Editor’s Verdict

Rocket21, founded in 2022, has a community of 50M+ traders from 7+ countries with payouts of $4M+, which is an impressive stat sheet for a company so young. Traders can choose from seven account types, one-step and two-step challenges, qualify for a scaling plan, and receive up to 90% profit share from minimum accounts starting at $5,000. My Rocket21 review aimed to evaluate the trading conditions to give prop traders the data they need to decide if Rocket21 is worth an evaluation period. Is Rocket21 the best trading prop firm for your strategy?

Overview

Headquarters | United States |

|---|---|

Year Established | 2022 |

Trading Platform(s) | DX Trade |

Minimum Evaluation Fee | $59 |

Profit-share | 85 - 90% |

Daily Loss Limit | 5% |

Maximum Trailing Drawdown | 10% |

Funded Account Options | 7 |

Minimum Funded Account | $5,000 |

Maximum Funded Account | $300,000 |

Rocket21 offers seven funded account options from $5,000 up to $300,000 starting at a $59 evaluation fee for the $5,000 account size.

I like that Rocket21 offers Eightcap’s trading platforms, ensuring traders get highly competitive Forex trading conditions. I also appreciate the absence of a time limit during the evaluation period, as it eliminates unnecessary time pressure on top of performance pressure. Traders can scale their portfolios via consistent performance, which increases the profit share to 90%.

Rocket21 Trustworthiness & Reputation

Trading with a prop firm, an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts and that the prop firm maintains an excellent reputation among its prop traders. By providing Eightcap’s trading platforms, Rocket21 enables its customers to access the benefits of a trusted broker.

Is Rocket21 Legit and Safe?

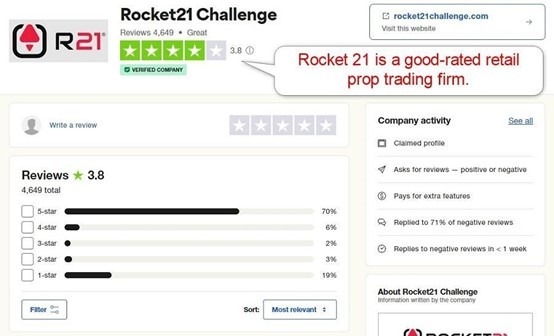

Rocket21, founded in 2022, is an established prop firm with solid foundations. Based on 4,646 reviews on Trustpilot, it has a 3.8 out of 5.0 rating.

I advise traders to consider any negative comments skeptically, as they could come from traders who have failed the paid-for evaluation challenge or breached trading rules in funded accounts. Therefore, I rate them as a prop trading firm interested traders can try to establish a rapport with.

Rocket21 Features

Rocket21 follows best practices established across the prop firm industry, which remains an expanding industry.

The most notable features of Rocket21 are:

- One-step or two-step evaluation.

- No time limits during the evaluation process.

- A profit target of 9% for the one-step evaluation.

- A profit target of 8 and 5% % for the two-step evaluation.

- At least three trading days for the one-step challenge and five trading days during the two-step evaluation.

- Access to the multi-asset, multi-market DX Trade trading platform facilitated by Eightcap.

- A maximum drawdown between 6% to 10%.

- 85% profit share scalable to 90%.

- Cryptocurrency withdrawals.

- Apollo 11 traders are eligible for a refund of their challenge fee on their first withdrawal

- News and weekend trading is only allowed in the Swing accounts.

- Up to $2,000,000 funded accounts per trader.

Rocket21 offers an integration with the TradingView widget, offering clients a user-friendly platform with advanced charting tools. It’s highly customizable, allowing users to personalize charts with their preferred colors, styles, and themes. Additionally, the widget comes equipped with over 100 built-in indicators, covering various aspects of technical analysis.

Evaluation Fees & Profit-Share

Minimum Evaluation Fee | $59 |

|---|---|

Maximum Evaluation Fee | $1,399 |

Profit-share | 85 - 90% |

Prop traders pay a one-time evaluation fee depending on their desired funded account size and evaluation type. Rocket21 features seven funding options, a choice between regular and swing trading accounts, and its Apollo 11 challenge. Evaluation fees range between $59 and $1,399, but the Apollo 11 program offers add-ons that can increase the fee to a minimum of $95 and a maximum of $2,000.

Rocket21 allows traders to revive a failed two-step challenge if they have passed the first step. The costs range between $113 and $2,332, allowing traders to restart at step two.

Please note that traders cannot change the account value once approved, meaning if they qualify on a $5,000 account, they will manage a $5,000 portfolio. The profit share at Rocket21 starts from 85% and scales to 90%, allowing traders to earn the industry maximum.

The minimum evaluation fee at Rocket21 for a $5,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $59 |

Monthly evaluation fee | $0 |

Hold-over-the-weekend | $0 |

Double leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $5,000 account | $59 |

Account Types

Rocket21 offers Regular and Swing trading accounts with seven funding options and a choice of a one-step or two-step evaluation. The funded account types are $5,000, $10,000, $25,000, $50,000, $100,000, $200,000, and $300,000. Prop traders can scale their accounts up to a maximum of $2,000,000.

The Apollo 11 alternative is a one-step challenge account featuring add-ons to increase the drawdown limits by 1%, boost the payout ratio to 90%, and enable weekly payouts. It also allows prop traders to request their first withdrawal after 14 days, which Rocket21 prohibits in the other account types. Maximum leverage is 1:30 versus 1:100 in the other account choices.

All trading accounts are provided by trusted Australian broker Eightcap on DX Trade.

What are the Trading Rules at Rocket21?

The Rocket21 evaluation begins after prospective prop traders choose their preferred evaluation account and pay the one-time evaluation fee. There is no time limit, and the profit target is 9% for the one-step evaluation and 8% and 5% for the two-step.

Violating the maximum overall loss rule results in a hard breach and cancellation of the evaluation. Potential prop traders can restart by paying the evaluation fee again or consider the revive fee for two-step evaluations.

The trading rules for the Rocket21 evaluation are:

- 6% maximum loss from the starting balance for the one-step evaluation.

- 10% maximum loss from the starting balance for the two-step evaluation.

- 3% daily loss limit for the one-step evaluation and 5% daily loss limit for the two-step alternative.

- At least three and five trading days for the one-step and two-step evaluation, respectively.

Trading Platforms

The DX Trade trading platform is facilitated by Eightcap. The maximum leverage is 1:100, except for the Apollo 11 accounts, where trades get 1:30. Simulated Forex commissions are $7.00 per 1.0 standard round lot, $3 for metals, and commission-free for indices, cryptocurrencies, and oil.

Education

Rocket21 does not offer education, and beginners should never consider prop trading, but the Rocket21 blog offers content with educational value.

Customer Support

Customer Support Methods |    |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

During my Rocket21 review, traders received 24/7 customer support via a chatbot available in English and Spanish. The other method to contact Rocket21 is via e-mail , but I recommend the FAQ section as it answers many questions.

How to Get Started with Rocket21

Interested prop traders can start the evaluation after selecting their desired package and paying the one-time fee.

Minimum Evaluation Fee

The minimum evaluation fee at Rocket21 is $59 for the $5,000 one-step Apollo 11 evaluation.

Payment Methods

Withdrawal options |    |

|---|---|

Deposit options |   |

Rocket21 accepts credit/debit cards and cryptocurrency transactions.

Accepted Countries

Traders from the following countries are ineligible to purchase challenges: Cuba, Iran, North Korea, Myanmar, Russia (or the Crimea, Donetsk, or Luhansk regions of Ukraine), Somalia and Syria.

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via credit/debit cards and cryptocurrencies. Rocket21 only accepts Bitcoin (BTC), Ethereum (ETH), and Tether (USDT).

The Bottom Line - Is Rocket21 a Good Prop Firm?

I like Rocket21 for its provision of Eightcap trading platforms, low-cost evaluation fees, funding options, and scalability that allows traders to manage up to $2,000,000. The evaluation conditions match established industry standards but exclude time pressure. Prop traders can improve trading conditions in the Apollo 11 evaluation, which is the only account type that allows algorithmic trading and is the one I recommend to retail prop traders Retail prop traders must pay and pass an evaluation, and once they become verified, they will manage a demo account with a profit share of up to 90%. Rocket21 may copy trades from prop traders into live accounts at their discretion. Rocket21, like all prop trading firms, is unregulated but duly registered as a company and offers the trading platforms of a well-regulated brokerage. Rocket21 has a good rating on Trustpilot, but every trader must evaluate this prop trading firm and derive their conclusion. Rocket21 processes withdrawals within 2-3 business days of the payout date.FAQs

How does Rocket21 work?

Is Rocket21 regulated?

Is Rocket21 safe?

How long does it take for Rocket21 to pay out?