Editor’s Verdict

tastyfx is an affiliate company of tastytrade and tastylive, which are subsidiaries of UK-based brokerage powerhouse and publicly listed company IG Markets, an industry leader. Tastyfx caters exclusively to US-resident Forex traders, offering four trading platforms and commission-free costs. I rank tastyfx among the best Forex brokers for beginners due to its simplicity and for high-volume traders due to fast order execution and up to 15% rebates. My in-depth review of the tastyfx trading environment covered all core aspects. So, is tastyfx the best Forex broker for you?

Overview

tastyfx offers US resident traders a pure-play Forex broker owned by IG Markets.

tastyfx Five Core Takeaways:

- An average order execution time of 17 ms

- Four trading platforms, including industry-leader MT4

- Up to $10,000 in bonuses and 15% in cash-back rebates

- Only Forex trading with 50+ currency pairs

- No cryptocurrency trading, deposits, and withdrawals

Headquarters | United States |

|---|---|

Regulators | CFTC, NFA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2019 |

Execution Type(s) | Market Maker |

Minimum Deposit | $250 |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 4, Proprietary platform, Trading View |

Average Trading Cost EUR/USD | $7.00 |

Average Trading Cost GBP/USD | $12.00 |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | Not applicable |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.7 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

tastyfx Regulation and Security

Country of the Regulator | United States |

|---|---|

Name of the Regulator | CFTC, NFA |

Regulatory License Number | NFA ID 509630 |

Regulatory Tier | 1 |

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. tastyfx has one regulated entity with a clean track record.

Is tastyfx Legit and Safe?

My tastyfx review found no verifiable misconduct or malpractice by this broker, founded in 2019 as IG Markets US. Therefore, I recommend tastyfx as a legitimate and safe broker.

tastyfx regulation and security components:

- tastyfx is a registered Retail Foreign Exchange Dealer (RFED) with the Commodity Futures Trading Commission (CFTFC) and a member of the National Futures Association (NFA ID 509630)

- tastyfx is not a registered broker-dealer with the Securities and Exchange Commission (SEC), a member of the Financial Industry Regulatory Authority (FINRA), a NFA-registered introducing broker, or a member of the Securities Investor Protection Corporation (SIPC)

- No negative balance protection

- Founded in 2019

- Segregation of client deposits from corporate funds

What Would I Like Tastyfx to Add?

tastyfx does not have any investor protection features. While it is typical for US-based Forex brokers, it does not make it right. I would appreciate it if tastyfx would offer third-party insurance.

Fees

Average Trading Cost EUR/USD | $7.00 |

|---|---|

Average Trading Cost GBP/USD | $12.00 |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | Not applicable |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.7 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. During my tastyfx review, Forex traders received a commission-free pricing environment with reasonable spreads from 0.7 pips or $7.00 per 1.0 standard round lot.

tastyfx does not mention an inactivity fee or how it handles currency conversion costs. I found no deposit fee, but tastyfx levies a $15 withdrawal fee for bank wires.

The minimum trading costs for the EUR/USD at tastyfx are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

0.7 pips | $0.00 | $8.00 |

Here is a snapshot of tastyfx spreads:

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free tastyfx account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for one night in the tastyfx account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.7 pips | $0.00 | $8.70 | X | -$15.70 |

0.7 pips | $0.00 | X | -$0.70 | -$7.70 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for seven nights in the tastyfx account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

0.7 pips | $0.00 | $60.90 | X | -$67.90 |

0.7 pips | $0.00 | X | -$4.90 | -$11.90 |

Noteworthy:

- tastyfx offers positive swap rates on some qualifying assets, allowing traders to earn money

Range of Assets

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

tastyfx is a pure-play Forex broker that does not provide cross-asset diversification opportunities. Therefore, tastyfx is only suitable for traders who prefer one asset class. I am disappointed by the asset selection, especially since tastyfx does not cover other sectors, but it suffices for most trading strategies. While tastyfx notes 70+ and 80+ currency pairs, I counted 54 during my tastyfx review.

tastyfx offers the following assets:

- 70+ Forex pairs

tastyfx Leverage

Maximum Retail Leverage | 1:50 |

Maximum Pro Leverage | 1:50 |

What should traders know about tastyfx’s forex leverage?

- Maximum retail Forex and index leverage is 1:50

- Not all assets within a sector may qualify for the maximum leverage

- Negative balance protection does not exist

- tastyfx e-mails a notification of a margin call at a 99% margin level, followed by a second notification at 75%

- At a margin level of 50%, tastyfx will begin forced liquidation

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses

Account Types

During my tastyfx review, all traders received one Forex trading account with a premium upgrade for active traders who trade at least $50M in notional volume monthly. After qualifying for a premium account, Forex traders will receive all benefits even if they trade less. tastyfx also has a demo account.

My observations concerning the tastyfx account type are:

- tastyfx only accepts US-resident traders

- The minimum deposit requirement is $250

- The maximum leverage of 1:50

- A margin call at 99% and 75% account margin

- An automatic stop-out at 50% account margin

- Fast order execution

- Commission-free spreads from 0.7 pips

Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 18:00 | Friday 17:00 |

Trading Platforms

Traders can choose the full suite of MT4 plus nice add-ons. Traders can use MT4 as a powerful desktop client, a lightweight web-based alternative, and a popular mobile app. I recommend the desktop client, as it offers all the functions, including algorithmic trading. Traders can upgrade MT4 via 25,000+ custom indicators, templates, and EAs.

tastyfx also offers the algorithmic-focused ProRealTime for chart-based trading, with 100+ indicators and customizable algorithms, its proprietary web-based tastyfx trading platform and mobile app, and TradingView, where social traders can interact with 50M+ peers.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

As I conducted my tastyfx review, the average order execution speed of 17ms and its four-tier cash-back rebates of up to 15% stood out. tastyfx also offers free VPS hosting to Forex traders with a minimum balance of $2,000. Otherwise, tastyfx charges a monthly fee of $50.

Research and Education

tastyfx does not provide research and is an execution-only market maker. Forex traders can sign up for a newsletter with weekly market commentary but no actionable research.

What about education at tastyfx?

Beginners receive introductory educational material at tastyfx, which helps with fundamentals, but a dedicated classroom-style course is unavailable. tastyfx also fails to provide an article on trading psychology or the importance of risk management.

My conclusion:

- I advise first-time traders to consider the introductory educational content published by tastyfx

- Beginners should also seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management

- Avoid paid-for courses and mentors

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

tastyfx offers 24/5, human, unscripted customer support, and I applaud tastyfx for its approach to customer service, ranking it among the best US-based brokers in this category. I recommend the Help Center as the first contact, as it answers many questions.

Noteworthy:

- tastyfx offers phone support, but I miss a direct line to the finance department, where most issues can arise

Bonuses and Promotions

During my tastyfx review, Forex traders qualified for a funding bonus of up to $10,000. Unlike a deposit bonus, this bonus applies to each traded lot. Terms and conditions apply, and I urge traders to read and understand them.

Awards

tastyfx has several industry awards, but they are all from one source. Three of the most recent ones include the Number One Overall Brokers 2024 award, the Number One Education 2024 award, and the Number One Mobile App award, all from ForexBrokers.com.

Opening an Account

The tastyfx online application is a five-step process that includes data mining, but the application should take less than five minutes. Please note that if traders select a country other than the US, the application will ask them to visit one of the IG Markets subsidiaries that cater to that region.

What should traders know about the tastyfx account opening process?

- tastyfx complies with global AML/KYC requirements

- Account verification is mandatory

- Most traders pass verification by uploading a copy of a government-issued ID

- tastyfx may ask for additional information on a case-by-case basis

Minimum Deposit

The minimum deposit at tastyfx is $250.

Payment Methods

Withdrawal options |    |

|---|---|

Deposit options |    |

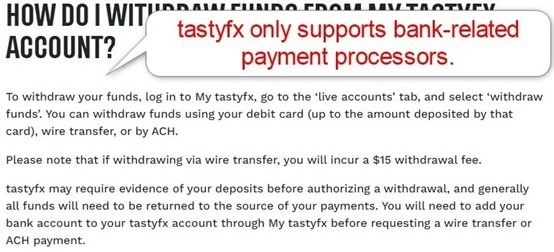

tastyfx supports bank wires and credit/debit cards.

Accepted Countries

tastyfx only accepts US-resident traders.

Deposits and Withdrawals

The secure tastyfx dashboard handles all financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at tastyfx?

- The minimum deposit is $250

- Forex traders must verify their payment processor before making a deposit or requesting a withdrawal

- tastyfx does not levy internal deposit fees

- Withdrawals are free except for bank wires, which incur a $15 fee

- External processing times and fees depend on the payment processor

- In compliance with AML regulations, the name of the trading account and payment processor must be identical

- tastyfx will send the deposit amount back to the funding method

Is tastyfx a Good Broker?

I like the trading environment at tastyfx for beginners, as it offers reasonable trading fees, a quality choice of trading platforms, and 24/5 human, unscripted customer support. While I rank tastyfx among the best US-based Forex brokers, it is primarily due to its ownership by UK-based broker IG Markets. tastyfx is a market maker offering fast order execution, a volume-based rebate program, and free VPS hosting. Compared to other US-based Forex brokers, tastyfx offers a competitive trading environment, and I recommend it to pure Forex traders who do not require cross-asset diversification. tastyfx is a registered Retail Foreign Exchange Dealer (RFED) with the Commodity Futures Trading Commission (CFTFC) and a member of the National Futures Association (NFA ID 509630). tastyfx only lists a $15 bank wire fee. The tastyfx minimum deposit is $250. tastyfx is a legitimate Forex broker regulated in the US.FAQs

Is tastyfx regulated in the US?

How much does tastyfx charge to withdraw money?

What is the minimum deposit for tastyfx?

Is tastyfx legit?