Editor’s Verdict

Quadcode Markets, part of FinTech firm Quadcode, offers traders a proprietary trading platform focused on blue chip equity CFDs and highly liquid currency pairs. Traders get 100+ technical analysis tools and 24/7 customer support. I conducted an in-depth Quadcode Markets review to determine if its trading platform ensures beginners get a user-friendly trading experience. Is Quadcode Markets the right broker for you?

Overview

A proprietary trading platform featuring 100+ technical indicators.

Headquarters | Australia |

|---|---|

Regulators | ASIC, CySEC |

Year Established | 2022 |

Execution Type(s) | Market Maker |

Minimum Deposit | $50 ,20€ |

Trading Platform(s) | Proprietary platform |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.9 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the user-friendly trading platform at Quadcode Markets. It offers 100+ technical indicators and seamless switching between demo and live trading. Customer support is available within the trading platform, adding to its appeal for first-time traders, but Quadcode Markets only accepts Australian-based traders.

Quadcode Markets Regulation & Security

Trading with a regulated broker will minimize the risk of the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Quadcode Markets is regulated in one tier 1 jurisdiction and maintains a secure trading environment.

Name of the Regulator | ASIC, CySEC |

|---|

Is Quadcode Markets Legit and Safe?

Quadcode Markets, founded in 2022, is owned by Quad Code AU Ltd, maintains a secure and trustworthy trading environment, and complies with the regulations of the Australian Securities & Investments Commission (ASIC).

Traders get negative balance protection, a necessity for leveraged portfolios, and Quadcode Markets segregates all client funds from corporate funds. Quadcode Markets has operational experience and a clean regulatory track record, making it a legit and safe broker.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Quadcode Markets presents a commission-free cost structure, but trading fees rank among the more expensive ones versus competitively priced brokers. While minimum markups can drop as low as 0.9 pips or $9.00 per 1.0 standard round lots, average costs for major currency pairs are over 1.5 pips or $15.00 per lot. The same applies to CFDs on equities, commodities, ETFs, and cryptocurrencies.

Swap rates on leveraged overnight positions are competitive. Overall, Quadcode Markets offers the best cost structure for medium-to-long-term traders.

Minimum Raw Spreads | Not applicable |

|---|---|

Minimum Standard Spreads | 0.9 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee |

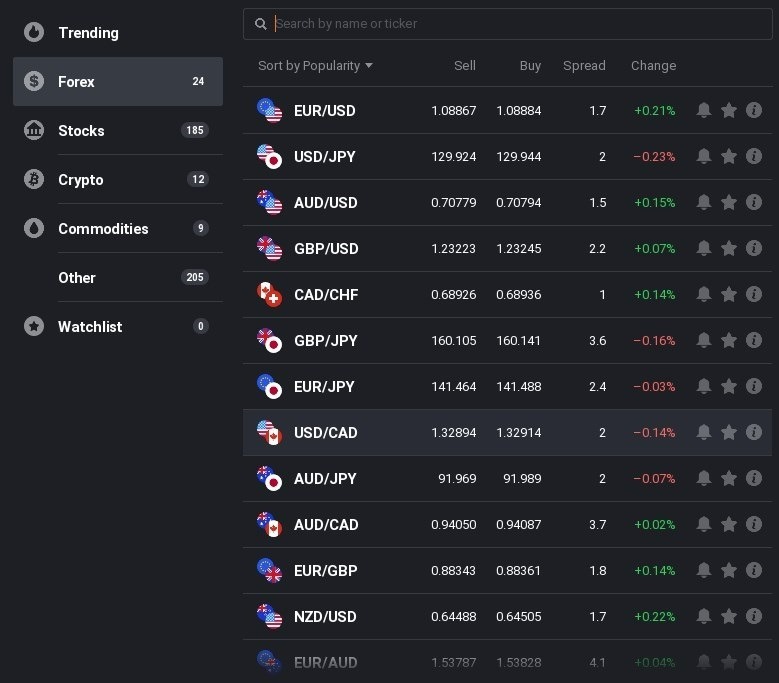

Here is a screenshot of Quadcode Markets fees during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The average trading costs for the EUR/USD at Quadcode Markets are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.5 pips | $0.00 | $15.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD and holding the trade for one night and seven nights.

HYPOTHETICAL EXAMPLE: Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

1.5 pips | $0.00 | -$2.5515 | X | $17.5515 |

1.5 pips | $0.00 | X | $-2.9673 | $17.9673 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

1.5 pips | $0.00 | -$17.8605 | X | $32.8605 |

1.5 pips | $0.00 | X | -$20.7711 | $35.7711 |

Range of Assets

Quadcode Markets focuses on blue-chip equity CFDs, with 185 names, while Forex traders get 24 liquid currency pairs, 23 ETFs, 9 commodities, 10 indices, and 12 cryptocurrencies. Novice traders can start by trading on a demo account first to enhance their trading experience. The Quadcode Markets asset selection also caters to traders who require fewer but highly liquid trading instruments, like scalpers.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds | |

ETFs |

Quadcode Markets Leverage

Quadcode Markets restricts retail Forex leverage to 1:30, per ASIC rules. CFDs on cryptocurrencies have a maximum leverage of 1:2, equity CFDs 1:5, index CFDs 1:20, and commodity CFDs range between 1:10 and 1:20, while ETF trading remains unleveraged. Negative balance protection ensures traders cannot lose more than their deposits.

Leverage can work both to your advantage and disadvantage since it may maximize profits, but it also maximizes risk and losses.

Quadcode Markets Trading Hours (UTC +10)

Asset Class | From | To |

|---|

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which essentially trade 24/5

Account Types

Quadcode Markets does not detail its trading account types but provides all traders with an identical CFD account. A replenishable demo account is also available. I like the equal treatment of all clients. A volume-based rebate program for frequent traders would be welcome.

Quadcode Markets Demo Account

Every trader has the opportunity to trade on a free and refillable demo account with a virtual balance of $10,000. Quadcode Markets trading platform supports seamless switching between demo and real account. I want to caution novice traders when using demo trading that it can be a useful education and familiarization tool, but it cannot replicate the psychological conditions of risking real money in the market. Demo trading can create unrealistic trading expectations.

Trading Platforms

Quadcode Markets offers its user-friendly proprietary trading platform but only supports manual trading and does not support algorithmic trading. I like the 100+ technical indicators, which ensures that manual traders have the flexibility to analyze assets. It includes sentiment analyses, which may assist traders in their decision-making process. The trading platform provides all the required information, including estimated pip value and margin requirement, before traders place orders, and supports micro-lots.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

Quadcode Markets focuses on its core trading environment, and at the time of my review, it did not offer any unique features. Its parent company continues to grow via acquisitions, and Quadcode Markets could expand its product and services offering moving forward.

Research & Education

Quadcode Markets does not produce in-house research, but its trading platform has a third-party market feed, including alerts and analytics.

Educational materials are not offered. One video tutorial exists, guiding traders on the mechanics of how to place trades.

I recommend traders seek in-depth education from third parties available for free, including trading psychology, before opening a Quadcode Markets trading account. Novice traders should always avoid paid-for courses and should practise trading with a demo account before risking real money.

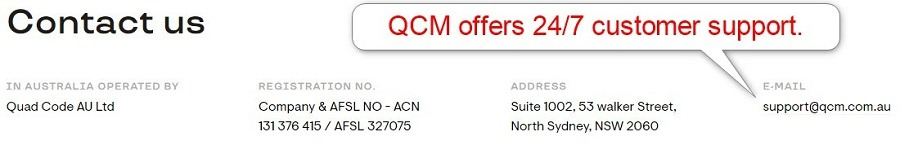

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

Quadcode Markets provides customer support 24/7 in English and only caters to Australian-resident clients. An e-mail address is available on the website, and the trading platform includes live chat. An FAQ section is not provided. I would appreciate a more optimized process via a detailed FAQ section.

Bonuses and Promotions

Quadcode Markets neither offers bonuses nor promotions, as they are legally prohibited by ASIC.

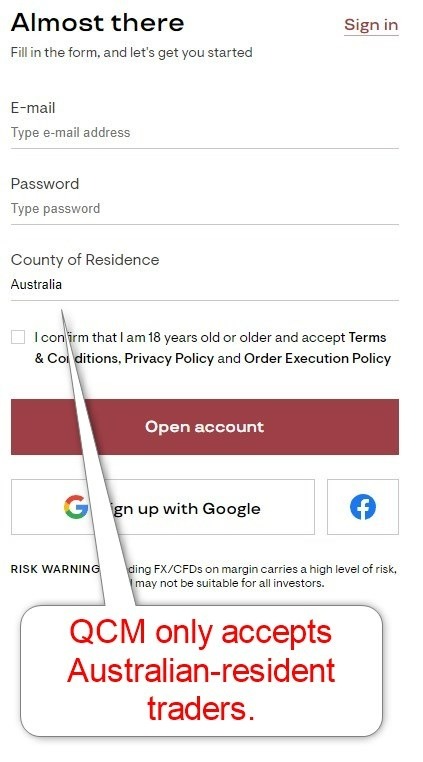

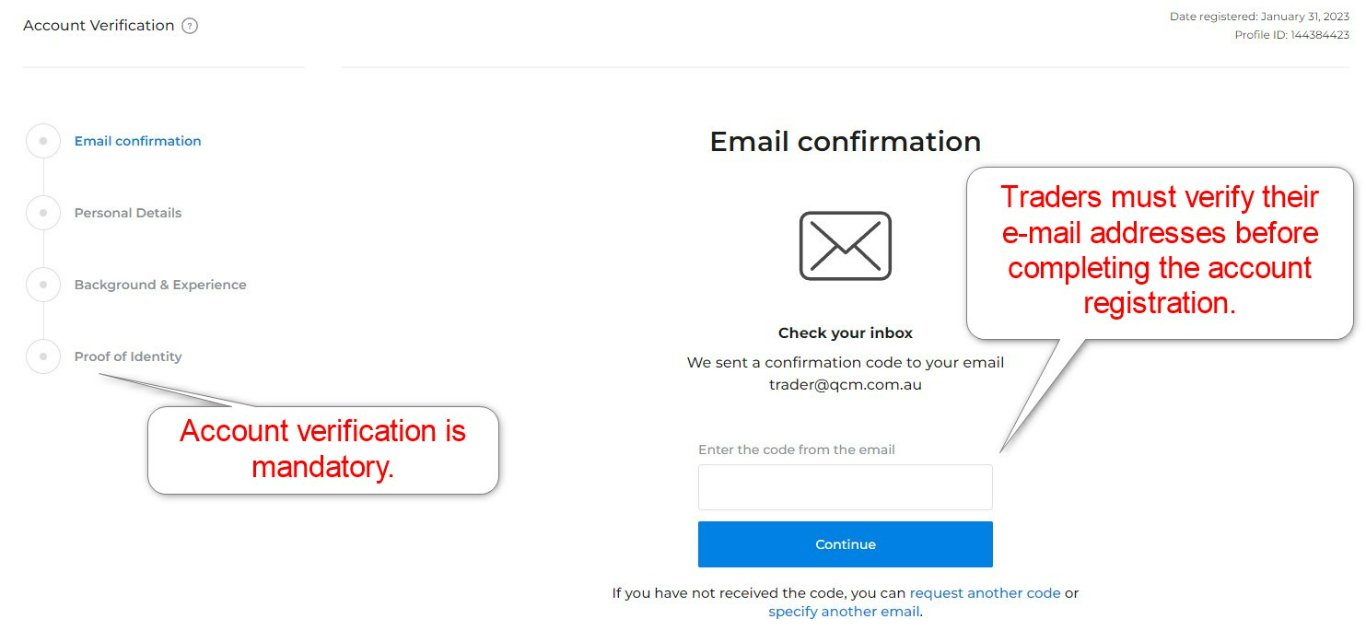

Opening an Account

The two-step registration process follows ASIC-mandated requirements. During the first step, traders must only provide their e-mail address and desired password. The country of residence is Australia, the only location accepted by Quadcode Markets. Traders may also use their Google or Facebook IDs to complete this step. Quadcode Markets will e-mail a verification code, which is necessary to complete the account registration.

Overall, account registration at Quadcode Markets is a swift process.

Quadcode Markets is ASIC regulated and fully compliant. Therefore, account verification is mandatory. Uploading a copy of their ID and one proof of residency document usually allows most traders to pass this step. Quadcode Markets might ask for additional information on a case-by-case basis.

Minimum Deposit

The minimum deposit at Quadcode Markets is $50. It makes Quadcode Markets easily accessible to Australian-resident traders.

Payment Methods

Withdrawal options |      |

|---|---|

Deposit options |      |

Accepted Countries

Quadcode Markets only accepts Australian-resident traders.

Deposits and Withdrawals

The secure Quadcode Markets trading platform handles all financial transactions for verified clients.

Quadcode Markets does not levy internal transaction fees, except for a $31 cost on bank withdrawals. Third-party payment processing fees and currency conversion costs may apply. Traders may deposit and withdraw using bank wires, credit/debit cards, Skrill, and Neteller. The Australian Dollar, the Euro, the British Pound, and the US Dollar are supported deposit and withdrawal currencies. Quadcode Markets promises instant deposit times except for bank wires, which take three to five business days.

Is Quadcode Markets a good broker?

I like the trading environment at Quadcode Markets due to its user-friendly trading platform. The minimum deposit of $50 makes it very accessible to Australian-resident traders. I find the corporate ownership of Quadcode Markets, FinTech company Quad Code AU Ltd, the most significant asset. It aims to create a one-stop solution for modern financial needs, where Quadcode Markets fulfills a central role. No, Quadcode Markets does not support algorithmic trading, but manual traders get 100+ technical indicators in the proprietary trading platform. The Quadcode Markets minimum deposit is $50. Yes, Quadcode Markets has been an ASIC-regulated broker since 2022 and has a clean operational track record. Quadcode Markets is an Australian-based multi-asset CFD broker owned by FinTech company QuadCode.FAQs

Does Quadcode Markets support algorithmic trading?

What is the minimum deposit at Quadcode Markets?

Is Quadcode Markets regulated?

What is Quadcode Markets?