Editor’s Verdict

Overview

Review

Headquarters | Australia |

|---|---|

Year Established | 2012 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | A$3,000 |

Trading Platform(s) | Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Saxo Capital Markets, the Australian subsidiary of Danish investment bank, Saxo Bank, was founded as a brokerage in 1992. In 2012, Saxo Capital Market became operational but just two days later it was reprimanded by the Australian Securities and Investments Commission (ASIC) over its risk management practices. After a rocky start, the online brokerage swiftly expanded, largely as a result of its competitive product and services portfolio. Saxo Capital Markets maintains over 40,000 assets, placing it in the top two spots among all online brokers globally, but traders must commit to a minimum deposit of A$3,000. Unlike other ASIC-regulated brokers which offer a maximum leverage of 1:500, Saxo Capital Markets caps it at 1:50. With more than 600,000 clients, it remains one of the most competitive Australian online brokers.

Regulation and Security

The Australian Securities and Investments Commission (ASIC) regulates Saxo Capital Markets, which remains fully compliant. Two days after Saxo Bank announced its intention to build an online brokerage arm in Australia, ASIC reprimanded Saxo Capital Markets for its risk management procedures. It requested additional licensing requirements and compelled Saxo Bank to hire a risk management expert to monitor Saxo Capital Market's credit, client, and compliance risk. Those issues related to Sonray Capital Markets, a white-label affiliate for Saxo Bank. Since then, Saxo Capital Markets has built one of the most trustworthy and safe online brokers in Australia, as evidenced by over 600,000 clients.

Saxo Capital Markets is fully compliant with all ASIC regulations.

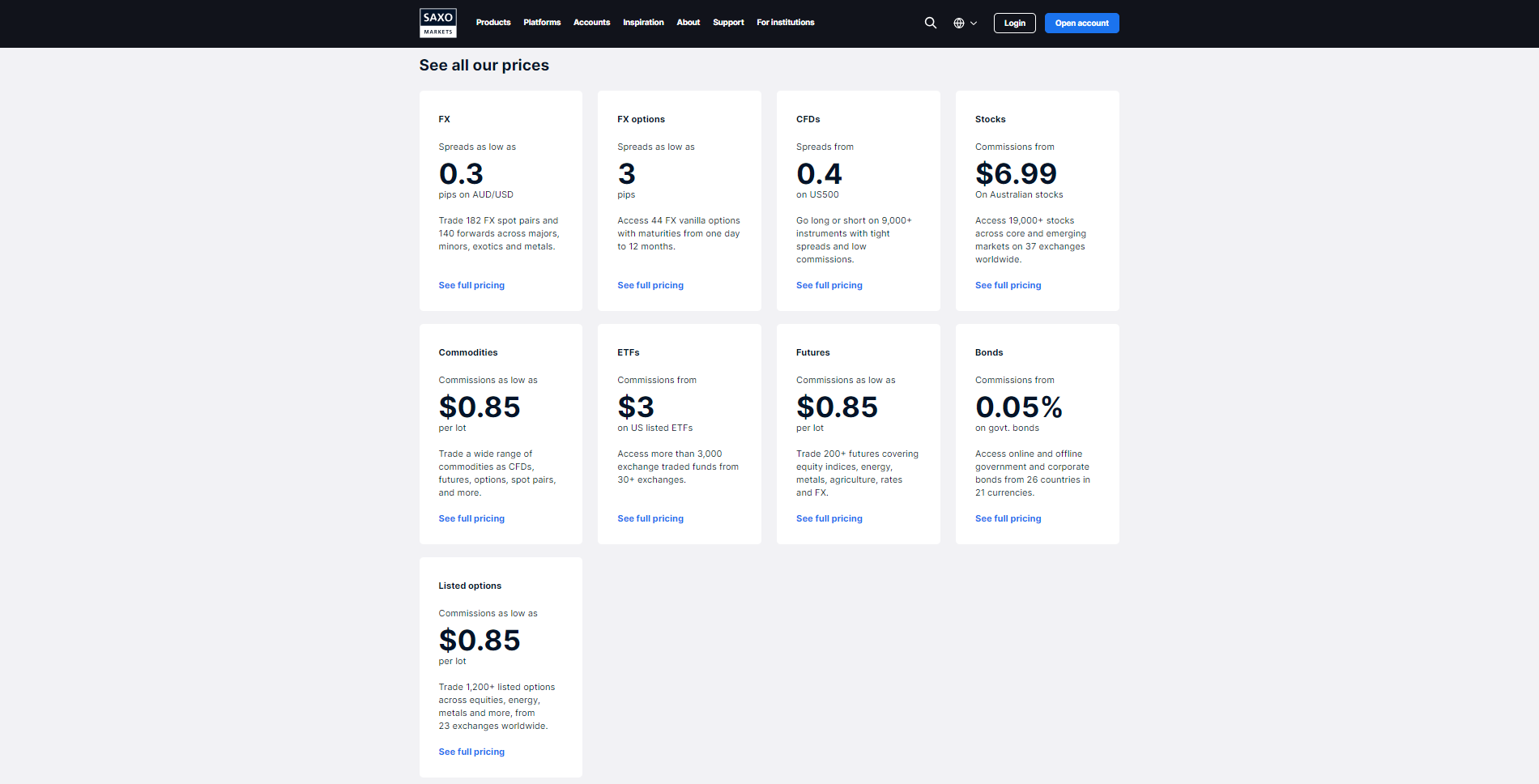

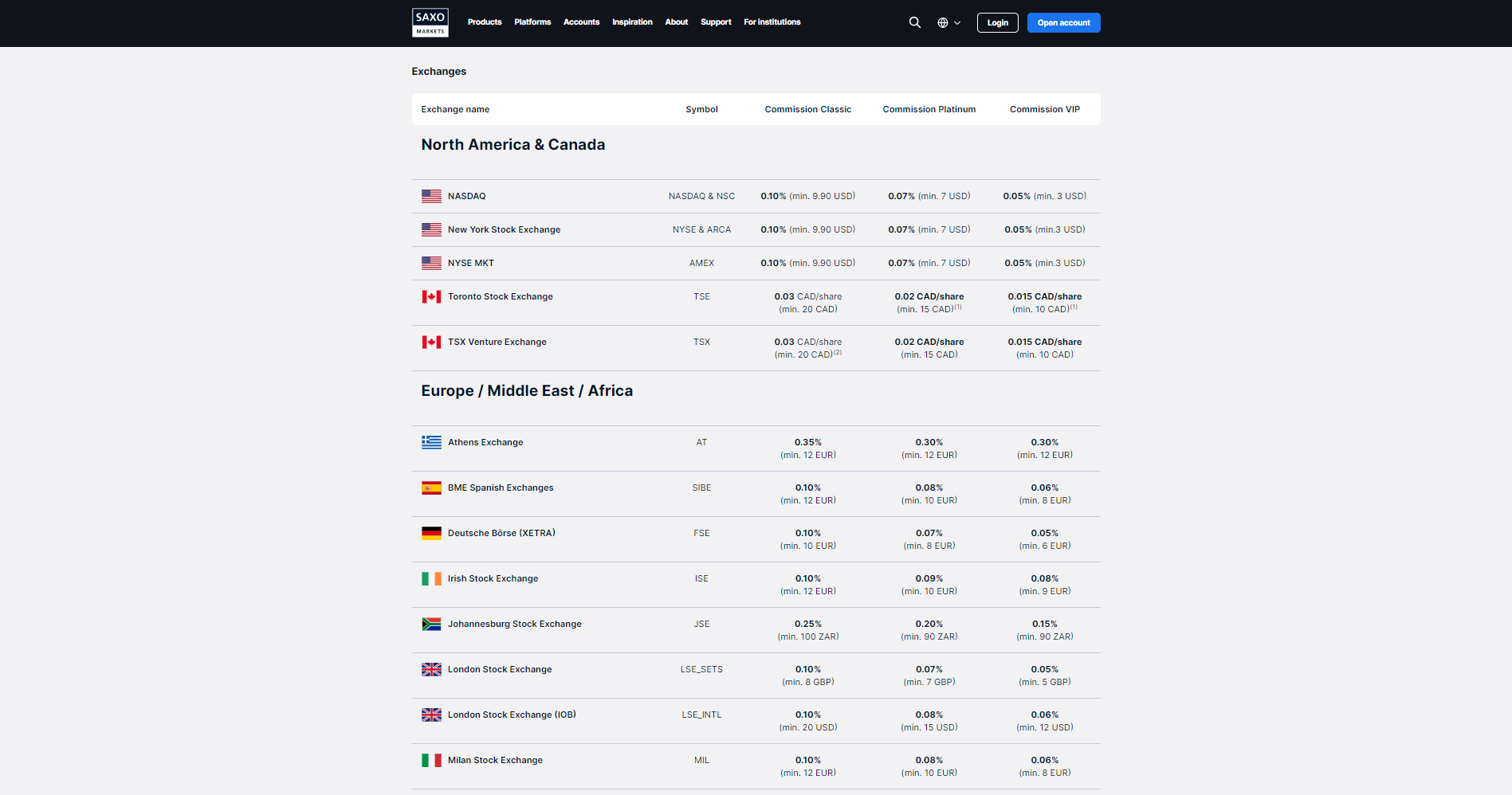

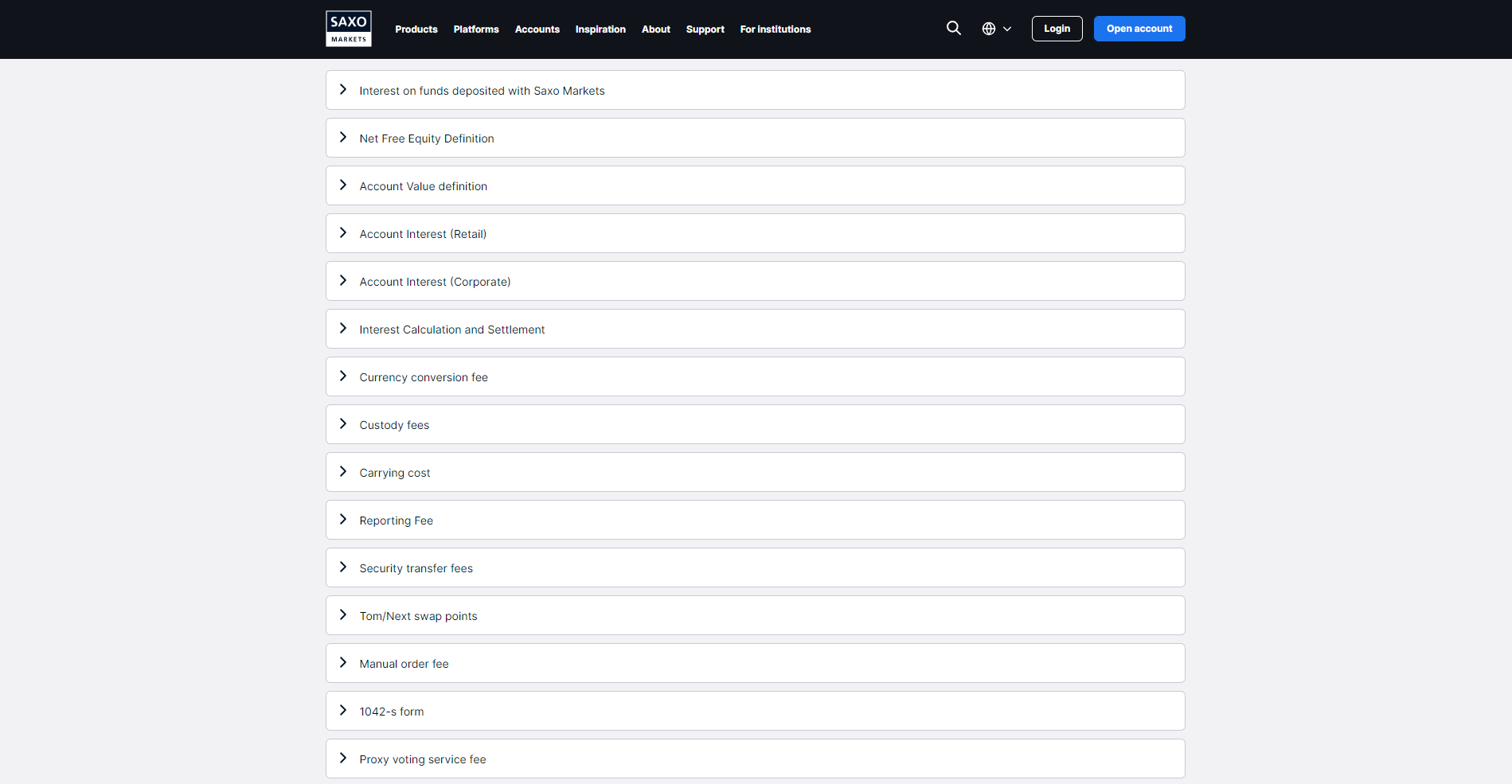

Fees

Saxo Capital Markets charges spreads and commissions, depending on the asset. Forex traders get currency pairs with minimum mark-ups of 0.3 pips, with average mark-ups commencing at 0.5 pips in a commission-free pricing environment. Forex options start from 3.0 pips and CFDs from 0.4 pips. Equity trading shows a minimum commission of A$6.99 for Australian equities but usually averages 0.10%, with a minimum value which depends on the exchange. Commodities, futures, and listed options cost 0.85$, ETFs incur a $3.00 commission, and bonds face a 0.05% fee.

Swap rates on leveraged overnight positions apply, and Saxo Capital Markets passes corporate actions such as dividends, splits, and mergers on to clients. Numerous other fees exist, but they only apply if the service is actually used by the client. Saxo Capital Markets lists all charges transparently on its website. Traders must also consider the currency conversion fee and third-party payment processor charges. The overall cost structure at Saxo Capital Markets remains among the best in the industry.

Traders get a competitive pricing environment at Saxo Capital Markets.

Equity commissions depend on the traded market, as do most other costs.

Saxo Capital Markets lists all costs transparently on its website.

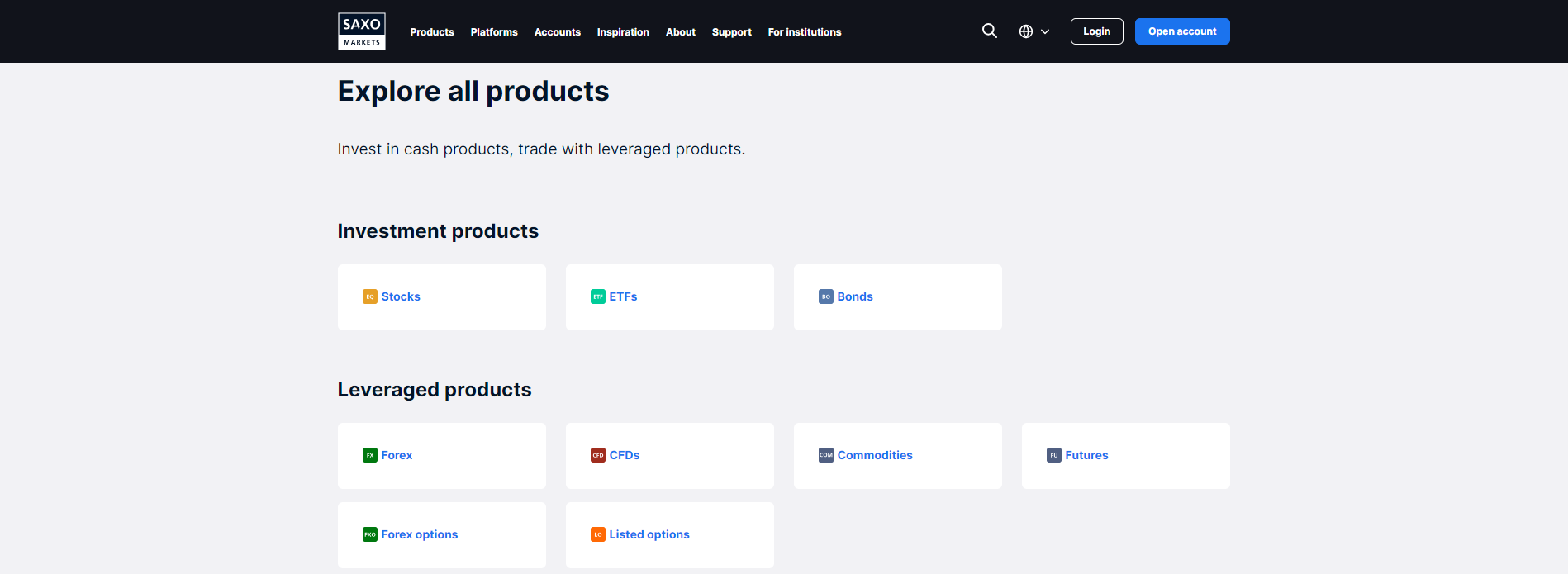

What Can I Trade?

Forex traders have access to 182 currency pairs, 140 forwards, and 44 vanilla options, making Saxo Capital Markets a prime Forex broker. More than 9,000 CFDs and 19,000 direct share dealing assets present the bulk of the asset selection. Adding depth are 3,000+ ETFs, 200+ futures contracts, and 1,200+ listed options. Completing the asset selection are commodities, and government and corporate bonds from 26 countries in 21 currencies. Saxo Capital Markets maintains an overall asset selection of 40,000+, ranking it number two globally among all online brokers.

Saxo Capital Markets offer clients one of the best asset selections and remains a prime Forex broker.

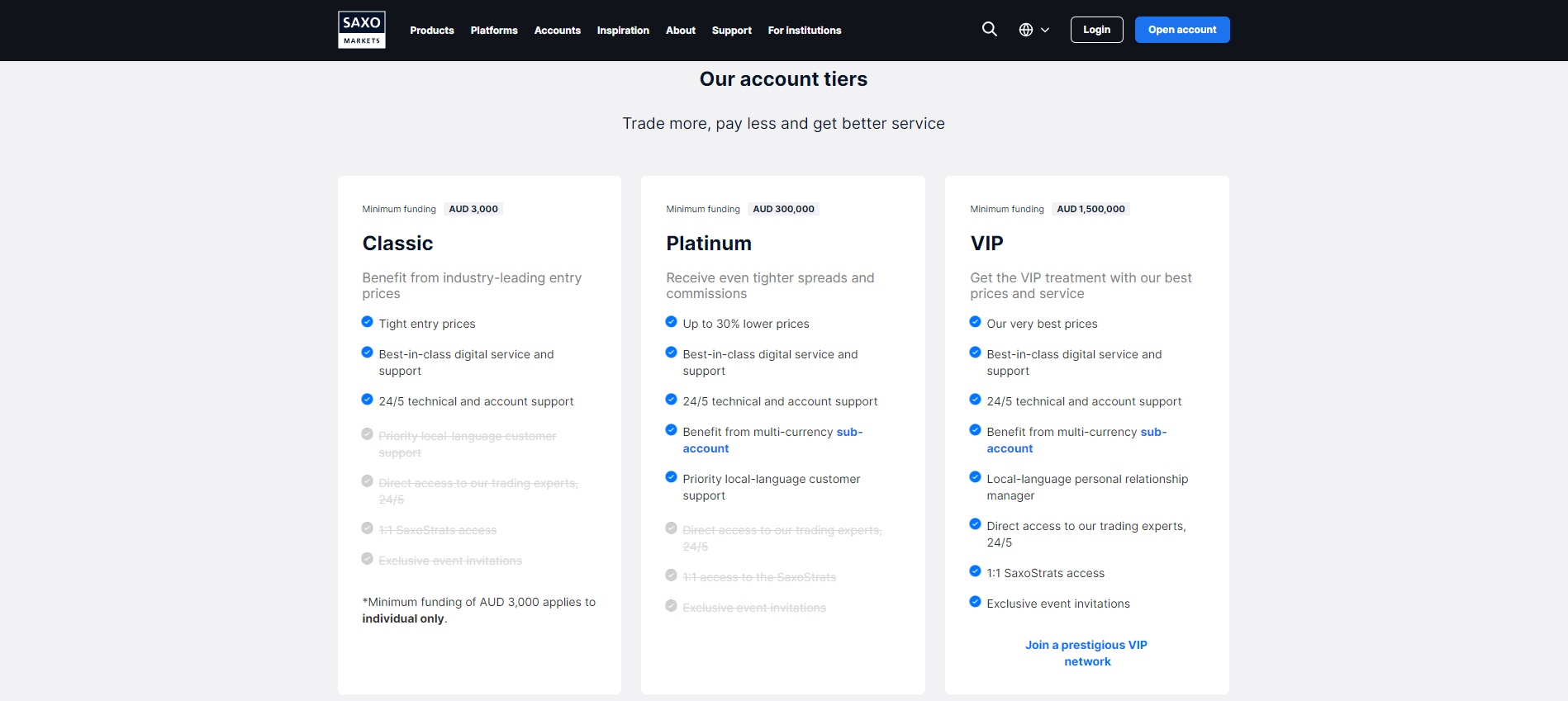

Account Types

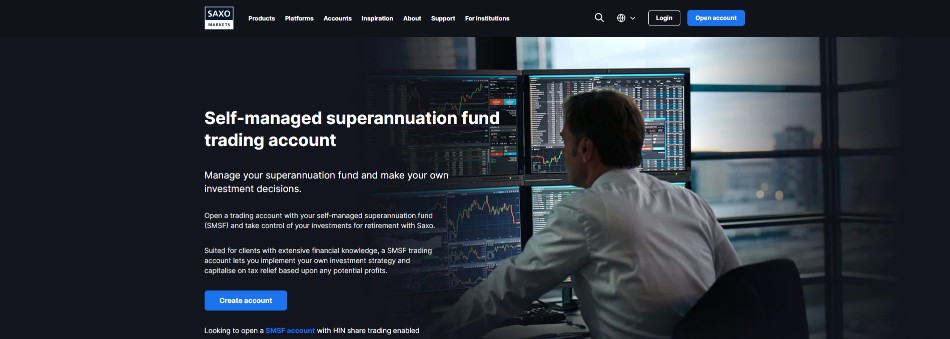

Clients may open an individual or joint account, a corporate account, trust accounts, wholesale accounts, and a self-managed superannuation fund (SMSF) account. Most traders opt for the individual option, which has three tiers. A minimum deposit of A$3,000 grants the Classic one, where most of the broker's 600,000 clients trade. For A$300,000, Saxo Capital Markets provides the Platinum versions, and a VIP upgrade exists from A$1,500,000. The self-managed superannuation fund is a popular choice for retirement planning. The minimum deposit remains among the highest in the industry and is not

suitable for new retail traders, as Saxo Capital Markets targets the mid-to-high-end segment.

The individual account at Saxo Capital Markets comes in three tiers, with a minimum deposit requirement of A$3,000.

The SMSF account at Saxo Capital Markets is a popular choice among investors.

The SMSF account at Saxo Capital Markets is a popular choice among investors.

Trading Platforms

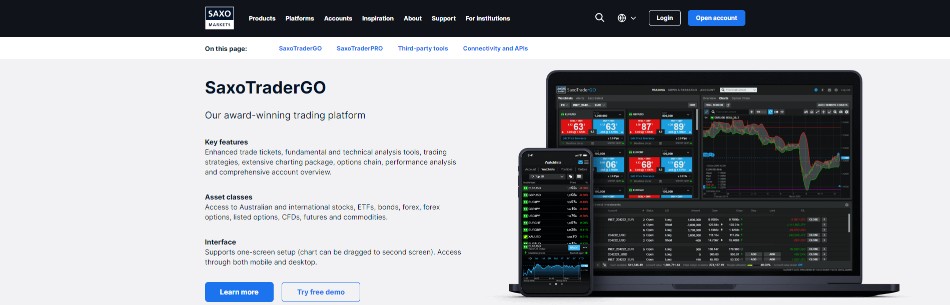

While Saxo Capital Markets does not offer traders the MT4 platform with its versatile infrastructure and support for automated trading solutions, it does provide in its place a pair of award-winning proprietary alternatives, namely SaxoTraderGO and SaxoTraderPRO. Each features a user-friendly interface, enhanced trade tickets, fundamental and technical analysis tools, news and expert research, an extensive charting package, and an options chain. The in-depth research hub assists traders in navigating markets. A comprehensive account overview delivers a portfolio summary, performance analytics, and a returns breakdown, which allows traders to improve their results. Innovative risk management features help clients protect their bottom line.

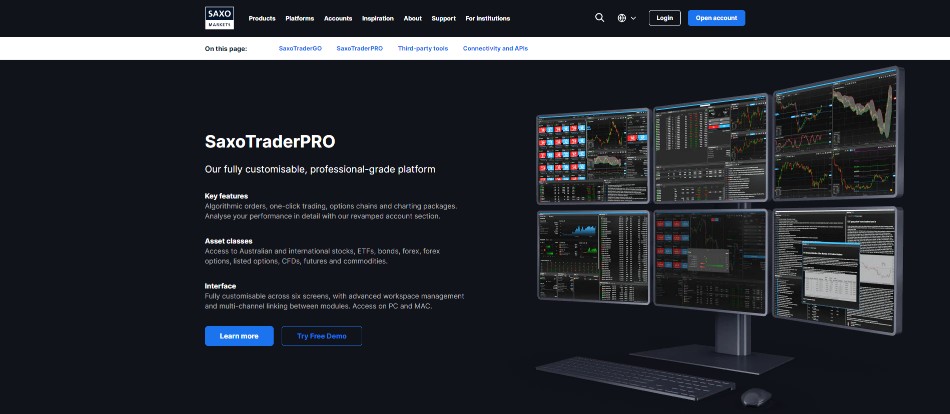

SaxoTraderPRO, intended for advanced traders, also features an advanced trade ticket, a depth trader, time and sales data, and algorithmic orders. Saxo Capital Markets provides third-party tools consisting of OpenAPI for Excel, Dynamic Trend, TradingView, MultiCharts, and Updata. FIX API and OpenAPI allows clients with advanced trading solutions to connect to the Saxo Capital Markets infrastructure and deploy automated trading solutions or other cutting-edge alternatives. The trading platforms and infrastructure at Saxo Capital Markets delivers a competitive edge to all clients.

SaxoTraderGO is an ideal trading platform for manual traders.

More demanding and algorithmic traders will rely on SaxoTraderPRO.

Saxo Capital Markets also maintains five third-party trading tools.

Two APIs allow traders to connect their proprietary trading solutions to the Saxo Capital Markets infrastructure.

Unique Features

Besides the outstanding infrastructure, pricing environment, deep liquidity, and asset selection, Saxo Capital Markets maintains one of the most transparent, honest, and reliable online brokerages globally. It also powers 120 banks and brokers, many via white label partnerships, and more than 300 financial intermediaries.

Saxo Capital Markets delivers exceptional trade execution and transparency.

More than 420 financial companies rely on Saxo Capital Markets.

More than 420 financial companies rely on Saxo Capital Markets.

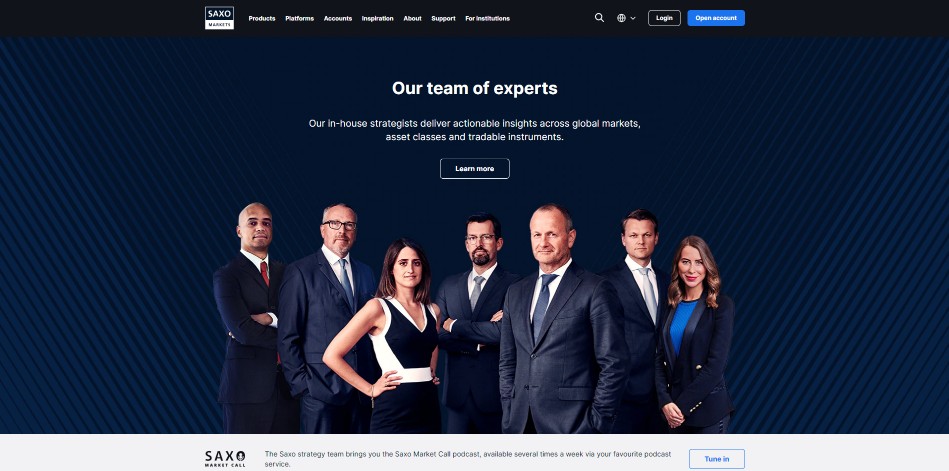

Research and Education

The seven-member SaxoStrats team delivers in-house research across all Saxo Bank subsidiaries. They present broad market research with detailed reports and trading ideas, complementing the competitive trading environment that already exists at Saxo Capital Markets. The research consists of written content and charts, all professionally presented and made available to all traders, not just clients of Saxo Capital Markets. Besides market commentary and trading ideas, the SaxoStrats team adds educational value.

Saxo Capital Markets is home to a seven-member research team.

Reports are accessible to clients and non-clients alike.

Saxo Capital Markets offers new traders numerous educational offers with podcasts and webinars; those hosted by the SaxoStrats members provide the best value. Trade Inspirations provide clients with education and research content, including client sentiment, market movers, and trade signals. Thought Starters adds well-explained topics with excellent educational value. While Saxo Capital Markets lacks an entry-level trading course, it provides a competitive overall educational section.

Podcasts present the best educational value at Saxo Capital Markets.

It also presents webinars hosted by the SaxoStrats team.

Trade Inspiration delivers a mix of education and research.

Thought Starters has valuable content covering a broad range of financial topics.

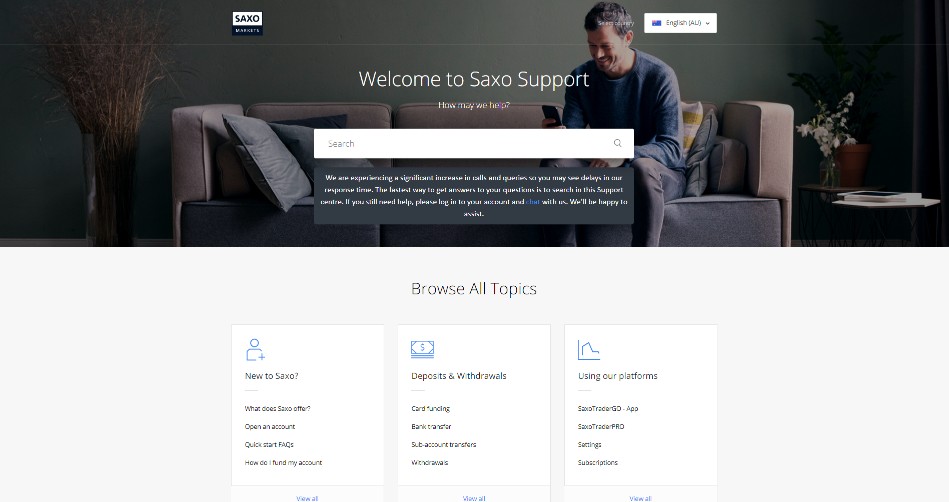

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |               |

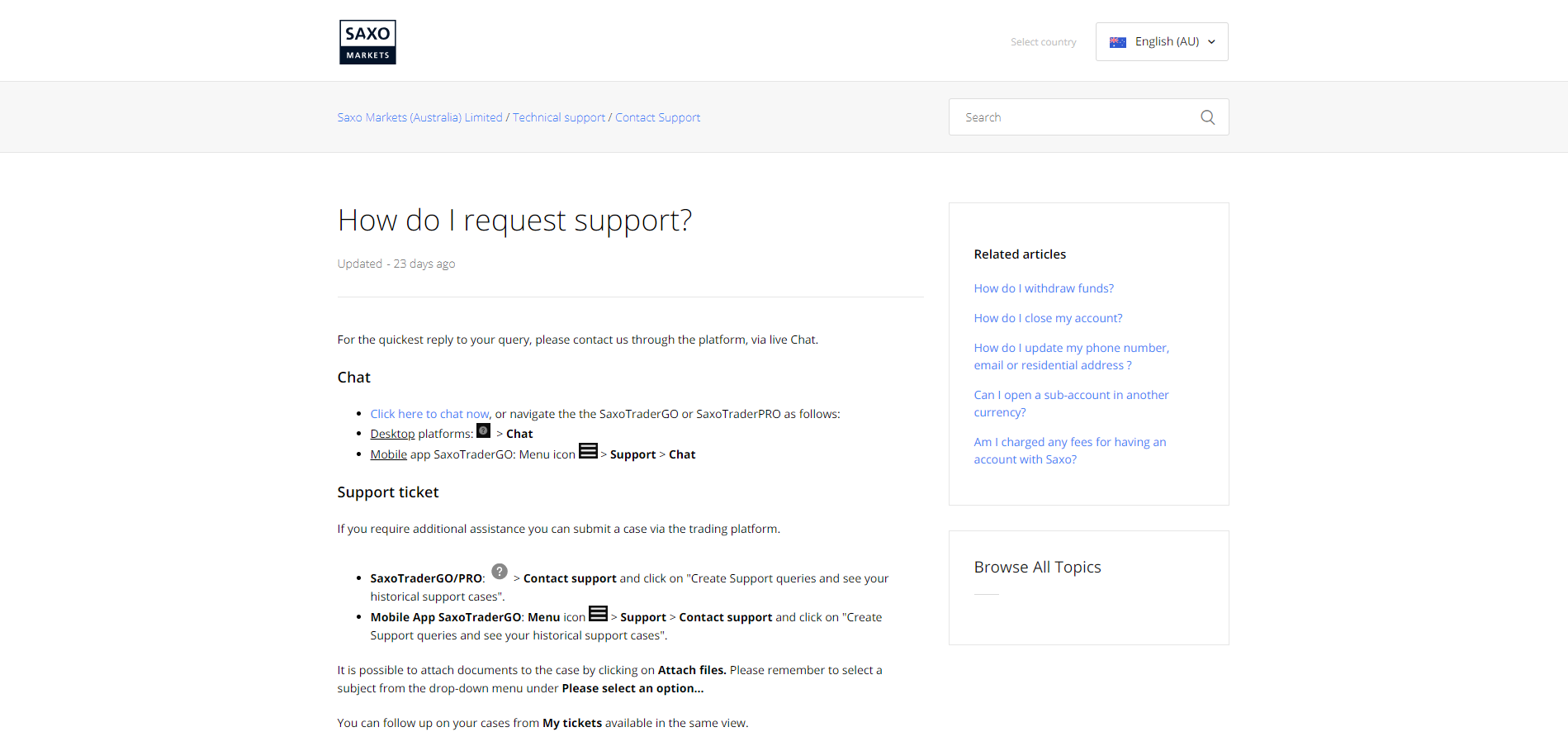

Clients have access to live chat, the most convenient contact method, with teams in sixteen countries. Operating hours are limited to times when markets are open. The FAQ section answers many of the most common questions, but Saxo Capital Markets also provides 25 phone numbers. While Saxo Capital Markets describes its products and services well, the extensive asset selection and product portfolio may require assistance, which is readily available.

Saxo Capital Markets has teams in sixteen countries.

The FAQ section covers many topics.

Clients can use the live chat function, open a support ticket, or call one of the 25 phone numbers.

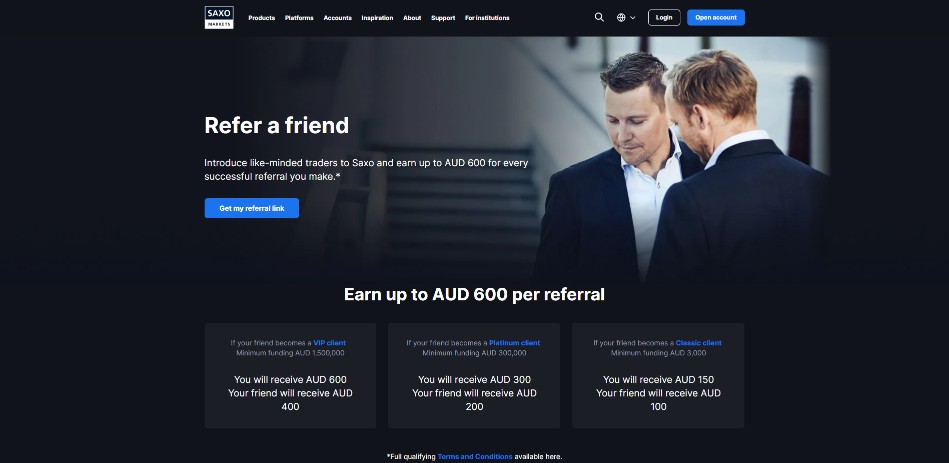

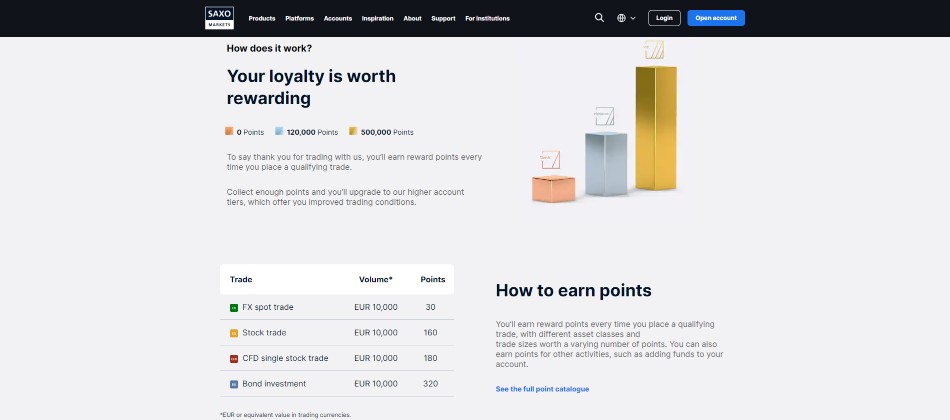

Bonuses and Promotions

At the time of this review, Saxo Capital Markets did not offer bonuses. A refer-a-friend campaign is available, paying up to A$600 per referral, while the Saxo Reward Program rewards active traders, upgrading clients to higher account tiers.

Saxo Capital Markets maintains a rewarding refer-a-friend campaign.

The Saxo Reward Program provides traders the opportunity to upgrade their account tier.

Opening an Account

An online application form handles new accounts. It requires less than two minutes to complete, but new traders must verify their account. A copy of their ID and one proof of residency document generally satisfies that requirement. Saxo Capital Markets only accepts clients from Australia and New Zealand.

Clients from Australia and New Zealand will complete an online application form.

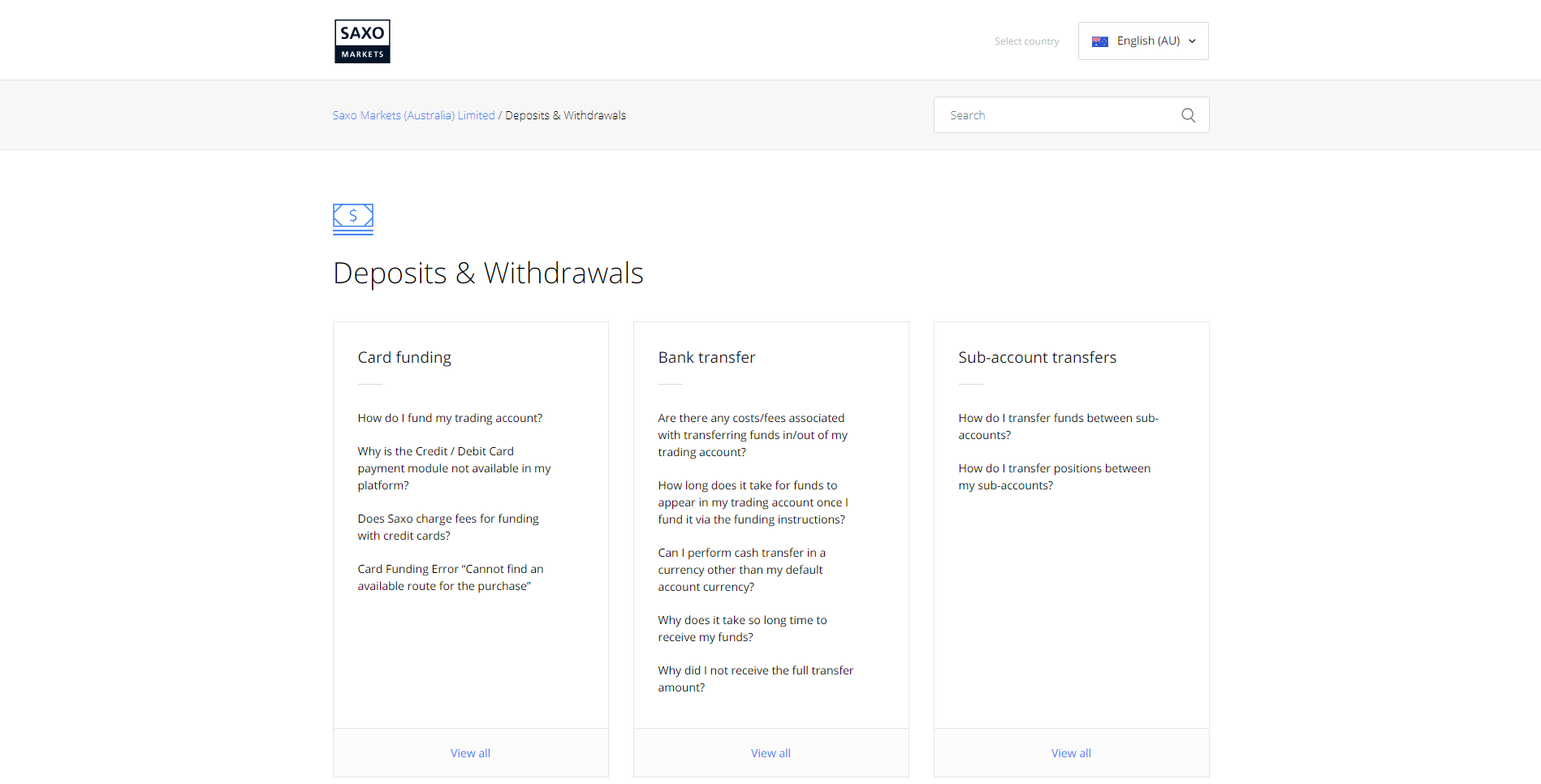

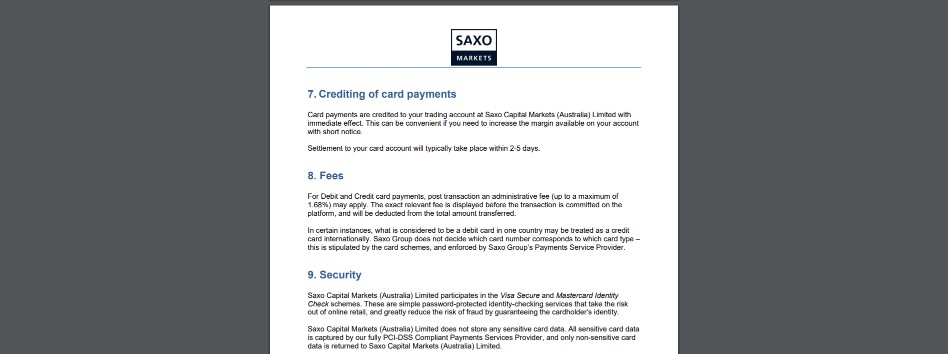

Deposits and Withdrawals

Unfortunately, Saxo Capital Markets only offers bank wires and credit/debit cards as payment options. Processing times can take up to five business days. Credit/debit cards incur a 1.68% maximum fee. Deposits and withdrawal options remain a distinct weakness at Saxo Capital Markets; traders should have access to more flexibility and modern third-party payment processors.

Bank wires and credit/debit cards are the only deposit and withdrawal options available.

Credit/debit card transactions face a maximum fee of 1.68%.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

Saxo Capital Markets, the Australian subsidiary of Danish investment bank Saxo Bank, was established in 2012. While the company had a rocky start, it quickly righted the wrongs cited by ASIC. Since then, it has expanded into one of the best online brokers in Australia. Traders have access to one of the most trader-friendly pricing environments, the second-best asset selection among all online brokers, and an excellent choice of two proprietary trading platforms. The minimum deposit of A$3,000 remains high, but the product and services portfolio warrants a higher capital commitment. Unfortunately, the maximum leverage is an atypical 1:50 versus 1:500 at other ASIC-regulated brokers. Saxo Capital Markets may not be best suited for new retail traders but presents one of the best choices for advanced, professional, and institutional clients. Saxo Capital Markets is also among the most transparent online brokers. Saxo Capital Markets provides one of the best overall trading environments available. Everything from the cost structure, asset selection, trading platforms and technology, transparency, and reliability remain among the industry leaders. The minimum deposit at Saxo Capital Markets is A$3,000 for the Classic account. Saxo Capital Markets listed no inactivity fee on its website or in its legal documents. Saxo Capital Markets only supports bank wires and credit/debit card withdrawals. Saxo Capital Markets maintains one of the safest and most trustworthy trading environments globally, and presently caters to more than 600,000 clients.FAQs

Is Saxo Capital Markets good?

What is the minimum deposit at Saxo Capital Markets?

Does Saxo Capital Markets have an inactivity fee?

How do I withdraw money from Saxo Capital Markets?

Is Saxo Capital Markets safe?