Editor’s Verdict

Revolut is a UK-headquartered, Lithuanian-authorized challenger bank that relies on its mobile app to offer a one-stop financial solution to customers. The Revolut motto is "One app, all things money," and it aims to please everyone, but does it deliver? My review will focus solely on investment services for equities, cryptocurrencies, and commodities to see if Revolut provides enough to make its app appealing to investors.

Overview

Revolut provides a one-stop solution for investors to move and use capital seamlessly.

I like the seamless transfer of capital across the Revolut ecosystem. Every account holder in the Plus plan gets a debit card, allowing profitable investors and traders easy day-to-day use of their profits. The Revolut plans are well-structured, and the monthly fees are well worth the benefits for active clients. I rate Revolut as the best app for enjoying the fruits of investments and trades, as it caters perfectly to the lifestyle. Still, there are limits to what Revolut can do well, and there are areas where it falls short.

Headquarters | United Kingdom |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2015 |

Execution Type(s) | Market Maker |

Minimum Deposit | £0 |

Negative Balance Protection | |

Trading Platform(s) | Other |

Average Trading Cost EUR/USD | Not applicable |

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | 3% - 5% |

Average Trading Cost Bitcoin | 5% - 6% |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Funding Methods | 7 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Revolut Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check the regulatory status, verifying it with the regulator by checking the provided license with their database. The Lithuanian central bank authorizes Revolut as a challenger bank, and the UK FCA regulated select business activities.

Is Revolut Legit and Safe?

Revolut, founded in 2015, is a FinTech company headquartered in the UK, and some of its services operate under FCA oversight. It also has a banking license as a challenger bank from the Lithuanian central bank, part of the EU-based banking infrastructure. It applied for a UK banking license, which the UK rejected. Catering to 30 million customers in 37 countries, Revolut has established itself as a trustworthy peer-to-peer processor, banking solution provider, investment app, reward program, insurance platform, and provider of additional associated services.

Cash deposits across the EU enjoy the EU-wide €100,000 Deposit Guarantee Scheme via the Bank of Lithuania. Revolut operates as an e-money institution and cannot make loans. Therefore, it uses safeguarding accounts at well-regulated banks.

My review found no malpractice or fraud at Revolut. Still, the September 2022 hack exposed the personal data of 50,000 customers. Overall, I rate Revolut as a secure and safe challenger bank.

Country of the Regulator | Australia, Lithuania, Singapore, United Kingdom |

|---|---|

Regulatory License Number | 304580906 (LB002119), 900562, 517589, PS20200326 |

Regulatory Tier | 1, 1, 1, 1 |

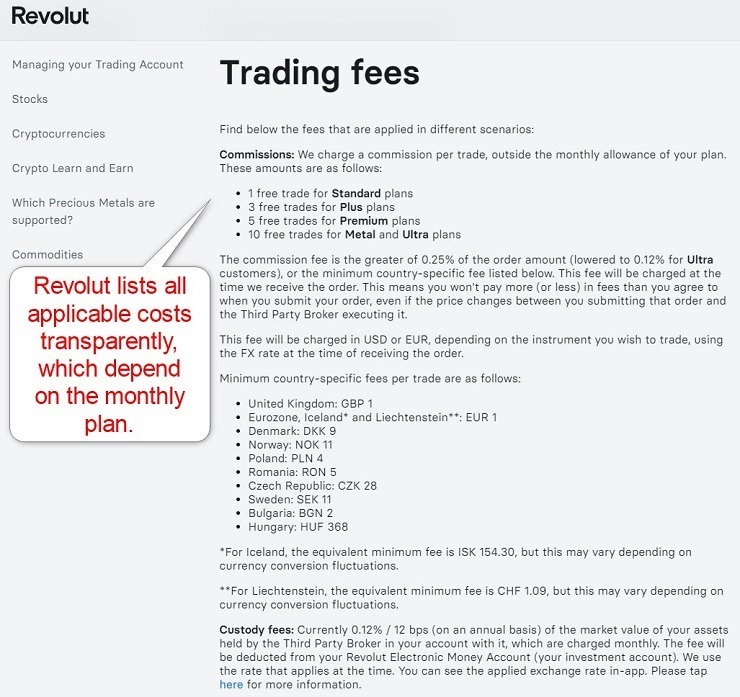

Fees

I rank trading costs among the most critical factors when evaluating a broker, as they directly impact profitability. Revolut offers commission-free investments, but the amount depends on the plan. Should traders exceed their monthly free transactions, a commission of £/€ 1.00 or 0.25% of the transaction value applies, whichever amount is higher, making investing with Revolut more than twice as expensive as with competitors. A 0.12% annual custody fee also applies based on the assets held at partner brokers, which Revolut deducts monthly.Revolut also notes an SEC fee of $22.900 per $1,000,000 in sold assets and the FINRA trading activity fee (TAF) of $0.000145 per share with a $0.01 minimum and $7.27 maximum. Another cost clients should consider is the up to 1.00% currency conversion fee, which only applies on weekends or when customers exceed the monthly allowance based on their monthly plan.

Here is a snapshot of Revolut fees:

Average Trading Cost EUR/USD | Not applicable |

|---|---|

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | 3% - 5% |

Average Trading Cost Bitcoin | 5% - 6% |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | FALSE |

Range of Assets

Revolut offers US-listed equities and ETFs, physical cryptocurrencies, and commodities (gold, silver, platinum, and palladium). It does not specify which cryptocurrencies traders can buy but notes 100+ assets in that sector in 30 currencies, which represents an excellent choice, and staking it equally available. Revolut aims to add more international exchanges to its portfolio.Commodity traders should know that they do not buy or sell physical assets or derivative contracts but get exposure to the commodity portfolio Revolut maintains. While the current asset selection is limited in scope, it serves the Revolut core market well. I like how Revolut cautiously expands based on demand.

Revolut Leverage

Revolut does not offer leveraged trading accounts.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Trading Hours

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Gold | Undisclosed | Undisclosed |

Stocks (non-CFDs) | Monday 09:30 (EST) | Friday 16:00 (EST) |

ETFs | Monday 17:30 (EST) | Friday 16:00 (EST) |

Account Types

Revolut offers five well-structured plans with increasing perks. Meanwhile, the monthly fees remain acceptable, particularly given the perks, products, and services. The five Revolut plans are:

- Standard - Free (1 free trade monthly)

- Plus - £2.99 monthly (3 free trades monthly)

- Premium - £6.99 monthly (5 free trades monthly)

- Metal - £12.99 monthly (10 free trades monthly)

- Ultra - £45.00 monthly (10 free trades monthly)

highly recommend the Metal account for active traders and Ultra for cryptocurrency traders and frequent travellers, as the transaction fee decreases from 0.99% to 0.49%, and travellers get unlimited airport lounge access at 1,400+ locations. There is no minimum deposit requirement.

Revolut Demo Account

Revolut does not offer a demo account. It is the most notable oversight and a necessity for any investment app.

Trading Platforms

Revolut only offers its mobile app, which presents the basics. It is not a pure investment app but an app that aims to please everyone, which includes shortfalls. It might be why Revolut fails to introduce its investment capabilities properly. It is best suited for investors who know what they want to buy, as they have researched elsewhere or engaged in social trading. It is nearly impossible to conduct technical analysis, but a news feed exists.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

The uniqueness of Revolut lies in its aim to provide a one-stop solution for all finance-related services and create an ecosystem where capital can flow freely to cater to a lifestyle rather than one need. Revolut is excellent at providing successful traders and investors with a mobile lifestyle app with many beneficial services and perks. It also features Vaults, allowing customers or groups to share toward a goal or split bills. They are available in 36 currencies, commodities, and cryptocurrencies.

Research & Education

Revolut provides no research to customers, which is surprising for a financial app that aims to be the Swiss army knife in a competitive market. It creates a massive gap compared to other brokers, magnified by the core client base of Revolut, which could benefit from one more well-designed service. Since there is plenty of research online for free and via paid-for services, I do not count it against Revolut.

Revolut features some introductory educational content via its app but fails to compete with a well-thought-through offer that allows beginners to learn how to trade or invest.

Therefore, I advise beginners to learn how to trade elsewhere via online educational resources available for free and start with trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

Customer Support

Revolut struggles with customer support, like most of its app-focused peers. It relies heavily on its FAQ section, though phone support exists for customers who have lost their debit card. Ultra plan members can request a callback, and live chat is available from within the app, where my review came across many complaints about the quality and speed. E-mail support is available, but Revolut recommends live chat. While Revolut explains its products and services well, given the scope of its reach across multiple sectors, issues could arise, and Revolut has yet to master how to deliver high-quality customer support.

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |             |

Bonuses and Promotions

Revolut does not offer bonuses, but it has plenty of rewards, perks, and cashback offers benefiting active users. They include annual insurance limits, lounge access at airports, annual savings accounts via its Vaults service, cashback on all debit card transactions, cashback on hotels, and discounts via in-app purchases.

Opening an Account

Revolut requires a valid mobile phone number, as traders must scan the QR code to begin their account application. Customers must provide personal details, but my review did not find unnecessary data collection, as required by EU-based brokers. Since Revolut is a challenger bank, the application process remains simple, and Revolut claims to approve new accounts within ten minutes.

Account verification is mandatory at Revolut, in compliance with global AML/KYC requirements. It consists of a picture of a government-issued ID and one selfie with the same document.

Minimum Deposit

There is no Revolut minimum deposit requirement.

Payment Methods

Revolut accepts bank wires, credit/debit cards, Apple Pay, Google Pay, transfers from existing Revolut customers, and localized methods like Early Salary for UK clients or via participating retailers where available.

Accepted Countries

Revolut aims to launch its services globally but currently only accepts customers from the European Economic Area (EEA), Australia, New Zealand, Singapore, Switzerland, Japan, Brazil, the UK, and the US. Lite accounts are available to customers residing in Azerbaijan, Sri Lanka, Saudi Arabia, Chile, Moldova, Macao, Armenia, Kuwait, Qatar, and Kazakhstan.

Deposits and Withdrawals

The Revolut mobile app handles all financial transactions for verified clients.

Revolut is a challenger bank, and every customer gets a debit card, which is the easiest way to withdraw money or use capital, as cashback rebates apply. No minimum deposit or withdrawal amounts exist, but fee-free withdrawals have monthly limits based on the plan before Revolut levies a cost. As a bank, Revolut prefers customers to spend their money via debit card or in-app transactions.

A fair usage limit applies on monthly Forex, cryptocurrency, and commodity exchanges exceeding £1,000. Excess transactions face an additional 1% levy on top of regular costs and weekend mark-ups.

Withdrawal options |  |

|---|---|

Deposit options |     |

Is Revolut a Good Broker?

I like Revolut as a lifestyle app for successful investors and traders who enjoy living an active life and spending their income. The app features plenty of perks, incentives, and benefits. Yet, from a pure investment or trading perspective, I cannot recommend it to anyone except cryptocurrency traders. It lacks core features, does not support in-depth analytics, and fails to cater to customers demanding a comprehensive support infrastructure. It is ideal for social traders and those with cutting-edge research capabilities who know what to buy. I highly recommend it to the latter group.

Revolut can act as a separate portfolio to finance a lifestyle and ensure frictionless capital flow across the Revolut ecosystem. I advise customers to opt for the Metal or Ultra plan. Revolut is the best lifestyle app with an investment service I have reviewed. Customers should check the app for detailed information. Revolut does not allow card usage in Afghanistan, Angola, Bahamas, Belarus, Burundi, Bolivia, Botswana, Cambodia, Crimea, Cuba, Egypt, Ethiopia, Haiti, Iran, Iraq, North Korea, Lao People's Democratic Republic, Liberia, Libya, Mozambique, Myanmar, Pakistan, Palau, Russia, Timor-Leste, Trinidad and Tobago, Sevastopol, Somalia, South Sudan, Sri Lanka, Sudan, Syrian Arab Republic, Swaziland, Uganda, Venezuela, Yemen, and Zimbabwe. Revolut charges several fees based on the monthly plan and services. One free monthly plan exists, while the other four have monthly costs between £2.99 and £45.00. Other fees apply. Revolut is unavailable in most countries but plans for gradual global expansion. It accepts customers from 38 countries for its complete list of services and accepts residents from another 10 countries for its Lite app. All customer deposits in the EU have the €100,000 Deposit Guarantee Scheme, making it one threshold to consider. Since Revolut is a challenger bank that keeps funds in well-regulated partner banks with an excellent standing in the global financial system, customers have little to worry about. Revolut attempts to be the Swiss army knife of financial apps but falls short in customer service and its investment app. Revolut is a challenger bank in the EU, following strict rules and regulations. It caters to 30M+ customers with an expanding global footprint, and customers can trust Revolut to safeguard their capital.FAQs

In which countries can I use the Revolut card?

Does Revolut charge fees?

What countries are not supported by Revolut?

How much money is it safe to have on Revolut?

What is the downside of Revolut?

Can Revolut be trusted?