Editor’s Verdict

TastyTrade is a subsidiary of industry-leading UK-based brokerage powerhouse and publicly listed company IG Markets. TastyTrade, founded in 2017 by the creators of well-known brokerage thinkorswim, offers traders a proprietary trading platform and a balanced selection of US-listed assets. I can recommend Tastytrade only for options traders, retirement accounts, and unleveraged buy-and-hold portfolios. My comprehensive Tastytrade review evaluated the trading conditions. How competitive is TastyTrade?

Overview

TastyTrade provides a balanced asset selection from a trusted broker.

TastyTrade Five Core Takeaways:

- A cutting-edge trading platform for manual trading

- A marketing-oriented, misleading pricing environment

- Micro deposit bonuses ($5K for a $1M+ deposit)

- No direct algorithmic trading

- No cryptocurrency deposits and withdrawals

Headquarters | United States |

|---|---|

Regulators | CFTC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2017 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform |

Average Trading Cost EUR/USD | Not applicable |

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Undisclosed |

Average Trading Cost Gold | Undisclosed |

Average Trading Cost Bitcoin | Undisclosed |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

TastyTrade Regulation & Security

Country of the Regulator | United States |

|---|---|

Name of the Regulator | CFTC |

Regulatory License Number | NFA ID 277027 |

Regulatory Tier | 1 |

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. TastyTrade has one regulated entity with a good track record.

Is TastyTrade Legit and Safe?

My TastyTrade review found no verifiable misconduct or malpractice by this broker, founded in 2017. Therefore, I recommend TastyTrade as a legitimate and safe broker.

TastyTrade regulation and security components:

- TastyTrade is regulated by FINRA and is an NFA member

- No negative balance protection

- SIPC coverage for qualifying assets

- Founded in 2017

- Segregation of client deposits from corporate funds

What would I like TastyTrade to add?

Although TastyTrade lacks investor protection features for the entire portfolio, which is typical for US-based brokers, it is still a problem. The SIPC protection only applies to select assets. I would appreciate it if TastyTrade offered third-party insurance.

Fees

Average Trading Cost EUR/USD | Not applicable |

|---|---|

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Undisclosed |

Average Trading Cost Gold | Undisclosed |

Average Trading Cost Bitcoin | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Deposit Fee | |

Withdrawal Fee |

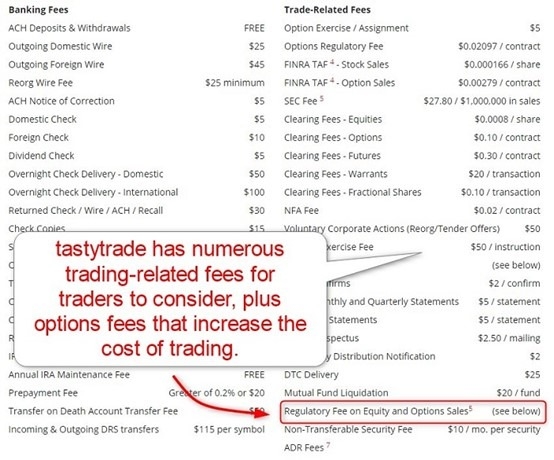

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. While TastyTrade advertises no closing commissions and presents a comparison table to other US-based brokers, the marketing-oriented pricing environment is misleading. Only options traders receive a genuine price advantage.

For example, TastyTrade adds the opening and closing commission with each opened trade, allowing it to advertise that there are no closing commissions. All assets incur additional fees. They are not hidden fees but in fine print.

Therefore, traders should read and understand all applicable fees to compare them with competing offers, as final trading fees are notably higher than advertised.

TastyTrade does not mention an inactivity fee or how it handles currency conversion costs. During my TastyTrade review, a deposit fee did not apply, but bank wire withdrawals cost $25 for domestic withdrawals and $45 for internal withdrawals.

Here is a snapshot of some tasty trade fees, excluding options fees:

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

TastyTrade lists a base rate of 10% and a seven-tier margin table with financing rates between 8% and 11%, which is average for US-based brokers but expensive for non-US brokers.

Range of Assets

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

TastyTrade offers a balanced asset selection of US-listed trading instruments suitable for most retail traders. While TastyTrade notes exposure to international stocks, it only provides it via ADRs.

TastyTrade offers the following asset classes:

- Stocks

- Options

- Futures

- Cryptocurrencies

- Options on futures

- ETFs

- Commodities

- Indices

TastyTrade Leverage

Maximum Retail Leverage | 1:2 |

Maximum Pro Leverage | 1:2 |

What should traders know about TastyTrade’s leverage?

- Maximum leverage is 1:2

- Negative balance protection does not exist.

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses

Account Types

TastyTrade offers numerous account types to cater to various trading needs. Besides the account types, which by default are cash accounts, traders can apply for trading permissions to receive a margin account, options and futures trading, portfolio margin trading, and cryptocurrency trading.

My observations concerning the TastyTrade account types are:

- No minimum deposit requirement, but a margin account requires a $2,000 balance

- Maximum leverage of 1:2

Available account types are:

- Individual cash account

- Joint cash account

- Joint cash account with rights to survivorship

- Traditional IRA

- Roth IRA

- SEP-IRA

- Beneficiary traditional IRA

- Beneficiary Roth IRA

- Corporate accounts (C Corp, S Corp, LLC, and partnership accounts)

- Trusts

- International accounts for select countries

TastyTrade Demo Account

TastyTrade does not offer demo accounts.

Trading Hours

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Sunday 00:00 | Saturday 24:00 |

Commodities | Monday 07:00 | Friday 16:00 |

Crude Oil | Monday 07:00 | Friday 16:00 |

Gold | Monday 07:00 | Friday 16:00 |

Metals | Monday 07:00 | Friday 16:00 |

Stocks (non-CFDs) | Monday 07:00 | Friday 19:00 |

ETFs | Monday 07:00 | Friday 19:00 |

Options | Monday 08:30 | Friday 15:00 |

Futures | Monday 07:00 | Friday 16:00 |

Trading Platforms

When this TastyTrade review was written, traders only received a proprietary platform with a dated design. It is available as a desktop platform, a web-based alternative, and a mobile app. While TastyTrade advertises rich features and cutting-edge technology, most of the features it lists have been available at other trading platforms for 15+ years.

The lack of algorithmic trading support stands out, but at least TastyTrade supports API trading. While the TastyTrade platform only allows manual trading, it lacks multi-screen support. Once again, the trading platform is best suited for options traders, where tools like curve analysis, quick roll, and quick order adjustments may benefit active options traders. Despite being an award-winning trading platform, I rank it as sub-standard due to the lack of cutting-edge features.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

My TastyTrade review found no unique features, but I want to note that TastyTrade advertises a sub-standard trading environment as a competitive one.

Research & Education

TastyTrade does not provide research and is an execution-only market maker.

What about education at TastyTrade?

TastyTrade offers limited, low-value educational content featuring trading strategies and a YouTube channel. The “Learn the Basics” article is poorly designed, with a long down-scroll and no structure. Overall, the entire education section is there for the sake of being there, without offering quality beginner education.

My conclusion:

- First-time traders can try to sort through the educational content and see if they can find value

- I strongly recommend that beginners seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management

- Avoid paid-for courses and mentors

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Monday through Thursday from 7 a.m. to 5 p.m. and Friday from 7 a.m. to 4 p.m |

Website Languages |  |

Customer support is the best feature at TastyTrade, as it provides human support. I recommend phone support for critical questions. Live chat and the help center should tackle all non-critical questions. Tastytrade offers support Monday through Thursday from 7 a.m. to 5 p.m. and Friday from 7 a.m. to 4 p.m.

Noteworthy:

- TastyTrade offers phone support, but I miss a direct line to the finance department, where many issues can arise

Bonuses and Promotions

The deposit bonus at TastyTrade is a poor offering. It ranges between $50 and $5,000, but the latter requires a $1M+ deposit. Terms and conditions apply, and I recommend traders read and understand them. Labeling the bonus as "big" is not accurate.

Awards

TastyTrade lists three industry awards. The Best Online Broker for Options Trading February 2024 award from Investopedia and the Best Broker for Options March 2024 from Forbes confirm my above comments that TastyTrade is best suited for options traders.

Opening an Account

The TastyTrade online application only asks for a country of residence, e-mail address, username, and desired password. Please note that it only grants access to the back office, where TastyTrade engages in data mining that is typical of US brokers.

What should traders know about the TastyTrade account opening process?

- TastyTrade complies with global AML/KYC requirements

- Account verification is mandatory

- Most traders pass verification by uploading a copy of a government-issued ID

- TastyTrade may ask for additional information on a case-by-case basis

Minimum Deposit

There is no minimum deposit requirement, but a margin account requires a $2,000 balance.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |   |

TastyTrade supports bank wires and checks.

Accepted Countries

TastyTrade accepts traders from the US, Egypt, Bahrain, India (cash accounts only), Indonesia, Israel, Kuwait, Malaysia, Saudi Arabia, Singapore, Taiwan, Thailand, United Arab Emirates, Andorra, Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Isle of Man, Italy, Lithuania, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Spain, Sweden, Switzerland, the UK, the Dominican Republic, Mexico, Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Peru, Uruguay, Australia, New Zealand, and French Polynesia.

Deposits and Withdrawals

The secure TastyTrade back office handles all financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at TastyTrade?

- A minimum deposit does not exist

- TastyTrade only accepts USD deposits

- TastyTrade does not levy internal deposit fees

- Domestic bank wire withdrawals cost $25, and international ones $45

- External processing times and fees depend on the bank

- In compliance with AML regulations, the name of the trading account and payment processor must be identical

Is TastyTrade a good broker?

I like the trading environment at TastyTrade for options traders, retirement accounts, and buy-and-hold investors, which requires an almost passive approach. The trading platform is sub-standard, beginner education is low-quality, low value, leverage is uncompetitive, and bonuses are not worth mentioning. I rank TastyTrade among the worst US-based brokers. Customer support is the best feature, followed by IG Markets ownership, but TastyTrade falls well short of the excellence IG Markets delivers globally. I cannot recommend Tastytrade to active traders. TastyTrade has no minimum deposit requirement. TastyTrade only supports bank wires. Verified traders can make a withdrawal request from the TastyTrade back office. Traders should consider their money safe at TastyTrade, a regulated broker in the US that fully complies with strict rules and regulations. TastyTrade is responsible for its fees, and while TastyTrade is more costly than it advertises, options traders have a cost advantage due to capped commissions.FAQs

What is the minimum deposit for TastyTrade?

How do I withdraw money from TastyTrade?

Is my money safe in TastyTrade?

Why is TastyTrade so expensive?