Editor’s Verdict

SoFi Invest is a brokerage service offered by publicly listed SoFi Technologies. It caters primarily to first-time buy-and-hold investors with low-frequency investment strategies.

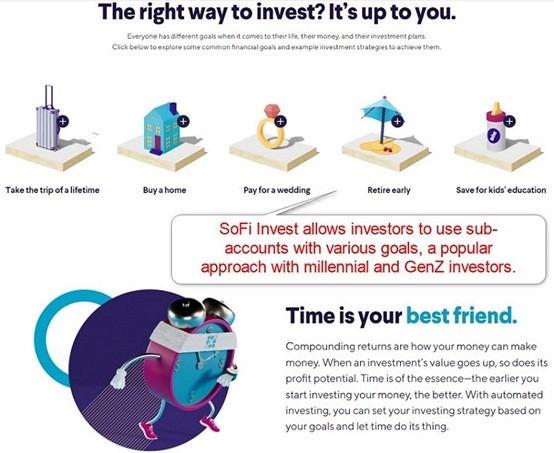

Attracting millennial and Gen Z investors through the implementation of competitive low fees, thereby significantly reducing costs across the entire spectrum of traditional investing. Uniquely, the firm also offers ATM withdrawals at 55K+ locations across the US. My SoFi review evaluated if the investment environment provides an edge or if it is an over-hyped, low-quality brokerage. This broker is unlikely to satisfy active traders but could be a good solution of passive investors looking for a robo-advisory service.

Overview

SoFi Invest provides fee-free financial planners and robo-advisory services.

SoFi Invest Five Core Takeaways:

- Trustworthy brokerage for US clients

- Commission-free investing

- Fee-free robo-advisory from $1 and fee-free access to financial planners

- Inadequate environment for active investors and traders

- No algorithmic trading and limited asset selection

Headquarters | United States |

|---|---|

Regulators | SEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2011 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | cTrader, Proprietary platform |

Average Trading Cost EUR/USD | NA |

Average Trading Cost GBP/USD | NA |

Average Trading Cost WTI Crude Oil | NA |

Average Trading Cost Gold | NA |

Average Trading Cost Bitcoin | NA |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | NA |

Minimum Standard Spreads | NA |

Minimum Commission for Forex | NA |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

SoFi Invest Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation status and verify it with the regulator independently by checking the provided license number with their online database of firms. SoFi Invest owner SoFi Technologies is a US-listed public company.

Country of the Regulator | United States |

|---|---|

Name of the Regulator | SEC |

Regulatory License Number | 151717, 8-68389 |

Regulatory Tier | 1, 1 |

Is SoFi Invest Legit and Safe?

My SoFi Invest review found no misconduct or malpractice by this broker, which is considered one of the best-managed US-based financial firms. Therefore, I recommend SoFi Invest as a legitimate broker with a secure investment environment.

SoFi Invest regulation and security components:

- Founded in 2011

- Excellent reputation and ownership by SoFi Technologies, a publicly listed US online bank

- SIPC protection up to $500,000 value per client, including a $250,000 cash limit

- No third-party insurance packages

What would I like SoFi Invest to add?

SoFi Invest could improve its regulatory transparency and consider a third-party insurance package giving clients more protection.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability.

Here is a snapshot of the SoFi Invest core investment fees:

- Stocks - $0

- ETFs - $

- Options - $0

- Robo-advisory fees - $0

- Financial planner fees - $0

SoFi does not implement withdrawal or inactivity fees, but selecting deposit methods incurs a $4.95 transaction cost. Regulatory investment fees and spreads apply, as no brokerage can provide 100% free transactions.

The most often ignored trading costs are swap rate markups on leveraged overnight positions. Depending on the trading strategy, it may become the most significant additional cost per trade. I recommend that traders check the provider's swaps when evaluating the total trading costs.

Noteworthy:

SoFi Invest offers leveraged trading and charges a 10% annual margin rate, swap or financing rates.

Average Trading Cost EUR/USD | NA |

|---|---|

Average Trading Cost GBP/USD | NA |

Average Trading Cost WTI Crude Oil | NA |

Average Trading Cost Gold | NA |

Average Trading Cost Bitcoin | NA |

Minimum Raw Spreads | NA |

Minimum Standard Spreads | NA |

Minimum Commission for Forex | NA |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | FALSE |

SoFi Invest Trading Hours

Asset Class | From | To |

|---|---|---|

Stocks (non-CFDs) | Monday 09:00 | Friday 20:00 |

ETFs | Monday 09:00 | Friday 20:00 |

Options | Monday 09:00 | Friday 20:00 |

Range of Assets

SoFi Invest maintains a limited asset selection, catering to investors with a buy-and-hold strategy, low-frequency transactions, and retirement planners. Margin trading exists, but the infrastructure fails to support active traders and other providers, the asset selection needs to be better, the sector coverage needs to be improved, and the absence of a comprehensive trading platform is notable.

SoFi Invest offers the following assets:

- Stocks

- ETFs, including in-house-created thematic alternatives

- Options

- IPO Investing

- Fractional share dealing from $5

- SoFi stopped offering cryptocurrencies and moved client accounts to Blockchain.com.

SoFi Invest Leverage

Maximum Retail Leverage | 1:4 |

|---|---|

Maximum Pro Leverage | 1:4 |

What should traders know about SoFi Invest leverage?

- My SoFi Invest review found no stated leverage details, but the maximum allowed by US regulations derived from more transparent competitors is 1:4.

- Margin trading may not apply to every tradable asset.

- Clients must have a minimum account balance of $2,000 to qualify for margin trading.

- SoFi Invest levies a 10% margin rate.

- Traders will receive a margin call if their buying power turns negative.

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Account Types

SoFi Invest keeps its account offering simple and caters well to its target market. Most investors will manage everything from the mobile app. My SoFi Invest review could not determine if the fee-free robo-advisory service requires a separate account, but it only focuses on ETFs. Clients can open multiple sub-accounts to set various goals or run different strategies if they want to separate their portfolios.

SoFi Invest has the following account types:

- Active investing account

- Margin trading account

- Roth IRA

- Traditional IRA

SoFi Invest Demo Account

Demo trading does not grant exposure to the important aspect of trading psychology and can, in turn, create unrealistic return expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations of a demo.

SoFi Invest offers a demo account labelled paper trading, allowing investors to set their desired account balance value. My SoFi Invest review found no time restrictions on it.

Trading Platforms

SoFi Invest fails to provide a quality investment platform; therefore, traders must accept an inadequate trading solution. I could not find a platform introduction or description during my SoFi Invest review. SoFi Invest follows a mobile-first approach and, therefore, sends out a clear sign that SoFi Invest caters to clients with a low frequency of transactions. Investors receive the bare minimum compared to similar offerings on the market, which I find unacceptable.

Therefore, SoFi Invest is ideal for investors using its robo-advisory service and those who place infrequent investments with a multi-year time horizon.

MT4 MT5 MT4/MT5 Add-Ons cTrader Proprietary Platform Automated Trading Social/Copy Trading DOM? Guaranteed Stop Loss Scalping Hedging One-Click Trading OCO Orders Interest on Margin

Unique Features

My SoFi Invest review discovered three unique features: fee-free advisory services, the absence of a comprehensive investment platform, and the integrated financial ecosystem. SoFi Invest relies mainly on its mobile app, which needs to be improved for weighty financial matters but a popular approach for its core client base.

Research & Education

Rather than research, SoFi Invest provides clients with complimentary access to financial planners and fee-free robo-advisory services using ETFs to accomplish goals within given parameters. Investors have access to a wealth of free and paid-for research available online. Therefore, I do not consider the lack of dedicated content at SoFi Invest to be a negative, and I consider the available services superior to the alternatives.

What about education at SoFi Invest?

SoFi Invest features educational content under its SoFi Learn section, which contains many articles with valuable information for beginners. SoFi Learn covers many financial subjects, but navigating the section could be more user-friendly. I wonder if most beginners will read past the articles on the front page, as there are 96 pages to navigate.

My conclusion:

- Beginners should explore SoFi Learn.

- I also recommend beginners seek in-depth education from third parties, starting with trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

Customer Support

SoFi Invest customer support is available from Monday 05:00 through Friday 17:00 EST. Clients can reach a chatbot 24/7. Before contacting customer support, I recommend the FAQ section, as it answers many common questions. During my SoFi Invest review, most product and service descriptions were detailed well enough and did not require further clarification or customer support.

Support Hours | Monday - Friday, 05:00 - 17:00 |

|---|---|

Website Languages |  |

Bonuses and Promotions

During my SoFi Invest review, clients received a 2% IRA match. Investors with a SoFi online bank credit card benefit from unlimited 2% cashback rewards and a 3% travel reward. New clients qualify for up to $1,000 in free stocks once they fund their account. The terms and conditions apply, and I recommend everyone interested in SoFi Invest rewards read and understand them.

Opening an Account

The SoFi Invest mobile app manages new account openings. Alternatively, investors can start with the online account application on the SoFi Invest website. It is a multi-step process and takes numerous clicks to get started on the mobile app. The application follows established US industry practices and data collection.

What should traders know about the SoFi Invest account opening process?

- SoFi Invest complies with global AML/KYC requirements

- Only US residents can open an account

- Account verification is mandatory

- SoFi Invest collects unnecessary data on employment and financial data

- Uploading a copy of a driver’s license or government-issued ID satisfies account verification for most clients

- SoFi Invest may ask for additional information on a case-by-case basis

Minimum Deposit

As mentioned above, there is no SoFi Invest minimum deposit requirement, but select services have minimum capital requirements.

Payment Methods

SoFi Invest only accepts bank wires and credit/debit cards.

Withdrawal options |   |

|---|---|

Deposit options |   |

Accepted Countries

SoFi Invest caters exclusively to US residents.

Deposits and Withdrawals

The secure SoFi Invest back office or mobile app handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at SoFi Invest?

- SoFi Invest only accepts bank-related deposits and withdrawals

- There is no minimum deposit requirement

- Investors may have to wait for funds to settle, which can take up to three business days.

- SoFi supports an Instant Deposit feature via linked debit cards with a $50 minimum and $500 maximum.

- Cash deposits via its partner GreenDot incur a $4.95 fee

- SoFi Invest does not list a minimum withdrawal amount

- The most convenient withdrawal method is via 55,000+ Allpoint ATMs, where no ATM fees apply

Is SoFi Invest a good broker?

I like the trading environment at SoFi Invest for long-term low-frequency investors using the fee-free robo-advisory service. While SoFi Invest shines with its minimal fees, free financial planner access, and mobile-first, all-included financial offering, I can only recommend it to those who meet the above criteria. SoFi does not offer a top-quality investment portal and needs some core features that are standard elsewhere. Some traders will find the product and services portfolio could be better.

SoFi Invest is popular among first-time investors in the millennial and GenZ crowd, but during my SoFi Invest review, the lack of fees was let down by the overall offering. For traders who accept what SoFi Invest offers, it is an acceptable solution, as it ranks among the better offers in the US, and free financial planner access could be worth an account. For active investors and traders, SoFi fails to offer a competitive environment. SoFi is a financially stable company, judged by its past performance. SoFi only caters well to investors using its robo-advisory service, for which its mobile app is excellent. However, the need for a quality investment and trading platform, limited asset selection, and mobile-first approach are notable obstacles to active trader clients. My SoFi Invest review determined that SoFi ranks among the most trusted apps due to its outstanding regulatory track record. SoFi Invest is a safe brokerage owned by publicly listed SoFi Technologies. It has an excellent regulatory history, a rare accomplishment among US-based brokers.FAQs

Is SoFi financially stable?

What is the downside of SoFi?

Is SoFi a trustworthy app?

Is SoFi Invest safe?