Editor’s Verdict

Overview

Swissquote is one of the top 10 online Forex brokers globally, following a series of acquisitions. It is also a publicly listed company and a leading bank. Clients get a commission-free trading environment but high spreads. Besides the MT4/MT5 trading platforms, Swissquote also deploys its proprietary webtrader and has expanded into the Robo-Advisory sector. I conducted this review to determine if Swissquote delivers on its promise of competitive trading conditions. Should you consider trading with Swissquote despite the high trading costs?

Summary

Headquarters | United Kingdom |

|---|---|

Regulators | DFSA, FCA, FINMA, MAS, MFSA, SFC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1990 |

Execution Type(s) | Market Maker |

Minimum Deposit | 1000 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 1.6 pips ($16.00) |

Average Trading Cost GBP/USD | 1.8 pips ($18.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.47 |

Average Trading Cost Bitcoin | $2.50 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like that Swissquote offers its proprietary trading platforms alongside upgraded MT4/MT5. The asset selection of 3,000,000+ remains market-leading, while CFD traders get 400+ assets. The trading costs and limited deposit and withdrawal methods are disappointing and lower the overall score of Swissquote.

Swissquote - First look:

- Its history dates to 1990 to its predecessor, Marvel Communication SA

- It became Swissquote in 1996 and had its shares floated on the Swiss SIX Exchange in 2000

- Swissquote became the top online bank in Switzerland and one of its most dominant financial services firms

- It expanded into the Forex market with the 2010 acquisitions of Tradejet AG and ACM Advanced Currency Markets AG

- In 2013, it acquired MIG Bank, which catapulted Swissquote into a Top 10 Forex broker

- The 2018 acquisition of Luxembourg-based Internaxx Bank SA solidified its position as one of the most dominant brokers

- Swissquote purchased Keytrade Bank Luxembourg in 2021

- Offers high-quality trading tools, upgraded MT4/MT5, and cutting-edge proprietary trading platforms

- Fully supports algorithmic trading, scalping, and high-frequency trading

- Transparent bank/broker with a highly secure trading environment

- Not all subsidiaries have equal pricing, with some up to 50% cheaper

- Competent Robo-Advisory unit developed by its in-house Quantitative Asset Management (QAM)

- Quality Research and education plus a growing cryptocurrency selection

Swissquote Main Features

Retail Loss Rate | 74.0% - 89.0% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 1.7 pips |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | 0.15% |

Commission Rebates | No |

Minimum Deposit | $1,000 |

Demo Account | Yes |

Managed Account | Yes |

Islamic Account | No |

Inactivity Fee | $10 monthly after six months |

Deposit Fee | Yes + Third-party |

Withdrawal Fee | Yes + Third-party |

Funding Methods | 2 |

Regulation and Security

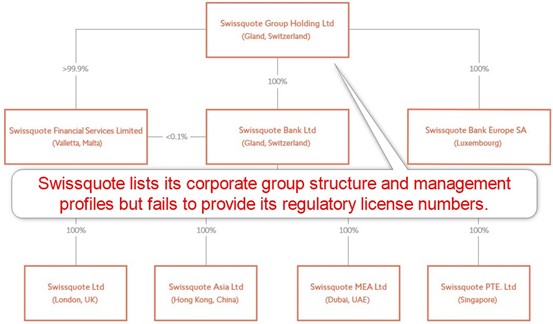

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Swissquote presents clients with seven well-regulated entities and eight regulators, four of them generally accepted as tier 1 Forex regulators. This makes Swissquote overall a very highly regulated Forex broker.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Switzerland | Swiss Financial Market Supervisory Authority | Undisclosed |

UK | Financial Conduct Authority | Undisclosed |

Dubai | Dubai Financial Services Authority | Undisclosed |

Hong Kong | Securities and Futures Commission | Undisclosed |

Malta | Financial Services Authority | Undisclosed |

Singapore | Monetary Authority of Singapore | Undisclosed |

Luxembourg | Commission de Surveillance du Secteur Financier | Undisclosed |

European Union | European Central Bank | Undisclosed |

Reasons I prefer the Swiss subsidiary:

- Higher leverage

- Negative balance protection

- Competitive regulator

- Segregation of client deposits from corporate funds

- Flexible trading conditions

What is missing?

- Third-party insurance

- Swissquote fails to list its regulatory license numbers

Noteworthy:

- The UK subsidiary offers an investor compensation fund up to £85,000

- Swissquote employs 805 staff

- Swissquote has a clean regulatory track record

- Transparent broker with management profiles and corporate structure on its website

- Swissquote is a publicly listed bank

- Excellent core capital ratio

Swissquote grew into one of the most secure and trusted banks and brokers, with an exceptional track record and transparency. It continues growing organically and via acquisitions and solidified its position as a Top 10 online global financial institution.

Fees

Average Trading Cost EUR/USD | 1.6 pips ($16.00) |

|---|---|

Average Trading Cost GBP/USD | 1.8 pips ($18.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.47 |

Average Trading Cost Bitcoin | $2.50 |

I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability.

Swissquote offers traders the following cost structure:

- Commission-free Forex trading but high spreads starting from 1.7 pips or $17.00 per 1 standard lot

- A deposit of $10,000 lowers Forex mark-ups to 1.4 pips or $14.00, while traders with portfolios exceeding $50,000 qualify for trading costs of 1.1 pips or $11.00

- Stocks commissions commence from 0.15% with no minimums

Noteworthy:

- Forex trading costs are nearly 300%+ higher and stock commissions 50% compared to competing brokers, and Swissquote’s minimum deposit is also relatively high.

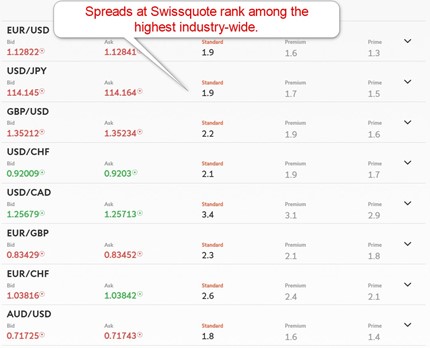

Here is a screenshot of Swissquote live quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

Here are my observations:

- Swissquote deploys expensive spreads and commissions across the board, a fact I urge traders to consider, as it directly reduces profitability

- Commissions on stocks remain high unless traders have a minimum portfolio of $50,000, where they decrease to a highly competitive rate

What is missing at Swissquote?

- A competitively priced commission-based ECN cost structure

- A volume-based rebate program for high-frequency traders

The absence of a competitively priced cost structure remains the most notable drawback at Swissquote. The 0.8 pips minimum Forex spread for select subsidiaries, like in Luxembourg, is also 25% higher versus other brokers.

The average trading costs for the EUR/USD in the commission-free Swissquote Standard account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

1.9 pips | $0.00 | $19.00 |

Noteworthy:

- It is on average 300%+ higher versus Forex brokers presenting the most competitive trading conditions

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Noteworthy:

- Swissquote offers a positive swap on qualifying assets, meaning traders get paid money to hold trades overnight

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free Swissquote Standard account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

1.9 pips | $0.00 | -$3.5386 | X | $22.5386 |

1.9 pips | $0.00 | X | $0.3597 | $18.6403 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

1.9 pips | $0.00 | -$24.7702 | X | $43.7702 |

1.9 pips | $0.00 | X | $2.5179 | $16.4821 |

My additional comments concerning trading costs at Swissquote:

- Swissquote levies a monthly inactivity fee of $10 after six months of dormancy

- Currency conversion fee between 0.95% and 2.00%

- Cryptocurrency fees range between 0.50% and 1.00%, dependent on the transaction amount

- Cryptocurrency deposits below $500 and all withdrawals face a $10 fee

- Options and futures contracts cost a minimum of CHF 1.50 or €1.00

- Each stock transaction has a CHF 0.85 surcharge for real-time data

- OTC orders cost 0.50% of the deal value with a $100 minimum

Swissquote Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Friday 22:58 |

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Commodities | Monday 00:05 | Friday 22:55 |

Crude Oil | Monday 00:05 | Friday 22:55 |

Gold | Monday 00:02 | Friday 22:58 |

Metals | Monday 00:05 | Friday 22:55 |

Equity Indices | Monday 00:05 | Friday 22:55 |

Stocks | Monday 08:02 | Friday 21:55 |

Stocks (non-CFDs) | Monday 01:02 | Friday 21:55 |

Bonds | Monday 00:05 | Friday 22:55 |

ETFs | Monday 08:02 | Friday 21:55 |

Options | Monday 00:05 | Friday 22:55 |

Futures | Monday 00:05 | Friday 22:55 |

Synthetics | Monday 08:02 | Friday 21:55 |

What Can I Trade?

Swissquote as a group offers a selection of more than 3 million assets, covering 12 sectors, creating a market-leading choice of trading instruments. The Forex and CFD division contain 400+ assets, including 78 currency pairs, 45 Forex options, and 26 cryptocurrencies.

I like the overall asset selection at Swissquote, it is suitable for all traders and strategies. Given the size of trading instruments, beginner traders should start their portfolio with the Forex and CFD section before considering the full list of available assets.

What is missing?

- Swissquote delivers a market-leading choice of trading instruments and continues to expand its cryptocurrency selection among other assets

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Swissquote Leverage

Swissquote offers maximum leverage of 1:100 to most retail traders. I find it sufficient for active traders, as it can help ensure overall trading flexibility, which directly impacts profitability.

Other things to note about Swissquote leverage:

- Swissquote of course limits retail leverage to 1:30 where regulators require it

- Negative balance protection exists, ensuring traders can never lose more than their deposit

Swissquote Trading Hours (UTC Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Forex | Monday 00:00 | Friday 24:00 |

Commodities | Sunday 00:05 | Friday 22:55 |

European CFDs | Monday 09:02 | Friday 16:58 |

US CFDs | Monday 15:02 | Friday 17:18 |

Noteworthy:

- Equity markets open and close each trading session and are not operational continuously like Forex and cryptocurrencies

- Swissquote offers access to after-hours trading

- Traders get over 60 global equity markets, including OTC stocks

- Swissquote offers IPO trading

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

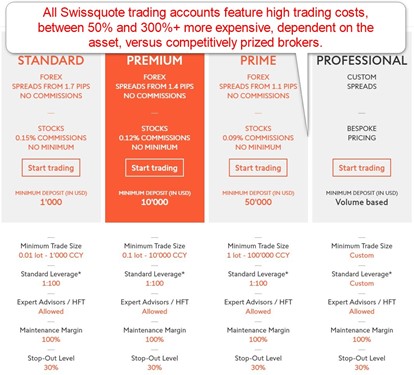

Swissquote offers four account types, but all have high minimum deposit requirements and trading fees.

- The Standard, Premium, and Prime accounts have identical trading conditions except for the minimum tradable lot size

- The maximum leverage remains capped at 1:100 for retail traders

- The Standard account requires a $1,000 minimum deposit, Premium $10,000, and Prime $50,000

- A Professional account exits with flexible terms, negotiated between the trader and Swissquote on a case-by-case basis

- Robo-Advisory services are available but require a minimum deposit of $50,000 or a currency equivalent

- Account base currencies are EUR, USD, JPY, GBP, CHF, CAD, AUD, TRY, PLN, SEK, NOK, SGD, XGD, HUF, and CZK

- Swissquote has no restrictions on trading strategies, so scalping and hedging are permitted

- Corporate accounts are available

My recommendation:

- All account types feature high minimum deposits and even higher trading costs, and traders should carefully consider whether other positive factors of this broker can outweigh these negatives.

Swissquote Demo Account

Demo accounts are available at Swissquote, ideal for testing EAs or different trading strategies. Regrettably, there is a 30-day time limit, which is a shame as so many brokers offer unlimited demo accounts. I want to caution beginner traders about using a demo account as an educational tool. It creates unrealistic trading expectations, and the absence of trading psychology often negates most of the potential educational value.

My recommendation:

- MT4/MT5 offer flexible deposits, and traders should select a nominal amount similar to what they plan to put into their live trading account

Trading Platforms

Swissquote offers traders MT4, MT5, and its proprietary Advanced Trader. It upgrades the out-of-the-box MT4/MT5 versions via Autochartist and Trading Central plugins. It also delivers the MetaTrader Master Edition package, consisting of twelve advanced tools and 15 indicators, creating one of the most competitive MT4/MT5 trading environments among all brokers.

The Advanced Trader features charts by TradingView, multiple order types, and automatic pattern detection, assisting manual traders with navigating fast-moving markets. Algorithmic traders can rely on the MT4/MT5 trading platforms, and Swissquote ensures its clients have a competitive edge by maintaining three excellent trading platforms.

MT4/MT5 is available as a desktop client, a web-based alternative, and a mobile app. Swissquote offers its Advanced Trader as a desktop client and mobile app. It also features a web-based platform, which presents traders outside its Forex and CFDs portfolio a functional alternative but could benefit from a design overhaul.

- Swissquote maintains one of the most competitive MT4/MT5 trading environments and delivers across the board with its trading platforms

My observations:

- Traders with MT4/MT5 EAs must use the desktop client

- The Advanced Trader, also available as a White Label solution for corporate clients, caters to manual traders only but has automatic pattern detection

- The web-based trading platform, which traders can evaluate without opening an account, requires an overhaul and is not suited for beginner traders

- Swissquote lists stock prices on all available exchanges in its web-based trading platform where 3,000,000+ instruments are available, allowing traders to take advantage of minor cost discrepancies

- It also grants access to options and futures from one screen for each asset, offering an in-depth overview for advanced traders

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | Yes |

cTrader | No |

Proprietary/Alternative Platform | Yes |

Automated Trading | Yes |

Social Trading / Copy Trading | Yes |

MT4/MT5 Add-Ons/Upgrades | Yes |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | Excellent order execution and deep liquidity |

Unique Feature Two | Superb asset selection |

Unique Features

I like the in-house Quantitative Asset Management (QAM) at Swissquote, offering a competitive Robo-Advisory service. Regrettably, the minimum deposit required to access this feature is CHF 50,000, placing it out of reach to retail traders. The advisory fee is 0.75%, divided into a 0.40% administration fee and a 0.35% management cost. Portfolios above CHF 500,000 are subject to a -0.75% interest rate charge. A certified asset management service is available for a flat fee of 1.50%.

Swissquote also delivers the FIX API, allowing advanced algorithmic traders to connect to its infrastructure. The sole requirement to access this is a minimum deposit of CHF 50,000. I also want to note the excellent order execution at Swissquote, confirming the availability of deep liquidity pools ideal for high-frequency traders, scalpers, and algorithmic solutions.

Swissquote also offers MAM/PAMM accounts for money managers with access to 15 Tier 1 liquidity pools and an Introducing Broker partnership program.

Research and Education

Swissquote offers quality market commentary on its website under the Newsroom section. It consists of Morning News and Themes Trading. The former, published each trading day, offers market commentary with some of the most market-moving events and analysts upgrades or downgrades with price targets. The latter provides more quality trading ideas based on trending themes.

New traders can benefit from the Swissquote Education Center, where two video trading courses, consisting of 31 videos and two hours of content combined, provide an excellent introduction to trading. Sixteen eBooks cover various topics, while Swissquote also hosts live webinars. Seminars are presently on hold, but Swissquote may resume them once conditions allow. Overall, Swissquote offers an excellent educational section, complementing its high-quality trading environment.

My takeaways:

- Swissquote does not grant direct trading recommendations, but traders get a set of trading tools to assist them with trading decisions

- Traders can find plenty of high-quality content on the Swissquote blog, which includes plenty of webinars and articles in a well-structured environment

- Swissquote also maintains a magazine with relevant financial content

- The Swissquote Educational Center provides beginner traders with an excellent introduction, which it supplements by webinars and eBooks for an in-depth offer

My recommendations:

- MT4/MT5 have thousands of EAs, and traders may explore them to determine if they suit their trading style, as the Robo-Advisory has a CHF 50,000 minimum deposit requirement

- The embedded copy trading service in MT4/MT5 offers another alternative for passive traders

- Traders can also access numerous free research available online, as Swissquote does not provide direct trading recommendations

- Traders should take their time reading and understanding the content in the Swissquote Education Center

- I also advise traders to seek additional information from trusted third parties free of charge for details of specifics that Swissquote does not cover

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | M-F 08:00 -22:00 |

Website Languages |          |

Swissquote offers customer support Monday through Friday between 08:00 and 22:00 via e-mail, phone, and live chat.

Since Swissquote explains its products and services well and ensures flawless operations, I doubt traders will require customer support unless emergencies arise, in which case it is readily available.

My recommendations:

- Traders should read through the FAQ section before reaching out to a customer service representative

- For non-urgent questions, I recommend live chat

- Swissquote provides phone support, ideal for urgent matters

Bonuses and Promotions

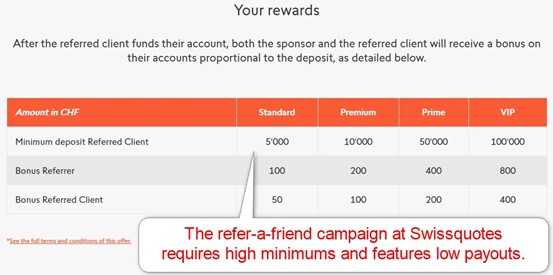

As I conducted this review, Swissquote neither offered bonuses nor hosted promotions. It does maintain a refer-a-friend campaign rewarding the referrer and referee, but the amounts require high deposits for minimal rewards.

Opening an Account

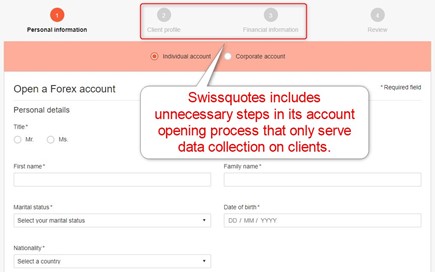

While the application process remains digital, per industry standards, Swissquote includes a series of unnecessary steps to collect data on clients, including financial information. Since no verification of provided data is required, opening accounts is unnecessarily long.

Account verification is mandatory, and most traders will complete it after sending a certified copy of their ID and one proof of residency document. Swissquote also offers a video call verification process.

Minimum Deposit

The minimum deposit for the Swissquote Standard account is $1,000 or a currency equivalent. The Premium and Prime alternatives require $10,000 and $50,000.

Payment Methods

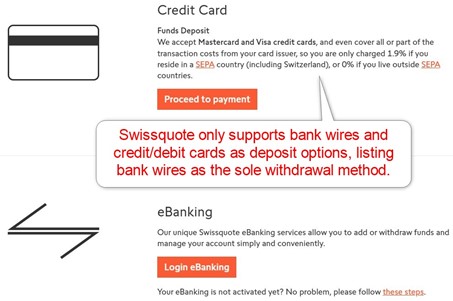

Swissquote only offers bank wires and credit/debit cards.

Accepted Countries

Swissquote caters to most international traders, including the UK, Switzerland, and the UAE. Like most international brokers, US-based clients cannot open trading accounts at Swissquote. The same applies to traders from Canada.

Deposits and Withdrawals

All financial transactions take place in the secure back office of Swissquote. Unfortunately, the absence of modern online payment providers is a weakness.

My observations:

- Swissquote favors its e-banking solution, keeping the process and revenues in-house

- Credit-debit card transactions face a 1.9% charge for SEPA countries but 0.0% for non-SEPA members

- Swissquote only lists e-Banking under withdrawal options

- Processing times vary on the location of the trader

- Withdrawal costs apply from Swissquote, and third parties involved in bank wires, with CHF 2.00 or €2.00 for SEPA countries and notably higher fees for everyone else

- Cryptocurrency withdrawals cost $10, irrelevant of the amount

My recommendations:

- Avoid using the bank or credit/debit card you use for your day-to-day financial operations

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

The Bottom Line

I like the trading environment at Swissquote for advanced traders who require a broad range of assets. The core trading environment at Swissquote is excellent, with 3,000,000+ trading instruments, upgraded MT4/MT5 trading platforms, competitive proprietary solutions, and FIX API for advanced algorithmic solutions. The most notable drawback is trading costs, where Swissquote maintains what can only be called a relatively expensive pricing environment. I’d like Swissquote to streamline its onboarding process and add more payment processors to complement its competitive core offer and to lower its trading fees. Swissquote is a good broker but charges relatively high trading costs. The absence of modern payment processors and lengthy application process lower the overall score of Swissquote. Swissquote operates under the oversight of seven regulators and one central bank. It has a clean track record and is one of the most trustworthy and transparent financial companies. Swissquote lists bank wires as the sole withdrawal method. Swissquote offers US stocks, including OTC equities. Swissquote remains one of the safest brokers operational. It is a publicly listed company and licensed bank in Switzerland. It also complies with eight regulators in seven jurisdictions. Swissquote deploys a market-making model with excessive spreads, the most significant drawback in an otherwise excellent trading environment. Swissquote supports e-banking and credit/debit cards only, which is unfortunate. Swissquote is a licensed bank in Switzerland with FINMA as its regulator. It is also a member of the Swiss Bankers Association.FAQs

Is Swissquote a good broker?

Is Swissquote regulated?

How do I withdraw money from Swissquote?

Can you trade US stocks on Swissquote?

Is Swissquote safe?

Is Swissquote a market maker?

How do I transfer money to Swissquote?

Is Swissquote a bank?