For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

PrimeXBT is a South African broker that has been operational since 2018, catering to 1M+ clients whom can access a wide range of tradable assets including Forex, crypto, commodities and stocks. Traders can choose between three platforms including MT5, also the proprietary platform. PrimeXBT which features an in-house copy trading service. PrimeXBT is among the best South African brokers with an expanded offering that caters perfectly to its target group. I evaluated the PrimeXBT trading environment during my in-depth PrimeXBT broker review. Should you trade with PrimeXBT?

Overview

Headquarters | South Africa |

|---|---|

Regulators | BCR, FSA, FSC Mauritius, FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2018 |

Execution Type(s) | Market Maker |

Minimum Deposit | $10 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 5, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | $9.00 |

Average Trading Cost GBP/USD | $16.00 |

Average Trading Cost WTI Crude Oil | $0.13 |

Average Trading Cost Gold | $0.38 |

Average Trading Cost Bitcoin | 0.01% - 0.75% |

Minimum Standard Spreads | 0.1 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 10+ |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

PrimeXBT is a South African broker with an excellent offering.

PrimeXBT Five Core Takeaways:

- User-friendly web-based trading platform and mobile app

- Transparent trading fees

- Well-structured rewards for active traders

- No algorithmic trading

- Wide range of local payment processors

Regulation and Security

Country of the Regulator | Mauritius, Peru, Seychelles, South Africa |

|---|---|

Name of the Regulator | BCR, FSA, FSC Mauritius, FSCA |

Regulatory License Number | 5210845697, SD162, Investment Dealer License, 66d10393e8a00a3181b8e457 |

Regulatory Tier | 2, 4, 4, 4 |

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. PrimeXBT complies with five regulators.

Is PrimeXBT Legit and Safe?

My PrimeXBT review found no verifiable misconduct or malpractice by this broker, founded in 2018. Therefore, I recommend PrimeXBT as a legitimate and safe broker, as has some good operational history. PrimeXBT operates under a multi-jurisdictional structure.

PrimeXBT regulation and security components:

- Regulated by the South African Financial Sector Conduct Authority (FSCS), the Financial Services Authority of Seychelles (FSA), and the Financial Services Commission of Mauritius (FSC)

- A Bitcoin Services Provider (BSP) license issued by the Banco Central de Reserva (BCR), and a Virtual Assets Services Provider (VASP) issued by the Lithuanian FCIS

- Founded in 2018 with no major security incidents

- PrimeXBT ensures asset protection via segregation of client deposits from corporate funds

- Negative balance protection

- Independent audits by the Hong Kong-based Financial Commission and an investor compensation fund of up to €20,000 per trader

- Hardware security modules (HSMs) rated FIPS PUB 140-2 Level 3 or higher

- Geographically distributed HSMs at secure data centers around the world

- Cold storage for the majority of digital assets with Multisignature technology

What would I like PrimeXBT to add?

PrimeXBT ticks all the boxes from a security perspective. The only item that needs to be added is more transparency about its core management team.

Fees

Average Trading Cost EUR/USD | $9.00 |

|---|---|

Average Trading Cost GBP/USD | $16.00 |

Average Trading Cost WTI Crude Oil | $0.13 |

Average Trading Cost Gold | $0.38 |

Average Trading Cost Bitcoin | 0.01% - 0.75% |

Minimum Standard Spreads | 0.1 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

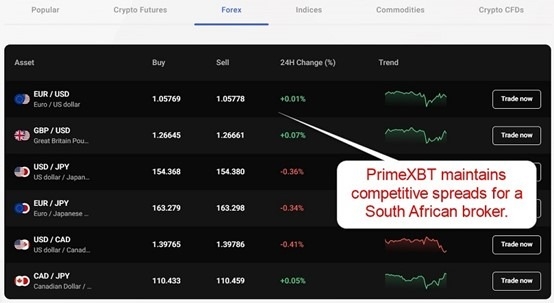

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. PrimeXBT presents a commission-free pricing environment for all non-crypto assets and follows a maker/taker fee model, from 0.01% (maker) and 0.045% (taker) on cryptocurrency CFDs and futures. The financing fees on crypto futures are applied ever 8 hours. The average spreads are among the lowest of South African competitor brokers. During my PrimeXBT broker review, the EUR/USD spread was, on average, 0.9 pips or $9.00 per 1.0 standard round lot.

There are no inactivity fees and fiat/e-wallet withdrawals are free in most cases. Crypto withdrawal fees start from 0.2 USDT, depending on the network used.

The average trading costs for the EUR/USD at PrimeXBT are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

0.9 pips (Standard) | $0.00 | $9.00 |

Here is a snapshot of PrimeXBT spreads during the London-New-York crossover session, where traders get the tightest spreads:

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free PrimeXBT account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the PrimeXBT account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.9 pips | $0.00 | $8.4680 | X | -$17.4680 |

0.9 pips | $0.00 | X | $2.1166 | -$11.1166 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights in the PrimeXBT account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.9 pips | $0.00 | $59.2760 | X | -$68.2760 |

0.9 pips | $0.00 | X | $14.8162 | -$23.8162 |

Range of Assets

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Traders get 300+ trading instruments focused on Forex and cryptocurrencies, with introductory diversification across commodities and indices. It makes PrimeXBT a niche broker where it excels. The absence of ETFs stands out, as they would fit perfectly into the asset mix for the core trader base.

PrimeXBT offers the following selection of assets:

- 99 Forex pairs

- 135 cryptocurrencies

- Commodities 24 (Gold, Brent Oil, Natural Gas, Coffee, etc.).

- 19 indices

- 16 stocks

PrimeXBT Leverage

Maximum Retail Leverage | 1:1000 |

Maximum Pro Leverage | 1:2000 |

What should traders know about PrimeXBT’s leverage?

- Maximum retail Forex leverage is 1:1000

- Cryptocurrency traders can use 1:500

- Commodities max out at 1:1000

- Index traders receive 1:1000

- Stocks up to 1:100

- Not all assets within a sector qualify for the maximum leverage.

- Negative balance protection exists, ensuring traders cannot lose more than their deposit.

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Account Types

PrimeXBT offers one account type to all traders that gives access to all platforms, ensuring equal treatment among its traders. It also provides discounts to high-volume traders.

My observations concerning the PrimeXBT account type are:

- A $10 minimum deposit requirement

- A maximum retail leverage of 1:1000

- The account supports multi-currency settlement, allowing users to fund, trade, and withdraw in BTC, ETH, USDT, USDC, or USD

- A minimum transaction size of $100 or a currency equivalent

- A maker/ taker transaction fee for cryptocurrency futures and commission-free trading fees for all other assets

- A minimum withdrawal fee of $0.50

PrimeXBT Demo Account

What stands out about the PrimeXBT demo account?

- PrimeXBT offers demo accounts.

- No expiry on demo accounts

- A demo account requires registration but not account verification.

Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 21:05 | Friday 21:00 |

Cryptocurrencies | Sunday 00:00 | Saturday 24:00 |

Commodities | Sunday 22:00 | Friday 21:00 |

Crude Oil | Sunday 22:00 | Friday 21:00 |

Gold | Sunday 22:00 | Friday 21:00 |

Metals | Sunday 22:00 | Friday 21:00 |

Equity Indices | Sunday 22:00 | Friday 21:00 |

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

PrimeXBT provides traders with the popular mt5, crypto futures platform and a user-friendly web-based proprietary trading platform and mobile app - PXTrader. It includes an in-house copy trading service, ideal for mobile traders, and the trading platform features charts from TradingView with 50+ technical indicators. Unfortunately, algorithmic trading is unavailable.

Unique Features

During my PrimeXBT review, the in-house copy trading service stood out. The copy trader receives 60% of the profit, the signal provider 20%, and PrimeXBT 20%. The 20% PrimeXBT platform fee is unusual, and traders should evaluate whether it’s a good fit for them if they want to be a signal provider.

Research and Education

PrimeXBT publishes daily market research with trading ideas for beginners, split into three categories: technical analysis, fundamental research, and price prediction research. Traders also receive market news with a focus on cryptocurrencies.

What about education at PrimeXBT?

The FSCA mandates that brokers offer quality education to beginners, and PrimeXBT has published 390+ educational articles. I appreciate the breadth of academic content, but more structure could improve the educational value.

- I advise first-time traders to consider the hundreds of educational pieces published by PrimeXBT.

- Beginners should also seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

- Monthly live webinars

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |          |

PrimeXBT has 24/7 customer service via live chat. Traders may also e-mail their questions, and I recommend the Help Centre as a first point of contact, as it answers many questions.

Bonuses and Promotions

During my PrimeXBT review, traders were offered a well-structured reward program worth $5,000+ for achieving trading milestones. Additionally, PrimeXBT hosts weekly trading contests. Terms and conditions apply, and I recommend traders read and understand them before accepting any incentives. The broker also offers a generous referrals program for inviting others to trade, a 20% of commission from the trading fees is paid automatically with no upper limit.

Awards

PrimeXBT has eleven industry awards. Three of the most recent ones include the Best Cryptocurrency Broker 2024 award by ADVFN, The Best Value Broker Asia 2024 award by Global Forex Awards, and the Best Cryptocurrency Broker LATAM 2024 award by the Peru Blockchain Conference.

Opening an Account

The online PrimeXBT account application only asks for an e-mail and desired password. Traders may also use their Apple or Google IDs to complete this step. PrimeXBT will send an e-mail with a verification link, which concludes the account registration.

What should traders know about the PrimeXBT account opening process?

- PrimeXBT complies with global AML/KYC requirements.

- Account verification is mandatory

- Most traders pass verification by uploading a copy of a government-issued ID and one proof of residency document.

- PrimeXBT may ask for additional information on a case-by-case basis.

Minimum Deposit

The minimum deposit at PrimeXBT is $10.

Payment Methods

Withdrawal options |    |

|---|---|

Deposit options |    |

PrimeXBT supports credit/debit cards, cryptocurrencies, and Volet for all traders. Popular options include Binance Pay, Neteller, Skrill, and regional e-wallets (UPI, JazzCash, Easypaisa, Capitec Pay) Geographic-specific payment processors may exist, so it would be great if PrimeXBT listed all available ones on its website.

Accepted Countries

PrimeXBT does not accept traders from The United States of America (US Reportable Persons) or residents of Japan, Canada, Cuba, Israel, Iran, New Zealand, Syria, North Korea, Sudan, United States of Minor Outlying Islands, America Samoa, Russian Federation, Myanmar, Saint Lucia, Puerto Rico, Guam, US Virgin Islands, and Northern Mariana Islands.

Deposits and Withdrawals

The secure PrimeXBT back office handles all financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at PrimeXBT?

- The minimum deposit is $10.

- The account supports a range of currencies as the base, allowing users to fund, trade, and withdraw in BTC, ETH, USDT, USDC, or USD

- PrimeXBT does not levy internal deposit fees.

- The withdrawal fee depends on the payment processor and currency but is a minimum of $0.50. Crypto withdrawal fees start from 0.2 USDT.

- Blockchain fees and minimum transaction amounts depend on the cryptocurrency.

- External processing times and fees depend on the payment processor.

- In compliance with AML regulations, the name of the trading account and payment processor must be identical.

Is PrimeXBT a good broker?

I like that PrimeXBT has evolved into a comprehensive multi-asset trading platform that bridges traditional and digital markets. With 0% CFD commissions, flexible leverage up to 1:1000, and multi-currency settlement options, it caters to modern traders seeking versatility and low-cost execution. Its decent regulatory presence, good security and feature-rich trading environment make it suitable for both retail and professional clients. PrimeXBT is a quality broker for Forex and cryptocurrency traders. PrimeXBT is safe to use as it complies with three well-known Forex regulators and has cryptocurrency licenses from two trusted industry regulators. PrimeXBT does not accept traders from The United States of America (US Reportable Persons), Japan, Canada, Cuba, Israel, Iran, New Zealand, Syria, North Korea, Sudan, United States of Minor Outlying Islands, America Samoa, Russian Federation, Myanmar, Saint Lucia, Puerto Rico, Guam, US Virgin Islands, and Northern Mariana Islands. PrimeXBT is a legitimate broker founded in 2018 and compliant with five regulatory authorities.FAQs

Is PrimeXBT a good broker?

Is PrimeXBT safe to use?

What countries are restricted by PrimeXBT?

Is Prime XTB legit?