 23 commodities, 10 indices, and 2 interest rates contracts. The range of assets is widest for commodity traders, who can benefit from a well-balanced choice of agricultural commodities, metals, and energies. I conclude the Plus500 Futures asset selection suffices for most traders, especially newer traders.

Asset List Overview

Currency Pairs | Yes |

|---|---|

Cryptocurrency Pairs | Yes |

Commodities and Metals | Yes |

Index CFDs | No |

Equity CFDs / DMA Shares | No |

Bonds | No |

ETFs | No |

Options, Futures, and Synthetics | Yes |

Maximum Retail Leverage | Contract dependent |

Maximum Pro Leverage | Contract dependent |

Plus500 Futures Trading Hours (EST)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Friday 23:00 |

Forex | Monday 00:00 | Friday 23:00 |

Commodities | Monday 00:00 | Friday 23:00 |

European Equities | Not applicable | Not applicable |

US Equities | Not applicable | Not applicable |

Account Types

Plus500 Futures has only one account type for retail traders. The account base currency is the US Dollar, and the minimum deposit is $100. Margin trading is available on all futures contracts, and the trading platform lists the necessary capital requirements per asset. Plus500 Futures promises to keep it simple and deliver on its promise.

Plus500 Futures Demo Account

Plus500 Futures offers demo accounts with a default account balance of $50,000. There is no expiry, and traders can easily switch between demo and live from the web-based trading platform. I recommend traders adjust the Plus500 Futures demo account balance to their planned live deposit amount, which they can do by navigating to “Funds” in the left-hand side menu.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to the full spectrum of trading psychology issues and can create unrealistic trading expectations.

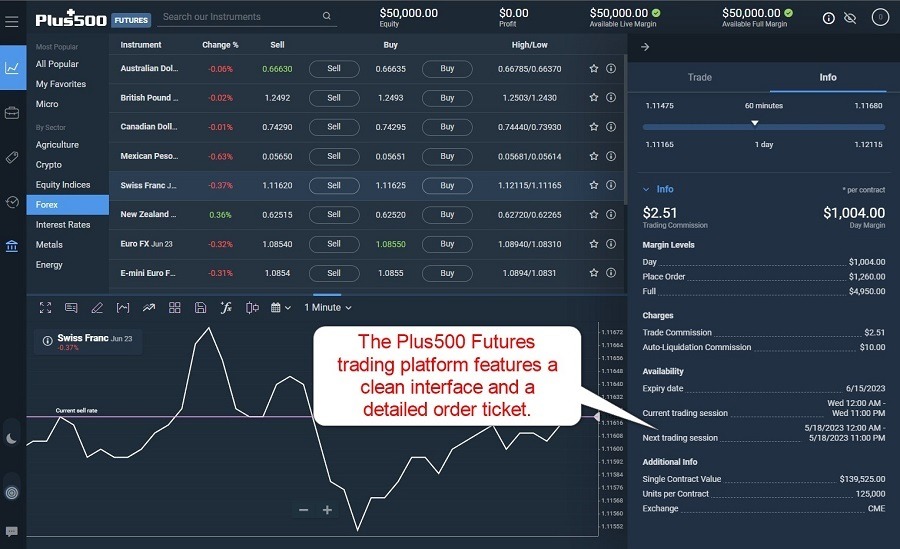

Trading Platforms

The simplicity extends to the Plus500 Futures trading platform, available as a web-based version or mobile app. It does not support algorithmic or copy trading but presents manual traders with a clean user interface. The order ticket includes all necessary details, including trading costs, day margin, place order margin, and full margin.

Overview of Trading Platforms

Platform Languages | English |

|---|---|

OS Comparability | Windows, Mac, Mobile |

Charting Package | Yes |

Scalping | Yes |

Hedging | Yes |

Mobile Alerts | Yes |

E-Mail Alerts | No |

Guaranteed Limit Orders | No |

Guaranteed Execution | No |

One-click Execution | No |

OCO Orders | No |

Interest on Margin | No |

Web-based Trading | Yes |

Mobile Trading | Yes |

MT4 | No |

MT5 | No |

cTrader | No |

Proprietary Platform | Yes |

Automated Trading | No |

Social Trading / Copy Trading | No |

MT4/MT5 Add-ons / Plugins | No |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Noteworthy:

- The Plus500 Futures trading infrastructure is not ideal for scalpers.

- Hedging is possible, but buying and selling the same volume in the same asset always results in netting.

Unique Features

Plus500 Futures focuses on delivering a simple futures trading experience and does not offer unique features besides its simplicity.

Research & Education

Plus500 Futures neither publishes in-house research or market commentary nor sources third-party content. It is an execution-only broker, which Plus500 Futures executes well, and I do not consider the absence of research a negative.

Beginner traders get a high-quality introduction to futures trading via the Plus500 Futures Academy. The content consists of short videos and well-written articles, which are ideal for the Plus500 Futures target group.

I recommend beginners start with the Plus500 Futures Academy before funding their trading account. I further advise beginners to seek in-depth education from third parties on trading psychology while avoiding paid-for courses.

Customer Support

Support Hours | 24/7 |

|---|---|

Customer Support | E-mail, live chat |

Website Languages | English |

Traders get 24/7 e-mail support, and the trading platform includes a live chat function, but service hours are unavailable. I recommend traders read the FAQ section, which answers most questions, and the order ticket lists all necessary information.

The Plus500 Futures trading environment is simplistic, and I doubt traders will require additional support.

Bonuses and Promotions

Plus500 US offers a deposit bonus of up to $200, which allows users to trade without paying commissions until the deposit amount is used up (for first deposits). When the deposit is completed, the respective bonus amount is automatically added to the trading account’s balance.

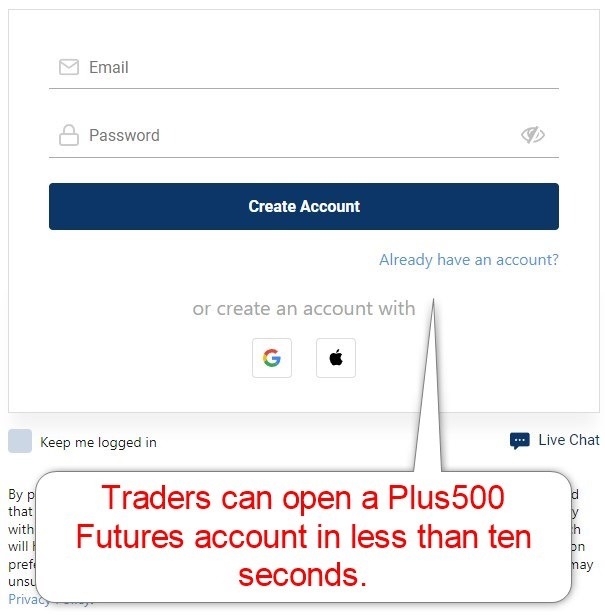

Opening an Account

The Plus500 Futures online account application only requires an e-mail and desired password. Traders may also use their Google or Apple IDs to open a Plus500 Futures trading account. I appreciate the straightforward approach, and Plus500 automatically opens a demo account with each registration.

Demo Account | Yes |

|---|---|

Managed Account | No |

Islamic Account | No |

Other Account Types | No |

OCO Orders | No |

Interest on Margin | No |

Account verification is mandatory, as Plus500 complies with global AML/KYC stipulations enforced by the CFTC. Most traders get verified after sending a copy of a government-issued ID and one proof of residency document. Plus500 Futures might ask for additional information on a case-by-case basis.

Minimum Deposit

The Plus500 Futures minimum deposit requirement is $100.

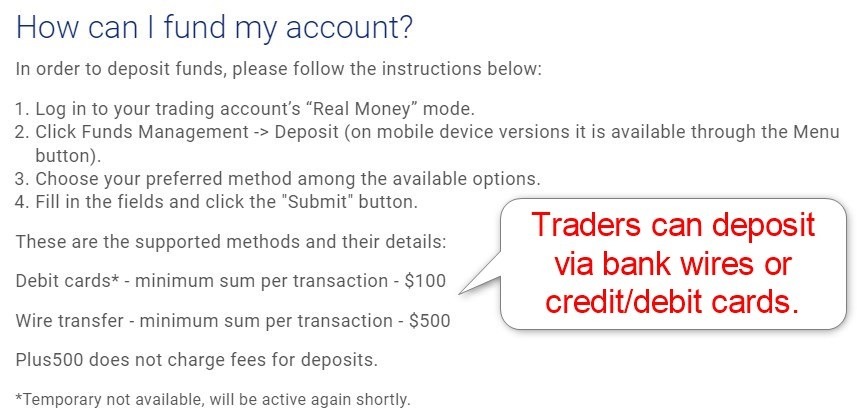

Payment Methods

Plus500 Futures supports bank wires and credit/debit cards, as well as ApplePay. Plus500 Futures is the first US trading platform to allow the use of ApplePay as a deposit. The minimum amount required for proessing through ApplePay is $100.

Accepted Countries

Plus500 Futures caters exclusively to US-based traders.

Deposits and Withdrawals

The secure Plus500 Futures trading platform handles all financial transactions for verified clients.

Plus500 only supports bank wires, where a $20 withdrawal fee applies, and credit/debit card transactions. The minimum deposit amount is $100. Plus500 Futures does not list a minimum withdrawal amount, and the finance department undertakes to process all withdrawal requests within three business days.

Only verified trading accounts can deposit and withdraw, and the name on the payment processor must match the Plus500 Futures account name. Plus500 Futures notes that it will send withdrawals to the funding source.

Is Plus500 Futures a good broker?

I like the simplistic trading environment for beginners at Plus500 Futures, as it offers a reasonably priced cost structure and a limited asset selection of liquid futures contracts. The order ticket includes all the data traders require, and the trading platform is user-friendly but only supports manual traders. The minimum deposit is $100, which is low for US-based brokers. Plus500 Futures promises a simple, fast, and accessible trading environment, and my review concluded that it delivers all three.

Furthermore, feel free to read our updated Plus500 broker review. Plus500 Futures is a futures broker, while eToro is a social and copy trading platform. Therefore, both serve a different market, and a direct comparison does not apply. Both brokers serve their core markets well. Plus500 Futures belongs to the Plus500 family of companies and ranks among the most trusted brokers. Trading futures is risky, but the risk depends on the traders and their ability to trade. Yes, traders can hedge their Plus500 futures account but buying and selling the same volume in the same asset results in netting. Yes, Plus500 Futures is exclusively a futures broker for US traders.FAQs

Is Plus500 Futures better than eToro?

Is Plus500 Futures risky?

Does Plus500 Futures allow hedging?

Can you trade futures on Plus500 Futures?