Editor’s Verdict

Spreadex, founded in 1999, is a UK-based and regulated spread betting, CFD trading, and sports betting firm. Traders get a proprietary, web-based trading platform and can connect to TradingView. Spreadex features excellent order execution and prides itself on superb customer support. Therefore, I consider Spreadex an excellent choice for UK-based spread betters. My Spreadex review evaluated its trading environment. Is Spreadex the right broker for you?

Overview

Review

Headquarters | United Kingdom |

|---|---|

Regulators | FCA |

Year Established | 1999 |

Execution Type(s) | Market Maker |

Minimum Deposit | None |

Trading Platform(s) | Proprietary platform, Web-based, Trading View |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Spreadex was established in 1999 and has, since then, continuously expanded in the sports and spread betting sectors. Between 2006 and 2008, it was identified as one of the Top 100 most profitable UK companies by the Sunday Times PriceWaterhouseCoopers Profit Track 100 list. Spreadex is among the most customer-friendly brokers in operation today, as evidenced by the Investment Trends UK, CFD, FX, and Spread Betting Report, which named Spreadex as the best spread betting firm for customer service five times. Spreadex primarily focuses on clients who prefer trading from mobile devices, it maintains an exceptional asset selection, and continues to increase market share via acquisitions and organic growth.

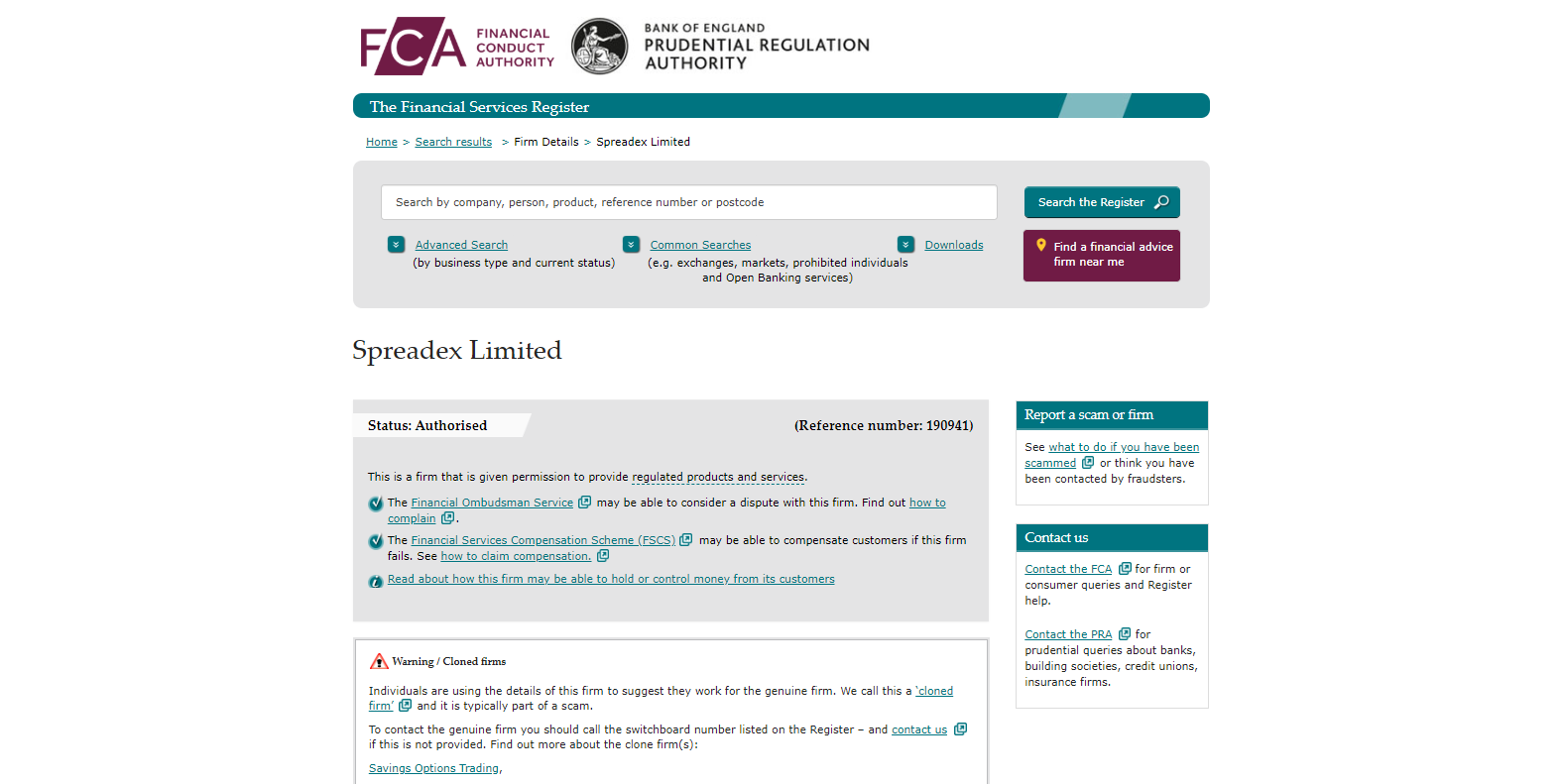

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check for regulations and verify them with the regulator by checking the provided license with their database. Spreadex has one regulated entity.

Is Spreadex Legit and Safe?

My review found no misconduct or malpractice by this broker. It has 25+ years of operational history, and I recommend Spreadex as a legitimate broker.

Spreadex regulation and security components:

- Regulated by the FCA, the UK Gambling Commission, and the AGCC

- Founded in 1999

- Segregation of client deposits from corporate funds

- Negative balance protection

- Financial Services Compensation Scheme (FSCS), up to £85,000, in the event of default

What would I like Spreadex to add?

I want Spreadex to consider a third-party insurance package to enhance protection. More transparency about its core management team would further increase trust in this broker.

Fees

I consider trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Spreadex offers competitive spreads and commissions. Spreadex also profits directly from client losses, where it is the counterparty.

Spreadex does not levy internal deposit or withdrawal fees, but third-party processing costs and currency conversion fees may apply. Spreadex has no inactivity fees.

The minimum trading costs for the EUR/USD at Spreadex are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

0.6 pips | $0.00 | $6.00 |

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Spreadex levies a 3.00% fee plus applicable financing fees, which depend on the asset and the borrowed amount. The formula is: (Adjusted ARR+ 3.00%) / 365.

Here is an example:

Adjusted ARR = 0.75%

Spreadex Markup = 3.00%

Position Size of Buy Order = £1,000

Daily Profit = £5

Therefore:

(0.75% + 3.00%) / 365 = 0.01027

(£1,000 x £5) x 0.01027 = £51.35

What Can I Trade

Spreadex maintains a balanced asset selection of 1,000+ trading instruments, including shares listed in 15+ countries and AIM-listed companies in the UK with a market cap above £5M.

Spreadex covers the following sectors:

- 30+ Forex pairs

- 9+ Commodities

- 30+ Indices

- 1,000+ Shares

- 200+ ETFs

- 19+ Bonds and Interest Rates

- Options

- IPOs

Account Types

International traders will manage their portfolios from the CFD account, which is identical for all clients. UK-based traders may additionally use a tax-free spread betting account. There are no minimum deposits, and there is no upselling of superior services for more significant deposits. An upgrade to professional status is available upon request and provided conditions are satisfied. Spreadex democratized client classification, joining a trend among retail brokerages to treat all accounts equally. The same account additionally grants clients access to the company’s sports betting services.

Trading Platforms

Spreadex features a proprietary trading platform, available as a webtrader or mobile version. It also connects to TradingView. Traders have access to an acceptable trading platform. The inability to deploy automated solutions, unless they run scripts on TradingView, places advanced traders at a clear disadvantage, especially considering the 10,000+ trading instruments.

Here are my observations about the Spreadex trading platforms:

- It is advertised as an award-winning platform, equipped with an advanced charting package and featuring automated pro trend lines and chart pattern recognition

- Advanced orders and price alerts are equally noted, together with one-click trading from the chart

- It duplicates MT4 trading platform features with a more professional interface but does not support automated trading solutions

- Regrettably, the MT4 trading platform is not supported, as Spreadex focuses on spread betting, which is unsuitable for MT4

- Third-party app development is not enabled

- Traders can place guaranteed stop-loss orders, confirming expected market manipulation from a market maker.

Unique Features

UK based clients classified as professional traders may request a tax-free credit limit. It is comparable to that of a “no deposit bonus” often provided by competing brokers to clients. Spreadex focuses on the core trading environment, where it maintains an acceptable overall product and services portfolio, placing it in the top-half of brokers. No unique features are present for retail traders.

Research and Education

Spreadex does not generate in-house research. It publishes a daily and weekly market commentary where traders receive a brief description of developments; regrettably, no signals or ideas are available. The trading platform has a candlestick pattern recognition program, which may assist in identifying trading opportunities. An economic diary is available, but the absence of proper research is dominant.

What about education at Spreadex?

The Spreadex Education Hub provides a well-structured educational introduction to trading and shows that Spreadex emphasizes education over research, where it has created a high-quality service for beginners.

- Beginners should start with the Spreadex Education hub

- Traders should also seek in-depth education from third parties, starting with trading psychology and the relationship between leverage and risk management

- Avoid paid-for courses and mentors

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

Customer support is available via e-mail and phone Monday through Sunday from 08:00 to 17:30. Spreadex also offers a direct line to the financial trading room. Spreadex is a well-managed brokerage focused on maintaining an efficient core trading environment. Most traders are unlikely to require customer support.

Bonuses and Promotions

Spreadex neither offers bonuses nor hosts special promotions.

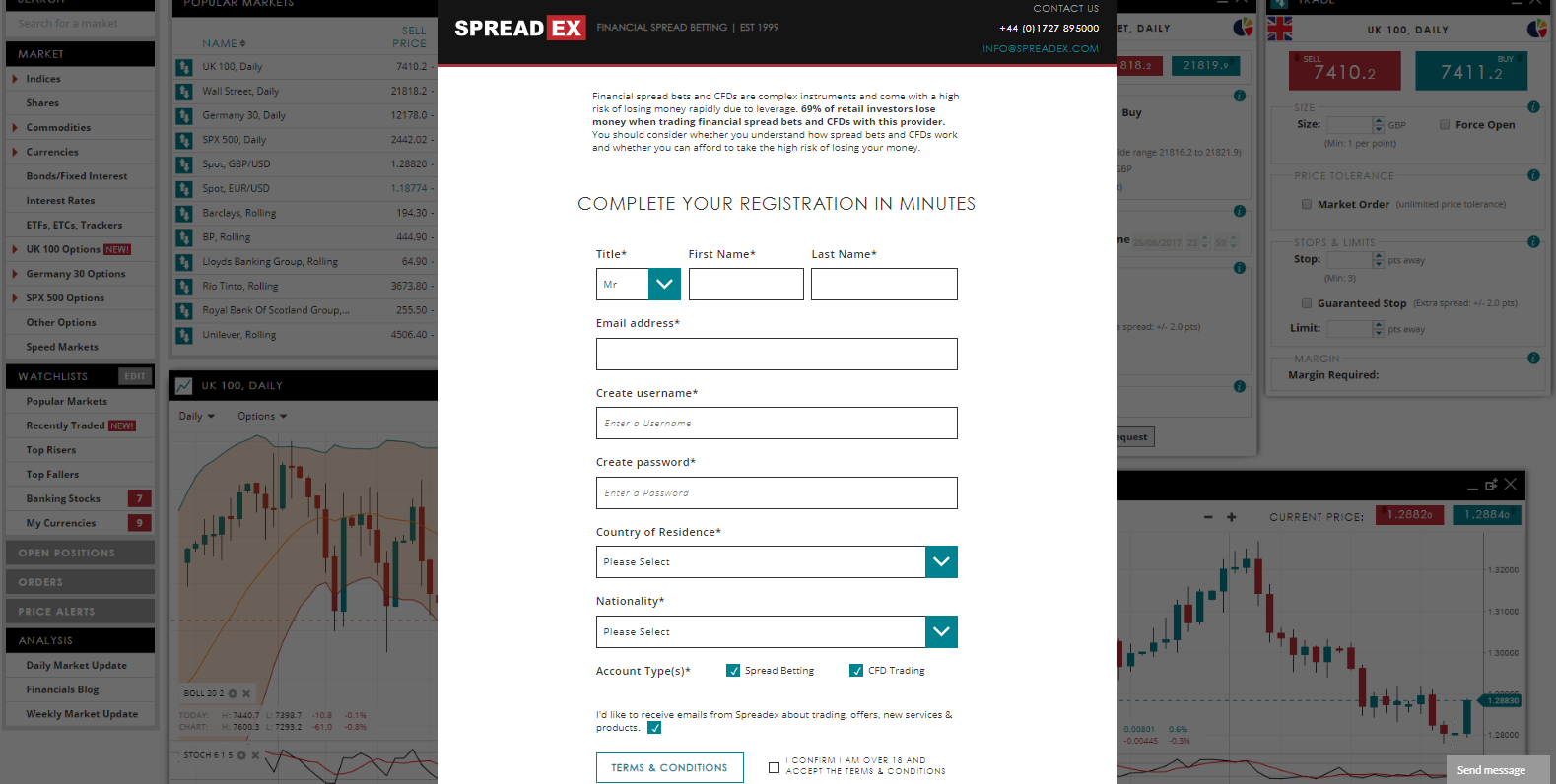

Opening an Account

Spreadex has a swift online application, but data mines to satisfy the FCA, including an appropriateness test and an economic profile.

What should traders know about the Spreadex account opening process?

- Spreadex complies with global AML/KYC requirements

- Account verification is mandatory

- Most traders pass verification by uploading a copy of a government-issued ID and one proof of residency document

- Spreadex may ask for additional information on a case-by-case basis

Minimum Deposit

A Spreadex minimum deposit does not exist.

Payment Methods

Spreadex accepts bank wires, credit/debit cards, checks, Apple Pay, and Google Pay.

Accepted Countries

Spreadex does not list accepted or restricted countries, but it notes: “The information on this website is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any law or regulatory requirement.”

An online application processes new account openings.

Deposits and Withdrawals

The secure Spreadex back office and mobile apps handle financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at Spreadex?

- Spreadex has no minimum deposit requirement

- The minimum withdrawal amount is £50, and if the account balance is less than that, traders must request a complete withdrawal

- Traders may request withdrawals over the phone by calling the back office team

- Spreadex offers select card withdrawals that arrive within two hours after approval, but the average processing time is between two to five business days

- Third-party payment processing costs and currency conversion fees may apply

- The name on the payment processor and Spreadex trading account must match in compliance with AML regulations

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Is Spreadex a Good Broker?

I like the trading environment at Spreadex for UK-based spread betting as it offers a user-friendly trading platform, a well-balanced asset selection, excellent order execution, and quality customer support. Adding CFD trading and sports betting combines the three most popular UK financial trends under one entity. Therefore, I rank Spreadex among the best spread betting brokers in the UK. Spreadex is a legitimate company dating back to 1999. Spreadex does not have a minimum deposit requirement. It depends on whether traders use spread betting, CFD trading, or sports betting. The basic principles of any brokerage or sports betting firm apply. Traders or bettors place bets or trades and earn if they are correct with their analysis, while they lose if they are wrong. Spreadex provides the infrastructure for traders and bettors, including the trading platform and asset selection, is the custodian of deposits, and is responsible for withdrawals of profits and winnings. Spreadex is a well-regulated UK-based brokerage and sports betting firm with 25+ years of experience and honors all valid withdrawal requests from verified clients.FAQs

Is Spreadex trading real or fake?

What is the minimum deposit for Spreadex?

How does Spreadex work?

Does Spreadex offer cash-out?