Editor’s Verdict

Overview

Review

SquaredFinancial is a multi-asset online CFD broker offering traders out-of-the-box MT4 and MT5 trading platforms, dynamic leverage, and one of the best cost structures in the industry through its commission-based account. I reviewed this broker to determine if the advertised execution speed delivers demanding traders the edge they require. Should you trade with SquaredFinancial?

Summary

SquaredFinancial - A competitive commission-based cost structure for advanced traders

Headquarters | Cyprus |

|---|---|

Regulators | CySEC, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2005 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | 0$ |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | 1.1 pips ($11.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.34 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the commission-based trading costs at SquaredFinancial. Combined with high leverage and fast order execution, they create ideal trading conditions for automated trading solutions, scalpers, and high-frequency traders.

SquaredFinancial Main Features

Retail Loss Rate | 63.20% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.2 pips |

Minimum Commission for Forex | $5.00 per round lot |

Commission for CFDs/DMA | 0.15% or $0.06 per share per side (US) |

Commission Rebates | No |

Minimum Deposit | $0 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | Yes |

Inactivity Fee | No |

Deposit Fee | No |

Withdrawal Fee | Third-party |

Funding Methods | 5 |

Regulation and Security

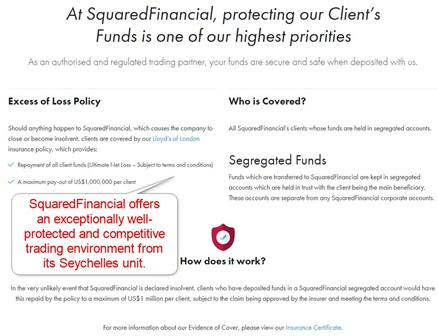

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. SquaredFinancial presents clients with two regulated entities.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | License Number 329/17 |

Seychelles | Financial Services Authority | License Number SD024 |

The Seychelles subsidiary offers:

- Higher leverage

- Flexible trading conditions

- Competitive regulator

- Negative balance protection

- Segregation of client deposits from corporate funds.

- Excess of Loss Policy via the SquaredFinancial Lloyd’s of London insurance policy with a maximum pay-out of US$1,000,000 per client.

Noteworthy:

- The Cyprus subsidiary offers an investor compensation fund up to 90% or €20,000 of deposits.

- SquaredFinancial has a clean regulatory track record.

- The core management team remains listed on the SquaredFinancial website.

SquaredFinancial obtained its Cyprus Securities and Exchange Commission (CySEC) license in 2017, but its corporate owner, SquaredFinancial Group, has existed since 2005 and is led by a seasoned management team.

Fees

Average Trading Cost EUR/USD | 1.1 pips ($11.00) |

|---|---|

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.34 |

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

SquaredFinancial offers Forex traders two cost structures:

- Commission-free trading costs start at 1.2 pips or $12.00 per 1 standard lot, which ranks among the more expensive offers.

- Commission-based accounts commence with a minimum spread of 0 pips and a commission of $5.00 per round lot for a final cost of $5.00, a very competitive offer.

Noteworthy:

- Equity traders pay a 0.15% commission or $0.06 per share for US-listed equities, 50% to 66% more expensive than other equity CFD brokers.

Which pricing environment should Forex traders select?

I recommend the following:

- The commission-based pricing environment results in 50%+ cheaper trading costs but requires a minimum deposit of $5,000, out of reach for many retail traders.

What could be improved at SquaredFinancial?

- A volume-based rebate program for high-volume traders.

- Equal access to the commission-based account for all traders.

Here is a screenshot of live quotes in the SquaredFinancial MT5 Elite account during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The average trading costs for the EUR/USD in the commission based SquaredFinancial account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.2 pips | $5.00 | $7.00 |

Noteworthy:

- Swap rates on leveraged overnight positions rank among the lowest in the industry, resulting in excellent trading costs for traders holding positions overnight.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- SquaredFinancial offers a positive swap on EUR/USD short positions (at the time of this review’s publication) and other select assets, meaning traders can get paid money for holding positions overnight.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission based SquaredFinancial account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.2 pips | $5.00 | -$3.48 | X | $10.48 |

0.2 pips | $5.00 | X | $1.53 | $5.47 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.2 pips | $5.00 | -$24.36 | X | $31.36 |

0.2 pips | $5.00 | X | $10.71 | -$3.71 |

Noteworthy:

- The short-selling example resulted in a profit assuming no movement in price action over the seven days, an unlikely event.

- It illustrates how short sellers can benefit from the honest swap rate environment at SquaredFinancial.

My additional comments concerning trading costs at SquaredFinancial:

- There are no inactivity fees.

- Currency conversion fees range between 15 and 30 basis points.

SquaredFinancial Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 21:05 | Friday 20:59 |

Cryptocurrencies | Sunday 00:00 | Saturday 24:00 |

Commodities | Sunday 22:00 | Friday 20:45 |

Crude Oil | Sunday 22:00 | Friday 20:45 |

Gold | Sunday 22:00 | Friday 20:45 |

Metals | Sunday 22:00 | Friday 20:45 |

Equity Indices | Sunday 22:00 | Friday 20:15 |

Stocks | Monday 08:01 | Friday 21:00 |

ETFs | Monday 08:01 | Friday 21:00 |

Futures | Sunday 23:00 | Friday 21:57 |

What Can I Trade

SquaredFinancial offers a selection of 10,000+ assets, which from a quantity perspective present and broad-based choice. The bulk consists of equity CFD across seventeen countries plus US-listed ETFs, which SquaredFinancial does not list on its website. They are available on the MT5 trading platform.

Outside of equity CFDs, the asset selection remains thin but suitable for traders with focused trading strategies who rely on liquid assets, where quality trumps quantity.

What could be better?

- A broader choice of cryptocurrencies and commodities.

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

SquaredFinancial Leverage

SquaredFinancial offers maximum dynamic leverage up to 1:500. I like this for active traders and scalpers, as it presents more overall trading flexibility, which directly impacts profitability. SquaredFinancial lowers it based on total open lots, which I think is an excellent approach to aid traders with risk management.

Other things to note about SquaredFinancial leverage:

- SquaredFinancial offers maximum leverage of 1:20 on equity CFDs and 1:2 on cryptocurrency CFDs.

- Negative balance protection exists, ensuring traders can never lose more than their deposit.

SquaredFinancial Trading Hours (GMT-2 Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Sunday 00:00 | Sunday 24:00 |

Forex | Sunday 22:05 | Friday 21:59 |

Commodities | Sunday 23:00 | Friday 22:00 |

European CFDs | Monday 07:00 | Friday 15:30 |

US CFDs | Monday 14:30 | Friday 21:00 |

Noteworthy:

- Equity markets open and close each trading and are not trading continuously like Forex and cryptocurrencies.

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

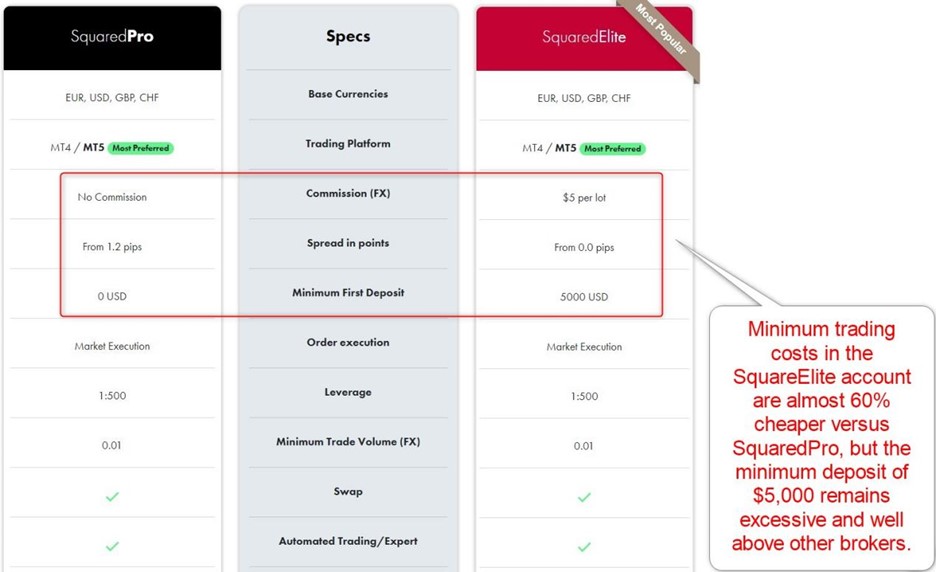

SquaredFinancial offers traders its commission-based SquaredPro account and its commission-based SquaredElite, which I recommend for all traders who can afford the $5,000 minimum deposit.

Traders must decide between the following:

- Commission-free versus commission-based account

My observations concerning the SquaredFinancial account types:

- While there is no minimum deposit for SquaredPro, SquaredElite commands an unusually high $5,000 requirement.

- Trading costs with SquaredElite are nearly 60% cheaper than with SquaredPro.

- Trading conditions are equal in both account types and allow hedging and scalping.

- Supported account base currencies are USD, EUR, GBP, and CHF.

- Swap-free Islamic accounts are available.

- SquaredFinancial also offers corporate accounts.

SquaredFinancial Demo Account

The default demo account at SquaredFinancial comes with a $50,000 portfolio, which I find excessive and unrealistic for retail traders. The MT4/MT5 trading platforms support unlimited demo accounts, and SquaredFinancial does not list restrictions. They are ideal for testing EAs or different trading strategies, but traders should not rely on them for educational purposes due to the absence of trading psychology in demo accounts.

Trading Platforms

The core MT4 and MT5 trading platforms are available at SquaredFinancial. Both support automated trading, but SquaredFinancial does not list an API that allows advanced solutions to connect. Traders may opt for the desktop client, the lightweight web-based version, or the mobile app.

Most retail traders will find required add-ons in the integrated MT4/MT5 Market, but the necessary ones come at a cost. The current choices remain acceptable, as traders can upgrade them.

What could be better?

- MT4/MT5 upgrades

- API trading

My observations:

- Traders with EAs must use the desktop client

- MT4 features notable more plugins and EAs

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | Yes |

cTrader | No |

Proprietary/Alternative Platform | No |

Automated Trading | Yes |

Social Trading / Copy Trading | Yes |

MT4/MT5 Plugins | No |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | Competitive commission-based costs |

Unique Feature Two | Broad equity CFD selection |

Unique Features

Aside from the US $1 million insurance policy for clients of the FSA subsidiary, SquaredFinancial does not really have notable unique features.

Research and Education

SquaredFinancial offers trading signals, analyst recommendations, and WebTV provided by Trading Central. A YouTube channel is also available, but it has only 80 subscribers and offers brief market commentary. While the research offering ranks below competitors in quantity, Trading Central remains a trusted third-party source.

Beginner traders have access to quality trading guides plus the Trading Central on-demand educational videos. A total of 31 videos and 23 quizzes provides first-time traders with an introduction to trading.

My takeaways:

- SquaredFinancial partnered with a quality firm to deliver competitive research and education for beginner traders.

My recommendations:

- Beginner traders should access additional research online free of charge.

- Manual traders get trading signals from Trading Central.

- The MT4/MT5 copy trading feature offers passive traders sufficient choices.

- MT4/MT5 has thousands of EAs, and traders may explore them to determine if they suit their trading style.

- Beginner traders should source in-depth educational content elsewhere before trading at SquaredFinancial.

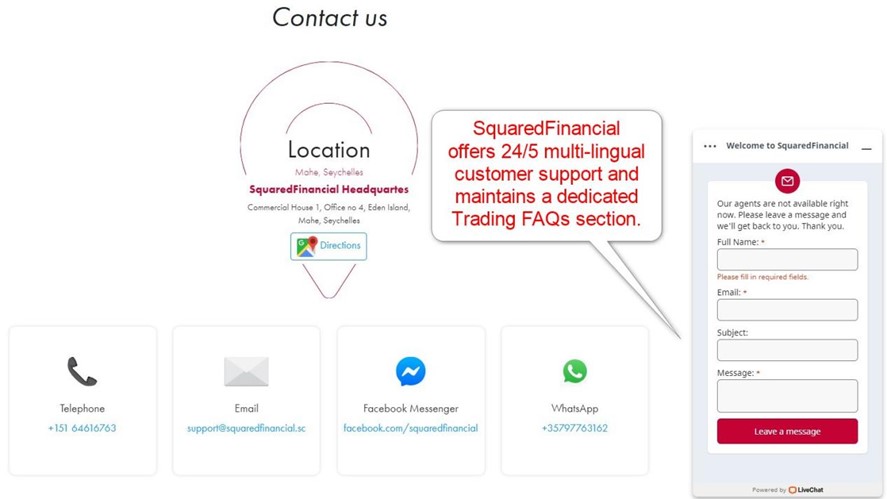

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |        |

SquaredFinancial offers 24/5 multi-lingual customer support via e-mail, web form, live chat, or phone. A dedicated Trading FAQs section answer most questions concerning the trading environment, and SquaredFinancial explains its products and services acceptably, limiting the need for additional support to emergencies.

My observations:

- Beginner traders should consult the Trading FAQs section before reaching out to a customer services representative.

- Dedicated support for financial transactions, where most traders may face issues, is not available.

- I recommend live chat for non-urgent matters.

- Phone support is ideal for urgent questions.

Bonuses and Promotions

SquaredFinancial neither provided bonuses nor hosted promotions at the time of this review.

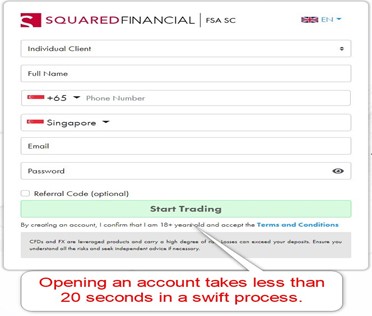

Opening an Account

The account opening process at SquaredFinancial usually takes less than 20 seconds. The form merely asks for the name, phone number, country, e-mail, and desired password. Account verification is mandatory, and most traders will complete it after sending a copy of their ID and one proof of residency document.

Minimum Deposit

There is no minimum deposit for SquaredPro, but traders must commit $5,000 for SquaredElite.

Payment Methods

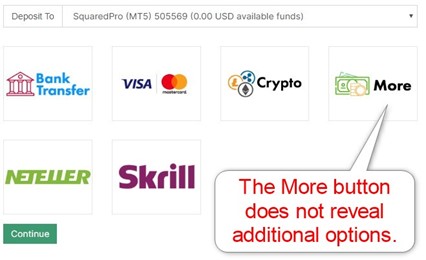

SquaredFinancial offers bank wires, credit/debit cards, Skrill, Neteller, and cryptocurrencies.

Accepted Countries

SquaredFinancial caters to most international traders, including traders from the UK. Like most international brokers, SquaredFinancial does not accept traders who are US persons.

Deposits and Withdrawals

All financial transactions take place in the secure back office of SquaredFinancial. The options remain limited, but I like the inclusion of cryptocurrencies.

My observations:

- SquaredFinancial lacks transparency concerning deposits and withdrawals, including costs and withdrawal times.

- SquaredFinancial does not list internal currency conversion fees, but they may apply from payment processors.

My recommendations:

- I recommend checking the costs from the payment processor to the bank account unless a debit/credit card is available.

- It is ideal to use an option besides the bank or credit/debit card used for day-to-day financial operations.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

The Bottom Line

I like the trading environment at SquaredFinancial for advanced algorithmic traders, scalpers, and high-frequency traders. This broker offers equity traders a broad-based asset selection from its core MT4/MT5 trading platforms. I like the security of the Seychelles subsidiary due to its Lloyd’s of London insurance policy with a maximum pay-out of US$1,000,000 per client in the unlikely event of default.

The dynamic leverage up to 1:500 and the competitive commission-based cost structure remain two advantages at SquaredFinancial, but it only applies to SquaredElite, which requires a minimum deposit of $5,000. The trading conditions in the commission-free SquaredPro, where no minimum applies, are somewhat less attractive. Therefore, SquaredFinancial is an especially good choice for traders with deposits above $5,000.

Yes, Squared Financial has regulatory oversight provided by the CySEC and the FSA. Yes, a demo account is available. SquaredFinancial provides traders with out-of-the-box MT4 and MT5 trading platforms. The commission-free SquaredPro has no minimum requirement, and the commission-based SquaredElite requires a minimum deposit of $5,000. SquaredFinancial is a legit, regulated, and fully compliant online broker. Yes, SquaredFinancial is a legit broker with licenses and oversight from two competent regulators.FAQs

Is SquaredFinancial regulated?

Does SquaredFinancial offer a demo account?

What trading platform does SquaredFinancial provide?

What is the minimum deposit to open a SquaredFinancial account?

Is SquaredFinancial a scam?

Is SquaredFinancial legit?