Editor’s Verdict

SmartFX is an MT5 multi-asset CFD broker maintaining one account type for all clients and a balanced asset selection focused on US equity CFDs. The daily market analysis offers actionable trading signals, and SmartFX launched its in-house copy trading service. I reviewed this broker to evaluate if retail traders should trust this broker with their deposits. Is SmartFX the right choice for you?

Overview

An MT5 broker with a balanced asset selection and proprietary copy trading service.

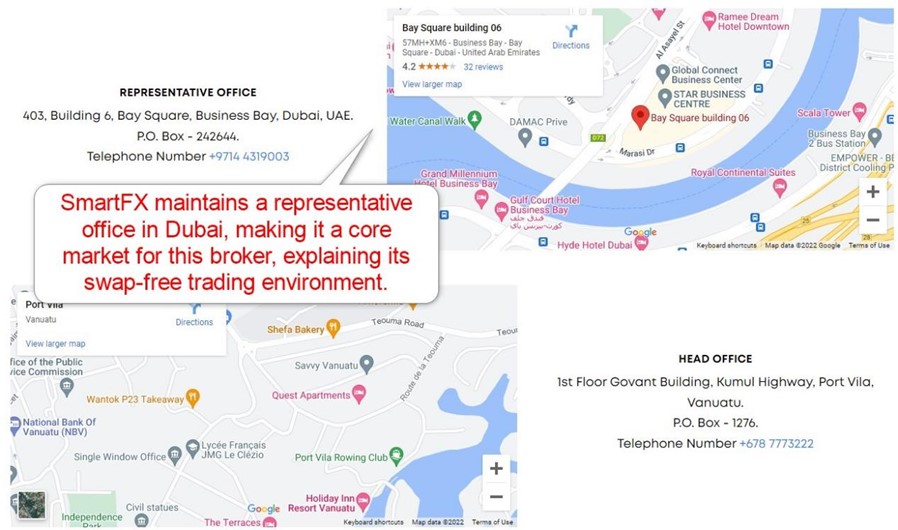

I like the choice of currency pairs and the suggestion that SmartFX can add more equity CFDs and currency pairs for valued clients. The addition of the in-house copy trading service was good, catering to what I presume is their core market. SmartFX continues to expand, especially from its trading hub in Dubai.

SmartFX Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. SmartFX presents clients with one regulated entity.

Name of the Regulator | VFSC |

|---|

Is SmartFX Legit and Safe?

The Vanuatu Financial Services Commission (VFSC) regulates SmartFX. It has maintained a clean track record since its founding in 2018. SmartFX segregates client deposits from corporate funds and provides negative balance protection to all its clients. It also operates and expands from a representative office in Dubai. I rate SmartFX as an overall secure broker.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability.

Minimum Raw Spreads | Not applicable |

|---|---|

Minimum Standard Spreads | 1.2 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

SmartFX offers traders a commission-free trading account. SmartFX does not charge any account maintenance fees, deposit or withdrawal fees, or currency conversion fees to its customers. Spreads are floating, and the benchmark EUR/USD currency pair typically averages approximately 2.5 pips, with a 1.2 pips minimum spread.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Customer support at SmartFX confirmed swap-free trading, but I encourage each trader to receive an individual confirmation about this.

MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Range of Assets

SmartFX offers clients a balanced asset selection with 2,000+ trading instruments, primarily US-listed equity CFDs, which account for just over 1,600, including ETFs. Forex traders get a choice of 43 currency pairs, plus a small number of commodities. Cryptocurrencies are not offered. Overall, I like SmartFX for US-focused equity traders.

Asset List Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

SmartFX Leverage

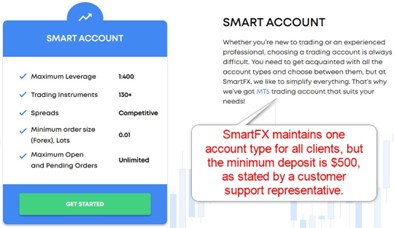

The maximum SmartFX leverage available for Forex retail traders is a highly competitive 1:400. It can provide traders with an edge, and negative balance protection ensures traders cannot lose more than their deposit.

Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses. Negative balance protection exists, meaning traders can never lose more than their deposits.

SmartFX Trading Hours

Asset Class | From | To |

|---|

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which trade non-stop

I recommend the following step for MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

All traders at SmartFX get the same trading account, called “Smart.” I like the equal treatment for all traders, as there is no intended upselling for better services to lure more substantial deposits. The minimum deposit is $500, which is higher than most brokers in the industry require.

SmartFX does not note an Islamic account, but with Dubai as one of its core markets, traders can contact customer service to apply for a swap-free trading account.

SmartFX Demo Account

SmartFX offers a demo account, and traders may select their desired demo account balance from within the MT5 trading platform, but phone verification is mandatory. Demo accounts at SmartFX remain unlimited in time, making them ideal for testing strategies and algorithmic trading solutions.

I recommend a demo account balance similar to the planned live deposit amount, but $3,000 is the minimum demo balance at SmartFX. I also want to caution beginner traders against using a demo account as a full simulation of a real money account, as trading psychology is different when real money is at risk.

Trading Platforms

SmartFX is a rare broker only offering the MT5 trading platform. It is available as the out-of-the-box version without any third-party upgrades. Traders may use the desktop client, opt for a lightweight, web-based version for manual trading, or use the mobile app. It supports algorithmic trading and comes with an integrated copy trading service, offering beginners everything they need to manage portfolios. Since MT5 lacks backward compatibility with MT4, traders must carefully consider which upgrades and EAs they purchase, where MT5 has notably less than the 25,000+ available on MT4.

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

SmartFX launched an in-house copy trading service, which traders can use instead of the embedded MT5 service or diversify with it. I wish SmartFX would introduce it properly, as it only provides a sign-up form to launch the service.

Research & Education

SmartFX maintains a blog where it publishes quality educational content. Beginners can also register for live webinars. I like the blog content and highly recommend new traders read it carefully, but it lacks a classroom-style approach to education.

I advise beginners to learn how to trade elsewhere via online educational resources available for free and start with trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

SmartFX also maintains a blog where it publishes quality educational content. Beginners can also register for live webinars. I like the blog content and highly recommend new traders read it carefully.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |    |

SmartFX offers 24/5 multilingual customer support. Traders may reach out via e-mail, live chat, or phone. A limited FAQ section leaves some questions unanswered, unfortunately. I relied heavily on live chat for answers that should be available on its website, and response times ranged between instant to not at all.

A direct line to the finance department where most issues may arise is missing, but phone support exists. Live chat is ideal for non-urgent matters.

Bonuses and Promotions

During my review, SmartFX neither offered bonuses not promotions, but an IB affiliate program for passive income generation exists.

Awards

SmartFX received one industry award from Global Brands Magazine in 2021, honoring it as the Fastest Growing Broker in the UAE, one of its core markets. Additionally, SmartFX received the Fastest Payout Broker award during the Forex Expo Dubai 2022. It confirms its commitment to the region, a fact local traders should consider.

Opening an Account

The swift online application handles new account openings, asking for name, e-mail, desired password, country, and valid mobile phone number. SmartFX will send a verification code to the mobile number, a requirement to complete the account opening process. It takes less than a minute to open a trading account at SmartFX, as this broker does not include unnecessary questionnaires to collect data.

Account verification is a mandatory step, and most traders will satisfy it by sending a copy of their ID and one proof of residency document.

Minimum Deposit

The minimum deposit at SmartFX is $500, somewhat higher than most comparable Forex brokers in the industry.

Payment Methods

SmartFX accepts bank wires, credit/debit cards, Skrill, Neteller, STICPAY, SorexPay, and My Fatoorah.

Withdrawal options |       |

|---|---|

Deposit options |       |

Accepted Countries

SmartFX caters to many international traders, except Cuba, Myanmar, Iran, North Korea, Sudan, Syria, Ukraine, India, and the US.

Deposits and Withdrawals

The secure SmartFX back office handles all financial transactions for verified clients.

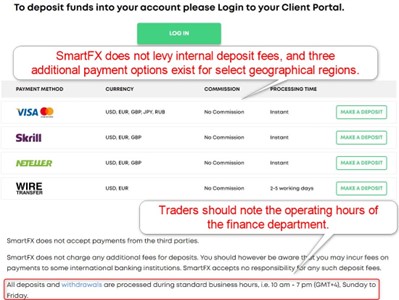

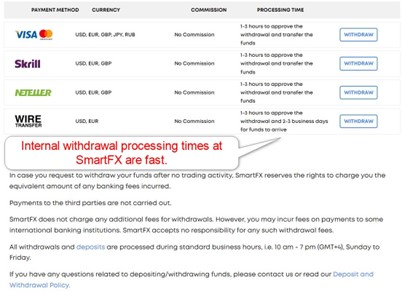

SmartFX requires a minimum deposit of $500, and the minimum withdrawal amount is $100. All withdrawals must follow the deposit path, with excess funds processed via bank wire. SmartFX does not levy internal processing fees, but traders may face third-party fees incurred by withdrawals. Deposit processing times are instant, except for bank wires, where SmartFX notes two to five business days.

SmartFX approves withdrawal requests between one and three hours if received during processing hours between 10 a.m. and 7 p.m. (GMT + 4) Sunday through Friday. Otherwise, SmartFX will process them the following business day. Traders must consider the additional time to receive funds after SmartFX processes the withdrawal request, which can range between a few hours and several business days, dependent on the payment processor and client location. Accepted deposit and withdrawal currencies are USD, EUR, GBP, JPY, and RUB for credit cards, USD, EUR, GBP for e-wallets, and USD and EUR for bank wires. Not all payment processors are available to every client, as some are restricted by geographic location.

Is SmartFX a good broker?

I like the trading environment at SmartFX for leveraged US-focused equity traders and Forex traders with medium-to-long-term strategies, as trading fees are unsuitable for scalpers, algorithmic traders, and other short-term trading strategies. I also like the daily, actionable trading signals and educational content on the SmartFX blog.

SmartFX continues to expand with services for its core market, including adding its in-house copy trading service and ongoing growth from its Dubai representative office. SmartFX presents a safe and secure trading environment with untapped potential, and I add this broker to my list of brokers worth keeping an eye on in the future. The Vanuatu Financial Services Commission regulates SmartFX. Traders may use the MT5 mobile app, but a proprietary solution does not exist. SmartFX works with the MT5 trading platform. SmartFX offers a maximum leverage of 1:400. SmartFX processes most withdrawals within 24 hours, but it may take up to five business days for clients to receive their funds, dependent on the payment processor. Most online payment processors will credit accounts instantly after SmartFX has completed the withdrawal. The minimum deposit for all traders is $500. SmartFX accepts deposits by Visa, MasterCard, American Express, Skrill, Neteller, STICPAY, and Bank Wire Transfers. SmartFX can be suitable for beginners as it offers weekly webinars and informational tools. Yes, SmartFX has no restrictions on scalping.FAQs

Is SmartFX regulated?

Is SmartFX available on mobile?

Which trading platform does SmartFX provide?

What maximum leverage does SmartFX offer?

How long does it take for a SmartFX withdrawal?

What is SmartFX’s minimum deposit?

How do I deposit money with SmartFX?

Is SmartFX good for beginners?

Does SmartFX allow scalping?