For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

PU Prime upgrades the MT4 platform with the Autochartist plugin, presenting a reasonable cost structure for most traders. This broker offers an ultra-low pricing environment for portfolios above USD 10,000 but has been experiencing increasing customer discontent since 2023. Other notable features include social and copy trading on its proprietary mobile app, which has 500K+ downloads and a well-balanced asset selection. My review of PU Prime analyzed all trading conditions to determine if this broker provides clients with a competitive edge. Should you fund a trading account at PU Prime?

Overview

PU Prime provides ultra-low trading fees for $10,000+ portfolios.

Headquarters | Seychelles |

|---|---|

Regulators | ASIC, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2015 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $20 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

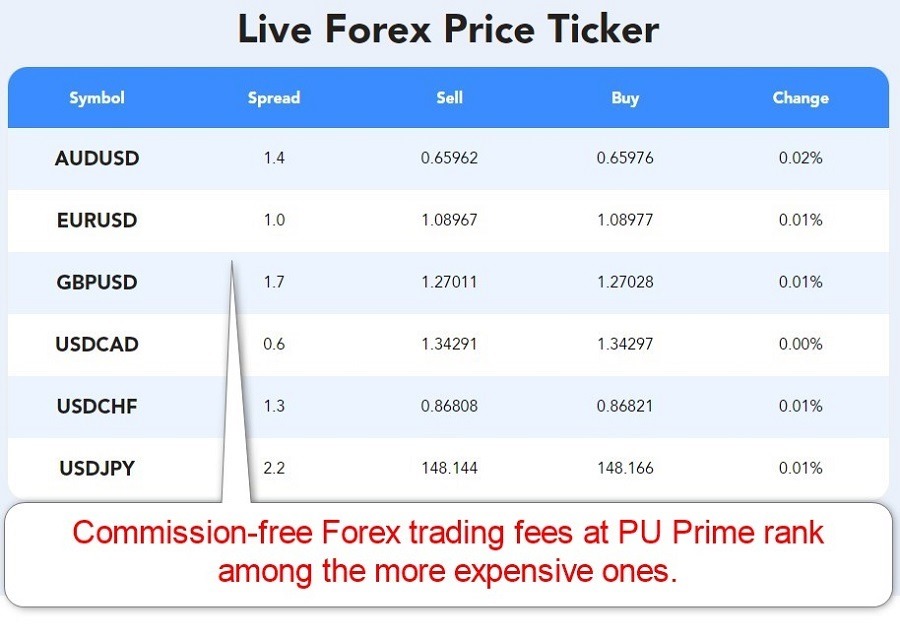

Average Trading Cost EUR/USD | 1.0 pips ($10.00) |

Average Trading Cost GBP/USD | 1.7 pips ($13.00) |

Average Trading Cost WTI Crude Oil | $0.10 |

Average Trading Cost Gold | $0.30 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.3 pips |

Minimum Commission for Forex | $2.00 |

Funding Methods | 6 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

PU Prime Five Core Takeaways:

- MT4 upgrade via Autochartist

- Ultra-low, commission-based trading fees available for $10,000+ portfolios

- Algorithmic, copy, and social trading support

- Well-balanced asset selection covering seven sectors

PU Prime Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation status and verify it with the relevant regulator by double-checking the provided license number with their database. PU Prime has two regulated subsidiaries with clean track records.

Country of the Regulator | Australia, Seychelles |

|---|---|

Name of the Regulator | ASIC, FSA |

Regulatory License Number | SD050, 000410681 |

Regulatory Tier | 4, 1 |

PU Prime is an approved broker member of the Hong Kong-based Financial Commission, which provides every PU Prime trader with a €20,000 compensation fund. The Financial Commission is an unbiased third-party mediation platform, adjudicating any disputes arising between approved broker members and their clients.

Is PU Prime Legit and Safe?

My PU Prime review found no verifiable misconduct or malpractice by this broker per its regulator.

PU Prime regulation and security components:

- Regulated by the Australian ASIC and the Seychelles FSA

- Founded in 2015

- Segregation of client deposits from corporate funds

- Negative balance protection

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact a trader's profitability. PU Prime has an expensive commission-free cost structure for three accounts, one competitive commission-based option, and an ultra-low commission-based alternative for portfolios above $10,000+.

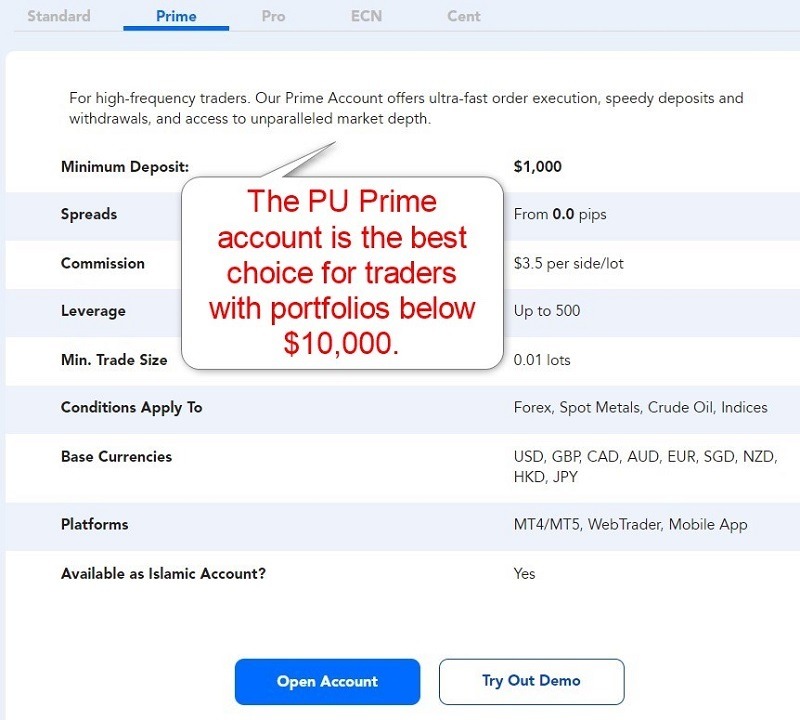

PU Prime features one of the cheapest trading fees for ECN traders and is an excellent choice for scalpers, high-frequency traders, and other short-term strategies. Traders who deposit less than $1,000 must accept above-average costs and consider if the PU Prime environment delivers an edge for their requirements.

There are no deposit or inactivity fees at PU Prime, but withdrawal costs may apply. Traders could also face third-party payment processing costs or currency conversion fees, which PU Prime does not control.

Average Trading Cost EUR/USD | 1.0 pips ($10.00) |

|---|---|

Average Trading Cost GBP/USD | 1.7 pips ($13.00) |

Average Trading Cost WTI Crude Oil | $0.10 |

Average Trading Cost Gold | $0.30 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.3 pips |

Minimum Commission for Forex | $2.00 |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

The minimum trading costs for the EUR/USD at PU Prime are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.3 pips (Cent) | $0.00 | $13.00 |

1.3 pips (Standard) | $0.00 | $13.00 |

1.3 pips (Pro) | $0.00 | $13.00 |

0.0 pips (Prime) | $7.00 | $7.00 |

0.0 pips (ECN) | $2.00 | $2.00 |

Here is a snapshot of PU Prime trading fees:

The most ignored trading costs are usually swap rate markups on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them when evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

- Right-click the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Below is an illustration of trading cost examples for buying and selling EUR/USD, holding the trade for one night and seven nights in the commission-based PU Prime account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the PU Prime account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $7.00 | $9.91 | X | -$16.91 |

0.0 pips | $7.00 | X | -$4.31 | -$2.69 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for 7 nights in the PU Prime account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $7.00 | $69.37 | X | -$76.37 |

0.0 pips | $7.00 | X | -$30.17 | $23.17 |

Noteworthy:

- PU Prime offers positive swap rates on qualifying assets, allowing traders to earn money when holding certain positions that attract positive financing, like in the example above.

PU Prime Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:01 | Friday 23:57 |

Cryptocurrencies | Sunday 00:00 | Saturday 24:00 |

Commodities | Monday 01:00 | Friday 24:00 |

Crude Oil | Monday 01:00 | Friday 24:00 |

Gold | Monday 01:01 | Friday 23:57 |

Metals | Monday 01:00 | Friday 24:00 |

Equity Indices | Monday 01:00 | Friday 24:00 |

Bonds | Monday 01:00 | Friday 24:00 |

ETFs | Monday 16:30 | Friday 23:00 |

Futures | Monday 01:00 | Friday 24:00 |

Range of Assets

Traders at PU Prime do benefit from a well-balanced asset selection covering seven sectors. I like the choice of metals and commodities, available as cash and futures contracts. PU Prime also maintains a good choice of indices and sufficient bond CFDs for active traders. PU Prime notes cryptocurrencies in one section but omits it elsewhere. I prefer more clarity, as the current presentation leaves traders needing clarification.

During my PU Prime review, the available ETFs sufficed to introduce traders to the sector, but they need to be improved for dedicated ETF traders wanting a wide range. The choice of equity CFDs covers blue-chip names in the US and the EU but needs to provide more exposure for a well-diversified equity portfolio.

I like the overall mix of assets, as they provide most traders with sufficient options, but I wish PU Prime would expand on its choice of ETFs.

PU Prime offers the following assets:

- 49 currency pairs

- 20 commodities

- 28 indices

- 51 ETFs

- 7 bonds

- 400+ equity CFDs

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

PU Prime Leverage

Maximum Retail Leverage | 1:1000 |

|---|---|

Maximum Pro Leverage | 1:1000 |

What should traders know about PU Prime leverage?

- Maximum retail Forex leverage is 1:1000 in all accounts.

- The same applies to index and commodity traders.

- Bond traders get 1:100.

- ETF traders max out at 1:33.

- Equity CFD traders get 1:20.

- Not all assets within a sector qualify for the maximum leverage stated.

- Negative balance protection exists, ensuring traders cannot lose more than their deposit.

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Account Types

PU Prime maintains three commission-free accounts (Cent, Standard, and Pro), one commission-based option (Prime), and one ultra-low-cost alternative (ECN). Islamic accounts are available for Standard, Prime, and Cent accounts, but PU Prime replaces swap rates with other administrative fees.

The minimum deposit is $20 for Cent, $50 for Standard and Pro, $1,000 for Prime, and $10,000 for ECN. PU Prime accepts USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, and JPY as account base currencies. No restrictions apply to algorithmic trading, scalping, and hedging-type strategies.

PU Prime Demo Account

Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations.

What stands out about the PU Prime demo account?

- PU Prime offers MT4/MT5 demo accounts.

- Traders can choose their trading platform, account base currency, leverage, and demo deposit balance.

- Demo accounts have no expiry as long as they remain active.

- There is no limit on how many demo accounts traders can open.

PU Prime PAMM

PU Prime caters to traditional fund management via PU Prime PAMM (Percentage Allocation Money Management). PAMM is a money management system that allows a fund manager to pool capital from interested investors and manage all portfolios from one master account. The PAMM system facilitates onboarding, and the distribution of profits based on the investor’s equity contribution in the PAMM account, including the PAMM manager. Fund managers get access to capital, which can scale their strategies, provide greater flexibility in their trading approach, and supplement their income via management fees.

Investors can access experienced fund managers and their trading strategies, benefit from a passive approach to investing without the need to engage manually in trading like in copy and social trading and ensure that the goals of the fund manager align with their goals, as each PAMM manager has a personal equity contribution in each PAMM account.

PU Prime Copy Trading

The in-house PU Prime copy trading service features 32,000+ signal providers and 150,000+ copy traders with 6,000,0000+ copied trades. Copy traders must open any PU Prime account types, available from as little as $50 or a currency equivalent, choose copy trading among the options during account configuration, and verify their account. The proprietary PU Prime App is ideal for copy traders, allowing them to copy signal providers on the go. PU Prime ensures profit sharing between signal providers and copy traders only during continuous gains by using the high watermark plus floating orders as a benchmark.

Signal providers can charge copy traders up to 50% of profits. They also benefit from automatic profit sharing every Saturday, multiple promotional channels, and copy-trading competitions for real cash prizes. Should cop traders stop following signal providers or request a withdrawal, PU Prime ensures 100% settlement to pay signal providers.

Trading Platforms

Traders can choose between the Autochartist-upgraded MT4 trading platform and the out-of-the-box MT5, both available as a powerful desktop client application; a web-based alternative is available as is the popular mobile app. Both trading platforms support algorithmic trading and have an embedded copy trading service. Traders can upgrade MT4 via 25,000+ custom indicators, templates, and EAs, while MT5 has 10,000+ indicators.

Forex traders can use MT4 or MT5, but PU Prime requires traders to use MT5 for access to all stated asset classes. PU Prime also offers its proprietary mobile app, the only one supporting in-house social and copy trading services. It has 500K+ downloads.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

PU Prime App

PU Prime caters to mobile traders with its PU Prime App, which claims an average rating of 4.5 and 1M+ downloads. It is available on the Google Play Store, where 500K+ traders downloaded it and given a rating of 4.2 out of 5.0 based on 990 reviews. PU Prime responds to low ratings and actively engages with its community. The PU Prime App is also available on the Apple App Store, where it has a 4.7 out of 5.0 rating, but based on only three reviews and no download statistics.

The PU Prime App is best suited for copy traders using the in-house PU Prime copy trading service, participating in the copy trading competition, and monitoring portfolios on the go. Traders can create custom watchlists, receive price alerts, monitor all PU Prime accounts with one login, make deposits, and request withdrawals. It also includes 24/5 in-app support.

Unique Features

During my PU Prime review, the ultra-low trading fees in the ECN account stood out. The in-house social and copy trading services are also noteworthy and represent an area where PU Prime could grow its market share. The availability of both services underscores the understanding of the differences between both, and I applaud the PU Prime management for it.

Research & Education

MT4 traders can get excellent market research within the trading platform via Autochartist. PU Prime publishes quality daily market commentary, which includes actionable trading setups. With the social and copy trading services, PU Prime relies on the community for the bulk of research, but it maintains a quality mix of services.

What about education at PU Prime?

Beginners get dozens of educational articles, 25 short videos, and 5 e-books. The videos are from a third party and are labelled as PU Prime content, which is fine. I like that PU Prime touches on trading psychology, but I wish it offered more in-depth content. Overall, the PU Prime education section is capable of introducing beginners to trading, from where they can build upon their knowledge base.

My conclusion:

- PU Prime provides a quality foundation for beginners to start their education.

- I recommend beginners seek further in-depth education from third parties after taking advantage of the PU Prime content, especially on trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

Customer Support

Traders can access PU Prime customer support 24/7 in 18 languages. PU Prime offers support via e-mail, phone, and live chat, but I recommend the FAQ section before contacting a customer support services representative, as it answers many common questions. PU Prime explains its products and services well, limiting or eliminating the need for customer support. I had no reason to contact customer support during my PU Prime review.

Bonuses and Promotions

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |              |

During my PU Prime review, traders had several bonuses and promotions available. Some arguably promote poor trading behaviour, forcing traders to deal in select assets or a non-withdrawable bonus. Terms and conditions apply, and traders must read and understand them before accepting PU Prime bonuses.

Traders receive the following PU Prime bonuses and promotions:

- A US NFP prediction worth $150.

- Mobile app-based promotion where traders must complete specific tasks for points, which they can use to spin a wheel for rewards.

- A 50% deposit bonus.

- A refer-a-friend free referral bonus per referral.

- A volume-based rebate program up to a maximum of $10,000.

- A 20% withdrawable rebate on the first deposit.

Opening an Account

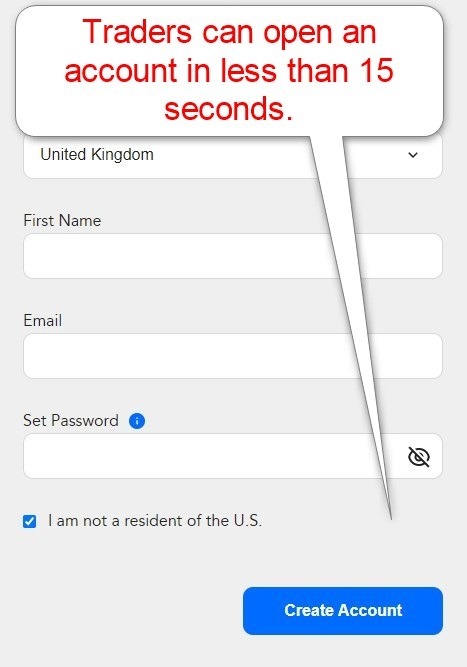

The PU Prime account application only asks for the country of residence, first name, e-mail, and desired password. Clicking “Create Account” completes the registration.

What should traders know about the PU Prime account opening process?

- PU Prime complies with global AML/KYC requirements.

- Account verification is mandatory.

- Most traders pass verification by uploading a copy of a government-issued ID and one proof of residency document.

- PU Prime may ask for additional information on a case-by-case basis.

Minimum Deposit

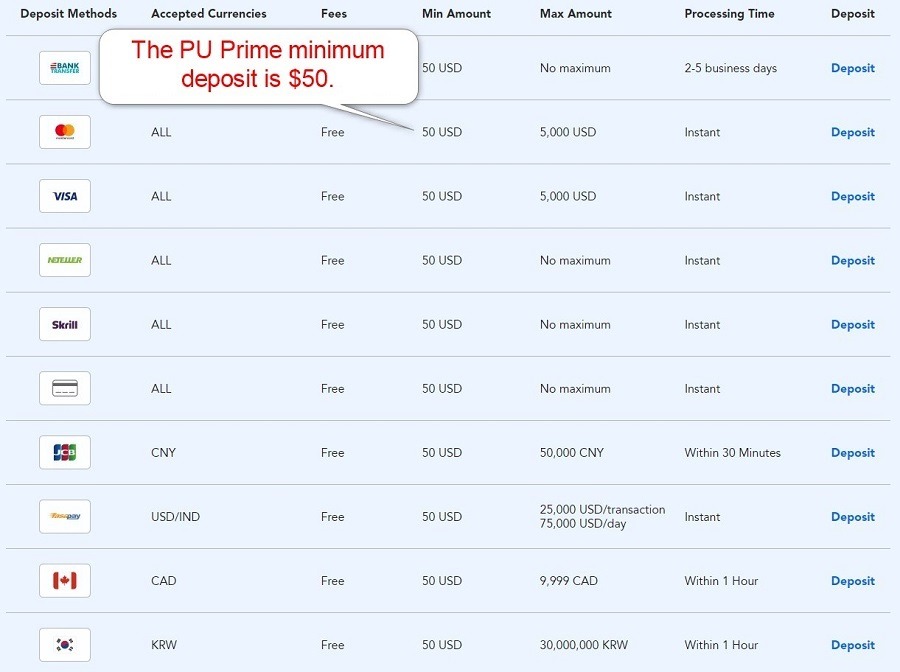

The PU Prime minimum deposit is $20 for the Cent account, $50 for Standard and Pro, $1,000 for Prime, and $10,000 for ECN.

Payment Methods

PU Prime accepts bank wires, credit/debit cards, Skrill, Neteller, JBC, and FasaPay. Localized deposit methods exist for traders in Canada, Korea, Vietnam, Indonesia, Myanmar, and the Philippines.

Withdrawal options |        |

|---|---|

Deposit options |        |

Accepted Countries

PU Prime accepts persons resident in most countries but singles out the US, Singapore, Australia, China, and Russia as restricted countries. It also adds that it does not accept traders from “some other regions, and is not intended for distribution to, or use by, any person in any countries or jurisdictions where such distribution or use would be contrary to local law or regulation.”

Deposits and Withdrawals

The secure PU Prime back office manages financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at PU Prime?

- PU Prime does not levy internal deposit fees.

- The minimum deposit requirement is $50 for all payment processors, invalidating the $20 minimum deposit requirement for the Cent account.

- Select payment processors have maximum deposit amounts.

- Deposit processing times are instant to near-instant for most payment processors.

- The minimum withdrawal amount is $40.

- Internal bank wire withdrawal fees of $20 apply from the second monthly withdrawal request.

- PU Prime processes withdrawal requests within one business day.

- It can take up to five business days for funds to arrive, but most payment processors have instant to near-instant processing once PU Prime approves a withdrawal.

- Traders may face third-party payment processing charges.

- The availability of payment processors depends on the geographic location of traders.

- The name on the payment processor and PU Prime trading account must match in compliance with AML regulations.

PU Prime Canada

While PU Prime does not have an entity regulated by the CIRO, it onboards Canadian traders from its well-regulated Seychelles and Mauritius entities. As a Financial Commission member, traders enjoy the protection of the investor compensation fund, which reimburses traders up to €20,000 per claim. PU Prime offers Standard, Prime, and ECN accounts denominated in Canadian Dollars. The minimum deposit requirements are C$50 for Standard, C$1,000 for Prime, and C$10,000 for ECN. Canadian traders can deposit and withdraw in Canadian Dollars via localized online banking, international bank wires, credit/debit cards, and e-wallets. Alternatively, PU Prime also supports cryptocurrency transactions.

Seven CAD currency crosses are among the PU Prime asset selection. Other assets associated with the Canadian economy are commodities and metals. Traders can also diversify via cryptocurrencies, stocks, ETFs, and bonds. The MT4/MT5 trading platforms support algorithmic trading, and PU Prime presents its in-house copy trading service.

Is PU Prime a good broker?

I like the trading environment at PU Prime for high-volume traders with portfolios exceeding $10,000, as the trading fees are ultra-low. My PU Prime review also revealed the quality of social and copy trading services via the proprietary PU Prime mobile app. Volume-based rebates exist but max out at $10,000. PU Prime offers research services by Autochartist, integrated with the MT4 trading platform, but traders must use MT5 to access the complete range of asset selection. My PU Prime review found no verifiable misconduct or malpractice. PU Prime is not FCA-regulated. PU Prime processes withdrawals within one business day, but it can take up to five business days for traders to receive their funds. PU Prime has 8+ years of operational history, making it a dependable broker, but traders should consider the negative comments about some trading and withdrawal aspects from 2023.FAQs

Is PU Prime FCA regulated?

How long does PU Prime withdrawal take?

Is PU Prime reliable?